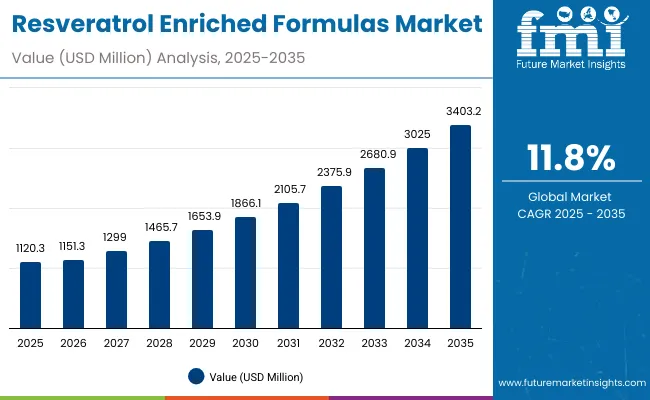

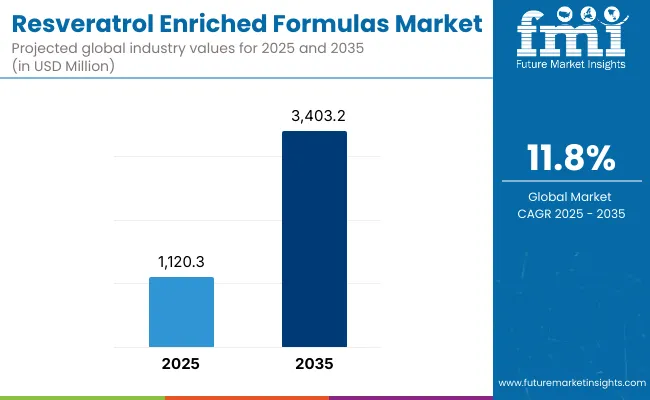

A valuation of USD 1,120.3 million is anticipated for the Resveratrol Enriched Formulas Market in 2025, which is forecasted to advance steadily to USD 3,403.2 million by 2035. This rise reflects an absolute gain of over USD 2.28 billion across the decade, translating into a robust CAGR of 11.8%. The trajectory indicates a market expansion nearly tripling in size, driven by the growing integration of resveratrol into anti-aging, antioxidant, and repair-focused solutions.

Resveratrol Enriched Formulas Market Key Takeaways

| Metric | Value |

|---|---|

| Resveratrol Enriched Formulas Market Estimated Value In (2025e) | USD 1,120.3 Million |

| Resveratrol Enriched Formulas Market Forecast Value In (2035f) | USD 3,403.2 Million |

| Forecast CAGR (2025 to 2035) | 11.80% |

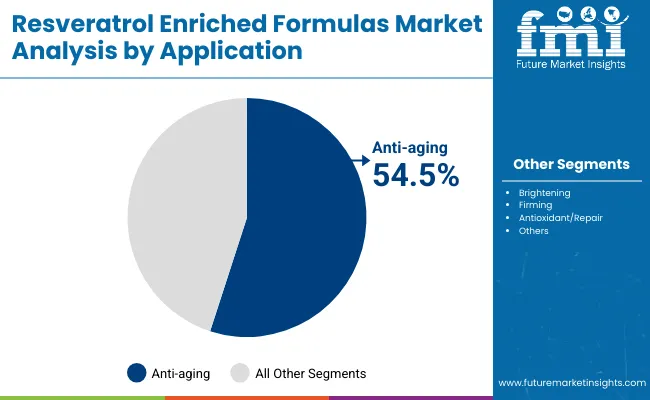

During the initial five years from 2025 to 2030, the market is expected to add approximately USD 746 million, moving from USD 1.12 billion to USD 1.87 billion. This stage will be shaped by product adoption across global skincare, nutricosmetics, and wellness platforms as consumer awareness of clinical efficacy strengthens. The segment leadership of anti-aging formulas, accounting for over 54.5% share in 2025, will reinforce this period of growth.

The second half of the forecast window, 2030 to 2035, is projected to contribute more than USD 1.53 billion in absolute value growth, equal to nearly two-thirds of the decade’s overall expansion. The market is expected to climb from USD 1.87 billion to over USD 3.40 billion within this interval.

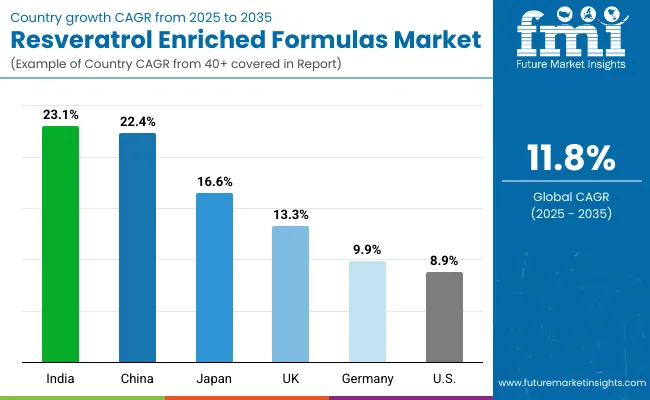

This acceleration will be driven by greater penetration in Asia-Pacific, where India, China, and Japan are forecasted to record the highest CAGRs of 23.1%, 22.4%, and 16.6% respectively. With evolving consumer preference for clean-label, plant-derived, and fermentation-based actives, sourcing diversification will further consolidate momentum. The outlook positions resveratrol-enriched formulas as a central ingredient category in advanced beauty and wellness ecosystems over the decade.

From 2020 to 2024, the Resveratrol Enriched Formulas Market steadily expanded, driven by rising consumer demand for anti-aging and wellness solutions. In 2025, market valuation is projected at USD 1,120.3 Million, with the revenue mix expected to evolve as clinical substantiation and digital-first distribution models gain traction.

By 2035, the market is forecasted to reach USD 3,403.2 Million, with software-like subscription models and clean-label positioning anticipated to increase recurring value streams. Competitive advantage is expected to move beyond ingredient sourcing to ecosystem strength, including regulatory alignment, consumer trust, and innovation in delivery formats.

Growth in the Resveratrol Enriched Formulas Market is being fueled by rising consumer preference for science-backed anti-aging and antioxidant solutions. Demand has been stimulated by expanding awareness of resveratrol’s role in cellular protection, wrinkle reduction, and skin-firmness enhancement. Clinical validations are increasingly being emphasized, leading to stronger adoption across beauty, wellness, and nutricosmetic platforms. The shift toward clean-label, natural, and plant-derived actives has encouraged wider acceptance of grape-derived and knotweed-based resveratrol, while fermentation-derived alternatives are being positioned to ensure supply stability and purity.

Digital channels and direct-to-consumer strategies are enabling rapid education and product discovery, particularly in emerging Asian markets where double-digit growth rates are anticipated. Premiumization is expected to be supported by higher willingness to pay for clinically proven outcomes, while regulatory advancements are pushing for standardization and quality assurance. Collectively, these factors are expected to reinforce sustained double-digit CAGR, with Asia-Pacific driving the strongest contribution to global expansion.

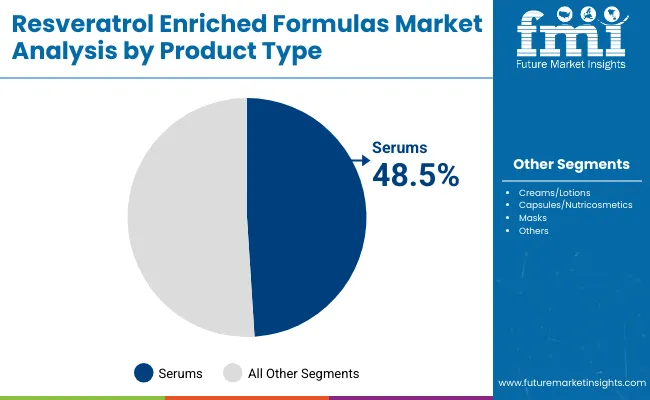

The Resveratrol Enriched Formulas Market is segmented across application, product type, and source, each contributing distinct growth drivers. These segments are shaping the industry’s competitive direction, enabling targeted innovation and differentiated product strategies. Insights into these categories reveal how consumer priorities, scientific validations, and sourcing advancements are influencing demand trajectories.

Application trends highlight anti-aging as the core growth catalyst, while product type analysis underscores the importance of formats that ensure efficacy and user convenience. Source analysis emphasizes how supply diversification is strengthening reliability and addressing sustainability needs. Each segment is forecasted to undergo dynamic shifts over the decade, driven by evolving consumer awareness, enhanced clinical substantiation, and expansion across digital and premium retail ecosystems.

| Segment | Market Value Share, 2025 |

|---|---|

| Anti-aging | 54.5% |

| Others | 45.6% |

The anti-aging segment is expected to remain the dominant application area within the Resveratrol Enriched Formulas Market, contributing 54.5% of total revenues in 2025. This dominance is being reinforced by rising demand for wrinkle-reduction, skin-firming, and cellular-repair claims that align with long-term consumer priorities. Products positioned with strong clinical substantiation are projected to secure greater adoption across premium and masstige tiers.

While antioxidant and repair-oriented products represent a significant share, the anti-aging positioning is anticipated to provide higher resilience against market fluctuations due to its strong association with visible outcomes. Over the forecast horizon, increased R&D investments and consumer trust in proven efficacy are expected to ensure that anti-aging remains the anchor segment for resveratrol-based innovations.

| Segment | Market Value Share, 2025 |

|---|---|

| Serums | 48.5% |

| Others | 51.5% |

The serum segment is projected to capture 48.5% of market revenues in 2025, driven by its role as a preferred delivery format for resveratrol actives. High concentration levels, better skin penetration, and perceived efficacy are reinforcing the appeal of serums among consumers seeking visible results. Premium positioning in e-commerce and specialty retail channels is expected to sustain growth momentum for this format.

While creams, capsules, and other categories contribute slightly higher cumulative value, the importance of serums lies in their ability to influence brand perception and consumer trust. With increasing consumer education on active formulations and multifunctional claims, serums are anticipated to consolidate their share as the benchmark product type within resveratrol-enriched skincare lines.

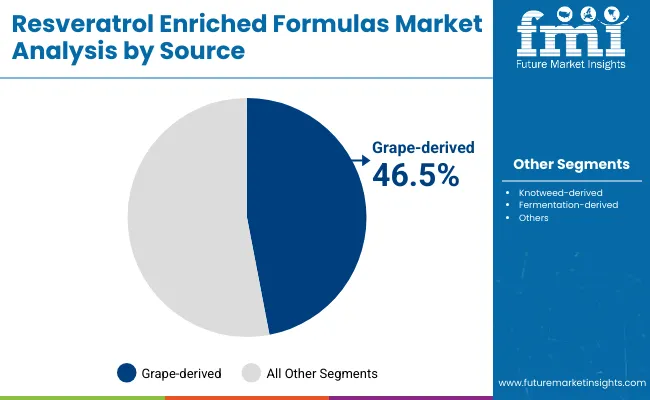

| Segment | Market Value Share, 2025 |

|---|---|

| Grape-derived | 46.5% |

| Others | 53.5% |

The grape-derived resveratrol segment is estimated to hold 46.5% share in 2025, reflecting its strong natural positioning and alignment with clean-label preferences. Consumer trust in grape-origin actives has supported steady adoption, particularly in premium skincare and nutricosmetics. However, growing concerns around supply volatility and rising emphasis on sustainable sourcing are expected to drive expansion of alternatives such as knotweed and fermentation-derived resveratrol.

While others collectively account for a higher share at 53.5%, grape-derived inputs are forecasted to maintain symbolic importance due to heritage associations and authenticity narratives. Over the forecast period, companies are expected to balance grape-derived credibility with scalable alternatives, ensuring that sourcing diversification supports both stability and consumer confidence.

The Resveratrol Enriched Formulas Market is advancing on the back of evolving consumer behaviors, scientific validations, and sourcing transformations. However, the trajectory is also shaped by structural challenges that influence pricing, accessibility, and strategic execution across regions.

Scientific substantiation and clinical validation

Market growth is being reinforced by the expanding emphasis on clinical substantiation of resveratrol’s anti-aging and cellular repair properties. Brands are increasingly required to demonstrate efficacy through peer-reviewed trials and dermatological testing to secure consumer trust and regulatory clearance.

Evidence-backed formulations are positioned to gain wider acceptance, particularly in premium and masstige categories where willingness to pay is directly linked to proven outcomes. Over the forecast period, the role of validated claims is expected to deepen, strengthening brand differentiation and providing long-term resilience against commoditization risks.

Restraint - Raw material volatility and supply chain fragility

Growth potential is being constrained by volatility in raw material sourcing, particularly for grape-derived resveratrol. Climate variability, agricultural yield instability, and supply chain bottlenecks are exerting pressure on procurement consistency and cost structures. These challenges are magnified by rising demand for clean-label ingredients, which increases pressure on reliable sourcing at scale.

Companies are expected to diversify supply through knotweed and fermentation-based alternatives; however, scalability, quality parity, and consumer acceptance remain hurdles. Such structural pressures could temper growth in certain geographies, emphasizing the importance of risk-hedged sourcing strategies and long-term supplier partnerships.

| Country | CAGR |

|---|---|

| China | 22.4% |

| USA | 8.9% |

| India | 23.1% |

| UK | 13.3% |

| Germany | 9.9% |

| Japan | 16.6% |

The Resveratrol Enriched Formulas Market demonstrates clear variations in growth dynamics across major economies, influenced by consumer awareness, regulatory environments, and innovation adoption. Asia-Pacific is projected to deliver the strongest performance, with India and China recording remarkable CAGRs of 23.1% and 22.4% respectively. India’s surge is being supported by a digitally native consumer base, rapid e-commerce expansion, and rising adoption of clean-label nutricosmetics.

China’s momentum is anchored by its social commerce ecosystem, high demand for nutricosmetics, and regulatory tightening that strengthens trust in clinically validated claims. Japan, with a 16.6% CAGR, reflects steady integration of resveratrol in anti-aging and functional wellness portfolios, supported by an aging population with high spending capacity.

In Europe, growth is robust though comparatively moderate. The United Kingdom is forecasted to expand at 13.3% CAGR, driven by premium skincare positioning and pharmacy-led adoption, while Germany’s 9.9% CAGR reflects stability in a mature but innovation-sensitive market.

North America shows a slower pace, with the United States projected at 8.9% CAGR, underpinned by premium product adoption and clinical substantiation but tempered by market maturity. Overall, Asia-Pacific is expected to outpace other regions, reshaping the global balance of the resveratrol market and consolidating leadership through digital-first strategies and sourcing innovations.

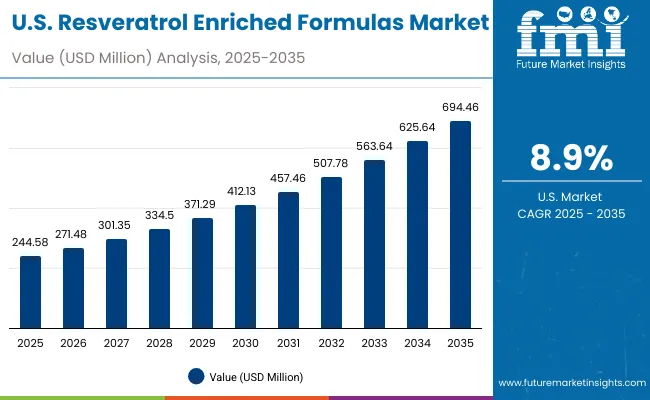

| Year | USA Resveratrol Enriched Formulas Market (USD Million) |

|---|---|

| 2025 | 244.58 |

| 2026 | 271.48 |

| 2027 | 301.35 |

| 2028 | 334.50 |

| 2029 | 371.29 |

| 2030 | 412.13 |

| 2031 | 457.46 |

| 2032 | 507.78 |

| 2033 | 563.64 |

| 2034 | 625.64 |

| 2035 | 694.46 |

A CAGR of 8.9% has been projected for the United States, reflecting steady expansion in a mature but innovation-driven market. Market value is expected to rise from USD 244.58 million in 2025 to USD 694.46 million by 2035, supported by premium adoption and scientific substantiation. Clinical validation remains a key growth catalyst, reinforcing consumer confidence in anti-aging and antioxidant benefits.

Specialty retail and pharmacy channels will anchor trust, while e-commerce and direct-to-consumer models are broadening accessibility and brand discovery. Premium and masstige tiers are expected to consolidate their leadership, supported by consumer willingness to pay for efficacy-driven products. The USA contribution will remain vital to global revenues, though relative growth will be outpaced by Asia-Pacific markets.

A CAGR of 13.3% has been projected for the United Kingdom, supported by consumer demand for clinically validated skincare and wellness formulations. Market expansion will be driven by premium positioning in anti-aging and repair categories, supported by pharmacy-led retail and growing e-commerce channels.

Digital engagement, particularly influencer-driven awareness campaigns, is creating greater resonance with younger consumers seeking science-backed solutions. Premiumization is expected to sustain growth despite cost pressures, as evidence-based branding enhances consumer willingness to pay. The UK’s contribution will remain vital within Europe, ensuring stable revenue progression through a balance of traditional pharmacy trust and modern digital ecosystems.

A CAGR of 23.1% has been forecasted for India, marking it as the fastest-growing country market globally. Growth is underpinned by rapid digital penetration, strong preventive skincare awareness, and rising disposable income. Direct-to-consumer channels are shaping affordability and transparency, while premium skincare categories gain traction in metro cities through global and domestic brand activity.

The young demographic and growing middle class are reinforcing adoption of nutricosmetics and resveratrol-based wellness formulations. Localization of formulations and culturally tailored campaigns are expected to accelerate adoption further, positioning India as a transformative market for resveratrol innovations.

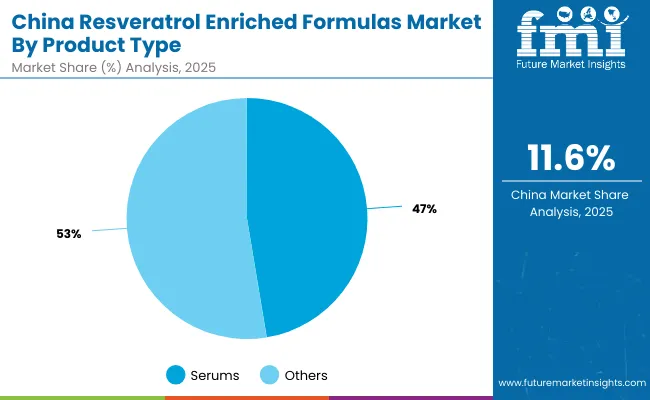

A CAGR of 22.4% has been projected for China, consolidating its position as one of the most dynamic growth engines worldwide. Adoption is being accelerated by beauty-from-within narratives, with nutricosmetics and serums leading value creation. Social commerce ecosystems, particularly influencer-driven platforms, are reshaping brand-consumer engagement.

Regulatory reforms mandating stronger claim validation and transparency are expected to reinforce trust in clinically supported products, favoring established and science-led players. Urban centers will dominate premium demand, while mass growth will expand through e-commerce penetration in lower-tier cities. China’s role in shaping global resveratrol demand will continue to strengthen, making it a pivotal growth hub.

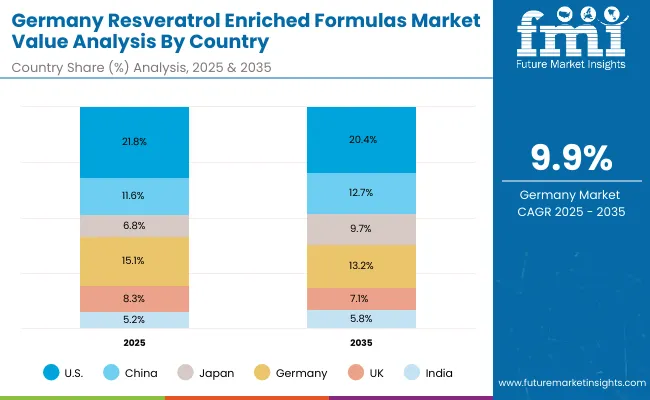

| Countries | 2025 |

|---|---|

| USA | 21.8% |

| China | 11.6% |

| Japan | 6.8% |

| Germany | 15.1% |

| UK | 8.3% |

| India | 5.2% |

| Countries | 2035 |

|---|---|

| USA | 20.4% |

| China | 12.7% |

| Japan | 9.7% |

| Germany | 13.2% |

| UK | 7.1% |

| India | 5.8% |

A CAGR of 9.9% has been projected for Germany, reflecting steady growth in a mature but innovation-driven market. Clinical substantiation remains central, ensuring that pharmacy and specialty retail channels anchor adoption. Anti-aging and repair-oriented formulations are expected to remain the largest contributors, as German consumers prioritize efficacy and dermatological credibility.

Sustainability narratives and clean-label preferences are shaping sourcing choices, with fermentation-derived resveratrol anticipated to gain traction for its stability and scalability. While competition intensifies, established players with strong dermatological partnerships are forecasted to retain leadership. Germany’s contribution will remain essential within Europe, offering stability, regulatory rigor, and quality benchmarks.

| Segment | Market Value Share, 2025 |

|---|---|

| Serums | 47.40% |

| Others | 52.60% |

The Resveratrol Enriched Formulas Market in Japan is projected to be valued at approximately USD 76.8 million in 2025, based on its 6.8% share of the global market. Within applications, anti-aging dominates with 54.5% share, reflecting strong consumer prioritization of wrinkle reduction, skin elasticity, and repair-focused formulations. The other category, contributing 45.5%, highlights multifunctional positioning such as antioxidant and brightening claims, which are also gaining steady traction. This balance demonstrates Japan’s inclination toward clinically validated, results-driven products where visible efficacy determines long-term adoption.

The prominence of anti-aging is being reinforced by Japan’s rapidly aging population, which maintains higher willingness to invest in functional skincare. Demand is further amplified by cultural emphasis on preventative beauty regimens and premium skincare rituals. With strong alignment toward science-led solutions, clinical substantiation, and dermatological partnerships, Japan is expected to record sustained momentum through 2035 at a CAGR of 16.6%.

| Segment | Market Value Share, 2025 |

|---|---|

| Anti-aging | 54.50% |

| Others | 45.50% |

The Resveratrol Enriched Formulas Market in South Korea is projected to be valued at approximately USD 55.9 million in 2025, based on its estimated 5% share of global revenues. Anti-aging is expected to dominate with 54.5% share, reflecting the country’s strong cultural emphasis on skin youthfulness, elasticity, and wrinkle reduction. Other applications, contributing 45.5%, highlight multifunctional positioning such as antioxidant repair and brightening benefits, which are also gaining traction in K-beauty portfolios.

Market growth is expected to be reinforced by South Korea’s reputation as a global beauty innovation hub. Rapid product launches, advanced formulations, and integration of resveratrol into both topical and nutricosmetic formats are anticipated to strengthen adoption. E-commerce platforms, coupled with global K-beauty influence, are projected to amplify exports, expanding South Korea’s role beyond domestic consumption. The market is forecasted to grow steadily at a double-digit pace, making South Korea a key contributor to Asia’s overall leadership in resveratrol adoption.

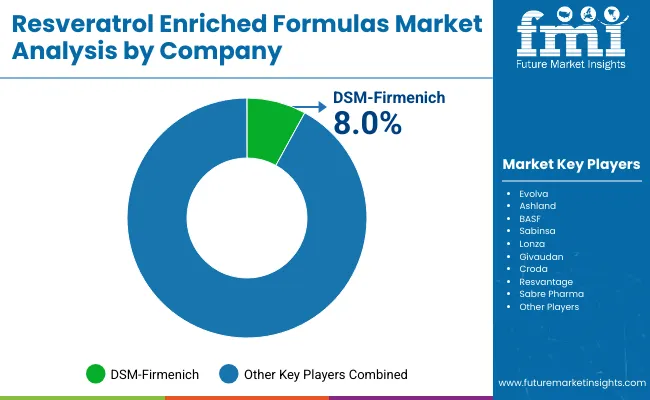

| Companies | Global Value Share 2025 |

|---|---|

| DSM-Firmenich | 8.00% |

| Others | 92.00% |

The Resveratrol Enriched Formulas Market is moderately fragmented, with global leaders, established mid-sized innovators, and specialized providers competing for share across applications such as anti-aging, antioxidant repair, and nutricosmetics. Global ingredient and fragrance majors such as DSM-Firmenich, BASF, Lonza, Givaudan, and Croda are recognized as dominant players, leveraging strong R&D capabilities, wide ingredient portfolios, and global distribution networks. Their strategies are increasingly focused on sustainable sourcing, fermentation-based resveratrol production, and clinical substantiation to meet regulatory and consumer expectations.

Mid-sized innovators such as Evolva, Ashland, Sabinsa, and Resvantage are expanding their footprints by delivering niche applications, clean-label solutions, and targeted formulations, particularly in serums and nutricosmetic categories. Their strengths lie in agility, partnerships with beauty brands, and faster adaptation to regional consumer preferences.

Specialized providers such as Sabre Pharma are focused on pharmaceutical and nutraceutical applications, emphasizing high-purity resveratrol formats tailored to health-focused formulations. These players often succeed through focused expertise and regional adaptability rather than global scale.

Competitive differentiation is expected to shift further from pure sourcing toward integrated positioning that combines clinical validation, sustainability narratives, and digital-first brand partnerships. This evolution will reward companies that balance innovation with compliance and consumer trust.

Key Developments in Resveratrol Enriched Formulas Market

| Item | Value |

|---|---|

| Market Size, 2025 | USD 1,120.3 Million |

| Market Size, 2035 | USD 3,403.2 Million |

| Absolute Growth (2025 to 2035) | USD 2,282.9 Million |

| CAGR (2025 to 2035) | 11.80% |

| Value Added 2025 to 2030 | USD 745.8 Million |

| Value Added 2030 to 2035 | USD 1,537.1 Million |

| Applications (2025) | Anti-aging: USD 598.5 Million (54.5%); Others: USD 510.3 Million (45.6%) |

| Product Type (2025) | Serums: USD 533.6 Million (48.5%); Others: USD 576.8 Million (51.5%) |

| Source (2025) | Grape-derived: USD 511.8 Million (46.5%); Others: USD 599.0 Million (53.5%) |

| Channels | E-commerce, Specialty Beauty Retail, Pharmacies, D2C |

| Growth Hotspots (CAGR) | India 23.1%; China 22.4%; Japan 16.6%; UK 13.3%; Germany 9.9%; USA 8.9% |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, China, India, Japan, United Kingdom, Germany, others in Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Key Companies Profiled | DSM-Firmenich, BASF, Lonza, Givaudan, Croda, Evolva, Ashland, Sabinsa, Resvantage, Sabre Pharma |

| Additional Attributes | Evidence-backed claims, clean-label focus, fermentation scale-up, and digital distribution strategies are shaping market e xpansion. |

The global Resveratrol Enriched Formulas Market is estimated to be valued at USD 1,120.3 Million in 2025, supported by growing demand for anti-aging, antioxidant, and nutricosmetic applications across global regions.

The Resveratrol Enriched Formulas Market is projected to reach USD 3,403.2 Million by 2035, reflecting the rapid expansion of clinically validated formulations and premium positioning in global beauty and wellness portfolios.

The Resveratrol Enriched Formulas Market is expected to grow at a CAGR of 11.8% between 2025 and 2035, adding nearly USD 2.3 Billion in incremental value over the ten-year period.

The key product types in the Resveratrol Enriched Formulas Market are serums and other formats such as capsules, creams, and lotions, with serums leading adoption due to high potency and fast absorption benefits.

In terms of applications, the anti-aging segment is expected to command 54.5% share in 2025, highlighting consumer prioritization of wrinkle reduction, elasticity improvement, and skin repair benefits.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Resveratrol Industry Analysis in Western Europe Size and Share Forecast Outlook 2025 to 2035

Resveratrol Market Analysis - Size, Share & Forecast 2025 to 2035

Resveratrol Industry Analysis in Japan Growth, Trends and Forecast from 2025 to 2035

Resveratrol Industry Analysis in Korea Growth, Trends and Forecast from 2025 to 2035

Triacetylresveratrol Market Size and Share Forecast Outlook 2025 to 2035

Demand for Resveratrol in EU Size and Share Forecast Outlook 2025 to 2035

Phosphorus Enriched Organic Manure Market Growth – Trends & Forecast 2024-2034

Demand of MFGM-enriched Powders & RTDs in European Union Size and Share Forecast Outlook 2025 to 2035

Psoriasis Care Formulas Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Coconut Water-Based Formulas Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Mimetic Silk Protein Formulas Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA