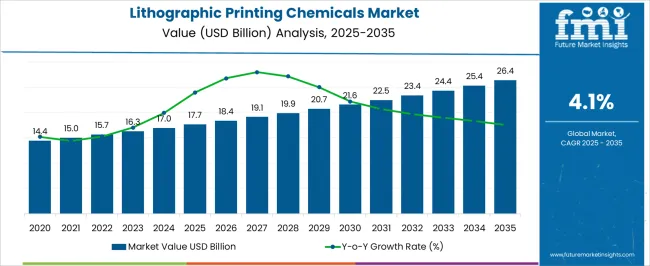

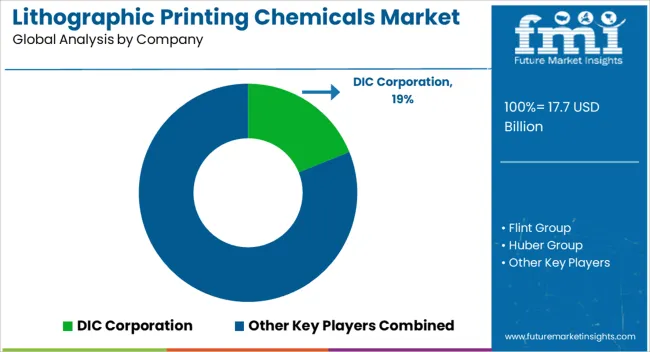

The global lithographic printing chemicals market is projected to grow from USD 17.7 billion in 2025 to USD 26.4 billion by 2035, reflecting a CAGR of 4.1%. In the early adoption phase (2020–2024), the market experienced steady growth, increasing from USD 14.4 billion to USD 17.0 billion. During this period, adoption was primarily driven by traditional printing processes and packaging applications, while innovations focused on environmentally friendly chemicals, improved plate sensitivity, and process efficiency.

The market remained niche in certain regions due to the dominance of existing printing technologies, regulatory challenges, and slow modernization in printing equipment, but growing awareness of cost reduction and sustainability created the foundation for broader adoption. From 2025–2030, the market enters a scaling phase, with revenues increasing from USD 17.7 billion to around USD 20.7 billion.

This period is characterized by wider adoption of advanced lithographic chemicals in commercial printing, packaging, and electronics applications, driven by regulatory support for eco-friendly materials and process efficiency improvements. Between 2030–2035, the market transitions into consolidation, reaching USD 26.4 billion by 2035. Growth stabilizes as industry standards mature, and leading manufacturers dominate the market. Focus shifts toward supply chain optimization, product standardization, and regulatory compliance, reflecting a mature, efficient, and sustainable industry poised for incremental innovation and steady long-term growth.

| Metric | Value |

|---|---|

| Lithographic Printing Chemicals Market Estimated Value in (2025 E) | USD 17.7 billion |

| Lithographic Printing Chemicals Market Forecast Value in (2035 F) | USD 26.4 billion |

| Forecast CAGR (2025 to 2035) | 4.1% |

The lithographic printing chemicals market is experiencing a gradual yet resilient expansion, driven by demand from commercial printing, flexible packaging, and publication sectors. Growth is being supported by evolving print technologies, advances in chemical formulations, and sustainability efforts across the supply chain. Printers are increasingly demanding chemicals that offer higher print fidelity, lower emissions, and compatibility with both traditional and UV-curable lithographic systems.

Moreover, the rise in demand for cost-efficient, high-speed production processes in packaging and labeling has encouraged investments in advanced lithographic setups. Regulatory compliance related to VOCs and heavy metals continues to influence R&D in ink and cleaning solutions.

Market dynamics are expected to benefit from growth in FMCG and e-commerce sectors, where printed packaging and labeling remain critical. Future demand will be shaped by the convergence of automation in printing workflows and increased adoption of sustainable chemical alternatives that do not compromise on performance.

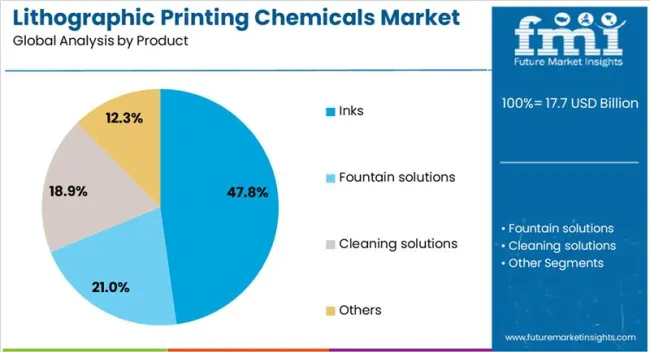

The lithographic printing chemicals market is segmented by product, application, and geographic regions. By product, the market is divided into Inks, Fountain solutions, Cleaning solutions, and Others. In terms of application, the market is classified into Packaging, Consumer electronics, Publication, Promotion, and Others. Regionally, the lithographic printing chemicals industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Inks are expected to account for 47.80% of the total market revenue in 2025, establishing them as the leading product type in the lithographic printing chemicals market. This leadership is being driven by the critical role inks play in defining image quality, color density, and substrate compatibility in offset printing processes.

Innovations in ink chemistry have improved drying time, reduced set-off, and enhanced adhesion across coated and uncoated papers. The demand for both conventional and UV-curable lithographic inks has remained strong, especially in high-volume commercial printing and packaging applications.

Additionally, the increasing shift toward low-VOC and vegetable-based inks has aligned with regulatory and environmental compliance trends, further solidifying the segment’s dominance. As printers seek greater efficiency and consistency, inks continue to serve as the cornerstone of lithographic output quality and sustainability goals.

Packaging is projected to hold 36.40% of the total market share in 2025, making it the dominant application for lithographic printing chemicals. This segment’s growth is being fueled by the rising demand for visually appealing, informative, and brand-differentiated packaging across food, personal care, and household product categories.

Lithographic printing enables high-resolution imagery and fine detail reproduction, which are essential in premium packaging formats. As brands compete on shelf appeal, chemical formulations used in inks, fountain solutions, and plate cleaners are evolving to meet speed, consistency, and color accuracy standards.

Growth in consumer-packaged goods and e-commerce logistics has further driven the need for cost-effective, large-batch printing solutions, where lithography maintains a competitive edge. Additionally, the transition toward recyclable and biodegradable packaging has intensified the need for chemical solutions compatible with sustainable substrates.

The lithographic printing chemicals market is expanding due to rising demand for high-quality print outputs in packaging, publishing, and commercial printing sectors. These chemicals—including inks, coatings, plates, and fountain solutions—enhance print precision, image sharpness, and surface adherence. Growth is driven by increasing packaging requirements, brand promotion activities, and the need for durable and visually appealing prints. Manufacturers are focusing on product consistency, eco-friendly formulations, and specialized chemicals for digital hybrid presses to cater to evolving market needs.

Lithographic printing chemicals play a vital role in achieving sharp, consistent, and vibrant print results. Properly formulated inks and coatings improve image resolution, color accuracy, and uniformity across print runs. High-quality chemicals also reduce smudging, plate wear, and substrate damage, ensuring durable end products. Commercial printers, packaging companies, and publishing houses increasingly rely on specialized formulations to meet client expectations and brand standards. The demand for precise and reproducible print quality across diverse media drives continued consumption of advanced lithographic chemicals globally.

Consistency in chemical properties, such as viscosity, drying time, and surface tension, is crucial for smooth press operation. Variability can lead to plate clogging, uneven ink transfer, and increased waste. Manufacturers invest in controlled production techniques and quality testing to maintain reproducible properties. Reliable formulations improve workflow efficiency, reduce downtime, and enhance overall productivity in high-volume printing environments. Consistent chemical performance also builds trust among end users, encouraging long-term adoption across printing and packaging industries worldwide.

The growth of food, beverage, and consumer goods packaging drives the need for high-performance printing chemicals. Brands seek visually appealing and durable printed materials to differentiate their products on crowded shelves. Specialty inks, coatings, and fountain solutions designed for flexible packaging, cartons, and labels are in high demand. The rise of premium packaging and custom designs further expands opportunities for advanced lithographic chemicals. As packaging remains a core driver of marketing and product visibility, the market continues to benefit from evolving brand requirements globally.

Manufacturers face stringent regulations regarding chemical composition, VOC content, and worker safety. Compliance ensures that printing chemicals meet environmental and health guidelines while maintaining performance standards. Regulatory adherence influences product formulation, labeling, and handling practices. Companies offering certified, safe, and approved chemicals gain a competitive advantage in markets where compliance is mandatory. Meeting these standards also increases trust among printers and end users, supporting broader adoption across both developed and emerging regions where regulatory scrutiny is rising.

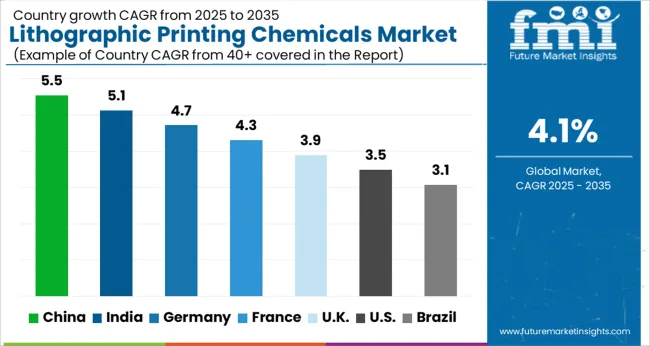

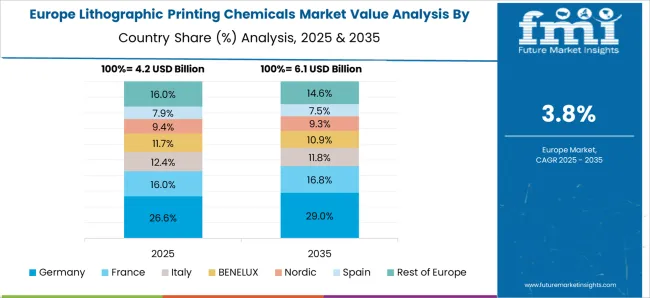

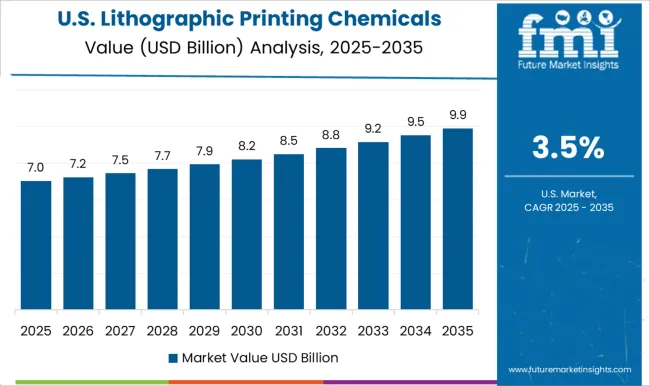

The global lithographic printing chemicals market is projected to grow at a CAGR of 4.1%, driven by demand in printing, packaging, and industrial applications. China leads the market with a 5.5% growth rate, supported by large-scale printing and packaging industries. India follows at 5.1%, driven by expansion in commercial printing and packaging sectors. Germany shows steady growth at 4.7%, leveraging advanced manufacturing and industrial demand. The UK and USA record moderate growth rates of 3.9% and 3.5%, respectively, reflecting stable demand in publishing and commercial printing. This report includes insights on 40+ countries; the top countries are shown here for reference.

China leads the lithographic printing chemicals market with a 5.5% growth rate, driven by rapid expansion of the printing and packaging industry. Compared to India, China benefits from a larger industrial base and high-volume commercial printing operations, supporting consistent demand for plates, inks, and developers. Investments in advanced printing technologies and automation enhance productivity and chemical efficiency. Rising demand from packaging, publishing, and advertising sectors also fuels market growth. Environmental regulations encourage adoption of eco-friendly chemicals, reducing volatile organic compounds and ensuring compliance with global standards. Export-oriented printing facilities further strengthen the market outlook. Continuous R&D in chemical formulations improves performance and reduces costs, giving Chinese manufacturers a competitive edge. Eco-efficiency and the growth of e-commerce also contribute to increased packaging needs, indirectly boosting demand for lithographic printing chemicals. Overall, China’s combination of industrial scale, technological innovation, and regulatory compliance positions it as the largest market globally.

Indian micro tactical ground robot market grows at 17.5%, propelled by increased defense spending and modernization initiatives. Compared to Germany, India focuses on cost-effective solutions tailored to regional security challenges. The government’s emphasis on “Make in India” encourages domestic production and technology transfer. Growing border tensions and internal security needs amplify demand for tactical ground robots. Collaborative programs with international defense firms support skill development and product refinement.

Lithographic printing chemicals market grows at 5.1%, fueled by the expansion of the packaging, publishing, and commercial printing sectors. Compared to Germany, India emphasizes cost-effective production methods while maintaining quality standards suitable for domestic and export markets. Growth in e-commerce, FMCG packaging, and advertising boosts demand for printing chemicals such as inks, developers, and cleaners. Manufacturers are increasingly adopting eco-friendly and water-based chemicals to meet environmental regulations. Efforts to upgrade printing technology and automation improve chemical efficiency and reduce waste. Export opportunities to Middle East and African markets further strengthen the market outlook. Urbanization, rising literacy rates, and increased consumer spending contribute to the overall demand for printed materials. Continuous industry collaborations and investments in R&D allow Indian manufacturers to produce high-quality, cost-efficient chemicals. Long-term growth is expected as packaging and commercial printing remain central to India’s industrial development.

The UK lithographic printing chemicals market grows at 3.9%, supported by demand from commercial printing, packaging, and publishing sectors. Compared to the USA, the UK places higher emphasis on environmentally friendly and regulatory-compliant chemicals. Growth in e-commerce packaging and luxury product labeling increases demand for high-performance inks, developers, and cleaning chemicals. Manufacturers invest in water-based and low-VOC formulations to meet sustainability goals. Technological upgrades in printing processes improve chemical efficiency, reduce waste, and enhance print quality. Export opportunities to European markets further support market stability. Despite slower growth than China and India, the UK market benefits from consistent industrial demand and regulatory focus. Continued innovation and adoption of eco-friendly chemical formulations will strengthen long-term prospects in lithographic printing.

The USA lithographic printing chemicals market grows at 3.5%, driven by demand from packaging, commercial printing, and publishing industries. Compared to China, the USA market emphasizes regulatory compliance, quality standards, and eco-friendly chemical formulations. Industrial and commercial printing operations require high-performance inks, developers, and cleaners to maintain precision and durability. Investments in automation and digital integration improve chemical utilization efficiency and reduce operational costs. Growth in e-commerce and FMCG packaging supports steady demand. Manufacturers increasingly adopt low-VOC and water-based chemicals to comply with environmental regulations. Export opportunities are moderate, but domestic industrial demand ensures market stability. Although growth is slower than Asian markets, continuous R&D and technological improvements help maintain competitiveness and ensure sustainable long-term expansion in lithographic printing chemicals.

The lithographic printing chemicals space is contested by diversified graphics suppliers and specialist pressroom brands. Rivalry is intense. Fujifilm Graphic Systems is positioned through integrated pressroom chemistry paired with its CtP plate portfolio to secure print stability at press and prepress. Competitive weight is applied via a wide pressroom range, with fountain solutions, blanket and roller washes, plate cleaners, silicones, and auxiliaries presented as interoperable sets that reduce make-ready, control waste, and support quick restarts. Distribution is executed through direct graphic divisions and authorized dealers with technical teams embedded at customer sites (observed industry pattern).

Pricing is typically tiered by concentrate strength, compliance profile, and application scope rather than by package size alone (observed industry pattern). Channel pull is reinforced by plate compatibility messaging and by diagnostic guides on water chemistry, pH, and conductivity that de-risk adoption. Strategy has been framed around low-chemistry workflows and alcohol-reduced operation, with environmental exposure lowered through product selection and usage guidance, while uptime is protected by standardized SKUs and consistent toll-blended formulations for legacy lines.

Growth is targeted in commercial sheetfed, heatset web, and newspaper plants requiring stable ink-water balance on mixed ink systems, where tolerance to variable water quality and fast restarts is prioritized by production managers. Scalability is pursued through common chemistries that span plate families and press types, enabling larger fleets to be standardized on fewer SKUs, with training and remote troubleshooting used to compress ramp times (observed industry pattern). In product brochures, the fountain solution ranges are specified for stable ink-water balance, improved dot structure, reduced waste, and decreased downtime, with options called out for UV and conventional inks, plus variants featuring calcium control additives for hard water. Wash portfolios are described by evaporation rate, solvent strength, and elastomer compatibility. Plate cleaners are presented for general use and UV ink removal, with short-stop desensitizing behavior noted. Ready references to pH windows, conductivity targets, and dosing guidance are provided. The promise is practical. Chemistry is supplied to start fast, hold color, and restart clean.

| Item | Value |

|---|---|

| Quantitative Units | USD 17.7 Billion |

| Product | Inks, Fountain solutions, Cleaning solutions, and Others |

| Application | Packaging, Consumer electronics, Publication, Promotion, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | DIC Corporation (Sun Chemical), Flint Group, hubergroup, Sakata INX Corporation, SICPA Holding SA, Siegwerk Druckfarben AG & Co. KGaA, T&K TOKA Co., Ltd., Tokyo Printing Ink Mfg. Co., Ltd., Toyo Ink SC Holdings Co., Ltd. |

| Additional Attributes | Dollar sales by type including fountain solutions, plate coatings, and cleaning agents, application across commercial printing, packaging, and publishing, and region covering North America, Europe, and Asia-Pacific. Growth is driven by rising demand for high-quality print output, expansion of packaging industries, and increasing adoption of eco-friendly printing solutions. |

The global lithographic printing chemicals market is estimated to be valued at USD 17.7 billion in 2025.

The market size for the lithographic printing chemicals market is projected to reach USD 26.4 billion by 2035.

The lithographic printing chemicals market is expected to grow at a 4.1% CAGR between 2025 and 2035.

The key product types in lithographic printing chemicals market are inks, fountain solutions, cleaning solutions and others.

In terms of application, packaging segment to command 36.4% share in the lithographic printing chemicals market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Printing Paper Market Size and Share Forecast Outlook 2025 to 2035

Printing Machinery Market Size and Share Forecast Outlook 2025 to 2035

Printing Toners Market Size and Share Forecast Outlook 2025 to 2035

Chemicals And Petrochemicals Electrostatic Precipitator Market Size and Share Forecast Outlook 2025 to 2035

Printing Supplies Market Analysis by Application, Technology, and Region Forecast Through 2035

Printing Plate Market

3D Printing Industry Analysis in Middle East Size and Share Forecast Outlook 2025 to 2035

3D Printing Ceramics Market Size and Share Forecast Outlook 2025 to 2035

3D Printing Metal Market Size and Share Forecast Outlook 2025 to 2035

3D Printing in Aerospace and Defense Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

3D Printing Market Size and Share Forecast Outlook 2025 to 2035

Biochemicals Control Market Size and Share Forecast Outlook 2025 to 2035

3D Printing in Automotive Market Size and Share Forecast Outlook 2025 to 2035

3D Printing In Construction Market Size and Share Forecast Outlook 2025 to 2035

3D Printing Dental Devices Market Growth - Trends & Forecast 2025 to 2035

3D Printing Photopolymers Market Trends, Analysis & Forecast by Material, Application and Region through 2035

3D Printing Materials Market Analysis by Material Type, Form, Application, and Region from 2025 to 2035

Market Positioning & Share in the 3D Printing Metal Industry

Evaluating 3D Printing Filament Market Share & Provider Insights

4D Printing Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA