The laminated glass market is estimated to be valued at USD 25.0 billion in 2025 and is projected to reach USD 45.7 billion by 2035, registering a compound annual growth rate (CAGR) of 6.2% over the forecast period. The regional growth dynamics are expected to show considerable imbalance between Asia Pacific, Europe, and North America. Asia Pacific is positioned as the primary growth hub, supported by a rapidly expanding construction sector, significant automotive manufacturing, and higher adoption of advanced safety standards.

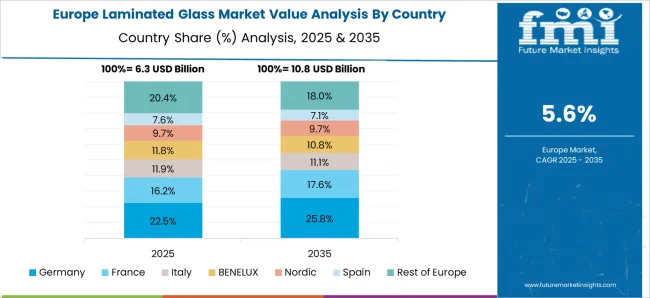

The region’s rising demand base drives the market steadily upward, contributing the largest incremental revenue share by 2035. Europe presents a more mature yet steady trajectory, where stringent safety regulations and sustainability-driven building codes act as consistent growth drivers.

While the expansion rate is slower than in the Asia Pacific, the regulatory framework ensures stable demand across architectural and automotive applications. The emphasis on energy-efficient glazing and smart building designs sustains Europe’s long-term position, though volume growth remains moderate compared with Asia Pacific. North America demonstrates resilience with steady growth supported by infrastructure renovation projects and consistent automotive sector adoption.

The slower adoption in certain construction segments limits its expansion relative to Asia Pacific. By 2035, Asia Pacific leads the market’s revenue contribution, Europe follows with stable regulated growth, and North America maintains a balanced but smaller share, highlighting a clear regional growth imbalance favoring Asia Pacific.

| Metric | Value |

|---|---|

| Laminated Glass Market Estimated Value in (2025 E) | USD 25.0 billion |

| Laminated Glass Market Forecast Value in (2035 F) | USD 45.7 billion |

| Forecast CAGR (2025 to 2035) | 6.2% |

The laminated glass market is witnessing notable growth due to increasing emphasis on safety standards, rising demand for noise reduction solutions, and architectural trends favoring energy efficiency and aesthetics. The use of laminated glass has expanded beyond automotive and construction into applications requiring enhanced structural integrity and ultraviolet protection.

Government regulations mandating the use of safety glazing in public infrastructure and vehicle manufacturing are significantly boosting adoption. Innovations in interlayer materials, light transmission control, and acoustic insulation are further enhancing the functional appeal of laminated glass.

As urban development accelerates and consumer awareness grows around occupant safety and environmental impact, the laminated glass market is expected to experience consistent and diversified demand across regions and industries.

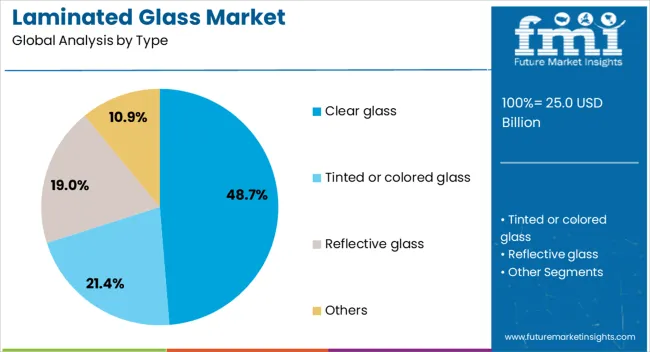

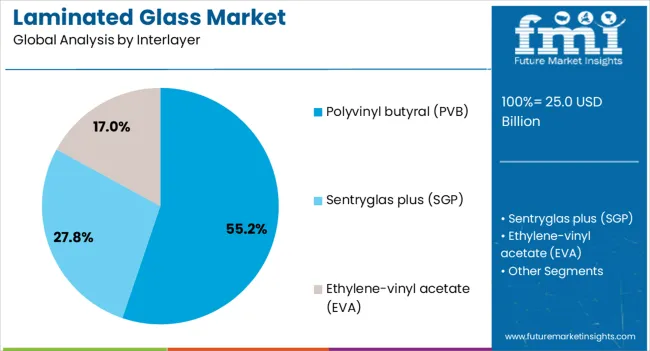

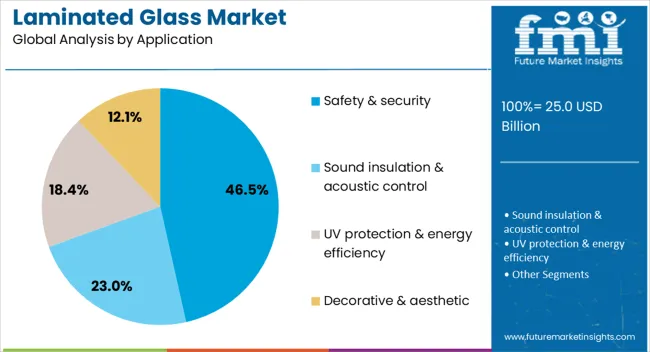

The laminated glass market is segmented by type, interlayer, application, end use industry, and geographic regions. By type, the laminated glass market is divided into Clear glass, Tinted or colored glass, Reflective glass, and Others. In terms of interlayer, the laminated glass market is classified into Polyvinyl butyral (PVB), Sentryglas Plus (SGP), and Ethylene-vinyl acetate (EVA). Based on application, the laminated glass market is segmented into Safety & security, Sound insulation & acoustic control, UV protection & energy efficiency, and Decorative & aesthetic. By end use industry, the laminated glass market is segmented into Construction, Automotive, Electronics, and Others. Regionally, the laminated glass industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The clear glass segment is projected to represent 48.70% of total revenue by 2025 under the type category, making it the most dominant segment. This is driven by its wide applicability in both commercial and residential constructions due to its high visibility, aesthetic flexibility, and ability to blend seamlessly with modern architectural designs.

Clear laminated glass offers transparency while maintaining safety and structural integrity, making it highly preferred for facades, partitions, and automotive windshields. Additionally, advancements in anti glare coatings and UV protection have expanded its usage across climates and geographies.

The balance between optical clarity and performance has led to clear glass maintaining its position as the top choice within the type segment.

The polyvinyl butyral interlayer segment is expected to account for 55.20% of overall revenue in 2025 within the interlayer category, placing it as the leading sub segment. Its dominance is attributed to excellent bonding strength, durability, and impact resistance properties which are critical in high safety and acoustic performance applications.

PVB interlayers provide superior adhesion between glass sheets while also delivering clarity and UV resistance, which are essential for both automotive and architectural uses. Their widespread availability, cost effectiveness, and compatibility with multiple glass types have further reinforced adoption.

As industries prioritize safety glazing and acoustic insulation, PVB continues to be the material of choice across major laminated glass applications.

The safety and security application segment is projected to capture 46.50% of market share by 2025, positioning it as the leading application area. Stringent building codes, increased risk preparedness, and rising demand for impact-resistant glass in high-traffic and high-risk environments drive the segment's growth.

Laminated glass used for safety and security helps reduce injury risks during breakage, provides protection against forced entry, and resists extreme weather conditions. Its role in securing banks, airports, commercial centers, and educational institutions has expanded steadily.

In automotive design, it is also central to occupant safety by offering shatterproof performance. These protective capabilities have positioned safety and security as the primary driver of demand in the laminated glass market.

The market has expanded as demand for advanced safety, structural integrity, and acoustic insulation in construction and automotive applications has increased. It is produced by bonding multiple glass layers with interlayers such as polyvinyl butyral or ethylene vinyl acetate, which improve durability and impact resistance. Applications in building facades, skylights, automotive windshields, and interior architecture have supported growth. Rising emphasis on security, energy efficiency, and sound reduction has positioned laminated glass as a preferred material across diverse industries, influencing global adoption significantly.

The role of laminated glass in enhancing safety and security has been central to its growing adoption across construction and automotive sectors. In buildings, it is widely used in facades, skylights, and windows due to its shatter-resistant properties that minimize risks of injury. Automotive windshields, side windows, and roofs have increasingly adopted laminated glass to ensure better passenger protection during collisions and accidents. Its ability to remain intact upon impact, even when shattered, has driven safety compliance across industries. The laminated glass has been increasingly used in security-sensitive infrastructures such as banks, airports, and government buildings, where its resistance to forced entry and blast mitigation capabilities provide additional protection. Growing awareness of accident prevention and compliance with international safety standards has strengthened its demand globally. These factors have firmly positioned laminated glass as a key safety material across infrastructure and mobility applications.

Acoustic insulation has become a major factor driving demand for laminated glass in residential, commercial, and industrial spaces. The interlayer within laminated glass has been designed to dampen sound vibrations, reducing noise transmission effectively. Urban expansion has resulted in greater exposure to external noise, which has increased the need for soundproofing solutions in homes, offices, and public buildings. Laminated glass has been widely utilized in airports, recording studios, and hotels for acoustic control. Automotive manufacturers have also introduced laminated side and rear windows to improve in-cabin sound quality by minimizing traffic and road noise. The role of laminated glass in creating comfortable and quiet environments has been recognized as a significant advantage. With increasing attention given to sound reduction in both construction and transportation, the application of laminated glass in acoustic solutions has been expected to grow at a considerable pace.

Energy efficiency has emerged as a significant driver of laminated glass demand, as buildings and vehicles require advanced glazing solutions to reduce energy consumption. Interlayers have been engineered to filter ultraviolet rays, minimize heat transfer, and allow natural light penetration, thereby improving insulation performance. Laminated glass has been incorporated into energy-efficient windows, facades, and skylights, supporting heating and cooling cost reduction. In automotive design, laminated glass has been applied to improve solar control by lowering cabin heat buildup and reducing the burden on air conditioning systems. Innovations in coatings and integration with smart glass technologies have further enhanced energy efficiency. With regulations emphasizing energy conservation in construction and transportation sectors, laminated glass has been adopted as a preferred solution. This trend has been strongly reinforced by the increasing focus on climate-friendly practices, ensuring sustained demand for energy-efficient glazing materials.

The market has been strongly influenced by architectural innovation, as designers and engineers increasingly seek materials that combine aesthetics with functionality. Laminated glass has been widely used in modern facades, balustrades, floors, staircases, and partitions, allowing the creation of transparent, safe, and visually appealing structures. Its ability to incorporate decorative interlayers, colored films, or printed patterns has enhanced its value in interior and exterior design. Skylights and glass roofs in large commercial complexes have also been constructed with laminated glass to meet safety and design requirements simultaneously. Architects have preferred laminated glass due to its versatility in combining structural performance with creative freedom. With demand for innovative and visually distinctive designs continuing to grow in both residential and commercial projects, laminated glass has been positioned as a vital material supporting the fusion of safety, design, and durability in modern architecture.

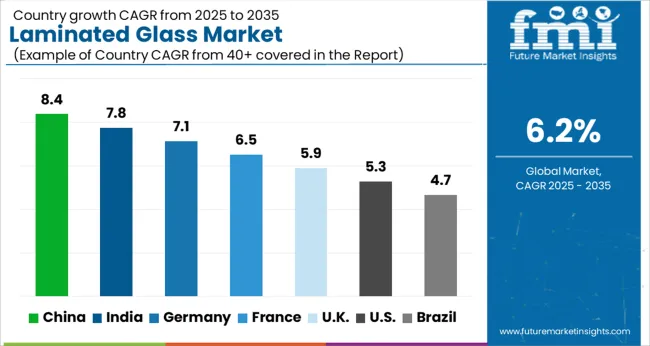

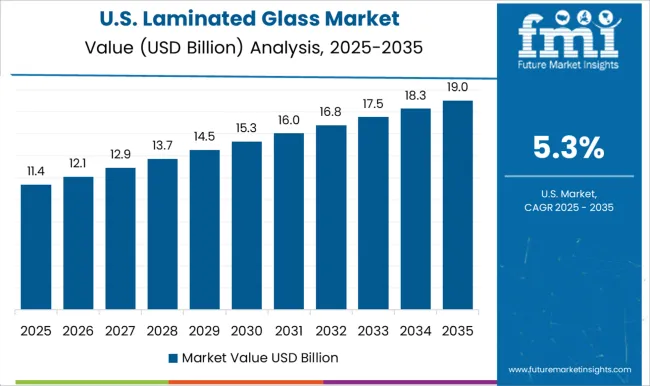

The market is forecasted to register a CAGR of 6.2% between 2025 and 2035, supported by rising demand in construction, automotive safety applications, and architectural glazing. China, with an 8.4% CAGR, drives the market through large-scale infrastructure development and extensive automotive manufacturing. India follows at 7.8%, expanding with increasing urban infrastructure projects and investments in transportation safety. Germany, growing at 7.1%, advances the market with engineering expertise and strong adoption in premium automotive segments. The UK, at 5.9%, strengthens demand through building regulations and modernization initiatives. The USA, at 5.3%, contributes steady growth with a focus on safety standards and architectural innovation. This report covers 40+ countries, with the top markets highlighted here for reference.

China is forecast to dominate the market with a CAGR of 8.4% between 2025 and 2035. Expanding construction projects, rising automobile production, and regulatory requirements for enhanced building safety standards are fueling demand. Adoption of laminated glass in commercial real estate, residential complexes, and transportation infrastructure is accelerating growth. Automotive manufacturers are increasingly utilizing laminated glass for sound insulation and safety features, strengthening market momentum.

India is anticipated to grow at a CAGR of 7.8%, driven by rapid infrastructure development and strong demand from the automotive industry. Increasing government mandates for safety in transport and buildings are stimulating laminated glass usage. Domestic production capacity expansion and collaborations with global manufacturers are improving supply chain efficiency. Growth in urban real estate projects and luxury vehicles is further reinforcing market adoption.

Germany is projected to advance at a CAGR of 7.1% during the forecast timeline. Rising demand for energy-efficient and safe building materials is contributing to higher adoption. Automakers are incorporating laminated glass for enhanced passenger protection and cabin comfort. Investments in research for lightweight and multi-layered laminated glass solutions are strengthening industrial competitiveness. Growth is also being shaped by regulations emphasizing environmental sustainability and structural safety.

The United Kingdom is set to expand at a CAGR of 5.9%, with demand supported by architectural projects and premium vehicle manufacturing. Laminated glass is being used extensively in skylights, facades, and soundproofing applications. Growing awareness of energy efficiency and safety compliance in buildings is reinforcing adoption. Automotive OEMs are integrating laminated glass for luxury and electric vehicles, enhancing passenger comfort and vehicle value.

The United States is anticipated to witness a CAGR of 5.3% through 2035, supported by growing emphasis on safety codes and modern architecture. Demand for energy-efficient glazing solutions in commercial and residential construction is accelerating market growth. Automotive adoption is being driven by increasing focus on advanced safety features and comfort standards. Expansion of infrastructure projects and technological advancements in laminated glass production are further enhancing competitiveness.

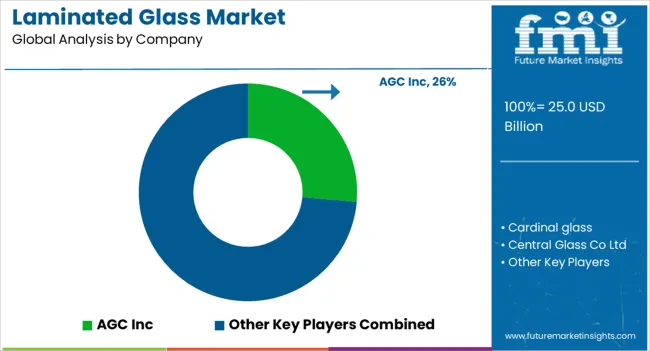

Companies such as Saint-Gobain, AGC Inc., and Guardian Industries hold strong market positions due to their wide product portfolios, advanced R&D capabilities, and extensive distribution networks. These providers invest in technologies that enhance durability, UV resistance, and acoustic insulation, which are critical for both construction and automotive applications. Nippon Sheet Glass, Xinyi Glass Holdings Limited, and Vitro Architectural Glass are significant contributors in Asia and the Americas, meeting rising demand in residential, commercial, and infrastructure projects. Cardinal Glass Industries, Central Glass Co., Ltd., and Oldcastle BuildingEnvelope strengthen the competitive landscape by delivering energy-efficient laminated glass solutions tailored to regional building codes and safety standards.

SCHOTT AG and Independent Glass expand their roles through innovative specialty products for niche applications, including defense and high-performance architecture. GSC Glass and other regional suppliers provide cost-competitive options and customized solutions, particularly for emerging markets where construction activities are rapidly increasing. The industry remains influenced by raw material costs, regulatory safety frameworks, and the rising need for energy-efficient building materials. Market leaders gain an edge by emphasizing product innovation, partnerships with builders and automakers, and integrated manufacturing processes that ensure scalability and long-term reliability in supply chains.

| Item | Value |

|---|---|

| Quantitative Units | USD 25.0 Billion |

| Type | Clear glass, Tinted or colored glass, Reflective glass, and Others |

| Interlayer | Polyvinyl butyral (PVB), Sentryglas plus (SGP), and Ethylene-vinyl acetate (EVA) |

| Application | Safety & security, Sound insulation & acoustic control, UV protection & energy efficiency, and Decorative & aesthetic |

| End use industry | Construction, Automotive, Electronics, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | AGC Inc.; Cardinal Glass Industries; Central Glass Co., Ltd.; GSC Glass Ltd.; Guardian Industries; Independent Glass; Nippon Sheet Glass Co., Ltd. (NSG Group); OBE (Oldcastle BuildingEnvelope); Saint Gobain. |

| Additional Attributes | Dollar sales by application and glass type, adoption across automotive windshields, architectural facades, skylights, and interior partitions, impact of regulatory standards on safety glazing, penetration of sound insulation and UV protection features, technological integration of smart laminated glass with switchable transparency, demand growth in residential and commercial construction, influence of energy efficiency and green building certifications, regional consumption patterns in Asia-Pacific, Europe, and North America, competitive innovations in interlayer materials such as polyvinyl butyral and ionoplast, and lifecycle considerations including recyclability and performance under extreme weather conditions. |

The global laminated glass market is estimated to be valued at USD 25.0 billion in 2025.

The market size for the laminated glass market is projected to reach USD 45.7 billion by 2035.

The laminated glass market is expected to grow at a 6.2% CAGR between 2025 and 2035.

The key product types in laminated glass market are clear glass, tinted or colored glass, reflective glass and others.

In terms of interlayer, polyvinyl butyral (pvb) segment to command 55.2% share in the laminated glass market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Laminated Busbar Market Forecast and Outlook 2025 to 2035

Laminated Tubes Market Size and Share Forecast Outlook 2025 to 2035

Laminated Labels Market Size and Share Forecast Outlook 2025 to 2035

Laminated Tube Closure Market from 2025 to 2035

Market Share Breakdown of Laminated Tubes Manufacturers

U.S. Laminated Tube Market Trends & Demand Forecast 2024-2034

Laminated Woven PP Bags Market

Silk Laminated Paper Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Litho Laminated Cartons Market Size and Share Forecast Outlook 2025 to 2035

Litho Laminated Packaging Market from 2025 to 2035

Cross Laminated Timber Market

USA Flexible Laminated Paper Market Growth – Trends & Forecast 2024-2034

Europe Flexible Laminated Paper Market Trends – Forecast 2024-2034

Aluminum Foil Laminated Paper Market

Glass Bottle and Container Market Size and Share Forecast Outlook 2025 to 2035

Glass Additive Market Forecast and Outlook 2025 to 2035

Glass Reactor Market Size and Share Forecast Outlook 2025 to 2035

Glass Cosmetic Bottle Market Size and Share Forecast Outlook 2025 to 2035

Glass & Metal Cleaner Market Size and Share Forecast Outlook 2025 to 2035

Glass Product Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA