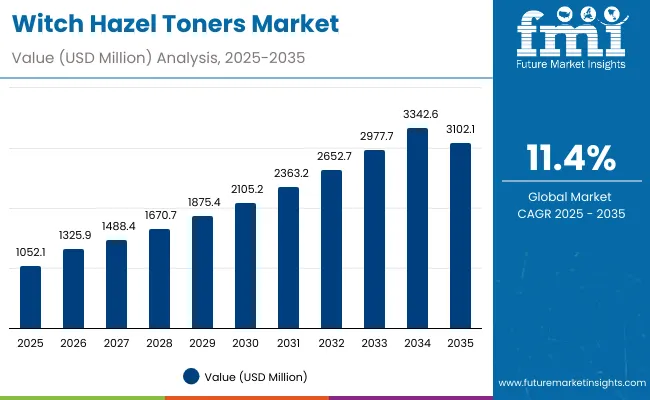

The Witch Hazel Toners Market is expected to record a valuation of USD 1,052.1 million in 2025 and USD 3,102.1 million in 2035, with an increase of USD 2,050 million, representing a growth of nearly 193% over the decade. This overall expansion translates into a CAGR of 11.4%, reflecting a more than 2X increase in market size.

Witch Hazel Toners Market Key Takeaways

| Metric | Value |

|---|---|

| Witch Hazel Toners Market Estimated Value in (2025E) | USD 1,052.1 million |

| Witch Hazel Toners Market Forecast Value in (2035F) | USD 3,102.1 million |

| Forecast CAGR (2025 to 2035) | 11.4% |

During the first five-year period from 2025 to 2030, the market grows from USD 1,052.1 million to USD 2,105.2 million, adding USD 1,053.1 million, which accounts for about 51% of the total decade growth. This phase is marked by steady adoption of alcohol-free formulations and oil-control toners, with strong traction in e-commerce channels and premium positioning in acne-care routines.

The second half from 2030 to 2035 contributes USD 996.9 million, equal to nearly 49% of total growth, as the market expands from USD 2,105.2 million to USD 3,102.1 million. This acceleration is driven by premium innovation in actives-infused toners (niacinamide, salicylic acid blends), sustainable packaging adoption, and deeper penetration in Asia-Pacific markets. Clean-label and hypoallergenic claims gain prominence, while Europe and North America see consolidation of heritage and premium skincare brands leveraging witch hazel toners.

From 2020 to 2024, the Witch Hazel Toners Market recorded steady growth, moving from niche natural skincare adoption to mainstream positioning across drugstores and e-commerce platforms. This early phase was dominated by heritage brands like Thayers and Dickinson’s, which controlled a significant share through alcohol-free and fragrance-free formulations. Differentiation centered on gentleness, natural sourcing, and acne/oil-control positioning, with premium entrants like The Ordinary and Paula’s Choice accelerating uptake through actives-infused blends.

By 2025, demand for witch hazel toners expands sharply, reaching USD 1,052.1 million, with revenue mix shifting toward alcohol-free, clean-label, and hypoallergenic claims. Traditional leaders face growing competition from indie and digital-first skincare brands leveraging social media-driven marketing and subscription-based product models. E-commerce strengthens its role as the largest channel, while Asia-Pacific markets emerge as key growth drivers. Competitive advantage is now moving away from brand heritage alone toward ingredient innovation, sustainable packaging, and holistic ecosystem positioning that blends wellness, natural actives, and clinical validation.

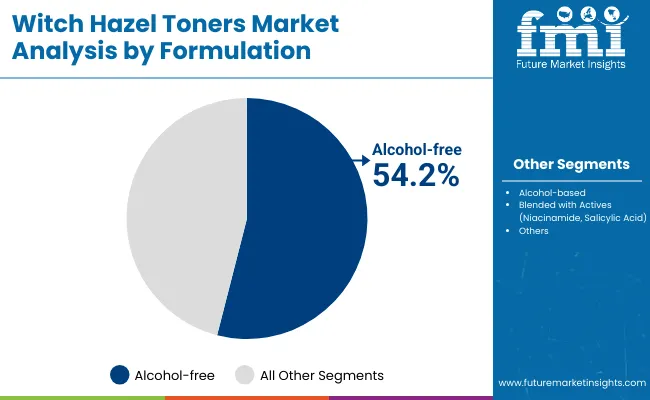

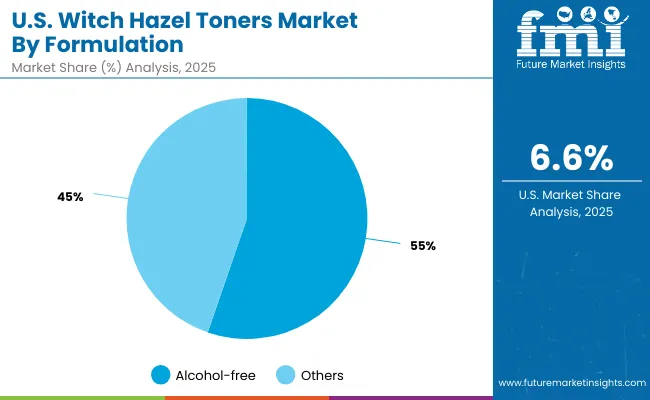

The rising preference for alcohol-free skincare products is a key driver of the Witch Hazel Toners Market. Consumers are increasingly cautious about harsh formulations that strip natural oils, opting instead for gentle, soothing alternatives. Witch hazel toners formulated without alcohol cater to this demand by balancing oil control with hydration, making them suitable for sensitive and acne-prone skin. This positioning has allowed the segment to capture over half the market share, reinforcing its long-term growth trajectory.

The growth of e-commerce platforms and digital-first retail strategies has significantly boosted the availability of witch hazel toners across diverse consumer segments. Brands leverage online marketplaces and social media campaigns to target millennials and Gen Z, who value convenience, transparency, and product authenticity. Subscription models and influencer partnerships further accelerate consumer adoption. This digital shift not only democratizes access to premium and clean-label witch hazel formulations but also amplifies global reach, fueling sustained double-digit growth rates.

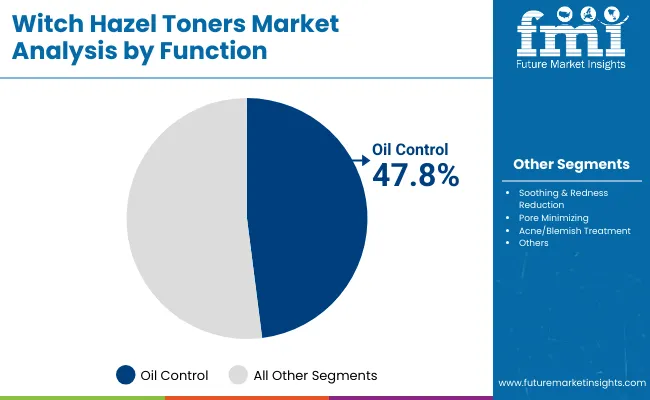

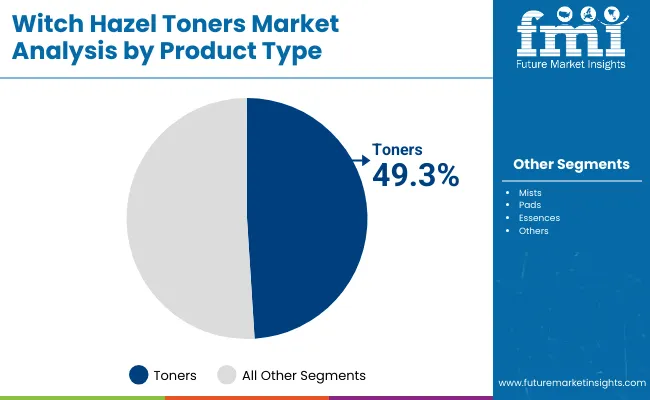

The Witch Hazel Toners Market is segmented by function, formulation, product type, distribution channel, claim, and geography. Functional categories include oil control, soothing & redness reduction, pore minimizing, and acne/blemish treatment, reflecting the broad dermatological benefits of witch hazel. By formulation, the market is divided into alcohol-free, alcohol-based, and blends with actives such as niacinamide or salicylic acid, with alcohol-free dominating in 2025. Product types span toners, mists, pads, and essences, catering to different skincare routines. Key distribution channels include e-commerce, pharmacies/drugstores, specialty beauty retail, and mass retail. Claims such as clean-label, fragrance-free, vegan, and hypoallergenic define product positioning and brand identity. Regionally, the market covers North America, Latin America, Europe, East Asia, South Asia & Pacific, and the Middle East & Africa, with China, India, Japan, the USA, Germany, and the UK emerging as high-growth countries.

| Formulation | Value Share% 2025 |

|---|---|

| Alcohol-free | 54.2% |

| Others | 45.8% |

The alcohol-free segment is projected to contribute 54.2% of the Witch Hazel Toners Market revenue in 2025, maintaining its lead as the dominant formulation type. This growth is driven by increasing consumer preference for gentle skincare solutions that avoid irritation, dryness, or sensitivity associated with alcohol-based products. Alcohol-free toners are strongly positioned among acne-prone and sensitive-skin consumers, aligning with global clean-label and hypoallergenic trends. The segment also benefits from premium branding in serums and mists, often blended with actives such as niacinamide or salicylic acid. With the rising importance of natural, safe, and multifunctional skincare, the alcohol-free category is expected to remain the backbone of witch hazel toner demand through 2035.

| Function | Value Share% 2025 |

|---|---|

| Oil control | 47.8% |

| Others | 52.2% |

The oil control segment is forecasted to hold 47.8% of the market share in 2025, driven by its effectiveness in addressing excess sebum, acne, and blemishesconcerns that dominate skincare routines for younger and combination-skin consumers. Oil-control witch hazel toners are widely adopted for their astringent properties, which help tighten pores and reduce shine without stripping the skin barrier. Their growth is bolstered by rising demand across Asia-Pacific, where humid climates increase oil-control needs, and by product innovation in pads and mists for convenient daily use. With increasing consumer awareness of preventive skincare, the oil control function is expected to maintain a central role in the witch hazel toners market.

| Product Type | Value Share% 2025 |

|---|---|

| Toners | 49.3% |

| Others | 50.7% |

The toners segment is projected to account for 49.3% of the Witch Hazel Toners Market revenue in 2025, establishing itself as the leading product type. Toners remain a core skincare step due to their ability to balance skin pH, tighten pores, and enhance the absorption of serums or moisturizers. Their versatilityoffered in alcohol-free, fragrance-free, and actives-enriched variantscaters to diverse consumer needs from acne treatment to hydration. Growth is further fueled by strong positioning in both pharmacies/drugstores and e-commerce channels. With continued innovation in clean-label and multifunctional toners, this segment is expected to maintain its leadership through 2035.

Rising Preference for Alcohol-Free and Gentle Skincare

Consumer demand for alcohol-free skincare has accelerated growth in witch hazel toners. Many buyers are increasingly aware of the irritation and dryness associated with alcohol-based formulations, opting instead for gentle, soothing options. Witch hazel toners align with this trend by offering oil control and pore-minimizing benefits while maintaining skin hydration. Dermatologist endorsements and the popularity of clean-label claims have further strengthened trust. This driver is particularly strong in North America and Europe, where sensitive-skin products dominate retail shelves, and in Asia, where multifunctional toners cater to diverse skin concerns.

Expansion of E-Commerce and Digital Marketing Channels

The growth of e-commerce platforms and direct-to-consumer strategies has significantly boosted witch hazel toner sales. Younger consumers, especially millennials and Gen Z, prefer shopping online where they encounter product reviews, ingredient transparency, and influencer-driven recommendations. Subscription models and digital-native skincare brands have amplified accessibility and awareness. Global platforms like Amazon and specialty retailers like Sephora Online provide wide distribution, while regional e-commerce hubs in Asia-Pacific add growth momentum. This trend not only enables small indie brands to compete with global leaders but also accelerates international expansion for established players.

Limited Clinical Validation Compared to Other Actives

While witch hazel toners are widely marketed for oil control and soothing properties, the segment faces limitations due to insufficient clinical validation compared to actives like niacinamide or salicylic acid. Consumers focused on evidence-based skincare often prioritize ingredients with robust scientific backing. This challenge is amplified in premium markets where efficacy claims undergo stricter scrutiny. As a result, some brands face skepticism when positioning witch hazel toners as primary treatment products. Without more clinical trials and dermatology-backed studies, the market risks losing share to actives-led formulations in competitive segments.

Blending Witch Hazel with Modern Actives for Hybrid Solutions

A key emerging trend is the formulation of witch hazel toners blended with active ingredients such as niacinamide, salicylic acid, and hyaluronic acid. These hybrids combine the natural astringent and soothing benefits of witch hazel with proven actives that address acne, hydration, and anti-aging. This approach positions toners as multifunctional solutions rather than simple pH balancers. Brands are leveraging this innovation to cater to ingredient-savvy consumers who seek both natural and clinically effective skincare. This fusion of traditional botanicals with modern actives is driving premiumization and higher consumer engagement globally.

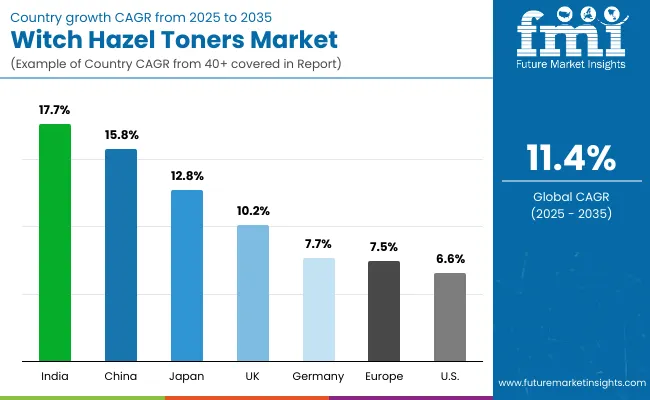

| Countries | Estimated CAGR (2025 to 2035) |

|---|---|

| China | 15.8% |

| USA | 6.6% |

| India | 17.7% |

| UK | 10.2% |

| Germany | 7.7% |

| Japan | 12.8% |

The global Witch Hazel Toners Market demonstrates diverse adoption patterns across regions, influenced by cultural preferences, skincare routines, and product innovation. Asia-Pacific emerges as the fastest-growing region, with India (17.7% CAGR) and China (15.8% CAGR) driving momentum. India’s growth is fueled by rising middle-class spending, preference for natural and Ayurvedic-inspired products, and rapid expansion of e-commerce. China shows strong adoption of clean-label and vegan claims, supported by younger consumers embracing multi-step skincare regimens and premium brands.

Japan (12.8% CAGR) also contributes significantly, with a preference for essences and mists that position witch hazel toners within luxury skincare rituals. In Europe, the UK (10.2% CAGR) and Germany (7.7% CAGR) reflect strong demand for fragrance-free and hypoallergenic variants, supported by regulatory emphasis on clean-label transparency and sustainable packaging. European consumers also drive premiumization, favoring hybrid witch hazel toners blended with modern actives like niacinamide.

In North America, the USA (6.6% CAGR) records steady growth, anchored by heritage brands such as Thayers and Dickinson’s, but facing intense competition from actives-driven alternatives. Demand is concentrated in alcohol-free and sensitive-skin formulations, with mass retail and drugstores remaining dominant. The overall global outlook reflects a split between mature markets prioritizing gentle, clinically backed claims and emerging economies driving growth through natural, affordable, and multifunctional formulations.

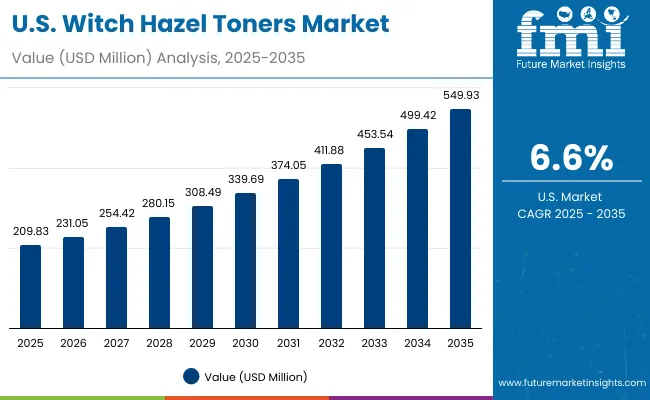

| Year | USA Witch Hazel Toners Market (USD Million) |

|---|---|

| 2025 | 209.83 |

| 2026 | 231.05 |

| 2027 | 254.42 |

| 2028 | 280.15 |

| 2029 | 308.49 |

| 2030 | 339.69 |

| 2031 | 374.05 |

| 2032 | 411.88 |

| 2033 | 453.54 |

| 2034 | 499.42 |

| 2035 | 549.93 |

The Witch Hazel Toners Market in the United States is projected to grow at a CAGR of 6.6% from 2025 to 2035, supported by rising consumer preference for alcohol-free and fragrance-free formulations. Demand is concentrated in oil-control and acne treatment functions, with growing interest in blends featuring salicylic acid and niacinamide. Distribution is dominated by pharmacies and drugstores, though e-commerce is rapidly expanding, particularly for premium and niche clean-label brands. Heritage players like Thayers and Dickinson’s maintain strong brand loyalty, while competition intensifies from newer digital-first skincare entrants.

The Witch Hazel Toners Market in the United Kingdom is expected to grow at a CAGR of 10.2% between 2025 and 2035, driven by rising adoption of clean-label, fragrance-free, and hypoallergenic formulations. Consumers are increasingly shifting toward alcohol-free toners, which now dominate market share, and premium segments are witnessing growth through active-infused blends combining witch hazel with niacinamide or hyaluronic acid. The UK’s mature skincare market also emphasizes sustainability, with brands investing in recyclable packaging and transparent sourcing. E-commerce and specialty beauty retailers are fueling expansion, while heritage natural brands face competition from fast-rising indie labels.

The Witch Hazel Toners Market in the United Kingdom is projected to grow at a CAGR of 10.2% from 2025 to 2035, fueled by the rising preference for clean-label, fragrance-free, and hypoallergenic formulations. Alcohol-free toners lead the market, aligning with consumer demand for gentle solutions suited to sensitive skin. The premium segment is expanding rapidly through active-infused blends that combine witch hazel with niacinamide, hyaluronic acid, and other functional ingredients. A strong emphasis on sustainability and recyclable packaging further defines consumer purchasing decisions. Growth is supported by e-commerce platforms and specialty beauty retailers, while heritage natural brands face competitive pressure from agile indie entrants.

The Witch Hazel Toners Market in China is expected to grow at a CAGR of 15.8% from 2025 to 2035, the fastest among leading economies. Growth is fueled by rising demand for clean-label, vegan, and fragrance-free skincare, driven by a young, ingredient-savvy consumer base. E-commerce platforms such as Tmall and JD.com amplify distribution, while domestic brands compete aggressively with international players by offering affordable yet premium-positioned alcohol-free toners. Active-infused variants, blending witch hazel with niacinamide or salicylic acid, are particularly popular among urban millennials seeking multifunctional products. China’s beauty market also benefits from social media and influencer-driven campaigns, which boost product awareness and adoption.

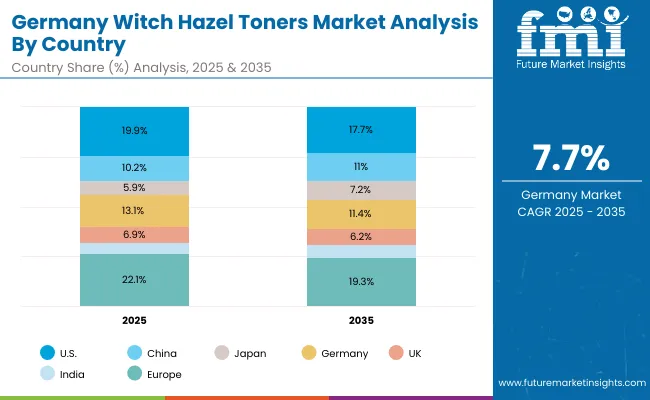

| Countries | 2025 Share (%) |

|---|---|

| USA | 19.9% |

| China | 10.2% |

| Japan | 5.9% |

| Germany | 13.1% |

| UK | 6.9% |

| India | 4.2% |

| Countries | 2035 Share (%) |

|---|---|

| USA | 17.7% |

| China | 11.0% |

| Japan | 7.2% |

| Germany | 11.4% |

| UK | 6.2% |

| India | 5.1% |

The Witch Hazel Toners Market in Germany is projected to grow at a CAGR of 7.7% between 2025 and 2035, supported by the country’s strong demand for fragrance-free, hypoallergenic, and dermatologically tested skincare. German consumers are highly cautious about skin sensitivity and allergic reactions, making alcohol-free toners the leading formulation type. Brands emphasizing clean-label certifications and sustainable packaging gain stronger traction due to EU-driven sustainability mandates. While heritage global players remain dominant, local and regional brands are leveraging eco-conscious positioning to attract younger, health-aware consumers. Growth is also supported by the expansion of pharmacies and specialty beauty retailers, which remain key distribution hubs in the German skincare market.

| USA By FORMULTAION | Value Share% 2025 |

|---|---|

| Alcohol-free | 55.3% |

| Others | 44.7% |

The Witch Hazel Toners Market in the United States is projected to grow steadily at a CAGR of 6.6% between 2025 and 2035, with alcohol-free formulations holding a dominant 55.3% share in 2025. Growth is fueled by consumer preference for gentle, fragrance-free, and hypoallergenic skincare, particularly among sensitive-skin users. Pharmacies and drugstores remain the strongest retail channel, but e-commerce platforms are gaining traction, driven by indie and clean-label brands. Innovation in formulations that blend witch hazel with modern actives like salicylic acid and niacinamide is also expanding the appeal of toners among acne-prone and younger demographics.

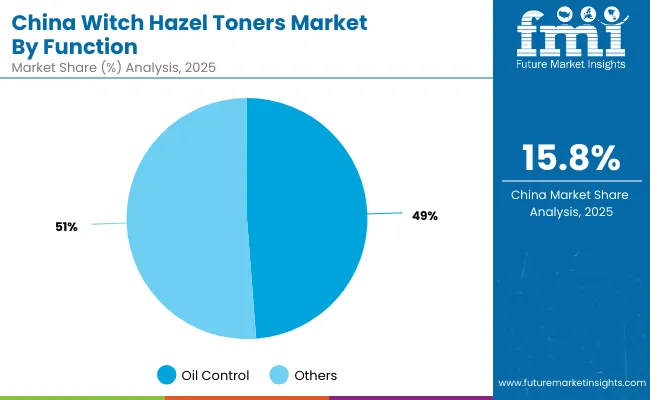

| China By Function | Value Share% 2025 |

|---|---|

| Oil control | 48.8% |

| Others | 51.2% |

The Witch Hazel Toners Market in China offers significant opportunities, projected to expand at a CAGR of 15.8% between 2025 and 2035. Oil-control formulations, holding 48.8% share in 2025, present strong growth prospects given the country’s large population of young, acne-prone consumers. Expanding middle-class spending power and a cultural preference for multi-step skincare routines create fertile ground for toners that combine witch hazel with modern actives like niacinamide and salicylic acid. E-commerce platforms such as Tmall and JD.com, paired with influencer-driven marketing, are further accelerating adoption. The market opportunity lies in scaling affordable alcohol-free solutions while premium brands capitalize on clean-label and vegan claims.

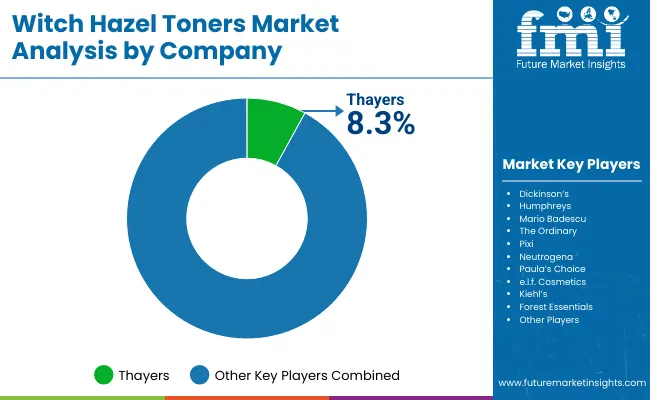

| Company | Global Value Share 2025 |

|---|---|

| Thayers | 8.3% |

| Others | 91.7% |

The Witch Hazel Toners Market is moderately fragmented, with global heritage brands, mid-sized innovators, and niche-focused natural skincare specialists competing for share. Thayers, with 8.3% global value share in 2025, leads the market by leveraging its strong heritage positioning, alcohol-free formulations, and clean-label appeal. Other established players like Dickinson’s, Humphreys, and Mario Badescu maintain strong footholds through pharmacies and drugstores, while premium brands such as The Ordinary, Pixi, and Paula’s Choice capture younger, ingredient-savvy consumers with active-infused blends.

Niche players, including Forest Essentials and e.l.f. Cosmetics, are expanding via vegan, Ayurvedic-inspired, and affordable positioning, supported by rapid e-commerce penetration. Competitive differentiation is shifting from heritage and price toward sustainability, hybrid actives integration, and transparent ingredient sourcing. Digital-first marketing strategies, influencer-driven campaigns, and eco-conscious packaging have become critical for maintaining relevance. As a result, the landscape favors brands that can balance tradition with innovation and adapt to regional skincare preferences.

Key Developments in Witch Hazel Toners Market

| Item | Value |

|---|---|

| Quantitative Units | USD 1,052.1 Million |

| Function | Oil control, Soothing & redness reduction, Pore minimizing, Acne/blemish treatment |

| Formulation | Alcohol-free, Alcohol-based, Blended with actives ( niacinamide, salicylic acid) |

| Product Type | Toners, Mists, Pads, Essences |

| Channel | E-commerce, Pharmacies/drugstores, Specialty beauty retail, Mass retail |

| Claim | Clean-label, Fragrance-free, Vegan, Hypoallergenic |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Thayers, Dickinson’s, Humphreys, Mario Badescu, The Ordinary, Pixi, Neutrogena, Paula’s Choice, e.l.f . Cosmetics, Kiehl’s, Forest Essentials |

| Additional Attributes | Dollar sales by formulation and channel, rising demand for alcohol-free and hypoallergenic products, and growing adoption of active-infused toners for acne and oil control. E-commerce and specialty retailers are driving revenue, while sustainability, clean-label claims, and recyclable packaging shape brand positioning. Regional growth is fueled by natural and vegan trends, with innovation focused on microbiome-friendly actives and fragrance-free formulations. |

The global Witch Hazel Toners Market is estimated to be valued at USD 1,052.1 million in 2025.

The market size for the Witch Hazel Toners Market is projected to reach USD 3,102.1 million by 2035.

The Witch Hazel Toners Market is expected to grow at a 11.4% CAGR between 2025 and 2035.

The key product types in the Witch Hazel Toners Market are toners, mists, pads, and essences.

n terms of function, oil control products are expected to contribute a significant share of the Witch Hazel Toners Market in 2025, supported by rising consumer preference for acne and blemish prevention.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Witch Hazel Distillates Market Size and Share Forecast Outlook 2025 to 2035

Switchgear for Data Centers Market Size and Share Forecast Outlook 2025 to 2035

Switchrack Assemblies Market Size and Share Forecast Outlook 2025 to 2035

Switching Residential Voltage Regulator Market Size and Share Forecast Outlook 2025 to 2035

Switching Commercial Voltage Regulator Market Size and Share Forecast Outlook 2025 to 2035

Switching Mode Power Supply Market - Growth & Forecast 2025 to 2035

Switched Reluctance Motors Market Growth - Trends & Forecast 2025 to 2035

Switchgear Market Growth - Trends & Forecast 2025 to 2035

AC Switchgear Market Size and Share Forecast Outlook 2025 to 2035

RF Switches Market Size and Share Forecast Outlook 2025 to 2035

DC Switchgear Market - Size, Share, and Forecast 2025 to 2035

Keyboard, Video (monitor), Mouse (KVM) Switch Market Size, Growth, and Forecast for 2025 to 2035

Time Switch Market Analysis Size and Share Forecast Outlook 2025 to 2035

Level Switches Market Growth - Trends & Forecast 2025 to 2035

Rocker Switch Market Size and Share Forecast Outlook 2025 to 2035

Hybrid Switchgear Market Size and Share Forecast Outlook 2025 to 2035

Bypass Switch Market Size, Growth, and Forecast 2025 to 2035

Safety Switches Market Trends – Growth & Forecast 2025 to 2035

Vacuum Switches Market

Antenna Switch Module Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA