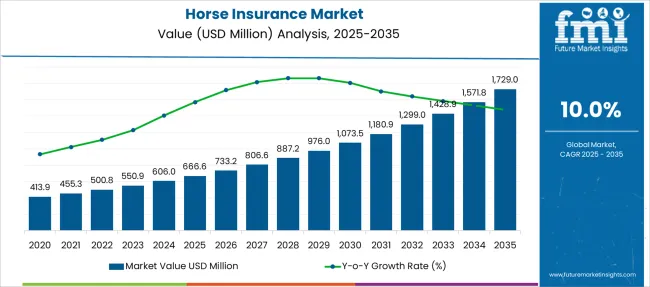

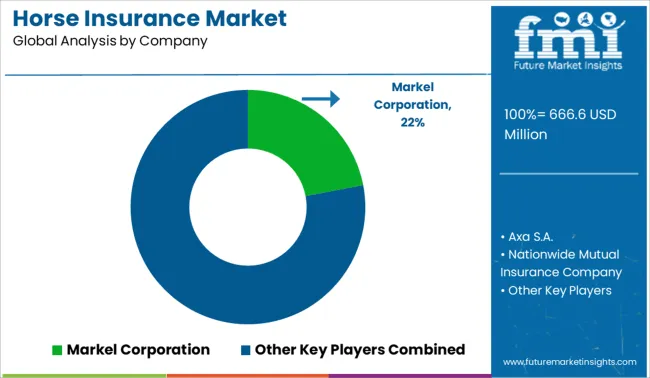

The Horse Insurance Market is estimated to be valued at USD 666.6 million in 2025 and is projected to reach USD 1729.0 million by 2035, registering a compound annual growth rate (CAGR) of 10.0% over the forecast period.

| Metric | Value |

|---|---|

| Horse Insurance Market Estimated Value in (2025 E) | USD 666.6 million |

| Horse Insurance Market Forecast Value in (2035 F) | USD 1729.0 million |

| Forecast CAGR (2025 to 2035) | 10.0% |

The horse insurance market is witnessing consistent growth as equine owners, breeders, and recreational riders prioritize financial protection against risks associated with horse ownership. Rising awareness of the high economic value of horses, coupled with the increasing costs of veterinary care and liability claims, is driving adoption of specialized insurance products.

Market dynamics are being shaped by stricter regulatory standards in animal welfare, growing participation in equestrian sports, and the rising popularity of recreational riding. Insurers are expanding their offerings with tailored policies that address mortality, medical, liability, and theft, meeting the diverse needs of horse owners.

Future expansion is expected to benefit from digitalization in insurance services, increasing penetration in emerging economies, and the growing emphasis on comprehensive risk management. These factors are creating opportunities for insurers to innovate in product design and delivery while strengthening customer trust through enhanced service and transparency.

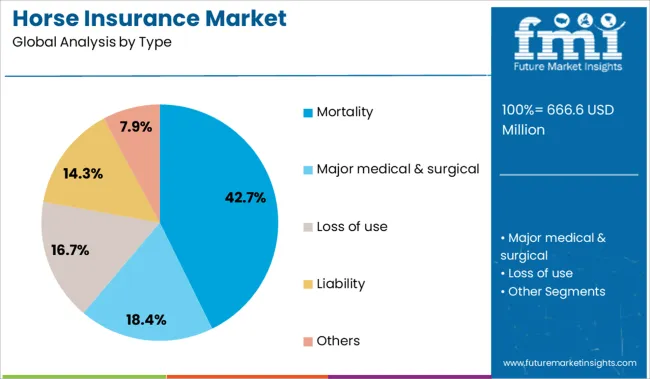

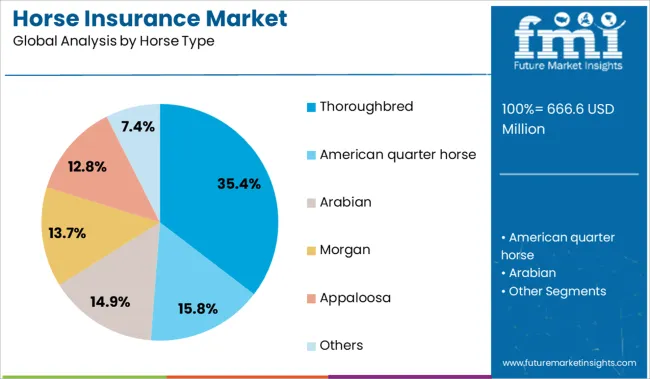

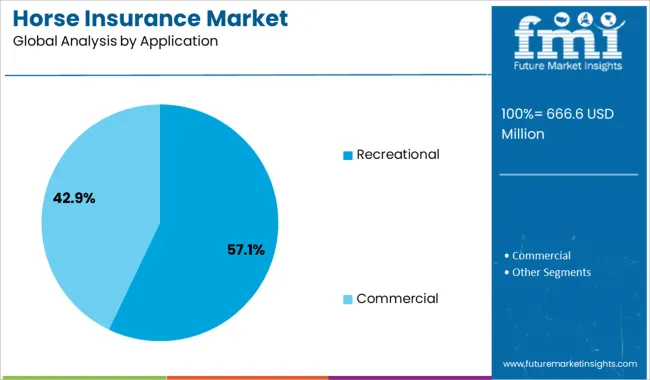

The horse insurance market is segmented by type, horse type, application, and distribution channel and geographic regions. The horse insurance market is divided by type into Mortality, Major medical & surgical, Loss of use, Liability, and Others. In terms of horse type, the horse insurance market is classified into Thoroughbred, American Quarter Horse, Arabian, Morgan, Appaloosa, and Others. Based on the application, the horse insurance market is segmented into Recreational and Commercial. The horse insurance market is segmented by distribution channel into Agents & brokers, Direct response, and Others. Regionally, the horse insurance industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

When segmented by type, the mortality segment is expected to account for 42.7% of the total horse insurance market revenue in 2025, positioning it as the leading type segment. This leadership is attributed to the fundamental necessity for horse owners to mitigate the financial impact of an animal’s unexpected death, which represents the most significant potential loss.

The mortality coverage has been increasingly adopted due to its role in protecting investments made in high-value horses used for breeding, competition, or recreation. Insurers have designed mortality policies to cover a wide range of causes including accidents, illnesses, and natural events, which has strengthened the segment’s appeal.

This segment’s prominence has also been reinforced by the comparatively higher predictability and transparency of claim settlement processes, making it a preferred choice among both individual and institutional horse owners.

Segmented by horse type, the thoroughbred segment is projected to hold 35.4% of the market revenue in 2025, emerging as the dominant horse type segment. This position has been underpinned by the high monetary and sentimental value associated with thoroughbreds, especially given their extensive use in competitive racing and breeding programs.

The substantial investments required to purchase, train, and maintain thoroughbreds have made owners more inclined to secure insurance to protect against potential losses. Insurers have responded with specialized products tailored for thoroughbred owners, covering not just mortality but also fertility, performance impairment, and transport risks.

The thoroughbred segment’s leadership has been further reinforced by the segment’s visibility in professional equine events and the demand for comprehensive risk management solutions to safeguard elite horses in high-stakes environments.

When segmented by application, the recreational segment is forecast to capture 57.1% of the market revenue in 2025, establishing itself as the leading application segment. This dominance is driven by the broad base of recreational horse owners who seek affordable and accessible insurance to mitigate everyday risks.

The increasing popularity of leisure riding, therapeutic equestrian programs, and amateur competitions has expanded the customer base for insurance products in this segment. Insurance providers have tailored offerings to meet the needs of this demographic by combining mortality, veterinary, and liability coverage in flexible, cost-effective packages.

The recreational segment has also benefited from the rise in organized riding clubs and associations that promote awareness of the benefits of insurance coverage. The ability of this segment to balance affordability with essential protection has strengthened its leadership in the horse insurance market.

Strong growth stems from increasing equine asset valuation, competition costs, and owner risk awareness. Emerging opportunities include specialized coverage for breeding, sports events, and digital platforms linking insurers with equestrian services.

Horse owners and equestrian businesses are purchasing insurance due to the high financial value of horses and the growing cost of veterinary care. Competition-grade equine used in dressage, showjumping, racing, and eventing represents significant investments, prompting coverage for mortality, theft, and major medical events. Liability protection for boarders, trainers, and facility operators is becoming standard. Many jurisdictions now require proof of insurance for event participation. Enhanced accessibility to specialized equine policies and customizable riders covering breeding, transport, and infertility helps tailor benefits to owner needs. These drivers raise overall demand in major horse-owning markets like North America, Europe, and Australia, as owners seek financial protection for high-value animals and operations.

Opportunities exist in offering tailored products such as infertility, foal mortality, or breeding liability coverage for stud farms and horse breeders. Coverage linked to equestrian eventssuch as show cancellation or injury during competitions serves an underserved niche. Insurtech platforms that integrate vet clinics, trainers, and event organizers can facilitate policy purchase and claims processing, improving customer experience. Partnering with equine associations, horse transport services, and event promoters can raise awareness and drive uptake. Digital assessment tools like veterinary health scoring and risk profilingenable customized premiums reflecting health data and usage patterns. Expanding into emerging equestrian markets such as Asia-Pacific and the Middle East, where recreational riding and competition are growing, offers a strong path to broader penetration.

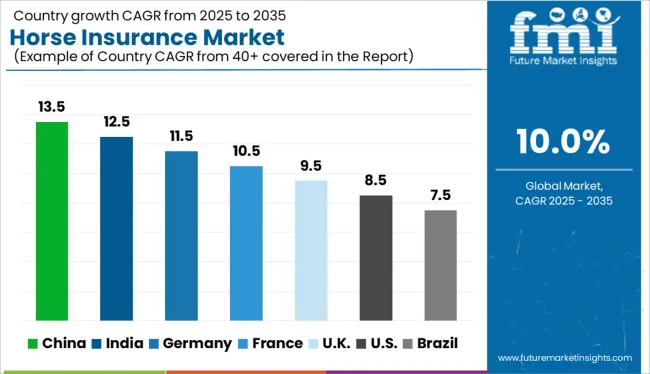

| Country | CAGR |

|---|---|

| China | 13.5% |

| India | 12.5% |

| Germany | 11.5% |

| France | 10.5% |

| UK | 9.5% |

| USA | 8.5% |

| Brazil | 7.5% |

The global horse insurance market is projected to grow at a CAGR of 10.0% from 2025 to 2035, driven by rising equine asset values, the growth of professional equestrian sports, and increasing awareness of veterinary risk coverage. BRICS nations are leading this expansion, with China recording a robust 13.5% CAGR, supported by surging investments in racing, breeding, and luxury ownership. India follows at 12.5%, fueled by rising equestrian events and improving insurance penetration in rural and agri-linked regions. Germany, part of the OECD, is advancing steadily at 11.5%, backed by high-value sport horses and breeding programs. In contrast, the United Kingdom (9.5%) and United States (8.5%) show more moderate growth, reflecting mature markets and stable regulatory environments. This report covers detailed analysis of 40+ countries, and the top five countries have been shared as a reference.

With a CAGR of 13.5%, horse insurance sales in China are rising rapidly, supported by the emergence of high-value equestrian sports and growing wealth among urban populations. As ownership of competitive and imported breeds increases, insurers are offering comprehensive coverage including mortality, injury, and event-related risks. State-supported sports academies and cross-border equine trade further drive formal policy adoption. Bundled services, like veterinary assistance and real-time tracking, are becoming popular with elite stables.

In India, horse insurance sector is poised to grow at a 12.5% CAGR, spurred by increased policy awareness and the expanding reach of rural insurers. Polo tournaments, cultural festivals, and a renewed interest in breed preservation are all pushing demand for specialized insurance products. Premium pricing models now account for breed, usage, and location, especially in Rajasthan and Punjab where ceremonial ownership is prevalent. Insurance tech startups are partnering with cooperatives to simplify onboarding for first-time buyers.

Horse insurance market in Germany is forecasted to grow at a 11.5% CAGR, anchored by mature infrastructure and deep-rooted equestrian practices. The country offers some of the most comprehensive policies in Europe, often covering transport, surgery, loss of use, and foaling risks. Advancements in equine biometrics and health monitoring are influencing both risk assessment and premium calculations. Competitive riding schools and high-value private ownership create consistent demand across generations.

The United Kingdom is expected to achieve a 9.5% CAGR in the horse insurance space, driven by a combination of leisure riding culture and equestrian sports. From vet fee cover to third-party liability, consumers are opting for comprehensive and flexible policies. Demand is bolstered by increased participation in riding therapy, competitions, and private ownership, particularly in southern England and Scotland. Market players are embracing embedded insurance, bundling horse cover into broader rural policies.

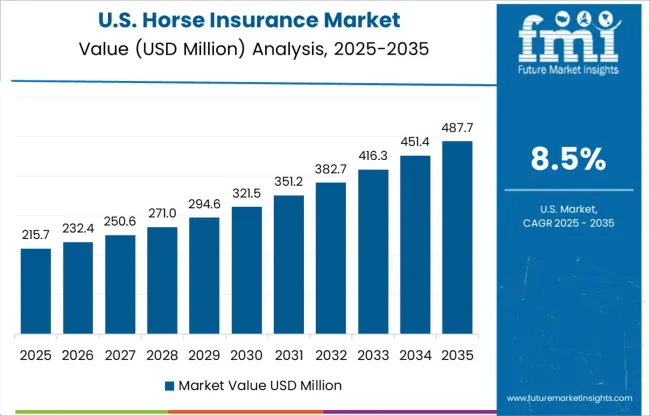

Horse insurance in the United States is projected to grow at a 8.5% CAGR, underpinned by a mature sports industry and shifting risk management preferences. Racehorses, therapy animals, and hobby horses are all contributing to broader policy segmentation. States like Kentucky, Texas, and California continue to dominate demand due to concentrated racing and breeding activity. Direct-to-consumer digital portals have made policy comparison and claims processing more accessible to small and medium-scale owners.

The horse insurance market is moderately consolidated, with Markel Corporation holding a leading share due to its specialized equine insurance products and deep underwriting expertise. Major insurers like AXA S.A., Lloyd’s of London, and Chubb Limited leverage their broad risk portfolios and global networks to offer comprehensive coverage including mortality, major medical, surgical, and liability protection. Nationwide and Great American Insurance Group cater to both individual owners and equine businesses, while Liberty Mutual offers equestrian property and liability policies. Market growth is driven by rising equine asset value, increased participation in competitive equestrian sports, and growing awareness among horse owners about risk mitigation and veterinary cost coverage.

On October 2, 2024, Agria Petinsure launched Ireland’s first lifetime equine insurance policy, offering up to €10,000 annual veterinary fee coverage, along with mortality, loss of use, and full transferability upon sale, delivering comprehensive, lifelong protection for horse owners.

| Item | Value |

|---|---|

| Quantitative Units | USD 666.6 Million |

| Type | Mortality, Major medical & surgical, Loss of use, Liability, and Others |

| Horse Type | Thoroughbred, American quarter horse, Arabian, Morgan, Appaloosa, and Others |

| Application | Recreational and Commercial |

| Distribution Channel | Agents & brokers, Direct response, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Markel Corporation, Axa S.A., Nationwide Mutual Insurance Company, Lloyd's of London, Great American Insurance Group, Chubb Limited, and Liberty Mutual Insurance Company |

| Additional Attributes | Dollar sales by policy type, horse use case, and coverage level; regional demand influenced by equestrian sports, breeding value, and rural economic trends; innovation in digital policy management, risk assessment algorithms, and tele-veterinary integration; cost dynamics shaped by breed, age, and activity risk; regulatory impact on livestock insurance frameworks; and emerging use cases in wellness coverage, travel protection, and genetic value insurance. |

The global horse insurance market is estimated to be valued at USD 666.6 million in 2025.

The market size for the horse insurance market is projected to reach USD 1,729.0 million by 2035.

The horse insurance market is expected to grow at a 10.0% CAGR between 2025 and 2035.

The key product types in horse insurance market are mortality, major medical & surgical, loss of use, liability and others.

In terms of horse type, thoroughbred segment to command 35.4% share in the horse insurance market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Horse Drawn Farming Equipment Market Size and Share Forecast Outlook 2025 to 2035

Horse Bunk Feeder Market Size and Share Forecast Outlook 2025 to 2035

Horse Grain Feeders Market Size and Share Forecast Outlook 2025 to 2035

Horse Corral Panels Market Size and Share Forecast Outlook 2025 to 2035

Horse Stable Supplies Market Size and Share Forecast Outlook 2025 to 2035

Horse Chestnut Seed Extract Market Size, Growth, and Forecast for 2025–2035

Horse Riding Equipment Market Analysis – Growth & Forecast 2025-2035

Insurance Telematics Market

Reinsurance Market Size and Share Forecast Outlook 2025 to 2035

Pet Insurance Market - Trends, Growth & Forecast 2025 to 2035

African Horse Sickness Treatment Market

Compound Horse Feedstuff Market Analysis by Feed Type, Horse Activity, and Ingredient Composition Through 2035

Commercial Insurance Market Insights – Growth & Forecast 2024-2034

Cybersecurity Insurance Market Size and Share Forecast Outlook 2025 to 2035

Telematics-based Auto Insurance Market - Trends & Forecast 2025 to 2035

Industrial Fractional Horsepower Motors Market Analysis by End-user and Region: Forecast for 2025 to 2035

Guaranteed Auto Protection Gap Insurance Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA