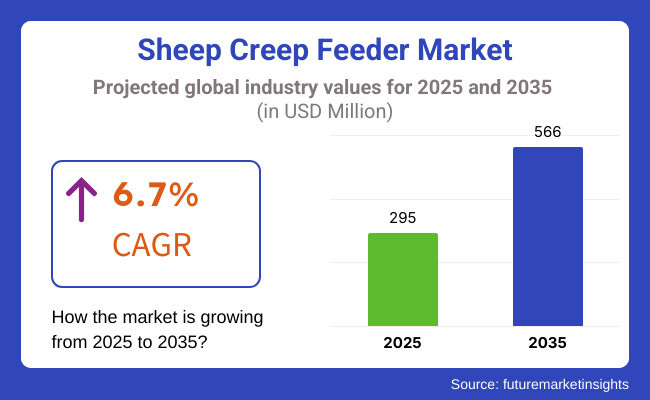

The global sheep creep feeder market is estimated to account for USD 295 million in 2025. It is anticipated to grow at a CAGR of 6.7% during the assessment period and reach a value of USD 566 million by 2035.

Industry Outlook

As per FMI analysis, the market will witness steady growth in the period from 2025 to 2035 on account of increased demand for efficient livestock feeding solutions, advances in automation and smart feeding systems, and an increasing focus on improving sheep nutrition and productivity. Increased adoption of precision farming and livestock management technologies is also expected to boost market growth.

Also, expanding sheep-rearing activities, especially in areas where there is a high emphasis on meat and wool production, will help to ensure continued market demand. Suppliers will invest in weather-proof and wear-resistant feeding solutions that are cost-efficient to meet the changing needs of contemporary sheep farms. Sustainability trends and incentives by the government towards efficiency in livestock farming can also affect the market dynamics.

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| The market witnessed steady growth, recovering from initial setbacks due to supply chain disruptions caused by the COVID-19 pandemic. The CAGR was moderate as industry players focused on stabilizing production. | Market growth is expected to accelerate, with the increasing adoption of automated and smart feeding solutions. Expansion in global sheep farming activities will further drive demand. |

| Adoption of traditional and semi-automated creep feeders was prevalent, with gradual integration of mechanized solutions. Smart feeding technologies were in the early stages. | The period will see widespread integration of AI-driven, automated, and IoT-based feeding systems to optimize feeding schedules and reduce feed wastage. |

| Demand was driven by the need to improve sheep growth rates and reduce manual labor, particularly in large-scale sheep farms. | Increasing pressure for sustainable and cost-effective livestock farming will lead to a shift toward energy-efficient and precision-feeding solutions. |

| Growth was concentrated in North America, Europe, and Australia, where sheep farming is well-established. Emerging markets were slowly entering the sector. | Emerging markets, particularly in Asia-Pacific and Africa, are expected to play a bigger role due to increased sheep farming investments and government support. |

| Limited focus on sustainability, with conventional feeders being widely used. Some manufacturers started experimenting with eco-friendly materials. | Sustainability will be a key focus, with increased use of recycled materials, solar-powered feeders, and smart feeding mechanisms to reduce waste. |

| Dominated by a few key players, with limited product differentiation; price-based competition was significant. | Intensified competition with new entrants bringing innovative and tech-enabled solutions, leading to a shift from price-based to value-based competition. |

| Some government incentives for sheep farming were present, but there were few mandates related to feeding system efficiency. | Stricter regulations on animal welfare and farm efficiency will encourage the use of smart and automated creep feeders. |

| Farmers faced high initial investment costs, and awareness about advanced feeding systems was relatively low in some regions. | Key challenges will include balancing affordability with technology adoption and ensuring that new solutions are scalable for small and medium-sized farms. |

Growing Demand for Automation and Smart Feeding Solutions

Smart and automatic products are more and more widely used by sheep farmers to promote better feeding efficiency and lower labor. Top-level fee IoT monitoringmoAI portionAI-portion control and automatic dispensing systems are popularizing themselves. The products ensure optimal usage of feeds for greater nutrition control and cost reductions for sheep farmers. App and remote-controlled feeders are also widely used, and farmers can now monitor feeding real-time real time.

There is a growing demand for eco-friendly and sustainable feeding solutions by consumers. Companies are responding to this by designing creep feeders made from recycled materials, biodegradable plastic, and solar-powered components. Sheep farmers are turning their attention to low-waste and energy-efficient feeding systems to address global sustainability goals. As carbon footprint reduction becomes a priority, eco-friendly consumers are choosing brands offering greener solutions.

The increase in small-scale farming and hobby farming is propelling demand for low-cost, easy-to-use, and small sheep creep feeders. Farmers prefer adjustable and modular feeders that can be fitted into different flock sizes and farm layouts. As more and more individuals engage in sheep farming for wool, meat, and milk production, they look for simple and low-cost feeding systems with high returns on investment.

Customers are embracing precision livestock farming (PLF) practices, leading to growing demand for data-driven feeding systems. Creep feeders today are equipped with RFID monitoring, weight sensors, and automatic portioning, allowing farmers to track individual sheep growth rates and modify feeding plans based on that. The trend is strongest among commercial sheep farms looking to optimize productivity and reduce wastage of feed.

Based on material, the market is divided into steel, plastic, and metal. Plastic, metal, and steel sheep creep feeders are most common because they are long-lasting, inexpensive, and flexible enough to accommodate various types of agricultural settings. Steel creep feeders are in high demand for their extreme strength and resistance to rough weather conditions, making them suitable for external applications. Farmers prefer galvanized steel versions since they are rust-proof and can last for a long time.

Plastic creep feeders, by contrast, are light, easy to transport, and corrosion-resistant. They find application in indoor and small-scale farming activities, where ease of movement and low cost are predominant considerations. Metal creep feeders, such as aluminum and coated metal types, offer a middle ground between weight and durability, offering sturdy feeding solutions without excess weight.

These materials make the feeders durable enough to handle the demands of everyday use with minimal maintenance needs. Farmers select these feeders depending on their requirements, flock size, and environmental conditions, hence their importance in contemporary sheep farming operations.

Based on characteristics, the market is divided into single-access, multi-access, and others. Multi-access are used extensively since they can accommodate several lambs to feed at one time, which enhances efficiency and eliminates competition for food.

Multi-access feeders have multiple feeding points to ensure that there are more lambs that can consume feed at the same time, which results in faster growth rates and consistent development throughout the flock. Farmers prefer multi-access feeders since they reduce crowding and aggression, hence minimizing stress among young sheep.

Also, the feeders are perfect for commercial use since they maximize feeding space at the expense of less labor involved in monitoring and refilling. Most of them have adjustable openings to fit lambs of various sizes, making them adaptable for different growth levels.

The construction also ensures that adult sheep do not eat creep feed, so young lambs get the appropriate nutrition for healthy development. Their longevity, effectiveness, and potential to improve feeding management make multi-access sheep creep feeders the choice of choice in contemporary sheep farming.

| Countries | Market Share |

|---|---|

| USA | 26.3% |

| Germany | 19.3% |

| UK | 9.5% |

| Japan | 5.3% |

| China | 10.3% |

The USA is likely to dominate the sheep creep feeder market because of its established livestock industry and rising demand for quality meat and wool. Growth will be driven by automation and intelligent feeding technology, with farmers focusing on efficiency and sustainability in farm animal management.

The use of precision feeding systems will improve nutrition control and minimize waste. Government schemes encouraging up-to-date farming techniques and the involvement of major players making an investment in new solutions will further consolidate the USA's leadership position on the international market.

Germany will remain a key player in the European sheep creep feeder market, fuelled by healthy technological innovation and growing awareness of sustainable livestock rearing. German farmers are quickly embracing IoT-based feeding systems and automated technology to maximize feeding efficiency and minimize labor expenses.

Increased emphasis on sustainability and environmentally friendly materials in equipment production will promote the use of energy-efficient and long-lasting creep feeders. As research and government incentives for precision agriculture increase, Germany is likely to solidify its position as a global sheep-feeding feeding technology.

The UK sheep creep feeder market is experiencing tremendous innovation, with major industry players investing in AI-based feeding systems to enhance livestock nutrition. The growing emphasis on automation and smart farming methods is likely to revosheep-feedingep feeding practices, making them more efficient and cost-effective.

With a robust sheep farming sector and growing investments in research and development, the UK is poised to witness extensive use of sensor-based feeders. Government programs supporting sheep-rearing rearing practices and sustainable animal husbandry will be important factors in the growth of this market.

The sheep creep feeder market in Japan is growing because of the growth in urbanization and higher consumer demand for high-quality meat products. Farmers are more investing in effective and space-saving feeding systems suitable for small and medium-scale sheep farms.

The incorporation of technology into sheep farming, such as automated and portable feeding systems, is projected to lead to market growth. Japan's emphasis on precision feeding methods to minimize feed expenditure and maximize the nutrition of livestock will facilitate the implementation of new creep feeders, which will become a staple in the country's changing sheep farming industry.

China's sheep creep feeder market is expanding gradually, driven by growing demand for sheep meat and governmental incentives favoring automation of livestock production. China is also experiencing a transition towards precision livestock farming, with more focus on intelligent feeding solutions that enhance efficiency and minimize feed waste.

Domestic producers are investing in the manufacture of sophisticated creep feeders to cater to the fast-growing sheep farming industry. The growth of export prospects and improvements in livestock handling technology are also likely to contribute to China's position in the global sheep creep feeder market even further.

The Australian sheep creep feeder market is growing as large sheep farms increasingly utilize automated feeding systems. The strong wool and meat industry in Australia is propelling demand for long-lasting, weather-resistant feeders that can operate in harsh environmental conditions.

Farmers are concentrating on energy-saving and drought-tolerant feeding technology to maximize the use of resources and ensure the health of livestock. Australia's dedication to sustainable agriculture and increasing investment in precision agriculture will continue to define the future of sheep creep feeding in the country, positioning it as a global market leader.

Sheep creep feeder market remains fairly concentrated with a combination of veteran manufacturers and new entrants competing in the market space. Top companies spend heavily on advancements in technology such as automated and IoT-based feeding systems to gain a competitive advantage. The existence of local and international manufacturers guarantees constant innovation and varied product offerings.

Major industry players highlight efficiency and sustainability, creating greener, harder-wearing, and affordable feeding solutions. Industries grow through collaborative partnerships, acquisition, and merging, broadening their product portfolio. The high demand for precision livestock farming challenges manufacturers to adopt personalized and intelligent feeding solutions, promoting competitiveness as well as geographic market growth in various regions.

Regional markets have differing levels of concentration, and North America and Europe are in the grip of mature brands dealing in high-technology solutions whereas Asia-Pacific and Latin America face increasing local competition. Governments as well as industries are favoring automation and intelligent farming technologies that prompt new entries to come in with sophisticated sheep creep feeders and address changing needs of innovative sheep farming.

The sheep creep feeder industry has a competitive environment influenced by product innovations and technological development. Major manufacturers concentrate on smart and automatic feeding systems, enhancing efficiency and minimizing wastage of feed. Manufacturers compete based on durability, quality of material, and sustainability, meeting contemporary sheep farming needs through environmentally friendly and affordable solutions.

Local and international industry players compete for market size expansion by investing in research and development to develop proprietary and technologically sophisticated feeding systems. The coexistence of established companies and new entrants creates an atmosphere that fosters innovation, with firms creating precision feeding systems suited for various sizes of farms and environments that provide the best sheep nutrition and effective livestock management.

Major players consolidate their market base through strategic alliances, mergers, and diversification of products. Market leaders engage in research institutes and agricultural associations to maximize feeding efficiency. Competitors concentrate on regional expansion by modifying their products to suit local farming environments, maintaining a balance between affordability, functionality, and long-term sustainability across different agricultural environments.

The growing use of precision livestock farming compels makers to incorporate IoT-enabled and sensor-based creep feeders. With competition growing to improve feeding accuracy, automate functions, and reduce feed expenses, companies strive harder. As customers demand efficient and long-lasting feeders, the business continually advances designs to keep up with a changing sheep farming sector.

With respect to material, the market is classified into steel, plastic, and metal.

In terms of characteristics, the market is segmented into single-access, multi-access, and others.

In terms of region, the market is segmented into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

The market is anticipated to reach USD 295 million in 2025.

The market is predicted to reach a size of USD 566 million by 2035.

Prominent players include Shaul's Manufacturing, Qingdao Huarui Jiahe Machinery Co., Ltd, Priefert Creep Feeder, and others.

Table 1: Global Market Value (US$ million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Units) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ million) Forecast by Material, 2018 to 2033

Table 4: Global Market Volume (Units) Forecast by Material, 2018 to 2033

Table 5: Global Market Value (US$ million) Forecast by Operation, 2018 to 2033

Table 6: Global Market Volume (Units) Forecast by Operation, 2018 to 2033

Table 7: Global Market Value (US$ million) Forecast by Application, 2018 to 2033

Table 8: Global Market Volume (Units) Forecast by Application, 2018 to 2033

Table 9: North America Market Value (US$ million) Forecast by Country, 2018 to 2033

Table 10: North America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 11: North America Market Value (US$ million) Forecast by Material, 2018 to 2033

Table 12: North America Market Volume (Units) Forecast by Material, 2018 to 2033

Table 13: North America Market Value (US$ million) Forecast by Operation, 2018 to 2033

Table 14: North America Market Volume (Units) Forecast by Operation, 2018 to 2033

Table 15: North America Market Value (US$ million) Forecast by Application, 2018 to 2033

Table 16: North America Market Volume (Units) Forecast by Application, 2018 to 2033

Table 17: Latin America Market Value (US$ million) Forecast by Country, 2018 to 2033

Table 18: Latin America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 19: Latin America Market Value (US$ million) Forecast by Material, 2018 to 2033

Table 20: Latin America Market Volume (Units) Forecast by Material, 2018 to 2033

Table 21: Latin America Market Value (US$ million) Forecast by Operation, 2018 to 2033

Table 22: Latin America Market Volume (Units) Forecast by Operation, 2018 to 2033

Table 23: Latin America Market Value (US$ million) Forecast by Application, 2018 to 2033

Table 24: Latin America Market Volume (Units) Forecast by Application, 2018 to 2033

Table 25: Europe Market Value (US$ million) Forecast by Country, 2018 to 2033

Table 26: Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 27: Europe Market Value (US$ million) Forecast by Material, 2018 to 2033

Table 28: Europe Market Volume (Units) Forecast by Material, 2018 to 2033

Table 29: Europe Market Value (US$ million) Forecast by Operation, 2018 to 2033

Table 30: Europe Market Volume (Units) Forecast by Operation, 2018 to 2033

Table 31: Europe Market Value (US$ million) Forecast by Application, 2018 to 2033

Table 32: Europe Market Volume (Units) Forecast by Application, 2018 to 2033

Table 33: Asia Pacific Market Value (US$ million) Forecast by Country, 2018 to 2033

Table 34: Asia Pacific Market Volume (Units) Forecast by Country, 2018 to 2033

Table 35: Asia Pacific Market Value (US$ million) Forecast by Material, 2018 to 2033

Table 36: Asia Pacific Market Volume (Units) Forecast by Material, 2018 to 2033

Table 37: Asia Pacific Market Value (US$ million) Forecast by Operation, 2018 to 2033

Table 38: Asia Pacific Market Volume (Units) Forecast by Operation, 2018 to 2033

Table 39: Asia Pacific Market Value (US$ million) Forecast by Application, 2018 to 2033

Table 40: Asia Pacific Market Volume (Units) Forecast by Application, 2018 to 2033

Table 41: MEA Market Value (US$ million) Forecast by Country, 2018 to 2033

Table 42: MEA Market Volume (Units) Forecast by Country, 2018 to 2033

Table 43: MEA Market Value (US$ million) Forecast by Material, 2018 to 2033

Table 44: MEA Market Volume (Units) Forecast by Material, 2018 to 2033

Table 45: MEA Market Value (US$ million) Forecast by Operation, 2018 to 2033

Table 46: MEA Market Volume (Units) Forecast by Operation, 2018 to 2033

Table 47: MEA Market Value (US$ million) Forecast by Application, 2018 to 2033

Table 48: MEA Market Volume (Units) Forecast by Application, 2018 to 2033

Figure 1: Global Market Value (US$ million) by Material, 2023 to 2033

Figure 2: Global Market Value (US$ million) by Operation, 2023 to 2033

Figure 3: Global Market Value (US$ million) by Application, 2023 to 2033

Figure 4: Global Market Value (US$ million) by Region, 2023 to 2033

Figure 5: Global Market Value (US$ million) Analysis by Region, 2018 to 2033

Figure 6: Global Market Volume (Units) Analysis by Region, 2018 to 2033

Figure 7: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 8: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 9: Global Market Value (US$ million) Analysis by Material, 2018 to 2033

Figure 10: Global Market Volume (Units) Analysis by Material, 2018 to 2033

Figure 11: Global Market Value Share (%) and BPS Analysis by Material, 2023 to 2033

Figure 12: Global Market Y-o-Y Growth (%) Projections by Material, 2023 to 2033

Figure 13: Global Market Value (US$ million) Analysis by Operation, 2018 to 2033

Figure 14: Global Market Volume (Units) Analysis by Operation, 2018 to 2033

Figure 15: Global Market Value Share (%) and BPS Analysis by Operation, 2023 to 2033

Figure 16: Global Market Y-o-Y Growth (%) Projections by Operation, 2023 to 2033

Figure 17: Global Market Value (US$ million) Analysis by Application, 2018 to 2033

Figure 18: Global Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 19: Global Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 20: Global Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 21: Global Market Attractiveness by Material, 2023 to 2033

Figure 22: Global Market Attractiveness by Operation, 2023 to 2033

Figure 23: Global Market Attractiveness by Application, 2023 to 2033

Figure 24: Global Market Attractiveness by Region, 2023 to 2033

Figure 25: North America Market Value (US$ million) by Material, 2023 to 2033

Figure 26: North America Market Value (US$ million) by Operation, 2023 to 2033

Figure 27: North America Market Value (US$ million) by Application, 2023 to 2033

Figure 28: North America Market Value (US$ million) by Country, 2023 to 2033

Figure 29: North America Market Value (US$ million) Analysis by Country, 2018 to 2033

Figure 30: North America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 31: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 32: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 33: North America Market Value (US$ million) Analysis by Material, 2018 to 2033

Figure 34: North America Market Volume (Units) Analysis by Material, 2018 to 2033

Figure 35: North America Market Value Share (%) and BPS Analysis by Material, 2023 to 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections by Material, 2023 to 2033

Figure 37: North America Market Value (US$ million) Analysis by Operation, 2018 to 2033

Figure 38: North America Market Volume (Units) Analysis by Operation, 2018 to 2033

Figure 39: North America Market Value Share (%) and BPS Analysis by Operation, 2023 to 2033

Figure 40: North America Market Y-o-Y Growth (%) Projections by Operation, 2023 to 2033

Figure 41: North America Market Value (US$ million) Analysis by Application, 2018 to 2033

Figure 42: North America Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 43: North America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 44: North America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 45: North America Market Attractiveness by Material, 2023 to 2033

Figure 46: North America Market Attractiveness by Operation, 2023 to 2033

Figure 47: North America Market Attractiveness by Application, 2023 to 2033

Figure 48: North America Market Attractiveness by Country, 2023 to 2033

Figure 49: Latin America Market Value (US$ million) by Material, 2023 to 2033

Figure 50: Latin America Market Value (US$ million) by Operation, 2023 to 2033

Figure 51: Latin America Market Value (US$ million) by Application, 2023 to 2033

Figure 52: Latin America Market Value (US$ million) by Country, 2023 to 2033

Figure 53: Latin America Market Value (US$ million) Analysis by Country, 2018 to 2033

Figure 54: Latin America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 55: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 57: Latin America Market Value (US$ million) Analysis by Material, 2018 to 2033

Figure 58: Latin America Market Volume (Units) Analysis by Material, 2018 to 2033

Figure 59: Latin America Market Value Share (%) and BPS Analysis by Material, 2023 to 2033

Figure 60: Latin America Market Y-o-Y Growth (%) Projections by Material, 2023 to 2033

Figure 61: Latin America Market Value (US$ million) Analysis by Operation, 2018 to 2033

Figure 62: Latin America Market Volume (Units) Analysis by Operation, 2018 to 2033

Figure 63: Latin America Market Value Share (%) and BPS Analysis by Operation, 2023 to 2033

Figure 64: Latin America Market Y-o-Y Growth (%) Projections by Operation, 2023 to 2033

Figure 65: Latin America Market Value (US$ million) Analysis by Application, 2018 to 2033

Figure 66: Latin America Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 67: Latin America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 68: Latin America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 69: Latin America Market Attractiveness by Material, 2023 to 2033

Figure 70: Latin America Market Attractiveness by Operation, 2023 to 2033

Figure 71: Latin America Market Attractiveness by Application, 2023 to 2033

Figure 72: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 73: Europe Market Value (US$ million) by Material, 2023 to 2033

Figure 74: Europe Market Value (US$ million) by Operation, 2023 to 2033

Figure 75: Europe Market Value (US$ million) by Application, 2023 to 2033

Figure 76: Europe Market Value (US$ million) by Country, 2023 to 2033

Figure 77: Europe Market Value (US$ million) Analysis by Country, 2018 to 2033

Figure 78: Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 79: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 80: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 81: Europe Market Value (US$ million) Analysis by Material, 2018 to 2033

Figure 82: Europe Market Volume (Units) Analysis by Material, 2018 to 2033

Figure 83: Europe Market Value Share (%) and BPS Analysis by Material, 2023 to 2033

Figure 84: Europe Market Y-o-Y Growth (%) Projections by Material, 2023 to 2033

Figure 85: Europe Market Value (US$ million) Analysis by Operation, 2018 to 2033

Figure 86: Europe Market Volume (Units) Analysis by Operation, 2018 to 2033

Figure 87: Europe Market Value Share (%) and BPS Analysis by Operation, 2023 to 2033

Figure 88: Europe Market Y-o-Y Growth (%) Projections by Operation, 2023 to 2033

Figure 89: Europe Market Value (US$ million) Analysis by Application, 2018 to 2033

Figure 90: Europe Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 91: Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 92: Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 93: Europe Market Attractiveness by Material, 2023 to 2033

Figure 94: Europe Market Attractiveness by Operation, 2023 to 2033

Figure 95: Europe Market Attractiveness by Application, 2023 to 2033

Figure 96: Europe Market Attractiveness by Country, 2023 to 2033

Figure 97: Asia Pacific Market Value (US$ million) by Material, 2023 to 2033

Figure 98: Asia Pacific Market Value (US$ million) by Operation, 2023 to 2033

Figure 99: Asia Pacific Market Value (US$ million) by Application, 2023 to 2033

Figure 100: Asia Pacific Market Value (US$ million) by Country, 2023 to 2033

Figure 101: Asia Pacific Market Value (US$ million) Analysis by Country, 2018 to 2033

Figure 102: Asia Pacific Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 103: Asia Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 104: Asia Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 105: Asia Pacific Market Value (US$ million) Analysis by Material, 2018 to 2033

Figure 106: Asia Pacific Market Volume (Units) Analysis by Material, 2018 to 2033

Figure 107: Asia Pacific Market Value Share (%) and BPS Analysis by Material, 2023 to 2033

Figure 108: Asia Pacific Market Y-o-Y Growth (%) Projections by Material, 2023 to 2033

Figure 109: Asia Pacific Market Value (US$ million) Analysis by Operation, 2018 to 2033

Figure 110: Asia Pacific Market Volume (Units) Analysis by Operation, 2018 to 2033

Figure 111: Asia Pacific Market Value Share (%) and BPS Analysis by Operation, 2023 to 2033

Figure 112: Asia Pacific Market Y-o-Y Growth (%) Projections by Operation, 2023 to 2033

Figure 113: Asia Pacific Market Value (US$ million) Analysis by Application, 2018 to 2033

Figure 114: Asia Pacific Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 115: Asia Pacific Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 116: Asia Pacific Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 117: Asia Pacific Market Attractiveness by Material, 2023 to 2033

Figure 118: Asia Pacific Market Attractiveness by Operation, 2023 to 2033

Figure 119: Asia Pacific Market Attractiveness by Application, 2023 to 2033

Figure 120: Asia Pacific Market Attractiveness by Country, 2023 to 2033

Figure 121: MEA Market Value (US$ million) by Material, 2023 to 2033

Figure 122: MEA Market Value (US$ million) by Operation, 2023 to 2033

Figure 123: MEA Market Value (US$ million) by Application, 2023 to 2033

Figure 124: MEA Market Value (US$ million) by Country, 2023 to 2033

Figure 125: MEA Market Value (US$ million) Analysis by Country, 2018 to 2033

Figure 126: MEA Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 127: MEA Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 128: MEA Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 129: MEA Market Value (US$ million) Analysis by Material, 2018 to 2033

Figure 130: MEA Market Volume (Units) Analysis by Material, 2018 to 2033

Figure 131: MEA Market Value Share (%) and BPS Analysis by Material, 2023 to 2033

Figure 132: MEA Market Y-o-Y Growth (%) Projections by Material, 2023 to 2033

Figure 133: MEA Market Value (US$ million) Analysis by Operation, 2018 to 2033

Figure 134: MEA Market Volume (Units) Analysis by Operation, 2018 to 2033

Figure 135: MEA Market Value Share (%) and BPS Analysis by Operation, 2023 to 2033

Figure 136: MEA Market Y-o-Y Growth (%) Projections by Operation, 2023 to 2033

Figure 137: MEA Market Value (US$ million) Analysis by Application, 2018 to 2033

Figure 138: MEA Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 139: MEA Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 140: MEA Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 141: MEA Market Attractiveness by Material, 2023 to 2033

Figure 142: MEA Market Attractiveness by Operation, 2023 to 2033

Figure 143: MEA Market Attractiveness by Application, 2023 to 2033

Figure 144: MEA Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Sheep Tilt Table Market Size and Share Forecast Outlook 2025 to 2035

Sheep and Goat Equipment Market Size and Share Forecast Outlook 2025 to 2035

Sheep Shearing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Sheep Handling Equipment Market Size and Share Forecast Outlook 2025 to 2035

Sheep Supplies Market Analysis by Supply, Farm, Sales and Region: A Forecast for 2025 and 2035

Creep and Stress Rupture Testers Market Size and Share Forecast Outlook 2025 to 2035

Goat Creep Feeder Market Analysis by Material, Operation, Application and Region: A Forecast for 2025 and 2035

Feeder Container Market Analysis - Growth & Forecast 2024 to 2034

Hog Feeder Market Size and Share Forecast Outlook 2025 to 2035

Belt Feeders Market Size and Share Forecast Outlook 2025 to 2035

Weft Feeder Market Trend Analysis Based on Type, Operation, Application, and Region 2025 to 2035

Pump Feeders Market Growth - Trends & Forecast 2025 to 2035

Part Feeder Market

Cattle Feeder Panels Market Size and Share Forecast Outlook 2025 to 2035

Cattle Feeder Market Size and Share Forecast Outlook 2025 to 2035

Chicken Feeder and Drinkers Market Size and Share Forecast Outlook 2025 to 2035

Poultry Feeder Market Size and Share Forecast Outlook 2025 to 2035

Vibratory Feeder Machine Market Size and Share Forecast Outlook 2025 to 2035

Horse Bunk Feeder Market Size and Share Forecast Outlook 2025 to 2035

Horse Grain Feeders Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA