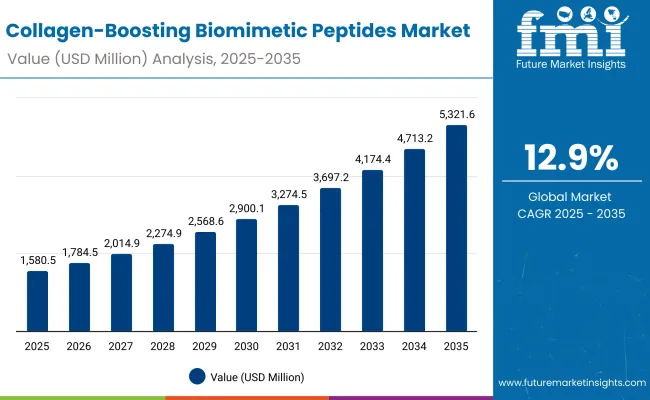

The Collagen-Boosting Biomimetic Peptides Market is expected to record a valuation of USD 1,580.5 million in 2025 and USD 5,321.6 million in 2035, with an increase of USD 3,741.1 million, which equals a growth of 193% over the decade. The overall expansion represents a CAGR of 12.9% and a 2X increase in market size.

Collagen-Boosting Biomimetic Peptides Market Key Takeaways

| Metric | Value |

|---|---|

| Collagen-Boosting Biomimetic Peptides Market Estimated Value (2025E) | USD 1,580.5 million |

| Collagen-Boosting Biomimetic Peptides Market Forecast Value (2035F) | USD 5,321.6 million |

| Forecast CAGR (2025 to 2035) | 12.9% |

During the first five-year period from 2025 to 2030, the market increases from USD 1,580.5 million to USD 2,900.1 million, adding USD 1,319.6 million, which accounts for 35.3% of the total decade growth. This phase records steady adoption in anti-aging skincare, dermatology applications, and cosmeceutical product launches, driven by the rising demand for clinically proven actives. Anti-aging functions dominate this period as they cater to over 56% of applications, supported by consumer preference for visible, rapid results.

The second half from 2030 to 2035 contributes USD 2,421.5 million, equal to 64.7% of total growth, as the market jumps from USD 2,900.1 million to USD 5,321.6 million. This acceleration is powered by expansion of dermo-cosmetic pipelines, AI-driven product personalization, and biotech innovations in peptide synthesis. Ampoules and serums together capture a larger share above 52% by the end of the decade. Digital skincare platforms and subscription-based peptide-infused regimens add recurring revenue, increasing the overall market penetration and brand loyalty.

From 2020 to 2024, the Collagen-Boosting Biomimetic Peptides Market expanded steadily, reaching a robust trajectory into 2025. The competitive landscape in this period was marked by the dominance of multinational skincare brands, with nearly 70-75% of the market concentrated among leaders such as Estée Lauder, Shiseido, and L’Oréal-backed brands. Differentiation was driven by clinical validation, dermatological endorsements, and consumer trust in premium anti-aging formulations. Service-based personalization models, including subscription skin diagnostics, were minimal in revenue contribution but emerging.

By 2025, the market value reached USD 1,580.5 million, and the revenue mix began shifting. While anti-aging remained dominant, clinical-grade claims and serum-based formulations added significant traction. Going forward to 2035, services and personalization platforms are expected to grow to over 20% of market value. Established players are moving toward hybrid innovation models—combining biotech-driven peptide engineering with AI-powered skin analysis to maintain relevance. Emerging brands emphasizing vegan, clean-label, and dermatologist-tested claims are rapidly gaining share. Competitive advantage is transitioning from product-only differentiation to ecosystem strength, clinical credibility, and recurring service models.

One of the strongest growth drivers is the increasing number of clinical trials and dermatological validations proving the efficacy of biomimetic peptides in stimulating collagen production. Unlike traditional cosmetic ingredients, these peptides demonstrate measurable improvements in anti-aging, wrinkle reduction, and skin elasticity. This scientific backing enhances consumer confidence and allows premium pricing, while also encouraging dermatologists and cosmeceutical brands to recommend peptide-based products as credible, results-driven solutions in professional skincare.

The rise of personalized skincare platforms and high-performance product categories has accelerated peptide adoption. Consumers are moving beyond generic moisturizers to seek targeted solutions, and biomimetic peptides fit perfectly with AI-driven skin diagnostics and subscription-based regimens. Their ability to mimic natural skin processes and deliver visible results positions them as a cornerstone of premium and personalized beauty products. This trend is further supported by demand for serums and ampoules, which dominate peptide delivery formats in advanced skincare routines.

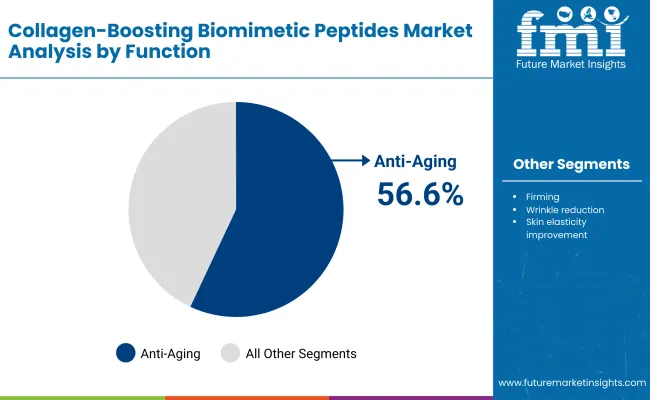

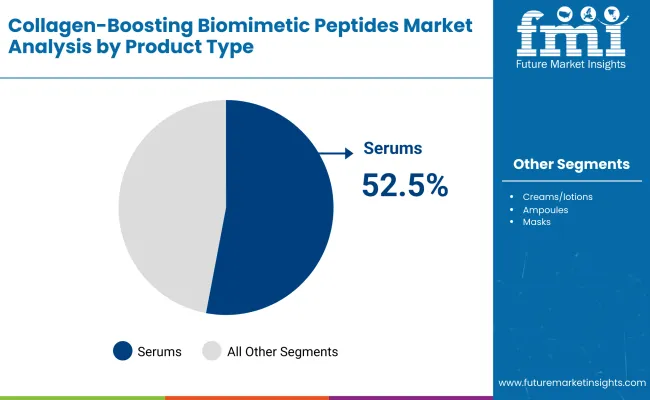

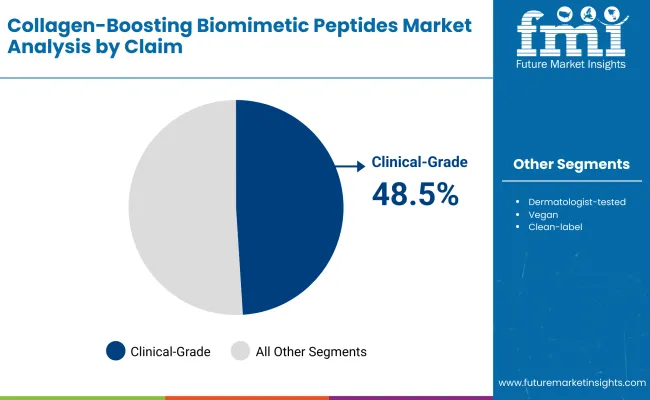

The market is segmented by function, product type, claim, channel, and region, representing the primary factors shaping adoption. Functions include Anti-aging, Firming, Wrinkle Reduction, and Skin Elasticity Improvement, highlighting the diverse application benefits of biomimetic peptides. Product types span Serums, Creams/Lotions, Ampoules, and Masks, which reflect consumer demand across premium and daily-use skincare formats. Claims are segmented into Clinical-grade, Dermatologist-tested, Vegan, and Clean-label, underscoring consumer trust in science-backed, ethical, and transparent formulations. Distribution channels include E-commerce, Pharmacies, Specialty Beauty Stores, and Mass Retail, emphasizing the balance between digital-first adoption and traditional beauty retail. Regionally, the scope of the market covers North America, Latin America, Europe, East Asia, South Asia & Pacific, and the Middle East & Africa, with particularly strong momentum in India, China, and Japan due to wellness-led demand and rising premium skincare consumption.

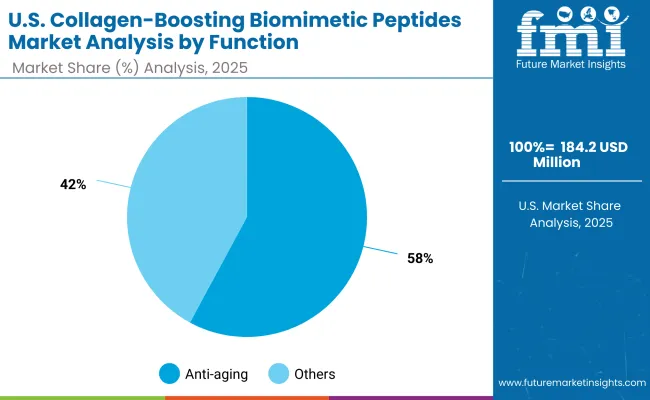

| Function | Value Share % 2025 |

|---|---|

| Anti-aging | 56.6% |

| Others | 43.4% |

The anti-aging function is projected to contribute the largest share of the Collagen-Boosting Biomimetic Peptides Market in 2025, reflecting its dominance as the leading application area. This growth is driven by rising consumer demand for solutions targeting wrinkle reduction, fine-line smoothing, and overall skin rejuvenation. Premium brands are prioritizing peptide-infused formulations that replicate the body’s natural collagen-boosting mechanisms, making anti-aging products both effective and science-backed.

The segment’s expansion is further supported by increased adoption in serums, creams, and ampoules, which are highly favored in both retail and professional dermatology settings. As consumer interest in preventative skincare rises among younger demographics, anti-aging peptide formulations are moving from luxury to mainstream. This ensures that anti-aging remains the cornerstone of market revenues through 2035.

| Product Type | Value Share % 2025 |

|---|---|

| Serums | 52.5% |

| Others | 47.5% |

The serums segment is forecasted to hold the largest share of the Collagen-Boosting Biomimetic Peptides Market in 2025, owing to their concentrated formulations and rapid skin absorption benefits. Serums are particularly favored for delivering high efficacy in targeting fine lines, wrinkles, and firmness, which makes them indispensable in premium skincare regimes.

Their lightweight texture and compatibility with layering in multi-step routines have driven adoption across both retail and professional skincare settings. The growth of serums is further supported by innovation in biomimetic peptide delivery systems, which enhance penetration and results. With consumers increasingly seeking targeted solutions over generalized skincare, serums are expected to maintain their dominance within the product type segment through 2035.

| Claim | Value Share % 2025 |

|---|---|

| Clinical-grade | 48.5% |

| Others | 51.5% |

The clinical-grade segment is projected to account for a significant share of the Collagen-Boosting Biomimetic Peptides Market revenue in 2025, underscoring its rising credibility and preference among consumers seeking medically validated skincare solutions. Products in this category are widely recognized for their scientifically backed formulations that meet dermatologist and lab-testing standards, offering higher trust and efficacy compared to conventional options.

This claim has gained traction in professional dermatology clinics and premium retail channels, where consumers increasingly demand assurance of safety and effectiveness. Growth is further supported by innovation in biomimetic peptide formulations, which mimic natural collagen-boosting mechanisms while passing stringent regulatory and clinical benchmarks. As consumer awareness of science-led skincare deepens, clinical-grade products are expected to continue shaping demand and serve as the cornerstone of credibility in the market through 2035.

Rising Demand for Preventive Skincare

In 2025, consumers are increasingly focusing on preventive rather than corrective skincare, with biomimetic peptides playing a crucial role in slowing visible signs of aging. Unlike traditional anti-aging products, peptides enhance collagen synthesis at the molecular level, providing measurable long-term results. This demand has grown sharply among millennials and Gen Z, who now consider peptide-infused serums and creams essential in routine skincare. With dermatologists endorsing peptides for early intervention, preventive skincare is becoming one of the most powerful growth accelerators for the market.

Expansion of Clinical-Grade and Dermatologist-Tested Products

Clinical-grade biomimetic peptides are gaining traction due to their proven safety and efficacy, supported by increasing dermatologist recommendations. By 2025, premium skincare lines are highlighting dermatologist-tested labels to differentiate themselves in a competitive market. Clinical validation enhances consumer confidence, especially in regions with strict regulatory frameworks like Europe and North America. This trend supports rapid adoption across both pharmacies and e-commerce. The strong association of peptides with clinical trustworthiness is making them indispensable in skincare portfolios, firmly establishing them as growth drivers through 2035.

High Production Costs and Complex Formulation Challenges

Despite high demand, biomimetic peptide formulations face significant challenges related to production cost and stability. Manufacturing these synthetic peptides requires advanced biotechnological processes, precise sequencing, and rigorous testing to ensure safety and efficacy. The added need for stabilizing agents to prevent peptide degradation in cosmetic formulations drives costs further upward. As a result, final products often fall into the premium pricing category, limiting accessibility for middle-income consumers. This cost barrier could slow mass-market adoption, confining peptide solutions to selective and high-end skincare brands.

Integration of Peptides into Hybrid Skincare Formats

A defining trend in the biomimetic peptides market is their integration into hybrid skincare products that combine anti-aging with multifunctional benefits such as hydration, barrier repair, and brightening. From 2025 onwards, brands are formulating peptide-based serums and creams with hyaluronic acid, ceramides, and botanical extracts to deliver comprehensive results. This trend reflects consumer demand for convenience and holistic skincare solutions, where one product addresses multiple skin concerns. Hybrid innovation also enables cross-segmentation into vegan, clean-label, and clinical-grade claims, keeping peptide-based products at the forefront of premium skincare evolution.

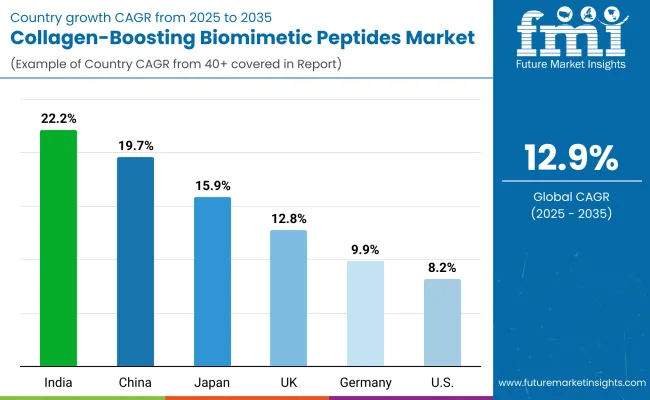

| Country | Estimated CAGR (2025 to 2035) |

|---|---|

| China | 19.7% |

| USA | 8.2% |

| India | 22.2% |

| UK | 12.8% |

| Germany | 9.9% |

| Japan | 15.9% |

The global Collagen-Boosting Biomimetic Peptides Market shows a pronounced regional disparity in adoption speed, strongly influenced by dermatology innovation, consumer awareness, and clinical validation mandates.

Asia-Pacific emerges as the fastest-growing region, anchored by China at 19.7% CAGR and India at 22.2%. This acceleration is driven by rising disposable incomes, preference for anti-aging solutions, and government-backed promotion of biotech innovation. China’s strong R&D base and regulatory acceptance of functional peptides are accelerating premium launches, while India’s growth reflects increased adoption across both mass retail and Ayurvedic-inspired product lines.

Europe maintains a strong growth profile, led by Germany at 9.9% and the UK at 12.8%, supported by premium positioning, dermatologist-tested claims, and strict EU cosmetic compliance. Clinical-grade formulations are driving adoption in professional dermatology clinics and pharmacy-led channels. High consumer trust in science-backed skincare continues to sustain the region’s expansion.

North America shows steady expansion, with the USA at 8.5% CAGR, reflecting maturity in premium skincare markets and established dominance of leading global brands. Growth is further supported by strong clinical validation pipelines and consumer preference for dermatologist-tested solutions. Unlike Asia, however, North America’s market is driven more by innovation in product claims and subscription-based skincare models than by sheer volume growth.

Japan, at 15.9% CAGR, highlights Asia’s premium skincare culture, with biomimetic peptides integrated into anti-aging and firming ranges. Its emphasis on high-quality formulations, combined with strong consumer loyalty to domestic brands, makes Japan a critical hub for clinical-grade peptide innovations.

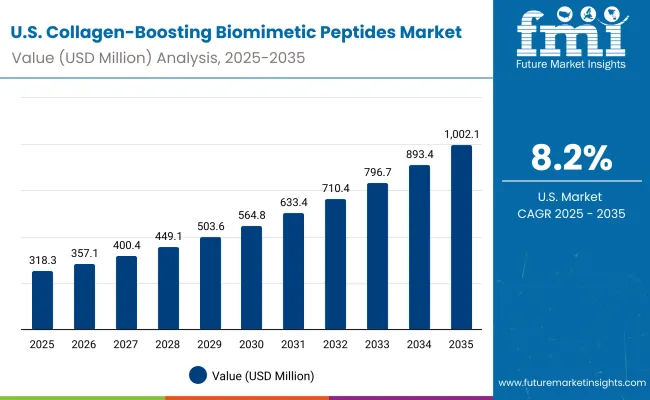

| Year | USA Collagen-Boosting Biomimetic Peptides Market (USD Million) |

|---|---|

| 2025 | 318.39 |

| 2026 | 357.07 |

| 2027 | 400.45 |

| 2028 | 449.10 |

| 2029 | 503.65 |

| 2030 | 564.84 |

| 2031 | 633.45 |

| 2032 | 710.41 |

| 2033 | 796.71 |

| 2034 | 893.49 |

| 2035 | 1,002.04 |

The Collagen-Boosting Biomimetic Peptides Market in the United States is projected to expand from USD 318.39 million in 2025 to USD 1,002.04 million by 2035, advancing at a CAGR of 8.5%. Growth is driven by surging demand for anti-aging formulations, clinical-grade skincare innovations, and consumer preference for dermatologist-tested products. The USA market benefits from strong R&D pipelines of leading players such as Estée Lauder, SkinCeuticals, and Olay, who emphasize clinical validation and science-backed claims. E-commerce platforms and specialty beauty retailers are further accelerating adoption, making biomimetic peptides central to premium skincare portfolios.

Increased penetration in dermatology clinics and professional skincare treatments underpins demand, with peptides often incorporated into serums and advanced ampoule formulations. High consumer willingness to invest in premium products is enabling strong revenue scaling, especially in urban markets. Additionally, marketing strategies centered around personalized skincare and AI-driven beauty apps are enhancing consumer awareness of biomimetic peptide efficacy.

The Collagen-Boosting Biomimetic Peptides Market in the United Kingdom is projected to grow at a CAGR of 12.8% between 2025 and 2035. The growth trajectory is supported by strong consumer demand for science-backed skincare, clinical-grade innovations, and a rising focus on anti-aging solutions. Premium retail channels and e-commerce platforms are fostering adoption, while collaborations between dermatology clinics and cosmetic brands are increasing the availability of professional-grade peptide formulations. The UK market also benefits from stringent EU/UK cosmetic safety standards, which enhance trust in biomimetic peptide-based products.

The country is witnessing robust adoption of serums and ampoules, driven by consumer preference for concentrated formulations with visible results. Marketing strategies highlighting dermatologist-tested claims and clean-label positioning resonate strongly with health-conscious buyers. Additionally, government and academic initiatives in cosmetic biotech are nurturing product development and commercialization, ensuring continued innovation and growth.

India is witnessing rapid growth in the Collagen-Boosting Biomimetic Peptides Market, projected to expand at a CAGR of 22.2% through 2035. Rising disposable incomes, urbanization, and heightened awareness of preventive skincare are propelling demand for biomimetic peptide-based products. Adoption is spreading beyond metro cities into tier-2 and tier-3 urban centers, supported by cost-competitive product launches and digital-first retail strategies. Domestic and global players are introducing Ayurvedic-inspired and clinical-grade peptide products, appealing to both traditional and modern consumer segments.

The healthcare and dermatology ecosystem is also playing a key role in accelerating adoption, with dermatologists increasingly recommending peptide formulations for anti-aging, wrinkle reduction, and skin elasticity improvement. Furthermore, India’s strong pharmaceutical and biotech R&D base is fostering innovation in peptide synthesis, supporting scalability. These factors combine to make India one of the most dynamic growth frontiers for biomimetic peptides globally.

The Collagen-Boosting Biomimetic Peptides Market in China is forecast to grow at a CAGR of 19.7%, the highest among leading economies, expanding from USD 169.84 million in 2025 to a significantly larger value by 2035. This growth is underpinned by strong consumer preference for anti-aging solutions, government-backed biotech initiatives, and competitive innovation by domestic brands. Local firms are producing affordable peptide-based serums and creams, widening accessibility across urban and tier-2 cities.

China’s digital-first ecosystem, anchored by e-commerce giants and social commerce platforms, is accelerating peptide adoption by offering personalized skincare recommendations and direct-to-consumer access. The clinical-grade and clean-label claims are particularly influential, aligning with growing health-consciousness among younger demographics. Cross-sector innovation, where biotech firms collaborate with cosmetic majors, is creating hybrid formulations that combine efficacy with affordability, ensuring both premium and mass-market penetration.

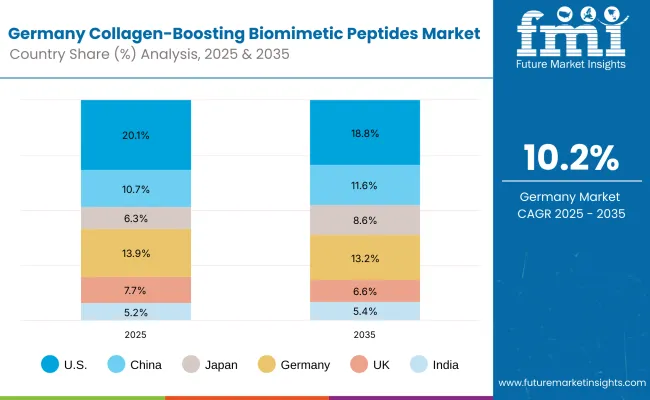

| Country | 2025 Share (%) |

|---|---|

| USA | 20.1% |

| China | 10.7% |

| Japan | 6.3% |

| Germany | 13.9% |

| UK | 7.7% |

| India | 5.2% |

| Country | 2035 Share (%) |

|---|---|

| USA | 18.8% |

| China | 11.6% |

| Japan | 8.6% |

| Germany | 13.2% |

| UK | 6.6% |

| India | 5.4% |

The Collagen-Boosting Biomimetic Peptides Market in Germany is projected to grow at a CAGR of 10.2% from 2025 to 2035, maintaining its position as a leading European hub for advanced skincare innovation. Germany’s growth is strongly underpinned by its pharmaceutical and dermocosmetic industries, where clinical-grade peptide formulations are gaining momentum. Dermatology clinics and pharmacies dominate sales channels, with strong emphasis on safety, efficacy, and compliance with stringent EU cosmetic standards. Premium global and domestic brands leverage Germany’s reputation for science-backed skincare to anchor their European strategies.

Consumer preference for anti-aging and wrinkle reduction products is particularly strong, with serums and creams leading adoption due to visible and fast-acting results. Innovation pipelines are also focusing on biomimetic peptides that enhance skin elasticity and barrier repair, aligning with Germany’s high demand for functional and clinically validated products. Additionally, collaborations between biotech firms and cosmetic companies are advancing peptide stability, ensuring scalability for premium and mid-tier categories.

| USA Function | Value Share % 2025 |

|---|---|

| Anti-aging | 57.9% |

| Others | 42.1% |

The Collagen-Boosting Biomimetic Peptides Market in the United States is projected to grow at a CAGR of 8.5% from 2025 to 2035, reaching over USD 1,002.04 million by 2035. Anti-aging dominates with a 57.9% share in 2025, reflecting strong consumer demand for clinically validated, science-backed skincare solutions. Growth is propelled by dermatology clinics, pharmacies, and premium retail channels, where clinical-grade and dermatologist-tested claims reinforce credibility and encourage adoption. The USA market also benefits from early adoption of biotechnology-led peptide synthesis, ensuring high-quality formulations for both professional and retail lines.

Expansion is further supported by innovation in serums and ampoules, with brands investing heavily in AI-driven personalization, subscription-based skincare models, and e-commerce distribution. Consumer preference for premium and clean-label products ensures continued growth, while collaborations between biotech labs and global cosmetic leaders strengthen product pipelines. By 2035, the USA is expected to remain one of the most mature yet innovation-driven markets globally.

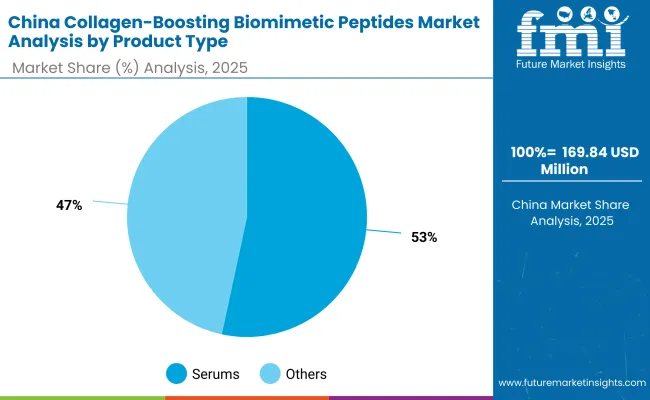

| China Product Type | Value Share % 2025 |

|---|---|

| Serums | 53.4% |

| Others | 46.6% |

The Collagen-Boosting Biomimetic Peptides Market in China is projected to witness one of the strongest global growth trajectories, expanding at a CAGR of 19.7% through 2035. Serums dominate with a 53.4% share in 2025, reflecting consumer preference for highly concentrated formulations with visible and fast-acting anti-aging benefits. This dominance is reinforced by China’s strong e-commerce ecosystem, where peptide-based serums are marketed heavily through live-streaming platforms, social commerce, and direct-to-consumer models.

The affordability of locally manufactured peptide products also enhances adoption across mass-market consumers, while premium brands target clinical-grade and dermatologist-tested categories to cater to affluent urban buyers. Government-backed biotech initiatives are fueling domestic R&D in peptide synthesis, enabling innovation and scalability. These dynamics position China as both a demand hub and a competitive manufacturing base in the global biomimetic peptides landscape.

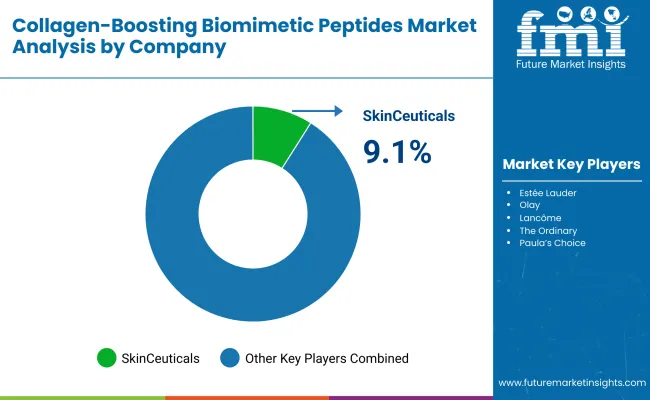

| Company | Global Value Share 2025 |

|---|---|

| SkinCeuticals | 9.1% |

| Others | 90.9% |

The Collagen-Boosting Biomimetic Peptides Market is moderately fragmented, with global leaders, established cosmetic majors, and niche-focused brands competing across functional skincare applications. Global leaders such as SkinCeuticals, Estée Lauder, and Shiseido dominate through clinically validated peptide-based products, leveraging strong R&D pipelines and dermatologist-tested claims. Their strategies emphasize premium positioning, high-efficacy formulations, and expanding e-commerce distribution across North America, Europe, and Asia.

Mid-sized innovators, including Paula’s Choice, Murad, and The Ordinary, are accelerating adoption by targeting younger demographics with affordable yet science-backed serums and ampoules. These players often emphasize clean-label and vegan claims, positioning themselves in both specialty retail and direct-to-consumer channels.

Niche-focused brands like Peptonic Medical and Forest Essentials are carving out space by offering Ayurvedic-inspired or clinical-grade biomimetic peptides, catering to regional preferences and building credibility in professional dermatology networks.

Competitive differentiation is shifting away from brand legacy alone, toward integration of clinical validation, clean-label positioning, and digital-first strategies. Subscription models, AI-powered personalization, and hybrid peptide formulations combining anti-aging with skin-barrier repair are emerging as decisive levers of competitive advantage.

Key Developments in Collagen-Boosting Biomimetic Peptides Market

| Item | Value |

|---|---|

| Quantitative Units | USD 1,580.5 Million |

| Function | Anti-aging, Firming, Wrinkle reduction, Skin elasticity improvement |

| Product Type | Serums, Creams/lotions, Ampoules, Masks |

| Channel | E-commerce, Pharmacies, Specialty beauty stores, Mass retail |

| Claim | Clinical-grade, Dermatologist-tested, Vegan, Clean-label |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | SkinCeuticals , Estée Lauder, Olay, Lancôme, The Ordinary, Paula’s Choice, Murad, Peptonic Medical, Dr. Dennis Gross Skincare, Shiseido |

| Additional Attributes | Dollar sales by product type and functional claims, adoption trends in clinical-grade and dermatologist-tested skincare, rising demand for serums and ampoules, sector-specific growth in anti-aging, wrinkle reduction, and skin elasticity improvement, revenue segmentation across e-commerce, pharmacies, and specialty beauty stores, integration with AR/VR and AI-based skin diagnostics, regional trends influenced by premium skincare adoption and regulatory benchmarks, and innovations in biomimetic peptide formulations, encapsulation methods, and clean-label product development. |

The global Collagen-Boosting Biomimetic Peptides Market is estimated to be valued at USD 1,580.5 million in 2025.

The market size for the Collagen-Boosting Biomimetic Peptides Market is projected to reach USD 5,321.6 million by 2035.

The Collagen-Boosting Biomimetic Peptides Market is expected to grow at a 12.9% CAGR between 2025 and 2035.

The key product types in the Collagen-Boosting Biomimetic Peptides Market include serums, creams/lotions, ampoules, and masks.

In terms of market segmentation by functional applications, the anti-aging category is expected to command the leading share in 2025 at 56.6%, with wrinkle reduction, firming, and skin elasticity improvement forming the other key segments.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Biomimetic Collagen Synthesis Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Medical Biomimetics Market Size and Share Forecast Outlook 2025 to 2035

Tuna Peptides Market – Growth, Demand & Functional Benefits

Plant Peptides Market Size and Share Forecast Outlook 2025 to 2035

Animal Peptides Market Size and Share Forecast Outlook 2025 to 2035

Lupine Peptides Market Size and Share Forecast Outlook 2025 to 2035

Endocrine Peptides Test Market Size and Share Forecast Outlook 2025 to 2035

Cocoa-Derived Peptides For Skin Repair Market Size and Share Forecast Outlook 2025 to 2035

Fish Collagen Peptides Market Analysis by Source, Application and Region Through 2035

Antimicrobial Peptides Market

Vegan Collagen Peptides Market Size and Share Forecast Outlook 2025 to 2035

Smart-Technology Anti-Wrinkle Peptides Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA