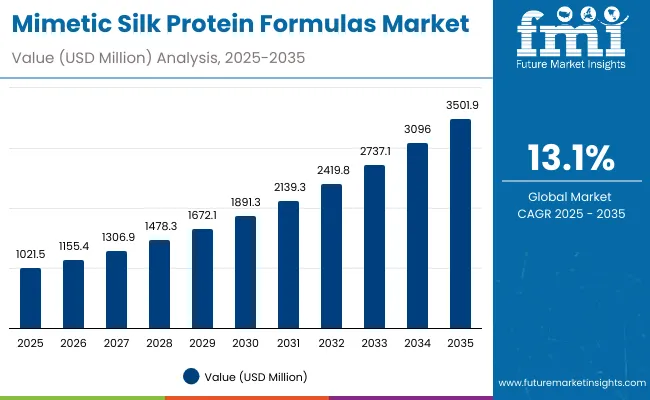

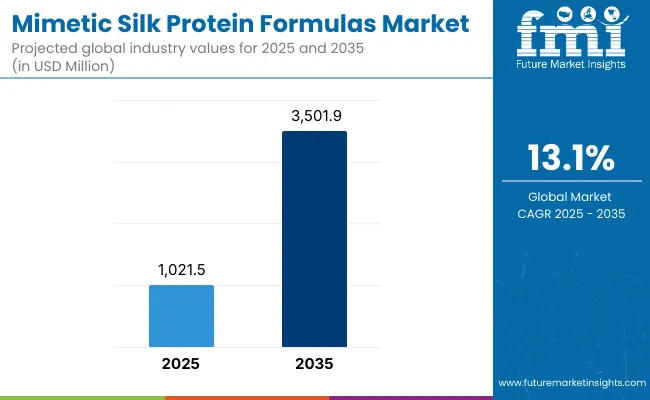

The Mimetic Silk Protein Formulas Market is expected to record a valuation of USD 1,021.5 million in 2025 and USD 3,501.9 million in 2035, with an increase of USD 2,480.4 million, which equals a growth of 243% over the decade. The overall expansion represents a CAGR of 13.1% and a 3.4X increase in market size.

Mimetic Silk Protein Formulas Market Key Takeaways

| Metric | Value |

|---|---|

| Mimetic Silk Protein Formulas Market Estimated Value in (2025E) | USD 1,021.5 million |

| Mimetic Silk Protein Formulas Market Forecast Value in (2035F) | USD 3,501.9 million |

| Forecast CAGR (2025 to 2035) | 13.1% |

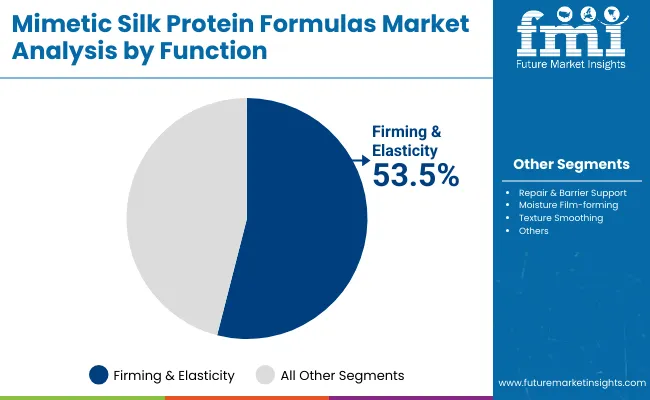

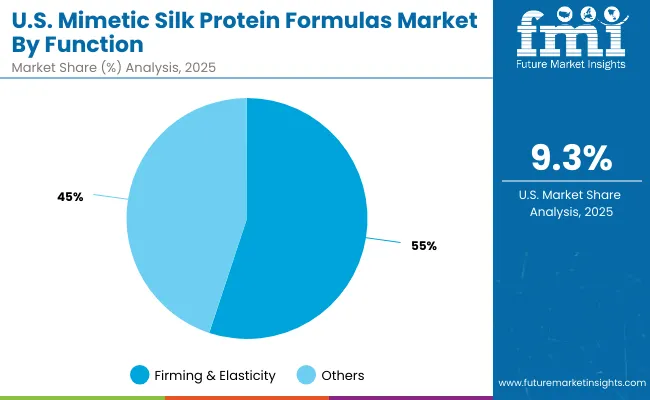

During the first five-year period from 2025 to 2030, the market increases from USD 1,021.5 million to USD 1,891.3 million, adding USD 869.8 million, which accounts for approximately 35.1% of the total decade growth. This phase reflects consistent adoption across premium skincare and dermatological applications, particularly in firming, anti-aging, and moisture-retaining formulations. Firming & elasticity functions dominate, with a 53.5% share in 2025, driven by demand for youthful skin performance across serum formats.

The second half from 2030 to 2035 contributes USD 1,610.6 million, equal to 64.9% of total growth, as the market grows from USD 1,891.3 million to USD 3,501.9 million. This acceleration is powered by innovations in recombinant silk analogs, vegan-certified bioactives, and AI-personalized beauty platforms. Key trends include wider application of mimetic silk in masks, primers, and clinical-grade leave-ons across e-commerce and dermatology clinics.

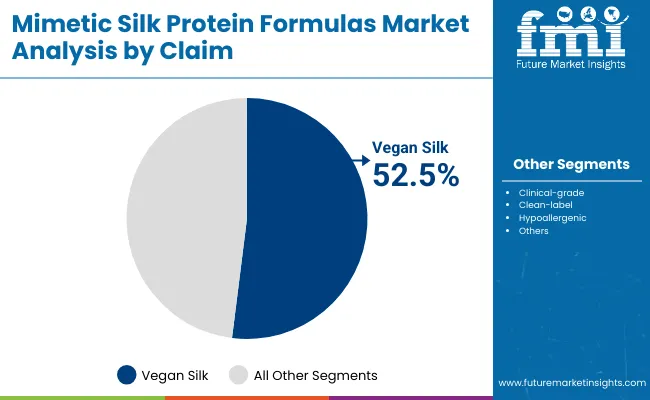

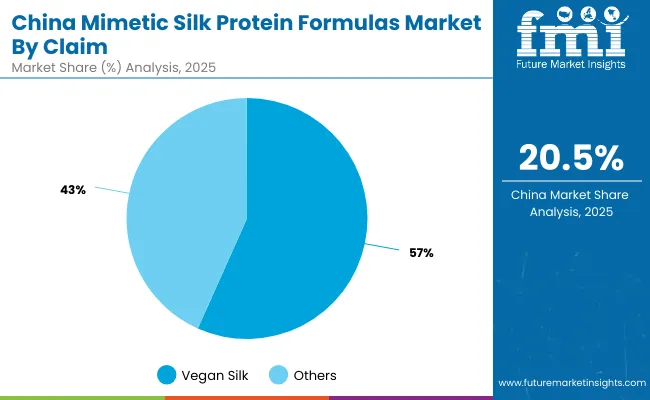

Vegan silk claims surpass 56.7% of value in China, reflecting clean-label and ethical ingredient momentum. Demand for high-efficacy silk peptides and custom beauty formulations significantly boosts recurring revenues from branded players, further supported by active ingredient licensing and texture-specific delivery systems.

From 2020 to 2024, the Mimetic Silk Protein Formulas Market matured from early R&D phases into commercial adoption, driven primarily by firming and elasticity claims and the rise of fibroin-like peptides in skincare applications. During this period, market leadership was shared by biotech formulators and legacy beauty brands experimenting with recombinant proteins and hybrid silk analogs.

Premium beauty retail and dermatology clinics emerged as primary channels. Competitive differentiation was rooted in clinical-grade efficacy, clean-label positioning, and patent-backed protein innovations, while vegan silk claims remained in niche applications.

Demand for Mimetic Silk Protein Formulas will expand to USD 1,021.5 million in 2025, and the revenue mix is shifting as vegan silk, texture-smoothing, and AI-personalized skincare systems gain traction. Leading brands are integrating cloud-enabled formulation platforms, ingredient traceability systems, and subscription-based skincare regimens.

Traditional ingredient suppliers now compete with lab-grown biomaterial startups and derma-beauty hybrids offering clinic-to-consumer value chains. The competitive advantage is no longer limited to novel proteins, but now rests on ecosystem strength, global manufacturing scalability, and recurring engagement with the end user through digital wellness platforms.

The rapid expansion of vegan cosmetic innovation is fueling demand for mimetic silk proteins, especially sericin-mimetic and fibroin-like peptides that offer cruelty-free alternatives to traditional silk. Brands are integrating these biomimetic actives in high-efficacy serums and creams that mimic silk’s firming, smoothing, and film-forming properties. This trend aligns with clean beauty standards and rising consumer preference for plant-based or lab-derived actives without sacrificing performance or sensorial appeal.

Clinical-grade skincare is gaining momentum in dermatology clinics and premium retail, and mimetic silk protein formulas meet rising demands for hypoallergenic, biocompatible actives. These proteins support barrier repair, texture refinement, and enhanced skin penetrationall critical in post-treatment or therapeutic skincare. The ability to combine functionality with low-irritation profiles makes these formulas ideal for medical esthetics, cosmeceuticals, and hybrid health-beauty product launches.

The market is segmented by protein type, function, product type, claim, channel, and region. Under protein type, segments include fibroin-like peptides, sericin-mimetic peptides, recombinant silk analogs, and hybrid silk-polymer systems, reflecting bioengineering innovations. The function-based segmentation includes firming & elasticity, repair & barrier support, moisture film-forming, and texture smoothing, each targeting specific skincare outcomes.

Product types cover serums, creams, masks, and leave-on primers, aligning with evolving consumer routines. Claims are segmented into vegan silk, clinical-grade, clean-label, and hypoallergenic, underscoring the rise of ethical and safe formulations. Distribution channels include premium beauty retail, e-commerce, pharmacies, and dermatology clinics, capturing both mass and professional demand.

Regionally, the market scope spans North America, Latin America, Western and Eastern Europe, Balkan and Baltic countries, Russia and Belarus, Central Asia, East Asia, South Asia and Pacific, and the Middle East and Africa, enabling tracking of regulatory shifts, innovation hubs, and consumer preferences globally.

| Function | Value Share % 2025 |

|---|---|

| Firming & elasticity | 53.5% |

| Others | 46.5% |

The firming & elasticity segment is projected to contribute 53.5% of the Mimetic Silk Protein Formulas Market revenue in 2025, emerging as the dominant functional category. This trend is primarily driven by the rising demand for biomimetic skincare actives that replicate silk’s natural tensile and lifting properties, making them ideal for anti-aging, toning, and skin-tightening applications in both clinical and premium cosmetic formulations.

Consumers are increasingly seeking alternatives to invasive treatments, and mimetic silk peptidesparticularly fibroin analogsare being formulated into high-performance serums and creams that visibly improve skin structure. The segment’s growth is further amplified by dermatology-led adoption and product launches highlighting elasticity improvement as a core claim.

With their proven ability to support collagen scaffolding and enhance biomechanical skin properties, firming-focused mimetic silk actives are expected to remain the preferred formulation direction over the forecast period.

| Claim | Value Share % 2025 |

|---|---|

| Vegan silk | 52.5% |

| Others | 47.5% |

The vegan silk segment is expected to account for 52.5% of the Mimetic Silk Protein Formulas Market value in 2025, emerging as the leading claim category. This dominance stems from growing consumer demand for cruelty-free and sustainable beauty solutions that mimic the benefits of traditional silk proteins without animal-derived components.

Vegan silk peptides, often fermented or synthesized from plant-based substrates, offer comparable performance in film-forming, moisture retention, and skin elasticity enhancement. Brands are leveraging this positioning across premium serums, masks, and primers to align with ethical skincare trends.

The market’s emphasis on clean-label and animal-free innovations has made vegan silk a cornerstone in product development, particularly for conscious consumers seeking performance without compromise. As regulatory pressures and buyer preferences shift toward transparency and sustainability, this segment is poised to see continued traction across global markets.

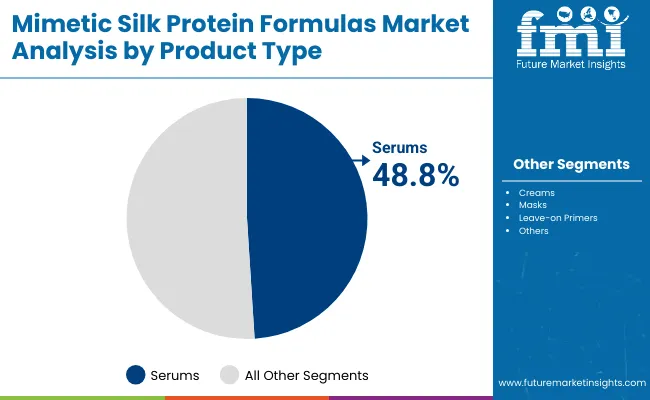

| Product Type | Value Share % 2025 |

|---|---|

| Serums | 48.8% |

| Others | 51.2% |

The serums category is projected to contribute 48.8% of the Mimetic Silk Protein Formulas Market value in 2025, making it the dominant product type. Serums provide an ideal delivery vehicle for mimetic silk peptides due to their lightweight texture, superior absorption, and compatibility with high concentrations of active ingredients.

Their popularity is further amplified by consumer preferences for minimalist routines and multi-benefit formulations that offer firming, repair, and hydration in a single application. Mimetic silk peptides, especially fibroin-like and sericin-mimetic variants, are being increasingly incorporated into anti-aging and elasticity-enhancing serums.

This segment benefits from its cross-demographic appeal and versatility in addressing skin concerns across age groups and skin types. As brands continue to prioritize innovation in water-based, fast-penetrating formats, serums will remain at the forefront of new product launches in the market.

Rising Preference for Biocompatible and Biomimetic Actives

The growing demand for clean, sustainable, and biocompatible skincare formulations is significantly driving the adoption of mimetic silk protein formulas. Fibroin-like peptides and sericin-mimetic variants closely mimic the skin’s natural proteins, improving barrier function, elasticity, and hydration with minimal irritation.

Their compatibility with sensitive skin and suitability for hypoallergenic and vegan-certified products make them attractive for brands looking to replace animal-derived or synthetic actives. This alignment with dermatological safety and ethical sourcing is expanding usage across premium and clinical-grade skincare segments globally.

Advancements in Recombinant Protein Synthesis and Green Fermentation

Breakthroughs in synthetic biology and protein engineering are enabling cost-effective and scalable production of silk protein analogs through fermentation-based platforms. Companies like AMSilk and Givaudan Active Beauty are leveraging recombinant systems to produce high-purity silk mimetics that offer better customization and consistency than natural extracts.

This biotechnological progress supports claims such as “vegan silk” and “cruelty-free,” while ensuring supply stability and formulation precision. As sustainability becomes a core value proposition, these innovations offer formulators new tools for developing high-performance and environmentally responsible cosmetic solutions.

Formulation Complexity and Regulatory Barriers in Multiregional Launches

Despite their potential, mimetic silk protein formulas face formulation and regulatory hurdles that may restrict broader commercialization. These proteins often require specific emulsification systems, pH control, and stabilizers, making product development complex and time-intensive.

Moreover, claims like “biomimetic,” “vegan silk,” or “recombinant peptides” are interpreted differently across global cosmetic regulatory frameworks, leading to labeling constraints and additional testing requirements. For companies scaling globally, aligning scientific innovation with region-specific compliance and shelf-life standards becomes a significant operational and cost burden.

Positioning of Vegan Silk as a Luxury-Performance Hybrid Ingredient

Mimetic silk protein formulas are increasingly positioned as luxury-performance hybrids, combining ethical appeal with advanced skincare efficacy. Brands are marketing vegan silk peptides as next-generation actives that deliver smooth texture, visible lifting, and moisture retentionbenefits traditionally attributed to collagen or animal-derived proteins.

This trend is redefining “clean luxury” by moving beyond natural botanicals to science-backed biomaterials. Additionally, the aesthetic sensorial finish of silk proteins enhances their use in primers, masks, and hybrid skincare-makeup lines. This dual-function positioning appeals strongly to ingredient-conscious premium consumers.

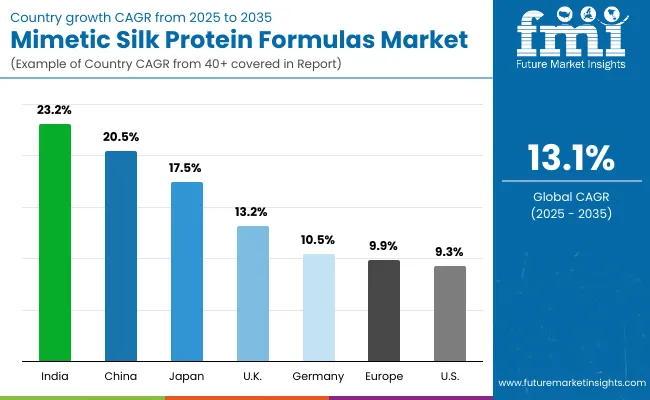

| Country | Estimated CAGR (2025 to 2035) |

|---|---|

| China | 20.5% |

| USA | 9.3% |

| India | 23.2% |

| UK | 13.2% |

| Germany | 10.5% |

| Japan | 17.5% |

| Europe | 9.9% |

The Mimetic Silk Protein Formulas Market exhibits distinct regional growth trajectories, primarily shaped by cosmetic innovation ecosystems, biotech ingredient development, and luxury skincare consumption trends.

Asia-Pacific is the fastest-growing region, led by India (23.2%) and China (20.5%). In India, the surge stems from increased localization of peptide manufacturing, government-supported biotech clusters, and rapid adoption of vegan-certified cosmetics among millennials. Domestic brands are scaling "derma-natural" formulations, integrating fibroin-like and sericin-mimetic actives to appeal to both efficacy-seeking and conscious consumers.

In China, demand is fueled by luxury skincare uptake and strategic government emphasis on biotech material self-reliance. Major domestic players are commercializing recombinant silk analogs for premium applications, particularly in repair creams, facial serums, and clinical K-beauty crossovers.Japan (17.5%) continues to be a high-value innovation hub, where legacy firms like Shiseido and Kao are investing in clean-label skin-barrier restoration using hybrid silk-polymer systems. Japanese R&D is pioneering “second-skin” formulations with advanced peptide encapsulation, driving demand in medical-grade and dermocosmetic sectors.

Europe sees strong, though comparatively moderate, growth led by Germany (10.5%), UK (13.2%), and broader continental dynamics (Europe: 9.9% CAGR). The region is bolstered by clean-beauty regulation, consumer demand for transparency, and dermocosmetic channels that favor clinically backed biomaterials. EU-based manufacturers are advancing biotechnological routes to silk peptide synthesis aligned with REACH compliance and COSMOS-certification.North America, especially the USA (9.3%), shows consistent but matured growth, reflecting a shift toward software-formulation platforms and AI-assisted skin compatibility personalization.

The region emphasizes ethical labeling (e.g., cruelty-free, hypoallergenic), and brands are investing in direct-to-consumer (DTC) models. The market is tilting towards hybrid offerings where mimetic silk peptides are embedded in multifunctional primers, wearable skincare, and adaptogenic serums.

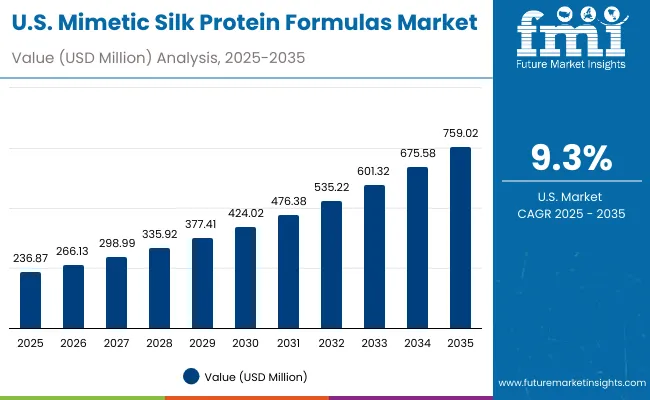

| Year | USA Mimetic Silk Protein Formulas Market (USD Million) |

|---|---|

| 2025 | 236.87 |

| 2026 | 266.13 |

| 2027 | 298.99 |

| 2028 | 335.92 |

| 2029 | 377.41 |

| 2030 | 424.02 |

| 2031 | 476.38 |

| 2032 | 535.22 |

| 2033 | 601.32 |

| 2034 | 675.58 |

| 2035 | 759.02 |

The Mimetic Silk Protein Formulas Market in the United States is expected to grow at a CAGR of 12.1% from 2025 to 2035, reflecting robust innovation activity and rising consumer demand for clinically validated, bioactive skincare solutions. The expansion is underpinned by strong adoption in the premium dermocosmetic sector, where firms are launching fibroin-like peptide serums and sericin-based barrier creams with vegan and hypoallergenic claims. Dermatology clinics and pharmacies are driving channel expansion, and bundled offerings with clinical-grade silk analogs are penetrating both retail and prescription-based segments.

Across categories, firming and elasticity solutions dominate, particularly in anti-aging serums and texture-smoothing masks. Mimetic silk peptides are being incorporated into AI-personalized skincare routines, where digital platforms suggest peptide combinations based on skin condition diagnostics. USA-based players are investing in recombinant silk production pipelines, supported by clean-label regulations and consumer trust in biotech innovation.

The Mimetic Silk Protein Formulas Market in the United Kingdom is projected to expand at a CAGR of 13.2% between 2025 and 2035, driven by both industrial and public-sector innovation. The market’s growth is heavily influenced by the country’s established motorsport and advanced engineering ecosystem, where sericin-mimetic and hybrid silk-polymer actives are being integrated into high-performance skincare formulations tailored to post-exertion recovery, anti-inflammatory support, and dermal barrier repair for athletes and professionals in extreme environments.

The heritage and restoration sectors are also showing strong uptake, with museums, conservation bodies, and academic labs incorporating mimetic silk proteins into preservation-focused skincare, particularly in hypoallergenic and clean-label formulations. In the retail and fashion domain, hybrid applications are emerging where silk protein serums are promoted alongside augmented reality (AR) shopping experiences, enabling users to digitally test skincare products before purchase.

Collaborations between UK universities, biotech startups, and cosmetic conglomerates are accelerating product innovation, with government grants and regulatory backing for sustainable, cruelty-free formulations providing additional momentum.

The Mimetic Silk Protein Formulas Market in India is anticipated to grow at a CAGR of 23.2% between 2025 and 2035, the highest among key global economies. This exceptional momentum is being driven by domestic cosmeceutical innovation, a surge in clean-label skincare demand, and biotech-led diversification of silk protein sourcing.

Indian startups and established players are actively developing sericin-mimetic and fibroin-based peptides for use in barrier-repair creams, vegan serums, and moisture-retention gels customized for tropical climates and pollution-prone skin types.

Smaller cities and semi-urban centers are fueling affordable innovation, as tier-2 and tier-3 brands collaborate with academic labs and Ayurvedic formulators to create cost-effective silk peptide solutions with natural carrier oils and herbal actives. Government-backed skincare accelerators, particularly in Bengaluru and Hyderabad, are providing funding and R&D resources for clinical-grade formulations targeting both domestic and export markets.

Public-private partnerships in pharmaceutical retail and dermatology clinics are accelerating the rollout of mimetic silk formulations in prescription-grade cosmeceuticals, especially for burn recovery, sensitive skin, and post-surgical healing.

The Mimetic Silk Protein Formulas Market in China is forecast to grow at a CAGR of 20.5% from 2025 to 2035, reflecting one of the highest rates among global economies. Growth is being propelled by a confluence of factors including smart factory upgrades, municipal digital twin initiatives, and rapid expansion of China’s biotech-based skincare ecosystem.

Local brands are pioneering recombinant silk analogs and sericin-mimetic peptides, capitalizing on government support for clean beauty and functional cosmetics aligned with China’s “Healthy China 2030” initiative.

Consumer preference is shifting toward fast-absorbing, vegan-certified, and clinically backed formulations, leading to high adoption across premium e-commerce platforms and dermatology chains. Domestically manufactured mimetic silk proteins, often derived from fermentation-based platforms, are now cost-competitive and customized for sensitive, pollution-exposed skin. This localization advantage, combined with strong IP protections and ingredient traceability, is driving wide adoption across both urban metropolises and Tier-2 cities.

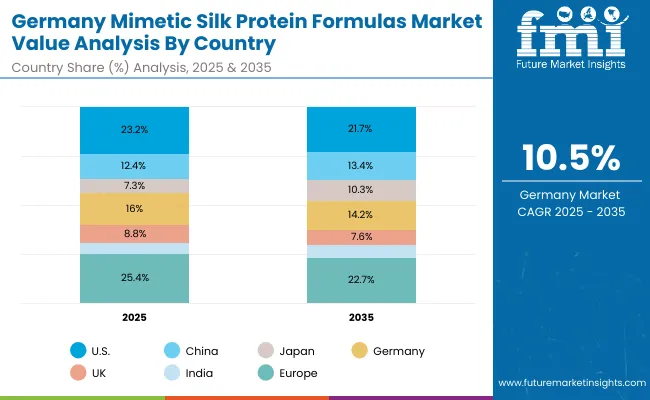

| Country | 2025 Share (%) |

|---|---|

| USA | 23.2% |

| China | 12.4% |

| Japan | 7.3% |

| Germany | 16.0% |

| UK | 8.8% |

| India | 5.5% |

| Europe | 25.4% |

| Country | 2035 Share (%) |

|---|---|

| USA | 21.7% |

| China | 13.4% |

| Japan | 10.3% |

| Germany | 14.2% |

| UK | 7.6% |

| India | 6.2% |

| Europe | 22.7% |

The Mimetic Silk Protein Formulas Market in Germany is projected to grow at a CAGR of 10.5% from 2025 to 2035, driven by its robust base in pharmaceutical biotechnology, cosmeceutical innovation, and EU-led sustainability benchmarks. As a leading economy in clinical dermatology and dermocosmetics, Germany is actively adopting sericin-mimetic and fibroin-like peptide formulations for firming, barrier repair, and regenerative skincare. The market is further fueled by eco-conscious R&D and EU Cosmetic Regulation compliance, promoting vegan silk and clean-label claims in mainstream and luxury segments.

Pharmaceutical giants and specialty beauty labs are integrating biotechnologically derived silk analogs into medical-grade skincare, especially for post-procedure recovery and aging skin. Demand is also rising for multifunctional serums and creams with texture-smoothing properties and rapid absorption profiles.

Germany’s concentration of clinical testing institutes and ingredient certifying bodies ensures a higher product development throughput and faster brand-to-market cycles, making it a hub for piloting next-generation mimetic silk-based innovations.

| USA by Function | Value Share % 2025 |

|---|---|

| Firming & elasticity | 55.1% |

| Others | 44.9% |

The Mimetic Silk Protein Formulas Market in the United States is expected to reach USD 236.87 million in 2025, driven by strong penetration across clinical dermatology, luxury skincare, and biotech-driven cosmeceuticals. Firming and elasticity-enhancing functions dominate with 55.1% share in 2025, led by growing demand for high-performance anti-aging solutions that mimic natural silk’s tensile and structural properties. The USA market benefits from robust private-label innovation, aggressive e-commerce expansion, and convergence between dermatology clinics and retail skincare channels.

Leading brands are introducing vegan silk peptides and recombinant fibroin analogs in serums and leave-on primers, responding to consumer preference for clean-label, hypoallergenic, and fast-absorbing products. Clinical-grade formulations are particularly popular in post-treatment regimens and dermocosmetic applications. Innovation is being shaped by bioactive ingredient layering, multi-functional textures, and digitally marketed claim-backed SKUs. With R&D pipelines accelerating in New Jersey, California, and Massachusetts, the USA remains a global launchpad for cutting-edge biomimetic beauty formulas.

| China by Claim | Value Share % 2025 |

|---|---|

| Vegan silk | 56.7% |

| Others | 43.3% |

China's Mimetic Silk Protein Formulas Market is poised for rapid expansion, with vegan silk claims commanding 56.7% of the market in 2025. This dominance reflects China's dual emphasis on plant-based innovation and sustainability in its booming clean beauty ecosystem. Chinese beauty brands are heavily investing in biotechnology R&D, positioning recombinant silk peptides and sericin-mimetic proteins as cruelty-free, performance-driven alternatives to traditional animal-derived actives.

The regulatory landscape is also evolving in favor of ingredient traceability and eco-certifications, allowing vegan silk-based formulas to capitalize on the demand surge in Tier 1 and Tier 2 cities. Additionally, e-commerce ecosystems such as Tmall Global and JD.com are amplifying access to these premium claims through targeted KOL campaigns and livestreaming, enabling deeper consumer education. Domestic companies are building localized supply chains for silk-inspired proteins, giving them a cost advantage and faster turnaround compared to imported peptide formulations.

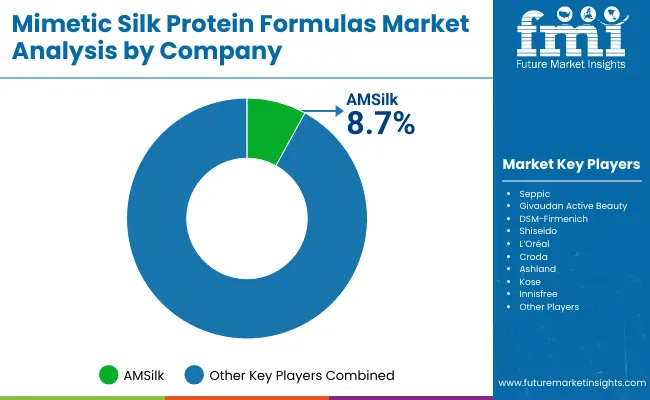

| Company | Global Value Share 2025 |

|---|---|

| AMSilk | 8.7% |

| Others | 91.3% |

The Mimetic Silk Protein Formulas Market is moderately consolidated, with a blend of biotechnology pioneers, cosmeceutical majors, and formulation specialists competing across skincare, dermatological, and clinical beauty segments. AMSilk, a recognized innovator in recombinant silk biopolymers, holds a notable 8.7% market share in 2025, driven by its advanced biotech platforms and growing global licensing footprint.

Global ingredient majors such as DSM-Firmenich, Givaudan Active Beauty, Seppic, and Croda are expanding portfolios to include fibroin- and sericin-like peptides, often co-developed with biotech startups. Their scale enables rapid deployment in vegan, hypoallergenic, and clean-label skincare ranges. These firms increasingly bundle efficacy data, regulatory clearance, and formulation support, catering to both mass-market and clinical-grade brands.

Mid-sized players and cosmetic labs, including Ashland, Shiseido, and Kose, focus on hybrid silk-polymer systems and clinical efficacy claims, especially in Asian and European premium skincare. These firms benefit from strong IP pipelines and regional production hubs that support customization.

Smaller innovators such as Innisfree and regional D2C brands are targeting niche segments through vegan silk, leave-on serums, and microbiome-safe products, using mimetic silk peptides to differentiate in natural actives and sustainable packaging formats.

The competitive advantage in this market is shifting from traditional ingredient supply to functionality-led partnerships, biotech-enabled customization, and digital formulation ecosystems with traceable sourcing and sustainability metrics.

Key Developments in Mimetic Silk Protein Formulas Market

| Item | Value |

|---|---|

| Quantitative Units | USD 1,021.5 Million |

| Protein Type | Fibroin-like peptides, Sericin -mimetic peptides, Recombinant silk analogs, Hybrid silk-polymer systems |

| Function | Firming & elasticity, Repair & barrier support, Moisture film-forming, Texture smoothing |

| Product Type | Serums, Creams, Masks, Leave-on primers |

| Channel | Premium beauty retail, E-commerce, Pharmacies, Dermatology clinics |

| Claim | Vegan silk, Clinical-grade, Clean-label, Hypoallergenic |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | AMSilk , Seppic , Givaudan Active Beauty, DSM- Firmenich , Shiseido, L’Oréal, Croda , Ashland, Kose , Innisfree |

| Additional Attributes | Dollar sales by protein type and function, formulation trends in vegan silk and clean-label claims, rising demand for serums and film-forming skincare, segment-specific growth in dermatology clinics, e-commerce, and premium beauty retail, revenue segmentation by product type and sales channel, integration with biomimetic peptide technologies and hybrid silk-polymer systems, regional trends driven by clean beauty and dermatological innovation, and advancements in recombinant silk analogs, fibroin-like peptide synthesis, and clinical-grade hypoallergenic formulations. |

The global Mimetic Silk Protein Formulas Market is estimated to be valued at USD 1,021.5 million in 2025.

The market size for the Mimetic Silk Protein Formulas Market is projected to reach USD 3,501.9 million by 2035.

The Mimetic Silk Protein Formulas Market is expected to grow at a 13.1% CAGR between 2025 and 2035.

The key product types in the Mimetic Silk Protein Formulas Market are serums, creams, masks, and leave-on primers.

In terms of claim-based segmentation, the vegan silk segment is projected to command the largest share in the Mimetic Silk Protein Formulas Market in 2025, driven by growing consumer demand for cruelty-free, plant-based, and sustainable skincare alternatives. Brands are increasingly positioning vegan silk-based formulas in serums and creams to appeal to clean beauty and ethical consumer segments.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Biomimetic Collagen Synthesis Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Bio-Mimetic Proteins Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Medical Biomimetics Market Size and Share Forecast Outlook 2025 to 2035

Collagen-Boosting Biomimetic Peptides Market Size and Share Forecast Outlook 2025 to 2035

Silk Market Size and Share Forecast Outlook 2025 to 2035

Silky Matte Film Market Size and Share Forecast Outlook 2025 to 2035

Silk Laminated Paper Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Silk Protein Market Analysis - Sericin & Fibroin Forecast 2024-2034

Spider Silk Fibers Market Size and Share Forecast Outlook 2025 to 2035

Spider Silk Fabric Market Size and Share Forecast Outlook 2025 to 2035

Hydrolyzed Silk Proteins Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Synthetic Spider Silk Proteins Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Psoriasis Care Formulas Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Coconut Water-Based Formulas Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Resveratrol Enriched Formulas Market Size and Share Forecast Outlook 2025 to 2035

Protein-Coating Line Market Forecast Outlook 2025 to 2035

Protein Labelling Market Size and Share Forecast Outlook 2025 to 2035

Protein Puddings Market Size and Share Forecast Outlook 2025 to 2035

Protein/Antibody Engineering Market Size and Share Forecast Outlook 2025 to 2035

Protein Expression Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA