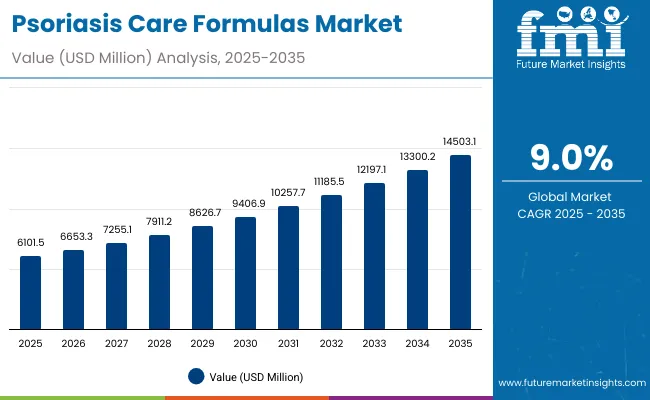

The Psoriasis Care Formulas Market is expected to record a valuation of USD 6,101.5 million in 2025 and USD 14,503.1 million in 2035, with an increase of USD 8,401.6 million, which equals a growth of 138% over the decade. The overall expansion represents a CAGR of 9.0% and more than a 2X increase in market size.

Psoriasis Care Formulas Market Key Takeaways

| Metric | Value |

|---|---|

| Psoriasis Care Formulas Market Estimated Value in (2025E) | USD 6,101.5 million |

| Psoriasis Care Formulas Market Forecast Value in (2035F) | USD 14,503.1 million |

| Forecast CAGR (2025 to 2035) | 9.0% |

During the first five-year period from 2025 to 2030, the market increases from USD 6,101.5 million to USD 9,406.9 million, adding USD 3,305.4 million, which accounts for 39% of the total decade growth. This phase records steady adoption in fragrance-free and dermatologist-tested products, with pharmacies and drugstores driving nearly half of distribution. The anti-inflammatory function segment dominates, supported by rising patient reliance on prescription topicals and OTC emollients.

The second half from 2030 to 2035 contributes USD 5,096.2 million, equal to 61% of total growth, as the market jumps from USD 9,406.9 million to USD 14,503.1 million. This acceleration is powered by widespread adoption of coal tar-free and sensitive-skin safe formulations, along with premiumization through clean-label and hypoallergenic claims. By 2035, fragrance-free products retain dominance with more than 55% share, while anti-inflammatory and barrier-support formulas expand their role in long-term psoriasis management.

From 2020 to 2024, the Psoriasis Care Formulas Market expanded steadily, supported by growing awareness of chronic skin conditions and increased OTC access to keratolytics, emollients, and prescription topicals. During this period, the competitive landscape was dominated by established dermatology brands, controlling the majority of revenue through pharmacist recommendations and dermatologist endorsements. Differentiation relied on clinically validated ingredients, safety profiles, and broad pharmacy distribution, while niche players with scalp-specific and adjunctive therapies remained secondary contributors.

Demand for Psoriasis Care Formulas will expand to USD 6,101.5 million in 2025, and the revenue mix is expected to shift further toward fragrance-free, dermatologist-tested, and coal tar-free claims, which are increasingly preferred by patients. Traditional leaders such as La Roche-Posay, Neutrogena, and Eucerin face rising competition from digital-first and clean-label brands leveraging e-commerce channels. Emerging entrants are focusing on sensitive-skin safe, natural, and herbal formulations to capture consumer trust. Competitive advantage is moving away from standard topical innovation alone to ecosystem strength, claim diversity, and multi-channel retail presence..

The psoriasis care market is experiencing strong growth due to a rapid consumer shift toward fragrance-free, coal tar-free, and sensitive-skin safe formulations. Patients are increasingly aware of potential irritants that worsen flare-ups, leading them to demand cleaner, dermatologist-tested options. This has encouraged global leaders like La Roche-Posay and Neutrogena to reformulate and expand their lines. The result is accelerating adoption, especially in North America and Europe, where safety and compliance with dermatological standards strongly influence purchasing behavior.

Growth is also fueled by the rising use of scalp-specific formulas and adjunctive therapies such as keratolytic shampoos and phototherapy-support products. Scalp psoriasis affects nearly half of psoriasis patients, creating consistent demand for specialized care solutions. Brands like MG217 and Ciclopoli are capitalizing on this need by offering targeted treatments that complement traditional prescription topicals. These innovations enhance patient quality of life, expand product portfolios, and strengthen brand differentiation, particularly in fast-growing Asia-Pacific markets where unmet needs remain high.

The Psoriasis Care Formulas Market is segmented by treatment type, function, form, channel, claim, and region. Treatment types include OTC keratolytics & emollients, prescription topicals such as vitamin D analogs and corticosteroids, phototherapy adjuncts, and scalp-specific formulas. By function, the market is divided into scale reduction, anti-inflammatory, itch relief, and barrier support. Forms encompass ointments, creams, shampoos/scalp solutions, and gels, reflecting varied patient needs.

Distribution channels include pharmacies/drugstores, dermatology clinics, e-commerce, and mass retail. Claims cover fragrance-free, dermatologist-tested, coal tar-free, and sensitive-skin safe. Regionally, the market is analyzed across North America, Latin America, Europe, Asia-Pacific, and the Middle East & Africa, with detailed insights for the USA, China, India, Japan, Germany, and the UK

| Claim | Value Share% 2025 |

|---|---|

| Fragrance-free | 55.1% |

| Others | 44.9% |

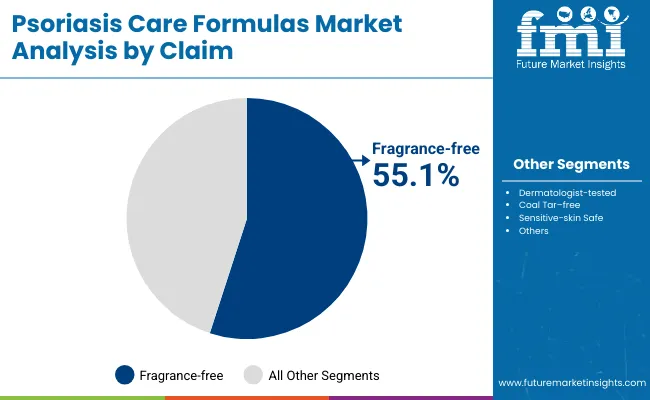

The fragrance-free segment is projected to contribute 55.1% of the Psoriasis Care Formulas Market revenue in 2025, maintaining its lead as the dominant claim category. This is driven by heightened consumer concerns around irritation and flare-ups caused by artificial fragrances, especially for chronic skin conditions like psoriasis. Dermatologists continue to recommend fragrance-free products as the safest option for long-term management, particularly among pediatric and sensitive-skin patients.

The segment’s growth is also supported by expanding clean-label innovation and greater availability of fragrance-free formulas across both pharmacies and e-commerce platforms. As patient awareness increases, fragrance-free products are expected to retain their leadership as the most trusted claim in psoriasis care.

| Function | Value Share% 2025 |

|---|---|

| Anti-inflammatory | 49.2% |

| Others | 50.8% |

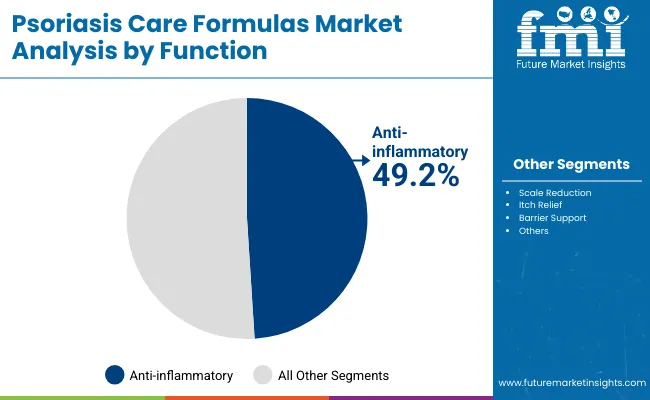

The anti-inflammatory segment is forecasted to hold 49.2% of the Psoriasis Care Formulas Market revenue in 2025, maintaining a critical role in patient treatment. Psoriasis is characterized by chronic inflammation, and products formulated with corticosteroids, vitamin D analogs, and soothing botanicals are widely recommended to reduce flare-ups and manage symptoms.

This segment’s growth is supported by continuous innovation in prescription topicals and OTC formulations, along with rising consumer preference for steroid-sparing options that combine efficacy with long-term safety. As awareness increases and dermatologist recommendations strengthen, anti-inflammatory solutions are expected to remain the backbone of psoriasis care formulas.

| Channel | Value Share% 2025 |

|---|---|

| Pharmacies/drugstores | 47.3% |

| Others | 52.7% |

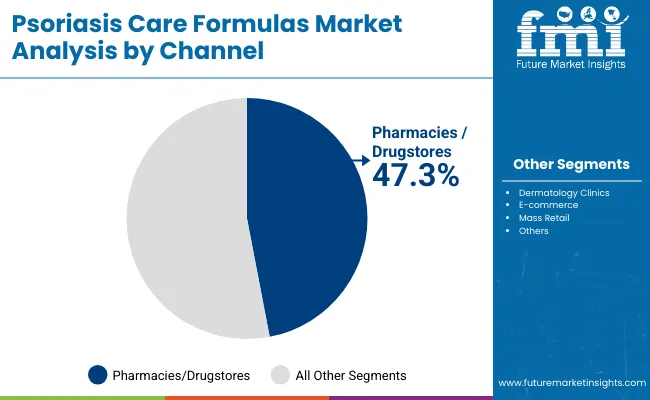

The pharmacies and drugstores segment is projected to contribute 47.3% of the Psoriasis Care Formulas Market revenue in 2025, maintaining its position as the most trusted distribution channel. Patients rely heavily on pharmacies for access to both prescription topicals and OTC keratolytics, supported by pharmacist guidance and dermatologist recommendations.

This segment’s growth is further strengthened by the availability of established brands such as Eucerin, La Roche-Posay, and CeraVe on pharmacy shelves. While e-commerce is expanding, pharmacies remain the cornerstone for psoriasis care due to their credibility, accessibility, and integration with clinical advice, ensuring continued dominance in the distribution landscape.

Rising prevalence of psoriasis and chronic skin conditions

The global increase in psoriasis prevalence, affecting both adults and children, is a key growth driver for the Psoriasis Care Formulas Market. Environmental stress, genetics, and lifestyle-related factors are contributing to higher incidence rates, creating sustained demand for effective care solutions. Patients increasingly seek long-term management products to control flare-ups, reduce scaling, and improve skin barrier function. This trend supports growing adoption of OTC keratolytics, emollients, and prescription topicals, driving consistent revenue growth across both developed and emerging regions.

Demand for fragrance-free and coal tar-free products

Consumer demand is shifting strongly toward formulations that are fragrance-free, coal tar-free, and safe for sensitive skin. Awareness of potential irritants and concerns about long-term side effects of traditional therapies have led to greater reliance on dermatologist-tested and hypoallergenic products. Leading brands such as La Roche-Posay, Eucerin, and CeraVe are expanding their fragrance-free and steroid-sparing portfolios. This transition not only addresses patient safety needs but also supports premiumization, as clean-label products are increasingly perceived as safer, more effective, and worth higher consumer investment.

Side effects and compliance challenges with corticosteroid use

Although corticosteroids are effective in controlling psoriasis symptoms, prolonged or unsupervised use often results in adverse effects such as skin thinning, burning, or rebound flares. These risks reduce consumer confidence and limit long-term adoption, particularly among patients seeking sustainable care. Compliance challenges also emerge when treatment regimens involve multiple applications per day, leading to inconsistent use and lower efficacy. Regulatory restrictions on corticosteroid concentrations in certain markets further constrain expansion, encouraging patients and healthcare providers to look toward safer alternatives, which slows corticosteroid-driven growth.

Expansion of e-commerce and direct-to-consumer brands

The psoriasis care market is being reshaped by the rapid growth of e-commerce and direct-to-consumer (D2C) platforms. Consumers are increasingly purchasing dermatologist-recommended and niche psoriasis solutions online, attracted by convenience, product variety, and competitive pricing. Subscription-based delivery models for creams, shampoos, and adjunctive therapies are gaining traction, particularly in Asia-Pacific. Smaller clean-label and natural-ingredient brands are leveraging digital channels to compete with global leaders, accelerating market democratization. This trend is expected to expand significantly, driving broader accessibility and reshaping competitive dynamics through online-focused growth strategies.

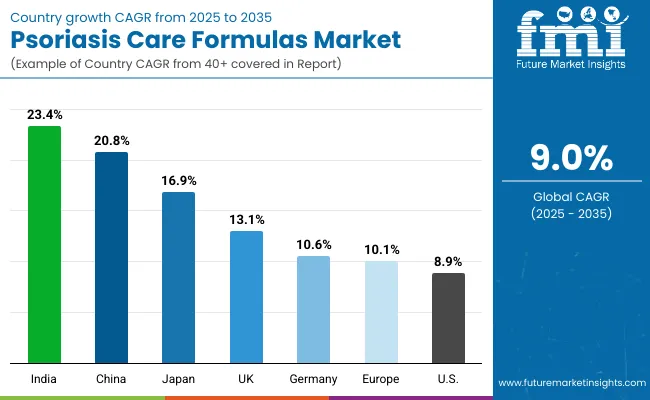

| Countries | Estimated CAGR (2025 to 2035) |

|---|---|

| China | 20.8% |

| USA | 8.9% |

| India | 23.4% |

| UK | 13.1% |

| Germany | 10.6% |

| Japan | 16.9% |

The global Psoriasis Care Formulas Market shows strong regional differences in adoption speed, shaped by healthcare access, consumer awareness, and distribution strength. Asia-Pacific emerges as the fastest-growing region, anchored by India at 23.4% CAGR and China at 20.8% CAGR. Growth here is driven by a rising prevalence of psoriasis, increasing affordability of OTC keratolytics and emollients, and rapid e-commerce expansion that brings dermatologist-tested brands into Tier-2 and Tier-3 cities. Japan also demonstrates robust growth at 16.9% CAGR, supported by innovation in sensitive-skin safe and steroid-sparing formulations.

Europe maintains a steady growth profile, led by the UK at 13.1% CAGR and Germany at 10.6% CAGR, supported by strong pharmacy penetration, consumer demand for fragrance-free and coal tar-free options, and regulatory emphasis on product safety. North America shows moderate expansion, with the USA at 8.9% CAGR, reflecting a mature but resilient market. Growth here is increasingly driven by clean-label, fragrance-free claims and expanding access through e-commerce and dermatology clinics.

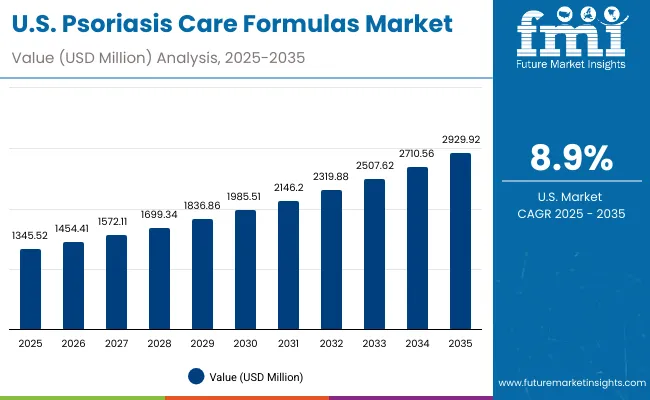

| Year | USA Psoriasis Care Formulas Market (USD Million) |

|---|---|

| 2025 | 1,345.52 |

| 2026 | 1,454.41 |

| 2027 | 1,572.11 |

| 2028 | 1,699.34 |

| 2029 | 1,836.86 |

| 2030 | 1,985.51 |

| 2031 | 2,146.20 |

| 2032 | 2,319.88 |

| 2033 | 2,507.62 |

| 2034 | 2,710.56 |

| 2035 | 2,929.92 |

The Psoriasis Care Formulas Market in the United States is projected to grow at a CAGR of 8.9% (2025-2035), driven by strong consumer demand for dermatologist-tested and fragrance-free products. The country’s high prevalence of psoriasis, combined with broad insurance and OTC access, supports consistent adoption of prescription topicals and emollient-based formulas. Pharmacies and drugstores remain the leading sales channel, while e-commerce growth is enabling clean-label and coal tar-free brands to expand reach. Premium brands such as La Roche-Posay, Eucerin, and CeraVe maintain strong positions, supported by clinical validation and dermatologist endorsements.

The Psoriasis Care Formulas Market in the United Kingdom is expected to grow at a CAGR of 13.1% (2025-2035), supported by increasing awareness of psoriasis management, high consumer preference for fragrance-free and dermatologist-tested products, and the strong presence of European premium skincare brands. Pharmacies and drugstores remain the dominant sales channel, while e-commerce is gaining traction as consumers seek convenient access to specialized formulations. Regulatory emphasis on product safety and clean-label claims further strengthens adoption across both pediatric and adult users.

India is witnessing rapid growth in the Psoriasis Care Formulas Market, which is forecast to expand at a CAGR of 23.4% through 2035. Rising prevalence of psoriasis, greater awareness of dermatological care, and increasing accessibility of affordable OTC keratolytics and emollients are driving adoption. Demand is particularly strong in Tier-2 and Tier-3 cities, supported by pharmacy expansion and digital retail platforms. Global brands such as La Roche-Posay and Neutrogena are entering premium segments, while local players strengthen their position with cost-effective, herbal-based formulations. Pediatric and adult consumers alike are fueling growth, with fragrance-free and coal tar-free claims becoming key purchase drivers.

The Psoriasis Care Formulas Market in China is expected to grow at a CAGR of 20.8% (2025-2035), the highest among leading economies. This rapid momentum is driven by the rising prevalence of psoriasis, increased awareness of dermatological treatments, and strong adoption of fragrance-free and dermatologist-tested formulations. E-commerce is a central growth driver, enabling nationwide access to premium brands such as La Roche-Posay, Eucerin, and CeraVe, as well as affordable domestic alternatives. Expansion into Tier-2 and Tier-3 cities is fueling volume growth, with pediatric care products gaining particular traction.

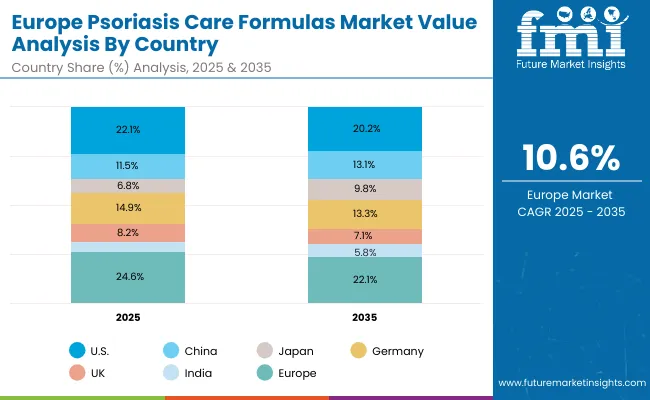

| Countries | 2025 Share (%) |

|---|---|

| USA | 22.1% |

| China | 11.5% |

| Japan | 6.8% |

| Germany | 14.9% |

| UK | 8.2% |

| India | 5.1% |

| Countries | 2035 Share (%) |

|---|---|

| USA | 20.2% |

| China | 13.1% |

| Japan | 9.8% |

| Germany | 13.3% |

| UK | 7.1% |

| India | 5.8% |

The Psoriasis Care Formulas Market in Germany is projected to grow at a CAGR of 10.6% (2025-2035), supported by strong consumer trust in dermatologist-endorsed brands and the dominance of pharmacy-led distribution. German consumers place high importance on product safety and efficacy, making fragrance-free, coal tar-free, and dermatologist-tested formulations the leading choices. Global brands such as Eucerin, La Roche-Posay, and Bioderma have a strong foothold, while local players emphasize sensitive-skin safe solutions. Additionally, sustainability concerns are shaping buying behavior, with rising demand for eco-certified, clean-label formulas gaining traction.

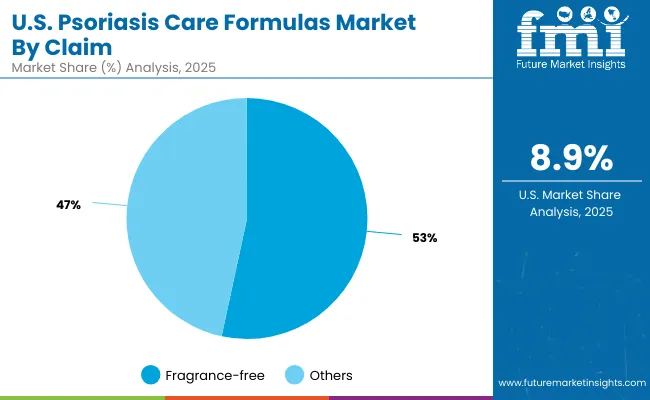

| USA by Claim | Value Share% 2025 |

|---|---|

| Fragrance-free | 53.4% |

| Others | 46.6% |

The Psoriasis Care Formulas Market in the United States is projected to grow at a CAGR of 8.9% (2025-2035), reaching nearly USD 2,929.9 million by 2035. Growth is driven by high prevalence of psoriasis, strong dermatologist involvement in treatment pathways, and consumer preference for fragrance-free, coal tar-free, and sensitive-skin safe formulations. Pharmacies and drugstores remain the largest sales channel, supported by widespread insurance coverage for prescription topicals. At the same time, e-commerce expansion is enabling clean-label and niche D2C brands to gain visibility.

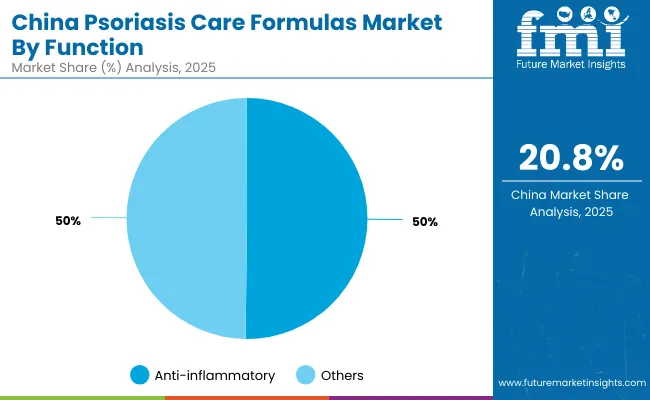

| China by Function | Value Share% 2025 |

|---|---|

| Anti-inflammatory | 50.2% |

| Others | 49.8% |

The Psoriasis Care Formulas Market in China presents strong growth opportunities, with a forecast CAGR of 20.8% (2025-2035). Anti-inflammatory formulas dominate, holding 50.2% of the market in 2025, supported by demand for vitamin D analogs, corticosteroid-based treatments, and emerging steroid-sparing alternatives. A rapidly expanding middle class, higher awareness of skin health, and strong digital retail penetration through platforms like Tmall and JD.com are fueling adoption. Domestic brands are leveraging affordability and herbal-based positioning to compete with premium imports, while pediatric and sensitive-skin safe formulations create further opportunities for expansion.

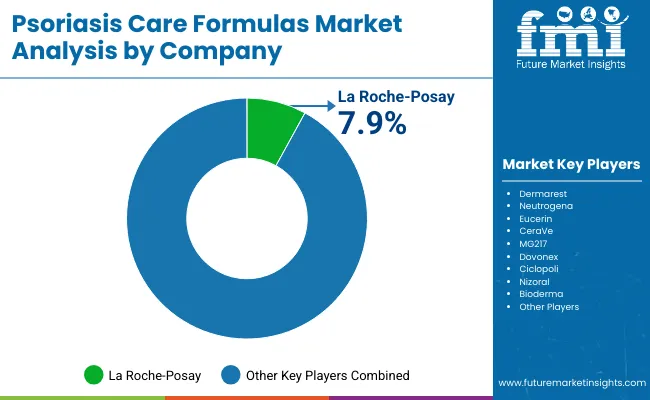

The Psoriasis Care Formulas Market is moderately fragmented, with global leaders, mid-tier brands, and niche-focused specialists competing across multiple treatment categories. Global leaders such as La Roche-Posay, Eucerin, Neutrogena, and CeraVe hold significant market share, driven by dermatologist endorsements, strong pharmacy distribution, and clinically validated formulations. Their strategies emphasize fragrance-free, coal tar-free, and sensitive-skin safe solutions, aligning with growing patient demand for safer and long-term management options.

Established mid-tier players, including Dermarest, Bioderma, and MG217, focus on targeted needs such as scalp-specific treatments and steroid-sparing formulas. These companies accelerate adoption by positioning their products as complementary therapies and expanding through both pharmacies and e-commerce platforms. Specialist brands such as Dovonex, Ciclopoli, and Nizoral compete in prescription and adjunctive niches, particularly within Europe and Asia-Pacific. Their strength lies in specialized product positioning and regional adaptability rather than global scale.

Competitive differentiation is shifting from product efficacy alone toward brand ecosystems built on dermatologist trust, clean-label claims, and digital retail expansion. With e-commerce reshaping access and awareness, market leaders are expanding into online-exclusive launches and subscription-based models, while local and herbal-based brands leverage affordability to win share in fast-growing Asia-Pacific markets.

Key Developments in Psoriasis Care Formulas Market

| Item | Value |

|---|---|

| Quantitative Units | USD 6,101.5 Million |

| Treatment Type | OTC keratolytics & emollients, Prescription topical (vitamin D analogs, corticosteroids), Phototherapy adjuncts, Scalp-specific formulas |

| Function | Scale reduction, Anti-inflammatory, Itch relief, Barrier support |

| Form | Ointment, Cream, Shampoo/scalp solution, Gel |

| Channel | Pharmacies/drugstores, Dermatology clinics, E-commerce, Mass retail |

| Claim | Fragrance-free, Dermatologist-tested, Coal tar-free, Sensitive-skin safe |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Dermarest, Neutrogena, Eucerin, La Roche-Posay, CeraVe, MG217, Dovonex, Ciclopoli, Nizoral, Bioderma |

| Additional Attributes | Dollar sales by treatment type and distribution channel, adoption trends in fragrance-free, coal tar-free, and dermatologist-tested formulations, rising demand for scalp-specific and adjunctive therapies, sector-specific growth across pharmacies, dermatology clinics, and e-commerce platforms, revenue segmentation by claim type (fragrance-free, sensitive-skin safe, steroid-free), integration of herbal and natural actives such as salicylic acid, coal tar alternatives, and vitamin D analogs, regional trends influenced by rising prevalence of psoriasis in Asia-Pacific, and innovations in steroid-sparing topicals, barrier-support formulas, and clean-label solutions. |

The global Psoriasis Care Formulas Market is estimated to be valued at USD 6,101.5 million in 2025.

The market size for the Psoriasis Care Formulas Market is projected to reach USD 14,503.1 million by 2035.

The Psoriasis Care Formulas Market is expected to grow at a 9.0% CAGR between 2025 and 2035.

The key form in the Psoriasis Care Formulas Market are ointments, creams, shampoos/scalp solutions, and gels.

In terms of function, the anti-inflammatory segment is expected to command the largest share in 2025, accounting for 49.2% of market value.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Global Psoriasis Biosimilars Market Analysis – Size, Share & Forecast 2024-2034

Suncare Products Market Size and Share Forecast Outlook 2025 to 2035

Skincare Supplement Market Size and Share Forecast Outlook 2025 to 2035

Skincare Oil Market Size and Share Forecast Outlook 2025 to 2035

Lip Care Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Skincare Nutritional Serum Market Size and Share Forecast Outlook 2025 to 2035

Haircare Supplement Market - Size, Share, and Forecast Outlook 2025 to 2035

Skincare Products Market Size and Share Forecast Outlook 2025 to 2035

Lip Care Packaging Market Size and Share Forecast Outlook 2025 to 2035

Skincare Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Sun Care Products Market Analysis – Growth, Applications & Outlook 2025–2035

Skincare Packaging Market Size, Share & Forecast 2025 to 2035

Pet Care Market Analysis – Demand, Trends & Forecast 2025–2035

Car Care Products Market Trends - Growth, Demand & Analysis 2025 to 2035

Pet Care Packaging Market Insights - Growth & Forecast 2025 to 2035

Eye Care Supplement Analysis by Ingredients, Dosage Form, Route of Administration, Indication, Distribution channel and Region 2025 to 2035

Homecare Medical Devices Market Outlook – Industry Growth & Forecast 2025 to 2035

Skincare Industry in India – Trends & Growth Forecast 2024-2034

Global Skincare Treatment Market Analysis – Size, Share & Forecast 2024-2034

Pet Care Ingredients Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA