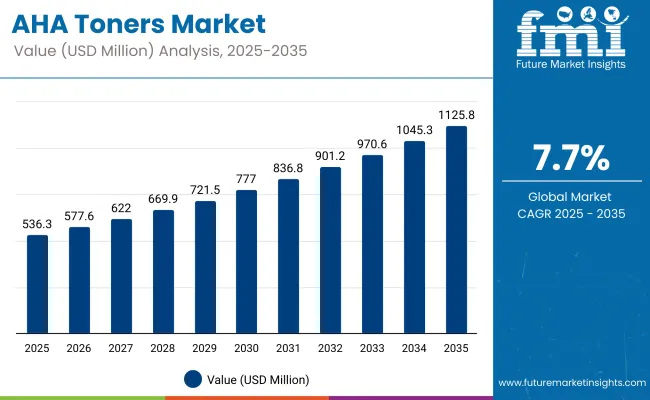

The AHA Toners Market is expected to record a valuation of USD 536.3 million in 2025 and USD 1125.8 million in 2035, which equals a growth of 110% over the decade. The overall expansion represents a CAGR of 7.7% and a 2.1X increase in market size.

AHA Toners Market Key Takeaways

| Metric | Value |

|---|---|

| Market Estimated Value (2025E) | USD 536.3 million |

| Market Forecast Value (2035F) | USD 1125.8 million |

| Forecast CAGR (2025 to 2035) | 7.7% |

During the first five-year period from 2025 to 2030, the market increases from USD 536.3 million to USD 876.8 million, adding USD 340.5 million, which accounts for 36.6% of the total decade growth. This phase records steady adoption across skincare routines, particularly within acne-prone, oily, and combination skin users, due to growing consumer awareness of exfoliation benefits. Glycolic acid-based toners dominate this period, accounting for over 33.9% of global product sales in 2025 due to their effectiveness in skin renewal applications.

The second half from 2030 to 2035 contributes USD 589.5 million, equal to 28.4% of total growth, as the market jumps from USD 876.8 million to USD 1125.8 million. This acceleration is powered by the rise of hybrid AHA blends, microbiome-friendly formulas, and active formulations suited for sensitive skin.

Premium segments and functional claims continue to grow in appeal, with cloud-based personalization platforms and e-commerce-exclusive AHA toner brands driving higher-margin revenues. By 2035, online-first retail channels are projected to contribute over 48.1% of the total market value, signaling a deep-rooted shift in product discovery and purchase behavior.

From 2020 to 2024, the AHA Toners Market grew from USD 322.1 million to USD 494.5 million, driven by increased adoption of glycolic acid and lactic acid-based skincare formulations across both mass and premium segments. During this period, the competitive landscape was dominated by skincare brands specializing in exfoliating treatments, with top players such as The Ordinary, Paula’s Choice, and COSRX together accounting for nearly 45% of market revenue.

Competitive differentiation relied on ingredient concentration, dermatological transparency, and consumer education through digital platforms. Product innovation centered on sensitivity-friendly formulas and layering compatibility with other actives. Service-based personalization remained limited, contributing less than 5% of total market value.

Demand for AHA toners is projected to reach USD 536.3 million in 2025, with the market shifting toward clinically-backed, multifunctional formulations that blend exfoliation with hydration, barrier repair, and anti-aging claims. By 2030, software-enabled skin diagnostics and AI-driven skincare recommendations are expected to raise the share of digital and personalized offerings to over 18%.

Traditional leaders are being challenged by emerging brands such as Beauty of Joseon, Neogen Dermalogy, and The Inkey List, which offer minimalist, skin-type specific solutions with transparent ingredient lists. Hybrid brand strategies are emerging, where routine-based subscription services, ingredient education, and dermatologist partnerships redefine the consumer touchpoint. The basis of competition is shifting from concentration and brand equity alone to holistic skin solutions, data-driven personalization, and omnichannel engagement capabilities.

AHA toners are gaining traction as brands integrate microbiome-balancing claims into exfoliating products, particularly glycolic and lactic acid-based toners. Instead of harsh stripping actions, newer formulations feature skin-friendly pH levels, prebiotic additives, and fermented botanicals to maintain the acid mantle and support the skin’s microbial diversity.

This shift has repositioned toners from secondary cleansing agents to primary skin health enhancers, driving adoption among users with sensitive and acne-prone skin. The science-backed narrative around barrier support and cell turnover synergy is reshaping consumer perception, prompting both clinical and clean beauty brands to invest in innovation within the AHA toner segment.

The growing popularity of “skin cycling” and acid layering routines on platforms like TikTok and Instagram has significantly influenced how AHA toners are used. Consumers are no longer applying toners sparingly but incorporating them on specific nights within curated routines to amplify results while avoiding irritation. As a result, repeat purchases and usage frequency have increased.

Brands have responded with differentiated AHA concentrations (5% to 15%) and product lines tailored to specific skin cycle stagesreset, exfoliate, hydrate, and repair. This behavior-driven segmentation has pushed both volume and value sales, accelerating AHA toner consumption across age groups and skin types.

The market is segmented by product functionality, skin concern, ingredient format, distribution channel, end user, and region. Product functionalities include exfoliating, hydrating, pore-refining, brightening, firming, and multifunctional toners, reflecting varied consumer goals from surface renewal to dermal toning. Skin concern classification spans dullness, acne, hyperpigmentation, fine lines, and uneven texture, targeting specific dermo-corrective outcomes.

Based on ingredient format, segmentation includes glycolic acid, lactic acid, mandelic acid, citric acid, malic acid, tartaric acid, and blends, capturing differences in molecular size, penetration depth, and sensitivity compatibility. In terms of distribution channels, categories encompass beauty specialty stores, pharmacy chains, DTC brand websites, e-commerce aggregators, aesthetic dermatology clinics, and spas. End users include millennials, Gen Z, men’s skincare users, and mature skin segments, indicating personalization across age and gender lines. Regionally, the market spans North America, Latin America, Western and Eastern Europe, Central Asia, East Asia, South Asia and Pacific, and the Middle East and Africa.

| Source | Value Share% 2025 |

|---|---|

| Glycolic Acid | 41.5% |

| Others | 58.5% |

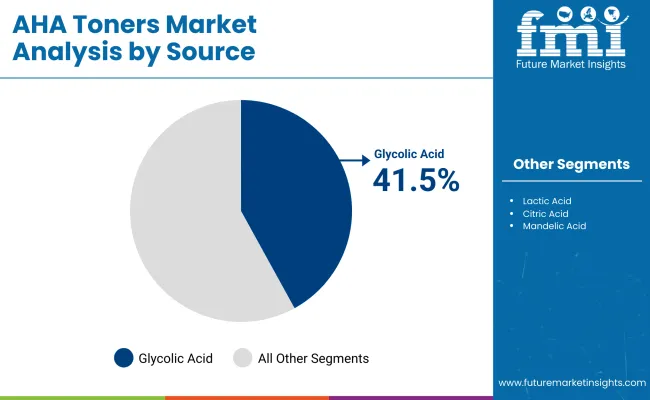

The AHA toners market, segmented by source, shows glycolic acid leading with a projected 41.5% value share in 2025. This prominence is credited to its smaller molecular size, enabling deeper skin penetration and superior exfoliation efficacy. Glycolic acid’s dual appeal in anti-aging and acne-care formulations has elevated its presence across both clinical and mainstream skincare brands. Its compatibility with minimalist and clean-label trends further enhances its commercial appeal.

Glycolic acid’s regulatory acceptance across North America, Europe, and East Asia has supported widespread product launches, giving it an edge over alternative AHA types. Meanwhile, the ‘Others’ segment, accounting for 58.5%, remains diverse but lacks a single dominant acid, with lactic acid, mandelic acid, and citric acid occupying niche roles. Their limited penetration, either due to lower efficacy or regional formulation restrictions, has restricted their global share. As a result, glycolic acid is expected to remain the anchor ingredient in AHA toner formulations.

| Form | Value Share% 2025 |

|---|---|

| Liquid Toners | 46.2% |

| Others | 53.8% |

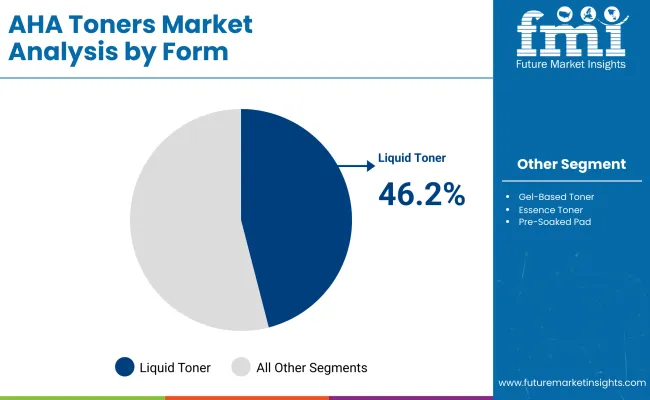

In the AHA toners market, liquid toners are projected to capture 46.2% of the value share in 2025, making them the most preferred formulation format. Their ease of application, quick absorption, and compatibility with layering routines have reinforced their popularity across mass and premium skincare categories. Liquid toners also offer versatility across skin types and are often the first step in active-based regimens, enhancing their everyday usage appeal.

Despite the broader ‘Others’ segment accounting for 53.8%, it remains fragmented across emerging formats such as gel-based, mist, and pad-based toners. While these alternatives offer targeted delivery or convenience, they are generally positioned as niche or seasonal variants. In contrast, liquid toners continue to serve as the foundational delivery form for glycolic and lactic acid-based actives, enabling brands to position them as both effective and gentle. This entrenched consumer familiarity ensures that liquid toners will remain central to AHA product portfolios.

| Packaging Type | Value Share% 2025 |

|---|---|

| Dispenser Bottles | 38.4% |

| Others | 61.6% |

Dispenser bottles are anticipated to account for 38.4% of the AHA toners market by value in 2025, underlining their functional appeal in skincare routines. Their controlled dispensing mechanism ensures hygienic usage and precise application, especially for formulations with active exfoliants like glycolic or lactic acid. Brands continue to favor dispenser formats for both mid-range and premium offerings to convey a clinical and efficacy-driven positioning.

The remaining 61.6% share is distributed among formats such as screw-cap bottles, pump sprays, mist cans, and pad jars. While these alternatives serve varying consumer preferences around portability or tactile experience, dispenser bottles retain strong association with stable, dermatologically-focused AHA toner products. This format is increasingly being adopted in travel-size SKUs and refillable packs as sustainability concerns grow, reinforcing its relevance. Their perceived convenience and alignment with routine skincare usage patterns will likely continue to support share stability over the forecast period.

Growing Preference for Exfoliating Actives in Daily Skincare

Consumers are increasingly shifting away from traditional physical exfoliants and adopting chemical exfoliators such as alpha hydroxy acids (AHAs), especially glycolic and lactic acid, in their daily routines. AHA toners are viewed as essential for achieving smoother skin, refined texture, and better absorption of subsequent skincare products. As awareness grows regarding the long-term skin damage caused by abrasive scrubs, AHAs have gained favor for their mild yet effective exfoliating action.

Brands are responding with formulations containing low concentrations of glycolic acid (typically 3-7%), which can be safely used daily, even on sensitive skin. This shift aligns with the broader trend of “skinimalism,” where consumers seek multi-benefit products that offer exfoliation, hydration, and barrier support. The market has witnessed increased launches in the affordable luxury and masstige segments, making AHA toners more accessible to a wider demographic. The ability of AHAs to target concerns such as dullness, hyperpigmentation, acne scars, and early aging signs is reinforcing their role as a mainstay in modern skincare regimens.

Expansion of Dermatologist-Backed and Clinical Skincare Brands

The rapid growth of dermocosmetic brands and clinical skincare players has strongly influenced AHA toner adoption globally. These brands focus on evidence-backed actives, precise pH formulations, and ingredient transparency, positioning AHA toners as medically informed solutions for skin concerns. Products containing glycolic acid, often formulated with buffering agents or paired with calming ingredients like panthenol or allantoin, are being recommended for conditions like keratosis pilaris, mild acne, and melasma.

The rise of direct-to-consumer (DTC) clinical skincare startups has also democratized access to these potent formulations, previously available mainly through dermatologists or medical spas. In retail channels, dermatologist-endorsed brands enjoy growing shelf space across pharmacies, specialty beauty retailers, and online marketplaces. These players often emphasize controlled clinical trials, skin tolerance studies, and post-market safety evaluations, helping build trust among new adopters. The consistent messaging around efficacy and safety from clinical skincare brands has enabled glycolic acid toners to penetrate even risk-averse consumer segments, including those with sensitive or aging skin.

Skin Sensitivity and Irritation Risks Among First-Time Users

One of the key restraints affecting market expansion is the potential for skin irritation, especially among first-time users of AHA-based toners. Glycolic acid, while effective, is known to increase skin sensitivity, especially under sun exposure or when overused. New users who are unaware of pH concentration, frequency of application, or appropriate sun protection may experience stinging, redness, flaking, or purging effects.

These reactions, though common during exfoliation adjustments, are often misunderstood as product failures. Moreover, users with rosacea, eczema, or compromised skin barriers are advised to avoid AHAs or use them cautiously. This caution limits repeat purchases or deters usage in certain geographies with humid climates and high UV exposure. Negative reviews or dermatological concerns regarding barrier damage and photosensitivity often influence buyer perception. As a result, educational gaps around product layering, usage frequency, and pH compatibility pose a challenge to broader adoption, particularly in mass-market segments or among older age groups less familiar with active ingredient skincare.

Rise of Multi-Acid and pH-Balanced Toner Formulations

A significant trend reshaping the AHA toner market is the evolution toward multi-acid and pH-balanced formulations. Instead of single-ingredient glycolic acid toners, brands are introducing products that combine AHAs with beta hydroxy acids (BHAs) like salicylic acid or polyhydroxy acids (PHAs) for a more nuanced exfoliation strategy. These blended acids offer a spectrum of molecular weights and penetration levels, allowing products to target multiple skin layers while minimizing irritation.

Additionally, new formulas are incorporating humectants like hyaluronic acid and glycerin, along with soothing agents such as aloe vera, chamomile extract, and allantoin, to offset the drying effects of acids. Maintaining an optimal pH range (usually 3.5 to 4.0) is being prioritized to ensure efficacy while preserving skin barrier integrity. These innovations have broadened the target audience, enabling daily use across skin types including dry, sensitive, and acne-prone. The growing emphasis on product layering in multi-step routines, particularly in Asian and North American skincare regimens, is accelerating the adoption of such hybrid formulations that combine exfoliation with hydration and comfort.

| Countries | Estimated CAGR (2025 to 2035) |

|---|---|

| China | 9.2% |

| USA | 7.5% |

| India | 6.8% |

| UK | 6.3% |

| Germany | 5.8% |

| Japan | 6.0% |

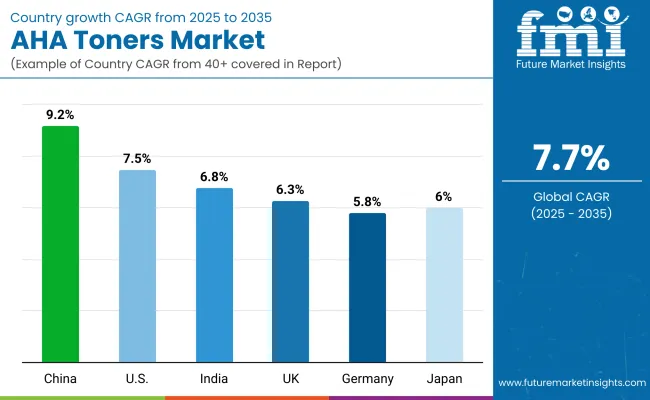

The global AHA toners market displays significant regional variation in growth rates, shaped by consumer skincare awareness, ingredient transparency, and product innovation ecosystems. Asia-Pacific stands out as the most dynamic growth region, with China expected to grow at a robust CAGR of 9.2% and India following at 6.8%, driven by a rising middle class, increasing skincare literacy, and the growing popularity of exfoliating actives like glycolic acid and lactic acid.

Chinese consumers have shown a marked preference for multifunctional and dermatologist-recommended toners, supported by domestic brand innovation and strong e-commerce penetration. India’s demand, while still nascent, is gaining traction among Gen Z and millennial consumers seeking acne-control and skin-brightening solutions, often fueled by K-beauty influence and DTC brand visibility. In Europe, the UK (6.3%) and Germany (5.8%) are projected to maintain steady growth, backed by consumer demand for clean label formulations and sustainable packaging.

Regulatory scrutiny around ingredient safety in the EU further fosters trust in glycolic acid-based toners. Japan, with an estimated CAGR of 6.0%, remains a stable market due to its culture of preventive skincare and consistent retail presence of exfoliating products. The USA market, growing at 7.5%, continues to benefit from clinical skincare trends, dermatological endorsements, and high demand for ingredient-led formulations that cater to concerns like uneven tone, enlarged pores, and dullness.

| Year | USA AHA Toners Market (USD Million) |

|---|---|

| 2025 | 147.48 |

| 2026 | 155.61 |

| 2027 | 164.19 |

| 2028 | 173.23 |

| 2029 | 182.78 |

| 2030 | 192.85 |

| 2031 | 203.48 |

| 2032 | 214.69 |

| 2033 | 226.52 |

| 2034 | 239.01 |

| 2035 | 252.18 |

The AHA toners market in the United States is projected to expand at a CAGR of 5.5% between 2025 and 2035, with growth anchored in consumer demand for clinical-grade exfoliating solutions targeting dullness, uneven skin tone, and enlarged pores. Brands are witnessing strong traction through dermatologist-backed claims and active ingredient transparency, especially glycolic and lactic acids.

The rising preference for ingredient-led skincare has fueled demand among Gen Z and millennials, who prioritize efficacy and clarity in formulation. Additionally, the integration of AHA toners into multi-step regimens promoted by estheticians and beauty influencers has enhanced daily-use acceptance. E-commerce platforms and DTC skincare brands are accelerating access and education, further driving trial and repurchase behavior.

The AHA Toners Market in the United Kingdom is projected to grow at a CAGR of 6.3% between 2025 and 2035, driven by rising consumer focus on skin resurfacing and exfoliation within daily routines. Demand has increased among consumers with acne-prone and sensitive skin, given the mild exfoliating action of AHAs. A growing preference for active ingredient-based skincare has spurred retail chains and e-commerce platforms in the UK to expand AHA toner listings, often bundling them with complementary serums or moisturizers.

The market is also gaining momentum among younger consumers due to education-led marketing campaigns on ingredient transparency and safe exfoliation practices. In the professional sector, dermatology clinics are increasingly recommending glycolic and lactic acid-based toners for post-treatment regimens. Brands are now investing in localized product formulations to comply with UK cosmetic standards and consumer preferences for fragrance-free, alcohol-free toners.

India is witnessing robust expansion in the AHA Toners Market, which is anticipated to register a CAGR of 6.8% through 2035, driven by the increasing adoption of skincare routines among urban and semi-urban consumers. The growing popularity of K-beauty trends, combined with social media influence and dermatologist-backed content, has accelerated demand for exfoliating toners featuring glycolic, lactic, and mandelic acids. AHA toners are gaining visibility among consumers in tier-2 and tier-3 cities as local beauty influencers, regional retail platforms, and vernacular campaigns demystify acid-based skincare.

Domestic brands are introducing budget-friendly formulations tailored for humid Indian climates, while premium international brands are expanding through partnerships with online beauty platforms and dermatology clinics. Salons and skincare clinics are also promoting mild AHA toners as part of monthly facials or chemical peel aftercare, further mainstreaming their use. The availability of fragrance-free, alcohol-free, and dermatologically tested variants is improving consumer confidence and repeat purchases.

The AHA Toners Market in China is projected to grow at a CAGR of 9.2% through 2035, marking the highest pace among leading skincare economies. This momentum is being shaped by rapid digitization in beauty retail, domestic brand innovation, and increased consumer sophistication around exfoliating actives. Urban consumers are adopting AHA formulations for their brightening and skin-smoothing properties, while livestreaming platforms and social commerce are elevating consumer awareness through expert-led demonstrations and dermatologist-backed content.

In addition, China’s skin clinics and aesthetic centers are integrating AHA toners into post-procedure homecare, boosting clinical endorsement and frequency of use. Domestic brands are pushing competitive pricing and offering customized AHA blends targeted at acne-prone, dull, and sensitive skin types. Imports from Korean and Japanese players are also witnessing traction, particularly among premium-conscious Gen Z buyers. This convergence of demand across e-commerce, clinical channels, and youth-driven social platforms is positioning AHA toners as a staple in modern Chinese skincare regimens.

| Countries | 2025 Share (%) |

|---|---|

| USA | 27.50% |

| China | 18.30% |

| Japan | 8.40% |

| Germany | 7.60% |

| UK | 6.80% |

| India | 5.90% |

| Countries | 2035 Share (%) |

|---|---|

| USA | 22.40% |

| China | 24.10% |

| Japan | 8.10% |

| Germany | 6.40% |

| UK | 5.70% |

| India | 7.40% |

The AHA Toners Market in Germany is projected to experience a moderate decline in its global share, from 7.6% in 2025 to 6.4% by 2035, as consumer attention shifts to newer exfoliation formats. Germany, long regarded for its ingredient-savvy skincare market, is seeing stagnation in AHA toner innovation amid the rising appeal of polyhydroxy acids (PHAs) and postbiotic formulations.

While dermatology-endorsed AHA toners continue to perform well in pharmacies and specialist beauty retailers, broader mass-market growth is being held back by regulatory constraints around acid concentrations and mounting demand for gentler alternatives. Market activity is now focused on hybrid AHA products that pair exfoliation with skin barrier support, aligning with German consumers’ preference for minimalist and functional skincare. However, reduced shelf space for single-function toners and growing traction of essence-toners and liquid exfoliants are expected to reshape the category dynamics through 2035.

| USA By Source | Value Share% 2025 |

|---|---|

| Glycolic Acid | 68.4% |

| Others | 31.6% |

The AHA Toners Market in the USA is poised for sustained dominance through 2035, with glycolic acid-based formulations accounting for 68.4% of the total value share in 2025. The segment’s continued strength stems from its established efficacy in chemical exfoliation, supported by high consumer awareness around anti-aging and skin-brightening benefits. American consumers have shown a strong preference for dermatologist-formulated products with clinically proven active ingredients, where glycolic acid has remained a staple in addressing hyperpigmentation, acne, and uneven skin tone.

The regulatory environment in the USA further supports the segment’s stability, allowing controlled usage of alpha hydroxy acids under FDA guidance. Additionally, skincare brands continue to innovate within the glycolic acid format, blending it with soothing agents like aloe vera or hyaluronic acid to improve tolerability. As premium skincare becomes increasingly ingredient-focused, glycolic acid has retained its position as the gold standard among AHAs. On the other hand, the ‘Others’ category comprising lactic, mandelic, and malic acids is gradually expanding, with growth driven by sensitive-skin users seeking gentler alternatives. However, it is unlikely to outpace glycolic acid in the near term given its comparatively lower potency and smaller consumer base in the USA market.

| China By Form | Value Share% 2025 |

|---|---|

| Liquid Toners | 38.7% |

| Others | 61.3% |

The AHA toners market in China presents notable growth opportunities, particularly in the evolving segment of non-liquid formats, which together account for 61.3% of the total value share in 2025. While liquid toners maintain a considerable 38.7% share, the shift toward innovative delivery formssuch as pads, essence gels, and emulsionsis reshaping consumer preferences. These alternative formats are being favored for their perceived convenience, better ingredient penetration, and compatibility with layering-based skincare routines, which are highly popular among Chinese consumers. The rise of multi-step regimens and demand for precision skincare have further encouraged companies to diversify beyond conventional water-based formulations.

At the same time, domestic and global brands are actively investing in sensorial textures and packaging innovation to attract digitally savvy, ingredient-conscious urban consumers. The liquid toner segment, although traditional, continues to perform steadily due to its affordability, ease of use, and broad availability across retail channels. However, the ‘Others’ category is expected to outpace liquid toners in growth as the market matures. Enhanced AHA stability in emulsified formats, rising disposable incomes, and the fusion of actives with K-beauty-inspired delivery systems are likely to unlock significant expansion potential in this segment.

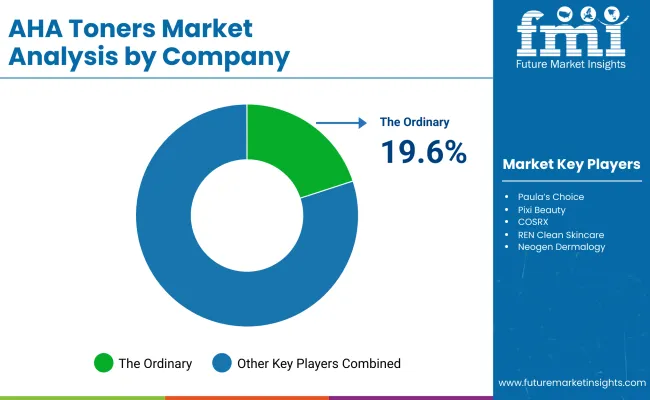

In 2025, The Ordinary is projected to command a dominant position in the global AHA toners market, accounting for an estimated 19.6% value share, while the remaining 80.4% of the market is distributed among various established and emerging players. Brands such as Paula’s Choice, Pixi Beauty, COSRX, REN Clean Skincare, NeogenDermalogy, The Inkey List, Beauty of Joseon, Some ByMi, and Mario Badescu are expected to compete within the 'Others' category. Despite The Ordinary’s stronghold, the broader market remains highly fragmented, with multiple brands targeting distinct consumer niches based on skin concerns, formulation preferences, and pricing strategies.

While some brands focus on minimalist, high-performance actives with affordable pricing, others emphasize clean beauty positioning, heritage formulation, or K-beauty trends. New product launches, ingredient transparency, and clinical efficacy claims have been shaping the competition. Differentiation in AHA concentrations, inclusion of complementary exfoliants like BHA or PHA, and formulation delivery systems are being increasingly used to capture consumer attention. Moreover, the DTC and e-commerce-led go-to-market strategies have enabled niche brands to scale rapidly across borders. As the global market matures, further competition is anticipated on the basis of product sensorial, skin barrier-supportive properties, and dermatologist-endorsed formulations.

Key Developments in AHA Toners Market

| Item | Value |

|---|---|

| Quantitative Units | USD 536.30 Million |

| Source | Glycolic Acid, Lactic Acid, Citric Acid, Mandelic Acid, Malic & Tartaric Acid, and Multi-AHA Blends |

| Form | Liquid Toners, Gel-Based Toners, Essence Toners, and Pre-Soaked Pads |

| Packaging Type | Dispenser Bottles, Spray Bottles, Dropper Bottles, Pad Jars, and Travel-size Tubes |

| Distribution Channel | Online Retail, Beauty Retail Chains, Dermatology Clinics & Salons, Drugstores & Pharmacies, and Supermarkets & Mass Retail |

| Application | Face, Neck & Décolletage, Body (e.g., back, shoulders), and Intimate Areas |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | The Ordinary, Paula’s Choice, Pixi Beauty, COSRX, REN Clean Skincare, Neogen Dermalogy, The Inkey List, Beauty of Joseon, Some By Mi, and Mario Badescu. |

| Additional Attributes | Dollar sales segmented by product type and application area, adoption trends in multi-functional skincare routines and dermocosmetic formulations, rising demand for sensitive-skin-compatible and dermatologist-tested AHA toners, segment-specific growth across face, neck, and body care categories, revenue segmentation by product format and packaging innovations, integration with skin tech devices and smart beauty diagnostics, regional trends shaped by clean beauty movements and regulatory updates, and product innovations driven by pH balancing, slow-release encapsulation, and exfoliation-enhancing delivery systems. |

The global AHA Toners Market is estimated to be valued at USD 536.30 million in 2025.

The market size for the AHA Toners Market is projected to reach USD 1125.8 million by 2035.

The AHA Toners Market is expected to grow at a 7.7% CAGR between 2025 and 2035.

The key product types in the AHA Toners Market include Glycolic Acid Toners, Lactic Acid Toners, Citric Acid Toners, Mandelic Acid Toners, and Multi-AHA Blends.

In terms of source, the Glycolic Acid segment is expected to command a 41.5% share in the AHA Toners Market in 2025, owing to its compatibility with exfoliating and brightening routines.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

AHA/BHA Chemical Peels Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Alpha Hydroxy Acid (AHA) Serums Market Size and Share Forecast Outlook 2025 to 2035

Printing Toners Market Size and Share Forecast Outlook 2025 to 2035

Beverage Cartoners Market Size and Share Forecast Outlook 2025 to 2035

Witch Hazel Toners Market Size and Share Forecast Outlook 2025 to 2035

Glycolic Acid Toners Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Wrap Around Cartoners Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA