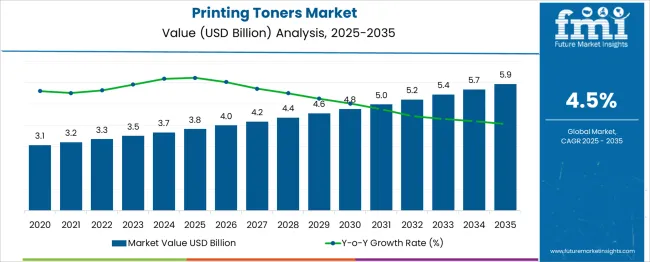

The Printing Toners Market is estimated to be valued at USD 3.8 billion in 2025 and is projected to reach USD 5.9 billion by 2035, registering a compound annual growth rate (CAGR) of 4.5% over the forecast period. This represents a 55.3% total value increase over ten years, underpinned by a CAGR of 4.5%. Breaking down the opportunity, the first half of the decade (2025–2030) will see the market expand from USD 3.8 billion to USD 4.8 billion, adding USD 1.0 billion, or approximately 48% of the total incremental gains.

Growth in this phase will be driven by steady demand for office and commercial printing, sustained requirements from the education sector, and moderate expansion in industrial printing applications such as packaging and labeling. The second half (2030–2035) will contribute an additional USD 1.1 billion, accounting for 52% of total absolute growth. This slightly stronger contribution is expected to stem from increased adoption of high-quality color toners, specialized formulations for 3D and security printing, and demand from emerging markets upgrading print infrastructure. The absolute dollar opportunity of USD 2.1 billion reflects a balanced growth profile, where innovation in eco-friendly toner formulations, compatibility with high-speed digital presses, and expansion into niche industrial printing segments will be key levers for capturing incremental revenue.

| Metric | Value |

|---|---|

| Printing Toners Market Estimated Value in (2025 E) | USD 3.8 billion |

| Printing Toners Market Forecast Value in (2035 F) | USD 5.9 billion |

| Forecast CAGR (2025 to 2035) | 4.5% |

The printing toners market is viewed as a specialized yet steadily expanding category across its parent industries. It is estimated to account for about 2.6% of the global office equipment and supplies market indicating continued reliance on printed documentation. Within the imaging consumables sector a share of approximately 3.8% is assessed driven by business and home printer usage. In the specialty chemical market around 2.4% is observed reflecting formulation of toner powders and coatings. Within the aftermarket printer supplies industry, a contribution of roughly 4.5% is calculated as third party compatibles and remanufactured cartridges gain wider acceptance. In the digital office technology market about 2.1% is evaluated supported by integration of printers within smart office systems. Trends in this market have been shaped by increasing use of high yield cartridges and extended page capacity models which deliver reduced cost per page. Innovations have been focused on development of low dust fine particle toners and chemical coatings to improve image clarity and scanner compatibility. Interest has increased in remanufactured and compatible toner formats which reduce waste and lower cost. The Asia Pacific region has been observed to show the fastest growth while North America has maintained strong demand for high quality and color accurate toner products. Strategic initiatives have included collaborations between toner formulators and office equipment manufacturers to deliver cartridge recycling programmes, consistent yield based supplies and predictive stock replenishment systems.

The printing toners market is witnessing steady growth, driven by consistent demand across office, commercial, and industrial printing applications. The rising need for high-resolution printing in packaging, labeling, and textile sectors is increasing toner consumption.

Digitalization across the education and enterprise landscape, combined with advancements in electrophotographic and laser printing technologies, continues to support toner usage globally. Manufacturers are increasingly focusing on improving toner formulations to deliver sharper image quality, reduced energy consumption, and faster fusing capabilities.

Moreover, the push toward sustainable packaging and eco-friendly printing materials is creating opportunities for bio-based and low-emission toner variants.

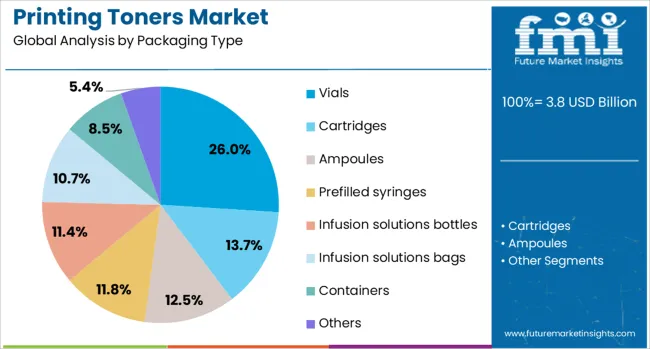

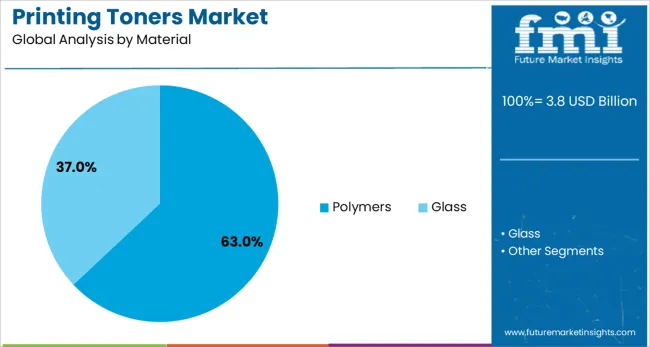

The printing toners market is segmented by packaging type, material, and geographic regions. The printing toners market is divided by packaging type into Vials, Cartridges, Ampoules, Prefilled syringes, Infusion solutions bottles, Infusion solutions bags, Containers, and Others. The printing toners market is classified by material into Polymers and Glass. Regionally, the printing toners industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Vials are expected to account for 26.0% of the printing toners market share in 2025, making them the leading packaging type segment. Their dominance stems from precise dosage delivery, safety during handling, and compact design, which suits the storage and transportation needs of specialty toners.

Vials help prevent contamination and moisture exposure, especially in climate-sensitive or industrial-use toner products. Their tamper-evident features and compatibility with automated dispensing systems make them increasingly preferred for institutional and refill packaging formats.

As demand for smaller and more efficient toner refill packs grows, vial-based packaging offers an effective solution for preserving toner integrity while minimizing waste.

Polymers are projected to contribute 63.0% of the total printing toners market revenue by 2025, maintaining their lead as the most used material in toner production. Their widespread use is driven by superior melt behavior, charge control properties, and compatibility with various substrates.

Polymeric toners provide consistent image quality while lowering the fusing temperature, resulting in energy-efficient printing processes. Additionally, innovations in chemically prepared toner (CPT) technology have enabled the creation of uniform polymer particles that deliver sharper text and images.

As sustainability becomes a priority, manufacturers are investing in biodegradable and bio-based polymer toner variants to meet regulatory requirements and reduce environmental impact across high-volume printing environments.

Printing toners have been extensively used in office equipment, commercial printing, and industrial labeling due to their ability to produce sharp, durable, and high-quality prints. Both monochrome and color toner formulations have been adopted based on application requirements. Demand has been influenced by the continued use of laser printers, multifunction devices, and production presses in corporate and institutional settings. Advancements in polymerized toner technology, enhanced color vibrancy, and energy-efficient fusing processes have supported market growth. Expansion of on-demand and variable data printing has also contributed to increased usage.

Despite the shift toward digital workflows, printing toners have remained essential in offices, educational institutions, and government agencies for document production. Monochrome toners have been widely used for high-volume text printing, while color toners have supported presentations, reports, and marketing materials. Laser printers and multifunction devices have continued to rely on toner cartridges for reliable, smudge-resistant output. Organizations have preferred toner-based printing for speed, sharpness, and consistent quality across large print runs. In North America, Europe, and Asia, procurement contracts for office printing supplies have maintained steady order volumes, ensuring ongoing replacement toner demand. The long shelf life of toner cartridges, combined with predictable yield performance, has reinforced their role in environments requiring dependable printing solutions.

The commercial printing industry has been a key consumer of advanced toner formulations, particularly for marketing collateral, packaging prototypes, and high-resolution imaging. Polymerized toners, with smaller and more uniform particles, have been preferred for producing vivid colors, fine gradients, and detailed graphics. Production presses in advertising, publishing, and label printing have relied on these toners for fast turnaround and consistent output across multiple substrates. Manufacturers in Japan, the United States, and Europe have developed toners with improved fusing efficiency to reduce energy consumption during the printing process. High-gloss and specialty-effect toners have been introduced for premium applications such as luxury packaging and promotional materials. The demand for consistent quality, combined with the need for short-run and variable-data printing capabilities, has strengthened the role of toner-based printing in the commercial segment.

Innovations in toner production and printer design have led to improved image resolution, better color reproduction, and lower operational costs. Chemically produced toner particles have enabled smoother layering and reduced toner waste. Low-temperature fusing technology has been incorporated to lower energy consumption, which has been particularly beneficial for high-volume users. Some manufacturers have focused on developing eco-friendly toner formulations with reduced volatile organic compounds and increased recyclability. Anti-clumping additives have improved toner flow in cartridges, ensuring consistent performance until depletion. Toner cartridges with integrated chip technology have allowed printers to monitor usage and optimize replacement schedules. These technological improvements have enhanced user satisfaction, positioning toner-based printing as a reliable and evolving solution across office and commercial printing applications.

The increasing adoption of paperless workflows and digital communication tools has reduced overall printing volumes in many corporate and institutional environments. In addition, competition from alternative printing technologies such as inkjet, which offers lower-cost entry for certain applications, has challenged toner-based systems in some segments. Price sensitivity in office supply procurement has put pressure on manufacturers to offer competitive pricing while maintaining quality. The availability of third-party and remanufactured toner cartridges has intensified cost competition, affecting profit margins for OEM suppliers. Environmental regulations and recycling challenges for toner cartridges have also posed operational hurdles. Unless supported by innovation, value-added features, and targeted marketing, toner consumption in mature markets may remain stable or decline gradually, with stronger growth potential in emerging regions with expanding printing infrastructure.

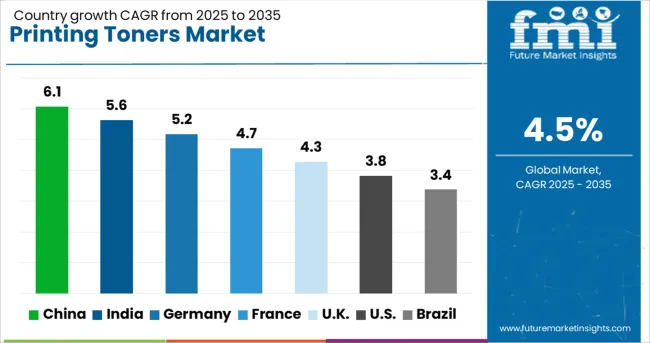

| Country | CAGR |

|---|---|

| China | 6.1% |

| India | 5.6% |

| Germany | 5.2% |

| France | 4.7% |

| UK | 4.3% |

| USA | 3.8% |

| Brazil | 3.4% |

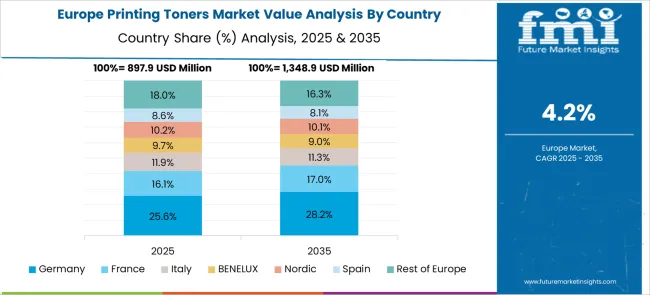

The printing toners market is expected to grow at a global CAGR of 4.5% between 2025 and 2035, driven by demand for high-quality printing in commercial, packaging, and office applications alongside advancements in toner formulations. China leads with a 6.1% CAGR, supported by large-scale toner manufacturing and expansion in domestic and export printing markets. India follows at 5.6%, fueled by growth in commercial printing and packaging sectors. Germany, at 5.2%, benefits from precision printing technologies and demand for premium quality prints. The UK, projected at 4.3%, sees growth from niche printing markets and graphic arts. The USA, at 3.8%, reflects stable demand from office printing and specialized print applications. The report provides insights for 40+ countries, with the five below highlighted for their strategic significance and growth potential.

China is projected to grow at a CAGR of 6.1% from 2025 to 2035 in the printing toners market, supported by its role as a major global hub for printer manufacturing and aftermarket supplies. Domestic producers such as Ninestar Corporation, Aprint, and Print-Rite are expanding production capacities for both conventional and eco-friendly toner formulations. The rise of small and medium enterprises, alongside growth in packaging and labeling applications, is fueling domestic consumption. Export demand for Chinese-made toners remains strong, particularly in emerging Asian, African, and South American markets. Additionally, the shift toward polymerized toners with finer particle sizes is enabling higher-quality print outputs while reducing energy consumption during fusing.

India is forecasted to achieve a CAGR of 5.6% from 2025 to 2035, driven by expansion in commercial printing, corporate office usage, and government documentation requirements. Companies such as ITDL Imagetec, Jet Tec Info-Consumables, and OEM brands like Canon India are catering to rising demand for compatible and remanufactured toner cartridges. Growth in the education sector, along with rapid adoption of digital printing in advertising and marketing materials, is boosting consumption. The push for cost-effective printing solutions is increasing sales of high-yield toner cartridges, especially in institutional buyers. Furthermore, growing adoption of toner recycling programs is shaping supply chain strategies for manufacturers and distributors.

Germany is projected to post a CAGR of 5.2% from 2025 to 2035, driven by strong demand for premium-quality printing in commercial and industrial applications. Leading suppliers such as Mitsubishi HiTec Paper Europe (toner coating solutions) and OEM brands like HP Deutschland and Brother are focusing on advanced toner formulations that offer improved color accuracy and lower melting points for energy efficiency. The country’s packaging and industrial labeling sectors are adopting specialty toners for durable, high-resolution printing on non-paper substrates. Additionally, demand for environmentally friendly toners, including plant-based resins, is steadily increasing in compliance with EU sustainability directives.

The United Kingdom is expected to record a CAGR of 4.3% from 2025 to 2035, with growth supported by demand from the corporate, publishing, and marketing sectors. Suppliers such as Static Control Components and Cartridge World UK are expanding their offerings of remanufactured toner cartridges to serve cost-conscious customers. The shift toward hybrid work models is leading to a rise in home-office printing needs, prompting demand for compact, low-maintenance toner solutions. Additionally, demand for specialty toners, such as metallic and fluorescent types used in creative printing, is on the rise among small printing businesses and design studios.

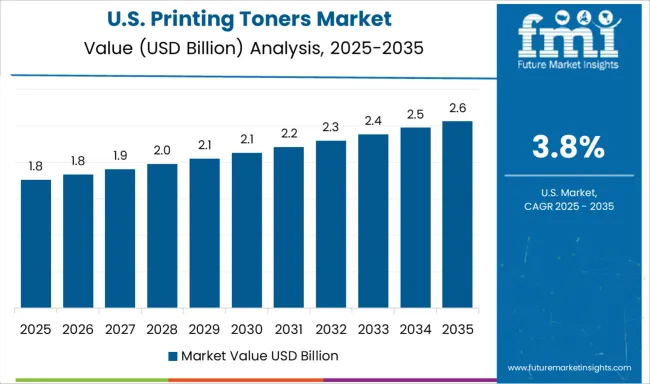

The United States is forecasted to grow at a CAGR of 3.8% from 2025 to 2035, driven by demand from the education, healthcare, and corporate sectors. Major players such as Xerox, Lexmark, and Ricoh USA are focusing on high-performance toners optimized for both monochrome and color printing at high speeds. Increasing demand for custom branding and short-run packaging applications is boosting sales of specialty and MICR (Magnetic Ink Character Recognition) toners. Sustainability trends are influencing product development, with more companies launching toners that use recycled materials or bio-based resins. Growth in managed print services is also contributing to recurring toner sales across large enterprise accounts.

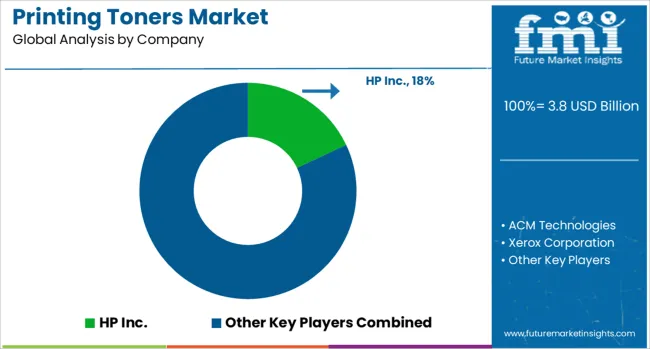

The printing toners market is dominated by global printer OEMs and specialized toner producers serving office, commercial, and industrial printing applications. HP Inc. and Canon lead with extensive toner portfolios designed for their proprietary laser printers, multifunction devices, and high-speed copiers, supported by large-scale production facilities and global distribution networks. Xerox Corporation and Konica Minolta maintain strong market positions with toners engineered for superior image resolution, fusing efficiency, and color consistency in professional printing environments.

Epson and Brother International Corporation focus on precision-formulated toners for small-office and home-office users, while Lexmark delivers toners optimized for enterprise-grade print management systems. Panasonic and Citizen-Systems serve niche printing applications, including compact office devices and specialized industrial printers. IBM retains a presence in the enterprise segment with toner solutions compatible with legacy high-volume systems. Specialized suppliers like ACM Technologies, IMEX Co. Ltd., and Lotte Fine Chemicals Toshiba produce OEM-compatible and remanufactured toner cartridges, targeting cost-sensitive markets and aftermarket demand. These companies emphasize consistent particle size, low-melt formulations, and environmental compliance in toner production. Key strategies across the sector include securing long-term OEM contracts, expanding remanufacturing and recycling programs, and investing in chemical toner technologies to improve energy efficiency during fusing. Entry into this market is restricted by the need for precision manufacturing, intellectual property protections around toner formulations, and established brand loyalty within the printer hardware ecosystem.

| Item | Value |

|---|---|

| Quantitative Units | USD 3.8 Billion |

| Packaging Type | Vials, Cartridges, Ampoules, Prefilled syringes, Infusion solutions bottles, Infusion solutions bags, Containers, and Others |

| Material | Polymers and Glass |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | HP Inc., ACM Technologies, Xerox Corporation, Panasonic, IMEX Co. Ltd., Lotte Fine Chemicals Toshiba, Epson, Canon, Citizen-Systems, Konica Minolta, IBM, Brother International Corporation, and Lexmark |

The global printing toners market is estimated to be valued at USD 3.8 billion in 2025.

The market size for the printing toners market is projected to reach USD 5.9 billion by 2035.

The printing toners market is expected to grow at a 4.5% CAGR between 2025 and 2035.

The key product types in printing toners market are vials, cartridges, ampoules, prefilled syringes, infusion solutions bottles, infusion solutions bags, containers and others.

In terms of material, polymers segment to command 63.0% share in the printing toners market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Printing Paper Market Size and Share Forecast Outlook 2025 to 2035

Printing Machinery Market Size and Share Forecast Outlook 2025 to 2035

Printing Supplies Market Analysis by Application, Technology, and Region Forecast Through 2035

Printing Plate Market

3D Printing Industry Analysis in Middle East Size and Share Forecast Outlook 2025 to 2035

3D Printing Ceramics Market Size and Share Forecast Outlook 2025 to 2035

3D Printing Metal Market Size and Share Forecast Outlook 2025 to 2035

3D Printing in Aerospace and Defense Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

3D Printing Market Size and Share Forecast Outlook 2025 to 2035

3D Printing in Automotive Market Size and Share Forecast Outlook 2025 to 2035

3D Printing In Construction Market Size and Share Forecast Outlook 2025 to 2035

3D Printing Dental Devices Market Growth - Trends & Forecast 2025 to 2035

3D Printing Photopolymers Market Trends, Analysis & Forecast by Material, Application and Region through 2035

3D Printing Materials Market Analysis by Material Type, Form, Application, and Region from 2025 to 2035

Market Positioning & Share in the 3D Printing Metal Industry

Evaluating 3D Printing Filament Market Share & Provider Insights

4D Printing Market

AHA Toners Market Size and Share Forecast Outlook 2025 to 2035

Pad Printing Machine Market Insights - Growth & Demand 2025 to 2035

Microprinting Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA