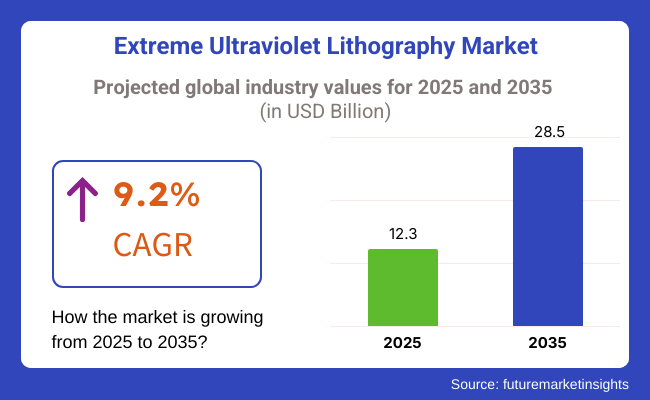

The Extreme Ultraviolet Lithography (EUV) market is projected to reach USD 12.3 billion in 2025 and expand to USD 28.5 billion by 2035, registering a CAGR of 9.2% over the forecast period. The growth is driven by increased investments from semiconductor manufacturers and ongoing R&D to improve EUV throughput and efficiency in chip fabrication.

Key drivers include rising demand for advanced logic chips, memory devices, and AI processors, as EUV technology enables higher transistor density and improved power efficiency. Growth is further fueled by adoption among major foundries, innovations in high-NA EUV lithography, and advancements in mask infrastructure and photoresist materials.

Restraints include high equipment costs, complex infrastructure requirements, and technical challenges in scaling EUV systems for mass production. A limited supplier base and the need for skilled personnel to operate and maintain EUV tools may hinder rapid adoption, especially among smaller fabs.

Opportunities lie in expanding EUV applications in emerging AI and 5G, rising demand for sub-5nm nodes, and strategic collaborations between foundries, equipment vendors, and research bodies to accelerate the commercialization of next-generation EUV platforms.

Trends include the shift toward high-NA EUV systems, integration of AI-driven process optimization, and focus on enhancing yield and process control. Collaborative innovation and investment in EUV ecosystem infrastructure are shaping the future of semiconductor manufacturing.

Between 2020 and 2024, the extreme ultraviolet (EUV) lithography market experienced rapid growth, driven by increasing demand for advanced semiconductor manufacturing, smaller node sizes below 7nm, and rising investments in next-generation chip fabrication. The implementation of AI, 5G, HPC, and IoT applications spurred the demand for accurate and affordable lithography technologies.

Large semiconductor foundries such as TSMC, Samsung, and Intel spearheaded the implementation of high numerical aperture (High-NA) EUV scanners, improving pattern resolution and manufacturing yields for AI processors, DRAM, and NAND flash chips. The USA CHIPS Act and European Union semiconductor strategy underpinned regional production, though geopolitical tensions made supply chain reliability more urgent. High capital expense equipment, delicate optics servicing, and a short supply of EUV pellicles and photoresists hindered progress.

From 2025 to 2035, the EUV lithography industry will evolve with high-NA EUV systems, AI-optimized process control, and quantum-inspired computational models. The shift to sub-2nm and angstrom-scale nodes will increase transistor density and power efficiency for AI, HPC, and metaverse-based applications.

High-NA EUV lithography will enable single-patterning exposure to become feasible for sub-3nm nodes, enhance edge placement accuracy, and decrease manufacturing defects. Hybrid EUV and nanoimprint lithography will enable economically feasible specialty chip solutions. EUV-based heterogeneous integration and 3D packaging will facilitate highest-order signal integrity and chipset architectures. Sustainability will be provided by low power consumption by EUV, low CO2 emission, and environmentally friendly manufacturing initiatives.

A Comparative Market Shift Analysis 2020 to 2024 vs. 2025 to 2035

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Governments introduced semiconductor manufacturing policies to strengthen domestic chip production. | AI-assisted process regulations, sustainability mandates, and localization policies will shape future governance. |

| High-NA EUV development, advanced EUV masks, and AI-driven process control improved semiconductor fabrication. | Quantum-enhanced computational lithography, hybrid EUV-nanoimprint techniques, and neuromorphic chip manufacturing will revolutionize lithography. |

| EUV lithography was used for 7nm, 5nm, and 3nm logic and memory chip manufacturing. | Sub-2nm and angstrom-level node fabrication, 3D heterogeneous integration, and chiplet-based semiconductor packaging will expand EUV applications. |

| Foundries used EUV scanners with AI-based defect detection and smart automation. | AI-based lithography robots, autonomous exposure systems, and quantum computing-based chip design will characterize next-generation semiconductor fabs. |

| Ambitious EUV systems require high-power lasers and sophisticated optics. | AI-optimized EUV power efficiency, low-emission lithography tools, and green semiconductor fabrication programs will improve cost-effectiveness. |

| AI-assisted mask design, defect forecast software, and real-time exposure adjustments improved lithography accuracy. | EUV simulation with the aid of quantum computing, real-time nanofabrication analytics, and AI-enhanced pre-emptive process optimization will revolutionize precision lithography. |

| Supply chain interruption, component shortages, and equipment prices of EUV influenced accessibility. | AI-driven supply chain optimization, decentralized EUV component manufacturing, and blockchain-secured semiconductor logistics will improve production stability. |

| Growth was driven by rising demand for AI, 5G, HPC, and IoT semiconductors. | AI-powered semiconductor design, autonomous process controls, and edge-AI chip solutions will drive growth. |

The extreme ultraviolet lithography (EUV) market is enjoying a period of very rapid ascent along with the semiconductor industry that advances toward the fabrication of more compact and powerful chips. Semiconductor manufacturers are the primary adopters, focusing on precision, efficiency, and cost reduction.

EUV technology provides the possibility for direct patterning of structures with sizes; besides nanotechnology, the only way to manufacture the advanced nodes is through extreme ultraviolet (EUV) projection lithography, which is high-resolution, vacuum lithography, and direct-write techniques.

The semiconductor industry is witnessing the highest adoption of EUV in the past years as the technology becomes more affordable and efficient. End-user industries that use semiconductor chips in smartphones, IoT devices, and computer products are equally important clients of the semiconductor industry.

Besides such applications, automation and autonomous vehicles, which are key parts of AI technology, are the two main domains where EUV is extensively used in the automotive and aerospace sectors. Though the initial cost and maintenance are high, EUV adoption is growing fast since it is the only way to implement upscalable, better chips and save electricity.

Contracts and Deals Analysis

| Company | Contract Value (USD Million) |

|---|---|

| TSMC and ASML | Approximately USD 20,000-22,000 |

| Intel and ASML | Approximately USD 383 |

| Albany NanoTech Complex | USD 825 |

During 2024 and the beginning of 2025, the industry saw some important developments through big deals. TSMC's initiative to buy more than 60 EUV lithography tools from ASML marks its determination to enhance chip fab capabilities, involving an estimated range of USD 20 billion to USD 22 billion. Intel's acquisition of ASML's sophisticated "High NA" EUV equipment, priced at around USD 383 million per unit, reflects its commitment to leadership in more advanced chip technologies. Furthermore, the pledge of USD 825 million in federal funding to the Albany NanoTech campus represents a strategic effort to boost domestic research and development of EUV lithography. Collectively, these innovations represent a broader industry movement toward investing in advanced lithography technology to address the growing demand for sophisticated semiconductors.

The extremely high price of EUV lithography systems is a critical barrier. The technology is built with very costly components, specialized high-precision optics, and powerful lasers, making it one of the most expensive semiconductor manufacturing equipment. Therefore, the industry is accessible only to high-scale chip manufacturers.

Technical challenges are the factors that hinder the adoption. EUV machines require ultra-clean environments and precisely controlled conditions in order to operate without defects. The dual challenge of maintaining stable power sources and controlling light reflection can result in reduced productivity, as well as additional operational risks.

Bottlenecks within supply chains are behind the hindered growth. The production of EUV devices is highly dependent on the availability of in-demand materials, complex technology expertise, and few vendors-disruptions whether geopolitical or logistical can result in delays of the production schedule and unexpected expenses.

Regulatory and intellectual property are risks that every key player faces. Governments are highly concerned about the progress of semiconductors, which is a national security issue that could impose possible restrictions on exports. Also, patent litigations related to EUV technology can create legal barriers and financial burdens for manufacturers.

The EUV Lithography industry is one of the most technologically advanced fields, with LPP likely to account for approximately 72.5% of the share in 2025. LPP is preferred as a light source due to its higher energy efficiency, greater EUV photon output, and capability to achieve a smaller feature size in semiconductor production, among other advantages. LPP-based sources for EUV generation are led by companies such as ASML, Trumpf, and Gigaphoton, allowing chipmakers to produce next-gen logic and memory chips using low-node technologies. The rapid rise in the need for HPC, AI, and 5G technologies is accelerating the adoption of LPP-based EUV lithography systems.

Vacuum Sparks, on the other hand, are expected to make a 27.5% contribution to the shares for 2025; however, it is used in niche applications where precision and cost-effectiveness are the key measures. While Vacuum Spark sources have lower EUV power output than LPP, they will continue to be utilized in specialized semiconductor manufacturing processes where cost drivers and target wavelengths are more critical. Also, Vacuum Spark has become a subject of interest to smaller chip manufacturers and research institutions for low-volume production and experimental semiconductor technology.

As semiconductor scaling progresses, LPP technology is well positioned to lead with higher throughput, stability, and the ability to address consumer demand for a smaller, more efficient chip. However, Vacuum Sparks continues to provide an alternative solution at an affordable price point, especially for cost-sensitive applications and research-based semiconductor development.

Globally, light-emitting diode (LED) devices will account for the majority of the share, with a projected share of approximately 61.3% by 2025, owing to the growth of high-resolution display devices, demand for energy-efficient lighting and miniaturized optoelectronic components. Atomic Midas is based on Extreme Ultraviolet (EUV) lithography technology that patterns much higher-resolution features more accurately, thus allowing next-generation-sized microLED and OLED displays.

Therefore, firms such as Samsung, LG Display, and Osram are pouring billions of dollars into extreme ultraviolet (EUV), which will refine the efficiency, color accuracy, and durability of light-emitting diodes (LEDs) for consumer electronics, automotive lighting, and industrial purposes.

Microfluidics hold a 38.7% share of the EUV lithography industry in 2025 with applications in lab-on-a-chip technology, the development of biomedical diagnostics, and the process of drug discovery in the pharmaceutical industry. All these applications require advanced microfluidic channels, and with the power of EUV lithography, ultra-precise microfluidic channels could be fabricated for the very first time to develop high-performance biosensors, point-of-care diagnostic devices, drug delivery systems, etc. EUV-Enabled Biomedical Solutions: Firms such as Dolomite Microfluidics, Fluigent, and Bio-Rad Laboratories are using EUV technology to enhance fluid control, reaction efficiency, and miniaturization for biomedical applications.

With industries continuing the demands for smaller, more efficient, and highly functional components, there are even more applications when it comes to the use of lithography systems using extreme ultraviolet (EUV) light sources to push technology further for the improvement of LED and microfluidic research. These innovations are already reshaping consumer electronics as well as scientific instrumentation and healthcare, leading to huge growth in the coming years.

| Country | CAGR (2025 to 2035) |

|---|---|

| The USA | 13.5% |

| The UK | 10.2% |

| France | 9.8% |

| Germany | 11.7% |

| Italy | 8.9% |

| South Korea | 14.3% |

| Japan | 12.5% |

| China | 15.1% |

| Australia | 7.6% |

| New Zealand | 6.9% |

2025 to 2035 CAGR will be 13.5% because of the leadership of semiconductor stalwarts Intel, GlobalFoundries, and IBM. EUV lithography technology is dominated by the USA, which has massive R&D investments and collaboration with the Dutch vendor ASML. Local manufacturing is encouraged by government initiatives like the CHIPS Act to reduce reliance on overseas manufacturers.

The availability of large foundries and firm industry demand from customers like AI, 5G, and automotive supports the industry. Greater emphasis on the production of advanced nodes ensures that the USA is a key EUV adopter. The industry is emphasizing even more advanced lithography equipment, maximizing chip efficiency and performance, and driving industry growth.

CAGR 2025 to 2035 is 10.2% because of investment in research on semiconductors and focus on local chip manufacturing. UK is also headquartered to industry leaders like ARM Holdings, which propels global chip designs. With few local foundries, collaboration with other European and Asian manufacturers makes it a leading player.

Government spending on semiconducting technology and growing demand for computing performance drive the adoption of EUV lithography. National emphasis on AI, IoT, and data centers raises the stakes for cutting-edge chip manufacturing, fueling industry growth.

The CAGR would be 9.8% from 2025 to 2035 with the STMicroelectronics and Leti, top French-based semiconductor technology companies. France is the backbone of European semiconductor supply chains and benefits from unprecedented EU investments and strategic partnerships.

EUVA lithography uptake accelerates as demand from the automotive and telecom industries rises. France's focus on energy-efficient chip manufacturing expands its sales. Government efforts towards semiconductor sovereignty further boost industry development.

2025 to 2035 CAGR is 11.7%, with the country at the forefront of advanced semiconductor equipment and industrial applications. The adoption of EUV lithography is spearheaded by companies such as Infineon Technologies and Bosch, capitalizing on Germany's dominance in automobile chips and power electronics.

Automotive and Industry 4.0 growth drives EUV growth for semiconductors. Government schemes and global semiconductor player engagement boost Germany's technological superiority and allow it to remain one step ahead of the competition for EUV lithography.

2025 to 2035 CAGR is at 8.9%, powered primarily by increases in semiconductor R&D facilities and interaction with foundries in Europe. Italy gains benefit from having STMicroelectronics, which is heavily investing in EUV chip production.

Industrial automation and automotive segments drive demand. Italy's participation in the European Chips Act, as well as R&D investment, position it as a future player in the EUV lithography market.

2025 to 2035 CAGR is estimated at 14.3%, and it is headed by semiconductor leaders in the world, Samsung and SK Hynix. South Korea aggressively leads the development of EUV lithography capacity around memory chips and logic semiconductors. Government incentives and strategic investment in future-proof fabs drive growth.

The cutting-edge infrastructure of domestic manufacturing and ongoing innovation in DRAM and NAND flash technology drive its adoption leadership of EUV lithography.

2025 to 2035 CAGR is estimated at 12.5%, driven by semiconductor firms like Tokyo Electron and Canon. Japan dominates the manufacturing of EUV lithography equipment, offering base materials and machines to the world. The country's focus on semiconductor autonomy and AI-driven chip demand forms the growth prospect.

High-performance computing and automotive semiconductor applications further drive the use of EUV, leading Japan to become a key leader.

The 2025 to 2035 CAGR will be 15.1% to mirror China's ambitious pursuit of semiconductor autonomy. Pioneering companies like SMIC and Huawei propel the use of EUV lithography despite geopolitical constraints on essential technologies.

Large-scale government investments in semiconductor development will step up the country's local manufacturing capacity. The rising demands for AI, 5G, and cloud computing fuel the country's requirement for sophisticated lithography equipment, thus turning China into a high-growth market.

2025 to 2035 CAGR is forecast to be 7.6%, with the growth fueled by research programs from universities and up-and-coming semiconductor startups. The Australian semiconductor market is not big but sustains growth by teaming up with international businesses.

The country's focus on quantum computing and material sciences needs accurate lithography. Government funding for technology research and semiconductor manufacturing research prompts low market growth.

6.9% CAGR from 2025 to 2035 shows the nation's small but growing semiconductor market. New Zealand lacks giant-scale foundries but has research initiatives in photonics and nanotechnology.

Technology development is encouraged through collaboration with overseas semiconductor firms and universities. The nation's focus on AI chip design and specialized semiconductor applications ensures periodic enhancement in EUV lithography applications.

Extreme Ultraviolet or EUV lithography is regarded as a market with rapid growth propelled by the advancement in semiconductor technology and, hence, the demand for ever-densified transistors and next-generation computing applications. It plays a vital role in the making of small, power-efficient, high-performance chips, developments supporting AI, 5G, and high-performance computing without evading chip manufacturing.

Major players are ASML, Canon, Nikon, and Intel, focusing primarily on the improvement of the efficiency of EUV scanners, development of customized pellicles, and minimization of the defects. Some of the niche providers and startups add value through special optics, the optimization of light sources, and improvements in resist materials.

The market now has higher NA EUV systems and is growing to address yield challenges and cost efficiency. Companies within the space want to increase EUV scanner throughput, reduce stochastic defects, and enhance overlay accuracy to address the requirements of the semiconductor industry.

Some of the strategic drivers include supply chain resilience, R&D investments in all components of the EUV ecosystem, and collaboration between semiconductor manufacturers and equipment suppliers. With the ever-increasing complexity of chips, EUV lithography acts as a linchpin of technology advancement, further pushing the innovation pace of the semiconductor industry.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| ASML Holding NV | 75-80% |

| Canon Inc. | 5-9% |

| Nikon Corporation | 3-7% |

| Intel Corporation (In-House) | 2-5% |

| Other Companies (combined) | 5-10% |

| Company Name | Key Offerings/Activities |

|---|---|

| ASML Holding NV | Develops EUV lithography scanners and light sources, leading in high-NA EUV advancements. |

| Canon Inc. | Research alternative EUV lithography methods and nanoimprint lithography solutions. |

| Nikon Corporation | Works on next-gen lithography solutions, including ArF immersion and EUV R&D. |

| Intel Corporation (In-House) | Develops proprietary EUV solutions for semiconductor fabrication efficiency. |

Key Company Insights

ASML Holding NV (75-80%)

ASML commands the greatest share of the EUV lithography market by supplying high-NA EUV scanners to major semiconductor manufacturers: TSMC, Samsung, and Intel. The company is enhancing its machine throughput and defect control policies with an eye to greater efficiency and cost-effectiveness in chip manufacturing.

Canon Inc. (5-9%)

Canon is working on alternative lithography techniques, including nanoimprint lithography, which could serve as a sideline or could indeed compete in certain applications with EUV. The company is also looking at low-cost options for high-resolution lithography to support some niche semiconductor markets.

Nikon Corporation (3-7%)

Nikon concentrates on improving ArF immersion lithography while conducting research in next-generation EUV lithography. The company's work in precision optics and advanced metrology solutions is supportive of the entire semiconductor manufacturing ecosystem.

Intel Corporation (In-House) (2-5%)

Intel is funding research programs on its own EUV lithography to evaluate the best optimization for its semiconductor manufacturing processes. The plan is to introduce the implementation of EUV for its advanced node fabrication, with the aim of boosting transistor density and performance.

Other Key Players (5-10% Combined)

The segmentation is into Laser Produced Plasmas, Vacuum Sparks, and Gas Discharges.

The segmentation is into Light Emitting Diodes (LEDs), Micro-Fluidics, Micro-Needles, and Biotechnology.

The report covers North America, Latin America, Europe, Asia Pacific, and The Middle East & Africa (MEA).

The Global EUV industry is projected to witness a CAGR of 9.2% between 2025 and 2035.

The Global EUV industry stood at USD 12.3 billion in 2025.

The Global EUV industry is anticipated to reach USD 28.5 billion by 2035 end.

Asia-Pacific is expected to record the highest CAGR, driven by semiconductor manufacturing expansion in China, South Korea, and Taiwan.

The key players operating in the Global EUV industry include Intel Corporation, Nikon Corporation, Canon Inc., IBM Corporation, ASML, Samsung Corporation, Tappan Photomasks Inc., and others.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Value (US$ Million) Forecast by Light Source Type, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 4: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 5: North America Market Value (US$ Million) Forecast by Light Source Type, 2018 to 2033

Table 6: North America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 7: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 8: Latin America Market Value (US$ Million) Forecast by Light Source Type, 2018 to 2033

Table 9: Latin America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 10: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 11: Western Europe Market Value (US$ Million) Forecast by Light Source Type, 2018 to 2033

Table 12: Western Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 13: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 14: Eastern Europe Market Value (US$ Million) Forecast by Light Source Type, 2018 to 2033

Table 15: Eastern Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 16: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 17: South Asia and Pacific Market Value (US$ Million) Forecast by Light Source Type, 2018 to 2033

Table 18: South Asia and Pacific Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 19: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 20: East Asia Market Value (US$ Million) Forecast by Light Source Type, 2018 to 2033

Table 21: East Asia Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 22: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 23: Middle East and Africa Market Value (US$ Million) Forecast by Light Source Type, 2018 to 2033

Table 24: Middle East and Africa Market Value (US$ Million) Forecast by Application, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Light Source Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Application, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 4: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 5: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 6: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 7: Global Market Value (US$ Million) Analysis by Light Source Type, 2018 to 2033

Figure 8: Global Market Value Share (%) and BPS Analysis by Light Source Type, 2023 to 2033

Figure 9: Global Market Y-o-Y Growth (%) Projections by Light Source Type, 2023 to 2033

Figure 10: Global Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 11: Global Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 12: Global Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 13: Global Market Attractiveness by Light Source Type, 2023 to 2033

Figure 14: Global Market Attractiveness by Application, 2023 to 2033

Figure 15: Global Market Attractiveness by Region, 2023 to 2033

Figure 16: North America Market Value (US$ Million) by Light Source Type, 2023 to 2033

Figure 17: North America Market Value (US$ Million) by Application, 2023 to 2033

Figure 18: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 19: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 20: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 21: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 22: North America Market Value (US$ Million) Analysis by Light Source Type, 2018 to 2033

Figure 23: North America Market Value Share (%) and BPS Analysis by Light Source Type, 2023 to 2033

Figure 24: North America Market Y-o-Y Growth (%) Projections by Light Source Type, 2023 to 2033

Figure 25: North America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 26: North America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 27: North America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 28: North America Market Attractiveness by Light Source Type, 2023 to 2033

Figure 29: North America Market Attractiveness by Application, 2023 to 2033

Figure 30: North America Market Attractiveness by Country, 2023 to 2033

Figure 31: Latin America Market Value (US$ Million) by Light Source Type, 2023 to 2033

Figure 32: Latin America Market Value (US$ Million) by Application, 2023 to 2033

Figure 33: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 34: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 35: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 36: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 37: Latin America Market Value (US$ Million) Analysis by Light Source Type, 2018 to 2033

Figure 38: Latin America Market Value Share (%) and BPS Analysis by Light Source Type, 2023 to 2033

Figure 39: Latin America Market Y-o-Y Growth (%) Projections by Light Source Type, 2023 to 2033

Figure 40: Latin America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 41: Latin America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 42: Latin America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 43: Latin America Market Attractiveness by Light Source Type, 2023 to 2033

Figure 44: Latin America Market Attractiveness by Application, 2023 to 2033

Figure 45: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 46: Western Europe Market Value (US$ Million) by Light Source Type, 2023 to 2033

Figure 47: Western Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 48: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 49: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 50: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 51: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 52: Western Europe Market Value (US$ Million) Analysis by Light Source Type, 2018 to 2033

Figure 53: Western Europe Market Value Share (%) and BPS Analysis by Light Source Type, 2023 to 2033

Figure 54: Western Europe Market Y-o-Y Growth (%) Projections by Light Source Type, 2023 to 2033

Figure 55: Western Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 56: Western Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 57: Western Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 58: Western Europe Market Attractiveness by Light Source Type, 2023 to 2033

Figure 59: Western Europe Market Attractiveness by Application, 2023 to 2033

Figure 60: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 61: Eastern Europe Market Value (US$ Million) by Light Source Type, 2023 to 2033

Figure 62: Eastern Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 63: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 64: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 65: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 66: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 67: Eastern Europe Market Value (US$ Million) Analysis by Light Source Type, 2018 to 2033

Figure 68: Eastern Europe Market Value Share (%) and BPS Analysis by Light Source Type, 2023 to 2033

Figure 69: Eastern Europe Market Y-o-Y Growth (%) Projections by Light Source Type, 2023 to 2033

Figure 70: Eastern Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 71: Eastern Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 72: Eastern Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 73: Eastern Europe Market Attractiveness by Light Source Type, 2023 to 2033

Figure 74: Eastern Europe Market Attractiveness by Application, 2023 to 2033

Figure 75: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 76: South Asia and Pacific Market Value (US$ Million) by Light Source Type, 2023 to 2033

Figure 77: South Asia and Pacific Market Value (US$ Million) by Application, 2023 to 2033

Figure 78: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 79: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 80: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 81: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 82: South Asia and Pacific Market Value (US$ Million) Analysis by Light Source Type, 2018 to 2033

Figure 83: South Asia and Pacific Market Value Share (%) and BPS Analysis by Light Source Type, 2023 to 2033

Figure 84: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Light Source Type, 2023 to 2033

Figure 85: South Asia and Pacific Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 86: South Asia and Pacific Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 87: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 88: South Asia and Pacific Market Attractiveness by Light Source Type, 2023 to 2033

Figure 89: South Asia and Pacific Market Attractiveness by Application, 2023 to 2033

Figure 90: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 91: East Asia Market Value (US$ Million) by Light Source Type, 2023 to 2033

Figure 92: East Asia Market Value (US$ Million) by Application, 2023 to 2033

Figure 93: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 94: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 95: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 96: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 97: East Asia Market Value (US$ Million) Analysis by Light Source Type, 2018 to 2033

Figure 98: East Asia Market Value Share (%) and BPS Analysis by Light Source Type, 2023 to 2033

Figure 99: East Asia Market Y-o-Y Growth (%) Projections by Light Source Type, 2023 to 2033

Figure 100: East Asia Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 101: East Asia Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 102: East Asia Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 103: East Asia Market Attractiveness by Light Source Type, 2023 to 2033

Figure 104: East Asia Market Attractiveness by Application, 2023 to 2033

Figure 105: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 106: Middle East and Africa Market Value (US$ Million) by Light Source Type, 2023 to 2033

Figure 107: Middle East and Africa Market Value (US$ Million) by Application, 2023 to 2033

Figure 108: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 109: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 110: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 111: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 112: Middle East and Africa Market Value (US$ Million) Analysis by Light Source Type, 2018 to 2033

Figure 113: Middle East and Africa Market Value Share (%) and BPS Analysis by Light Source Type, 2023 to 2033

Figure 114: Middle East and Africa Market Y-o-Y Growth (%) Projections by Light Source Type, 2023 to 2033

Figure 115: Middle East and Africa Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 116: Middle East and Africa Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 117: Middle East and Africa Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 118: Middle East and Africa Market Attractiveness by Light Source Type, 2023 to 2033

Figure 119: Middle East and Africa Market Attractiveness by Application, 2023 to 2033

Figure 120: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Extreme Ultraviolet Light Source Market Size and Share Forecast Outlook 2025 to 2035

Ultraviolet Transilluminator Imaging Systems Market Size and Share Forecast Outlook 2025 to 2035

Lithography Equipment Market Size and Share Forecast Outlook 2025 to 2035

Ultraviolet Analyzers Market Growth - Trends & Forecast 2025 to 2035

Ultraviolet Currency Detector Market

EUV Lithography Market Size and Share Forecast Outlook 2025 to 2035

Stencil Lithography Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA