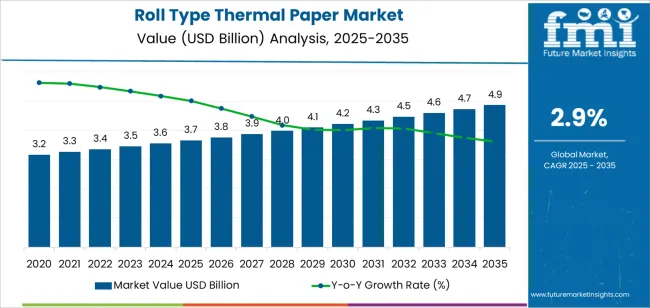

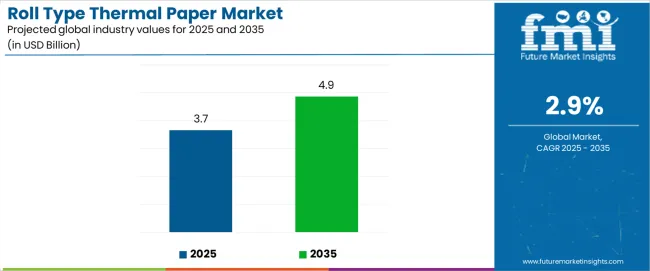

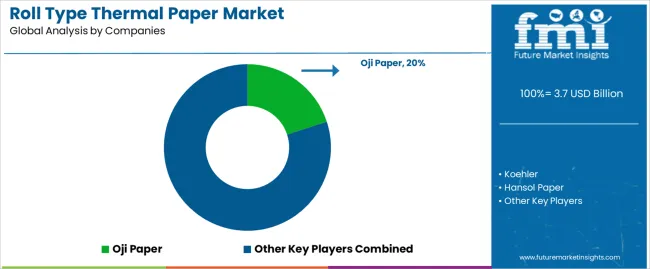

The global Roll Type Thermal Paper market is projected to grow from USD 3.7 billion in 2025 to approximately USD 4.9 billion by 2035, recording an absolute increase of USD 1,209.3 million over the forecast period. This translates into a total growth of 33.1%, with the market forecast to expand at a CAGR of 2.9% between 2025 and 2035.

The market size is expected to grow by 1.33X during the same period, supported by increasing demand for point-of-sale receipts, expanding e-commerce logistics operations, and growing adoption of thermal printing technologies across retail, hospitality, and healthcare sectors worldwide.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 3.7 billion |

| Market Forecast Value (2035) | USD 4.9 billion |

| Forecast CAGR (2025 to 2035) | 2.9% |

| RETAIL & E-COMMERCE EXPANSION | LOGISTICS & SUPPLY CHAIN GROWTH | TECHNOLOGY & EFFICIENCY ADVANCES |

|---|---|---|

| Point-of-Sale Growth - Expanding retail operations and increased transaction volumes driving demand for thermal receipt printing across supermarkets, restaurants, and specialty stores globally. | Shipping Label Requirements - Growing e-commerce logistics necessitating thermal paper for shipping labels, tracking documentation, and warehouse management systems. | Print Quality Enhancement - Advanced thermal coating technologies delivering improved print clarity, fade resistance, and operational durability for professional applications. |

| Restaurant & Hospitality - Food service industry expansion requiring thermal paper for order tickets, receipts, and kitchen communication systems supporting operational efficiency. | Inventory Management - Warehouse operations implementing thermal printing for barcode labels, inventory tracking, and automated sorting systems requiring reliable paper performance. | Speed & Efficiency - Thermal printing offering instant output without ink requirements, reducing operational costs and maintenance compared to traditional printing methods. |

| Mobile Payment Integration - Digital payment systems generating increased receipt printing as businesses maintain transaction records and customer service requirements. | Cold Chain Documentation - Temperature-sensitive logistics requiring thermal paper for monitoring labels and documentation throughout pharmaceutical and food distribution networks. | Environmental Considerations - Development of eco-friendly thermal paper formulations reducing environmental impact while maintaining performance standards. |

| Category | Segments / Values |

|---|---|

| By GSM Type | Below 60GSM; 60-100GSM; Above 100GSM |

| By Application | Retail; Logistics; Catering; Medical; Others |

| By End-Use Industry | Food & Beverage; Healthcare; Transportation; Banking; Hospitality; Others |

| By Distribution Channel | Direct Sales; Distributors; Online Channels; Specialty Paper Suppliers |

| By Region | Asia Pacific; North America; Europe; Latin America; Middle East & Africa |

| Segment | 2025 to 2035 Outlook |

|---|---|

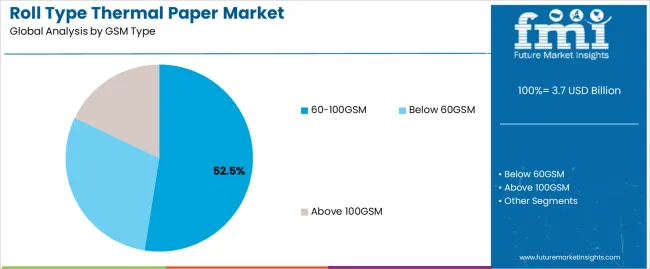

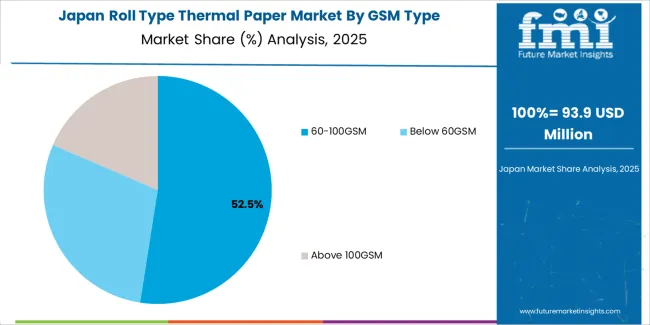

| 60-100GSM | Market leader in 2025 with 52.5% market share, optimal balance of durability and cost-effectiveness for standard retail and logistics applications. Provides excellent print quality while maintaining reasonable thickness for storage. Momentum: steady growth driven by mainstream adoption. Watchouts: competition from lighter weight options in cost-sensitive applications. |

| Below 60GSM | Cost-effective solution with 28.8% share, primarily used in high-volume, short-term receipt applications where storage longevity is less critical. Popular in quick-service restaurants and basic retail operations. Momentum: moderate growth in price-sensitive markets. Watchouts: durability limitations and print quality concerns. |

| Above 100GSM | Premium segment with 18.7% share, utilized in applications requiring enhanced durability, archival quality, and professional presentation such as medical records and important documentation. Momentum: growing in specialized applications. Watchouts: higher costs limiting mass market adoption. |

| Segment | 2025 to 2035 Outlook |

|---|---|

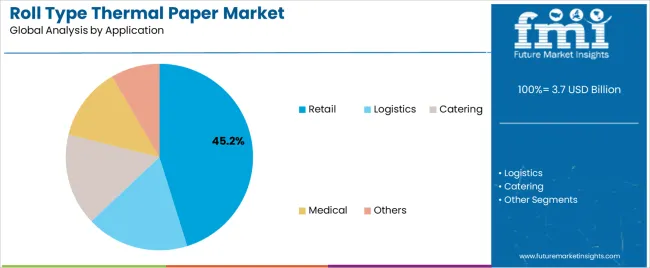

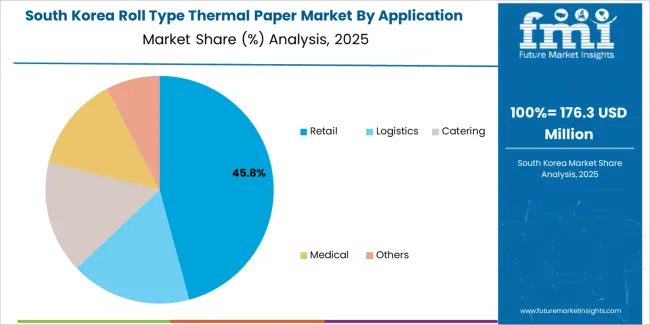

| Retail | Dominant application segment in 2025 with 45.2% share, encompassing point-of-sale receipts, price labels, and customer documentation across supermarkets, department stores, and specialty retailers. Momentum: strong growth from retail expansion and transaction volume increases. Watchouts: digital receipt adoption and environmental concerns about paper waste. |

| Logistics | Rapidly growing segment with 26.5% share, driven by e-commerce expansion requiring shipping labels, tracking documentation, and warehouse management systems. Critical for supply chain operations and package identification. Momentum: excellent growth prospects from continued e-commerce development. Watchouts: competition from digital tracking systems and label alternatives. |

| Catering | Food service segment with 15.3% share, including restaurant receipts, kitchen order tickets, and delivery documentation. Essential for operational efficiency in quick-service and full-service establishments. Momentum: steady growth from restaurant industry expansion. Watchouts: digital ordering systems and environmental regulations. |

| Medical | Specialized segment with 8.7% share, utilized for patient records, prescription labels, laboratory results, and medical device outputs requiring archival quality and regulatory compliance. Momentum: growing with healthcare digitization and documentation requirements. Watchouts: electronic health records reducing some paper-based applications. |

| Others | Includes banking, transportation, and specialty applications accounting for 4.3% share. Encompasses ATM receipts, parking tickets, and various industrial labeling requirements. Momentum: selective growth in niche applications. |

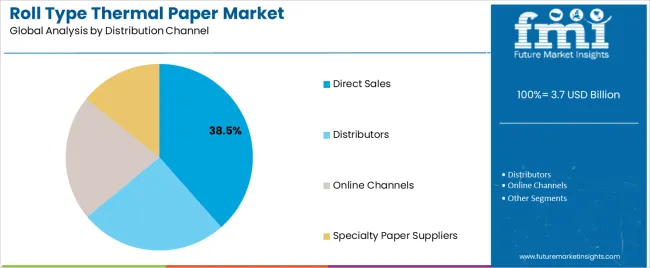

| Distribution Channel | Status & Outlook (2025 to 2035) |

| Direct Sales | Primary channel in 2025 with 38.5% share for large-volume customers including major retailers, logistics companies, and healthcare systems. Offers customized solutions, bulk pricing, and technical support. Momentum: steady growth driven by relationship-based sales and volume contracts. Watchouts: margin pressure from competitive bidding and procurement processes. |

| Distributors | Traditional channel with 35.2% share serving mid-size businesses and regional markets. Provides inventory management, local service, and product variety for diverse customer requirements. Momentum: stable growth through established relationships and service capabilities. Watchouts: disintermediation as manufacturers develop direct customer relationships. |

| Online Channels | Emerging channel with 16.8% share, growing rapidly among small businesses and cost-conscious buyers seeking competitive pricing and convenient ordering. Momentum: strong growth as digital procurement increases and B2B e-commerce expands. Watchouts: price transparency reducing profit margins and service differentiation challenges. |

| Specialty Paper Suppliers | Niche channel with 9.5% share focusing on technical applications and specialized requirements such as medical-grade or archival-quality thermal paper. Momentum: moderate growth in high-value applications requiring technical expertise and certification. Watchouts: limited market size and specialized knowledge requirements. |

| DRIVERS | RESTRAINTS | KEY TRENDS |

|---|---|---|

| E-commerce Growth driving increased demand for shipping labels, tracking documentation, and logistics applications across global supply chains and last-mile delivery operations. | Digital Receipt Adoption - Growing consumer preference for electronic receipts and mobile payment confirmations reducing traditional paper receipt requirements. | Eco-Friendly Formulations - Development of phenol-free and recyclable thermal paper options addressing environmental concerns and regulatory requirements. |

| Retail Sector Expansion - Growing number of retail outlets, restaurants, and service establishments requiring point-of-sale documentation and customer receipts for business operations. | Environmental Regulations - Increasing restrictions on thermal paper chemicals and waste disposal requirements impacting traditional formulations and usage patterns. | Smart Labeling Integration - Combination of thermal printing with RFID technology and QR codes enabling enhanced tracking and digital connectivity. |

| Healthcare Documentation - Expanding medical facilities and patient care requirements driving demand for reliable thermal printing in diagnostic equipment and record-keeping systems. | Alternative Technologies - Competition from digital displays, mobile apps, and paperless documentation systems in various application segments. | Premium Quality Standards - Enhanced print durability, fade resistance, and archival properties meeting professional and regulatory requirements. |

| Manufacturing Automation - Industrial operations implementing thermal printing for inventory tracking, quality control documentation, and production labeling requirements. | Raw Material Costs - Fluctuating prices for thermal coating chemicals and paper substrates affecting profitability and pricing strategies. | Customization Capabilities - Specialized formulations for specific applications including temperature-resistant, water-resistant, and chemical-resistant variants. |

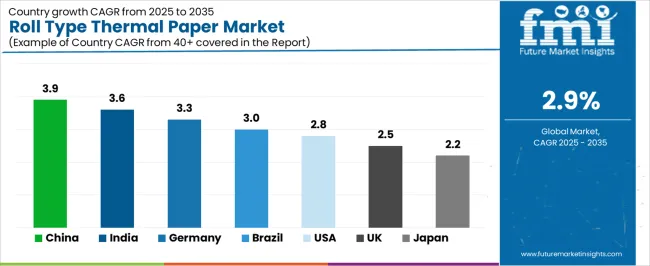

| Country | CAGR (2025 to 2035) |

|---|---|

| China | 3.9% |

| India | 3.6% |

| Germany | 3.3% |

| Brazil | 3.0% |

| United States | 2.8% |

| United Kingdom | 2.5% |

| Japan | 2.2% |

Revenue from roll type thermal paper in China is projected to reach USD 1,892.5 million by 2035, driven by comprehensive manufacturing infrastructure and extensive domestic demand from retail, logistics, and industrial applications creating substantial opportunities for paper manufacturers across consumer goods operations, e-commerce fulfillment centers, and export-oriented production facilities. The country's established paper manufacturing expertise and expanding thermal coating technologies are creating significant demand for both standard and specialized thermal paper products. Major paper companies including Shandong Chenming Paper, Gold East Paper, and Shandong Sun Paper are establishing advanced thermal coating facilities to support large-scale production operations and meet growing demand for efficient printing solutions.

Revenue from roll type thermal paper in India is expanding to reach USD 1,156.8 million by 2035, supported by extensive digital payment adoption and comprehensive retail sector modernization creating demand for thermal paper solutions across diverse point-of-sale applications and logistics operations. The country's growing organized retail sector and expanding e-commerce infrastructure are driving demand for thermal paper products that provide consistent print quality while supporting cost-effective operational requirements. Paper manufacturers and coating specialists are investing in local production capabilities to support growing consumer operations and professional printing demand.

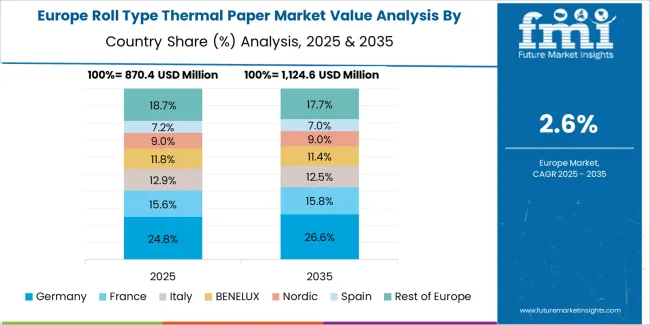

Demand for roll type thermal paper in Germany is projected to reach USD 847.3 million by 2035, supported by the country's leadership in precision manufacturing and advanced thermal coating technologies requiring sophisticated chemical formulations for professional and industrial applications. German paper companies are implementing high-precision coating systems that support enhanced print quality, operational reliability, and comprehensive performance protocols. The market is characterized by focus on technical innovation, environmental compliance, and adherence to stringent quality and performance standards.

Revenue from roll type thermal paper in Brazil is growing to reach USD 658.4 million by 2035, driven by retail sector expansion programs and increasing point-of-sale technology adoption creating opportunities for thermal paper suppliers serving both consumer electronics operations and commercial printing contractors. The country's expanding retail infrastructure and growing middle-class consumption are creating demand for thermal paper products that support diverse transactional requirements while maintaining cost-effectiveness. Paper distributors and printing service providers are developing supply strategies to support operational efficiency and customer satisfaction.

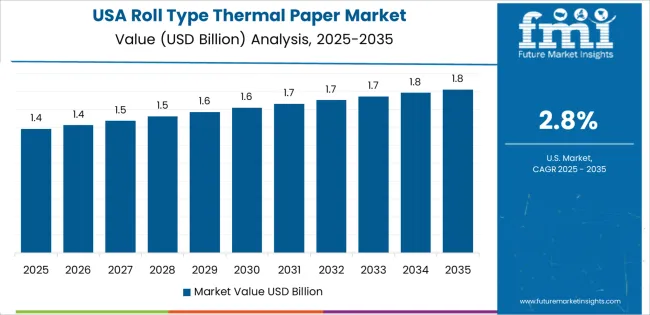

Demand for roll type thermal paper in United States is projected to reach USD 596.7 million by 2035, expanding at a CAGR of 2.8%, driven by premium retail excellence and specialized healthcare applications supporting advanced point-of-sale development and comprehensive medical documentation requirements. The country's established retail technology infrastructure and mature thermal printing market segments are creating demand for high-quality thermal paper products that support operational performance and regulatory standards. Paper manufacturers and specialty suppliers are maintaining comprehensive production capabilities to support diverse customer requirements.

Revenue from roll type thermal paper in United Kingdom is growing to reach USD 445.2 million by 2035, supported by retail sector excellence and established commercial printing capabilities driving demand for thermal paper solutions across traditional retail systems and professional documentation applications. The country's mature retail infrastructure and comprehensive regulatory compliance requirements create demand for thermal paper products that support both standard commercial applications and specialized professional requirements.

Demand for roll type thermal paper in Japan is projected to reach USD 394.8 million by 2035, driven by precision manufacturing tradition and established thermal coating technology leadership supporting both domestic commercial markets and export-oriented component production. Japanese companies maintain sophisticated thermal paper development capabilities, with established manufacturers continuing to lead in coating formulation technology and print quality standards.

European roll type thermal paper operations are increasingly concentrated between German technical excellence and Scandinavian manufacturing sustainability. German facilities dominate premium thermal paper production for industrial and professional applications, leveraging advanced coating technologies and strict environmental protocols that command price premiums in global markets. Nordic manufacturers maintain leadership in eco-friendly thermal paper development and large-volume production, with companies driving technical specifications that smaller suppliers must meet to access European commercial contracts.

Eastern European operations in Poland and Czech Republic are capturing cost-competitive production contracts through skilled manufacturing advantages and EU regulatory compliance, particularly in standard-grade thermal paper for retail and logistics applications. These facilities increasingly serve as production capacity for Western European brands while developing their own coating expertise.

The regulatory environment presents both opportunities and constraints. REACH compliance requirements create quality standards that favor established European manufacturers over imports while ensuring consistent chemical safety specifications. Brexit has created complexity for UK thermal paper sourcing from EU suppliers, driving opportunities for direct relationships between manufacturers and international distributors.

Supply chain consolidation accelerates as manufacturers seek economies of scale to absorb rising chemical costs and coating technology expenses. Vertical integration increases, with major paper manufacturers acquiring thermal coating facilities to secure component supplies and quality control. Smaller manufacturers face pressure to specialize in niche applications or risk displacement by larger, more efficient operations serving mainstream commercial requirements.

South Korean roll type thermal paper operations reflect the country's advanced manufacturing sector and technology integration capabilities. Major electronics companies drive thermal paper procurement strategies for their retail and industrial divisions, establishing direct relationships with specialized paper suppliers to secure consistent quality and pricing for their point-of-sale and documentation systems targeting both domestic and export markets.

The Korean market demonstrates particular strength in integrating thermal paper applications with digital technology systems, with companies developing solutions that bridge traditional printing and modern data capture systems. This integration approach creates demand for specific performance specifications that differ from traditional applications, requiring suppliers to adapt coating formulations and paper characteristics.

Regulatory frameworks emphasize chemical safety and environmental protection, with Korean Ministry of Environment standards often exceeding international requirements. This creates barriers for smaller paper suppliers but benefits established manufacturers who can demonstrate compliance capabilities. The regulatory environment particularly favors suppliers with K-REACH certification and comprehensive environmental documentation systems.

Supply chain efficiency remains critical given Korea's export-oriented business model and competitive market dynamics. Companies increasingly pursue development contracts with suppliers in Japan, Germany, and specialized manufacturers to ensure access to advanced thermal coating technologies while managing supply risks. Investment in research and development supports quality advancement during extended product development cycles.

Profit pools are consolidating upstream in thermal coating chemistry development and downstream in application-specific thermal paper solutions for retail, logistics, and professional markets where print quality, durability, and regulatory compliance command premiums. Value is migrating from basic thermal paper production to specification-driven, application-ready products where coating expertise, environmental compliance, and reliable performance create competitive advantages.

Several archetypes define market leadership: established Asian manufacturers defending share through production scale and cost efficiency; European specialty producers leveraging technical innovation and environmental standards; North American suppliers focusing on premium applications and customer service; and emerging manufacturers pursuing cost-competitive production while developing coating capabilities.

Switching costs - equipment compatibility, supplier qualification, print quality consistency - provide stability for established suppliers, while technological advancement and environmental requirements create opportunities for innovative manufacturers.

Consolidation continues as companies seek manufacturing scale; direct sales channels grow for large-volume customers while traditional distribution remains service-driven. Focus areas: secure retail and logistics market positions with application-specific performance specifications and technical support; develop thermal coating technology and environmental compliance capabilities; explore specialized applications including medical and industrial requirements.

| Stakeholder Type | Primary Advantage | Repeatable Plays |

|---|---|---|

| Asian Volume Producers | Manufacturing scale; cost efficiency; established supply chains | Large-volume production; competitive pricing; market penetration |

| European Technical Specialists | Advanced coating technology; environmental compliance; premium quality | Technical innovation; regulatory leadership; specialized applications |

| North American Service Leaders | Customer relationships; application expertise; supply chain reliability | Service excellence; market knowledge; relationship-based sales |

| Emerging Manufacturers | Production flexibility; competitive costs; market responsiveness | Cost competition; capacity development; regional market focus |

| Specialty Distributors | Market knowledge; customer service; inventory management | Technical support; logistics capabilities; customer education |

| Item | Value |

|---|---|

| Quantitative Units | USD 3.7 billion |

| GSM Types | Below 60GSM; 60-100GSM; Above 100GSM |

| Applications | Retail; Logistics; Catering; Medical; Others |

| End-Use Industries | Food & Beverage; Healthcare; Transportation; Banking; Hospitality; Others |

| Distribution Channels | Direct Sales; Distributors; Online Channels; Specialty Paper Suppliers |

| Regions Covered | Asia Pacific; North America; Europe; Latin America; Middle East & Africa |

| Key Countries | China; India; Germany; Brazil; United States; United Kingdom; Japan (+35 additional countries) |

| Key Companies Profiled | Oji Paper; Koehler; Hansol Paper; Ricoh; Mitsubishi HiTec Paper; Zhejiang Xianhe Special Paper; Guangdong Guanhao High-tech; HENAN JIANGHE PAPER; Shandong Chenming Paper; Guangdong Weiminte Technology; Gold East Paper; Shandong Sun Paper; Shenzhen Jinbao Xiongdi Paper Industry; Guangdong Tango Information Paper; Suzhou Guanwei Thermal Paper |

| Additional Attributes | Dollar sales by GSM type and distribution channel; Regional demand trends (APAC, NA, EU); Competitive landscape; Direct vs. distributor sales patterns; Manufacturing and coating integration; Thermal coating innovations driving print quality, durability enhancement, and environmental compliance |

The global roll type thermal paper market is estimated to be valued at USD 3.7 billion in 2025.

The market size for the roll type thermal paper market is projected to reach USD 4.9 billion by 2035.

The roll type thermal paper market is expected to grow at a 2.9% CAGR between 2025 and 2035.

The key product types in roll type thermal paper market are 60-100gsm, below 60gsm and above 100gsm.

In terms of application, retail segment to command 45.2% share in the roll type thermal paper market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Roller Press Gear Units Market Size and Share Forecast Outlook 2025 to 2035

Rolling Stock Management Market Forecast Outlook 2025 to 2035

Roll Handling Machine Market Size and Share Forecast Outlook 2025 to 2035

Roll-dried Starch Market Size and Share Forecast Outlook 2025 to 2035

Rolling Stocks Market Size and Share Forecast Outlook 2025 to 2035

Roller Sports Product Market Size and Share Forecast Outlook 2025 to 2035

Rolled-Dried Starch Market Size and Share Forecast Outlook 2025 to 2035

Rolling Mill Machine Market Size and Share Forecast Outlook 2025 to 2035

Roll-up Laminate Tubes Market Analysis Size and Share Forecast Outlook 2025 to 2035

Rolled Or Extruded Aluminum Rods Bars And Wires Market Size and Share Forecast Outlook 2025 to 2035

Roll Containers Market Size and Share Forecast Outlook 2025 to 2035

Roll Trailer Market Growth – Trends & Forecast 2025 to 2035

Roll-Your-Own Tobacco Products Market Trends - Growth & Forecast 2025 to 2035

Industry Share & Competitive Positioning in Roll Forming Machines

Market Share Breakdown of Roll Containers Manufacturers

Roll Forming Machine Market by Type from 2024 to 2034

Rolle Market

Roll Slitting Machine Market

Roll-on Bottles Market

Rolling Papers Market Trends - Growth & Demand 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA