The laminated busbar market is experiencing steady growth driven by the increasing demand for efficient power distribution systems and compact electrical designs. Rising investments in renewable energy, electric vehicles, and industrial automation are boosting adoption. The market is being supported by technological advancements in insulation and conductor materials that enhance electrical performance and reliability.

Manufacturers are focusing on improving thermal management, dielectric strength, and modularity to meet the evolving needs of high-power electronic systems. The shift toward energy-efficient infrastructure and electrification of transport is contributing to significant market expansion. Regulatory emphasis on safety and sustainability is also influencing product innovation and material selection.

The future outlook remains positive as industries adopt laminated busbars to reduce wiring complexity, minimize energy losses, and improve overall system efficiency The combination of technological refinement, infrastructure growth, and electrification trends is expected to sustain strong revenue potential across diverse industrial and automotive applications.

| Metric | Value |

|---|---|

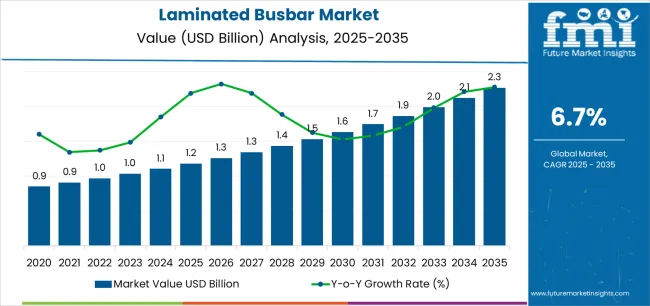

| Laminated Busbar Market Estimated Value in (2025 E) | USD 1.2 billion |

| Laminated Busbar Market Forecast Value in (2035 F) | USD 2.3 billion |

| Forecast CAGR (2025 to 2035) | 6.7% |

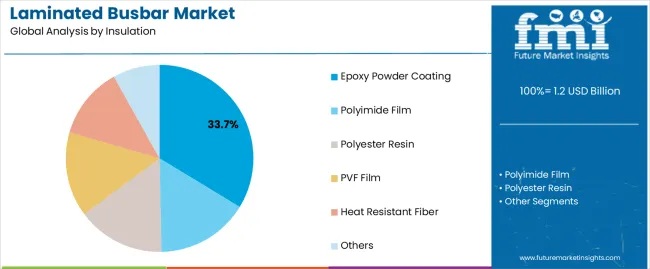

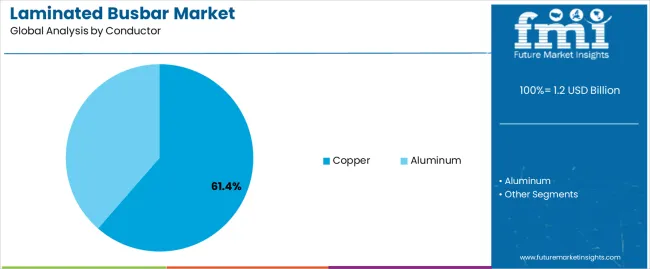

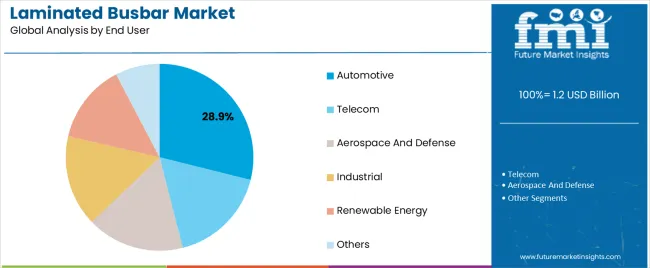

The market is segmented by Insulation, Conductor, and End User and region. By Insulation, the market is divided into Epoxy Powder Coating, Polyimide Film, Polyester Resin, PVF Film, Heat Resistant Fiber, and Others. In terms of Conductor, the market is classified into Copper and Aluminum. Based on End User, the market is segmented into Automotive, Telecom, Aerospace And Defense, Industrial, Renewable Energy, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

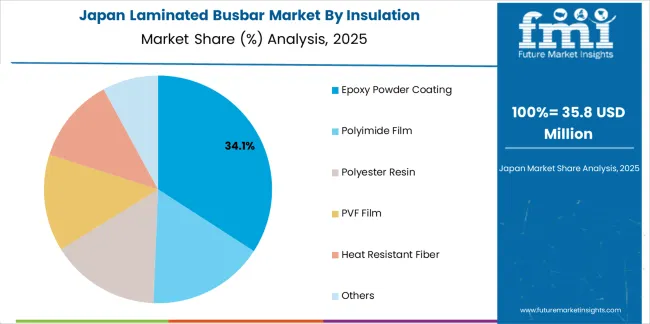

The epoxy powder coating segment, accounting for 33.70% of the insulation category, has emerged as the leading type due to its superior electrical insulation, mechanical strength, and resistance to environmental stress. Its dominance has been supported by growing utilization in high-voltage and high-current applications where durability and reliability are critical.

The material’s ability to maintain insulation integrity under thermal stress and mechanical vibration has made it a preferred choice for manufacturers seeking long-lasting solutions. Process improvements in coating uniformity and adhesion have further enhanced product quality.

Consistent demand from renewable energy, industrial equipment, and electric vehicle applications continues to reinforce segment growth The combination of safety compliance, cost-effectiveness, and performance efficiency is expected to sustain the epoxy powder coating segment’s leading position within the laminated busbar market.

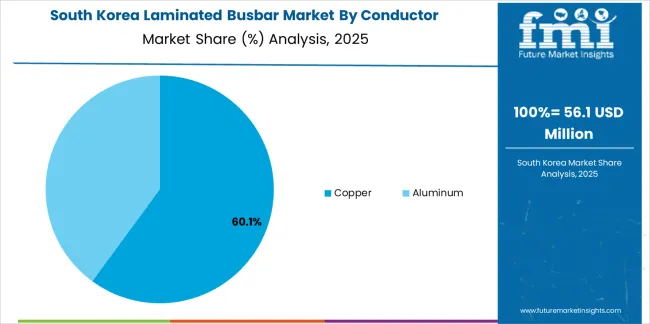

The copper segment, holding 61.40% of the conductor category, has maintained its dominance owing to its excellent electrical conductivity, high thermal efficiency, and mechanical flexibility. Its widespread adoption has been driven by its proven performance in minimizing power losses and enabling efficient current flow in compact systems.

The segment benefits from ongoing demand in energy storage, industrial automation, and mobility solutions where consistent energy transfer is vital. Advances in fabrication and lamination processes have optimized copper utilization and reduced production costs, supporting profitability for manufacturers.

Strong compatibility with modern insulation technologies and superior recyclability are also contributing to its preference With growing electrification initiatives globally, copper is expected to retain its position as the conductor of choice in laminated busbar systems.

The automotive segment, representing 28.90% of the end-user category, has been leading the market due to accelerating electrification trends and the proliferation of electric and hybrid vehicles. The increasing integration of laminated busbars in EV battery systems, inverters, and charging infrastructure is driving segment expansion.

Automotive OEMs are adopting these components to improve thermal management, reduce wiring complexity, and enhance energy efficiency. The emphasis on lightweight, compact, and durable designs has further strengthened demand.

Continuous innovations in vehicle power electronics and battery module design are creating new opportunities for market growth As global emission regulations tighten and EV adoption increases, the automotive segment is expected to sustain its leadership and contribute substantially to the laminated busbar market’s overall development.

The proliferation of electronic devices and telecommunications infrastructure has created opportunities for laminated busbars in these sectors. The busbars are used for power distribution and thermal management in various electronic and communication devices and systems.

The scope for laminated busbar rose at an 8.8% CAGR between 2020 and 2025. The global market is anticipated to grow at a moderate CAGR of 7.1% over the forecast period 2025 to 2035.

The increasing need for efficient power distribution solutions across various industries, including renewable energy, transportation, data centers, and manufacturing, LED to the market growth during the historical period.

The global shift towards renewable energy sources such as wind, solar, and hydroelectric power had also driven the demand for laminated busbars used in power generation, transmission, and distribution systems during the historical period.

The growing adoption of electric vehicles, hybrid electric vehicles, and electrified transportation systems is creating opportunities for laminated busbars in automotive, aerospace, and public transportation applications. Laminated busbars enable efficient power distribution within electric drivetrains, battery packs, charging systems, and onboard electronics.

Ongoing advancements in materials science, manufacturing processes, and design technologies are expected to drive innovation in laminated busbar solutions during the forecast period. Manufacturers are developing laminated busbars with enhanced properties such as higher current carrying capacity, improved thermal performance, and reduced weight to meet evolving customer requirements and industry standards.

The expansion of cloud computing, big data analytics, and Internet of Things technologies is driving the growth of data center infrastructure worldwide. Laminated busbars are used in data center power distribution systems for efficient energy management, load balancing, and backup power solutions, supporting the scalability and reliability of data center operations.

The rising demand for renewable energy sources like wind and solar power has LED to the need for efficient power distribution systems. Laminated busbars offer advantages such as high conductivity, compactness, and reliability, making them suitable for renewable energy applications.

The initial investment costs associated with laminated busbar systems, including materials, manufacturing processes, and installation, can be relatively high compared to traditional busbar solutions. The higher upfront costs may deter some end users from adopting laminated busbars, particularly in cost sensitive industries and applications.

The below table showcases revenues in terms of the top 5 leading countries, spearheaded by Korea and the United Kingdom. The countries are expected to lead the market through 2035.

| Countries | Forecast CAGRs from 2025 to 2035 |

|---|---|

| The United States | 7.4% |

| The United Kingdom | 8.3% |

| China | 7.8% |

| Japan | 6.0% |

| Korea | 9.3% |

The laminated busbar market in the United States expected to expand at a CAGR of 7.4% through 2035. The government of the country has been emphasizing infrastructure development and modernization, including investments in energy, transportation, and telecommunications infrastructure. Laminated busbars play a vital role in efficient power distribution systems, making them integral components of various infrastructure projects across the country.

The demand for data centers and IT infrastructure in the United States is on the rise, with the rapid growth of digitalization and cloud computing. Laminated busbars are critical components in data center power distribution systems, providing efficient energy management and supporting the increasing power demands of data center operations.

The laminated busbar market in the United Kingdom is anticipated to expand at a CAGR of 8.3% through 2035. Ongoing advancements in materials science, manufacturing processes, and design technologies are driving innovation in the laminated busbar market.

Manufacturers in the country are investing in research and development to develop high performance busbar solutions that meet the evolving needs of customers and industry standards.

The United Kingdom government has set ambitious targets to phase out the sale of new petrol and diesel vehicles by 2035, promoting the adoption of electric vehicles and charging infrastructure. Laminated busbars play a vital role in powering electric drivetrains, battery systems, and charging stations for EVs, supporting the electrification of transportation and driving market demand.

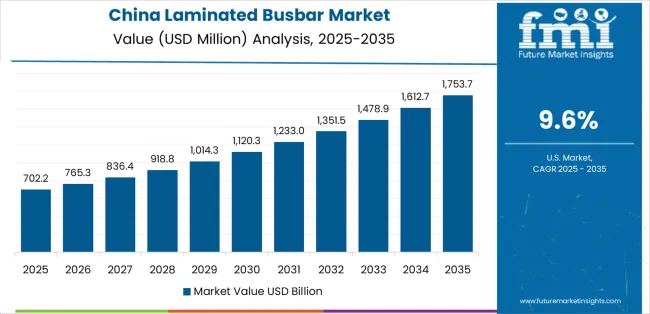

Laminated busbar trends in China are taking a turn for the better. A 7.8% CAGR is forecast for the country from 2025 to 2035. Besides major cities, the tier 2 and tier 3 cities in China are witnessing rapid urbanization and infrastructure expansion.

Laminated busbars are essential components in building construction, transportation networks, and utility infrastructure, supporting the growing energy needs and urban development in these cities.

China is one of the largest markets for renewable energy, with significant investments in solar, wind, hydroelectric, and biomass power generation. Laminated busbars are integral to connecting renewable energy sources to the grid and distributing power efficiently, supporting renewable energy goals and driving market demand in the country.

The laminated busbar market in Japan is poised to expand at a CAGR of 6.0% through 2035. The Japanese government provides support, incentives, and subsidies for initiatives aimed at promoting renewable energy, energy efficiency, and technological innovation.

Government funding and incentives create opportunities for the laminated busbar market to expand and thrive in Japan, stimulating investment and adoption of advanced power distribution solutions.

Japan has stringent quality and safety standards for electrical products and components. Laminated busbars designed to meet Japanese regulatory requirements and industry standards are preferred by end users, ensuring product reliability, safety, and compliance with Japanese regulations.

The laminated busbar market in Korea is anticipated to expand at a CAGR of 9.3% through 2035. Korea is a major producer and consumer of electric appliances and consumer electronics.

Laminated busbars are used in various appliances and electronic devices for power distribution and thermal management. The growing demand for electric appliances drives the need for efficient power distribution solutions, contributing to the growth of the laminated busbar market.

Korea is investing in the development of smart grid technologies to improve energy efficiency, reliability, and resilience of the electrical grid. Laminated busbars play a crucial role in smart grid infrastructure for efficient power distribution, load balancing, and integration of renewable energy sources, supporting smart grid initiatives and driving market growth in the country.

The below table highlights how epoxy powder coating segment is projected to lead the market in terms of insulation, and is expected to account for a CAGR of 6.8% through 2035. Based on conductor, the copper segment is expected to account for a CAGR of 6.6% through 2035.

| Category | CAGR through 2035 |

|---|---|

| Epoxy Powder Coating | 6.8% |

| Copper | 6.6% |

Based on insulation, the epoxy powder coating segment is expected to continue dominating the laminated busbar market. Epoxy powder coating offers excellent insulation properties, which are crucial for ensuring the safety and reliability of laminated busbars.

The epoxy coating helps prevent electrical arcing, short circuits, and insulation breakdown, reducing the risk of electrical hazards and improving the overall performance of the busbar system.

Epoxy powder coating provides a protective barrier against corrosion and environmental degradation, extending the service life of laminated busbars in harsh operating conditions. The corrosion resistance of epoxy coated busbars makes them suitable for outdoor applications, industrial environments, and marine applications where exposure to moisture, chemicals, and contaminants is a concern.

In terms of conductor, the copper segment is expected to continue dominating the laminated busbar market, attributed to several key factors. Copper is renowned for its exceptional electrical conductivity, making it an ideal material for conducting electricity efficiently within laminated busbars.

The high conductivity of copper minimizes power losses, voltage drops, and heat generation during power transmission, ensuring optimal performance and energy efficiency in electrical systems.

Copper possesses excellent thermal conductivity properties, allowing it to dissipate heat effectively and maintain stable operating temperatures within laminated busbars. The superior thermal conductivity of copper helps prevent overheating, thermal stress, and insulation degradation, ensuring reliable and safe operation in demanding environments.

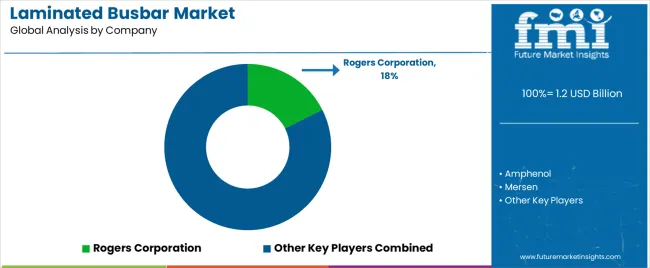

The competitive landscape of the laminated busbar market is characterized by the presence of several key players, ranging from large multinational corporations to smaller regional manufacturers. The companies compete based on factors such as product quality, innovation, pricing, distribution networks, and customer service.

Company Portfolio

| Attribute | Details |

|---|---|

| Estimated Market Size in 2025 | USD 1.1 billion |

| Projected Market Valuation in 2035 | USD 2.2 billion |

| Value-based CAGR 2025 to 2035 | 7.1% |

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2025 |

| Market Analysis | Value in USD Billion |

| Key Regions Covered | North America; Latin America; Western Europe; Eastern Europe; South Asia and Pacific; East Asia; The Middle East & Africa |

| Key Market Segments Covered | Insulation, Conductor, End User, Region |

| Key Countries Profiled | The United States, Canada, Brazil, Mexico, Germany, France, France, Spain, Italy, Russia, Poland, Czech Republic, Romania, India, Bangladesh, Australia, New Zealand, China, Japan, South Korea, GCC countries, South Africa, Israel |

| Key Companies Profiled | Amphenol; Rogers Corporation; Mersen; ABB; Bevone; Jans Copper Private Limited; Sun.King Power Electronics Group Limited; Methode Electronics; OEM Automatic Ltd; Raychem RPG; Schneider Electric; Storm Power Components |

The global laminated busbar market is estimated to be valued at USD 1.2 billion in 2025.

The market size for the laminated busbar market is projected to reach USD 2.3 billion by 2035.

The laminated busbar market is expected to grow at a 6.7% CAGR between 2025 and 2035.

The key product types in laminated busbar market are epoxy powder coating, polyimide film, polyester resin, pvf film, heat resistant fiber and others.

In terms of conductor, copper segment to command 61.4% share in the laminated busbar market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Laminated Tubes Market Size and Share Forecast Outlook 2025 to 2035

Laminated Glass Market Size and Share Forecast Outlook 2025 to 2035

Laminated Labels Market Size and Share Forecast Outlook 2025 to 2035

Laminated Tube Closure Market from 2025 to 2035

Market Share Breakdown of Laminated Tubes Manufacturers

U.S. Laminated Tube Market Trends & Demand Forecast 2024-2034

Laminated Woven PP Bags Market

Silk Laminated Paper Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Litho Laminated Cartons Market Size and Share Forecast Outlook 2025 to 2035

Litho Laminated Packaging Market from 2025 to 2035

Cross Laminated Timber Market

USA Flexible Laminated Paper Market Growth – Trends & Forecast 2024-2034

Europe Flexible Laminated Paper Market Trends – Forecast 2024-2034

Aluminum Foil Laminated Paper Market

Busbars Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA