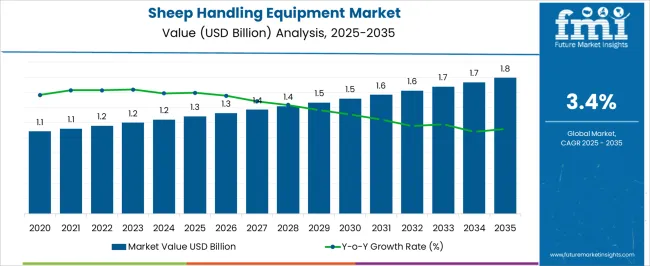

The Sheep Handling Equipment Market is estimated to be valued at USD 1.3 billion in 2025 and is projected to reach USD 1.8 billion by 2035, registering a compound annual growth rate (CAGR) of 3.4% over the forecast period.

| Metric | Value |

|---|---|

| Sheep Handling Equipment Market Estimated Value in (2025 E) | USD 1.3 billion |

| Sheep Handling Equipment Market Forecast Value in (2035 F) | USD 1.8 billion |

| Forecast CAGR (2025 to 2035) | 3.4% |

The Sheep Handling Equipment Market is experiencing stable growth as livestock management practices across major agricultural economies continue to modernize. The market is being shaped by the growing demand for efficient, safe, and welfare-compliant systems that reduce manual labor and animal stress. Agricultural publications and industry news have emphasized that farmers are increasingly investing in adaptable and mobile systems due to the need for flexible operations across varying terrain and flock sizes.

Advancements in materials, combined with ergonomic designs and the need for productivity gains, are enabling a shift from traditional equipment to engineered solutions. The growing emphasis on animal welfare regulations and worker safety protocols has also fueled innovation in this market.

Additionally, increased funding for livestock farming infrastructure and modernization schemes, particularly in emerging rural economies, has created fresh avenues for adoption These market dynamics are expected to continue supporting the positive trajectory of sheep handling equipment across global markets.

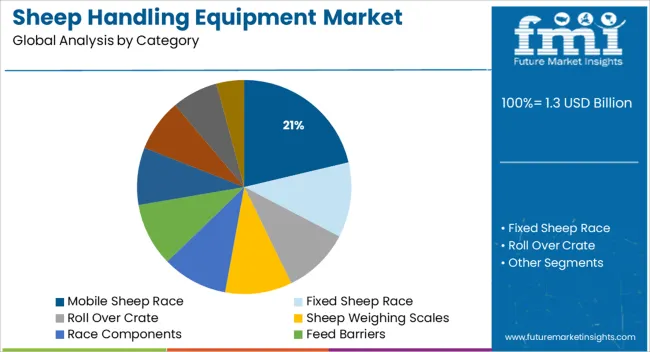

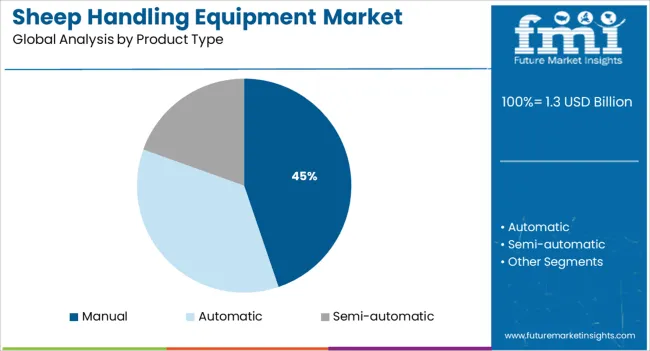

The market is segmented by Category and Product Type and region. By Category, the market is divided into Mobile Sheep Race, Fixed Sheep Race, Roll Over Crate, Sheep Weighing Scales, Race Components, Feed Barriers, Pen Division, Walk through feeder, Sheep Plastic, and Other. In terms of Product Type, the market is classified into Manual, Automatic, and Semi-automatic. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The mobile sheep race category is expected to account for 21.3% of the Sheep Handling Equipment Market revenue share in 2025, marking it as a significant segment in the overall landscape. This growth has been supported by the rising need for transportable, lightweight, and durable systems that offer convenience in flock movement and treatment across variable grazing locations.

According to insights from agriculture-focused publications and equipment supplier press releases, mobile sheep races have been increasingly preferred by small to mid-sized sheep farms aiming to reduce handling time and physical strain. The segment’s strong performance has been enabled by its compatibility with modular attachments and accessories, which enhance utility without compromising ease of transport.

Furthermore, adoption has been reinforced by government-supported livestock welfare initiatives that emphasize stress-free handling The segment has also gained traction due to its ability to operate without permanent infrastructure, making it ideal for rotational grazing systems and field-based veterinary interventions.

The manual product type is projected to hold 44.8% of the Sheep Handling Equipment Market revenue share in 2025, making it the dominant product type in this space. This leadership position has been driven by the affordability, simplicity, and widespread availability of manual equipment, especially in developing agricultural regions.

Farmers continue to prefer manual systems due to their low maintenance requirements, operational reliability, and independence from power sources, as highlighted in agricultural trade platforms and livestock equipment demonstrations. The segment’s strength is also being attributed to its strong presence in established supply chains and its suitability for operations where automation is not economically viable.

Adoption has been further encouraged by familiarity among users, ease of training, and minimal setup time, especially in traditional and smallholder farming settings These characteristics have allowed manual systems to maintain strong market penetration, with their relevance expected to persist alongside gradual integration of semi-automated tools in more mechanized farms.

When compared to the 3.0% CAGR recorded between 2020 and 2025, the sheep-handling equipment business is predicted to expand at a 3.4% CAGR between 2025 and 2035. The average growth of the market is expected to be approx 44% between 2025 and 2035.

| Market Statistics | Details |

|---|---|

| Market Share (2020) | USD 985.8 million |

| Market Share (2024) | USD 1,145.3 million |

| Market Share (2025) | USD 1,180.1 million |

Short-term Growth (2025 to 2029): it's becoming more and more common to handle sheep using low-stress animal handling methods, leading towards potential growth.

Medium-term Growth (2035 to 2035): market expansion is accelerated by an increase in the use of breeding and milking equipment to increase total yield and management techniques.

Long-term Growth (2035 to 2035): An essential commercial development has been the creation of portable sheep-handling equipment. Farmers may now transport sheep without having to move them physically due to new technology.

In order to facilitate farming operations, new farm gear and equipment use technologies like Global Positioning Systems (GPS), measuring sensors, and digital monitoring systems. They are also able to provide an output that is more productive and sustainable due to data collected from the field.

Many recent advancements in the sheep-handling equipment industry aim to minimize human contact while boosting farm production.

It is projected that the adoption of cutting-edge technology, such as robots and automated systems in sheep handling equipment, presents significant opportunities for market expansion. The adoption of sheep-handling equipment is growing by the continued demand for innovative technologies in the agriculture sector to improve operational efficiency.

More and more automated technology is being used to manage the sheep and perform numerous activities, such as feeding, milking, monitoring, and cleaning. The need for organically grown meat and wool, along with continued technical advancements, is providing new prospects to the major manufacturers of sheep-handling equipment.

The industry growth for sheep handling equipment is mildly impacted by the rising number of people who are lactose intolerant. Also, the trend toward vegetarianism and veganism is affecting the demand for sheep-handling equipment.

Top manufacturers of sheep handling equipment are tracking the sheep and sending real-time alerts via smartphone applications by using smart radio-frequency identification (RFID) tags.

It is projected that the adoption of cutting-edge technology, such as robots and automated systems in sheep handling equipment, presents significant opportunities for market expansion. The adoption of sheep-handling equipment is growing by the continued demand for innovative technologies in the agriculture sector to improve operational efficiency.

More and more automated technology is being used to manage the sheep and perform numerous activities, such as feeding, milking, monitoring, and cleaning. The need for organically grown meat and wool, along with continued technical advancements, is providing new prospects to the major manufacturers of sheep-handling equipment.

The industry growth for sheep handling equipment is mildly impacted by the rising number of people who are lactose intolerant. Also, the trend toward vegetarianism and veganism is affecting the demand for sheep-handling equipment.

Top manufacturers of sheep handling equipment are tracking the sheep and sending real-time alerts via smartphone applications by using smart radio-frequency identification (RFID) tags.

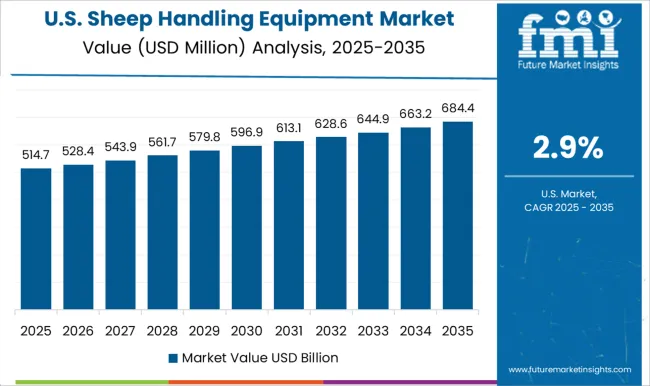

With a share of 30.5%, the sheep-handling equipment business in the United States is worth USD 1.3 million in 2025. This market is made up of both small and large businesses and is highly fragmented.

Some of the industry top plates in the US

With a 20% market share, Colorado Lamb & Wool is the market's top player. The growing need for high-quality livestock products in the livestock business is driving the demand for sheep-handling equipment. The US has an increased demand for natural and organic animal products, which leads to small-scale livestock farm growth.

The adoption of sheep-handling equipment is high due to its utilization in animal exhibitions and shows. The leading firms' increasing investments in Research and Development activities are projected to fuel the US market expansion in the near future.

| Attributes | Statistics |

|---|---|

| UK Market Value 2025 | USD 115.6 million |

| UK Market Value 2035 | USD 165.4 million |

| UK Market Share (2025 to 2035) | 9.8% |

| UK Market CAGR (2025 to 2035) | 3.6% |

The bulk of suppliers in the UK's sheep-handling equipment sector is situated in England and Wales, with a small number in Scotland and Northern Ireland. The top five providers control over 80% of the market, indicating a highly consolidated market.

The demand for sheep handling equipment in the UK is anticipated to expand, as producers attempt to adopt new procedures to increase productivity.

The market for sheep handling equipment in the UK is quite competitive, with many suppliers providing a range of goods and services. Large agricultural equipment producers, specialized sheep-handling equipment manufacturers, and individual sheep-handling equipment experts are some of these sources.

| Country | China |

|---|---|

| Market Share (2025) | 8.3% |

| CAGR (2025 to 2035) | 2.7% |

| Market Value (2035) | USD 127.6 million |

| Country | India |

|---|---|

| Market Share (2025) | 3.6% |

| CAGR (2025 to 2035) | 4% |

| Market Value (2035) | USD 62.3 million |

Compared to other nations, China and India contribute the most to huge livestock. Over the projection period, the regional market would expand due to the rising demand for farm automation in response to the rising livestock.

Governments in the area are likewise promoting and aiding investments in the agricultural industry, aiding the sales of sheep-handling equipment.

The trend of China's growing urbanization has also led to a rise in the demand for sheep and sheep products. As it aids in effective flock management, this has raised the requirement for sheep-handling equipment.

Indian Projects Making Up the Demand

Australia held a 2% market share for sheep handling equipment in 2025, with a market value of USD 23.5 million.

Australia's agricultural sector is most challenging, but new sheep handling equipment is making it safer. Additionally, it might alleviate staff shortages by enabling senior farmers to continue working in the sheep's yards.

According to the National Centre for Farmer Health, farms account for 21% of worker fatalities across all Australian industries, and more people have hospital-treated injuries.

Automatic sheep handling equipment is the largest segment of the industry, based on product type. As the demand for automated systems rises in the agricultural sector, this category is anticipated to dominate the market throughout the forecast period.

Automated solutions give farmers more precision and control over their livestock operations, allowing them to cut labor expenses and boost productivity. Demand for automated sheep handling equipment is desirable since it also provides benefits like increased safety and less animal discomfort.

Farmers' desire to transport sheep quickly and safely from one location to another is the main driver of the fixed sheep race segment of the sheep handling equipment industry. In the upcoming years, the market for sheep handling equipment is predicted to have significant growth in the mobile sheep race category.

The rising demand from farmers and other livestock producers for mobile sheep races is what propels this market. Mobile sheep races are made to make it possible for farmers to transport sheep automatically from one field to another.

Manufacturers need to look out for solutions that solve the challenges of the sheep-handling equipment industry.

The sheep-handling equipment sector is still in its infancy and is expected to grow quickly. Over the past few years, demand in the industry has steadily increased as farmers seek to strengthen the effectiveness and security of their sheep-handling operations.

The demand is expanding as a result of rising farmer demand and the creation of new and enhanced sheep-handling tools. Currently, a select group of significant players-including Gallagher, Tru-Test, and Sheepmaster-dominate the market. These businesses have a lengthy history in the industry and are recognized as industry leaders.

Smaller businesses, on the other hand, are beginning to enter the market and are providing cutting-edge new goods and services. Future market growth is anticipated due to growing farmer demand, the creation of new, improved goods, and other factors.

Furthermore, through a number of programs, governments and organizations globally are pushing the creation and use of modern livestock management systems. The industry has also expanded as a result of numerous technological developments in the area of sheep management.

Key players in the sheep-handling equipment market are also making investments in R&D to provide goods that are cutting-edge, dependable, and technologically sophisticated. To grow their market share, industry participants are increasingly turning to a stronger regional presence.

Recent Developments

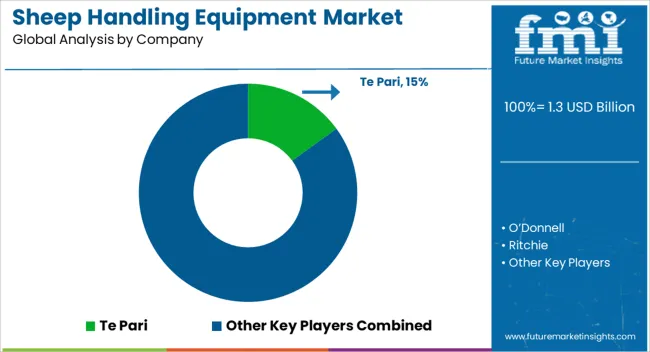

The global sheep handling equipment market is estimated to be valued at USD 1.3 billion in 2025.

The market size for the sheep handling equipment market is projected to reach USD 1.8 billion by 2035.

The sheep handling equipment market is expected to grow at a 3.4% CAGR between 2025 and 2035.

The key product types in sheep handling equipment market are mobile sheep race, fixed sheep race, roll over crate, sheep weighing scales, race components, feed barriers, pen division, walk through feeder, sheep plastic and other.

In terms of product type, manual segment to command 44.8% share in the sheep handling equipment market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Sheep Tilt Table Market Size and Share Forecast Outlook 2025 to 2035

Sheep Supplies Market Analysis by Supply, Farm, Sales and Region: A Forecast for 2025 and 2035

Sheep Creep Feeder Market – Innovations & Market Outlook 2025-2035

Sheep and Goat Equipment Market Size and Share Forecast Outlook 2025 to 2035

Sheep Shearing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Cattle and Sheep Disease Diagnostic Kits Market Size and Share Forecast Outlook 2025 to 2035

Air Handling Unit Market Size and Share Forecast Outlook 2025 to 2035

BOP Handling Systems Market Growth - Trends & Forecast 2025 to 2035

Roll Handling Machine Market Size and Share Forecast Outlook 2025 to 2035

Goat Handling Equipment Market Size and Share Forecast Outlook 2025 to 2035

Drum Handling Equipment Market

Crate Handling Systems Market Size and Share Forecast Outlook 2025 to 2035

Glass Handling Robot Market Trends & Forecast 2025 to 2035

Cattle Handling Systems Market Size and Share Forecast Outlook 2025 to 2035

Sludge Handling Equipment Market Size and Share Forecast Outlook 2025 to 2035

Manure Handling Equipment Market Size and Share Forecast Outlook 2025 to 2035

Patient Handling Equipment Market Size and Share Forecast Outlook 2025 to 2035

Material Handling Integration Market Size and Share Forecast Outlook 2025 to 2035

Material Handling Monorails Market

Material Handling Equipment Market Growth - Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA