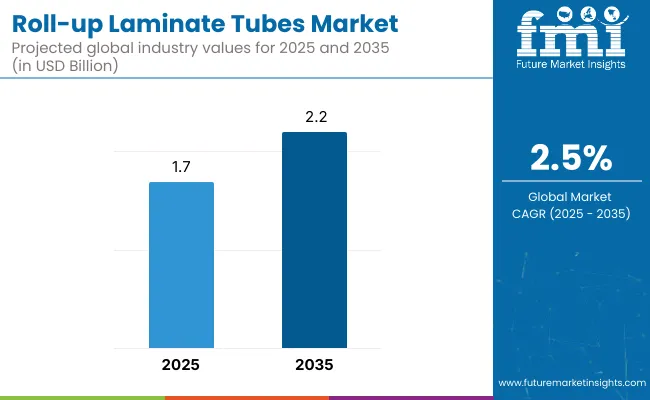

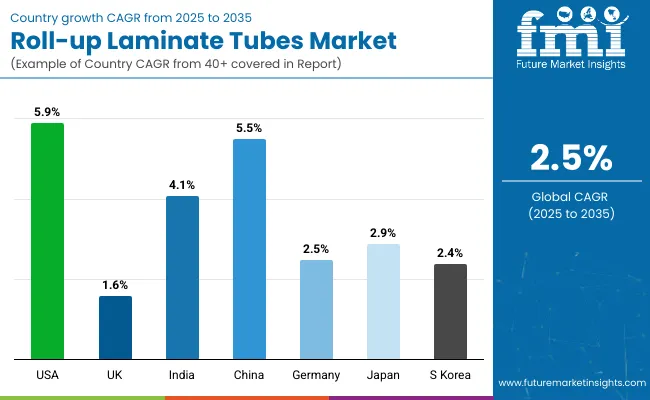

The roll-up laminate tubes market is forecast to grow from USD 1.7 billion in 2025 to USD 2.2 billion by 2035, reflecting a modest gain of USD 0.5 billion over the ten-year period. This represents a 29.4% overall increase, with the market expanding at a compound annual growth rate (CAGR) of 2.5%. The total market size increases by a 1.2 multiple between 2025 and 2035.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 1.7 billion |

| Industry Value (2035F) | USD 2.2 billion |

| CAGR (2025 to 2035) | 2.5% |

During the first five years (2025-2030), the market progresses from USD 1.7 billion to USD 1.9 billion, contributing USD 0.2 billion, which accounts for 40.0% of the total decade’s growth. Growth is supported by rising applications in oral care, cosmetics, and food sectors, where controlled dispensing, product protection, and lightweight packaging are prioritized. Brands emphasize affordability and barrier performance, with a focus on metallized layers for light-sensitive formulations.

In the latter half of the forecast period (2030-2035), the market rises from USD 1.9 billion to USD 2.2 billion, generating USD 0.3 billion, or 60.0% of total growth. This phase is driven by increasing demand for recyclable and mono-material laminate structures that align with global sustainability goals. Advances in laser scoring, flip-top caps, and reduced layer-count laminates also enhance functionality and branding potential in personal care and dermo-cosmetic packaging applications.

From 2020 to 2024, the roll-up laminate tubes market grew from USD 780 million to USD 1.2 billion, driven by hardware-centric adoption across cosmetics, personal care, oral care, and OTC pharmaceuticals seeking lightweight, collapsible, and hygienic dispensing formats.

During this period, the competitive landscape was dominated by tube converters and specialty packaging manufacturers controlling nearly 70% of revenue, with leaders such as Top Tubes, EPL Europe, ALLTUB, and Tubapack focusing on multi-layer laminate constructions with barrier protection and print-on-laminate capabilities.

Competitive differentiation relied on material flexibility, print aesthetics, and closure compatibility, while smart packaging integrations such as serialization or track-and-trace were often bundled as auxiliary features rather than primary revenue generators. Service-based models had limited traction, contributing less than 10% of the total market value, as converters remained focused on volume supply and aesthetic differentiation.

Demand for roll-up laminate tubes will expand to USD 1.9 billion in 2030, and the revenue mix will shift as customization services, digital design integration, and sustainability offerings grow to over 40% share. Traditional tube manufacturers face rising competition from digital-native converters offering rapid prototyping, mono-material laminates, and recyclable design formats. Major vendors are pivoting to hybrid models, incorporating bio-based laminates, direct-to-tube digital printing, and refill-friendly configurations to remain competitive.

Emerging players such as Global Pack Source, Pactek Industries, Pack-Tubes, Paramount Tube, Erich Müller, and Tokan Kogyo Co., Ltd. are gaining share by specializing in application-specific formats, agile production models, and regionally certified sustainable tube systems. The competitive advantage is moving away from conventional tube construction toward end-to-end design agility, regulatory adaptability, and recurring value via customizable, eco-conscious tube solutions.

Rising demand for lightweight, flexible, and barrier-protected packaging in personal care, oral care, and pharmaceutical products is driving the growth of the roll-up laminate tubes market. These tubes combine the structural integrity of multi-layer laminates with user-friendly roll-up functionality, enabling complete product evacuation and minimizing material wastage. The blend of premium aesthetics, product protection, and convenience is contributing to strong uptake among both global brands and private labels.

Aluminum barrier laminate (ABL) and plastic barrier laminate (PBL) formats have gained popularity due to their ability to offer excellent moisture, oxygen, and light resistance while maintaining flexibility. Roll-up features support controlled dispensing and extend shelf life by minimizing air ingress. Advances in laminating technology and digital printing have further enhanced tube customization, branding, and recyclability.

Industries such as skincare, OTC healthcare, toothpaste, and topical medications are driving demand for tubes that preserve product efficacy, enhance portability, and meet consumer preferences for ease of use. These tubes also support hygienic dispensing in travel-sized and on-the-go applications.

Segment growth is expected to be led by plastic barrier laminate tubes, oral care products in end-use applications, and mono-material recyclable laminates due to their barrier functionality, sustainability alignment, and compatibility with mass-market and premium brand requirements.

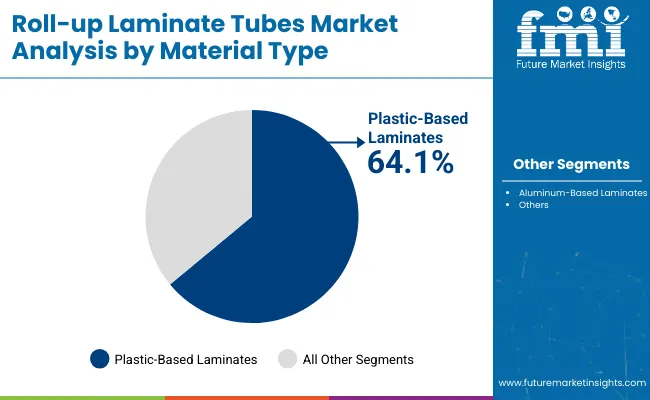

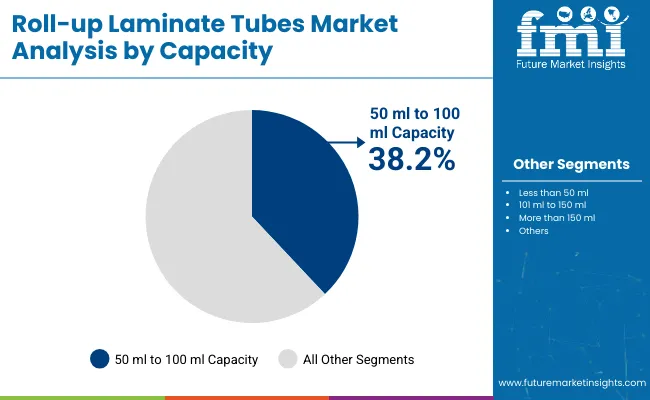

The market is segmented by material type, capacity, layer type, end-use industry, and region. Material type includes plastic-based laminates and aluminum-based laminates, each offering specific advantages in terms of barrier properties, recyclability, and cost efficiency. Capacity segmentation includes less than 50 ml, 50 ml to 100 ml, 101 ml to 150 ml, and more than 150 ml, catering to diverse consumer and industrial usage needs.

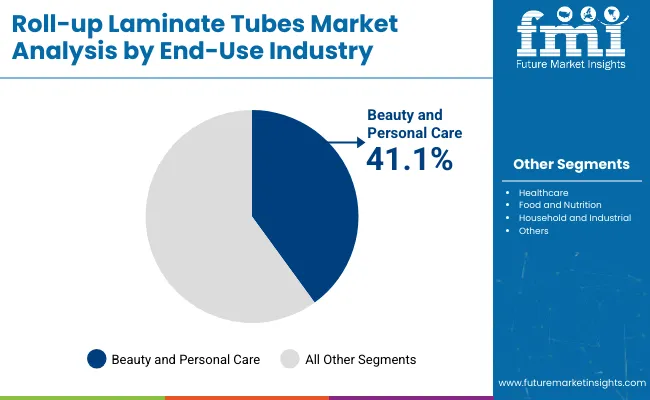

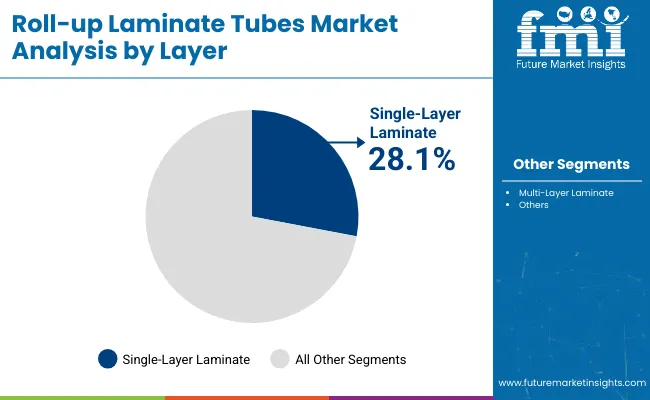

Based on layer type, the market is divided into single-layer laminate and multi-layer laminate formats, addressing varying requirements for protection, shelf-life, and sustainability. End-use industries include healthcare, beauty & personal care, food & nutrition, and household & industrial, where laminate tubes serve as durable and flexible primary packaging solutions. Regionally, the market is segmented into North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa.

The plastic-based laminates segment is projected to account for the highest share of 64.1% in 2025, driven by their superior barrier properties and cost-effective scalability. These laminates, typically composed of polyethylene (PE), polypropylene (PP), or multi-layer co-extrusions, ensure optimal protection against moisture, oxygen, and UV exposure making them well-suited for high-viscosity and reactive formulations.

Their structural flexibility allows brand owners to deploy high-speed filling and sealing operations while maintaining tube aesthetics and functionality. Advancements in recyclable mono-material laminates are allowing brands to meet both performance and sustainability goals. Several packaging converters are now offering plastic laminate tubes with up to 60-70% post-consumer recycled content (PCR), accelerating circular packaging initiatives. As the market moves toward lightweight, squeezable formats that balance shelf appeal with environmental compliance, plastic-based laminate tubes will remain the mainstream choice across fast-moving consumer goods (FMCG) categories.

The beauty and personal care segment is projected to lead the end-use industry category, accounting for a 41.1% share in 2025. This growth stems from the surging demand for hygienic, portable, and aesthetically designed primary packaging formats among skincare, haircare, and cosmeceutical brands.

Roll-up laminate tubes offer ideal characteristics for viscous creams, gels, and lotions combining barrier strength with ease of application and product evacuation. As consumers increasingly seek travel-friendly and hygienic dispensers, these tubes provide a tamper-evident, contamination-free packaging experience.

Major beauty brands are leveraging metallized finishes, direct-to-tube digital printing, and textured laminates to create shelf-distinctive packaging that aligns with premiumization trends. With the rise of e-commerce and influencer-led marketing, visual differentiation and tactile experience are crucial further cementing roll-up laminate tubes as the packaging format of choice in the beauty and personal care sector.

The 50 ml to 100 ml capacity segment is expected to account for the highest share of 38.2% in 2025 in the roll-up laminate tubes market. This capacity range strikes the ideal balance between portability and sufficient content volume, making it especially popular for personal care, oral care, and OTC pharmaceutical products. It aligns with mid-range SKU preferences in both mass-market and premium product portfolios, offering cost-effective packaging without compromising user convenience.

Brands increasingly favor this segment due to its compatibility with shelf-ready retail packaging, on-the-go consumer habits, and e-commerce shipping norms.

The single-layer laminate segment is projected to account for a 28.1% share in 2025 in the roll-up laminate tubes market. This dominance is driven by increasing demand for lightweight, cost-efficient tube constructions in high-volume applications such as toothpaste, hand creams, and everyday skincare products. Single-layer laminates offer sufficient barrier protection for non-reactive or short-shelf-life formulations while reducing material complexity and overall packaging weight.

Manufacturers benefit from simplified production workflows, faster line speeds, and reduced lamination costs. These tubes also appeal to brands focused on sustainability by enabling easier recyclability due to their mono-material nature.

Lamination bonding complexities and recycling incompatibility restrain growth, even as demand rises in cosmetics, oral care, and pharmaceuticals for lightweight, hygienic, and brand-friendly packaging formats with controlled dispensing and extended shelf life.

Convenient Dispensing and Branding Demand in Personal and Oral Care

Roll-up laminate tubes are increasingly favored in personal care, oral hygiene, and over-the-counter pharmaceutical products due to their flexible form, ease of dispensing, and efficient product evacuation. Their ability to retain shape while collapsing as content is squeezed offers a mess-free and consumer-friendly experience.

The laminated structure, often consisting of plastic and aluminum layers, provides excellent barrier properties against moisture, oxygen, and light extending product shelf life. Their smooth printable surface supports high-quality graphics, making them suitable for competitive retail environments. As brands seek innovative and premium-looking packaging formats that maintain functionality, roll-up laminate tubes provide the ideal balance of aesthetics, protection, and user convenience.

Material Incompatibility with Recycling and Production Constraints

Despite their widespread use, roll-up laminate tubes face key challenges in sustainability and production scalability. Their multilayer construction typically involving combinations of polyethylene, ethylene vinyl alcohol (EVOH), and aluminum renders them difficult to recycle through standard municipal systems. Separation of layers is technically demanding, limiting circularity. Forming these tubes requires specialized sealing and lamination equipment, adding to capital investment and operational complexity. Any delamination during storage or transit can compromise both product integrity and brand perception. These factors raise concerns for companies seeking packaging that meets both environmental goals and mass-market manufacturing efficiency.

Mono-material Transition and Light Weighting Innovations Leading the Way

One of the most prominent trends in the roll-up laminate tubes market is the shift toward recyclable mono-material structures, especially those based on high-barrier polyethylene or polypropylene. This material simplification is aimed at enhancing recyclability while maintaining protective performance.

In tandem, light weighting strategies are being employed to reduce material consumption without compromising tube strength or functionality. Tube manufacturers are adopting digital printing and tactile finishes to improve customization and shelf appeal. As sustainability regulations tighten and brands face scrutiny over packaging waste, roll-up laminate tubes are being redesigned to deliver on environmental promises without sacrificing consumer experience or product protection.

The global roll-up laminate tubes market is demonstrating stable growth, fueled by increasing demand for barrier-protected, collapsible packaging in oral care, cosmetics, pharmaceuticals, and food paste applications. With sustainability and shelf-life optimization as dual priorities, brands are transitioning from rigid plastic to laminate structures that combine recyclability with protection.

The United States and China lead global expansion due to high-volume demand across toothpaste, dermo-cosmetic, and ointment packaging. Europe, including Germany, the UK and France, reflects moderate growth, as sustainability and mono-material compliance shape packaging choices. Japan and South Korea are adapting laminate technology to meet minimalistic design and hygiene needs, while India shows strong growth in price-sensitive segments through cost-effective laminated alternatives.

The roll-up laminate tubes market in the United States is forecast to grow at a CAGR of 5.9% between 2025 to 2035. High-volume categories like toothpaste, over-the-counter topicals, and specialty food spreads are embracing recyclable laminate solutions for their lightweight, collapsible, and brand-friendly printability. The shift toward PCR (post-consumer recycled) laminates and mono-materials is also driving innovation across mainstream and premium segments.

The roll-up laminate tubes market in the United Kingdom is expected to grow at a CAGR of 1.6%, driven by eco-friendly personal care packaging and regulatory incentives for recyclable mono-material formats. British brands are gradually adopting laminate tubes in premium oral care and dermatology applications. Rigid plastics and aluminum tubes still hold significant market share in mass-market segments.

India’s roll-up laminate tubes market is forecast to grow at a CAGR of 4.1%, driven by demand for lightweight, tamper-resistant packaging across ayurvedic pastes, topical medications, and herbal creams. Cost-effective multi-layer laminate structures are increasingly preferred over rigid tubes in both rural and urban retail. Domestic converters are scaling up digital print capabilities to support local D2C skincare and health brands.

The roll-up laminate tubes market in China is projected to grow at a CAGR of 5.5%, backed by widespread use in cosmetics, toothpaste, and fast-moving OTC pharmaceutical products. With consumers demanding hygienic, resealable, and aesthetically pleasing packaging, laminate tubes are replacing aluminum and rigid formats. Local OEMs are heavily investing in mono-material laminates to meet national sustainability goals.

Germany’s roll-up laminate tubes market is expected to grow at a CAGR of 2.5%, with emphasis on pharma-grade and eco-certified packaging. German brands are transitioning toward mono-material laminate tubes with HDPE layers to comply with EU recycling targets. Functional product categories such as anti-inflammatory gels, medicated creams, and baby-care items are increasingly packaged in barrier laminate tubes for precision dispensing.

The roll-up laminate tubes market in Japan is projected to grow at a CAGR of 2.9%, driven by demand for clean, compact, and portable dispensing formats. Japanese consumers favor slim, travel-friendly tubes for skincare, medicated creams, and food pastes. Manufacturers are focusing on low-friction, anti-contamination tube formats with premium closures. Laminate tubes offering precision dosing and minimal residue are gaining preference in clinical and cosmeceutical channels.

The roll-up laminate tubes market in South Korea is projected to grow at a CAGR of 2.4%, supported by growing acceptance in K-beauty, oral care, and functional food sectors. As packaging shifts toward recyclable, airless, and easy-to-use formats, laminate tubes are being adopted for formulation-sensitive creams and concentrated gels. Social media-driven product aesthetics and ease-of-use are key to format innovation in this market.

The roll-up laminate tubes market is moderately fragmented, with global converters, specialty laminate developers, and private-label suppliers competing across personal care, oral care, pharmaceuticals, and industrial paste applications.

Global leaders such as EPL Europe, ALLTUB, and Tokan Kogyo Co., Ltd. hold significant market share, driven by multi-layer laminate innovations, high-barrier properties, and automated tube-forming lines. Their strategies increasingly emphasize sustainability upgrades, aluminum-free laminate structures, and decoration flexibility for high-SKU categories like toothpaste, topical creams, and food gels.

Established mid-sized players, including Tubapack, Pack-Tubes, and Erich Müller, address the demand for customizable roll-up tubes with enhanced printing options, puncture resistance, and hybrid barrier layers (e.g., EVOH + PET). These firms cater to mid-volume personal care, nutraceutical, and veterinary brands seeking cost-effective packaging with aesthetic appeal and collapsibility for viscous products.

Specialized providers such as, Global Pack Source, Pactek Industries, and Paramount Tube focus on low-to-medium batch laminate tubes for niche applications like adhesives, semi-pharma, and industrial lubricants. Their competitive strength lies in short lead times, prototyping services, and adaptability to specialty diameters and nozzle configurations.

Competitive differentiation is shifting away from standard foil-based laminates toward mono-material recyclable formats, digitally printed surfaces, and integrated dispensing closures that enhance consumer convenience, product protection, and compliance with circular economy packaging mandates

Key Development of Roll-up Laminate Tubes Market

| Item | Value |

|---|---|

| Quantitative Units | USD 1.7 billion |

| Material | Plastic based Laminates and Aluminium based Laminates |

| Capacity | Less than 50 ml, 50-100 ml, 101-150 ml and 150+ ml |

| Layer | Single Layer and Multi-layer Laminate |

| End-use Application | Healthcare, Beauty and Personal Care, Food Nutrition, Household and Industrial |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Korea |

| Key Companies Profiled | All Tub, Paramount Tube, Essel Propack, Erich Muller |

| Additional Attributes | Market segmentation by product, material, layer, end-use application, packaging format and design analysis, pricing analysis, customer identification, competitive analysis, trade data and regulations |

The global roll-up laminate tubes market is estimated to be valued at USD 1.7 billion in 2025.

The market size for the roll-up laminate tubes market is projected to reach USD 2.2 billion by 2035.

The roll-up laminate tubes market is expected to grow at a 2.5% CAGR between 2025 and 2035.

The key product types in the roll-up laminate tubes market include ABL (Aluminum Barrier Laminate) tubes, PBL (Plastic Barrier Laminate) tubes, and eco-friendly laminate tubes.

In terms of material, the plastic-based laminates segment is expected to command the highest share of 64.1% in the roll-up laminate tubes market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Laminated Busbar Market Forecast and Outlook 2025 to 2035

Laminated Glass Market Size and Share Forecast Outlook 2025 to 2035

Laminated Labels Market Size and Share Forecast Outlook 2025 to 2035

Laminated Woven PP Bags Market

Laminated Tubes Market Size and Share Forecast Outlook 2025 to 2035

Laminated Tube Closure Market from 2025 to 2035

Market Share Breakdown of Laminated Tubes Manufacturers

U.S. Laminated Tube Market Trends & Demand Forecast 2024-2034

Lid Laminates Market Size and Share Forecast Outlook 2025 to 2035

BOPP Laminated Woven Sacks Market Size and Share Forecast Outlook 2025 to 2035

Foil Laminates Market Size and Share Forecast Outlook 2025 to 2035

Poly Laminate Capsules Market Insights - Growth & Forecast 2025 to 2035

Silk Laminated Paper Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Market Positioning & Share in the Foil Laminates Sector

Litho Laminated Cartons Market Size and Share Forecast Outlook 2025 to 2035

Litho Laminated Packaging Market from 2025 to 2035

Cross Laminated Timber Market

Elastic Laminate Market Size and Share Forecast Outlook 2025 to 2035

Competitive Overview of Elastic Laminate Companies

USA Flexible Laminated Paper Market Growth – Trends & Forecast 2024-2034

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA