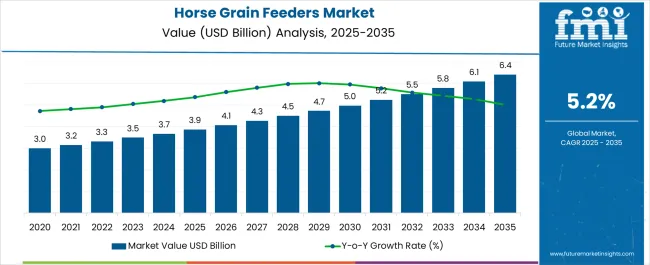

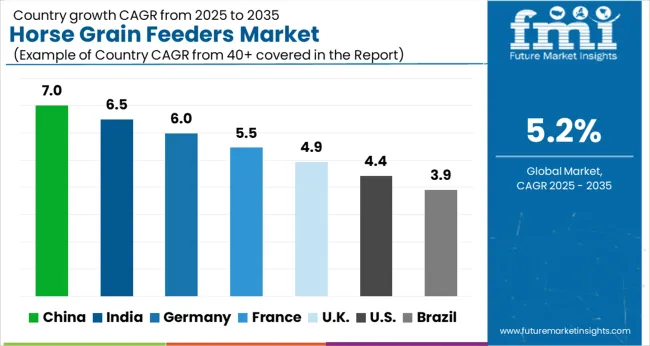

The horse grain feeders market is estimated to be valued at USD 3.9 billion in 2025 and is projected to reach USD 6.4 billion by 2035, registering a compound annual growth rate (CAGR) of 5.2% over the forecast period.

Commercial boarding facilities represent the dominant consumption segment where grain feeders enable efficient feeding operations across multiple horses while reducing labor requirements and ensuring consistent nutrition delivery throughout daily feeding schedules. Stable managers specify feeder systems that accommodate different grain types, supplement additions, and individual dietary requirements while preventing feed theft between horses and minimizing spillage that attracts rodents and creates sanitation challenges. Quality control protocols emphasize feeder durability under constant use conditions and weather resistance for outdoor installations where equipment exposure to moisture and temperature variations affects operational reliability.

Professional equine operations demonstrate increasing adoption of slow-feed grain systems that promote natural eating behaviors while preventing digestive disorders associated with rapid grain consumption including colic, founder, and gastric ulcers. Veterinary recommendations drive demand for feeding solutions that extend consumption time and encourage thorough chewing that improves digestion and reduces health risks common in performance horses subjected to intense training regimens. Racing stables utilize precision feeding equipment that enables exact portion control and supplement administration necessary for maintaining optimal body condition and competitive performance levels.

Innovation development focuses on anti-waste mechanisms and feeding rate control systems that prevent horses from consuming grain too rapidly while ensuring complete consumption of prescribed portions. Adjustable opening sizes accommodate different grain types and individual eating speeds while preventing bridging and flow interruptions that could affect feeding reliability. Integration with pasture management systems enables coordinated feeding programs that balance grazing and supplemental feeding based on seasonal grass availability and nutritional requirements.

Environmental sustainability initiatives drive development of recycled materials and energy-efficient automated systems that reduce environmental impact while maintaining performance reliability. Solar power integration enables remote feeding installations without electrical infrastructure requirements while reducing operational costs for facilities implementing sustainable management practices. Waste reduction features minimize spillage and contamination that contributes to environmental cleanup costs and attracts pest species.

Competitive dynamics involve partnerships between feeder manufacturers and feed companies who provide integrated nutrition and equipment solutions that optimize feeding programs while supporting customer loyalty through comprehensive service offerings. Technical support capabilities include installation assistance, maintenance training, and troubleshooting guidance that ensure proper equipment operation and maximize customer satisfaction throughout product lifecycles. Distribution expansion strategies target emerging equine markets where growing horse populations create demand for professional feeding equipment and management systems.

| Metric | Value |

|---|---|

| Horse Grain Feeders Market Estimated Value in (2025 E) | USD 3.9 billion |

| Horse Grain Feeders Market Forecast Value in (2035 F) | USD 6.4 billion |

| Forecast CAGR (2025 to 2035) | 5.2% |

The horse grain feeders market is experiencing consistent growth as equine management practices increasingly emphasize efficiency, animal health, and cost optimization. Rising awareness around proper feed management to prevent waste and ensure nutritional balance is driving demand for specialized grain feeding solutions.

Technological improvements in durable materials, ergonomic design, and weather resistant construction have further enhanced adoption across both small and large farms. Additionally, the trend of prioritizing animal welfare and sustainable farming practices is encouraging investment in reliable and hygienic feeder systems.

Direct-to-consumer sales channels and e-commerce platforms have also expanded product accessibility, supporting market penetration in developed as well as emerging equine markets. The outlook remains positive as both commercial farms and individual owners continue to invest in functional, long lasting feeders that improve feed efficiency and promote horse well-being.

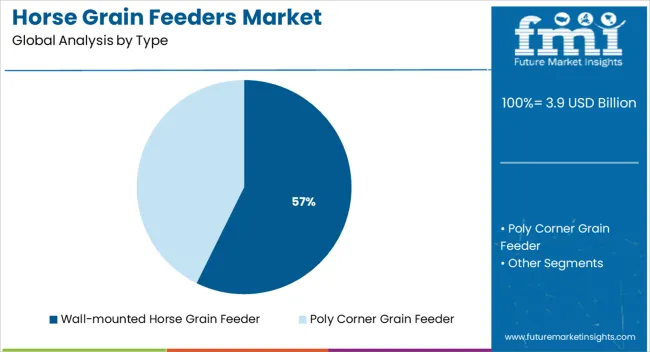

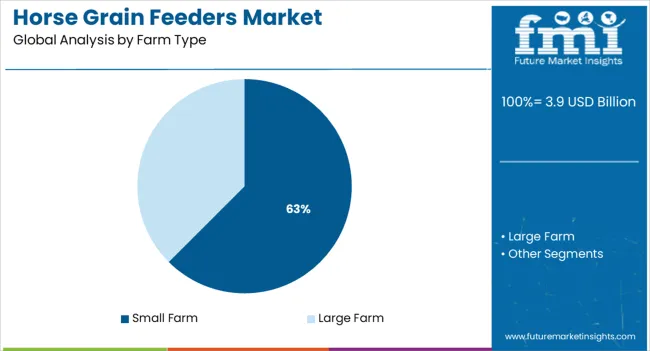

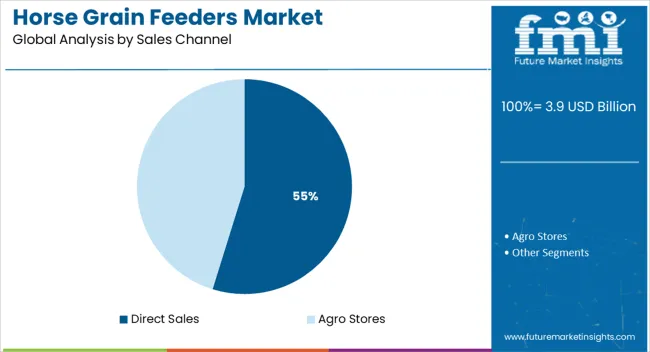

The market is segmented by Type, Farm Type, and Sales Channel and region. By Type, the market is divided into Wall-mounted Horse Grain Feeder and Poly Corner Grain Feeder. In terms of Farm Type, the market is classified into Small Farm and Large Farm. Based on Sales Channel, the market is segmented into Direct Sales and Agro Stores. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The wall mounted horse grain feeder type segment is projected to hold 57.30% of the total revenue by 2025, positioning it as the leading type. This is driven by its space saving design, ease of installation, and ability to minimize feed spillage, which improves cost efficiency for farm owners.

Wall mounted feeders provide controlled access to feed, reduce contamination risks, and enhance stable hygiene. Their durability and suitability for both small and large equine facilities have further encouraged adoption.

The combination of practicality and long term value has reinforced the dominance of this segment within the type category.

The small farm segment is expected to represent 62.50% of total revenue by 2025 under the farm type category, making it the most prominent segment. Growth is being driven by the rising number of small and hobby farms that prioritize cost effective and efficient feeding solutions.

Small farms often require versatile feeders that can be easily installed and maintained, making grain feeders a practical choice. The trend toward backyard farming and personalized horse care has further supported adoption.

As a result, this segment continues to dominate the farm type category by combining affordability, ease of use, and adaptability to diverse feeding practices.

The direct sales segment is anticipated to account for 54.80% of total market revenue by 2025 within the sales channel category, securing its leadership position. This dominance is supported by the ability of manufacturers and distributors to establish closer relationships with buyers, offer customized solutions, and provide better after sales support.

Direct sales also reduce dependency on intermediaries, thereby lowering distribution costs and improving margins. Increasing adoption of e-commerce and brand owned channels has further enhanced direct consumer access.

This has enabled farm owners to make informed purchasing decisions, reinforcing the growth of the direct sales segment in the horse grain feeders market.

When compared to the 4.7% CAGR recorded between 2020 and 2025, the horse grain feeders market is predicted to expand at a 5.2% CAGR between 2025 and 2035.

| 2020 | USD 2.52 billion |

|---|---|

| 2024 | USD 3.16 billion |

| 2025 | USD 3.31 billion |

| 2025 | USD 3.49 billion |

| 2035 | USD 6.4 billion |

The horse grain feeder market has grown steadily over the past few years, impelled by the increasing demand for horse-related products and services. In the early days, horse grain feeders were primarily made of wood and metal and were relatively simple in design. Over the years, the market has seen a steady rise in the adoption of automatic feeders.

| Short Term (2025 to 2029) | As the market has evolved, manufacturers have started to introduce more advanced designs and features. These feeders are likely to become increasingly popular among horse owners and breeders as they offer greater convenience and control over the entire feeding process. |

|---|---|

| Medium Term (2029 to 2035) | The use of automated feeders is increasing as they become more widely available and affordable. This has been driven by the growing focus on animal welfare and the need to provide horses with proper nutrition and care. This is expected to open up new opportunities for the market players. |

| Long Term (2035 to 2035) | Advancements in technology are also expected to force market expansion during this period. As technology continues to evolve, manufacturers are likely to introduce new designs like programmed feeders with IoT technology, which will be more convenient and efficient for horse owners and breeders. |

These factors are anticipated to support a 1.6X increase in the horse grain feeders market between 2025 and 2035. The market is projected to be worth USD 6.4 billion by the end of 2035, according to FMI analysts

As a consequence of numerous significant factors that have been noticed, the global market is projected to grow considerably during the forecast period. FMI researchers examined possible threats, alluring possibilities, and limiting elements that can affect the sales of horse grain feeders in addition to the market's growth determinants.

| Drivers |

|

|---|---|

| Restraints |

|

| Opportunities |

|

| Threats |

|

| Country | United States of America |

|---|---|

| Market Share (2025) | 30.4% |

| Market Value (2025) | USD 1,010.2 million |

| Country | Germany |

|---|---|

| Market Share (2025) | 17.9% |

| Market Value (2025) | USD 593.1 million |

| Country | United Kingdom |

|---|---|

| Market Share (2025) | 9.6% |

| Market Value (2025) | USD 318.2 million |

| Country | China |

|---|---|

| Market Share (2025) | 8.6% |

| Market Value (2025) | USD 284.33 million |

| Country | Japan |

|---|---|

| Market Share (2025) | 5.3% |

| Market Value (2025) | USD 176.3 million |

| Country | India |

|---|---|

| Market Share (2025) | 3.3% |

| Market Value (2025) | USD 108.3 million |

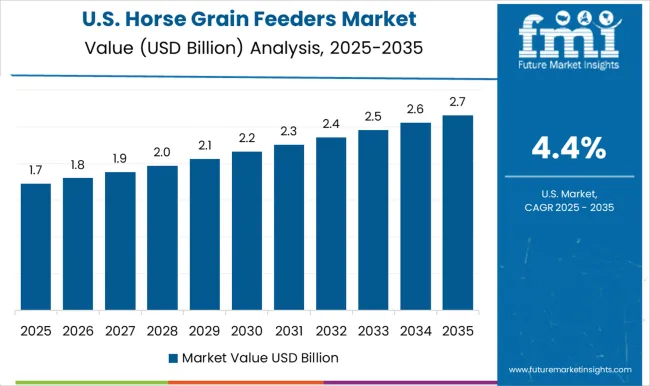

The market in the USA is a significant segment of the equine industry. Feeding grain to horses is a common practice among horse owners, as it provides a balanced diet and essential nutrients for their health and performance. In recent years, there has been a growing trend toward automatic feeders in the country. These are designed to dispense feed at specific intervals or in response to a horse’s proximity. Moreover, the country has an increasing demand for feeders that are easy to clean as well as durable.

The USA horse grain feeders market is also influenced by factors such as the state of the economy, the number of horse owners, and the popularity of horse riding. According to the American Horse Council, the horse industry is estimated to be USD 122 billion in economic activity. Manufacturers in the USA are developing feeders that are made from sustainable materials, such as stainless steel or galvanized metal, to ensure longevity and safety. The primary reason behind this development is the horse owners’ fondness for sustainable ingredients over synthetic ones.

The United Kingdom's equine industry is a significant economic sector. The industry provides a wide range of services, including horse racing, breeding, showing, and leisure activities such as riding, carriage driving, and trekking. There are several horse grain feeders available in the United Kingdom market, including traditional troughs, bunk feeders, and automatic feeders. Certain key players in the market include Equestrian, Shires, and Horseware. In recent years, there has been a growing trend toward the adoption of automatic grain feeders in the country.

Horse owners are becoming conscious of the ingredients in the products they purchase for horses and are opting for feeders made with natural components. Many manufacturers are now offering feeders from recycled materials or using more sustainable manufacturing processes. Moreover, the United Kingdom horse grain feeders market is also influenced by the current regulations and guidelines regarding equine feed. Therefore, the market in the United Kingdom is likely to reach USD 6.4 million by 2035, exhibiting a CAGR of 5.6%

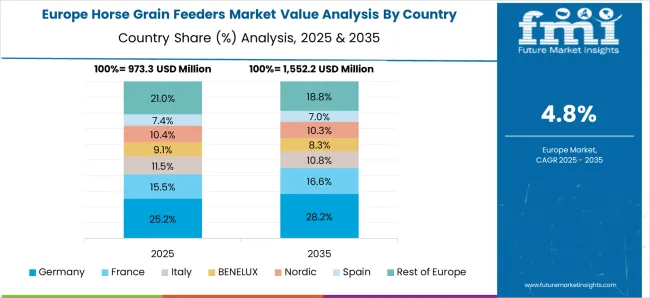

The market in Germany is a niche but growing industry, driven by the increasing popularity of horse riding and equestrian sports. Germany is home to a large equestrian community, with over 2 million horses and ponies kept for recreational and competitive use. This has led to a demand for high-quality horse feeders that can safely and efficiently dispense grain.

The market is growing since the country has rising disposable income and increasing awareness of horse health and nutrition. The key players in the German horse grain feeders market include Busse, Waldhausen, and JFC. These companies offer a wide range of horse grain feeders including traditional feed bins, automatic feeders, and slow feeders. They also offer various horse feed options such as hay, straw, and different types of grain.

One of the key drivers of the growth in the market in China is the increasing popularity of equestrian sports, such as horse racing and show jumping. The government of China has also been promoting equestrian sports as a way to improve the country’s overall sports performance and boost tourism. This has led to the construction of new equestrian facilities and an increase in the horse population in China, which in turn has boosted the demand for horse grain feeders.

China's horse grain feeders market is also being influenced by the growing e-commerce sector in the country. Online sales of horse grain feeders have been growing in recent years, as more consumers in China are turning to the internet to purchase goods and services. This trend is expected to continue during the forecast period, as the number of internet users in China continues to grow and more consumers become comfortable with buying products online. Therefore, the market is expected to surpass USD 427.7 million by 2035, registering a CAGR of 4.2%.

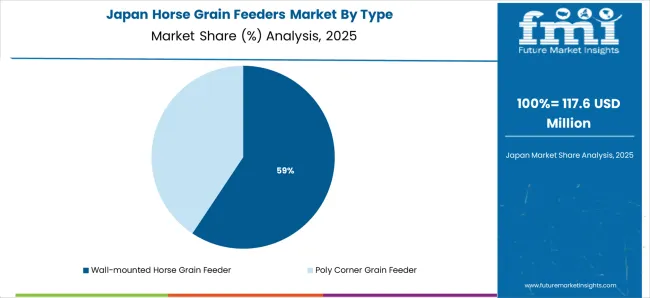

The market in Japan is relatively small compared to other equine products and services. However, there is still a dedicated group of horse owners and trainers who prioritize the health and well-being of their equine partners and are willing to invest in quality feeders. Japan is home to various horse breeds, including the Japanese Thoroughbred, which is known for its speed and endurance. These horses are often used in horse racing, an industry that generates significant revenue in Japan.

Despite the relatively small market size, several companies in Japan specialize in the production and distribution of horse grain feeders. Certain popular players operating in Japan's horse grain feeders market include ASAHI and Tsurumi Manufacturers. These companies often work closely with equine professionals and organizations to ensure that their products meet the needs of the horse-owning community.

The market in India is a small but developing market. Horse ownership in India is relatively low compared to other countries, but there is a growing interest in equestrian sports and activities, which is driving the demand for horse feeders. In the country, the prominent horse grain feeders are imported from other countries, particularly from Europe and the USA. These imported feeders are typically more expensive than locally made feeders but are seen as being of higher quality and more durable.

Even though the Indian horse grain feeders market is relatively small, several companies manufacture and sell horse grain feeders in India. These companies offer a wide range of horse feeders, including basic feeders, automatic feeders, and feeders with special features such as weather-proofing and anti-waste design. Hence, the market in India is estimated to reach a valuation of USD 195.9 million, exhibiting a CAGR of 6.1%.

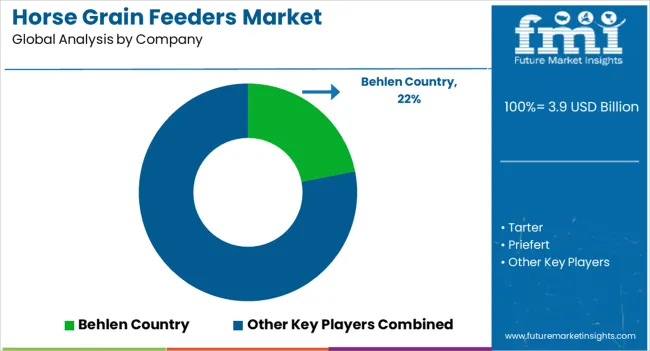

The horse grain feeders market is shaped by established agricultural equipment manufacturers and specialized livestock solutions providers focused on durability, feeding efficiency, and animal safety. Behlen Country and Tarter lead the market with a wide range of heavy-duty metal and poly grain feeders designed for both stable and pasture use. Their products are recognized for structural strength, corrosion resistance, and ease of maintenance, catering to large equine facilities and small-scale farms alike. Priefert maintains a strong position in North America, offering innovative horse feeding systems integrated with safe access designs that reduce feed waste and promote animal well-being.

Stallion and Rower & Rub serve the premium equestrian segment with advanced feeding systems emphasizing ergonomics, hygiene, and material quality suited for professional stables and training centers. DP Agri Ltd. provides automated and semi-automatic grain feeders optimized for labor efficiency and controlled feeding, addressing the growing demand for precision livestock management. SIEPLO and IOTTI ZOOTECNIA SRL focus on technologically advanced feeding equipment, integrating smart monitoring and mechanical dosing systems that ensure balanced nutrition and minimize feed loss. Polidas and BISEN INDUSTRY offer cost-effective, durable feeder designs targeting emerging markets, emphasizing customization for different stable configurations.

Manufacturers in the horse grain feeders market are focusing on research and development to innovate and improve their products. Strategies that manufacturers are implementing include:

| Items | Values |

|---|---|

| Quantitative units (2025) | USD 3.9 billion |

| Type | Wall-mounted horse grain feeder; Poly corner grain feeder |

| Farm Type | Small farm; Large farm |

| Sales Channels | Direct sales; Agro stores; e-commerce and brand channels implied |

| Regions covered | North America; Latin America; Western Europe; Eastern Europe; Balkan & Baltic; Russia & Belarus; Central Asia; East Asia; South Asia & Pacific; Middle East & Africa |

| Key countries covered | United States; Germany; United Kingdom; China; Japan; India; plus other regional markets (60+ country splits in full report) |

| Key companies profiled | Behlen Country; Tarter; Priefert; Stallion; Rower & Rub; DP Agri Ltd.; SIEPLO; IOTTI ZOOTECNIA SRL; Polidas; BISEN INDUSTRY. |

| Additional Attributes |

Dollar sales by type, farm, channel, and region; automation and IoT-enabled feeders, sustainable materials, animal welfare focus, e-commerce expansion, R&D in smart designs, and modernization of equine feeding systems. |

The global horse grain feeders market is estimated to be valued at USD 3.9 billion in 2025.

The market size for the horse grain feeders market is projected to reach USD 6.4 billion by 2035.

The horse grain feeders market is expected to grow at a 5.2% CAGR between 2025 and 2035.

The key product types in horse grain feeders market are wall-mounted horse grain feeder and poly corner grain feeder.

In terms of farm type, small farm segment to command 62.5% share in the horse grain feeders market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Horse Drawn Farming Equipment Market Size and Share Forecast Outlook 2025 to 2035

Horse Bunk Feeder Market Size and Share Forecast Outlook 2025 to 2035

Horse Corral Panels Market Size and Share Forecast Outlook 2025 to 2035

Horse Insurance Market Size and Share Forecast Outlook 2025 to 2035

Horse Stable Supplies Market Size and Share Forecast Outlook 2025 to 2035

Horse Chestnut Seed Extract Market Size, Growth, and Forecast for 2025–2035

Horse Riding Equipment Market Analysis – Growth & Forecast 2025-2035

African Horse Sickness Treatment Market

Compound Horse Feedstuff Market Analysis by Feed Type, Horse Activity, and Ingredient Composition Through 2035

Industrial Fractional Horsepower Motors Market Analysis by End-user and Region: Forecast for 2025 to 2035

Grain Hardness Meter Market Size and Share Forecast Outlook 2025 to 2035

Grain Cooling Spear Market Size and Share Forecast Outlook 2025 to 2035

Grain Roller Market Size and Share Forecast Outlook 2025 to 2035

Grain Mill Grinder Market Size and Share Forecast Outlook 2025 to 2035

Grain Alcohol Market Size and Share Forecast Outlook 2025 to 2035

Grain-Free Pet Food Market Trends - Growth & Industry Forecast 2024 to 2034

Grain And Seed Cleaning Equipment Market

Migraine Treatment Market Insights by Drug Class, Route of Administration, Distribution Channel, Treatment, and Region through 2035

Migraine Nasal Spray Market Outlook – Trends, Growth & Forecast 2025 to 2035

Feed Grain Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA