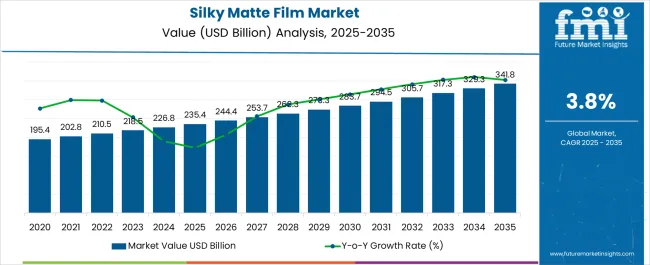

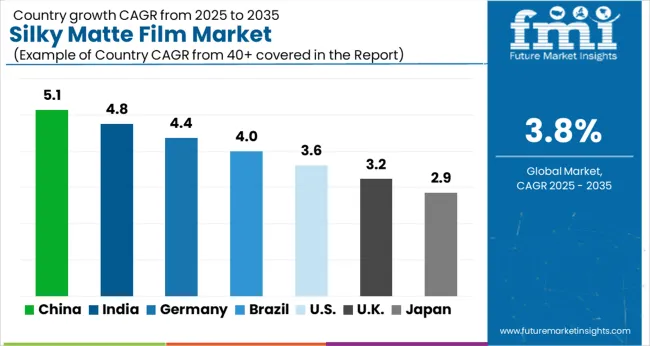

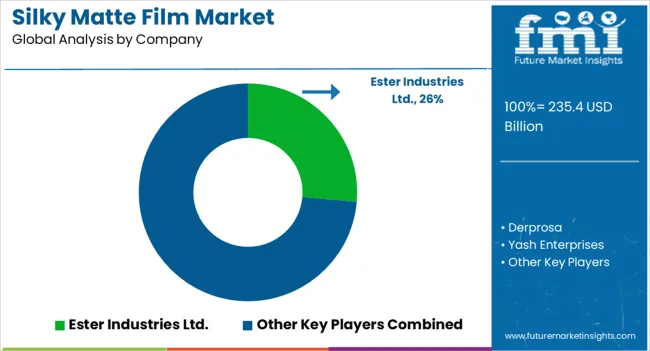

The Silky Matte Film Market is estimated to be valued at USD 235.4 billion in 2025 and is projected to reach USD 341.8 billion by 2035, registering a compound annual growth rate (CAGR) of 3.8% over the forecast period.

| Metric | Value |

|---|---|

| Silky Matte Film Market Estimated Value in (2025 E) | USD 235.4 billion |

| Silky Matte Film Market Forecast Value in (2035 F) | USD 341.8 billion |

| Forecast CAGR (2025 to 2035) | 3.8% |

The silky matte film market is witnessing strong growth momentum as industries increasingly emphasize premium packaging aesthetics, sustainability, and consumer engagement. Demand is being fueled by the rising use of matte finishes to enhance brand visibility, reduce glare, and create a luxurious appearance across food, beverage, personal care, and luxury goods.

Advancements in polymer science and coating technologies are enabling higher durability, printability, and compatibility with sustainable substrates, thereby widening application scope. Regulatory focus on recyclable and eco friendly materials is further accelerating adoption, particularly in food and beverage packaging where visual appeal and shelf impact are critical.

With continued investment in high performance laminates and digitally printable films, the market outlook remains positive, supported by consumer preference for sophisticated packaging that combines both functionality and visual differentiation.

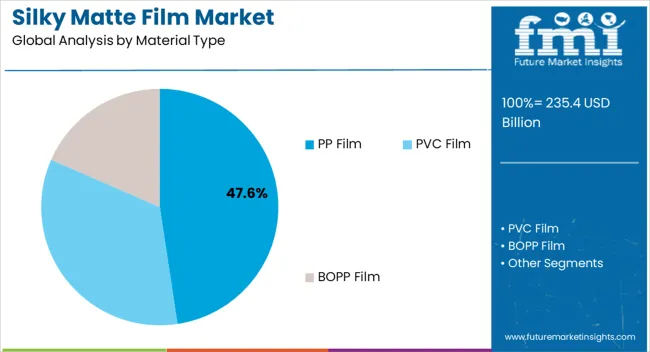

The PP film segment is expected to account for 47.60% of market revenue by 2025 within the material type category, positioning it as the leading segment. Its dominance is attributed to lightweight properties, cost efficiency, and excellent barrier performance against moisture and contaminants.

The versatility of PP film makes it widely adopted across packaging formats where both durability and flexibility are required. Furthermore, recyclability and compatibility with sustainable packaging initiatives have reinforced its growth.

As demand for eco friendly yet high performance packaging materials intensifies, PP film continues to secure its leadership position within the material type segment.

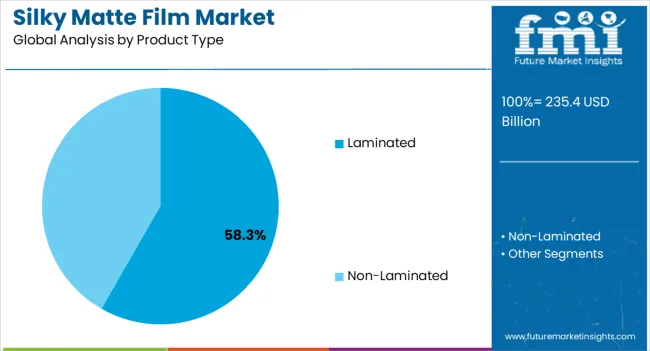

The laminated segment is projected to hold 58.30% of market revenue by 2025 under the product type category, making it the most significant contributor. Its growth is driven by superior protection, enhanced strength, and multipurpose functionality.

Laminated films provide durability during transportation, extend product shelf life, and allow advanced printing and branding opportunities. This has resulted in high preference across industries seeking packaging that balances safety, performance, and aesthetics.

With innovations in adhesive technologies and sustainable laminates, laminated films are increasingly preferred, solidifying their dominance in the product type category.

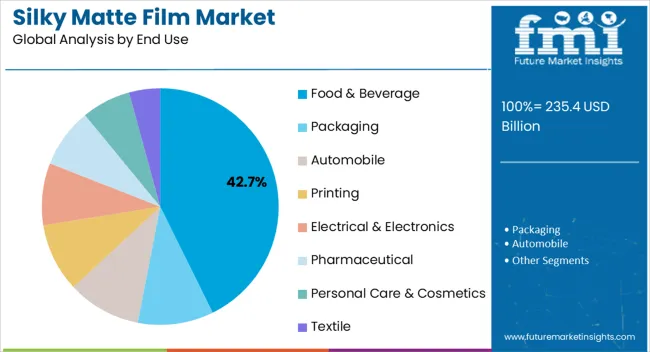

The food and beverage segment is anticipated to represent 42.70% of market revenue by 2025, ranking as the top end use category. Its leadership is underpinned by the rising demand for attractive, protective, and functional packaging that preserves freshness while supporting brand identity.

Matte finishes have been widely adopted to enhance shelf appeal and consumer perception of premium quality. Additionally, the growth of ready to eat meals, packaged snacks, and beverages has increased reliance on silky matte films that combine strong barrier properties with aesthetic value.

As consumer focus shifts toward sustainable and visually distinctive packaging, food and beverage continues to drive the largest share of demand within the end use category.

From 2020 to 2025, the global silky matte film market experienced a CAGR of 2.8%, reaching a market size of USD 235.4 million in 2025.

Concerns have been raised regarding the propensity of plastic matte films to promote the flow of vapors and gases, which can degrade the consistency of novel coatings and barrier films addressing the health of packaging goods. Matte films, for example, are increasingly used in digital packaging to improve the shelf-life of the product and provide a clear indicator of its quality and status.

From 2020 to 2025, with the rise in number of applications of the product in various industry, the market growth can be seen. Also, with the eco-friendly properties of silky matte films, the demand in e-commerce sector is increasing.

Looking ahead, the global silky matte film industry is expected to rise at a CAGR of 3.8% from 2025 to 2035. During the forecast period, the market size is expected to reach USD 317.3 million.

End Use industries such as food & beverage, personal care, pharmaceuticals, automotive and other end use industries are increasing adopting the silky matte film. The current growth of e-commerce sector is boosting the market, which indirectly boost the growth of market in emerging economies. North America region is expected to dominate the market. The strong presence of key players in North America is boosting the market growth.

| Country | United States |

|---|---|

| Market Size (USD million) by End of Forecast Period (2035) | USD 46.8 million |

| CAGR % 2025 to End of Forecast (2035) | 3.3% |

The silky matte film industry in the United States is expected to reach a market share of USD 341.8 billion by 2035, expanding at a CAGR of 3.3%. The rise of the packaging sector and consumption of packaged foods is driving the growth of United States market.

This increase can be attributed to the rising use of these films in surface coatings to prevent photocopying across the United States. Nowadays, some companies in the United States use film as a security printing medium on top of official papers such as passports and driver's licenses, which aids in the prevention of counterfeiting and duplication.

The BOPP segment is expected to dominate the silky matte film industry with a CAGR of 3.1% from 2025 to 2035. BOPP silky matte film has a surface and hot melt adhesive layer by extrusion coating. These films have some luxurious features such as excellent resistance to tear and elongation, matte surface suitable UV spot varnishing foil stamping which is useful for any type of packaging.

The laminated segment is expected to dominate the silky matte film industry with a CAGR of 4.0% from 2025 to 2035. Laminated silky matte film conceals tiny flaws in packaging materials and adds a tactile sense to the box, making it more appealing to touch and hold. Matte lamination lowers glare and reflection, making it excellent for materials that will be viewed under bright lighting or in direct sunlight.

The silky matte film industry is highly competitive, with new entrants trying to gain market share. The major key players are focusing on research and development which can help to keep them updated with latest technologies and trends.

Key Strategies Adopted by the Players

Strategic Partnerships and Collaborations

The new entrants are collaborating to gain competitive advantage, and gain access to latest technologies. The major key players are adopting these strategies to enter new markets.

Increasing Product Efficiency and Accuracy

The major key players are focusing on product innovations, and develop market opportunities. This can eventually increase the adoption rate of the silky matte film.

Expansion into Emerging Markets

The major key players are investing and expanding their channels into the emerging economies which can help them gain market position. And will help them to increase their customer base. The companies are also investing in research and development to increase the application of product in different industries.

The global silky matte film market is estimated to be valued at USD 235.4 billion in 2025.

The market size for the silky matte film market is projected to reach USD 341.8 billion by 2035.

The silky matte film market is expected to grow at a 3.8% CAGR between 2025 and 2035.

The key product types in silky matte film market are pp film, pvc film and bopp film.

In terms of product type, laminated segment to command 58.3% share in the silky matte film market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

White Matter Injury Treatment Market Size and Share Forecast Outlook 2025 to 2035

Particulate Matter Monitoring Market Size and Share Forecast Outlook 2025 to 2035

Film Forming Starches Market Size and Share Forecast Outlook 2025 to 2035

Film Formers Market Size and Share Forecast Outlook 2025 to 2035

Film Capacitors Market Analysis & Forecast by Material, Application, End Use, and Region Through 2035

Film Tourism Industry Analysis by Type, by End User, by Tourist Type, by Booking Channel, and by Region - Forecast for 2025 to 2035

Filmic Tapes Market

PE Film Market Insights – Growth & Forecast 2024-2034

TPE Films and Sheets Market Size and Share Forecast Outlook 2025 to 2035

PET Film Coated Steel Coil Market Size and Share Forecast Outlook 2025 to 2035

PSA Film Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Breaking Down PCR Films Market Share & Industry Positioning

PCR Films Market Analysis by PET, PS, PVC Through 2035

VCI Film Market Growth – Demand, Innovations & Outlook 2024-2034

PBS Film Market Trends & Industry Growth Forecast 2024-2034

Thin Film Coatings Market Size and Share Forecast Outlook 2025 to 2035

Thin-film Platinum Resistance Market Size and Share Forecast Outlook 2025 to 2035

Thin Film Platinum Resistance Temperature Sensor Market Size and Share Forecast Outlook 2025 to 2035

Thin Film Solar Cells Market Size and Share Forecast Outlook 2025 to 2035

Thin Film Photovoltaics Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA