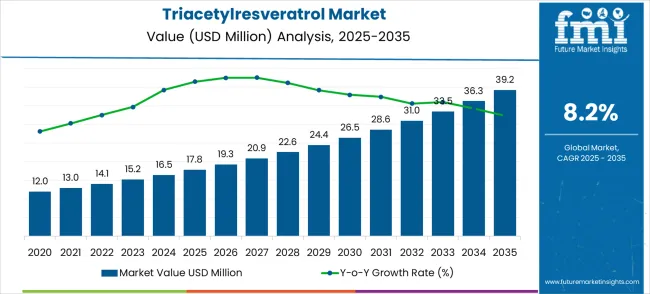

The global triacetylresveratrol market is projected to grow from USD 17.8 million in 2025 to approximately USD 39.2 million by 2035, recording an absolute increase of USD 21.4 million over the forecast period. This translates into a total growth of 120.2%, with the market forecast to expand at a compound annual growth rate (CAGR) of 8.2% between 2025 and 2035. The overall market size is expected to grow by nearly 2.20X during the same period, supported by increasing demand for enhanced bioavailable resveratrol derivatives and growing applications in functional food formulations and nutraceutical products.

Between 2025 and 2030, the triacetylresveratrol market is projected to expand from USD 17.8 million to USD 26.4 million, resulting in a value increase of USD 8.6 million, which represents 40.2% of the total forecast growth for the decade. This phase of growth will be shaped by rising awareness of resveratrol bioavailability challenges and increasing adoption of acetylated derivatives for enhanced cellular uptake, growing penetration of functional foods incorporating bioactive compounds, and expanding research validation of triacetylresveratrol benefits over conventional resveratrol forms. Manufacturing facilities are expanding their acetylation capabilities to address the growing demand for premium bioavailable antioxidant compounds.

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 17.8 million |

| Forecast Value in (2035F) | USD 39.2 million |

| Forecast CAGR (2025 to 2035) | 8.2% |

The Triacetylresveratrol market is experiencing robust growth due to increasing recognition of its enhanced bioavailability compared to conventional resveratrol. Scientific studies have shown that triacetylresveratrol offers superior cellular uptake and stability, making it a preferred choice for supplement manufacturers aiming to deliver more effective antioxidant benefits. The acetylation process allows for better tissue penetration and reduces metabolic degradation during gastrointestinal processing, driving its adoption in nutraceuticals and dietary supplements targeting health-conscious consumers.

The integration of triacetylresveratrol into the functional food industry and advancing pharmaceutical research are key growth drivers. Food manufacturers are incorporating this bioenhanced compound into products as a premium ingredient, ensuring stability during processing and storage while providing proven antioxidant effects. Simultaneously, clinical research and pharmaceutical companies are exploring its potential in cardiovascular, neuroprotective, and anti-aging applications, fueling demand for pharmaceutical-grade materials and investment in specialized synthesis capabilities. However, market expansion is moderated by high manufacturing costs, limited raw material suppliers, and regulatory complexities associated with novel bioactive ingredients requiring extensive safety documentation.

The Triacetylresveratrol market (USD 17.8M → 39.2M by 2035, CAGR ~8.2%) is driven by rising applications in food & beverage fortification, health products, and specialty nutraceuticals. Growth is shaped by consumer preference for bioavailable resveratrol derivatives, higher purity requirements (≥98% and ≥99%), and the expansion of health-conscious populations in Asia-Pacific and Europe. Together, purity-led positioning and application diversification unlock ~USD 21–22M in incremental revenue opportunities by 2035.

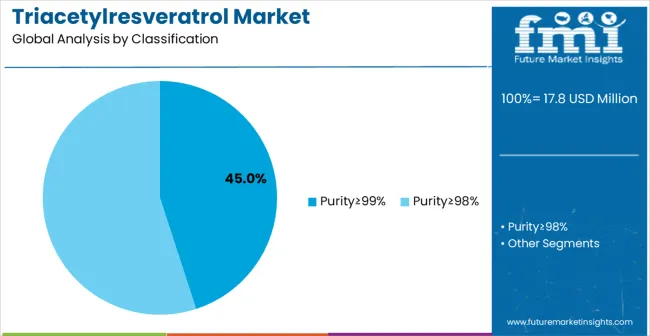

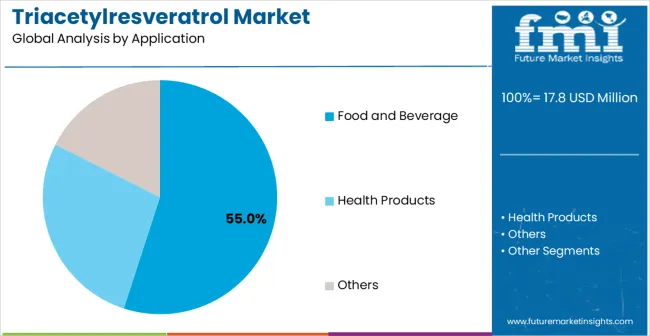

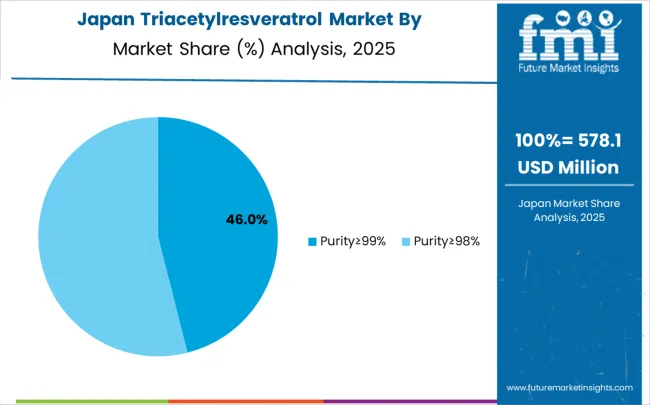

The market is segmented by purity grade, application, and region. By purity grade, the market is divided into Purity ≥98%, Purity ≥99%, and Others, reflecting analytical specifications and pharmaceutical quality standards. By application, the market is categorized into food and beverage, health products, pharmaceutical intermediates, and cosmetic formulations. Regionally, the market is classified into North America, Europe, east Asia, South Asia & Pacific, Latin America, and Middle East & Africa.

Purity≥99% grade is projected to account for 45% of the triacetylresveratrol market in 2025. This significant share is supported by the demanding quality requirements of pharmaceutical applications and premium nutraceutical formulations where product consistency and minimal impurities are essential for therapeutic efficacy and regulatory compliance. High-purity grades enable pharmaceutical-grade positioning and justify premium pricing while meeting international quality standards for advanced bioactive applications.

The dominance of ultra-high purity grades reflects the sophisticated nature of triacetylresveratrol applications across pharmaceutical research, clinical nutrition, and premium supplement markets. Manufacturing facilities require specialized purification technologies including advanced chromatography systems, crystallization processes, and analytical testing capabilities to consistently achieve and verify purity levels exceeding 99%. These technical requirements create substantial barriers to market entry while enabling established manufacturers to command premium pricing for verified pharmaceutical-grade materials.

Quality differentiation through purity specifications drives market segmentation and pricing strategies, with pharmaceutical companies and premium nutraceutical manufacturers willing to pay significant premiums for guaranteed ultra-high purity materials that meet regulatory requirements for clinical applications. The segment benefits from growing therapeutic research interest in triacetylresveratrol for cardiovascular, neuroprotective, and anti-aging applications where product purity directly impacts clinical efficacy and safety profiles. Regulatory compliance requirements for pharmaceutical and clinical nutrition applications continue strengthening demand for documented ultra-high purity grades with comprehensive quality documentation and batch traceability systems.

Manufacturing complexity associated with achieving consistent 99%+ purity levels requires significant capital investment in specialized equipment, quality control systems, and technical expertise. Supply chain considerations include limited availability of pharmaceutical-grade chemical precursors and specialized purification reagents that can create cost volatility and supply security challenges during periods of rapid market growth or supply chain disruptions.

Food and beverage applications are estimated to hold 55% of the market share in 2025, representing the largest application category for triacetylresveratrol consumption. This dominance reflects the ingredient's enhanced stability compared to conventional resveratrol in food processing environments and growing consumer demand for functional foods with documented antioxidant benefits. The segment leverages superior chemical stability during food processing, better solubility characteristics for beverage formulations, and enhanced bioavailability that delivers measurable health benefits to end consumers.

The food and beverage segment benefits from triacetylresveratrol's improved processing tolerance compared to conventional resveratrol, which degrades rapidly under heat, light, and pH conditions typical in food manufacturing. Acetylation chemistry provides protective benefits that enable ingredient survival through pasteurization, sterilization, and extended shelf storage without significant potency loss. This technical advantage creates opportunities for functional food applications previously impossible with conventional resveratrol formulations.

Market growth drivers include increasing functional food market expansion, consumer demand for clean-label antioxidants with documented bioavailability advantages, regulatory acceptance of acetylated resveratrol derivatives in food applications, and food manufacturer interest in premium bioactive ingredients for product differentiation strategies. Premium functional beverages, healthy snack formulations, dietary supplements positioned as food products, and specialized nutrition products represent the fastest-expanding subsegments within food and beverage applications.

The segment faces challenges from higher ingredient costs compared to conventional antioxidants, regulatory complexity for novel food ingredient approvals in some markets, and consumer education requirements regarding enhanced bioavailability benefits. Manufacturing considerations include formulation stability optimization, flavor masking requirements, and supply chain coordination for specialized bioactive ingredients with limited supplier bases.

The triacetylresveratrol market is experiencing significant growth driven by increasing scientific validation of its enhanced bioavailability and superior stability compared to conventional resveratrol. This recognition has fueled demand among nutraceutical, pharmaceutical, and functional food manufacturers seeking premium antioxidant ingredients with proven therapeutic benefits. Consumers and health-conscious markets are increasingly prioritizing products that offer measurable efficacy, which has positioned triacetylresveratrol as a preferred choice for high-value formulations. Regulatory approvals for bioactive compounds and rising awareness of oxidative stress-related health conditions are further propelling market expansion.

Despite strong growth prospects, the market faces notable challenges. The production of triacetylresveratrol involves complex acetylation chemistry requiring specialized equipment, high-purity raw materials, and strict quality control measures. These factors contribute to elevated manufacturing costs and create a limited supplier base, potentially restricting large-scale adoption. The regulatory complexities associated with novel bioactive ingredients require extensive safety and efficacy documentation, particularly for pharmaceutical and functional food applications. Market participants are continuously navigating these constraints while seeking opportunities for innovation and differentiation.

The growing scientific evidence highlighting triacetylresveratrol’s superior bioavailability has spurred increased clinical research investments. Pharmaceutical companies and research institutions are actively exploring its potential in cardiovascular health, neuroprotection, and anti-aging therapies. Clinical validation studies indicate that triacetylresveratrol offers three to five times higher cellular uptake than conventional resveratrol, providing measurable therapeutic advantages. Such findings support premium positioning in the nutraceutical and pharmaceutical markets and justify higher ingredient costs in specialized formulations. These research advancements are also stimulating product development pipelines and encouraging collaborations between manufacturers, clinical research organizations, and healthcare providers.

Manufacturers are increasingly adopting advanced acetylation and purification technologies to achieve pharmaceutical-grade quality while improving efficiency. Continuous flow reactors, automated chromatography systems, and sophisticated quality control processes ensure consistency, reduce production variability, and optimize yield. These technological improvements not only lower manufacturing costs over time but also enable the scale-up of production to meet growing demand across nutraceutical, pharmaceutical, and functional food segments. dherence to stringent quality standards strengthens market confidence, supports regulatory compliance, and enhances the global competitiveness of triacetylresveratrol-based products.

| Country | CAGR (2025-2035) |

|---|---|

| China | 11.1% |

| India | 10.3% |

| Germany | 9.4% |

| Brazil | 8.6% |

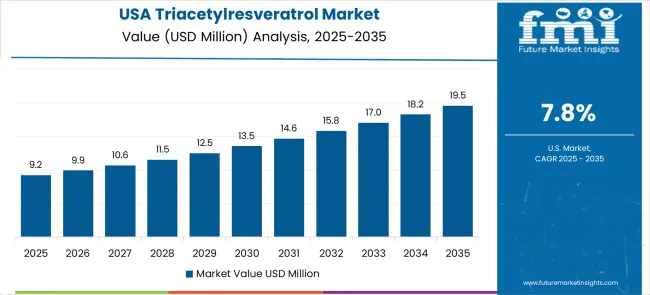

| United States | 7.8% |

| United Kingdom | 7.0% |

| Japan | 6.2% |

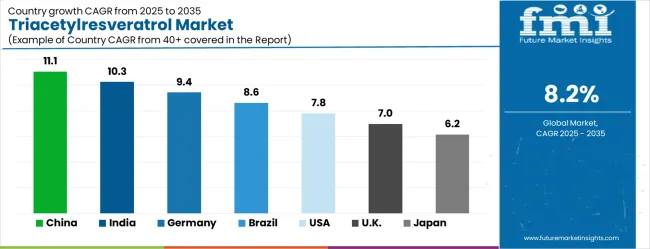

The triacetylresveratrol market demonstrates strong growth momentum across global markets, with Asia Pacific manufacturing centers driving production innovation while developed markets focus on premium applications and therapeutic development. Growth leaders include China at 11.1% CAGR and India at 10.3% CAGR, benefiting from chemical synthesis expertise and expanding domestic nutraceutical consumption. Steady performers encompass Germany at 9.4% CAGR and Brazil at 8.6% CAGR, representing markets with established supplement industries and growing functional food adoption. Emerging premium markets including the United States at 7.8% CAGR, United Kingdom at 7.0% CAGR, and Japan at 6.2% CAGR emphasize pharmaceutical-grade applications and clinical research development.

Revenue from triacetylresveratrol in China is projected to exhibit the highest growth rate with a CAGR of 11.1% through 2035, driven by advanced chemical synthesis capabilities and expanding domestic market for premium bioactive compounds. The country's specialized chemistry expertise in acetylation processes and cost-effective manufacturing scales provide significant competitive advantages in producing high-quality triacetylresveratrol for both domestic consumption and international export markets. Major chemical manufacturers are investing in pharmaceutical-grade production facilities and international quality certifications to serve global nutraceutical and pharmaceutical customers. China's position as a specialized chemical manufacturing hub enables efficient integration of complex acetylation chemistry with cost optimization across raw material sourcing, synthesis processes, and quality control systems. The domestic market expansion reflects growing consumer sophistication regarding bioavailability benefits and increasing investment in premium health products among urban populations with rising disposable incomes. Export market development drives continuous quality improvements and international pharmaceutical compliance achievements among Chinese manufacturers focusing on specialized bioactive compound production. Manufacturing consolidation creates specialized production centers with economies of scale for complex chemical synthesis processes while maintaining pharmaceutical-grade quality specifications.

The triacetylresveratrol market in India is anticipated to expand at a CAGR of 10.3%, supported by established pharmaceutical chemical manufacturing capabilities and growing nutraceutical market penetration. The country's pharmaceutical industry expertise provides technical foundation and production infrastructure suitable for complex acetylation chemistry and pharmaceutical-grade synthesis requirements. Domestic demand growth reflects rising health consciousness, increasing disposable incomes, and expanding retail distribution of premium bioactive supplements across urban populations seeking scientifically validated health solutions. India's pharmaceutical manufacturing ecosystem offers competitive production costs while maintaining international quality standards required for export markets and domestic pharmaceutical applications. The regulatory environment continues evolving to support novel bioactive ingredients and advanced supplement formulations containing enhanced resveratrol derivatives. Growing consumer acceptance of premium health products creates expanding opportunities for triacetylresveratrol applications across nutraceutical and functional food categories, particularly among educated urban consumers seeking documented bioavailability advantages over conventional alternatives and therapeutic benefits supported by clinical research validation. Professional training and certification programs develop technical expertise among pharmaceutical manufacturers, enabling comprehensive synthesis capabilities that meet international quality standards.

Demand for triacetylresveratrol in Germany is forecasted to grow at a CAGR of 9.4%, supported by the country's emphasis on pharmaceutical research and therapeutic applications requiring advanced bioactive compound development. German companies focus on clinical-grade production and specialized applications requiring highest purity specifications and comprehensive therapeutic validation through clinical studies. The market is characterized by pharmaceutical positioning, research collaboration with academic institutions, and compliance with European Union regulatory frameworks governing novel bioactive ingredients and therapeutic applications. Consumer and healthcare professional preferences favor scientifically validated bioactive compounds with proven therapeutic benefits and documented bioavailability advantages over conventional alternatives. Manufacturing standards emphasize pharmaceutical-grade quality control systems, comprehensive documentation requirements, and clinical validation supporting therapeutic positioning across pharmaceutical and premium nutraceutical applications. The regulatory environment provides frameworks for therapeutic ingredient development while maintaining rigorous safety and efficacy standards through comprehensive approval processes requiring clinical research validation and pharmaceutical-grade quality specifications for commercial applications. German market dynamics prioritize precision manufacturing, quality excellence, and advanced expertise in specialized chemical synthesis.

Revenue from triacetylresveratrol in Brazil is growing at a CAGR of 8.6%, driven by expanding nutraceutical market and increasing consumer awareness of enhanced bioavailability benefits compared to conventional resveratrol formulations. The country's established supplement manufacturing sector provides foundation for specialty bioactive ingredient applications and premium product development targeting health-conscious consumers. Market growth reflects rising urbanization, increasing health consciousness, and growing acceptance of advanced antioxidant supplements among Brazilian consumers seeking enhanced therapeutic benefits and scientifically validated health solutions. Brazil's nutraceutical industry continues developing capabilities for premium bioactive ingredients and specialized supplement formulations incorporating enhanced resveratrol derivatives with documented bioavailability advantages. The domestic market expansion benefits from increasing consumer education about bioavailability differences and expanding retail distribution of premium health products across major metropolitan areas. International partnership opportunities support market development and technology transfer for advanced bioactive ingredient applications. Consumer demographics show growing interest in preventive healthcare approaches and willingness to invest in scientifically validated health products with documented benefits over conventional alternatives. Manufacturing capacity development focuses on meeting international quality standards while serving domestic demand growth across urban populations.

The triacetylresveratrol market in the United States is expanding at a CAGR of 7.8%, driven by advanced clinical research programs and sophisticated consumer understanding of bioavailability benefits. The market benefits from established nutraceutical distribution networks, healthcare professional awareness, and consumer willingness to invest in scientifically validated premium bioactive ingredients with documented therapeutic advantages. American consumers are increasingly focused on clinical validation, pharmaceutical development, and premium positioning through scientific differentiation and therapeutic benefit documentation. The regulatory framework supports clinical research applications while maintaining strict quality standards for novel bioactive compounds. Market development focuses on therapeutic applications, clinical nutrition, and specialized supplement categories requiring advanced bioactive ingredients with proven enhanced cellular uptake characteristics. Healthcare professional education programs promote understanding of enhanced bioavailability advantages and appropriate therapeutic applications. The market demonstrates strong demand for pharmaceutical-grade materials supporting drug development programs and clinical research initiatives targeting cardiovascular, neuroprotective, and anti-aging applications where enhanced bioavailability provides measurable therapeutic benefits over conventional resveratrol formulations. Innovation focus creates specialized therapeutic applications and personalized medicine opportunities.

Revenue from triacetylresveratrol in the UK is projected to grow at a CAGR of 7.0% through 2035, supported by sophisticated research focus and emphasis on clinical validation for therapeutic applications. British research institutions and supplement manufacturers demonstrate strong interest in enhanced bioavailability systems and scientifically validated antioxidant ingredients with documented therapeutic benefits. The market benefits from established pharmaceutical research capabilities and regulatory frameworks supporting clinical development of novel bioactive compounds requiring comprehensive safety and efficacy validation. Market development emphasizes clinical research, therapeutic applications, and premium positioning based on scientific validation and enhanced bioavailability documentation. Consumer and healthcare professional acceptance depends on comprehensive clinical validation, transparent scientific communication, and documented therapeutic advantages over conventional alternatives. The regulatory environment provides clear pathways for novel ingredient development while maintaining rigorous safety and efficacy standards through established pharmaceutical approval processes. Market positioning focuses on evidence-based health products with documented therapeutic benefits, regulatory approval, and clinical research support demonstrating enhanced bioavailability advantages and therapeutic applications. British consumers demonstrate preference for scientifically validated products with comprehensive clinical research support.

The triacetylresveratrol market in Japan is expected to expand at a CAGR of 6.2% through 2035, characterized by stringent quality requirements and comprehensive scientific validation standards for bioactive ingredients. Japanese market dynamics emphasize quality differentiation, scientific substantiation, and long-term therapeutic relationships built through consistent clinical results and transparent research communication practices. The market benefits from established pharmaceutical research infrastructure, consumer acceptance of premium scientifically validated products, and regulatory frameworks supporting clinical development of enhanced bioactive compounds. Manufacturing standards require comprehensive quality documentation and clinical validation supporting therapeutic positioning across pharmaceutical and premium nutraceutical applications requiring highest safety and efficacy standards. Japanese consumers demonstrate preference for products with extensive clinical research support, pharmaceutical-grade quality certifications, and documented bioavailability advantages over conventional alternatives. The regulatory environment emphasizes rigorous safety and efficacy validation through clinical studies and comprehensive quality control systems. Market development focuses on therapeutic applications supported by clinical research and quality differentiation through advanced synthesis technologies. Consumer acceptance requires transparent scientific communication and documented clinical benefits validated through comprehensive research programs.

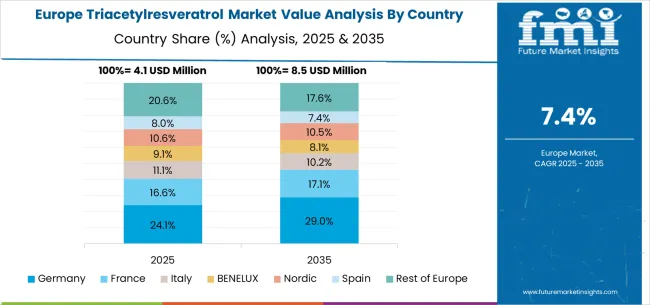

The triacetylresveratrol market in Europe demonstrates specialized development across major economies with Germany showing strong presence through its pharmaceutical research capabilities and consumer preference for scientifically validated bioactive compounds, supported by manufacturers leveraging clinical expertise to develop pharmaceutical-grade triacetylresveratrol formulations that address enhanced bioavailability requirements and therapeutic applications. France represents a significant market driven by its nutraceutical industry expertise and sophisticated understanding of antioxidant science, with companies focusing on premium triacetylresveratrol products that combine French pharmaceutical traditions with advanced acetylation chemistry for enhanced cellular uptake and metabolic stability benefits.

The UK exhibits considerable growth through its emphasis on clinical research and evidence-based ingredient development, with research institutions and supplement manufacturers leading validation studies for triacetylresveratrol applications in cardiovascular and anti-aging formulations. Italy and Spain show expanding interest in enhanced bioavailability solutions, particularly in premium nutraceutical formulations targeting therapeutic benefits and advanced antioxidant protection. BENELUX countries contribute through their focus on pharmaceutical quality standards and specialized chemical manufacturing capabilities, while Eastern Europe and Nordic regions display growing potential driven by increasing pharmaceutical research activities and expanding access to advanced bioactive ingredients across specialized healthcare and research channels.

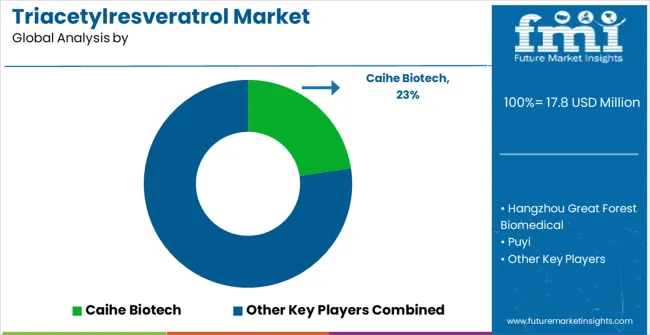

The triacetylresveratrol market operates through a specialized competitive structure with established chemical manufacturers, pharmaceutical ingredient suppliers, and emerging biotechnology companies competing across synthesis expertise, quality capabilities, and clinical application development. Market concentration remains high, with specialized chemical producers focusing on pharmaceutical-grade synthesis and advanced acetylation technologies, while emerging companies pursue niche applications and regional opportunities. Key players in the market include Caihe Biotech, Hangzhou Great Forest Biomedical, Puyi, Suzhou Senfeida Chemical, Sigma-Aldrich (Merck), Enzo Life Sciences, Focus Biomolecules, RayBiotech, AbMole BioScience, Chemodex, Adipogen Life Sciences, and LKT Laboratories. Tier 1 competitors emphasize manufacturing excellence, pharmaceutical-grade quality systems, and global supply capabilities, leveraging proprietary acetylation technologies, comprehensive quality control systems, and established relationships with pharmaceutical and nutraceutical customers.

Tier 2 suppliers compete on specialized synthesis capabilities, regional market expertise, and application-specific formulations, typically serving pharmaceutical development programs, nutraceutical applications, or regional markets while gradually building capabilities for broader commercial opportunities. Tier 3 players include emerging biotechnology companies and specialized chemical producers developing innovative synthesis methods, novel applications, or targeted market segments. Competitive dynamics across tiers revolve around technology advancement, clinical validation, and pharmaceutical partnership development, with market evolution likely to continue toward consolidation among chemical producers and expansion of synthesis capabilities and pharmaceutical-grade certifications through strategic investments and research collaborations.

Competitive dynamics between tiers involve technology advancement, pharmaceutical partnership development, and clinical validation competition. Market evolution suggests continued consolidation among chemical producers while established manufacturers expand synthesis capabilities and pharmaceutical-grade certifications through strategic investments and clinical research partnerships.

| Item | Value |

|---|---|

| Quantitative Units | USD 17.8 million |

| Purity Grade | Purity≥98%, Purity≥99%, Others |

| Application | Food and Beverage, Health Products, Pharmaceutical Intermediates, Cosmetic Formulations |

| Regions Covered | North America, Latin America, Europe, East Asia, South Asia & Pacific, Middle East & Africa |

| Countries Covered | United States, Germany, India, China, United Kingdom, Japan, Brazil |

| Key Companies Profiled | Caihe Biotech, Hangzhou Great Forest Biomedical, Puyi, Suzhou Senfeida Chemical, Sigma-Aldrich (Merck), Enzo Life Sciences, Focus Biomolecules, RayBiotech, AbMole BioScience, Chemodex, Adipogen Life Sciences, LKT Laboratorie |

| Additional Attributes | Dollar sales by purity grade, application, and end-use industry, regional consumption trends across North America, Europe, and Asia-Pacific, competitive landscape with established chemical manufacturers and emerging biotechnology companies, buyer preferences for pharmaceutical-grade versus industrial-grade materials, integration with enhanced bioavailability research and clinical validation studies, innovations in acetylation synthesis technologies and purification processes, and development of therapeutic applications with improved cellular uptake and stability characteristics for pharmaceutical and premium nutraceutical formulations. |

The global triacetylresveratrol market is estimated to be valued at USD 17.8 million in 2025.

The market size for the triacetylresveratrol market is projected to reach USD 39.2 million by 2035.

The triacetylresveratrol market is expected to grow at a 8.2% CAGR between 2025 and 2035.

The key product types in triacetylresveratrol market are purity≥99% and purity≥98%.

In terms of application, food and beverage segment to command 55.0% share in the triacetylresveratrol market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA