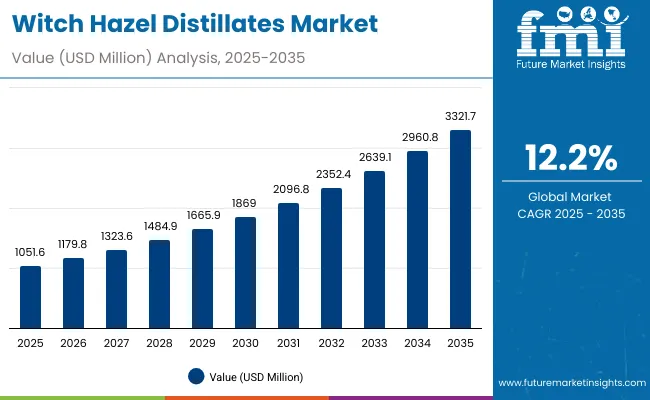

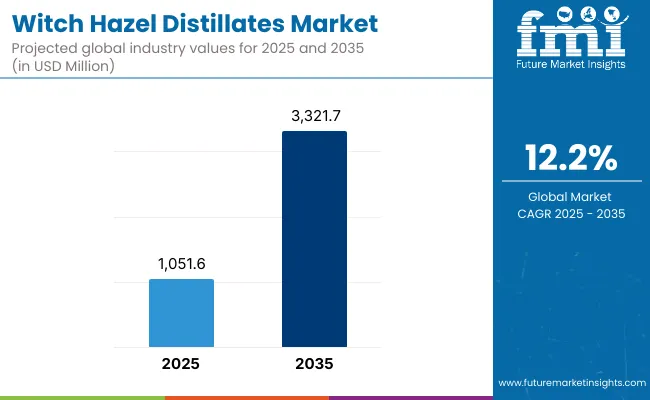

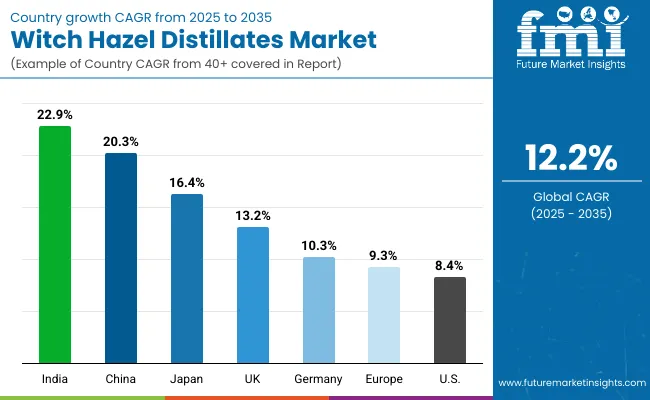

The Witch Hazel Distillates Market is expected to record a valuation of USD 1,051.6 million in 2025 and USD 3,321.7 million in 2035, with an increase of USD 2,270.1 million, which equals a growth of 216% over the decade. The overall expansion represents a CAGR of 12.2% and a more than 3X increase in market size.

Witch Hazel Distillates Market Key Takeaways

| Metric | Value |

|---|---|

| Witch Hazel Distillates Market Estimated Value in (2025E) | USD 1,051.6 million |

| Witch Hazel Distillates Market Forecast Value in (2035F) | USD 3,321.7 million |

| Forecast CAGR (2025 to 2035) | 12.2% |

During the first five-year period from 2025 to 2030, the market increases from USD 1,051.6 million to USD 1,869.0 million, adding USD 817.4 million, which accounts for 36% of the total decade growth. This phase records steady adoption across skincare and cosmetic formulations, driven by demand for astringent, soothing, and anti-acne benefits. Toners dominate this period as they cater to over 54% of applications, reinforcing their role as the leading product type.

The second half from 2030 to 2035 contributes USD 1,401.1 million, equal to 62% of total growth, as the market jumps from USD 1,869.0 million to USD 3,321.7 million. This acceleration is powered by the widespread adoption of natural/organic skincare claims, AI-enabled product personalization, and expansion of e-commerce channels. Astringent formulations maintain leadership with over 51% share, while clean-label and vegan claims push premiumization. Regional growth is strongest in China (20.3% CAGR) and India (22.9% CAGR), highlighting Asia’s role as the primary growth engine.

From 2020 to 2024, the Witch Hazel Distillates Market steadily expanded, driven by rising demand for natural/organic skincare and multifunctional cosmetic applications. During this period, the competitive landscape was dominated by heritage skincare brands and pharmaceutical players, controlling nearly all of the revenue. Leaders such as Thayers, Dickinson’s, and Neutrogena focused on mass retail penetration and product positioning around skin benefits like soothing, anti-acne, and redness reduction. Competitive differentiation relied on brand trust, clinical claims, and affordability, while premium botanical offerings had smaller but growing traction.

Demand for Witch Hazel Distillates is projected to reach USD 1,051.6 million in 2025, and the revenue mix will evolve as e-commerce, clean-label, and vegan claims expand beyond 50% of share. Traditional leaders face rising competition from digital-first skincare brands offering personalized routines, direct-to-consumer models, and subscription-based services. Major brands are pivoting to hybrid retail strategies, integrating online platforms, influencer-driven marketing, and data-backed formulations to retain relevance. Emerging entrants specializing in organic sourcing, AI-driven personalization, and sustainability are gaining share. The competitive advantage is shifting from mass heritage branding alone to ecosystem-driven positioning, transparency, and innovation in delivery formats.

The growth of the Witch Hazel Distillates Market is strongly driven by the rising consumer preference for natural and clean-label skincare products. Increasing awareness of chemical-free formulations has accelerated the adoption of witch hazel distillates across toners, cleansers, and serums. With dermatologists endorsing its soothing, anti-acne, and redness-reduction benefits, consumers are shifting toward botanical solutions, fueling premiumization and product diversification across both mass retail and e-commerce platforms.

A significant driver of market expansion is the rapid growth of digital-first and direct-to-consumer skincare brands that are integrating witch hazel distillates into personalized regimens. Backed by AI-driven product recommendations, subscription-based sales, and influencer-led marketing, these players are disrupting the traditional retail model. This trend is especially notable in high-growth markets like China and India, where younger consumers prioritize convenience, natural claims, and online availability, creating a strong tailwind for demand.

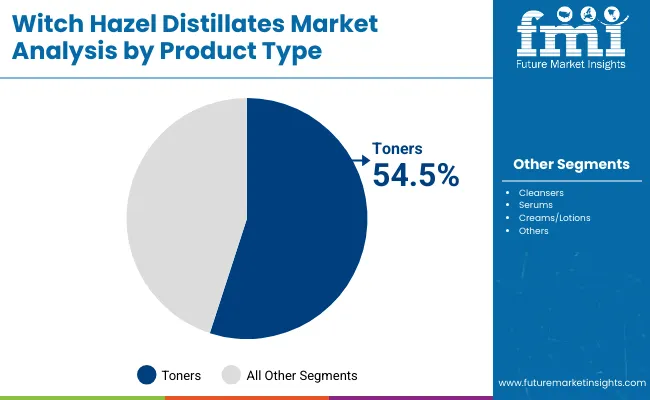

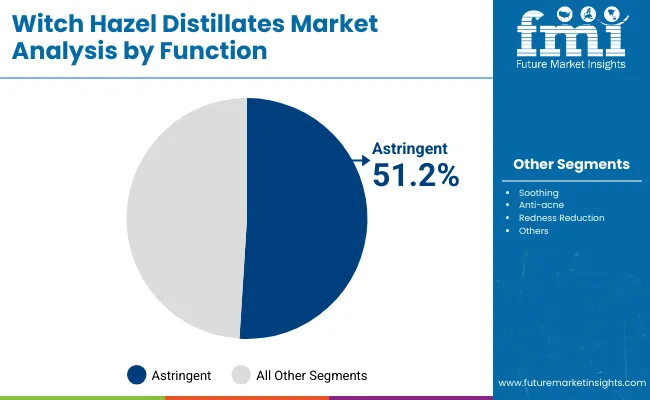

The Witch Hazel Distillates Market is segmented by function, product type, claim, channel, and geography. By function, key segments include astringent, soothing, anti-acne, and redness reduction, each catering to specific skincare needs. Product type segmentation covers toners, cleansers, serums, and creams/lotions, with toners leading the market. By claim, the market spans natural/organic, vegan, dermatologist-tested, and clean-label products. Distribution channels include pharmacies, e-commerce, specialty beauty stores, and mass retail outlets. Geographically, the scope extends across North America, Europe, East Asia, South Asia & Pacific, Latin America, and the Middle East & Africa, with Asiaespecially China and India emerging as the fastest-growing regions.

| Product Type | Value Share% 2025 |

|---|---|

| Toners | 54.5% |

| Others | 45.5% |

The toners segment is projected to contribute 54.5% of the Witch Hazel Distillates Market revenue in 2025, maintaining its lead as the dominant product category. This dominance is driven by the widespread use of witch hazel toners for astringent, soothing, and anti-acne applications, making them a staple in both mass-market and premium skincare lines. Consumers increasingly view toners as multifunctional solutions that prepare the skin while delivering natural therapeutic benefits.

The segment’s growth is further supported by strong adoption in e-commerce and specialty beauty stores, where toners are often marketed with clean-label and organic claims. As premium brands innovate with vegan and dermatologist-tested formulations, toners continue to retain their position as the backbone of witch hazel-based skincare systems.

| Function | Value Share% 2025 |

|---|---|

| Astringent | 51.2% |

| Others | 48.8% |

The astringent segment is forecasted to hold 51.2% of the market share in 2025, led by its widespread application in skincare for tightening pores, reducing oiliness, and providing an immediate refreshing effect. Astringent formulations are favored for their visible results in acne-prone and sensitive skin, making them a core ingredient across toners and cleansers.

Their popularity is further reinforced by strong consumer trust in witch hazel’s natural therapeutic properties and its endorsement in dermatologist-tested products. Growth is also fueled by rising demand in e-commerce and specialty beauty channels, where astringent solutions are often promoted as multifunctional products combining cleansing, soothing, and redness-reduction benefits. As consumer focus shifts toward natural efficacy and convenience, the astringent segment is expected to maintain its leadership in the Witch Hazel Distillates Market.

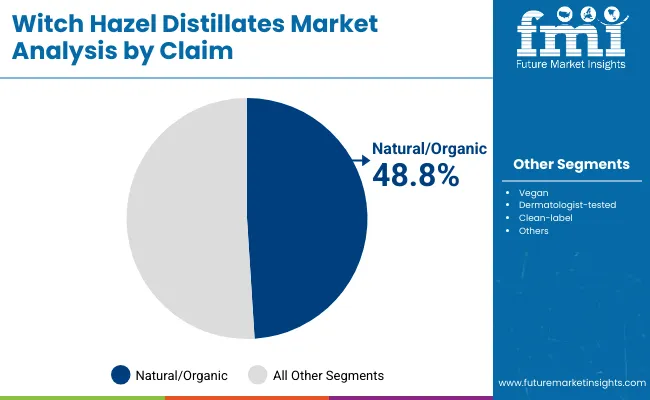

| Claim | Value Share% 2025 |

|---|---|

| Natural/organic | 48.8% |

| Others | 51.2% |

The natural/organic claim segment is projected to account for 48.8% of the Witch Hazel Distillates Market revenue in 2025, positioning it as a leading category driving consumer choices. Products positioned under this claim are preferred for their chemical-free, skin-friendly, and environmentally sustainable profile, appealing strongly to health-conscious and younger demographics. Its popularity is supported by the clean-beauty movement, which emphasizes transparency, botanical sourcing, and eco-friendly packaging. Growing adoption in e-commerce and specialty beauty stores has accelerated visibility, as brands highlight natural/organic witch hazel distillates in toners, cleansers, and serums. With increasing regulatory pressure and consumer skepticism toward synthetic additives, natural/organic formulations are expected to strengthen their role as a key driver of premiumization and long-term brand loyalty in the Witch Hazel Distillates Market.

Rising Demand for Natural Skincare

The global shift toward natural and plant-based skincare is a major growth driver for the Witch Hazel Distillates Market. Consumers are increasingly skeptical of chemical-laden products, leading to a preference for herbal solutions with proven dermatological benefits. Witch hazel’s efficacy in soothing irritation, reducing acne, and addressing redness has made it a core ingredient in toners, cleansers, and serums. The clean-label and organic positioning further amplifies its appeal, aligning with evolving beauty standards focused on safety, transparency, and sustainability.

Expansion of E-Commerce and D2C Channels

The rapid rise of online retail and direct-to-consumer models is significantly boosting the visibility and accessibility of witch hazel distillates. Digital-first skincare brands leverage influencer marketing, targeted ads, and personalized skincare regimens to drive adoption. E-commerce platforms allow smaller, niche players to reach global audiences, accelerating category growth. Subscription-based models and trial-size packaging have also gained traction online, encouraging repeat purchases. This growing digital ecosystem enables brands to differentiate via clean claims, transparency, and unique customer experiences, fueling sustained market expansion worldwide.

Intense Market Competition and Substitutes

Despite its growth potential, the Witch Hazel Distillates Market faces intense competition from both synthetic skincare actives and alternative natural ingredients like aloe vera, green tea, and chamomile. Many of these substitutes offer overlapping benefits such as soothing, anti-acne, or anti-inflammatory properties, diluting witch hazel’s unique positioning. Moreover, larger cosmetic brands with diversified ingredient portfolios often overshadow witch hazel-based formulations in visibility and distribution. This high competitive intensity may restrict pricing power, limit brand differentiation, and pose challenges for new entrants seeking to establish a foothold.

Premiumization with Clean and Vegan Claims

A key trend shaping the Witch Hazel Distillates Market is the premiumization of formulations through clean-label, vegan, and dermatologist-tested claims. Consumers are willing to pay more for products that combine botanical efficacy with transparency in sourcing and production. Brands are innovating with multifunctional witch hazel blends in serums, masks, and creams, expanding beyond traditional toners. The trend also intersects with sustainability, as eco-conscious packaging and cruelty-free certification become important purchase drivers. This evolving landscape is gradually shifting witch hazel products from mass-market basics to aspirational skincare staples.

| China | 20.3% |

|---|---|

| USA | 8.4% |

| India | 22.9% |

| UK | 13.2% |

| Germany | 10.3% |

| Japan | 16.4% |

| China | 20.3% |

Asia-Pacific emerges as the fastest-growing region, anchored by China at 20.3% CAGR and India at 22.9% CAGR. China’s expansion is driven by strong demand for natural and herbal skincare, rapid e-commerce penetration, and rising disposable incomes among younger consumers. India reflects an even steeper growth curve, fueled by booming beauty and personal care consumption, influencer-led product adoption, and preference for affordable natural remedies. Both markets are positioned as growth engines for global witch hazel distillates demand.

Europe maintains a solid profile, led by Germany (10.3% CAGR) and the UK (13.2% CAGR). Growth in the region is supported by stringent regulatory frameworks for clean-label and dermatologist-tested products, as well as increasing demand for vegan and sustainable skincare. Germany leads with a strong heritage of pharmaceutical-grade botanical extracts, while the UK benefits from a rising D2C beauty brand ecosystem. Japan demonstrates a notable 16.4% CAGR, reflecting the alignment of witch hazel distillates with the country’s skincare culture of multifunctional, lightweight, and high-efficacy products. Integration into serums and lotions is gaining momentum, particularly among premium brands.

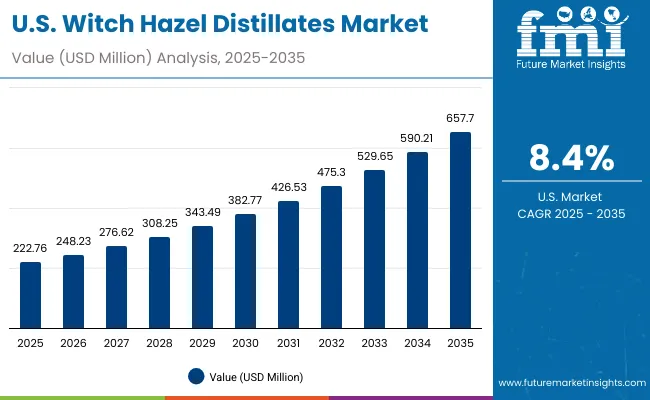

North America shows moderate expansion, with the USA at 8.4% CAGR. The region is characterized by market maturity and strong penetration of established players such as Thayers and Neutrogena. Growth is increasingly driven by e-commerce, clean-label positioning, and diversification into niche categories such as men’s grooming and sustainable packaging, though competition from alternative botanicals tempers acceleration.

| Year | USA Witch Hazel Distillates Market (USD Million) |

|---|---|

| 2025 | 222.76 |

| 2026 | 248.23 |

| 2027 | 276.62 |

| 2028 | 308.25 |

| 2029 | 343.49 |

| 2030 | 382.77 |

| 2031 | 426.53 |

| 2032 | 475.30 |

| 2033 | 529.65 |

| 2034 | 590.21 |

| 2035 | 657.70 |

The Witch Hazel Distillates Market in the United States is projected to grow from USD 222.76 million in 2025 to USD 657.70 million in 2035, reflecting a CAGR of 8.4%. Growth is led by the rising demand for natural and clean-label skincare products, particularly toners and multi-benefit formulations that resonate with health-conscious consumers. The market is also benefitting from the expansion of e-commerce platforms and D2C brands, which are enhancing consumer access and personalization options.

Increasing popularity of dermatologist-tested and vegan claims is boosting adoption among younger demographics, while mass retail and specialty beauty outlets continue to expand distribution reach. Established players such as Thayers, Neutrogena, and Burt’s Bees maintain strong positions, but competition from indie brands leveraging digital marketing and influencer engagement is intensifying.

The Witch Hazel Distillates Market in the United Kingdom is forecasted to expand at a CAGR of 13.2% between 2025 and 2035, driven by rising demand for natural, multipurpose skincare solutions. Consumers are increasingly opting for witch hazel-based products in toners, cleansers, and soothing formulations, reflecting a shift toward clean-label and sustainable beauty. The market is further supported by premium skincare adoption, where witch hazel is positioned as both a functional and botanical ingredient.

The UK’s strong retail and e-commerce ecosystem is accelerating accessibility, with leading pharmacy chains, supermarkets, and online beauty platforms stocking a wider range of witch hazel formulations. Indie and organic skincare brands are gaining traction through influencer marketing and eco-conscious packaging. Additionally, collaborations with dermatologists and sustainability certifications are building trust among health-conscious buyers.

India is emerging as one of the fastest-growing regions in the Witch Hazel Distillates Market, forecast to expand at a CAGR of 22.9% through 2035. This growth is propelled by the rapid shift towards herbal skincare adoption in urban and semi-urban markets, where consumers are actively replacing synthetic astringents with natural remedies. Rising disposable incomes and increased awareness of plant-based cosmetics are further fueling demand.

The local FMCG and MSME ecosystem is integrating witch hazel into facial toners, anti-acne solutions, and multipurpose cleansers, enhancing accessibility for mass consumers. Additionally, India’s strong foothold in Ayurveda and botanical exports is positioning the country as a global supplier of witch hazel extracts. Public health campaigns and dermatology-focused educational initiatives are also driving consumer trust, making India a critical growth engine for the global market.

The Witch Hazel Distillates Market in China is expected to grow at a CAGR of 20.3%, the highest among leading economies. Growth is fueled by smart factory rollouts, large-scale city modeling programs, and strong innovation from domestic tech firms. Electronics and automotive manufacturers are driving adoption with the use of scanners for automated inspection, quality control, and rapid prototyping. Municipal governments are deploying LiDAR and digital twin technologies to support urban infrastructure planning and modernization projects.

Affordable, high-performance scanners from local Chinese manufacturers are enabling cost-effective adoption across education, e-commerce, and fashion industries, where digital visualization is becoming mainstream. This combination of industrial, public-sector, and consumer-driven demand positions China as a global leader in witch hazel distillates deployment and innovation.

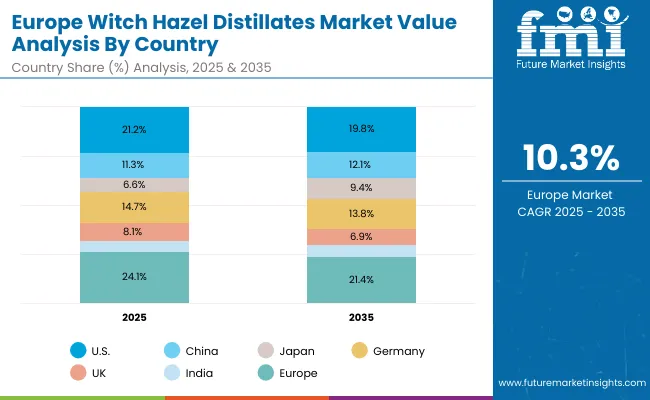

| Country | 2025 Share (%) |

|---|---|

| USA | 21.2% |

| China | 11.3% |

| Japan | 6.6% |

| Germany | 14.7% |

| UK | 8.1% |

| India | 5.5% |

| Country | 2035 Share (%) |

|---|---|

| USA | 19.8% |

| China | 12.1% |

| Japan | 9.4% |

| Germany | 13.8% |

| UK | 6.9% |

| India | 5.6% |

The Witch Hazel Distillates Market in Germany is projected to grow at a CAGR of 10.3%, supported by the country’s strength in precision engineering, industrial automation, and advanced manufacturing. German factory floors are increasingly deploying inline 3D scanners with robotic arms for dimensional inspection and real-time QA monitoring. CNC workshops are adopting structured light scanning systems to validate complex geometries during milling and machining operations, enhancing productivity and reducing waste.

In healthcare, dental and orthopedic labs are accelerating the shift from traditional mold-based techniques to digital scanner-based modeling using intraoral and handheld devices, improving accuracy and patient outcomes. Additionally, Germany’s stringent EU compliance requirements and strong sustainability focus are driving demand for scanner-enabled prototyping and additive manufacturing workflows. Despite its global market share declining from 14.7% in 2025 to 13.8% in 2035, Germany will remain a cornerstone of adoption due to its high-value industrial base and innovation-led growth.

.webp)

| USA Product Type | Value Share % 2025 |

|---|---|

| Toners | 54.7% |

| Others | 45.3% |

The Witch Hazel Distillates Market in the US is projected at USD 222.76 million in 2025. Toners dominate with 54.7% of the market, reflecting strong consumer preference for liquid-based skincare products that are easy to integrate into daily routines. The “Others” segment, which includes creams, lotions, and serums, contributes 45.3% of the market, showing a consistent demand for diversified product offerings. Market growth is driven by increasing consumer awareness of natural and clean-label skincare, rising e-commerce penetration, and innovation in premium hybrid formulations.

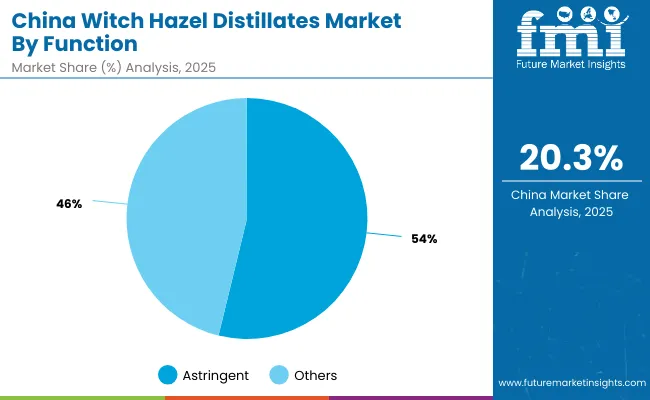

| China Function | Value Share% 2025 |

|---|---|

| Astringent | 53.8% |

| Others | 46.2% |

The Witch Hazel Distillates Market in China is valued at USD 118.83 million in 2025, with Astringent formulations leading at 53.8%, followed by Others at 46.2%. The dominance of astringent products is a direct outcome of China’s skincare composition, where toners, pore-tightening solutions, and acne-control products require strong herbal astringent properties. These segments demand close adherence to natural efficacy, making astringent-based distillates indispensable. Portability in usage across multiple product formstoners, cleansers, and spraysfurther enhances adoption, allowing seamless integration into mass retail and e-commerce.

This advantage positions astringent formulations as an essential tool for consumer trust and natural skincare efficacy. Other functional variants remain relevant for soothing and redness reduction, but demand is smaller compared to astringent-led categories. As wellness frameworks expand, AI-powered personalization combined with herbal skincare innovation will become a core enabler of connected, error-free beauty solutions.

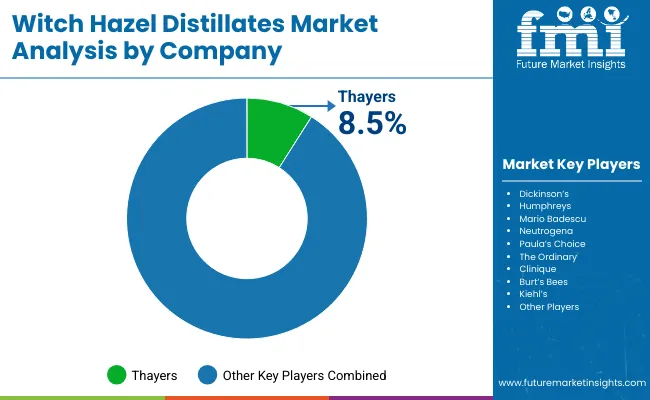

| Company | Global Value Share 2025 |

|---|---|

| Thayers | 8.5% |

| Others | 91.5% |

The Witch Hazel Distillates Market is moderately fragmented, with one brand maintaining a measurable global lead and a wide pool of competitors sharing the majority of market revenues. Thayers, with an 8.5% share in 2025, continues to be the most visible brand due to its heritage positioning and strong penetration in the USA market. Its growth is anchored in natural and organic astringent formulations that resonate with consumers seeking herbal skincare.

The “Others” segment, accounting for 91.5% of the global value, consists of brands such as Dickinson’s, Humphreys, Mario Badescu, Neutrogena, Paula’s Choice, The Ordinary, Clinique, Burt’s Bees, and Kiehl’s. These players differentiate across positioningmass retail distribution, dermatologist-tested claims, and premium cosmetic branding. The competitive field also reflects the rise of indie skincare labels in China, Japan, and Europe, leveraging e-commerce and social media to build share in niche categories.

Competitive differentiation is shifting from raw product attributes to integrated offerings such as vegan claims, dermatologist-tested credentials, and clean-label certifications, which align with consumer expectations. Success increasingly depends on channel strength, particularly in pharmacies, specialty beauty stores, and e-commerce, where brand trust and authenticity strongly influence repeat purchases.

Key Developments in Witch Hazel Distillates Market

| Item | Value |

|---|---|

| Quantitative Units | USD 1,051.6 Million |

| Function | Astringent, Soothing, Anti-acne, Redness reduction |

| Product Type | Toners, Cleansers, Serums, Creams/lotions |

| Channel | Pharmacies, E-commerce, Specialty beauty stores, Mass retail |

| Claim | Natural/organic, Vegan, Dermatologist-tested, Clean-label |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | FARO Technologies, Inc., 3D Digital Corporation, 3D Systems, Inc., Autodesk, Inc., Artec 3D, Automated Precision, Inc. (API), Carl Zeiss Optotechnik GmbH, Creaform Inc., Direct Dimensions Inc., GOM GmbH, Hexagon AB, Konica Minolta, Inc., NextEngine Inc., Nikon Corporation, OGI Systems Ltd, and ShapeGrabber |

| Additional Attributes | The Witch Hazel Distillates Market is defined by sales across product types and functions, with strong adoption of natural, organic, and clean-label claims. Demand is rising for portable formats such as toners, sprays, and wipes, while growth is concentrated in personal care and e-commerce. Leading brands are also leveraging AI personalization and AR/VR trials, with regional momentum driven by wellness trends and innovations in alcohol-free distillation and botanical blends. |

The global Witch Hazel Distillates Market is estimated to be valued at USD 1,051.6 million in 2025.

The market size for the Witch Hazel Distillates Market is projected to reach USD 3,321.7 million by 2035.

The Witch Hazel Distillates Market is expected to grow at a 12.2% CAGR between 2025 and 2035.

The key product types in the Witch Hazel Distillates Market are Toners, Cleansers, Serums, and Creams/Lotions.

In terms of function, the Astringent segment is projected to command the leading share in 2025, holding 53.8% of China’s market (USD 63.9 million) and 51.2% globally (USD 541.4 million).

Explore Similar Insights

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA