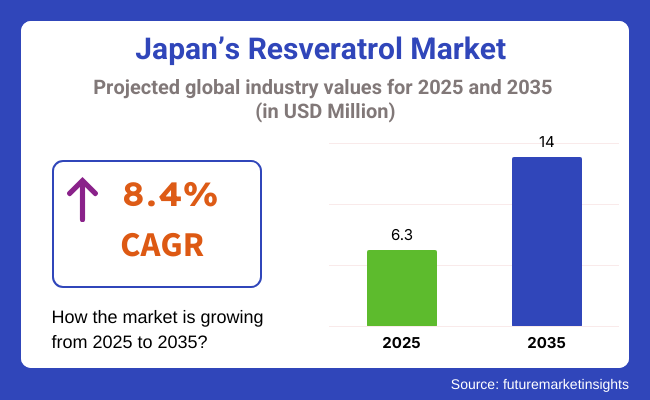

Japan’s resveon and beyond by 2035. The major growth attribute would be the increasing interest in nutraceuticals for longevity in Japan, driving the demand for resveratrol because ratrol market is estimated to be valued at USD 6.3 million during the year 2025 and will have a projected CAGR of 8.4% from 2025 until 2035, and it can rise to USD 14 million of its antioxidant, anti-inflammatory, and cardio protective properties.

In this increasingly health-conscious society in Japan, resveratrol found its landing in functional foods, dietary supplements, and skincare formulations. Its source is natural grapes, berries, and resveratrol, a knotweed, which has domestic taste patterns for plant-based health products. It can be regarded as an important ingredient in the preventive health system in Japan concerning anti-aging and metabolic health.

Clinical-grade applications of resveratrol are also on the upswing in Japan, particularly targeted at cognitive health, cardiovascular support, and preventive cellular aging through specific formulations. Several research initiatives by local pharmaceutical and cosmeceutical companies are underway to develop synergistic formulations of resveratrol with other bio actives to facilitate better health applications and beauty verticals under the consumer segment.

Such deliverables are made possible by using advanced methods in encapsulation, bioavailability enhancement, and fermentation-based extraction processes, as well as increased consumer confidence, which is driving even higher adoption of high-purity, standardized resveratrol. The advanced regulatory environment of Japan endorses science-based claims and product transparency, which support consumer faith, thereby promoting higher adoption of resveratrol usage.

From an evolving demographic profile of the country, with age-related population growth, the natural compounds-for-a-longer-life segment has continuously clustered in demand. Resveratrol, being a multifunctional bioactive, is going to be much-needed and relevant in the long-term in the ever-increasing nutraceutical and wellness markets in Japan.

In 2025, the extract will lead the shares of the resveratrol industry in Japan by 67.8%, with fermentation-based resveratrol will hold at 18.6%.

Extract-based resveratrol leads the field, as it finds its application in dietary supplements, functional foods, and cosmeceuticals. Most of the extracts are derived from grape skin, Japanese knotweed, and red wine and are in line with the consumer preference for natural plant-based ingredients. Major manufacturers in Japan like Kaneka Corporation, San-Ei Gen F.F.I., Inc., and Ichimaru Pharcos Co., Ltd. have encashed the demand for Resveratrol extracts used for anti-aging-disposal.

In contrast, cardiovascular health supplements and skin nourishing formulations are by other brands like Orihiro Co., Ltd., which also make use of extract-resveratrol in antioxidant supplements supporting cholesterol balance and longevity. The clean label reputation and compatibility with the aging society's demand for natural wellness solutions have worked in favor of this segment.

Fermentation-derived Resveratrol, although with a smaller industry share, is gaining momentum because of sustainable production, high purity, and reproducibility. Microbial or yeast fermentation is the process used to produce a steady supply chain bioactive consistency of this form that is mainly suitable for pharmaceutically relevant and precision-targeted nutraceuticals.

Companies like Kikkoman Biochemifa Company and Mitsui & Co. are playing a huge role in pioneering fermentation technologies to serve consumers demanding scientifically validated, vegan, and allergen-free alternatives. Apart from these, functional product developers like Morinaga Milk Industry Co., Ltd. and Suntory Wellness Ltd. are using fermentation-based Resveratrol for beverages and dairy products designed for preventive health purposes.

Japan will be highly powered by resveratrol powder in 2025, accounting for an 85.9% share of the industry, with liquid form taking up the remaining 14.1%.

Powdered resveratrol has found favor in the Japanese industry due to its versatility, stability, and ease of use in a variety of end-use sectors, catering widely to dietary supplements, capsules, tablets, and functional food mixtures. The industry for powdered Resveratrol is supplied by manufacturers, such as Kaneka Corporation and San-Ei Gen F.F.I., Inc., producing high-purity powdered resveratrol, preferably extracted from natural sources or fermented to consumer demand for high-performance, shelf-stable health-oriented products.

The nutraceutical sector especially favors the powder form because of the stability of the active ingredient during processing and storage. Dosing is also a big concern, especially for clinical supplements and products for cardiovascular health, anti-aging, and antioxidant support areas. It is also powdered Resveratrol that allows synergy with other actives for applications in wellness powders, instant beverages, and snacks protein-enriched, which again solidifies the marketplace in favor of Japan's trendiest consumer sector.

Contrary to powdered resveratrol, the liquid form is gaining traction, albeit modestly, particularly in the ready-to-drink functional beverage industry and some skin-care applications. Designed to suit a hassle-free lifestyle with near-immediate effects, the preparations are soon absorbed into the system and are straightforward to ingest.

For instance, Suntory Wellness Ltd. and Morinaga Milk Industry Co., Ltd. have incorporated the liquid form of resveratrol into their nutraceutical drinks or fortified dairy products mainly aimed at middle-aged and old consumers. Liquid formulations are also added to premium cosmetic serums for age-defying and brightening effects, targeting the sophisticated beauty industry in Japan.

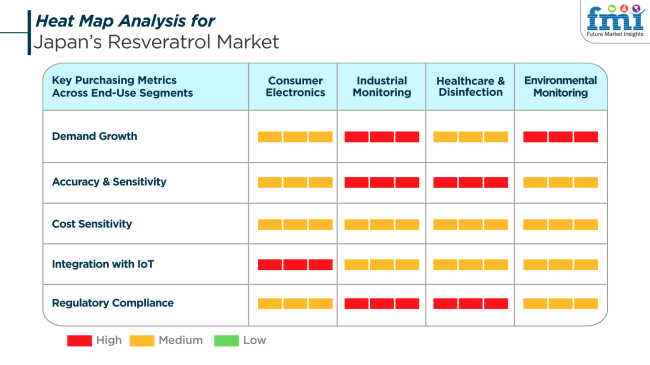

The resveratrol industry in Japan is multi-sectorial, with a variety of end-use segments pushing for their adoption through various innovation pathways. Industrial monitoring, environmental testing, bioassay developmental work, and oxidative stress measurements are also increasingly being given applications requiring great precision, regulatory robustness, and process stability.

Healthcare and disinfection are the two core industrial sectors in which resveratrol is now being functionalized into medical-grade supplements and topical applications. These buyers demand stringent adherence to quality certifications on bioavailability and active compound integrity while managing cost efficiency in a highly competitive health ingredients industry.

Key Purchasing Metrics Across End-Use Segments

In consumer electronics, interest in the integration of these functional bioactive with smart diagnostic systems is growing in wellness tech and health monitoring devices. Decisions here are made on the basis of factors including IoT compatibility, data synchronization, and sensory responsiveness. Regulatory compliance, though certainly less arduous than in the clinical applications discussed, remains highly relevant, as Japan maintains strict regulation on consumer safety and efficacy claims.

During 2020 to 2024, the Japanese industry for resveratrol saw remarkable growth due to heightened consumer interest in health and wellness. The increase in lifestyle diseases, including obesity and diabetes, resulted in the growing need for dietary supplements. Resveratrol, which is antioxidant and anti-aging in nature, became increasingly popular in the manufacture of functional foods, drinks, and dietary supplements. The aging population in Japan also helped fuel the demand for supplements that promote healthy aging.

In the future, up to 2025 to 2035, the Japanese resveratrol industry is expected to keep growing. Food technology and formulation advancements hold promise to lead to the production of a line of resveratrol derivatives with improved activity and bioavailability. The inclination towards healthy life and individual nutrition is also foreseen to accelerate demand for supplements of resveratrol even more. Besides, the focus on sustainable sourcing and transparent labeling will increasingly assume significance to respond to consumer concerns and regulatory demands.

Comparative Market Shift Analysis 2020 to 2024 vs. 2025 to 2035

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Health-conscious consumers looking for antioxidant-based, anti-aging supplements | Sustained focus on health and wellness, with emphasis on personalized nutrition |

| Functional foods, beverages, dietary supplements | Increased application in personalized nutrition solutions and innovative formulations |

| Adherence to food safety and labeling rules | Expected tighter regulations influencing product development and advertising |

| Aging population, rising incidence of lifestyle diseases | Increasing need for tailored nutrition and sustainable, clean-label solutions |

| Formulation development with enhanced bioavailability | Launch of personalized resveratrol products and sustainable ranges |

The Japanese resveratrol industry has potential but is strategically at risk. Regulatory hurdles, complexities, and functional claims can act as entry barriers for new formulations, especially when there is little clinical backing. Products failing to comply with Japan's strict evidence-based labeling requirements would stand the risk of being denied entry or having limited access to the industry.

The availability of raw materials also poses a threat since resveratrol sources, like grape skins or knotweed extract, are primarily exported from other countries to Japan. Disruption of global supply chains and quality control problems, not to mention trade restrictions, could escalate costs and delay manufacturing.

The industry saturation and consumer skepticism toward unverifiable health claims are reputational risks. Brands will have to set themselves apart based on clinically validated benefits and sourcing transparency. The companies that invest in scientific proof, consumer education campaigns, and regulatory compliance will be best able to earn and maintain consumer confidence and secure long-term competitive advantage in Japan's upscale health industry.

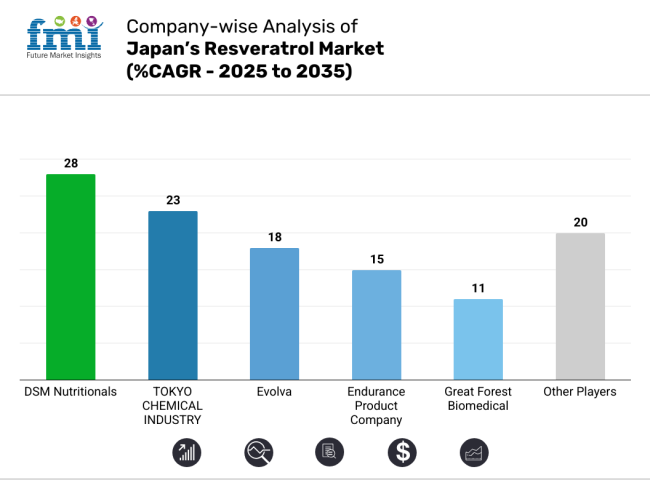

The industry features a diverse competitive landscape with distinct positioning strategies among global ingredient specialists and domestic suppliers. DSM Nutritionals leads the premium segment through its high-purity, clinically validated resveratrol formulations targeting the nutraceutical and pharmaceutical sectors.

TOKYO CHEMICAL INDUSTRY dominates the research-grade and laboratory supply segment, leveraging its strong domestic distribution network and technical expertise. Evolva competes with its fermentation-derived resveratrol, appealing to manufacturers seeking sustainable and non-GMO ingredients.

The industry shows clear segmentation between pharmaceutical-grade and dietary supplement applications. Endurance Product Company and Great Forest Biomedical focus on the supplement industry with cost-effective solutions, while Laurus Labs Limited and Sabinsa Corporation cater to both pharmaceutical and nutraceutical applications with standardized extracts.

JF-NATURAL has carved a niche in traditional Japanese health products, incorporating resveratrol into heritage formulations. International players like Resvitale LLC and Shanghai Natural Bio-engineering are gaining traction through competitive pricing, though they face challenges in meeting Japan's stringent quality standards for health ingredients.

Key Success Factors Driving the Resveratrol Industry in Japan

DSM Nutritionals commands 25-28% of Japan's resveratrol industry through its high-purity, science-backed formulations preferred by premium supplement brands and pharmaceutical companies. The company's strong clinical dossier and global reputation reinforce its leadership position.

TOKYO CHEMICAL INDUSTRY holds a 20-23% share as the dominant supplier of research-grade resveratrol to Japan's extensive academic and industrial research sectors, benefiting from its technical expertise and local manufacturing capabilities.

Evolva maintains a 15-18% industry share with its innovative fermentation-derived resveratrol, appealing to manufacturers seeking sustainable and traceable ingredients. Endurance Product Company accounts for 12-15% share through cost-effective solutions for mainstream dietary supplements.

Great Forest Biomedical rounds out the top five with an 8-11% share, specializing in resveratrol combinations with traditional Japanese botanicals. These industry leaders are driving innovation in bioavailability enhancement and clinical validation to meet Japan's sophisticated health ingredient requirements.

By product, the industry is segmented into extract, fermentation, and synthetic.

By form, the industry is categorized into powder and liquid.

By isomer, the industry is divided into trans- and cis-.

By end use, the industry includes applications in skin care (including cream & lotion, scrub exfoliator, cleanser & toner, balm & butter, serum & mask, makeup remover, and others), hair care (including shampoo, conditioner, essential oil, hair colour, hair stylist products, and hair oil), makeup (including facial makeup, eye makeup, lip makeup, and nail makeup), bath care (including shower products, liquid bath products, bath additives, and bar soaps), fragrance (including perfume, deodorant, and cologne), tools, dietary supplements, pharmaceuticals, and others.

By region, the industryincludes Kanto, Chubu, Kinki, Kyushu & Okinawa, Tohoku, and the Rest of Japan.

The industry is expected to reach USD 6.3 million in 2025.

The industry is projected to grow to USD 14 million by 2035.

The industry is expected to grow at a CAGR of approximately 8.4% during the forecast period.

Extract form is a key segment in the industry.

Key players include TOKYO CHEMICAL INDUSTRY, DSM Nutritionals, Evolva, Endurance Product Company, Great Forest Biomedical, Laurus Labs Limited, JF-NATURAL, Sabinsa Corporation, Resvitale LLC, and Shanghai Natural Bio-engineering.

Table 1: Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Market Volume (Tons) Forecast by Region, 2018 to 2033

Table 3: Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 4: Market Volume (Tons) Forecast by Product, 2018 to 2033

Table 5: Market Value (US$ Million) Forecast by Form, 2018 to 2033

Table 6: Market Volume (Tons) Forecast by Form, 2018 to 2033

Table 7: Market Value (US$ Million) Forecast by Isomer, 2018 to 2033

Table 8: Market Volume (Tons) Forecast by Isomer, 2018 to 2033

Table 9: Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 10: Market Volume (Tons) Forecast by End Use, 2018 to 2033

Table 11: Kanto Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 12: Kanto Market Volume (Tons) Forecast by Product, 2018 to 2033

Table 13: Kanto Market Value (US$ Million) Forecast by Form, 2018 to 2033

Table 14: Kanto Market Volume (Tons) Forecast by Form, 2018 to 2033

Table 15: Kanto Market Value (US$ Million) Forecast by Isomer, 2018 to 2033

Table 16: Kanto Market Volume (Tons) Forecast by Isomer, 2018 to 2033

Table 17: Kanto Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 18: Kanto Market Volume (Tons) Forecast by End Use, 2018 to 2033

Table 19: Chubu Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 20: Chubu Market Volume (Tons) Forecast by Product, 2018 to 2033

Table 21: Chubu Market Value (US$ Million) Forecast by Form, 2018 to 2033

Table 22: Chubu Market Volume (Tons) Forecast by Form, 2018 to 2033

Table 23: Chubu Market Value (US$ Million) Forecast by Isomer, 2018 to 2033

Table 24: Chubu Market Volume (Tons) Forecast by Isomer, 2018 to 2033

Table 25: Chubu Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 26: Chubu Market Volume (Tons) Forecast by End Use, 2018 to 2033

Table 27: Kinki Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 28: Kinki Market Volume (Tons) Forecast by Product, 2018 to 2033

Table 29: Kinki Market Value (US$ Million) Forecast by Form, 2018 to 2033

Table 30: Kinki Market Volume (Tons) Forecast by Form, 2018 to 2033

Table 31: Kinki Market Value (US$ Million) Forecast by Isomer, 2018 to 2033

Table 32: Kinki Market Volume (Tons) Forecast by Isomer, 2018 to 2033

Table 33: Kinki Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 34: Kinki Market Volume (Tons) Forecast by End Use, 2018 to 2033

Table 35: Kyushu & Okinawa Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 36: Kyushu & Okinawa Market Volume (Tons) Forecast by Product, 2018 to 2033

Table 37: Kyushu & Okinawa Market Value (US$ Million) Forecast by Form, 2018 to 2033

Table 38: Kyushu & Okinawa Market Volume (Tons) Forecast by Form, 2018 to 2033

Table 39: Kyushu & Okinawa Market Value (US$ Million) Forecast by Isomer, 2018 to 2033

Table 40: Kyushu & Okinawa Market Volume (Tons) Forecast by Isomer, 2018 to 2033

Table 41: Kyushu & Okinawa Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 42: Kyushu & Okinawa Market Volume (Tons) Forecast by End Use, 2018 to 2033

Table 43: Tohoku Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 44: Tohoku Market Volume (Tons) Forecast by Product, 2018 to 2033

Table 45: Tohoku Market Value (US$ Million) Forecast by Form, 2018 to 2033

Table 46: Tohoku Market Volume (Tons) Forecast by Form, 2018 to 2033

Table 47: Tohoku Market Value (US$ Million) Forecast by Isomer, 2018 to 2033

Table 48: Tohoku Market Volume (Tons) Forecast by Isomer, 2018 to 2033

Table 49: Tohoku Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 50: Tohoku Market Volume (Tons) Forecast by End Use, 2018 to 2033

Table 51: Rest of Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 52: Rest of Market Volume (Tons) Forecast by Product, 2018 to 2033

Table 53: Rest of Market Value (US$ Million) Forecast by Form, 2018 to 2033

Table 54: Rest of Market Volume (Tons) Forecast by Form, 2018 to 2033

Table 55: Rest of Market Value (US$ Million) Forecast by Isomer, 2018 to 2033

Table 56: Rest of Market Volume (Tons) Forecast by Isomer, 2018 to 2033

Table 57: Rest of Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 58: Rest of Market Volume (Tons) Forecast by End Use, 2018 to 2033

Figure 1: Market Value (US$ Million) by Product, 2023 to 2033

Figure 2: Market Value (US$ Million) by Form, 2023 to 2033

Figure 3: Market Value (US$ Million) by Isomer, 2023 to 2033

Figure 4: Market Value (US$ Million) by End Use, 2023 to 2033

Figure 5: Market Value (US$ Million) by Region, 2023 to 2033

Figure 6: Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 7: Market Volume (Tons) Analysis by Region, 2018 to 2033

Figure 8: Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 9: Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 10: Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 11: Market Volume (Tons) Analysis by Product, 2018 to 2033

Figure 12: Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 13: Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 14: Market Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 15: Market Volume (Tons) Analysis by Form, 2018 to 2033

Figure 16: Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 17: Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 18: Market Value (US$ Million) Analysis by Isomer, 2018 to 2033

Figure 19: Market Volume (Tons) Analysis by Isomer, 2018 to 2033

Figure 20: Market Value Share (%) and BPS Analysis by Isomer, 2023 to 2033

Figure 21: Market Y-o-Y Growth (%) Projections by Isomer, 2023 to 2033

Figure 22: Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 23: Market Volume (Tons) Analysis by End Use, 2018 to 2033

Figure 24: Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 25: Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 26: Market Attractiveness by Product, 2023 to 2033

Figure 27: Market Attractiveness by Form, 2023 to 2033

Figure 28: Market Attractiveness by Isomer, 2023 to 2033

Figure 29: Market Attractiveness by End Use, 2023 to 2033

Figure 30: Market Attractiveness by Region, 2023 to 2033

Figure 31: Kanto Market Value (US$ Million) by Product, 2023 to 2033

Figure 32: Kanto Market Value (US$ Million) by Form, 2023 to 2033

Figure 33: Kanto Market Value (US$ Million) by Isomer, 2023 to 2033

Figure 34: Kanto Market Value (US$ Million) by End Use, 2023 to 2033

Figure 35: Kanto Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 36: Kanto Market Volume (Tons) Analysis by Product, 2018 to 2033

Figure 37: Kanto Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 38: Kanto Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 39: Kanto Market Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 40: Kanto Market Volume (Tons) Analysis by Form, 2018 to 2033

Figure 41: Kanto Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 42: Kanto Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 43: Kanto Market Value (US$ Million) Analysis by Isomer, 2018 to 2033

Figure 44: Kanto Market Volume (Tons) Analysis by Isomer, 2018 to 2033

Figure 45: Kanto Market Value Share (%) and BPS Analysis by Isomer, 2023 to 2033

Figure 46: Kanto Market Y-o-Y Growth (%) Projections by Isomer, 2023 to 2033

Figure 47: Kanto Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 48: Kanto Market Volume (Tons) Analysis by End Use, 2018 to 2033

Figure 49: Kanto Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 50: Kanto Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 51: Kanto Market Attractiveness by Product, 2023 to 2033

Figure 52: Kanto Market Attractiveness by Form, 2023 to 2033

Figure 53: Kanto Market Attractiveness by Isomer, 2023 to 2033

Figure 54: Kanto Market Attractiveness by End Use, 2023 to 2033

Figure 55: Chubu Market Value (US$ Million) by Product, 2023 to 2033

Figure 56: Chubu Market Value (US$ Million) by Form, 2023 to 2033

Figure 57: Chubu Market Value (US$ Million) by Isomer, 2023 to 2033

Figure 58: Chubu Market Value (US$ Million) by End Use, 2023 to 2033

Figure 59: Chubu Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 60: Chubu Market Volume (Tons) Analysis by Product, 2018 to 2033

Figure 61: Chubu Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 62: Chubu Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 63: Chubu Market Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 64: Chubu Market Volume (Tons) Analysis by Form, 2018 to 2033

Figure 65: Chubu Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 66: Chubu Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 67: Chubu Market Value (US$ Million) Analysis by Isomer, 2018 to 2033

Figure 68: Chubu Market Volume (Tons) Analysis by Isomer, 2018 to 2033

Figure 69: Chubu Market Value Share (%) and BPS Analysis by Isomer, 2023 to 2033

Figure 70: Chubu Market Y-o-Y Growth (%) Projections by Isomer, 2023 to 2033

Figure 71: Chubu Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 72: Chubu Market Volume (Tons) Analysis by End Use, 2018 to 2033

Figure 73: Chubu Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 74: Chubu Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 75: Chubu Market Attractiveness by Product, 2023 to 2033

Figure 76: Chubu Market Attractiveness by Form, 2023 to 2033

Figure 77: Chubu Market Attractiveness by Isomer, 2023 to 2033

Figure 78: Chubu Market Attractiveness by End Use, 2023 to 2033

Figure 79: Kinki Market Value (US$ Million) by Product, 2023 to 2033

Figure 80: Kinki Market Value (US$ Million) by Form, 2023 to 2033

Figure 81: Kinki Market Value (US$ Million) by Isomer, 2023 to 2033

Figure 82: Kinki Market Value (US$ Million) by End Use, 2023 to 2033

Figure 83: Kinki Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 84: Kinki Market Volume (Tons) Analysis by Product, 2018 to 2033

Figure 85: Kinki Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 86: Kinki Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 87: Kinki Market Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 88: Kinki Market Volume (Tons) Analysis by Form, 2018 to 2033

Figure 89: Kinki Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 90: Kinki Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 91: Kinki Market Value (US$ Million) Analysis by Isomer, 2018 to 2033

Figure 92: Kinki Market Volume (Tons) Analysis by Isomer, 2018 to 2033

Figure 93: Kinki Market Value Share (%) and BPS Analysis by Isomer, 2023 to 2033

Figure 94: Kinki Market Y-o-Y Growth (%) Projections by Isomer, 2023 to 2033

Figure 95: Kinki Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 96: Kinki Market Volume (Tons) Analysis by End Use, 2018 to 2033

Figure 97: Kinki Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 98: Kinki Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 99: Kinki Market Attractiveness by Product, 2023 to 2033

Figure 100: Kinki Market Attractiveness by Form, 2023 to 2033

Figure 101: Kinki Market Attractiveness by Isomer, 2023 to 2033

Figure 102: Kinki Market Attractiveness by End Use, 2023 to 2033

Figure 103: Kyushu & Okinawa Market Value (US$ Million) by Product, 2023 to 2033

Figure 104: Kyushu & Okinawa Market Value (US$ Million) by Form, 2023 to 2033

Figure 105: Kyushu & Okinawa Market Value (US$ Million) by Isomer, 2023 to 2033

Figure 106: Kyushu & Okinawa Market Value (US$ Million) by End Use, 2023 to 2033

Figure 107: Kyushu & Okinawa Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 108: Kyushu & Okinawa Market Volume (Tons) Analysis by Product, 2018 to 2033

Figure 109: Kyushu & Okinawa Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 110: Kyushu & Okinawa Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 111: Kyushu & Okinawa Market Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 112: Kyushu & Okinawa Market Volume (Tons) Analysis by Form, 2018 to 2033

Figure 113: Kyushu & Okinawa Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 114: Kyushu & Okinawa Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 115: Kyushu & Okinawa Market Value (US$ Million) Analysis by Isomer, 2018 to 2033

Figure 116: Kyushu & Okinawa Market Volume (Tons) Analysis by Isomer, 2018 to 2033

Figure 117: Kyushu & Okinawa Market Value Share (%) and BPS Analysis by Isomer, 2023 to 2033

Figure 118: Kyushu & Okinawa Market Y-o-Y Growth (%) Projections by Isomer, 2023 to 2033

Figure 119: Kyushu & Okinawa Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 120: Kyushu & Okinawa Market Volume (Tons) Analysis by End Use, 2018 to 2033

Figure 121: Kyushu & Okinawa Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 122: Kyushu & Okinawa Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 123: Kyushu & Okinawa Market Attractiveness by Product, 2023 to 2033

Figure 124: Kyushu & Okinawa Market Attractiveness by Form, 2023 to 2033

Figure 125: Kyushu & Okinawa Market Attractiveness by Isomer, 2023 to 2033

Figure 126: Kyushu & Okinawa Market Attractiveness by End Use, 2023 to 2033

Figure 127: Tohoku Market Value (US$ Million) by Product, 2023 to 2033

Figure 128: Tohoku Market Value (US$ Million) by Form, 2023 to 2033

Figure 129: Tohoku Market Value (US$ Million) by Isomer, 2023 to 2033

Figure 130: Tohoku Market Value (US$ Million) by End Use, 2023 to 2033

Figure 131: Tohoku Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 132: Tohoku Market Volume (Tons) Analysis by Product, 2018 to 2033

Figure 133: Tohoku Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 134: Tohoku Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 135: Tohoku Market Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 136: Tohoku Market Volume (Tons) Analysis by Form, 2018 to 2033

Figure 137: Tohoku Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 138: Tohoku Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 139: Tohoku Market Value (US$ Million) Analysis by Isomer, 2018 to 2033

Figure 140: Tohoku Market Volume (Tons) Analysis by Isomer, 2018 to 2033

Figure 141: Tohoku Market Value Share (%) and BPS Analysis by Isomer, 2023 to 2033

Figure 142: Tohoku Market Y-o-Y Growth (%) Projections by Isomer, 2023 to 2033

Figure 143: Tohoku Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 144: Tohoku Market Volume (Tons) Analysis by End Use, 2018 to 2033

Figure 145: Tohoku Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 146: Tohoku Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 147: Tohoku Market Attractiveness by Product, 2023 to 2033

Figure 148: Tohoku Market Attractiveness by Form, 2023 to 2033

Figure 149: Tohoku Market Attractiveness by Isomer, 2023 to 2033

Figure 150: Tohoku Market Attractiveness by End Use, 2023 to 2033

Figure 151: Rest of Market Value (US$ Million) by Product, 2023 to 2033

Figure 152: Rest of Market Value (US$ Million) by Form, 2023 to 2033

Figure 153: Rest of Market Value (US$ Million) by Isomer, 2023 to 2033

Figure 154: Rest of Market Value (US$ Million) by End Use, 2023 to 2033

Figure 155: Rest of Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 156: Rest of Market Volume (Tons) Analysis by Product, 2018 to 2033

Figure 157: Rest of Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 158: Rest of Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 159: Rest of Market Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 160: Rest of Market Volume (Tons) Analysis by Form, 2018 to 2033

Figure 161: Rest of Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 162: Rest of Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 163: Rest of Market Value (US$ Million) Analysis by Isomer, 2018 to 2033

Figure 164: Rest of Market Volume (Tons) Analysis by Isomer, 2018 to 2033

Figure 165: Rest of Market Value Share (%) and BPS Analysis by Isomer, 2023 to 2033

Figure 166: Rest of Market Y-o-Y Growth (%) Projections by Isomer, 2023 to 2033

Figure 167: Rest of Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 168: Rest of Market Volume (Tons) Analysis by End Use, 2018 to 2033

Figure 169: Rest of Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 170: Rest of Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 171: Rest of Market Attractiveness by Product, 2023 to 2033

Figure 172: Rest of Market Attractiveness by Form, 2023 to 2033

Figure 173: Rest of Market Attractiveness by Isomer, 2023 to 2033

Figure 174: Rest of Market Attractiveness by End Use, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Resveratrol Enriched Formulas Market Size and Share Forecast Outlook 2025 to 2035

Resveratrol Market Analysis - Size, Share & Forecast 2025 to 2035

Resveratrol Industry Analysis in Western Europe Size and Share Forecast Outlook 2025 to 2035

Resveratrol Industry Analysis in Korea Growth, Trends and Forecast from 2025 to 2035

Triacetylresveratrol Market Size and Share Forecast Outlook 2025 to 2035

Demand for Resveratrol in EU Size and Share Forecast Outlook 2025 to 2035

Industry 4.0 Market

Industry Analysis of Syringe and Needle in GCC Size and Share Forecast Outlook 2025 to 2035

Industry Analysis Non-commercial Acrylic Paint in the United States Size and Share Forecast Outlook 2025 to 2035

Industry Analysis of Medical Device Packaging in Southeast Asia Size and Share Forecast Outlook 2025 to 2035

Industry Analysis of Paper Bag in North America Size and Share Forecast Outlook 2025 to 2035

Industry Analysis of Lidding Film in the United States Size and Share Forecast Outlook 2025 to 2035

Industry Analysis of Automotive Lightweight Body Panel in the United States Size and Share Forecast Outlook 2025 to 2035

Industry Analysis of Electronic Skin in Korea Size and Share Forecast Outlook 2025 to 2035

Industry Analysis of Electronic Skin in Western Europe Size and Share Forecast Outlook 2025 to 2035

Germany Outbound Tourism Market Trends – Growth & Forecast 2024-2034

Europe Second-hand Apparel Market Growth – Trends & Forecast 2024-2034

Industry Analysis of Electronic Skin in Japan Size and Share Forecast Outlook 2025 to 2035

Industry Analysis of Last-mile Delivery Software in Japan Size and Share Forecast Outlook 2025 to 2035

DOAS Industry Analysis in the United States Forecast and Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA