The Industrial rolling ladder market is expected to grow substantially, particularly in segments where workplace safety, efficiency in materials, and maintenance, and evolving ladder designs are in high demand. The growing demand for industrial warehousing, logistics, manufacturing, and construction operations is driving market growth, as rolling ladders provide greater mobility, stability, and ergonomic advantages over traditional fixed ladders.

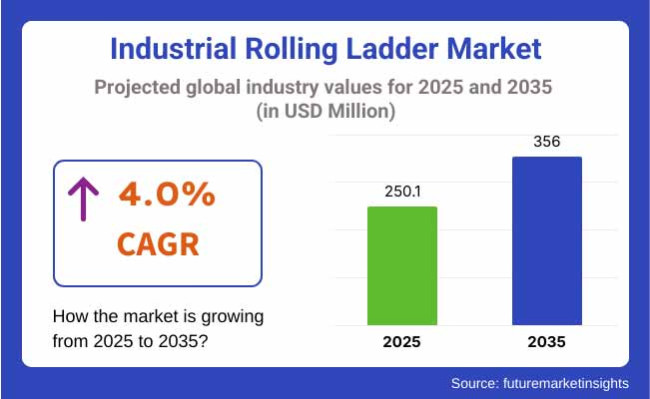

The market is anticipated to reach USD 356.0 Million by 2035, up from USD 250.1 Million in 2025 at a CAGR of 4.0 % for the forecast period. Innovation in the market is being driven by stringent workplace safety regulations from OSHA, ANSI, and EU standards as well as the need for customizable, heavy-duty, and corrosion-resistant ladder solutions.

North America, being the most important region of the Industrial Rolling Ladder Market, likely due to the higher emphasis on industrial safety regulations, is expected to remain the leading market share across the United States and Canada, where continuous warehousing expansion and logistics infrastructural development is taking place, overtaken in due course by Asia and Europe respectively.

Due to the OSHA workplace safety standards, high-durability rolling ladders have sought out opportunities in the manufacturing, aviation and automotive industries, among others. The country’s booming e-commerce and warehouse automation sectors are also boosting growth in the market.

The Europe region accounts for a significant share of the market and is known to have strict regulations regarding worker safety based on the occupational health policy of EU. Germany, France, and the UK are major contributors to global trade, supported by strong industrial and logistics networks.

The expansion of automated multi-level storage warehouses is driving the demand for lightweight but robust aluminum and steel rolling ladders. Also, stringent safety standards have also nudged manufacturers to emphasize on anti-slip and self-locking mechanisms.

The Asia-Pacific region should witness robust market growth owing to the growing manufacturing industries in China, India, and Japan. Increasing warehousing, construction projects and logistics hub activities are expected to boost the market growth for high-load-capacity rolling ladders.

Industrial safety measures are being enforced by governments in the region, which is driving the market for ergonomic, mobile and height-adjustable ladder systems. The increasing adoption of smart homes and smart ITSs is also contributing to the market.

Challenge

High Cost of Advanced Rolling Ladder Designs

The incorporation of advanced safety features like braking systems, corrosion-resistant coatings, and ergonomic designs contributes to higher manufacturing and procurement expenses. Many SMEs don’t justify spending the small fortune required for high-end rolling ladder systems and invest in home depot ladders that are less expensive but provide very basic safety features.

To ensure compliance with safety regulations, manufacturers are also looking at the cheapest production methods to make rolling ladders affordable.

Opportunity

Rising Demand for Customizable and Smart Rolling Ladders

The growing need for customized ladder applications for specific industrial applications is one of the trends and drivers that will have a strong impact on the ladder solutions market. To reduce risks associated with stacks and shelves, more manufacturers are adopting IoT-based safety monitoring, sensor-enabled weight distribution and height-adjustable mechanisms that contribute to improved worker safety and productivity.

Furthermore, rising investments in automated warehouse storage systems are providing new growth opportunities for smart, foldable, and motorized rolling ladders.

Industrial rolling ladders are needed in the warehousing, manufacturing, and logistics, which is more in demand between 2020 and 2024 when the industrial rolling ladder market grew. The explosion in e-commerce and supply chain optimization have driven the demand for efficient material handling solutions, which, in turn, have pushed up the adoption of rolling ladders.

With workplace safety and OSHA compliance a priority, demand for industrial ladders with anti-slip platforms, handrails, and higher load-bearing capacity drove growth. The use of lightweight but durable materials such as aluminium and fortified steel enhanced portability and lifespan.

Cultural challenges around high upfront costs, maintenance and restricted space in compact warehouses all constrained widespread uptake. But they also raise the challenges of complex designs and modular becoming unsatisfactory for cognitive designs.

2025 to 2035 Most of the technological advancements and improvement of ergonomics will be seen in the industrial rolling ladder market. Smart sensors and Internet of services-enabled safety components will analyse the weight of goods, patterns of use and wear and tear on individual machines, assuring both preventive maintenance and real-time safety monitoring.

Ergonomics will become priority, with work surfaces that change heights, small platforms that absorb shock and automatic motion assist systems to reduce worker fatigue and thereby improve productivity. Sustainability will also become a major trend: expect to see eco-friendly materials, recyclable alloys and energy-efficient manufacturing becoming more prevalent.

The market will witness an additional advancement with the incorporation of automated rolling ladders in intelligent warehouses, leading to less manual work and more efficient material extraction in high-density areas for storing.

Market Shifts: A Comparative Analysis (2020 to 2024 vs. 2025 to 2035)

| Market Shift | 2020 to 2024 |

|---|---|

| Industrial Demand | Growth in warehousing, e-commerce, and logistics. |

| Safety Innovations | OSHA-compliant designs with anti-slip and reinforced structures. |

| Material Advancements | Lightweight aluminum and reinforced steel. |

| Ergonomic Improvements | Basic handrails and step customization. |

| Technology Integration | Limited automation, manual operation. |

| Market Shift | 2025 to 2035 |

|---|---|

| Industrial Demand | Expansion into automated warehouses and robotics-assisted operations. |

| Safety Innovations | Smart safety sensors, IoT monitoring, and predictive maintenance. |

| Material Advancements | Sustainable, recyclable alloys and advanced composite materials. |

| Ergonomic Improvements | Adjustable step heights, shock-absorbing platforms, and automated mobility. |

| Technology Integration | IoT-enabled smart ladders with automated movement and load detection. |

With the increased adoption of workplace safety regulations and the need for efficient material handling solutions, the United States Industrial Rolling Ladder Market is at a steady growth. High-quality rolling ladders are now part of any warehousing, manufacturing, and logistics business's list of essential tools for lifting purposes, as the investment improves operational safety and boosts productivity. The growing need for customizable and ergonomic ladder solutions is another driving factor behind the market growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 4.1% |

The United Kingdom has witnessed a boom in its market for industrial rolling ladders as businesses respond to the need to comply with strict workplace safety legislation. Rolling ladders are being widely adopted by these industries, especially the logistics and e-commerce sectors to make their warehouses more efficient. Further, growing trends of automated and semi-automated ladder solutions are also driving the market.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 4.4% |

Industrial Rolling Ladder Market include Germany, France, Italy, and Spain, where industrial automation is on the rise to address safety needs. Germany, France, and Italy are major adopters of high-performance rolling ladders, especially in the manufacturing, warehousing, and construction sectors. With strict labour safety laws and a move towards ergonomic workplace solutions too are contributing to the market growth.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 4.5% |

Japan’s market for industrial rolling ladders is growing at a steady rate, driven by the expanding logistics sector and the need for space-efficient storage solutions in industrial facilities. With increasing investments in automation, companies are integrating rolling ladders with advanced safety features and lightweight materials to improve usability.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 4.2% |

The industrial rolling ladder market in South Korea is growing at a gradual rate as industrial safety regulations become a growing focus in the region and demand surges from warehouses and production facilities. Rolling ladders have seen the evolution of advanced designs that are made to be more durable and have better safety mechanisms.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 4.3% |

| Product Type | Market Share (2025) |

|---|---|

| Safety Rolling Ladders | 41.3% |

Industrial rolling ladders are primarily segmented into safety rolling ladders, whose advanced design gives way to worker safety and ergonomic usability. To mitigate the risks of workplace accidents, these ladders are equipped with handrails, anti-slip steps, and automatic locking mechanisms. With strict occupational safety regulations imposed on different industries like manufacturing, warehousing, and logistics, the use of safety rolling ladders has become necessary.

Safety rolling ladders are designed for better and safer elevated access when the workers are doing their routine work of retrieving heavy goods, performing maintenance tasks, or passing through areas with high storage. Safety rolling ladders differ from ordinary ladders in that they are made of reinforced steel or aluminium frames that are stronger, more durable and have a higher weight-bearing capacity.

The design of their units is mobile, meaning they can navigate smoothly through an aisle in a warehouse or a factory floor to the necessary workspace, which is essential for fast-moving environments.

Advances in safety ladder designs, including self-locking casters, extended guardrails, and slip-resistant treads, have spurred investments amid a stronger emphasis on worker safety and productivity. They keep improving these features with ergonomic step spacing and wide platforms to help workers balance and keep comfortable. This trend is making safety rolling ladders a desired part of several industrial applications due to the increasing need of regulatory compliant access equipment.

| End Use | Market Share (2025) |

|---|---|

| Warehouse | 45.7% |

The vast majority of the end-use segment within the industrial rolling ladder market can be accounted to warehouses, as is the case with most quality logistics facilities the use of high-sets and high reach is integral to maintaining a good stock turnover and storage levels. Warehouse storage on a massive scale often uses rolling ladders to allow workers to pull, organize and transport goods on elevated shelves.

The growing scope of e-commerce and global supply chain operations makes capacities on the warehouses always at their peak, resulting in a growing need of both mobile and durable ladder solutions.

Modern warehouses employ automated processes and high-density storage systems that have increased the demand for more mobile and flexible industrial rolling ladders. Warehouse managers often prioritize ladders with multi-directional rolling capabilities and external ribs for bulk goods. Folding and space-efficient experts pull extra weight, too, making upper-shelf areas more accessible without impinging on your floor usage.

Warehouse operators also sink money into rolling ladders that height can be adjusted on the run so that employees can use them to reach shelving at varying heights without a loss of stability. These ladders are designed to withstand heavy use and provide long-term value; they are often made from heavy-duty materials such as powder-coated steel and industrial-grade aluminium.

The steady growth of logistics hubs, fulfilment centres and distribution facilities continues to drive the need for industrial rolling ladders in warehouse settings.

The industrial rolling ladder market is growing significantly due to the growing concerns to the workplace safety, increased material handling efficiency, and regulations compliance. Companies cater to this industry by manufacturing durable, lightweight, and ergonomic ladder designs.

An increasing focus on technological innovations related to ladder construction, such as anti-slip surfaces, reinforced materials, and modular customization, also drives market growth. Some are industrial equipment manufacturers, others are specialized ladder producers focused on serving warehouses, factories and commercial facilities.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Louisville Ladder | 18-22% |

| Cotterman | 14-18% |

| Hasegawa | 12-16% |

| Günzburger SteigtechnikTianjin Jinmao | 10-14% |

| Shanghai Ruiju | 8-12% |

| Other Companies (combined) | 30-40% |

| Company Name | Key Offerings/Activities |

|---|---|

| Louisville Ladder | In 2024, introduced high-strength aluminum rolling ladders with enhanced load capacity and mobility. |

| Cotterman | In 2025, expanded its modular rolling ladder line with custom height and width options for industrial applications. |

| Hasegawa | In 2024, launched anti-corrosion coated ladders designed for harsh manufacturing environments. |

| Günzburger SteigtechnikTianjin Jinmao | In 2025, developed new ergonomic rolling ladders with lightweight composite materials. |

| Shanghai Ruiju | In 2024, enhanced its safety-certified rolling ladders with reinforced non-slip platforms. |

Key Company Insights

Louisville Ladder (18-22%)

Louisville Ladder leads the market with high-durability rolling ladders, offering superior load-bearing capacity and advanced safety features.

Cotterman (14-18%)

Cotterman specializes in customizable rolling ladders, ensuring versatility for industrial and warehouse applications.

Hasegawa (12-16%)

Hasegawa develops corrosion-resistant rolling ladders, catering to manufacturing and chemical processing industries.

Günzburger SteigtechnikTianjin Jinmao (10-14%)

Günzburger focuses on lightweight yet robust rolling ladders with ergonomic features for enhanced user comfort.

Shanghai Ruiju (8-12%)

Shanghai Ruiju enhances safety and stability in rolling ladders with reinforced platforms and non-slip surfaces.

Other Key Players (30-40% Combined)

Several industrial ladder manufacturers contribute to product innovations and market expansion. These include:

The overall market size for the Industrial Rolling Ladder Market was USD 250.1 Million in 2025.

The Industrial Rolling Ladder Market is expected to reach USD 356.0 Million in 2035.

The demand is driven by increasing adoption of workplace safety regulations, growing demand for efficient material handling solutions, expanding warehousing and logistics industries, and rising construction and industrial activities requiring mobile access solutions.

The top 5 countries driving market growth are the USA, UK, Europe, Japan and South Korea.

The Safety rolling ladders segment is expected to command a significant share over the assessment period.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2019 to 2034

Table 2: Global Market Volume (Units) Forecast by Region, 2019 to 2034

Table 3: Global Market Value (US$ Million) Forecast by Product Type, 2019 to 2034

Table 4: Global Market Volume (Units) Forecast by Product Type, 2019 to 2034

Table 5: Global Market Value (US$ Million) Forecast by End Use, 2019 to 2034

Table 6: Global Market Volume (Units) Forecast by End Use, 2019 to 2034

Table 7: North America Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 8: North America Market Volume (Units) Forecast by Country, 2019 to 2034

Table 9: North America Market Value (US$ Million) Forecast by Product Type, 2019 to 2034

Table 10: North America Market Volume (Units) Forecast by Product Type, 2019 to 2034

Table 11: North America Market Value (US$ Million) Forecast by End Use, 2019 to 2034

Table 12: North America Market Volume (Units) Forecast by End Use, 2019 to 2034

Table 13: Latin America Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 14: Latin America Market Volume (Units) Forecast by Country, 2019 to 2034

Table 15: Latin America Market Value (US$ Million) Forecast by Product Type, 2019 to 2034

Table 16: Latin America Market Volume (Units) Forecast by Product Type, 2019 to 2034

Table 17: Latin America Market Value (US$ Million) Forecast by End Use, 2019 to 2034

Table 18: Latin America Market Volume (Units) Forecast by End Use, 2019 to 2034

Table 19: Western Europe Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 20: Western Europe Market Volume (Units) Forecast by Country, 2019 to 2034

Table 21: Western Europe Market Value (US$ Million) Forecast by Product Type, 2019 to 2034

Table 22: Western Europe Market Volume (Units) Forecast by Product Type, 2019 to 2034

Table 23: Western Europe Market Value (US$ Million) Forecast by End Use, 2019 to 2034

Table 24: Western Europe Market Volume (Units) Forecast by End Use, 2019 to 2034

Table 25: Eastern Europe Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 26: Eastern Europe Market Volume (Units) Forecast by Country, 2019 to 2034

Table 27: Eastern Europe Market Value (US$ Million) Forecast by Product Type, 2019 to 2034

Table 28: Eastern Europe Market Volume (Units) Forecast by Product Type, 2019 to 2034

Table 29: Eastern Europe Market Value (US$ Million) Forecast by End Use, 2019 to 2034

Table 30: Eastern Europe Market Volume (Units) Forecast by End Use, 2019 to 2034

Table 31: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 32: South Asia and Pacific Market Volume (Units) Forecast by Country, 2019 to 2034

Table 33: South Asia and Pacific Market Value (US$ Million) Forecast by Product Type, 2019 to 2034

Table 34: South Asia and Pacific Market Volume (Units) Forecast by Product Type, 2019 to 2034

Table 35: South Asia and Pacific Market Value (US$ Million) Forecast by End Use, 2019 to 2034

Table 36: South Asia and Pacific Market Volume (Units) Forecast by End Use, 2019 to 2034

Table 37: East Asia Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 38: East Asia Market Volume (Units) Forecast by Country, 2019 to 2034

Table 39: East Asia Market Value (US$ Million) Forecast by Product Type, 2019 to 2034

Table 40: East Asia Market Volume (Units) Forecast by Product Type, 2019 to 2034

Table 41: East Asia Market Value (US$ Million) Forecast by End Use, 2019 to 2034

Table 42: East Asia Market Volume (Units) Forecast by End Use, 2019 to 2034

Table 43: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 44: Middle East and Africa Market Volume (Units) Forecast by Country, 2019 to 2034

Table 45: Middle East and Africa Market Value (US$ Million) Forecast by Product Type, 2019 to 2034

Table 46: Middle East and Africa Market Volume (Units) Forecast by Product Type, 2019 to 2034

Table 47: Middle East and Africa Market Value (US$ Million) Forecast by End Use, 2019 to 2034

Table 48: Middle East and Africa Market Volume (Units) Forecast by End Use, 2019 to 2034

Figure 1: Global Market Value (US$ Million) by Product Type, 2024 to 2034

Figure 2: Global Market Value (US$ Million) by End Use, 2024 to 2034

Figure 3: Global Market Value (US$ Million) by Region, 2024 to 2034

Figure 4: Global Market Value (US$ Million) Analysis by Region, 2019 to 2034

Figure 5: Global Market Volume (Units) Analysis by Region, 2019 to 2034

Figure 6: Global Market Value Share (%) and BPS Analysis by Region, 2024 to 2034

Figure 7: Global Market Y-o-Y Growth (%) Projections by Region, 2024 to 2034

Figure 8: Global Market Value (US$ Million) Analysis by Product Type, 2019 to 2034

Figure 9: Global Market Volume (Units) Analysis by Product Type, 2019 to 2034

Figure 10: Global Market Value Share (%) and BPS Analysis by Product Type, 2024 to 2034

Figure 11: Global Market Y-o-Y Growth (%) Projections by Product Type, 2024 to 2034

Figure 12: Global Market Value (US$ Million) Analysis by End Use, 2019 to 2034

Figure 13: Global Market Volume (Units) Analysis by End Use, 2019 to 2034

Figure 14: Global Market Value Share (%) and BPS Analysis by End Use, 2024 to 2034

Figure 15: Global Market Y-o-Y Growth (%) Projections by End Use, 2024 to 2034

Figure 16: Global Market Attractiveness by Product Type, 2024 to 2034

Figure 17: Global Market Attractiveness by End Use, 2024 to 2034

Figure 18: Global Market Attractiveness by Region, 2024 to 2034

Figure 19: North America Market Value (US$ Million) by Product Type, 2024 to 2034

Figure 20: North America Market Value (US$ Million) by End Use, 2024 to 2034

Figure 21: North America Market Value (US$ Million) by Country, 2024 to 2034

Figure 22: North America Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 23: North America Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 24: North America Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 25: North America Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 26: North America Market Value (US$ Million) Analysis by Product Type, 2019 to 2034

Figure 27: North America Market Volume (Units) Analysis by Product Type, 2019 to 2034

Figure 28: North America Market Value Share (%) and BPS Analysis by Product Type, 2024 to 2034

Figure 29: North America Market Y-o-Y Growth (%) Projections by Product Type, 2024 to 2034

Figure 30: North America Market Value (US$ Million) Analysis by End Use, 2019 to 2034

Figure 31: North America Market Volume (Units) Analysis by End Use, 2019 to 2034

Figure 32: North America Market Value Share (%) and BPS Analysis by End Use, 2024 to 2034

Figure 33: North America Market Y-o-Y Growth (%) Projections by End Use, 2024 to 2034

Figure 34: North America Market Attractiveness by Product Type, 2024 to 2034

Figure 35: North America Market Attractiveness by End Use, 2024 to 2034

Figure 36: North America Market Attractiveness by Country, 2024 to 2034

Figure 37: Latin America Market Value (US$ Million) by Product Type, 2024 to 2034

Figure 38: Latin America Market Value (US$ Million) by End Use, 2024 to 2034

Figure 39: Latin America Market Value (US$ Million) by Country, 2024 to 2034

Figure 40: Latin America Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 41: Latin America Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 42: Latin America Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 43: Latin America Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 44: Latin America Market Value (US$ Million) Analysis by Product Type, 2019 to 2034

Figure 45: Latin America Market Volume (Units) Analysis by Product Type, 2019 to 2034

Figure 46: Latin America Market Value Share (%) and BPS Analysis by Product Type, 2024 to 2034

Figure 47: Latin America Market Y-o-Y Growth (%) Projections by Product Type, 2024 to 2034

Figure 48: Latin America Market Value (US$ Million) Analysis by End Use, 2019 to 2034

Figure 49: Latin America Market Volume (Units) Analysis by End Use, 2019 to 2034

Figure 50: Latin America Market Value Share (%) and BPS Analysis by End Use, 2024 to 2034

Figure 51: Latin America Market Y-o-Y Growth (%) Projections by End Use, 2024 to 2034

Figure 52: Latin America Market Attractiveness by Product Type, 2024 to 2034

Figure 53: Latin America Market Attractiveness by End Use, 2024 to 2034

Figure 54: Latin America Market Attractiveness by Country, 2024 to 2034

Figure 55: Western Europe Market Value (US$ Million) by Product Type, 2024 to 2034

Figure 56: Western Europe Market Value (US$ Million) by End Use, 2024 to 2034

Figure 57: Western Europe Market Value (US$ Million) by Country, 2024 to 2034

Figure 58: Western Europe Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 59: Western Europe Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 60: Western Europe Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 61: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 62: Western Europe Market Value (US$ Million) Analysis by Product Type, 2019 to 2034

Figure 63: Western Europe Market Volume (Units) Analysis by Product Type, 2019 to 2034

Figure 64: Western Europe Market Value Share (%) and BPS Analysis by Product Type, 2024 to 2034

Figure 65: Western Europe Market Y-o-Y Growth (%) Projections by Product Type, 2024 to 2034

Figure 66: Western Europe Market Value (US$ Million) Analysis by End Use, 2019 to 2034

Figure 67: Western Europe Market Volume (Units) Analysis by End Use, 2019 to 2034

Figure 68: Western Europe Market Value Share (%) and BPS Analysis by End Use, 2024 to 2034

Figure 69: Western Europe Market Y-o-Y Growth (%) Projections by End Use, 2024 to 2034

Figure 70: Western Europe Market Attractiveness by Product Type, 2024 to 2034

Figure 71: Western Europe Market Attractiveness by End Use, 2024 to 2034

Figure 72: Western Europe Market Attractiveness by Country, 2024 to 2034

Figure 73: Eastern Europe Market Value (US$ Million) by Product Type, 2024 to 2034

Figure 74: Eastern Europe Market Value (US$ Million) by End Use, 2024 to 2034

Figure 75: Eastern Europe Market Value (US$ Million) by Country, 2024 to 2034

Figure 76: Eastern Europe Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 77: Eastern Europe Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 78: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 79: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 80: Eastern Europe Market Value (US$ Million) Analysis by Product Type, 2019 to 2034

Figure 81: Eastern Europe Market Volume (Units) Analysis by Product Type, 2019 to 2034

Figure 82: Eastern Europe Market Value Share (%) and BPS Analysis by Product Type, 2024 to 2034

Figure 83: Eastern Europe Market Y-o-Y Growth (%) Projections by Product Type, 2024 to 2034

Figure 84: Eastern Europe Market Value (US$ Million) Analysis by End Use, 2019 to 2034

Figure 85: Eastern Europe Market Volume (Units) Analysis by End Use, 2019 to 2034

Figure 86: Eastern Europe Market Value Share (%) and BPS Analysis by End Use, 2024 to 2034

Figure 87: Eastern Europe Market Y-o-Y Growth (%) Projections by End Use, 2024 to 2034

Figure 88: Eastern Europe Market Attractiveness by Product Type, 2024 to 2034

Figure 89: Eastern Europe Market Attractiveness by End Use, 2024 to 2034

Figure 90: Eastern Europe Market Attractiveness by Country, 2024 to 2034

Figure 91: South Asia and Pacific Market Value (US$ Million) by Product Type, 2024 to 2034

Figure 92: South Asia and Pacific Market Value (US$ Million) by End Use, 2024 to 2034

Figure 93: South Asia and Pacific Market Value (US$ Million) by Country, 2024 to 2034

Figure 94: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 95: South Asia and Pacific Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 96: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 97: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 98: South Asia and Pacific Market Value (US$ Million) Analysis by Product Type, 2019 to 2034

Figure 99: South Asia and Pacific Market Volume (Units) Analysis by Product Type, 2019 to 2034

Figure 100: South Asia and Pacific Market Value Share (%) and BPS Analysis by Product Type, 2024 to 2034

Figure 101: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Product Type, 2024 to 2034

Figure 102: South Asia and Pacific Market Value (US$ Million) Analysis by End Use, 2019 to 2034

Figure 103: South Asia and Pacific Market Volume (Units) Analysis by End Use, 2019 to 2034

Figure 104: South Asia and Pacific Market Value Share (%) and BPS Analysis by End Use, 2024 to 2034

Figure 105: South Asia and Pacific Market Y-o-Y Growth (%) Projections by End Use, 2024 to 2034

Figure 106: South Asia and Pacific Market Attractiveness by Product Type, 2024 to 2034

Figure 107: South Asia and Pacific Market Attractiveness by End Use, 2024 to 2034

Figure 108: South Asia and Pacific Market Attractiveness by Country, 2024 to 2034

Figure 109: East Asia Market Value (US$ Million) by Product Type, 2024 to 2034

Figure 110: East Asia Market Value (US$ Million) by End Use, 2024 to 2034

Figure 111: East Asia Market Value (US$ Million) by Country, 2024 to 2034

Figure 112: East Asia Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 113: East Asia Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 114: East Asia Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 115: East Asia Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 116: East Asia Market Value (US$ Million) Analysis by Product Type, 2019 to 2034

Figure 117: East Asia Market Volume (Units) Analysis by Product Type, 2019 to 2034

Figure 118: East Asia Market Value Share (%) and BPS Analysis by Product Type, 2024 to 2034

Figure 119: East Asia Market Y-o-Y Growth (%) Projections by Product Type, 2024 to 2034

Figure 120: East Asia Market Value (US$ Million) Analysis by End Use, 2019 to 2034

Figure 121: East Asia Market Volume (Units) Analysis by End Use, 2019 to 2034

Figure 122: East Asia Market Value Share (%) and BPS Analysis by End Use, 2024 to 2034

Figure 123: East Asia Market Y-o-Y Growth (%) Projections by End Use, 2024 to 2034

Figure 124: East Asia Market Attractiveness by Product Type, 2024 to 2034

Figure 125: East Asia Market Attractiveness by End Use, 2024 to 2034

Figure 126: East Asia Market Attractiveness by Country, 2024 to 2034

Figure 127: Middle East and Africa Market Value (US$ Million) by Product Type, 2024 to 2034

Figure 128: Middle East and Africa Market Value (US$ Million) by End Use, 2024 to 2034

Figure 129: Middle East and Africa Market Value (US$ Million) by Country, 2024 to 2034

Figure 130: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 131: Middle East and Africa Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 132: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 133: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 134: Middle East and Africa Market Value (US$ Million) Analysis by Product Type, 2019 to 2034

Figure 135: Middle East and Africa Market Volume (Units) Analysis by Product Type, 2019 to 2034

Figure 136: Middle East and Africa Market Value Share (%) and BPS Analysis by Product Type, 2024 to 2034

Figure 137: Middle East and Africa Market Y-o-Y Growth (%) Projections by Product Type, 2024 to 2034

Figure 138: Middle East and Africa Market Value (US$ Million) Analysis by End Use, 2019 to 2034

Figure 139: Middle East and Africa Market Volume (Units) Analysis by End Use, 2019 to 2034

Figure 140: Middle East and Africa Market Value Share (%) and BPS Analysis by End Use, 2024 to 2034

Figure 141: Middle East and Africa Market Y-o-Y Growth (%) Projections by End Use, 2024 to 2034

Figure 142: Middle East and Africa Market Attractiveness by Product Type, 2024 to 2034

Figure 143: Middle East and Africa Market Attractiveness by End Use, 2024 to 2034

Figure 144: Middle East and Africa Market Attractiveness by Country, 2024 to 2034

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Industrial Ladder Market

Industrial Lift Ladder Market

Industrial Grade Electrochemical CO Sensor Market Size and Share Forecast Outlook 2025 to 2035

Industrial Bench Scale Market Size and Share Forecast Outlook 2025 to 2035

Industrial Low Profile Floor Scale Market Size and Share Forecast Outlook 2025 to 2035

Industrial Sand Mill Market Size and Share Forecast Outlook 2025 to 2035

Industrial Control Network Modules Market Size and Share Forecast Outlook 2025 to 2035

Industrial Precision Oven Market Size and Share Forecast Outlook 2025 to 2035

Industrial Water Chiller for PCB Market Size and Share Forecast Outlook 2025 to 2035

Industrial & Commercial HVLS Fans Market Size and Share Forecast Outlook 2025 to 2035

Industrial Robot Controller Market Size and Share Forecast Outlook 2025 to 2035

Industrial Wired Routers Market Size and Share Forecast Outlook 2025 to 2035

Industrial Evaporative Condensers Market Size and Share Forecast Outlook 2025 to 2035

Industrial Energy Management System Market Size and Share Forecast Outlook 2025 to 2035

Industrial Insulation Market Size and Share Forecast Outlook 2025 to 2035

Industrial Safety Gloves Market Size and Share Forecast Outlook 2025 to 2035

Industrial Cleaner Market Size and Share Forecast Outlook 2025 to 2035

Industrial Dust Treatment System Market Size and Share Forecast Outlook 2025 to 2035

Industrial Vertical Washing Tower Market Size and Share Forecast Outlook 2025 to 2035

Industrial Pepper Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA