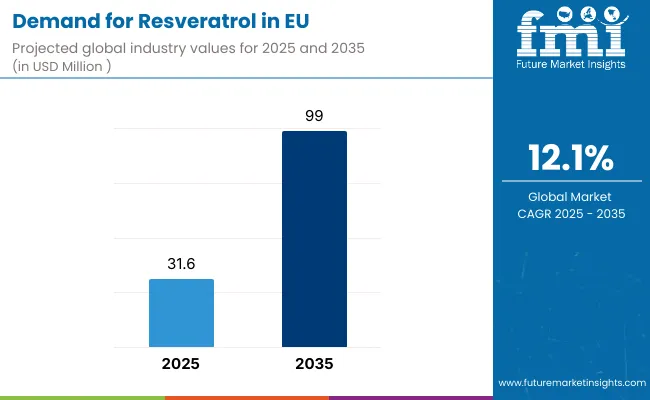

European Union resveratrol sales are projected to increase from USD 31.6 million in 2025 to approximately USD 99 million by 2035, representing an absolute rise of USD 67.7 million over the forecast period. This translates to a total growth of 214.2%, with demand forecasted to expand at a compound annual growth rate (CAGR) of 12.1% between 2025 and 2035. The overall industry size is expected to grow by nearly 3.1 times during the same period, supported by increasing awareness of anti-aging benefits, growing demand for natural antioxidants, and the development of applications across dietary supplements, skincare, and pharmaceutical formulations in European markets.

Between 2025 and 2030, EU resveratrol demand is projected to expand from USD 31.6 million to USD 56.0 million, resulting in a value increase of USD 24.4 million, which represents 36.0% of the total forecast growth for the decade. This phase of development will be shaped by rising consumer awareness of resveratrol's cardiovascular benefits, increasing scientific validation of its anti-aging properties, and growing adoption across nutraceutical and cosmeceutical applications. Manufacturers are expanding their extraction capabilities and developing innovative fermentation technologies to address the evolving demand for high-purity resveratrol with improved bioavailability and standardized potency for pharmaceutical-grade applications.

From 2030 to 2035, sales are forecast to grow from USD 56.0 million to USD 99 million, adding another USD 43.3 million, which constitutes 64.0% of the overall ten-year expansion. This period is expected to be characterized by breakthrough applications in pharmaceutical formulations, integration of resveratrol in premium skincare products targeting anti-aging benefits, and development of synergistic combinations with other bioactive compounds for enhanced efficacy. The growing emphasis on natural ingredients and increasing clinical evidence supporting resveratrol's health benefits will drive demand for premium-quality extracts that deliver consistent therapeutic outcomes with verified purity standards.

Between 2020 and 2025, EU resveratrol sales experienced steady expansion at a CAGR of 9.8%, growing from USD 19.8 million to USD 31.6 million. This period was driven by increasing health consciousness among European consumers, rising awareness of resveratrol's role in the "French Paradox," and growing recognition of its antioxidant properties. The industry developed as nutraceutical companies and cosmetic manufacturers recognized the commercial potential of resveratrol as a premium active ingredient. Product innovations, improved extraction techniques, and bioavailability enhancements began establishing consumer confidence and scientific credibility for resveratrol-based products.

Industry expansion is being supported by the rapid increase in preventive healthcare adoption across European countries and the corresponding demand for scientifically-validated natural compounds with proven antioxidant and anti-inflammatory properties. Modern consumers rely on resveratrol supplements as part of comprehensive wellness routines targeting cardiovascular health, cognitive function, and healthy aging, driving demand for products that deliver therapeutic concentrations with enhanced bioavailability through advanced formulation technologies. The compound's association with red wine's health benefits and Mediterranean diet patterns resonates strongly with European consumers, supporting mainstream acceptance beyond specialized supplement users.

The growing body of clinical research demonstrating resveratrol's potential in addressing age-related conditions, metabolic disorders, and oxidative stress is driving demand for pharmaceutical-grade resveratrol from certified producers with appropriate quality credentials and manufacturing standards. Regulatory authorities are increasingly establishing clear guidelines for resveratrol content claims, purity specifications, and safety assessments to maintain consumer protection and ensure product consistency. Scientific research studies and clinical trials are providing evidence supporting resveratrol's therapeutic benefits, requiring specialized extraction methods and standardized production protocols for consistent trans-resveratrol content, optimal stability, and appropriate bioavailability profiles suitable for therapeutic applications.

Sales are segmented by product type (form), application (end-use), distribution channel, nature (source), and country. By product type, demand is divided into solid and liquid formats. Based on application, sales are categorized into dietary supplements, skincare, pharmaceuticals, hair care, makeup, bath care, fragrance, tools, and others. In terms of distribution channel, demand is segmented into B2B ingredients, online retail/e-commerce, specialty & health stores, and mass retail/grocery. By nature, sales are classified into natural (extract and fermentation) and synthetic. Regionally, demand is focused on Germany, France, Italy, Spain, the Netherlands, and the Rest of Europe.

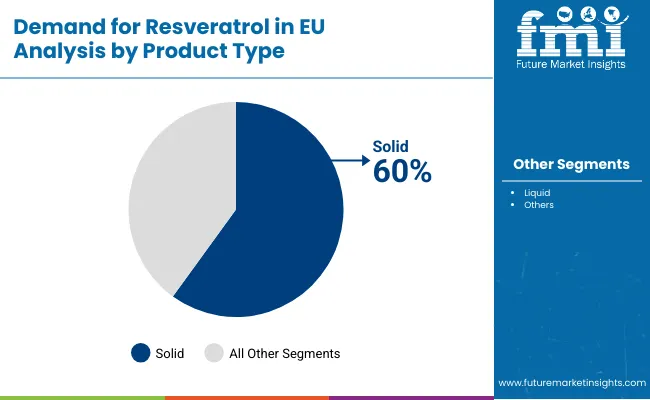

The solid segment is projected to account for 60.0% of EU resveratrol sales in 2025, declining slightly to 57.0% by 2035, establishing itself as the preferred format across pharmaceutical and nutraceutical applications. This commanding position is fundamentally supported by solid formulations' superior stability characteristics, convenient dosing precision for therapeutic applications, and established manufacturing infrastructure enabling cost-effective production. The solid format delivers exceptional versatility, providing manufacturers with a stable ingredient that facilitates extended shelf life, consistent potency maintenance, and flexibility across capsule, tablet, and powder applications essential for commercial success.

This segment benefits from mature encapsulation technologies, well-established quality control protocols, and extensive formulation expertise from multiple ingredient suppliers who maintain rigorous purity standards and continuous innovation. The solid resveratrol offers advantages in bulk transportation, storage efficiency, and formulation flexibility, supported by proven technologies that address traditional challenges in resveratrol's poor water solubility and limited oral bioavailability through advanced delivery systems.

Key advantages:

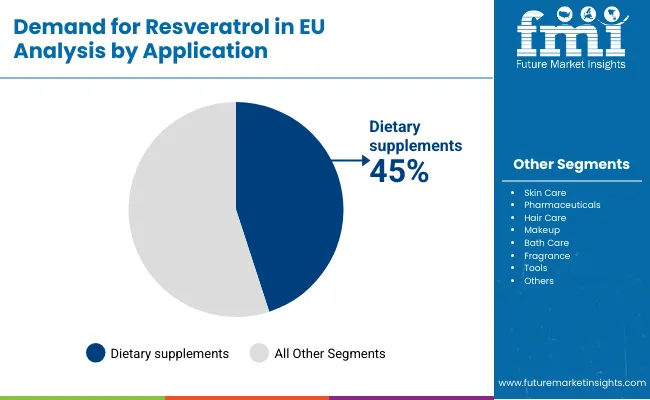

Dietary supplements are positioned to represent 45.0% of total resveratrol demand across European operations in 2025, moderating to 40.0% by 2035, reflecting the segment's maturity as the primary application channel within the overall category. This considerable share directly demonstrates that dietary supplements represent the core market, with consumers purchasing resveratrol capsules, tablets, and powder formulations for cardiovascular support, anti-aging benefits, and general wellness optimization.

Modern consumers increasingly view resveratrol supplements as essential components of preventive health strategies, driving demand for products optimized for bioavailability with appropriate dosing that delivers therapeutic benefits, standardized trans-resveratrol content ensuring consistent efficacy, and combination formulations that enhance synergistic effects with complementary antioxidants. The segment benefits from continuous innovation focused on enhanced delivery systems, time-release formulations, and bioavailability improvements through nanotechnology and liposomal encapsulation.

Key drivers:

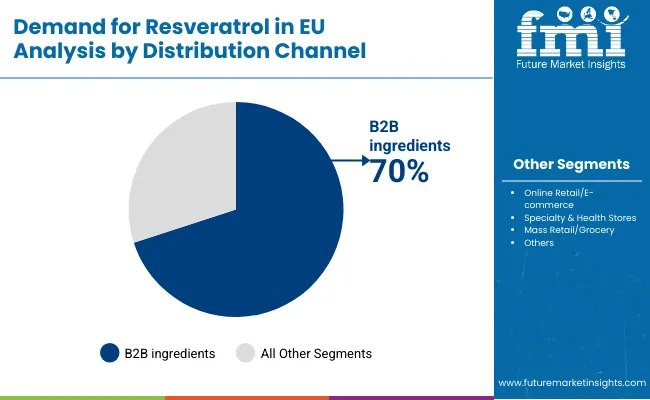

B2B ingredients channels are strategically estimated to control 70.0% of total European resveratrol sales in 2025, declining to 60.0% by 2035, reflecting the critical importance of ingredient supply to manufacturers for formulation development and commercial production. European manufacturers consistently demonstrate growing demand for high-quality resveratrol that delivers consistent purity, reliable supply chain stability, and technical support across pharmaceutical, nutraceutical, and cosmeceutical applications.

The segment provides essential supply chain infrastructure through established ingredient distributors, technical service providers, and specialty chemical companies where expertise optimizes formulation success and product development. Major European ingredient suppliers, including DSM Nutritionals, Evolva, and Sabinsa Corporation, systematically expand resveratrol portfolios, often featuring different purity grades, enhanced bioavailability versions, and application-specific formulations that support diverse manufacturing requirements and end-product specifications.

Success factors:

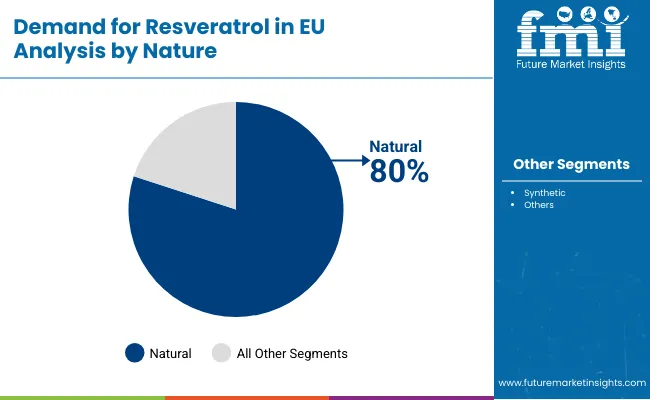

Natural resveratrol products derived from plant extraction and fermentation are strategically positioned to contribute 80.0% of total European sales in 2025, expanding to approximately 85.0% by 2035, representing products produced through botanical extraction from Japanese knotweed, grape skins, or microbial fermentation processes. These natural products successfully deliver consumer-preferred clean-label positioning and perceived safety advantages while ensuring regulatory acceptance across pharmaceutical and nutraceutical applications that prioritize natural sourcing over synthetic alternatives.

Natural production serves health-conscious consumers, premium product developers, and pharmaceutical applications that require naturally-derived active ingredients meeting stringent quality specifications. The segment derives significant competitive advantages from consumer preference for natural ingredients, regulatory favorability in health claims substantiation, and marketing advantages emphasizing botanical origins and traditional use history supporting product credibility.

Competitive advantages:

EU resveratrol sales are advancing rapidly due to increasing clinical evidence supporting health benefits, growing consumer awareness of anti-aging properties, and rising demand for natural antioxidants. The industry faces challenges, including bioavailability limitations affecting therapeutic efficacy, high production costs for pure trans-resveratrol extraction, and regulatory uncertainties regarding health claims substantiation. Continued innovation in delivery technologies and clinical validation remains central to industry development.

The rapidly accelerating development of bioavailability enhancement technologies is fundamentally transforming resveratrol from a poorly absorbed compound to therapeutically effective formulations, enabling blood concentrations previously unattainable through conventional oral administration. Advanced delivery platforms featuring nanotechnology, liposomal encapsulation, and cyclodextrin complexation allow manufacturers to create resveratrol products with 5-10 times higher bioavailability, sustained plasma levels, and genuine therapeutic potential comparable to clinical study doses. These technological innovations prove particularly transformative for pharmaceutical applications, clinical nutrition products, and premium supplements, where bioavailability directly determines therapeutic efficacy.

Major resveratrol manufacturers invest heavily in delivery technology partnerships, clinical bioavailability studies, and formulation optimization programs, recognizing that enhanced absorption represents breakthrough solutions for efficacy challenges limiting market expansion. Manufacturers collaborate with pharmaceutical technology companies, research institutions, and clinical investigators to develop scalable formulations that increase bioavailability while maintaining stability and cost-effectiveness supporting commercial viability.

Modern resveratrol producers systematically implement microbial fermentation technologies, including engineered yeast strains, optimized bioprocessing conditions, and sustainable production methods that deliver consistent purity, reduced environmental impact, and scalable manufacturing capacity exceeding traditional botanical extraction limitations. Strategic integration of fermentation technology enables manufacturers to produce pharmaceutical-grade resveratrol with >99% purity where consistency directly determines regulatory acceptance and clinical application suitability. These production improvements prove essential for pharmaceutical development, as drug manufacturers demand reproducible quality, validated production processes, and supply chain reliability supporting long-term commercial commitments.

Companies implement extensive fermentation optimization programs, strain development partnerships with biotechnology firms, and process validation protocols targeting regulatory compliance, including GMP certification, quality system implementation, and stability demonstration throughout shelf life. Manufacturers leverage fermentation advantages in marketing communications, sustainability reporting featuring reduced environmental footprint, and supply security messaging, positioning fermented resveratrol as technologically advanced alternatives delivering superior consistency.

European pharmaceutical companies increasingly investigate resveratrol's therapeutic potential through rigorous clinical trials targeting cardiovascular disease, metabolic disorders, and neurodegenerative conditions that establish scientific credibility and support regulatory submissions. This clinical development trend enables manufacturers to transition from dietary supplement positioning toward pharmaceutical applications through evidence-based efficacy, safety profiling through controlled studies, and mechanism elucidation supporting therapeutic claims. Clinical validation proves particularly important for healthcare provider acceptance where scientific evidence drives recommendation behavior and formulary inclusion decisions.

The development of pharmaceutical-grade resveratrol formulations, including standardized dosing protocols, validated analytical methods, and stability data packages expands manufacturers' abilities to pursue drug development pathways delivering higher value propositions without supplement market limitations. Companies collaborate with clinical research organizations, academic medical centers, and regulatory consultants to develop clinical programs balancing scientific rigor with commercial feasibility, supporting premium pricing and medical positioning while maintaining development timeline efficiency.

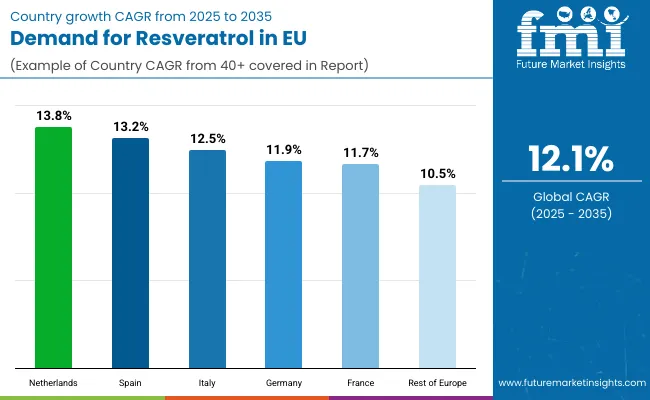

| Country | CAGR % (2025-2035) |

|---|---|

| Netherlands | 13.8% |

| Spain | 13.2% |

| Italy | 12.5% |

| Germany | 11.9% |

| France | 11.7% |

| Rest of Europe | 10.5% |

EU resveratrol sales demonstrate differentiated growth trajectories across major European economies, with emerging markets outpacing established ones through 2035, driven by varying market maturity levels and adoption patterns. Netherlands shows exceptional growth from USD 1.4 million in 2025 to USD 5.1 million by 2035 at 13.8% CAGR. Spain expands rapidly from USD 4.2 million to USD 14.6 million at 13.2% CAGR. Italy records strong growth from USD 5.3 million to USD 17.4 million at 12.5% CAGR. Germany shows steady expansion from USD 11.4 million to USD 35.2 million at 11.9% CAGR. France maintains consistent growth from USD 9.3 million to USD 28.4 million at 11.7% CAGR. Overall, sales show varied regional development reflecting different market dynamics, regulatory environments, and consumer adoption rates across European countries.

Revenue from resveratrol in Germany is projected to exhibit steady growth with a CAGR of 11.9% through 2035, driven by exceptionally well-developed pharmaceutical industry infrastructure, comprehensive regulatory framework for nutraceuticals, and strong consumer commitment to evidence-based supplementation throughout the country. Germany's sophisticated understanding of bioactive compounds and internationally recognized leadership in pharmaceutical development are creating substantial demand for pharmaceutical-grade resveratrol across therapeutic applications.

Major distributors, including pharmaceutical wholesalers, specialized ingredient suppliers, and nutraceutical manufacturers, systematically expand resveratrol portfolios, often offering multiple purity grades and enhanced bioavailability formulations to serve diverse application requirements. German demand benefits from high healthcare expenditure, substantial research investment supporting clinical validation, and regulatory clarity that naturally supports resveratrol adoption across pharmaceutical and supplement sectors.

Growth drivers:

Revenue from resveratrol in France is expanding at a CAGR of 11.7%, reflecting a more mature market with established consumer base and steady adoption patterns. France's unique cultural connections to resveratrol through wine heritage and the "French Paradox" concept have created early market development, resulting in current moderate growth rates as the market transitions from rapid expansion to sustainable maturation. France's sophisticated understanding of polyphenols and continued interest in scientifically-validated natural compounds are maintaining consistent demand for premium resveratrol products across diverse applications.

Major companies, including pharmaceutical manufacturers, cosmetic brands, and supplement producers, actively incorporate resveratrol into formulations leveraging French consumers' positive associations with wine-derived health benefits. French sales particularly benefit from premium positioning emphasis, driving product innovation and quality differentiation within the resveratrol category. Scientific research institutions and clinical studies conducted in France significantly enhance credibility and consumer acceptance of resveratrol-based products.

Success factors:

Revenue from resveratrol in Italy is growing at a robust CAGR of 12.5%, fundamentally driven by increasing integration in premium cosmeceutical applications, expanding pharmaceutical research activities, and growing wellness consciousness among affluent Italian consumers. Italy's strong beauty and personal care industry is increasingly incorporating resveratrol into anti-aging formulations, creating additional demand beyond traditional supplement applications.

Major Italian cosmetic manufacturers, pharmaceutical companies, and supplement producers actively develop innovative resveratrol applications leveraging Italy's reputation for premium beauty products and Mediterranean wellness traditions. Italian sales particularly benefit from synergies between fashion, beauty, and wellness sectors, driving premium product development and luxury positioning within the resveratrol category. The country's emphasis on aesthetic medicine and anti-aging treatments significantly enhances demand for high-quality resveratrol ingredients.

Development factors:

Demand for resveratrol in Spain is projected to grow at an impressive CAGR of 13.2%, substantially supported by rapidly evolving health consciousness, expanding distribution networks, and increasing consumer education about preventive nutrition. Spanish consumer transformation toward wellness-oriented lifestyles positions resveratrol as perfectly aligned with contemporary health trends, particularly among younger demographics embracing supplementation.

Major Spanish retailers, pharmacy chains, and e-commerce platforms systematically expand resveratrol offerings, with increased accessibility driving mainstream adoption through competitive pricing and consumer education initiatives. Spain's growing fitness culture and sports nutrition sector support resveratrol integration into performance and recovery formulations, expanding beyond traditional anti-aging applications. The country's improving economic conditions and rising disposable income enable premium supplement purchases previously limited to higher-income segments.

Growth enablers:

Demand for resveratrol in the Netherlands is expanding at a leading CAGR of 13.8%, fundamentally driven by exceptional biotechnology innovation capabilities, progressive regulatory environment for novel ingredients, and sophisticated consumer base with high scientific literacy. Dutch companies demonstrate particular strength in fermentation technology and bioavailability enhancement, positioning the Netherlands as European innovation hub for advanced resveratrol development.

Netherlands sales significantly benefit from strategic location as European distribution center, facilitating ingredient trade and formulation development for broader European markets. The country's world-class research institutions, including Wageningen University and TNO, conduct cutting-edge resveratrol research advancing clinical validation and application development. Dutch consumers' early adoption tendencies and willingness to try innovative health products support rapid market penetration for next-generation resveratrol formulations, particularly those featuring enhanced bioavailability or novel delivery systems.

Innovation drivers:

EU resveratrol sales are projected to grow from USD 31.6 million in 2025 to USD 99 million by 2035, registering a robust CAGR of 12.1% over the forecast period. The Netherlands is expected to demonstrate the strongest growth trajectory with a 13.8% CAGR, supported by innovative biotechnology sector, strong research infrastructure, and early adoption of novel health ingredients. Spain follows with 13.2% CAGR, attributed to rapidly expanding wellness market and increasing health consciousness among younger demographics.

Germany maintains the largest share at 36.1% in 2025, driven by advanced pharmaceutical infrastructure and strong supplement culture, while growing at 11.9% CAGR. France follows with 29.4% share and 11.7% CAGR growth. Italy demonstrates 12.5% CAGR, benefiting from premium positioning in cosmeceutical applications.

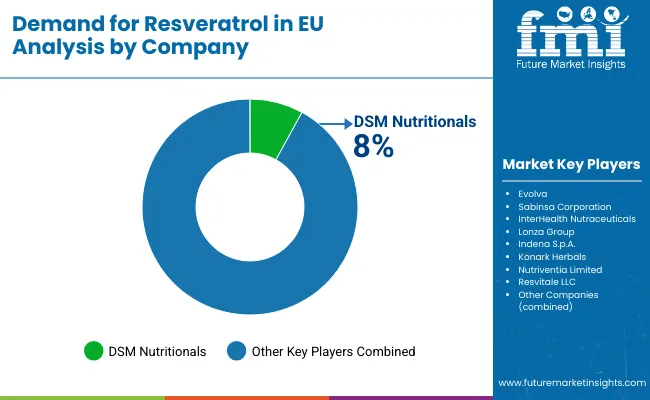

EU resveratrol sales are defined by competition among specialty ingredient suppliers, biotechnology companies, and pharmaceutical manufacturers. Companies are investing in extraction technologies, fermentation processes, bioavailability enhancement, and clinical validation to deliver high-quality, therapeutically effective, and commercially viable resveratrol solutions. Strategic partnerships with research institutions, pharmaceutical developers, and nutraceutical manufacturers emphasizing quality consistency and technical support are central to strengthening competitive position.

Major participants include DSM Nutritionals with an estimated 8.0% share, leveraging its nutritional ingredient expertise, European distribution network, and technical service capabilities through comprehensive product support. DSM benefits from established customer relationships, formulation expertise, and ability to provide application-specific solutions supporting customer success.

Evolva holds approximately 7.0% share, emphasizing fermentation technology leadership, sustainable production methods, and consistent quality through biotechnology platforms. Evolva's success in developing fermentation-derived resveratrol with superior purity creates strong positioning and customer acceptance, supported by supply chain reliability and environmental sustainability messaging.

Sabinsa Corporation accounts for roughly 6.0% share through its position as botanical extract specialist with extensive phytochemical expertise, providing standardized resveratrol through validated extraction processes. The company benefits from vertical integration, quality certification, and comprehensive documentation supporting regulatory compliance, attracting pharmaceutical and nutraceutical customers seeking reliable ingredient partners.

Other companies collectively hold 79.0% share, reflecting the fragmented nature of European resveratrol sales, where numerous ingredient suppliers, regional distributors, contract manufacturers, and emerging biotechnology companies serve specific applications, quality requirements, and customer segments.

| Item | Value |

|---|---|

| Quantitative Units | USD 99 million |

| Product Type (Form) | Solid, Liquid |

| Application (End-use) | Dietary Supplements, Skincare, Pharmaceuticals, Hair Care, Makeup, Bath Care, Fragrance, Tools, Others |

| Distribution Channel | B2B Ingredients, Online Retail/E-commerce, Specialty & Health Stores, Mass Retail/Grocery |

| Nature (Source) | Natural (Extract + Fermentation), Synthetic |

| Countries Covered | Germany, France, Italy, Spain, the Netherlands, and the Rest of Europe |

| Key Companies Profiled | DSM Nutritionals, Evolva, Sabinsa Corporation, Specialized suppliers |

Solid

The global demand for resveratrol in EU is estimated to be valued at USD 31.6 million in 2025.

The market size for the demand for resveratrol in EU is projected to reach USD 99.0 million by 2035.

The demand for resveratrol in EU is expected to grow at a 12.1% CAGR between 2025 and 2035.

The key product types in demand for resveratrol in EU are solid and liquid.

In terms of application (end-use), dietary supplements segment to command 45.0% share in the demand for resveratrol in EU in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Resveratrol Industry Analysis in Western Europe Size and Share Forecast Outlook 2025 to 2035

Europe Radiotherapy Patient Positioning Market Size and Share Forecast Outlook 2025 to 2035

Europe Polyvinyl Alcohol Industry Analysis Size and Share Forecast Outlook 2025 to 2035

Europe Cruise Market Forecast and Outlook 2025 to 2035

Europium Market Forecast and Outlook 2025 to 2035

Eucommia Leaf Extract Market Size and Share Forecast Outlook 2025 to 2035

Europe Massage Therapy Service Market Size and Share Forecast Outlook 2025 to 2035

Europe Cement Market Analysis Size and Share Forecast Outlook 2025 to 2035

European Union Tourism Industry Size and Share Forecast Outlook 2025 to 2035

Europe Injection Molding Machines Market Size and Share Forecast Outlook 2025 to 2035

Europe Injection Moulders Market Size and Share Forecast Outlook 2025 to 2035

Europe and MENA Generic Oncology Drug Market Size and Share Forecast Outlook 2025 to 2035

Europe Masking Tapes Market Size and Share Forecast Outlook 2025 to 2035

Europe Liners Market Size and Share Forecast Outlook 2025 to 2035

Europe Dermal Fillers Market Size and Share Forecast Outlook 2025 to 2035

Europe Trolley Bus Market Size and Share Forecast Outlook 2025 to 2035

EU Battery Passport Solutions Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Resveratrol Enriched Formulas Market Size and Share Forecast Outlook 2025 to 2035

Europe Protease Market Size and Share Forecast Outlook 2025 to 2035

Europe Luxury Packaging Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA