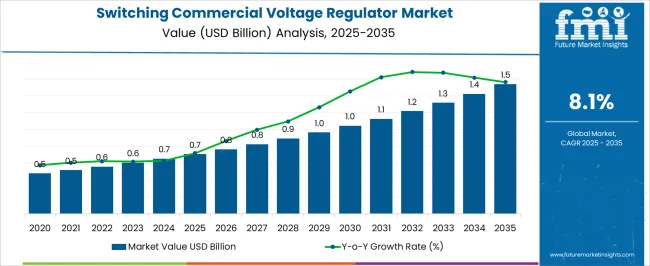

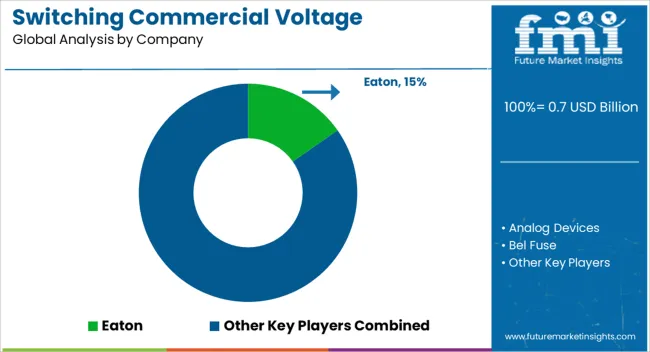

The Switching Commercial Voltage Regulator Market is estimated to be valued at USD 0.7 billion in 2025 and is projected to reach USD 1.5 billion by 2035, registering a compound annual growth rate (CAGR) of 8.1% over the forecast period. Between 2020 and 2030, the market value grows from USD 0.5 billion to around USD 1.0 billion, reflecting consistent adoption driven by the rising need for stable and efficient voltage regulation in commercial facilities. Demand is fueled by the growing deployment of advanced electrical infrastructure in sectors such as manufacturing, data centers, healthcare, and retail, where uninterrupted and precise voltage control is critical for operational efficiency.

The transition toward energy-efficient systems and smart grid integration has encouraged the adoption of switching voltage regulators over traditional linear counterparts due to their superior efficiency, compact size, and adaptability to varying load conditions. From 2030 to 2035, the market advances from USD 1.0 billion to USD 1.5 billion, supported by increased investments in renewable energy projects, expansion of electric vehicle charging infrastructure, and modernization of commercial power distribution networks. Technological developments in wide bandgap semiconductor devices such as GaN and SiC further enhance performance, reliability, and energy savings. Emerging economies are expected to witness accelerated uptake as commercial infrastructure expands, while mature markets will focus on upgrading existing systems to meet evolving energy efficiency and regulatory standards, ensuring sustained market momentum through 2035.

| Metric | Value |

|---|---|

| Switching Commercial Voltage Regulator Market Estimated Value in (2025 E) | USD 0.7 billion |

| Switching Commercial Voltage Regulator Market Forecast Value in (2035 F) | USD 1.5 billion |

| Forecast CAGR (2025 to 2035) | 8.1% |

The switching commercial voltage regulator market is expanding steadily, fueled by the increasing demand for stable power supply and voltage regulation in commercial and industrial sectors. Growing investments in infrastructure and manufacturing facilities have raised the need for reliable voltage control to protect sensitive equipment and ensure operational efficiency.

Industry developments have focused on enhancing regulator performance to manage voltage fluctuations and prevent electrical faults. Technological advances in switching mechanisms have improved energy efficiency and response times.

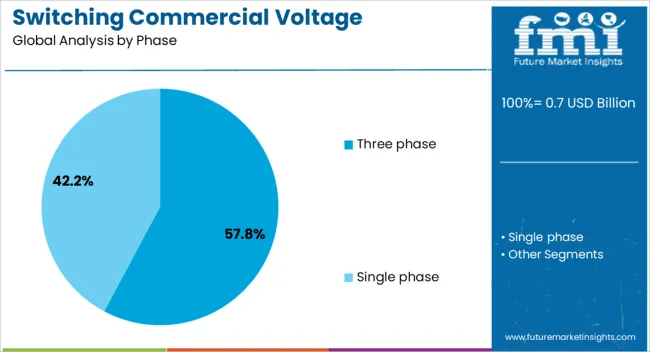

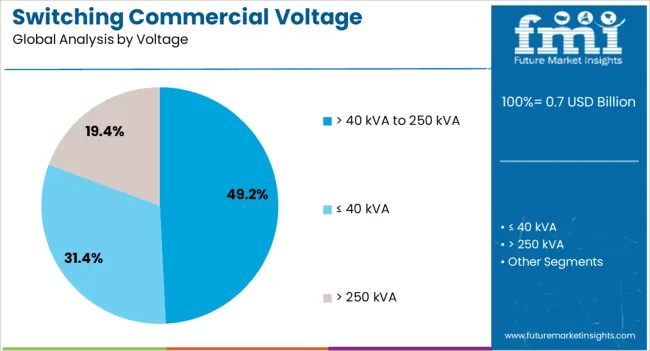

The rising adoption of three-phase power systems in commercial buildings and factories has further driven the market forward. Future growth is expected to benefit from ongoing urbanization, industrialization, and modernization of electrical networks. Segmental growth is anticipated to be led by the three-phase segment due to its suitability for large commercial loads and the voltage range of above 40 kVA to 250 kVA, which caters to mid-sized power requirements.

The switching commercial voltage regulator market is segmented by phase, voltage, and geographic regions. By phase, the switching commercial voltage regulator market is divided into Three phase and Single phase. In terms of voltage, the commercial switching voltage regulator market is classified into three categories:> 40 kVA to 250 kVA, ≤ 40 kVA, and > 250 kVA. Regionally, the switching commercial voltage regulator industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The three-phase segment is projected to hold 57.8% of the switching commercial voltage regulator market revenue in 2025, establishing itself as the dominant phase category. This segment’s expansion is driven by the prevalence of three-phase electrical systems in commercial and industrial settings where balanced and stable voltage is critical.

The efficiency and capacity of three-phase systems to handle larger loads make them ideal for complex facilities and manufacturing processes. The segment has benefited from improvements in regulator design that ensure precise voltage regulation and protection against surges and drops.

As commercial power demands continue to rise and electrical infrastructure upgrades proceed, the three-phase voltage regulator segment is expected to maintain its leading role.

The voltage segment above 40 kVA to 250 kVA is anticipated to account for 49.2% of the market revenue in 2025, positioning itself as the largest voltage category. This range suits mid-sized commercial applications requiring robust voltage regulation to safeguard electrical equipment and maintain productivity.

Demand in this segment has been supported by expanding commercial real estate, data centers, and manufacturing units that operate within this power capacity range. Products in this voltage category are favored for their balance of capacity and cost-effectiveness, making them accessible for a wide range of commercial uses.

The continued modernization of commercial power systems and increasing reliance on sensitive electronic devices are expected to sustain demand for voltage regulators in this segment.

The switching commercial voltage regulator market is driven by rising demand for stable power supply, efficiency improvements, and integration with advanced control systems. Expanding commercial infrastructure and energy optimization needs are shaping growth patterns.

The increasing reliance on electronics in commercial environments is fueling the need for switching commercial voltage regulators. Businesses such as data centers, healthcare facilities, and telecom operations require stable voltage to avoid costly downtime and equipment damage. These regulators deliver rapid response to voltage fluctuations, making them ideal for environments where uninterrupted power is essential. Their ability to maintain tight voltage tolerances under varying load conditions has positioned them as a preferred choice in mission-critical applications. This demand is amplified by the expansion of high-performance commercial spaces, where the cost of power interruptions is substantial, and electrical stability is a top operational priority.

Switching commercial voltage regulators are increasingly being paired with intelligent monitoring and control systems. Such integration allows for real-time performance tracking, remote adjustments, and predictive maintenance alerts. These capabilities not only improve operational efficiency but also reduce maintenance costs by identifying issues before they escalate. The ability to log performance data and adapt voltage regulation dynamically enhances the flexibility of commercial power systems. This integration is particularly valuable in multi-site operations where centralized monitoring streamlines energy management. As more commercial operators adopt smart building frameworks, demand for regulators that can communicate seamlessly with these systems continues to grow.

Recent design improvements in switching commercial voltage regulators are delivering higher conversion efficiencies and lower energy losses. Enhanced heat dissipation systems and optimized power conversion circuits contribute to longer equipment lifespans and reduced operational costs. Compact form factors are enabling easier installation in constrained commercial spaces without compromising performance. These advancements are also improving compatibility with renewable energy sources, allowing smooth voltage stabilization even with variable inputs. Efficiency gains are becoming a major purchase driver, as commercial users seek solutions that combine reliability with lower total cost of ownership while meeting performance benchmarks for demanding operational environments.

Adoption of switching commercial voltage regulators is broadening across sectors such as retail chains, manufacturing plants, educational institutions, and transport hubs. Each of these sectors has unique voltage regulation needs, from protecting point-of-sale systems to safeguarding industrial control machinery. The regulators’ adaptability to different load profiles and environmental conditions has supported their widespread use. Expansion of commercial infrastructure in developing markets, coupled with modernization projects in established economies, is increasing the overall installation base. As more industries digitize their operations and integrate automation, the dependence on stable and efficient voltage regulation solutions is expected to rise steadily.

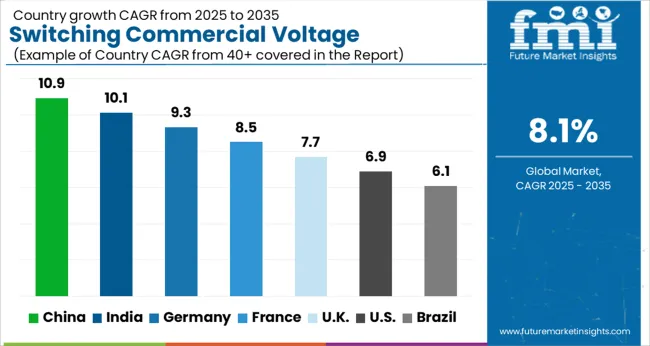

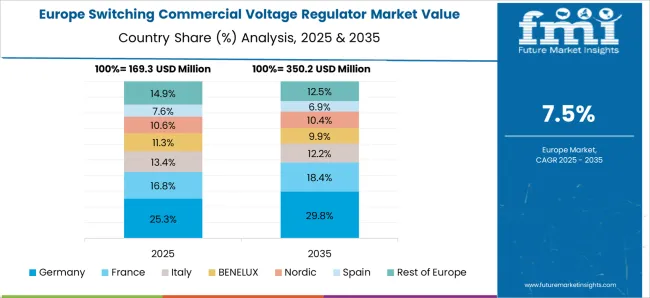

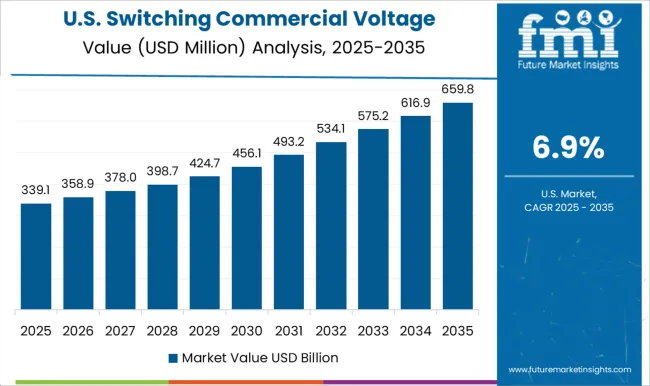

The switching commercial voltage regulator market is projected to grow globally at a CAGR of 8.1% between 2025 and 2035, supported by expanding commercial infrastructure, rising adoption of sensitive electronic equipment, and increased demand for energy-efficient voltage stabilization. China leads with a CAGR of 10.9%, driven by large-scale data center development, manufacturing modernization, and commercial building automation. India follows at 10.1%, fueled by telecom network expansion, smart city projects, and increased retail infrastructure. Germany posts 9.3%, benefiting from industrial automation, advanced commercial facility upgrades, and integration with renewable power systems. The United Kingdom records 7.7%, supported by modernization of commercial grids, demand from financial hubs, and strict voltage quality compliance. The United States stands at 6.9%, shaped by upgrades in healthcare facilities, digital infrastructure growth, and demand from educational and government institutions. The analysis spans over 40 countries, with these five serving as benchmarks for technology integration strategies, investment priorities, and capacity planning in the global switching commercial voltage regulator industry.

China is projected to post a CAGR of 10.9% during 2025–2035, above the global benchmark of 8.1%, as large-scale commercial infrastructure growth continues alongside power quality improvement programs. During 2020–2024, the CAGR was around 8.4%, driven by regulator adoption in telecom towers, financial hubs, and large office complexes. The stronger growth ahead is linked to expansion in hyperscale data centers, automation in retail complexes, and integration of voltage regulation in energy-efficient building frameworks. In my assessment, supply chain localization and integration with building energy management systems are positioning China for long-term dominance in this sector.

India is expected to achieve a CAGR of 10.1% for 2025–2035, above the global 8.1% rate, as telecom, retail, and logistics sectors expand their footprint in both metro and tier-two cities. Between 2020–2024, CAGR was near 7.9%, supported by gradual replacement of outdated systems in industrial parks and public sector buildings. The sharper growth in the coming decade will be driven by smart grid rollouts, renewable integration in commercial estates, and increased deployment of automated voltage regulation in malls and large-format retail. I believe the combination of favorable energy policies and rising commercial load density will keep this segment on a strong growth path.

Germany is forecast to post a CAGR of 9.3% for 2025–2035, compared to about 7.2% during 2020–2024, indicating a clear growth acceleration. Early growth came from regulator usage in industrial automation facilities, logistics hubs, and government complexes. The projected increase is due to a rising number of energy-efficient commercial retrofits, integration with renewable energy-powered commercial estates, and modernized public transport infrastructure. In my view, Germany’s strict compliance requirements and early adoption of voltage quality standards will sustain growth momentum, especially in sectors where downtime costs are significant.

The United Kingdom is projected to grow at a CAGR of 7.7% for 2025–2035, up from around 6.0% during 2020–2024, showing a healthy improvement in growth pace. Earlier expansion was supported by regulator installation in urban commercial zones, educational institutions, and healthcare facilities. The higher growth ahead is expected from modernization of the commercial grid, broader adoption in financial hubs, and integration into backup power systems for data-driven operations. I see the UK’s focus on improving operational resilience and voltage quality compliance as a core driver for adoption in both metropolitan and regional commercial sectors.

The United States is expected to post a CAGR of 6.9% during 2025–2035, up from roughly 5.8% in 2020–2024, representing a steady growth improvement. The earlier period’s expansion was primarily due to modernization in universities, hospitals, and municipal complexes. The stronger performance ahead will be driven by investments in cloud infrastructure, the growth of distributed commercial power networks, and stricter electrical compliance codes. From my perspective, the expansion of commercial automation and rising reliance on uninterrupted power supply are shaping the demand for high-efficiency switching voltage regulators across the country.

The switching commercial voltage regulator market consists of a diverse mix of global semiconductor giants and specialized electronics manufacturers competing on efficiency, compact design, and application-specific performance. Eaton offers a broad range of power management solutions integrated into commercial infrastructure, while Analog Devices focuses on precision regulation with advanced signal processing capabilities. Bel Fuse delivers high-reliability components for telecom and industrial voltage stabilization, complemented by Infineon Technologies’ portfolio targeting energy efficiency and compact form factors.

Legrand positions itself in the commercial infrastructure segment with integrated electrical distribution and regulation systems. MaxLinear and Microchip Technology enhance regulator functionality through embedded control features for high-performance computing and networking applications. Minmax Technology and Nisshinbo Micro Devices cater to niche industrial and communication segments, while NXP Semiconductors and Renesas Electronics Corporation emphasize automotive-grade and industrial-strength solutions. ROHM, SEMTECH, and Siemens contribute with innovation in high-frequency switching and scalable voltage modules. STMicroelectronics and SynQor are recognized for rugged, high-density solutions for mission-critical environments. TOREX SEMICONDUCTOR and Toshiba Electronic Devices & Storage Corporation bring miniaturized, high-efficiency designs for portable and embedded systems. Vicor Corporation stands out for modular, high-power density architectures, while Vishay Intertechnology offers broad compatibility components meeting diverse application demands. Competitive strategies focus on enhancing energy efficiency, expanding into emerging commercial electronics markets, and developing application-specific integrated solutions that improve system reliability and reduce total operational costs. Strategic partnerships with OEMs, investments in advanced packaging, and expansion of global manufacturing capabilities remain central to maintaining share in a rapidly evolving commercial electronics landscape.

| Item | Value |

|---|---|

| Quantitative Units | USD 0.7 Billion |

| Phase | Three phase and Single phase |

| Voltage | > 40 kVA to 250 kVA, ≤ 40 kVA, and > 250 kVA |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Eaton, Analog Devices, Bel Fuse, Infineon Technologies, Legrand, MaxLinear, Microchip Technology, Minmax Technology, Nisshinbo Micro Devices, NXP Semiconductors, Renesas Electronics Corporation, ROHM, SEMTECH, Siemens, STMicroelectronics, SynQor, TOREX SEMICONDUCTOR, Toshiba Electronic Devices & Storage Corporation, Vicor Corporation, and Vishay Intertechnology |

| Additional Attributes | Dollar sales, share, competitive landscape, pricing trends, key end-user sectors, regional demand shifts, technology preferences, supply chain risks, and regulatory impacts. |

The global switching commercial voltage regulator market is estimated to be valued at USD 0.7 billion in 2025.

The market size for the switching commercial voltage regulator market is projected to reach USD 1.5 billion by 2035.

The switching commercial voltage regulator market is expected to grow at a 8.1% CAGR between 2025 and 2035.

The key product types in switching commercial voltage regulator market are three phase and single phase.

In terms of voltage, > 40 kva to 250 kva segment to command 49.2% share in the switching commercial voltage regulator market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Switching Mode Power Supply Market - Growth & Forecast 2025 to 2035

Switching Residential Voltage Regulator Market Size and Share Forecast Outlook 2025 to 2035

Server and Switching Equipment Market Growth – Trends & Forecast 2024-2034

SP Routing And Ethernet Switching Market Size and Share Forecast Outlook 2025 to 2035

Commercial Water Heater Market Size and Share Forecast Outlook 2025 to 2035

Commercial High-Speed Oven Market Size and Share Forecast Outlook 2025 to 2035

Commercial Turboprop Aircrafts Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vehicle Foundation Brakes Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vehicle Brake Chambers Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vehicles LED Bar Lights Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vehicle AMT Transmission Market Size and Share Forecast Outlook 2025 to 2035

Commercial Greenhouse Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vessel Market Size and Share Forecast Outlook 2025 to 2035

Commercial Slush Machine Market Size and Share Forecast Outlook 2025 to 2035

Commercial Earth Observation (CEO) Market Size and Share Forecast Outlook 2025 to 2035

Commercial Ozone Generator Market Size and Share Forecast Outlook 2025 to 2035

Commercial Gas-Fired Boiler Market Size and Share Forecast Outlook 2025 to 2035

Commercial Deep Fryer Parts & Accessories Market Size and Share Forecast Outlook 2025 to 2035

Commercial Gas Restaurant Ranges Market Size and Share Forecast Outlook 2025 to 2035

Commercial Heat Pump Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA