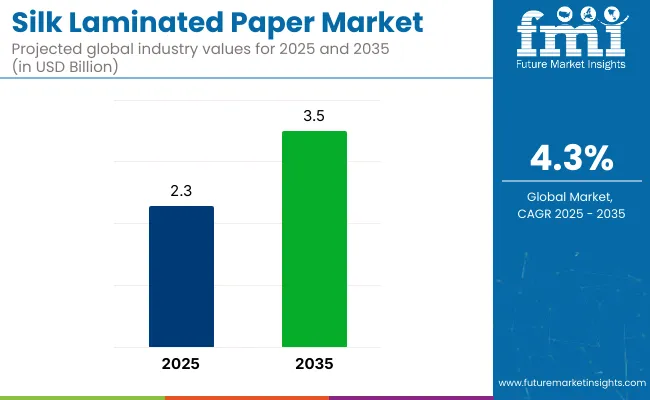

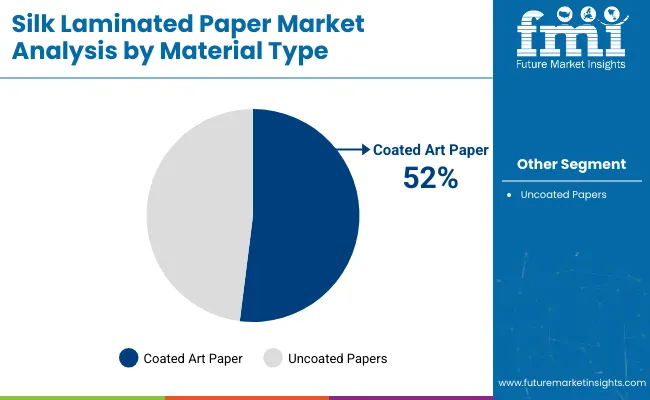

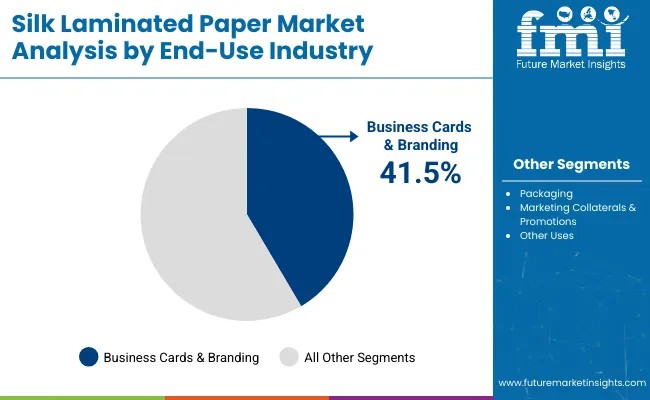

The silk laminated paper market is valued at USD 2.3 billion and is projected to reach USD 3.5 billion by 2035, growing at a CAGR of 4.3%. Coated art paper will continue to be the leading material, capturing 52% of the industry in 2025. The demand for laminated paper in business cards and branding will remain strong, accounting for 41.5% of total industry demand. As companies shift toward premium, durable, and eco-friendly materials for packaging and promotional materials, the silk laminated paper industry will experience steady growth.

The increasing use of silk laminated sheets in sectors like packaging and promotions will continue to support industry expansion, especially in emerging economies such as India and China, where the demand for high-quality, durable packaging solutions is rising. The focus on enhancing product aesthetics and the rise in brand-conscious consumer behavior will also contribute to the continued growth of the industry.

The industry is driven by coated art paper in the material segment, business cards & branding in the end-use segment, and 200-300 gsm thickness for durability and premium feel. These segments are expected to maintain dominance, with steady growth supported by increasing demand for high-quality, visually appealing, and eco-friendly printed materials.

Coated art paper is expected to dominate the material segment in 2025, capturing 52% of the industry share. Known for its smooth finish and superior printability, coated art paper is widely used in premium packaging, business cards, and promotional materials.

Business cards and branding are expected to account for 41.5% of the silk laminated paper industry in 2025. As businesses seek premium, durable, and visually appealing materials to represent their brand, silk laminated paper continues to be a popular choice for business cards and marketing collateral.

The 200-300 gsm thickness segment will hold the largest share in the silk laminated paper industry, representing 45% in 2025. This thickness range is preferred for applications such as business cards, promotional materials, and packaging, where durability and a premium feel are essential.

The industry is driven by the increasing demand for premium, eco-conscious products, particularly in business cards, branding, and packaging. However, raw material price fluctuations present challenges for manufacturers. As eco-responsibility and eco-friendly production become key trends, these dynamics will shape the industry's growth over the coming years.

Rising demand for premium and eco-conscious paper solutions

The demand for silk laminated paper is growing as businesses and consumers increasingly prefer high-quality, eco-conscious products for branding and packaging. Coated art paper and premium finishes are especially in demand for business cards, marketing materials, and promotional packaging. As eco-responsibility becomes a growing priority for industries, manufacturers are turning to eco-friendly production methods to meet industry expectations. This shift toward premium and eco-conscious materials is driving industry growth across key regions.

Raw material price fluctuations are affecting growth

Fluctuations in raw material prices, especially for coated art paper and specialty finishes, are posing challenges to manufacturers in the industry. These price changes can impact production costs, affecting the profitability of manufacturers. As the demand for eco-friendly materials rises, companies must navigate these price fluctuations while meeting customer expectations for premium quality. Managing raw material costs will be crucial for maintaining profitability and competitiveness in the industry.

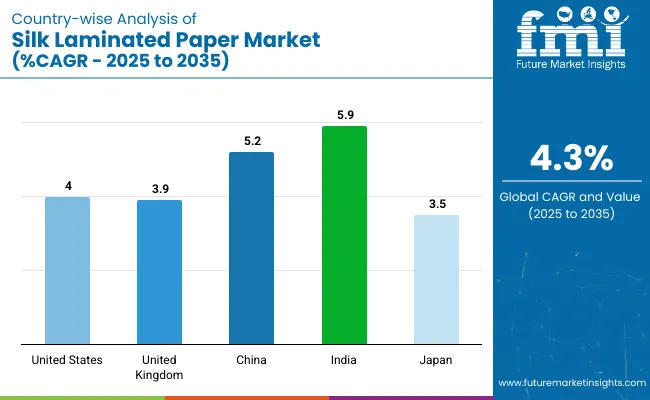

The industry is growing steadily across the United States, the United Kingdom, China, India, and Japan, driven by strong demand in business cards, branding, and premium packaging. Coated art paper remains the dominant material, and eco-responsibility trends are supporting industry expansion. China and India are expected to experience the fastest growth, driven by increasing industrial demand.

| Countries | CAGR (2025 to 2035) |

|---|---|

| United States | 4% |

| United Kingdom | 3.9% |

| China | 5.2% |

| India | 5.9% |

| Japan | 3.5% |

The industry in the United States is expected to grow at a CAGR of 4%, supported by continued demand from marketing, packaging, and branding sectors. The USA is the largest industry for silk laminated paper, with a growing demand for premium materials used in business cards, branding, and promotional materials.

With a CAGR of 3.9%, the industry in United Kingdom is expected to continue expanding, fueled by increasing demand for premium business cards, branded marketing materials, and eco-conscious packaging solutions in various industries. The UK is experiencing steady growth in the industry, driven by demand from the premium packaging, marketing, and promotional materials sectors.

With a projected CAGR of 5.2%, China’s industry is expected to maintain strong growth, particularly in the packaging and branding sectors, as the demand for high-quality, durable paper increases across multiple industries.

Companies like Omkar Paper are tapping into the growing industry by offering eco-conscious, high-quality options. India is projected to grow at a CAGR of 5.9%, with increased demand from the agriculture, manufacturing, and retail sectors. India’s silk laminated paper industry is expected to grow rapidly, driven by the rising demand for premium materials in business cards, packaging, and promotional products.

With a projected CAGR of 3.5%, Japan’s industry is expected to continue expanding, driven by both local demand for premium products and increasing export opportunities in the Asia-Pacific region.Japan is seeing steady demand for silk laminated paper, especially for premium materials used in business cards, branding, and promotional items.

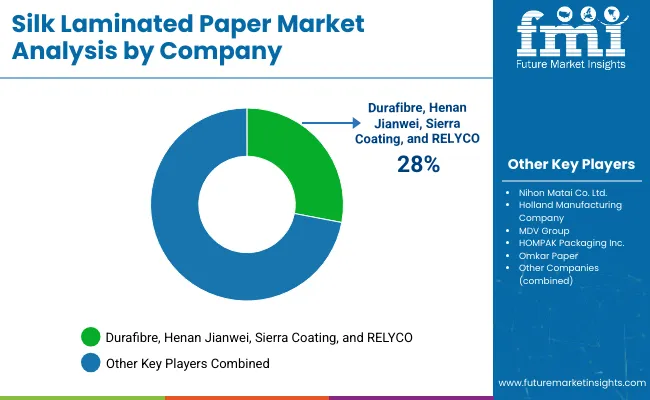

The industry is characterized by a mix of leading suppliers and emerging players who focus on enhancing product offerings through innovation and strategic initiatives. Key players such as Laminate Technologies, Tekra, and Arkwright Advanced Coating, Inc. are leveraging advanced R&D to introduce new and improved products.

These companies are heavily investing in creating eco-friendly and green solutions, responding to increasing consumer demand for environmentally responsible packaging. For instance, Dura-Fibre, LLC. Focuses on providing high-quality laminated papers with a strong emphasis on performance and durability. New product launches and continuous technological advancements are key strategies driving their position.

The market is fragmented, with numerous small and medium-sized enterprises entering the space, although consolidation is visible with some mergers and acquisitions. Entry barriers include significant capital investment in research, production, and technology, making it challenging for new entrants. However, as companies continue to innovate and cater to diverse industry needs, the competitive landscape remains dynamic and growth-oriented.

Recent Industry News

The industry has been witnessing a shift towards eco-responsibility and innovation. Companies are increasingly focusing on developing eco-friendly materials and enhancing the durability and aesthetics of their products. For instance, advancements in coating technologies have led to the creation of silk laminated papers that are not only visually appealing but also resistant to wear and environmental factors.

Additionally, the demand for premium packaging solutions has driven the adoption of silk laminated paper in various applications, including business cards, promotional materials, and packaging. These trends indicate a growing emphasis on quality, eco-responsibility, and functionality in the industry.

| Report Attributes | Details |

|---|---|

| Current Total Industry Size (2025) | USD 2.3 billion |

| Projected Industry Size (2035) | USD 3.5 billion |

| CAGR (2025 to 2035) | 4.3% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD billion for value and thousand tons for volume |

| Material Types Analyzed | Coated Art Paper, Uncoated Papers |

| End-Use Segmentation | Business Cards & Branding, Packaging, Market ing Collaterals & Promotions, Other Uses |

| Thickness Segmentation | 200 - 300 gsm, 300 - 400 gsm, Above 400 gsm |

| Regions Covered | North America, Europe, Asia Pacific, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Mexico, Brazil, Argentina, Germany, France, United Kingdom, Italy, Spain, Netherlands, China, India, Japan, South Korea, Australia, New Zealand, GCC Countries, South Africa |

| Key Players Influencing the Industry | Laminate Technologies, Tekra, Arkwright Advanced Coating, Inc., Dura-Fibre, LLC., Multiplastics Limited, LGR Packaging, Lam Pro, Inc., Bell Laminates, Specialty Laminates, and D&K Group. |

| Additional Attributes | Dollar sales by material type, end-use, and thickness, growing demand in premium packaging applications, adoption in ecofriendly and eco-friendly packaging trends, regional differences in silk laminated paper adoption, innovation in design and functionality in market ing collaterals. |

The industry is segmented into coated art paper and uncoated papers.

The industry is segmented into business cards & branding, packaging, marketing collaterals & promotions, and other uses.

The industry is segmented into 200-300 gsm, 300-400 gsm, and above 400 gsm.

The industry is segmented into North America, Europe, Asia Pacific, Latin America, and Middle East & Africa.

The global industry is projected to reach USD 3.5 billion by 2035.

The industry is expected to be valued at USD 2.3 billion in 2025.

Coated art paper is expected to dominate the material segment, accounting for 52% of the industry share in 2025.

Business cards & branding will hold the largest share, accounting for 41.5% of the industry demand in 2025.

The 200-300 gsm thickness segment will dominate, holding 45% of the industry share in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Silk Market Size and Share Forecast Outlook 2025 to 2035

Silky Matte Film Market Size and Share Forecast Outlook 2025 to 2035

Silk Protein Market Analysis - Sericin & Fibroin Forecast 2024-2034

Spider Silk Fibers Market Size and Share Forecast Outlook 2025 to 2035

Spider Silk Fabric Market Size and Share Forecast Outlook 2025 to 2035

Mimetic Silk Protein Formulas Market Size and Share Forecast Outlook 2025 to 2035

Hydrolyzed Silk Proteins Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Synthetic Spider Silk Proteins Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Laminated Busbar Market Forecast and Outlook 2025 to 2035

Laminated Tubes Market Size and Share Forecast Outlook 2025 to 2035

Laminated Glass Market Size and Share Forecast Outlook 2025 to 2035

Laminated Labels Market Size and Share Forecast Outlook 2025 to 2035

Laminated Tube Closure Market from 2025 to 2035

Market Share Breakdown of Laminated Tubes Manufacturers

U.S. Laminated Tube Market Trends & Demand Forecast 2024-2034

Laminated Woven PP Bags Market

BOPP Laminated Woven Sacks Market Size and Share Forecast Outlook 2025 to 2035

Litho Laminated Cartons Market Size and Share Forecast Outlook 2025 to 2035

Litho Laminated Packaging Market from 2025 to 2035

Cross Laminated Timber Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA