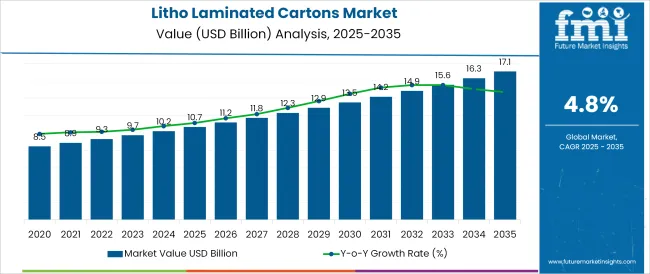

The Litho Laminated Cartons Market is estimated to be valued at USD 10.7 billion in 2025 and is projected to reach USD 17.1 billion by 2035, registering a compound annual growth rate (CAGR) of 4.8% over the forecast period.

The litho laminated cartons market is undergoing a phase of robust growth driven by increasing demand for high-quality, visually appealing packaging that supports both branding and product protection. A rising emphasis on shelf-ready packaging, especially in consumer goods and food applications, is influencing manufacturers to adopt litho lamination for its superior printability and structural rigidity.

The market is also benefiting from advances in corrugation techniques and paperboard substrates that offer lightweight solutions without compromising durability. Growing retail competition and the importance of visual impact on purchasing decisions are encouraging brand owners to invest in premium litho-laminated cartons.

In parallel, environmental considerations are prompting the use of recyclable inks, coatings, and substrates, aligning with sustainability goals. As packaging transitions from being merely functional to becoming a brand engagement tool, the market is expected to continue expanding, especially in processed foods, electronics, and personal care categories where product protection and shelf appeal are equally critical.

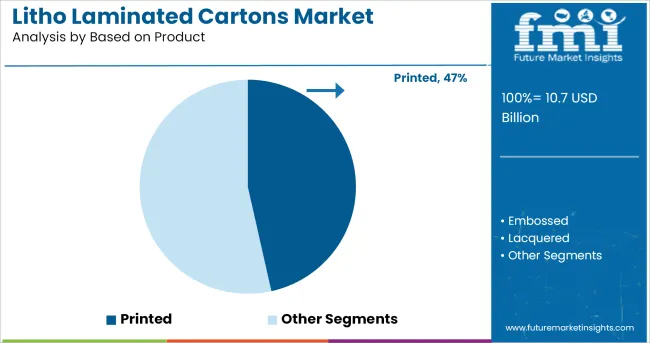

It is observed that the printed product segment accounts for 46.50% of the total revenue share in the litho laminated cartons market, making it the leading product type. This dominance is attributed to its role in enhancing brand visibility, product differentiation, and consumer engagement. The printed format offers superior graphical clarity, high-resolution branding, and adaptability across various packaging formats, which is particularly valuable in competitive retail environments.

The ability to incorporate brand colors, detailed imagery, and marketing messages has been central to its adoption across industries. Furthermore, advances in offset lithography and digital print technologies have made printed cartons more cost-effective for both short and long runs.

As packaging becomes a key brand touchpoint, especially for fast-moving consumer goods, the printed variant continues to lead, supported by its blend of functional performance and visual appeal.

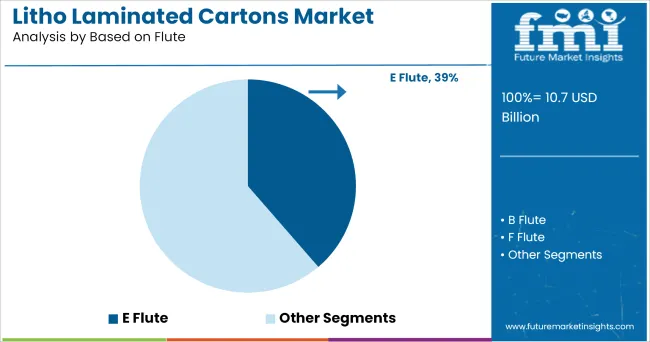

It has been observed that E flute holds a 38.70% share of the market under the flute type category, marking it as the most prominent sub-segment. This is primarily due to its balance of strength, thin profile, and compatibility with high-quality printing.

E flute provides a smooth surface that enhances the application of lithographic prints, while also offering sufficient rigidity for protective packaging. The thinner profile allows for greater pallet density and space optimization during storage and transport, contributing to lower logistics costs. Its structural integrity also supports die-cutting and complex folding without compromising durability.

Due to its printability and form factor, E flute has become a preferred option in packaging for electronics, cosmetics, and premium food products, where both aesthetics and protection are critical.

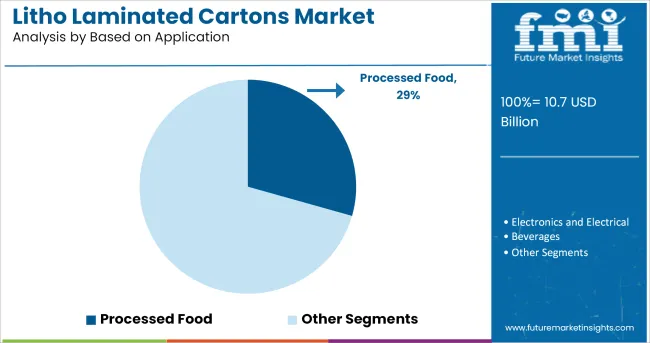

The processed food segment holds 29.40% of the market share under the application category, positioning it as the largest contributor to demand. This is attributed to the growing need for shelf-stable, branded packaging solutions that can preserve food integrity while enhancing visual merchandising.

Litho laminated cartons offer excellent barrier compatibility when used with internal linings and allow for vibrant, consumer-friendly printing-making them ideal for processed food categories such as snacks, cereals, frozen foods, and ready meals. In addition, increasing urbanization and the rise in on-the-go consumption are accelerating demand for packaged processed food, further driving adoption.

The segment also benefits from regulatory compliance features such as tamper evidence, recyclability, and food-safe inks, which are increasingly required by both manufacturers and retailers. As a result, litho laminated cartons are being widely preferred for their multi functional properties, reinforcing processed food as a dominant application segment in the market.

The litho laminated cartons are generally used as a secondary packaging solution in many industries. Litho laminated cartons are formed by joining two pieces of paper and cardboard, one printed by lithographic printing technology and the other acts as a back liner.

The two sheets often have a fluted medium between them to ensure enhanced protection to packaged contents. These are a lightweight, efficient and attractive alternative to traditional heavyweight folding cartons. As a result of the several benefits provided by the target product many industries like beverage, food, electrical and electronics among others are switching to litho laminated cartons for their secondary packaging needs.

The evolving e-commerce industry is playing a major role in the expansion of the litho laminated cartons market. The sheer volume of products being shipped in the global e-commerce market daily is consistently on the rise.

Litho laminated cartons are the preferred choice of the manufacturers in the industry as they are not only light in weight but are also comparatively economical than the traditional heavy cartons. The high packaging demand generated by the e-commerce industry is projected to bolster the market growth for litho laminated cartons across the globe.

With constant technological advancements, the electronics industry is growing at a steady pace. The innovation in the electronics industry has increased the dependency of humans on technology. Due to the convenience and comfort offered by the equipment and gadgets the demand for these items is always elevated in the market.

Many of the electronic products are packaged in litho laminated cartons as they tend to be less bulky, comparatively economical and provide necessary protection to the contents. On the back of the rising electronics industry, the litho laminated cartons market is anticipated to experience elevated demand during the foreseeable future.

The litho laminated cartons are technically sustainable and can be reused and recycled as well, but the majority of them end up in waste dump sites. This contributing to the waste generation and accumulation problem which is a cause of concern.

The increasing waste amount of waste might restraint the growth of the target market. Furthermore, the widely available and comparatively economical alternatives are contributing to slowing down the growth of litho laminated cartons in the market.

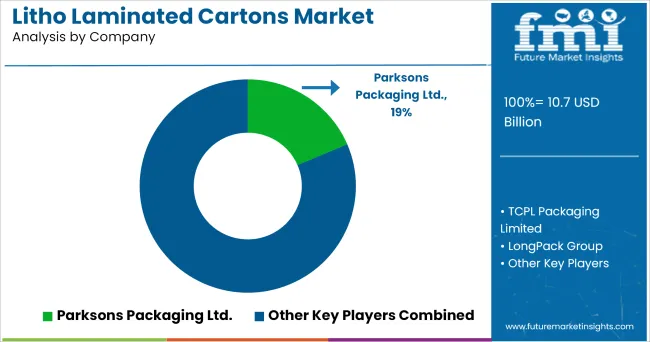

Key global players such as

are in the litho laminated cartons market.

In the Asian region, players like

are actively involved in the litho laminated cartons market.

Key players in the litho laminated cartons market are focused on the expansion of their product portfolio and production capacities to capture maximum market share. Mergers, acquisitions, product launches are some of the strategies adopted by the key players.

For instance, in July 2024, Graphic Packaging International announced the completion of the acquisition of Americraft Carton Inc.

The litho laminated cartons market is highly competitive because of presence of many regional players. In order to stand out in this highly competitive market the manufacturers need to launch innovative and customized litho laminated cartons. Manufacturers can offer innovative products like cartons with PVC window, tuck top snap bottom and UV spot to gain maximum market share.

The Indian government is making consistent efforts to attract more global manufacturers in the electronics industry to set up their plants in India. This has resulted in key players in the electronic devices market like Samsung Electronics, OnePlus Technology Co., Ltd. among many other to start new production plants in the country.

With the increasing number of manufacturers, India is anticipated to generate significant demand for the litho laminated cartons market.

The global litho laminated cartons market is estimated to be valued at USD 10.7 billion in 2025.

The market size for the litho laminated cartons market is projected to reach USD 17.1 billion by 2035.

The litho laminated cartons market is expected to grow at a 4.8% CAGR between 2025 and 2035.

The key product types in litho laminated cartons market are printed, embossed and lacquered.

In terms of based on flute, e flute segment to command 38.7% share in the litho laminated cartons market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Lithography Equipment Market Size and Share Forecast Outlook 2025 to 2035

Lithotripsy Devices Market Size and Share Forecast Outlook 2025 to 2035

Lithographic Printing Chemicals Market Size and Share Forecast Outlook 2025 to 2035

Litho Laminated Packaging Market from 2025 to 2035

EUV Lithography Market Size and Share Forecast Outlook 2025 to 2035

Stencil Lithography Market Size and Share Forecast Outlook 2025 to 2035

Extreme Ultraviolet Lithography (EUV) Market Analysis by Light Source Type, Application, and Region through 2025 to 2035

Coronary Intravascular Lithotripsy Market Size and Share Forecast Outlook 2025 to 2035

Laminated Busbar Market Forecast and Outlook 2025 to 2035

Laminated Tubes Market Size and Share Forecast Outlook 2025 to 2035

Laminated Glass Market Size and Share Forecast Outlook 2025 to 2035

Laminated Labels Market Size and Share Forecast Outlook 2025 to 2035

Laminated Tube Closure Market from 2025 to 2035

Market Share Breakdown of Laminated Tubes Manufacturers

U.S. Laminated Tube Market Trends & Demand Forecast 2024-2034

Laminated Woven PP Bags Market

Silk Laminated Paper Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Cross Laminated Timber Market

USA Flexible Laminated Paper Market Growth – Trends & Forecast 2024-2034

Europe Flexible Laminated Paper Market Trends – Forecast 2024-2034

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA