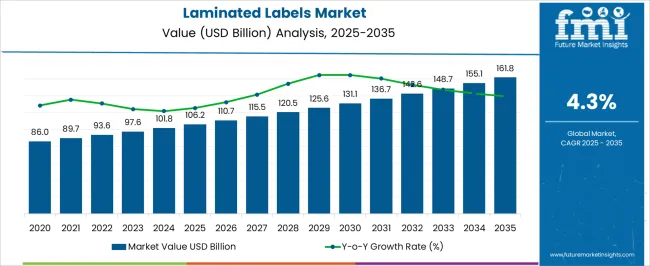

The Laminated Labels Market is estimated to be valued at USD 106.2 billion in 2025 and is projected to reach USD 161.8 billion by 2035, registering a compound annual growth rate (CAGR) of 4.3% over the forecast period. The laminated labels market is expected to grow steadily and consistently, rising from USD 86.0 billion in 2020 to about USD 161.8 billion by 2035. This steady growth is driven by increasing demand for durable, high-quality labeling solutions across industries, including food and beverage, pharmaceuticals, logistics, and consumer goods. Between 2020 and 2025, the market expands from USD 86.0 billion to USD 106.2 billion, fueled by product differentiation, branding requirements, and regulatory mandates requiring clear, long-lasting labels.

The growth is further supported by rising packaged goods production and the expansion of e-commerce. From 2026 to 2030, the market continues its upward trend, increasing from USD 110.7 billion to USD 131.1 billion. This period benefits from advances in label materials, printing technologies, and the adoption of smart labeling systems such as QR codes and RFID for improved tracking, authentication, and customer interaction.

Between 2031 and 2035, growth accelerates with the market reaching USD 161.8 billion, driven by expanding adoption in emerging economies due to urbanization and retail modernization, alongside demand for sustainable and eco-friendly materials that comply with environmental regulations.

Technological progress in digital printing and heightened focus on product safety and traceability further propel this expansion. Overall, the laminated labels market demonstrates resilient, sustained growth supported by evolving consumer needs, regulatory requirements, and continuous innovation in labeling technologies.

| Metric | Value |

|---|---|

| Laminated Labels Market Estimated Value in (2025 E) | USD 106.2 billion |

| Laminated Labels Market Forecast Value in (2035 F) | USD 161.8 billion |

| Forecast CAGR (2025 to 2035) | 4.3% |

Emphasis on branding, compliance labeling, and product traceability has fueled innovation in both material composition and printing technologies. With regulations tightening around labeling accuracy and sustainability, brands are increasingly investing in pressure-sensitive, laminated solutions that offer extended shelf life and visual appeal. Developments in digital printing, RFID tagging, and recyclable label laminates are reshaping procurement priorities, with converters adopting eco-conscious substrates and low-VOC adhesives.

Furthermore, supply chain digitization and the rise of e-commerce packaging are boosting the requirement for scuff- and water-resistant labels that maintain performance through handling and transit. The market outlook remains positive, with value creation expected through high-speed labeling systems, smart label integration, and the adoption of mono-material packaging strategies.

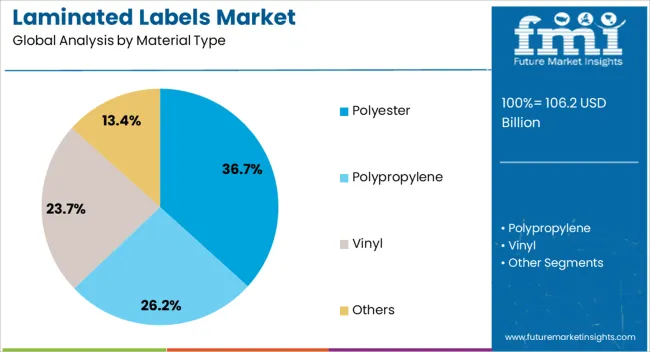

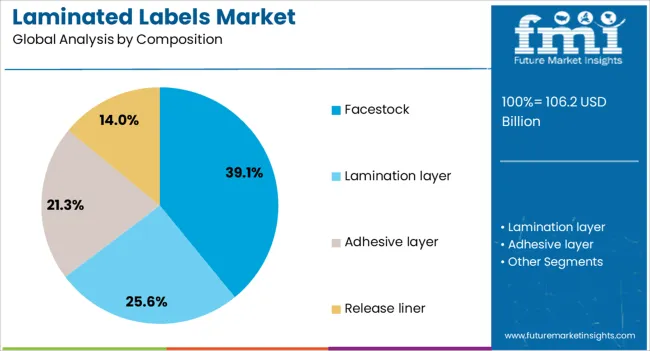

The laminated labels market is segmented by material type, composition, end-use industry, and geographic regions. The laminated labels market is divided by material type into Polyester, Polypropylene, Vinyl, and Others. The laminated labels market is composed of Facestock, Lamination layer, Adhesive layer, and Release liner.

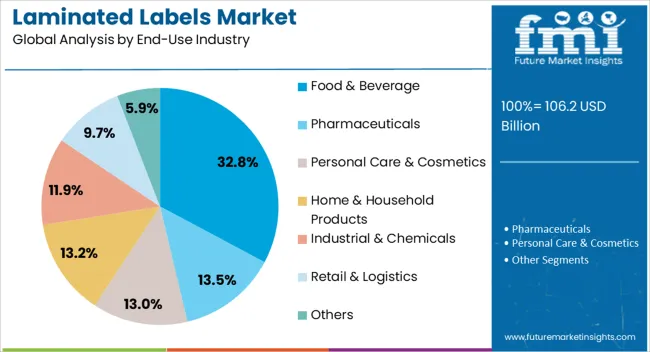

The laminated labels market is segmented by end-use industry into Food & Beverage, Pharmaceuticals, Personal Care & Cosmetics, Home & Household Products, Industrial & Chemicals, Retail & Logistics, and Others. Regionally, the laminated labels industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Polyester is projected to account for 36.70% of the laminated labels market revenue by 2025, making it the leading material type. Its dominance is being driven by exceptional durability, tensile strength, and chemical resistance, which are crucial for labels exposed to harsh or variable environments.

Polyester substrates offer superior print receptivity and dimensional stability, which ensures consistent barcode scannability and brand clarity throughout product lifecycles. Their compatibility with high-speed printing processes and resistance to UV, moisture, and abrasion make them particularly suited for industrial, pharmaceutical, and refrigerated applications.

Additionally, the growing use of polyester in returnable transport packaging and safety labeling continues to support its top position within the material category.

Facestock is expected to contribute 39.10% of total laminated label revenues in 2025, making it the dominant composition segment. This is being supported by its critical role as the printable surface that defines label performance, clarity, and durability.

High-grade facestock materials ensure ink adhesion, resist environmental wear, and support a range of finishes, including gloss, matte, and textured coatings. The segment's growth is further propelled by innovation in recyclable and compostable substrates that meet both regulatory requirements and brand sustainability targets.

As brands demand enhanced label aesthetics and resilience without compromising recyclability, facestock materials are evolving to incorporate bio-based fibers and low-migration chemistries, reinforcing their central role in next-generation laminated label solutions.

The food and beverage sector is projected to capture 32.80% of the laminated labels market revenue in 2025, making it the leading end-use industry. Growth in this segment is being driven by the industry's stringent compliance requirements for safety, freshness indication, and traceability.

Laminated labels are favored for their resistance to moisture, oil, and temperature fluctuations-conditions frequently encountered across food packaging lines and cold-chain logistics. The need for tamper-evident sealing, smart labeling for product authentication, and improved shelf appeal has led to increased adoption of laminated solutions.

Additionally, the rise of premium, ready-to-eat, and organic food segments has created new demand for high-quality label materials that communicate value and transparency, strengthening the segment’s leadership position.

The laminated labels market is driven by rising demand in packaging, eco-friendly solutions, competitive dynamics, and raw material price fluctuations. Growth remains strong due to the increasing need for durable and attractive packaging across industries.

The laminated labels market is benefiting from increasing demand across various packaging sectors, particularly in food and beverage, pharmaceuticals, and cosmetics. With packaging playing a vital role in product branding, laminated labels are favored for their durability and high-quality finish. These labels are essential for ensuring product integrity, especially for goods exposed to moisture, temperature fluctuations, or rough handling. The demand for premium packaging with attractive designs and functionality continues to drive growth in the laminated labels market. Additionally, the expansion of e-commerce has further amplified the need for durable, visually appealing labels that help products stand out on retail platforms.

The laminated labels market is witnessing a shift towards environmentally friendly materials as industries seek to meet consumer preferences and comply with regulatory requirements. Consumers are increasingly favoring packaging options that are recyclable or use biodegradable materials. This trend is prompting manufacturers to explore and implement sustainable solutions such as water-based adhesives, recyclable films, and biodegradable substrates for laminated labels. In response to this demand, label producers are adopting eco-conscious practices while maintaining the durability and quality required for packaging solutions. The rise of sustainable packaging options is expected to play a critical role in shaping the laminated labels market in the coming years.

The laminated labels market is characterized by intense competition, with both global and regional players vying for market share. Key manufacturers are focusing on enhancing their product portfolios through mergers, acquisitions, and strategic partnerships to broaden their geographic reach and technological capabilities. Companies are also investing in improving operational efficiency and production capacity to meet the growing demand for high-quality labels across various industries. Additionally, regional players are increasingly consolidating to expand their market presence and enhance their competitiveness by offering customized solutions tailored to specific market needs. These dynamics are expected to shape the competitive landscape and fuel industry consolidation.

Price volatility in raw materials such as paper, plastic, and adhesive components poses challenges to the laminated labels market. Manufacturers face rising costs for high-quality materials due to fluctuations in supply and demand, as well as geopolitical factors. This results in margin pressures and may lead to higher production costs, which could be passed on to consumers. To mitigate this impact, companies are exploring alternative materials and optimizing production processes to reduce costs. Despite these challenges, the market’s overall growth potential remains intact due to continued demand across various sectors for laminated labels that offer enhanced durability and visual appeal.

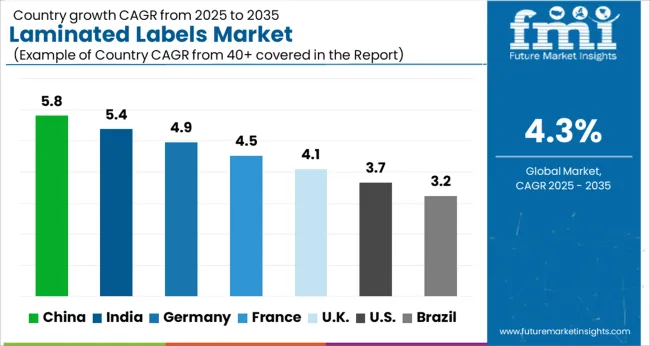

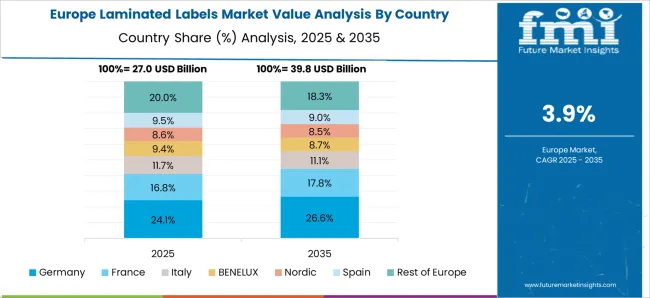

The laminated labels market is projected to grow globally at a CAGR of 4.3% from 2025 to 2035, driven by the increasing demand for high-quality packaging, convenience, and product branding. China leads with a CAGR of 5.8%, fueled by rapid industrialization, growing e-commerce, and a strong demand for packaging across various sectors, including food, beverages, and consumer goods. India follows with a CAGR of 5.4%, supported by the rise in packaged goods consumption, an expanding retail sector, and a growing focus on sustainable and premium packaging solutions.

France grows at 4.5%, benefiting from strong demand in the automotive, food, and beverage industries, alongside increased investments in eco-friendly and durable packaging solutions. The United Kingdom grows at 4.1%, driven by demand for advanced labeling in the packaging sector, while the United States records a CAGR of 3.7%, supported by steady demand from food, healthcare, and consumer products markets. This growth trajectory highlights the continued significance of laminated labels in product packaging, with an increasing focus on sustainability, quality, and consumer branding across regions.

The UK’s laminated labels market grew at a CAGR of 3.4% from 2020 to 2024 and is expected to rise to 4.1% during 2025-2035. The growth rate from 2020 to 2024 was moderate, as the demand for laminated labels was steady across sectors like packaging and consumer goods. The market is expected to accelerate in the next decade due to rising demand for more sustainable packaging solutions, as well as growing demand from the food, beverage, and healthcare industries. The shift toward eco-friendly, recyclable materials and innovations in label printing technology will also boost the demand for laminated labels in the UK. As industries adopt more premium packaging solutions, the market for laminated labels is likely to experience a significant rise.

China’s laminated labels market is projected to grow at a CAGR of 5.8% during 2025-2035, higher than the global average of 4.3%. The market grew at a CAGR of 5.0% from 2020 to 2024, driven by rapid industrialization, growing demand for packaged goods, and expanding e-commerce platforms. The significant rise in the coming decade is expected to be fueled by China’s increasing focus on product branding, consumer goods packaging, and a shift toward high-quality, durable labeling solutions. The demand for laminated labels will also be supported by technological advancements in label printing and the increased importance of sustainable packaging solutions in the country’s regulatory framework.

India’s laminated labels market is expected to grow at a CAGR of 5.4% from 2025 to 2035, exceeding the global average of 4.3%. The market grew at a CAGR of 4.8% during 2020-2024, fueled by the expanding retail sector, increasing demand for packaged goods, and the rise of organized retail chains. The growth rate is expected to accelerate in the coming decade due to a greater focus on packaging aesthetics, brand recognition, and the demand for sustainable labeling solutions. As consumer preferences for eco-friendly packaging continue to rise, India will see a shift toward the adoption of laminated labels that meet both environmental and branding needs.

France’s laminated labels market is expected to grow at a CAGR of 4.5% from 2025 to 2035. The market grew at a CAGR of 4.2% during 2020-2024, supported by strong demand in the food, beverage, and healthcare packaging sectors. In the next decade, the market will likely accelerate due to the growing importance of sustainable and eco-friendly packaging solutions in line with EU regulations. France’s shift toward more premium, branded packaging and a push for more durable, high-quality labels in the retail and luxury goods sectors will drive demand for laminated labels. Increased adoption of digital and flexographic printing technologies will further boost the market.

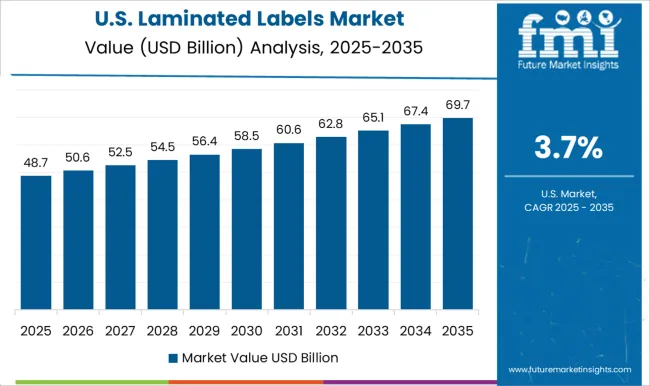

The USA laminated labels market is projected to grow at a CAGR of 3.7% during 2025-2035. The market grew at a CAGR of 3.2% from 2020 to 2024, driven by demand from consumer goods, food, beverage, and pharmaceutical sectors. While the market has grown steadily, the rise in the next decade will be driven by the increasing preference for high-quality, durable, and aesthetically appealing packaging solutions. As consumer demand for sustainable products rises, the adoption of eco-friendly laminated labels will increase, especially with the introduction of recyclable, biodegradable label materials. Furthermore, technological innovations in printing and enhanced labeling techniques will further fuel demand.

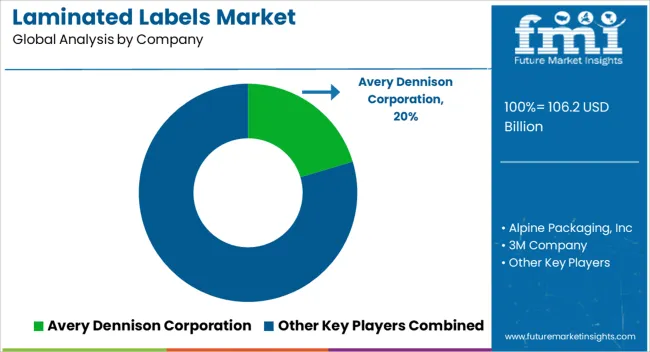

The laminated labels market is dominated by global packaging solution providers such as Avery Dennison Corporation, 3M Company, CCL Industries Inc., Henkel Adhesives Technologies India Pvt Ltd, and Mondi, with several regional players such as Alpine Packaging, Inc., Flexcon Company, Inc., Lintec Corporation, and Stickythings Limited also holding strong positions.

These companies compete based on their ability to deliver high-performance labels, customization capabilities, and sustainable packaging solutions. Avery Dennison is known for its vast portfolio of pressure-sensitive products and innovative adhesive technologies, while 3M leverages its advanced material science to offer durable, high-quality laminated labels.

CCL Industries is recognized for its diversified label solutions catering to a wide range of end-use industries, including food and beverage, consumer goods, and pharmaceuticals. Henkel Adhesives Technologies emphasizes superior adhesive technologies, focusing on the performance of its laminated labels for specialized applications. Lintec Corporation has built a strong presence by providing high-performance labels for industrial, automotive, and electronics sectors, while Alpine Packaging and Flexcon Company focus on providing tailored, cost-effective solutions for niche markets.

Mondi, with its expertise in sustainable packaging, is driving the adoption of eco-friendly laminated labels. Stickythings Limited has carved out a niche by offering highly customizable and unique label designs, catering to creative and branding-driven industries. The competitive dynamics are influenced by the growing demand for high-quality, durable labels, innovations in printing technology, and a focus on eco-conscious materials.

Strategic priorities include enhancing production capabilities, investing in digital printing technologies, and expanding sustainability initiatives. Companies are also focusing on regional expansion and forming partnerships to meet the growing demand for customized, premium laminated labels in emerging markets.

A renowned innovator in high-performance materials, 3M offers durable laminated labels engineered for chemical resistance, extreme environments, and industrial use—all backed by strong R&D. UK-based provider of custom laminated labels known for digital printing finesse, durability, and customer-friendly, eco-focused offerings.

| Item | Value |

|---|---|

| Quantitative Units | USD 106.2 Billion |

| Material Type | Polyester, Polypropylene, Vinyl, and Others |

| Composition | Facestock, Lamination layer, Adhesive layer, and Release liner |

| End-Use Industry | Food & Beverage, Pharmaceuticals, Personal Care & Cosmetics, Home & Household Products, Industrial & Chemicals, Retail & Logistics, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Avery Dennison Corporation, Alpine Packaging, Inc, 3M Company, CCL Industries Inc., Flexcon Company, Inc., Henkel Adhesives Technologies India Pvt Ltd, Lintec Corporation, Mondi, and Stickythings Limited |

| Additional Attributes | Dollar sales projections, market share by material type, application, and region, key growth drivers in packaging sectors, emerging demand trends in eco-friendly labels, and the competitive landscape with key player strategies. |

The global laminated labels market is estimated to be valued at USD 106.2 billion in 2025.

The market size for the laminated labels market is projected to reach USD 161.8 billion by 2035.

The laminated labels market is expected to grow at a 4.3% CAGR between 2025 and 2035.

The key product types in laminated labels market are polyester, polypropylene, vinyl and others.

In terms of composition, facestock segment to command 39.1% share in the laminated labels market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Laminated Tubes Market Size and Share Forecast Outlook 2025 to 2035

Laminated Glass Market Size and Share Forecast Outlook 2025 to 2035

Laminated Tube Closure Market from 2025 to 2035

Market Share Breakdown of Laminated Tubes Manufacturers

U.S. Laminated Tube Market Trends & Demand Forecast 2024-2034

Laminated Busbar Market Growth – Trends & Forecast 2024-2034

Laminated Woven PP Bags Market

Silk Laminated Paper Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Litho Laminated Cartons Market Size and Share Forecast Outlook 2025 to 2035

Litho Laminated Packaging Market from 2025 to 2035

Cross Laminated Timber Market

USA Flexible Laminated Paper Market Growth – Trends & Forecast 2024-2034

Europe Flexible Laminated Paper Market Trends – Forecast 2024-2034

Aluminum Foil Laminated Paper Market

Labels Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Labels, Tapes And Films Market Size and Share Forecast Outlook 2025 to 2035

Competitive Overview of Labels Companies

USA Labels Market Size and Share Forecast Outlook 2025 to 2035

Market Share Distribution Among USA Labels Providers

Foam Labels Market Trends and Growth 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA