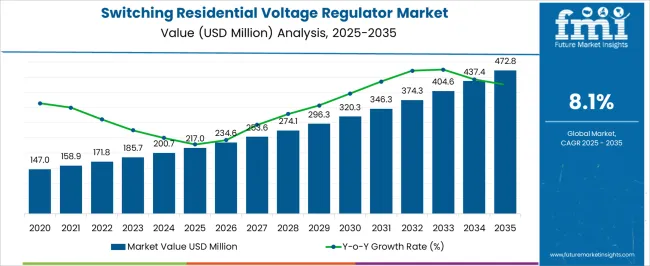

The switching residential voltage regulator market is forecasted to expand from USD 217.0 million in 2025 to USD 472.8 million by 2035, advancing at a compound annual growth rate of 8.1%. Regulatory impact is expected to play a defining role in shaping adoption patterns and influencing manufacturing strategies across global markets. Standards related to energy efficiency, grid stability, and consumer safety are being enforced with greater stringency, creating both opportunities and compliance challenges for stakeholders.

Governments are actively pushing regulations that mandate voltage stability in residential power distribution systems, particularly in regions experiencing frequent grid fluctuations. Energy-efficiency directives in Europe and North America are driving manufacturers to design regulators that minimize losses and improve operational reliability. Compliance with safety certifications such as CE, UL, and IEC standards increases costs for producers but simultaneously improves product reliability and consumer trust, supporting market penetration.

In the Asia-Pacific region, regulatory frameworks are less uniform, but national policies encouraging grid modernization and reliable electricity delivery provide indirect stimulus for adoption. Trade regulations and standards for electronic components also influence the supply chain, particularly as manufacturers diversify sourcing strategies to meet compliance requirements. The regulatory frameworks are acting as both a driver and barrier, ensuring technological innovation while necessitating strategic investment in certification, testing, and design compliance. This balance significantly determines the competitive positioning of manufacturers and the pace of adoption across regions.

| Metric | Value |

|---|---|

| Switching Residential Voltage Regulator Market Estimated Value in (2025 E) | USD 217.0 million |

| Switching Residential Voltage Regulator Market Forecast Value in (2035 F) | USD 472.8 million |

| Forecast CAGR (2025 to 2035) | 8.1% |

The switching residential voltage regulator market represents a specialized segment within the power management and home electrical equipment industry, emphasizing voltage stability, energy efficiency, and appliance protection. Within the overall voltage regulation equipment market, it accounts for about 5.4%, driven by rising household electricity demand and sensitive appliance usage. In the residential electrical devices segment, it holds nearly 4.9%, reflecting adoption for protecting consumer electronics, HVAC systems, and home automation equipment. Across the smart home and energy management solutions market, the segment captures 3.7%, supporting integration with monitoring and control systems. Within the electrical protection and surge management category, it represents 3.2%, highlighting safeguarding capabilities.

In the renewable and distributed energy integration sector, it secures 2.6%, emphasizing compatibility with rooftop solar and microgrid installations. Recent developments in this market have focused on solid-state switching technology, compact design, and digital control integration. Innovations include microprocessor-based voltage regulation, adaptive response to load fluctuations, and high-efficiency transformerless designs. Key players are collaborating with smart home system providers and utility companies to enhance performance and reliability. Advanced features such as LCD monitoring, remote control, and automated fault detection have gained traction. The eco-friendly materials, reduced standby power consumption, and compliance with international safety standards are shaping product development.

The switching residential voltage regulator market is gaining momentum, supported by the rising need for stable and efficient power supply in modern households. Increasing usage of sensitive electronics, the integration of renewable energy sources, and fluctuations in grid voltage have driven demand for advanced voltage regulation solutions.

Technological innovations have resulted in regulators with higher efficiency, compact designs, and enhanced safety features, aligning with consumer expectations for reliability and energy savings. Residential construction growth, especially in urban and suburban areas, has further contributed to adoption rates.

Government initiatives promoting energy-efficient electrical infrastructure and smart home systems have accelerated the installation of high-performance regulators. With electricity consumption patterns evolving and the emphasis on reducing energy losses intensifying, the market is expected to maintain a steady growth trajectory.

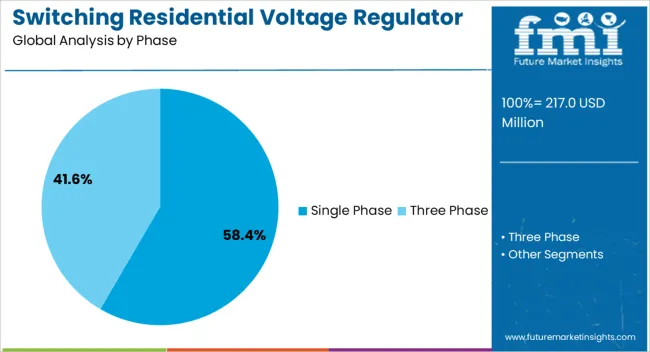

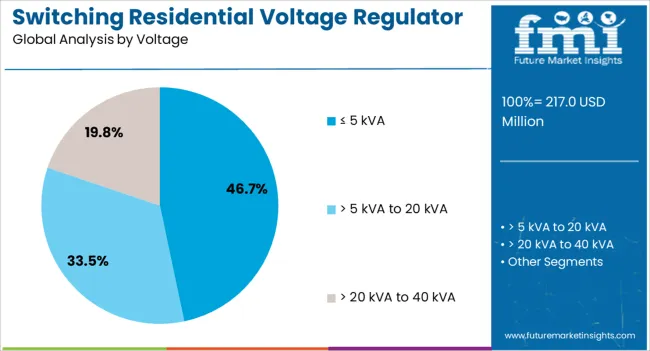

The switching residential voltage regulator market is segmented by phase, voltage, and geographic regions. By phase, switching residential voltage regulator market is divided into Single Phase and Three Phase. In terms of voltage, switching residential voltage regulator market is classified into ≤ 5 kVA, > 5 kVA to 20 kVA, and > 20 kVA to 40 kVA. Regionally, the switching residential voltage regulator industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The single phase segment is projected to account for 58.4% of the switching residential voltage regulator market revenue in 2025, maintaining its dominant market share. This leadership is driven by the widespread use of single-phase electrical supply in residential settings, which makes these regulators essential for stable voltage delivery. Their compatibility with most household electrical systems and ease of installation has enhanced adoption rates. Manufacturers have focused on developing compact, efficient, and cost-effective single-phase models that can handle varying load demands without compromising output stability.

The segment’s growth has also been reinforced by increasing urban housing projects, where single-phase systems remain the standard electrical configuration. With rising energy demands and the continued expansion of residential infrastructure, the Single Phase segment is expected to remain a primary choice for homeowners seeking reliable voltage regulation.

The ≤ 5 kVA segment is estimated to hold 46.7% of the switching residential voltage regulator market revenue in 2025, making it the leading capacity category. This dominance is attributed to its suitability for typical residential power requirements, where load demands generally fall within this range. Compact and affordable, ≤ 5 kVA regulators meet the needs of households operating common appliances and electronics without the need for high-capacity solutions. Manufacturers have prioritized this segment due to its large customer base, focusing on enhancing performance, energy efficiency, and durability.

Ease of integration into existing home electrical systems and minimal maintenance requirements have supported its market share. As residential consumers continue to invest in protecting appliances from voltage fluctuations while optimizing energy usage, the ≤ 5 kVA segment is expected to retain its leading position.

The market has witnessed substantial growth as residential electricity consumers increasingly seek stable, reliable, and efficient power supply. Switching regulators help maintain voltage stability, protect household appliances from fluctuations, and improve energy efficiency. Rising penetration of electronic devices, smart home systems, and energy-intensive equipment has reinforced demand. Technological advancements, including high-speed switching, compact design, and improved thermal management, have enhanced performance and efficiency. Expansion of urban housing, adoption of renewable energy sources, and government initiatives for energy optimization have further accelerated market growth.

Household safety and appliance protection have emerged as primary drivers for switching residential voltage regulators. Voltage fluctuations, surges, and electrical instability can damage sensitive electronics such as air conditioners, refrigerators, televisions, and smart home devices. Switching regulators maintain consistent voltage output, reducing the risk of appliance failure and extending lifespan. Homeowners are increasingly adopting these devices to ensure safe operation, particularly in regions with unreliable grid supply or frequent power surges. The growing penetration of electronic and smart appliances, coupled with rising consumer awareness of electrical safety, has created consistent demand for high-quality residential voltage regulation solutions across urban and semi-urban households.

Technological innovations in switching regulators have improved efficiency, size, and performance. Features such as rapid response to voltage fluctuations, energy-saving modes, thermal protection, and digital monitoring capabilities allow enhanced control and durability. Compact and lightweight designs have facilitated integration into residential electrical systems with minimal space requirements. Advanced semiconductor components and high-frequency switching technologies have increased efficiency while reducing energy loss. Digital displays and IoT-enabled monitoring allow homeowners to track voltage conditions and receive alerts, improving reliability. Continuous development in design, material quality, and electronic controls has made switching voltage regulators more effective, safe, and appealing for modern residential applications.

The adoption of residential renewable energy solutions, including solar panels and energy storage systems, has further boosted switching regulator demand. These systems require precise voltage regulation to prevent overvoltage, maintain battery efficiency, and ensure appliance safety. Integration with smart home systems, home automation platforms, and IoT-enabled devices requires stable power supply, making switching regulators essential components. Growing investments in energy-efficient and renewable-powered homes, coupled with government incentives for clean energy adoption, have reinforced market expansion. As consumers seek intelligent, energy-saving solutions for their residences, switching regulators have become increasingly critical for seamless and safe operation of home electrical systems.

Emerging markets in Asia-Pacific, Latin America, and Africa present significant opportunities for switching residential voltage regulators due to expanding residential infrastructure, urbanization, and rising electronic device penetration. In regions with unstable grids, frequent voltage fluctuations, and increasing energy demand, these regulators provide critical protection and efficiency benefits. Manufacturers are focusing on localized production, cost-effective designs, and energy-efficient models to cater to these markets. Regulatory support for energy efficiency, combined with awareness campaigns about appliance protection and electrical safety, has further strengthened adoption potential. These factors collectively position emerging economies as key growth regions for the switching residential voltage regulator market over the coming decade.

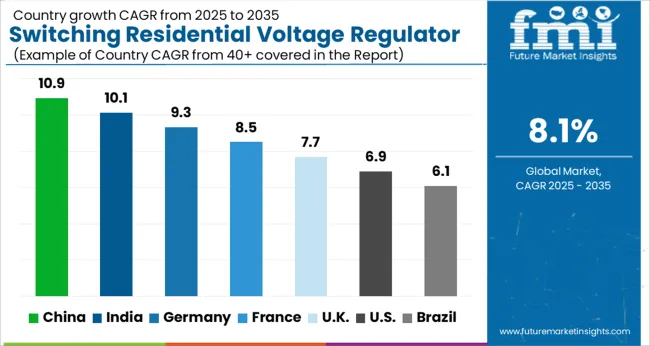

| Country | CAGR |

|---|---|

| China | 10.9% |

| India | 10.1% |

| Germany | 9.3% |

| France | 8.5% |

| U.K. | 7.7% |

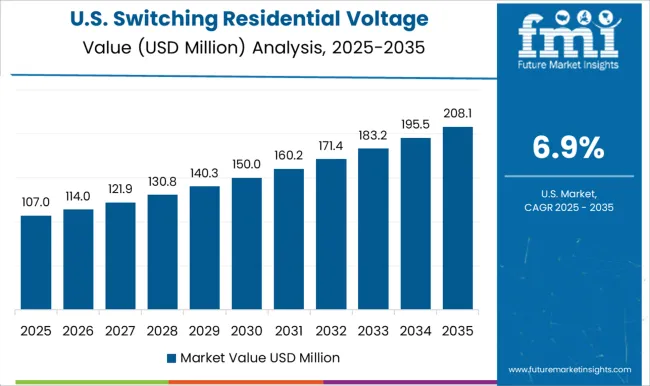

| U.S. | 6.9% |

| Brazil | 6.1% |

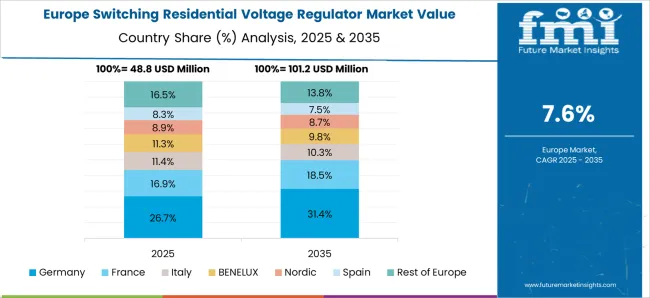

The market is expected to witness consistent growth due to rising residential electricity consumption, demand for stable power supply, and technological improvements in voltage regulation devices. China leads with a 10.9% growth rate, driven by extensive adoption in residential and commercial buildings. India follows at 10.1%, scaling through increasing urban electrification and government-supported energy efficiency programs. Germany grows at 9.3%, supported by innovations in energy-saving and smart voltage regulation technologies. The United Kingdom records 7.7%, innovating through advanced residential electrical systems and smart grid integration. The United States achieves 6.9%, where modernization of power infrastructure and energy management systems sustain steady market activity. These countries collectively represent a diverse environment of production, deployment, and technological advancement in switching residential voltage regulators. This report includes insights on 40+ countries; the top markets are shown here for reference.

China’s market is projected to grow at a CAGR of 10.9%, fueled by rapid urban development, increasing residential electrification, and rising adoption of smart home technologies. Consumers are increasingly seeking voltage regulation solutions that protect home appliances from power fluctuations, enhance energy efficiency, and improve system reliability. Manufacturers are focusing on high-performance, compact, and energy-efficient products to cater to varied residential needs. Distribution through electrical equipment suppliers, e-commerce platforms, and retail chains is expanding market reach. Strategic collaborations with residential developers and utility companies are accelerating adoption. Government initiatives promoting energy conservation and electrical safety standards are further supporting market growth. Rising awareness among homeowners regarding appliance protection is also influencing purchasing patterns.

India is expected to expand at a CAGR of 10.1%, supported by rising residential electricity demand, urban infrastructure growth, and increasing smart home installations. Homeowners are increasingly investing in devices that prevent power surges and enhance appliance longevity. Manufacturers are innovating with compact, energy-efficient, and user-friendly designs tailored for Indian household requirements. Distribution networks, including retail chains and online marketplaces, are improving product availability across urban and semi-urban regions. Awareness campaigns highlighting reliability, safety, and energy conservation are influencing consumer preferences. Partnerships with residential builders, electrical contractors, and utility providers are facilitating broader adoption, ensuring steady market penetration. Government initiatives promoting efficient electricity use and appliance safety are also contributing to sustained market growth.

Germany is anticipated to grow at a CAGR of 9.3%, driven by residential modernization, energy efficiency regulations, and demand for reliable electrical systems. Consumers prefer voltage regulators that enhance system performance, prevent appliance damage, and improve energy savings. Manufacturers are focusing on advanced, compact, and eco-friendly designs, integrating digital monitoring capabilities. Distribution through specialized electrical equipment suppliers, industrial channels, and e-commerce platforms ensures product accessibility across urban and suburban areas. Marketing campaigns highlighting safety, reliability, and long-term cost savings support adoption. Collaborations with residential developers, electrical contractors, and technology providers strengthen market presence. Rising homeowner awareness of electrical safety standards further reinforces Germany’s growth trajectory.

The UK market for switching residential voltage regulators is projected to grow at a CAGR of 7.7%, driven by rising residential power consumption, smart home adoption, and the need for consistent electricity supply. Homeowners increasingly prioritize devices that prevent voltage fluctuations, enhance appliance life, and improve energy efficiency. Manufacturers are investing in compact, efficient, and aesthetically compatible solutions suitable for modern homes. Distribution networks, including electrical suppliers and e-commerce platforms, ensure broad product availability. Marketing initiatives highlighting safety, energy savings, and reliability are influencing purchasing behavior. Partnerships with residential developers, electricians, and energy utility providers are enabling broader adoption. Regulatory focus on appliance protection and energy efficiency standards is further shaping market growth.

The United States market for switching residential voltage regulators is expected to expand at a CAGR of 6.9%, supported by increasing residential electricity usage, smart home integration, and awareness of appliance protection. Homeowners seek devices that offer voltage stability, surge protection, and enhanced energy efficiency. Manufacturers are developing compact, high-performance, and user-friendly products suitable for varied residential applications. Distribution through electrical suppliers, retail chains, and online marketplaces ensures accessibility nationwide. Marketing campaigns emphasizing safety, reliability, and long-term savings are shaping consumer behavior. Collaborations with residential construction companies, electricians, and energy utility providers are facilitating market penetration. Regulatory emphasis on residential electrical safety and energy conservation is further supporting adoption and steady market growth.

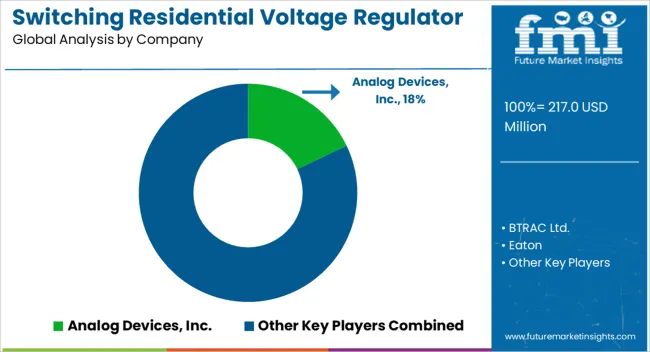

The market is characterized by strong participation from both multinational corporations and specialized solution providers that cater to power management and residential energy stability. Analog Devices, Inc., Infineon Technologies AG, STMicroelectronics, and NXP Semiconductors are leading semiconductor innovators offering high-efficiency switching regulators designed to optimize voltage stability in modern households. Eaton, General Electric, Siemens, and Legrand have developed integrated residential power management systems, ensuring reliability and safety in grid-connected and backup energy applications. Maschinenfabrik Reinhausen GmbH and Sollatek provide specialized regulator technologies tailored for fluctuating grids and regions with unstable power supply conditions. MaxLinear, ROHM Co. Ltd., SEMTECH, TOREX SEMICONDUCTOR LTD., Vicor, and Vishay Intertechnology, Inc. focus on advanced circuit-level solutions for compact, efficient, and high-performance switching regulators suitable for residential appliances and renewable-powered systems.

Purevolt addresses consumer-oriented voltage regulation products, while Ricoh USA, Inc. contributes through integrated electronic solutions. BTRAC Ltd. enhances the market landscape with region-specific offerings, particularly in emerging economies. The demand for switching residential voltage regulators is expanding due to increasing household electronics usage, integration of renewable energy systems, and the rising need for energy efficiency and protection against voltage fluctuations. This competitive environment continues to foster technological innovations in compact design, digital monitoring, and sustainable energy compatibility, shaping the future trajectory of residential power regulation.

| Item | Value |

|---|---|

| Quantitative Units | USD 217.0 Million |

| Phase | Single Phase and Three Phase |

| Voltage | ≤ 5 kVA, > 5 kVA to 20 kVA, and > 20 kVA to 40 kVA |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Analog Devices, Inc., BTRAC Ltd., Eaton, General Electric, Infineon Technologies AG, Legrand, Maschinenfabrik Reinhausen GmbH, MaxLinear, Microchip Technology Inc., NXP Semiconductors, Purevolt, Ricoh USA, Inc., ROHM Co. Ltd., SEMTECH, Siemens, Sollatek, STMicroelectronics, TOREX SEMICONDUCTOR LTD., Vicor, and Vishay Intertechnology, Inc. |

| Additional Attributes | Dollar sales by regulator type and capacity, demand dynamics across residential and small commercial sectors, regional trends in voltage stabilization adoption, innovation in efficiency, compact design, and load handling, environmental impact of energy savings and electronic waste, and emerging use cases in smart homes and renewable energy integration. |

The global switching residential voltage regulator market is estimated to be valued at USD 217.0 million in 2025.

The market size for the switching residential voltage regulator market is projected to reach USD 472.8 million by 2035.

The switching residential voltage regulator market is expected to grow at a 8.1% CAGR between 2025 and 2035.

The key product types in switching residential voltage regulator market are single phase and three phase.

In terms of voltage, ≤ 5 kva segment to command 46.7% share in the switching residential voltage regulator market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Switching Mode Power Supply Market - Growth & Forecast 2025 to 2035

Switching Commercial Voltage Regulator Market Size and Share Forecast Outlook 2025 to 2035

Server and Switching Equipment Market Growth – Trends & Forecast 2024-2034

SP Routing And Ethernet Switching Market Size and Share Forecast Outlook 2025 to 2035

Residential Generator Market Size and Share Forecast Outlook 2025 to 2035

Residential Energy-Efficient Technologies Market Size and Share Forecast Outlook 2025 to 2035

Residential Interior Wood Doors Market Size and Share Forecast Outlook 2025 to 2035

Residential Air-to-Air Heat Pump Market Size and Share Forecast Outlook 2025 to 2035

Residential Automatic Motor Starter Market Size and Share Forecast Outlook 2025 to 2035

Residential AMI Gas Meter Market Size and Share Forecast Outlook 2025 to 2035

Residential Vacuum Circuit Breaker Market Size and Share Forecast Outlook 2025 to 2035

Residential Solar Tracker Market Size and Share Forecast Outlook 2025 to 2035

Residential Non-metal Electrical Conduit Market Size and Share Forecast Outlook 2025 to 2035

Residential Carpet Roll Market Size and Share Forecast Outlook 2025 to 2035

Residential Air Insulated Power Distribution Component Market Size and Share Forecast Outlook 2025 to 2035

Residential Electrical Conduit Market Size and Share Forecast Outlook 2025 to 2035

Residential Energy Efficient Windows Market Size and Share Forecast Outlook 2025 to 2035

Residential Solar Energy Storage Market Size and Share Forecast Outlook 2025 to 2035

Residential Electric Underfloor Heating Market Size and Share Forecast Outlook 2025 to 2035

Residential Solar PV Inverter Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA