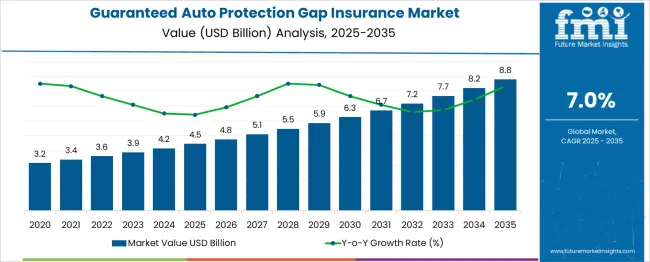

The Guaranteed Auto Protection Gap Insurance Market is estimated to be valued at USD 4.5 billion in 2025 and is projected to reach USD 8.8 billion by 2035, registering a compound annual growth rate (CAGR) of 7.0% over the forecast period. This growth, supported by a CAGR of 7%, is driven by the rising adoption of vehicle financing, growth in auto leasing, and increasing consumer awareness about financial protection in case of total vehicle loss. During the first five-year phase (2025–2030), the market is expected to reach USD 6.3 billion, adding USD 1.8 billion, or 41.9% of the total incremental gain, with a 5-year multiplier of 1.40x. The second half (2030–2035) contributes USD 2.5 billion, representing 58.1% of incremental growth, as digital insurance platforms and embedded finance solutions accelerate GAP insurance penetration across emerging markets. Annual increments rise from USD 0.3 billion in early years to nearly USD 0.6 billion by 2035, reflecting stronger demand linked to premium car sales and extended auto loan tenures. Insurers focusing on AI-based claim processing, bundled policies, and omnichannel distribution strategies will be best positioned to capture value in this USD 4.3 billion opportunity, as financial risk protection becomes an essential component of automotive ownership models.

| Metric | Value |

|---|---|

| Guaranteed Auto Protection Gap Insurance Market Estimated Value in (2025 E) | USD 4.5 billion |

| Guaranteed Auto Protection Gap Insurance Market Forecast Value in (2035 F) | USD 8.8 billion |

| Forecast CAGR (2025 to 2035) | 7.0% |

The guaranteed auto protection (GAP) insurance market holds a distinct share within multiple financial and insurance-related sectors. In the Automotive Insurance Market, it accounts for about 6%, as traditional coverage types like liability and collision dominate. Within the Vehicle Finance and Leasing Services Market, its share is approximately 8%, since GAP insurance is commonly bundled with financing agreements to protect lenders and consumers. For the Auto Loan Protection Products Market, it represents nearly 20%, given its critical role in covering the difference between a vehicle’s actual cash value and the loan balance in case of total loss. In the Personal Insurance Solutions Market, its contribution is around 3%, as broader personal policies overshadow vehicle-specific products. Within the Specialty Insurance Products Market, its share is close to 10%, as GAP coverage is categorized as a niche, optional insurance offering. Growth is driven by increasing vehicle prices, extended loan terms, and rising adoption of leasing, which heighten the risk of negative equity. Consumers are seeking added financial security against depreciation, while automotive dealers and lenders are promoting GAP insurance as a value-added service. Digital distribution, integration with auto financing platforms, and heightened awareness are expected to further strengthen its position globally.

The GAP insurance market is witnessing stable growth, driven by increasing vehicle financing, rising vehicle depreciation rates, and heightened consumer awareness about residual value risk. Automotive lenders and insurers are emphasizing value-added services to strengthen customer retention and mitigate financial exposure in case of total loss events.

Regulatory alignment in motor insurance frameworks and growing vehicle ownership in both developed and emerging economies are enhancing the uptake of GAP policies. Vehicle affordability concerns and economic uncertainties have further increased reliance on financial protection products.

As digitization improves underwriting and claim automation, product customization across vehicle types and buyer profiles is expected to become a growth catalyst. Continued adoption is anticipated from dealerships, online platforms, and agents aligning GAP insurance with bundled automotive services.

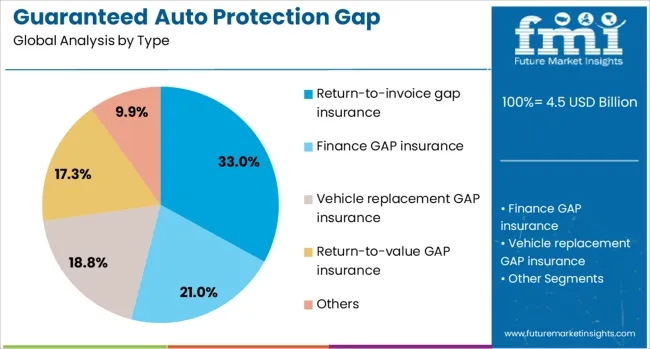

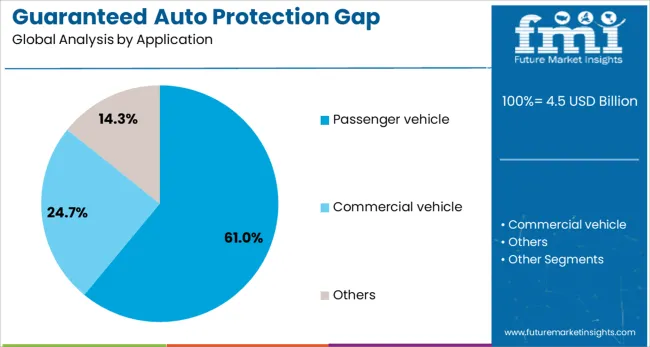

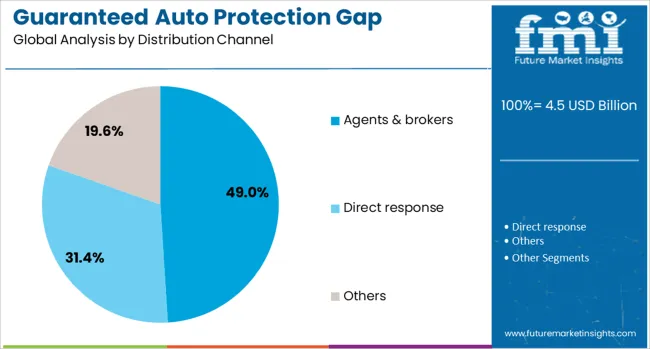

The guaranteed auto protection gap insurance market is segmented by type, application, distribution channel, and geographic regions. The guaranteed auto protection gap insurance market is divided by type into Return-to-invoice gap insurance, Finance GAP insurance, Vehicle replacement GAP insurance, Return-to-value GAP insurance, and Others. In terms of application, the guaranteed auto protection gap insurance market is classified into passenger vehicles, commercial vehicles, and Others. Based on the distribution channel, the guaranteed auto protection gap insurance market is segmented into Agents & brokers, Direct response, and Others. Regionally, the guaranteed auto protection gap insurance industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Return-to-invoice GAP insurance is projected to hold 33.0% of the total market revenue in 2025, making it the leading policy type in the GAP insurance landscape. The segment’s prominence stems from its comprehensive payout structure that bridges the gap between the insurer’s settlement and the original invoice value of the vehicle.

This has increased consumer trust, especially among new vehicle buyers seeking full reimbursement coverage. Automakers and dealerships have integrated this variant as a default add-on, enhancing uptake through financing contracts.

Its appeal is reinforced by rising average invoice prices, which amplify perceived benefit. As consumers seek greater financial protection for depreciating assets, return-to-invoice policies are gaining stronger traction in both private and commercial segments.

Passenger vehicles are forecast to account for 61.0% of the GAP insurance market revenue in 2025, marking them as the dominant application area. The segment’s lead has been driven by consistent growth in personal vehicle ownership and vehicle financing.

Due to high initial depreciation, passenger vehicles present greater risk exposure in the early years of ownership, enhancing the appeal of GAP coverage. Manufacturers, finance providers, and dealers frequently embed GAP offerings into sales contracts for these vehicles, streamlining adoption.

Additionally, rising penetration of EVs and SUVs, often carrying higher sticker prices, has created new relevance for GAP products in mitigating potential out-of-pocket losses for buyers. This segment is expected to retain dominance as retail automotive demand expands.

Agents and brokers are estimated to hold a 49.0% share of GAP insurance distribution in 2025, leading all other sales channels. Their dominance is attributed to the personalized service, advisory role, and bundled offerings that they provide during vehicle financing or insurance purchasing stages.

Consumers often prefer intermediaries for guidance on policy complexity and claim handling support. Agents and brokers have also developed longstanding partnerships with automotive dealers and financiers, giving them strategic control over retail-level distribution.

Enhanced digital integration and CRM tools have allowed agents to operate more efficiently, extending their reach while maintaining advisory depth. As GAP insurance products become more diverse and configurable, intermediated distribution is expected to remain influential.

The guaranteed auto protection (GAP) insurance market is growing due to the rising cost of vehicles, longer loan terms, and higher financing rates. Growth in 2024 and 2025 was supported by increased auto loan penetration and heightened awareness of coverage benefits for vehicle owners. Opportunities are emerging in subscription-based insurance models and partnerships with digital auto marketplaces. Key trends include embedded GAP coverage in leasing agreements, real-time claims processing, and bundled policy packages. However, challenges such as pricing sensitivity, limited consumer understanding, and strict regulatory compliance continue to restrict broader adoption.

The major growth driver is the surge in vehicle financing combined with extended repayment terms. In 2024 and 2025, GAP insurance was increasingly adopted as consumers financed high-value vehicles under long-term loans, leaving them exposed to negative equity risks. Lenders and dealerships offered GAP coverage as part of purchase contracts to safeguard borrowers against unexpected total loss scenarios. Higher replacement costs of electric and luxury vehicles further pushed demand. These developments indicate that financing trends and the desire for financial protection will continue to influence GAP insurance market expansion globally.

Significant opportunities exist in expanding digital insurance platforms and flexible subscription offerings. In 2025, online auto marketplaces integrated GAP coverage options at the point of vehicle purchase, simplifying policy adoption for buyers. Subscription-based GAP insurance packages, allowing users to pay monthly premiums aligned with loan tenure, gained traction among younger consumers. Cross-selling opportunities also emerged through fintech partnerships, where GAP coverage was bundled with auto financing solutions. These patterns reveal that insurers focusing on digital accessibility and convenience-driven models are positioned to capture growth across both developed and emerging markets.

Emerging trends include the integration of GAP coverage within automotive lease and financing agreements, reducing friction for consumers. In 2024, OEMs partnered with insurers to embed GAP protection directly into loan contracts, creating bundled offerings for ease of adoption. AI-driven claims management tools also gained momentum, accelerating settlement processes and reducing administrative costs for insurers. Personalized GAP policies based on real-time vehicle valuation and driver profiles were introduced to enhance risk assessment. These innovations indicate that automation and embedded solutions will redefine competitive positioning in this insurance segment.

Market restraints are shaped by affordability issues and lack of consumer education regarding GAP coverage benefits. In 2024 and 2025, premium pricing for high-value vehicles, especially electric cars, deterred adoption among budget-conscious buyers. Many consumers remained unaware of the financial exposure resulting from vehicle depreciation and loan structures, reducing policy penetration rates. Additionally, stringent compliance requirements in certain regions increased operational costs for insurers. These factors highlight the importance of targeted awareness campaigns, simplified policy terms, and flexible pricing strategies to overcome adoption barriers in a competitive insurance landscape.

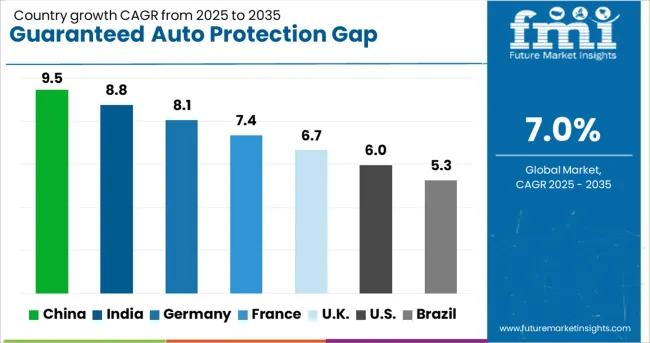

| Country | CAGR |

|---|---|

| China | 9.5% |

| India | 8.8% |

| Germany | 8.1% |

| France | 7.4% |

| UK | 6.7% |

| USA | 6.0% |

| Brazil | 5.3% |

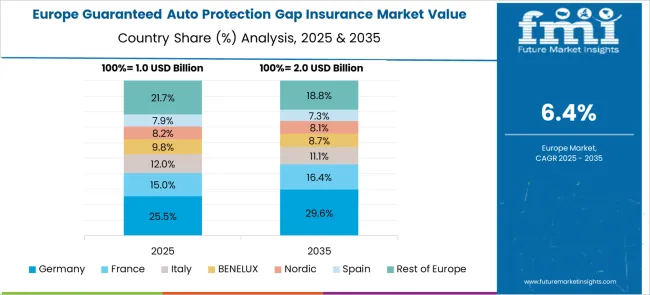

The global guaranteed auto protection (GAP) insurance market is projected to grow at 7% CAGR between 2025 and 2035. China leads with 9.5% CAGR, driven by growing vehicle financing and rising awareness of asset protection solutions. India follows at 8.8%, supported by increasing automotive sales and digital insurance platforms. France records 7.4% CAGR, emphasizing compliance-driven insurance offerings and bundled finance packages. The United Kingdom grows at 6.7%, while the United States posts 6.0%, reflecting steady demand in mature auto finance ecosystems prioritizing customized GAP solutions. Asia-Pacific dominates growth due to expanding vehicle loan penetration, while Europe and North America focus on regulatory alignment and advanced risk-assessment tools.

The guaranteed auto protection insurance market in China is expected to grow at 9.5% CAGR, fueled by increasing vehicle ownership and the rise of auto financing among urban consumers. Digital insurance platforms enhance GAP product accessibility through mobile-based applications and instant policy issuance. Partnerships between automotive OEMs and insurers strengthen bundled offerings with extended warranty and GAP coverage. Consumers prefer add-on GAP policies for high-value vehicles and electric cars due to depreciation risks. Regulatory support for digital finance further boosts market penetration.

The GAP insurance market in India is projected to grow at 8.8% CAGR, driven by rising vehicle loan disbursements and growing awareness of asset protection products. Adoption of GAP coverage expands among urban middle-class buyers purchasing vehicles under long-tenure financing schemes. Insurance aggregators and fintech platforms integrate GAP insurance with loan approvals for simplified access. Increasing penetration of electric vehicles and luxury cars further strengthens the need for GAP protection to offset depreciation losses. Regulatory support for digital insurance sales enhances consumer adoption.

The GAP insurance market in France is expected to grow at 7.4% CAGR, supported by a mature auto finance ecosystem and strong compliance frameworks. Vehicle leasing and long-term financing remain primary growth drivers for GAP coverage adoption. Insurers introduce customized GAP products integrated with value-added services such as roadside assistance and extended warranties. Online platforms and dealership-based insurance sales models expand accessibility. Sustainability-driven automotive policies indirectly support GAP adoption in electric vehicle financing and shared mobility solutions.

The GAP insurance market in the United Kingdom is forecasted to grow at 6.7% CAGR, driven by strong consumer demand for financial protection against depreciation losses in financed and leased vehicles. Online comparison platforms boost transparency, making GAP products widely accessible. Regulatory compliance under the Financial Conduct Authority (FCA) ensures fair pricing and prevents mis-selling, improving consumer trust. Electric vehicle adoption accelerates GAP policy uptake due to high initial depreciation rates. Dealers and insurers collaborate to offer competitive bundled solutions.

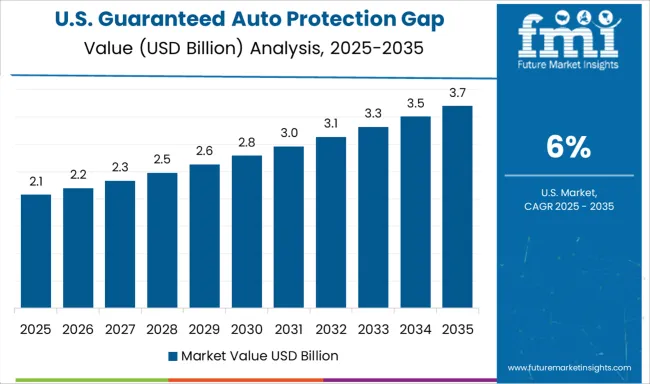

The GAP insurance market in the United States is projected to grow at 6.0% CAGR, reflecting steady adoption in a mature financial environment. Rising vehicle loan tenures and negative equity risks drive demand for GAP policies in both new and used car segments. Auto finance companies integrate GAP coverage within loan agreements for convenience. Digital sales platforms, combined with telematics-driven risk assessment, improve product customization and pricing accuracy. Increasing electric vehicle adoption adds momentum to GAP policies due to higher depreciation rates.

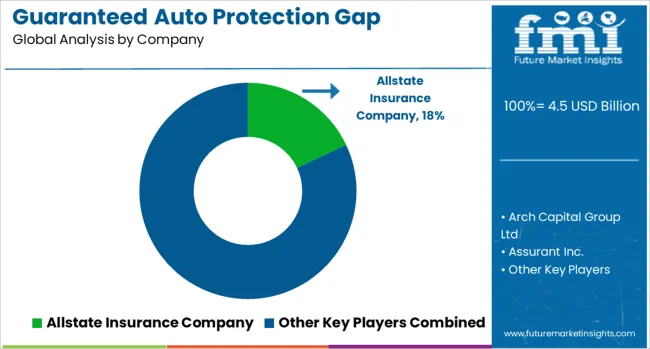

The guaranteed auto protection (GAP) insurance market is dominated by Allstate Insurance Company, which secures its leadership through a comprehensive portfolio of vehicle protection plans, strong underwriting expertise, and an extensive distribution network across dealerships and financial institutions. Allstate’s dominance is reinforced by brand reliability and its ability to integrate GAP coverage within broader auto insurance products, enhancing convenience for policyholders. Key players such as Zurich Insurance Group Ltd., Assurant Inc., Berkshire Hathaway Inc., Arch Capital Group Ltd., and Nationwide Mutual Insurance Company hold significant shares by offering customized GAP solutions for both new and used vehicles, focusing on flexibility in coverage terms and fast claim settlement processes. These companies prioritize partnerships with auto lenders and manufacturers to strengthen market penetration and enhance customer experience. Emerging players including Car Care Plan Ltd., Direct Gap Ltd., and Infinity Insurance (Assurity Solutions Ltd.) are gaining traction by targeting niche segments through digital platforms and cost-effective GAP insurance packages. Their strategies focus on transparency in pricing, simplified policy structures, and value-added features like return-to-invoice and negative equity protection. Market growth is being driven by increasing vehicle financing, longer loan terms, and heightened consumer awareness regarding depreciation risks. The trend toward online policy purchase, integration with auto finance platforms, and innovative add-on services is expected to influence competitive dynamics, making customer-centric offerings and digital capability critical for future success.

| Item | Value |

|---|---|

| Quantitative Units | USD 4.5 Billion |

| Type | Return-to-invoice gap insurance, Finance GAP insurance, Vehicle replacement GAP insurance, Return-to-value GAP insurance, and Others |

| Application | Passenger vehicle, Commercial vehicle, and Others |

| Distribution Channel | Agents & brokers, Direct response, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Allstate Insurance Company, Arch Capital Group Ltd, Assurant Inc., Berkshire Hathaway Inc, Car Care Plan Ltd, Direct Gap Ltd, Infinity Insurance, Assurity Solutions Ltd., Nationwide Mutual Insurance Company, and Zurich Insurance Group Ltd. |

| Additional Attributes | Dollar sales segmented by contract type (annual vs one-time) and channel (OEM, dealer, insurer). North America dominates; Europe shows steady uptake. Buyers prioritize transparent pricing and digital claims. Innovations include telematics-linked coverage, bundled warranties, and AI-driven claim adjudication, supported by regulations on fee caps and disclosure standards. |

The global guaranteed auto protection gap insurance market is estimated to be valued at USD 4.5 billion in 2025.

The market size for the guaranteed auto protection gap insurance market is projected to reach USD 8.8 billion by 2035.

The guaranteed auto protection gap insurance market is expected to grow at a 7.0% CAGR between 2025 and 2035.

The key product types in guaranteed auto protection gap insurance market are return-to-invoice gap insurance, finance gap insurance, vehicle replacement gap insurance, return-to-value gap insurance and others.

In terms of application, passenger vehicle segment to command 61.0% share in the guaranteed auto protection gap insurance market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Autonomous Driving Simulation Tester Market Size and Share Forecast Outlook 2025 to 2035

Automotive Direct Liquid Cooling IGBT Module Market Size and Share Forecast Outlook 2025 to 2035

Automotive Hoses and Assemblies Market Size and Share Forecast Outlook 2025 to 2035

Automobile Brake Shoes Market Size and Share Forecast Outlook 2025 to 2035

Automotive Network Testing Market Size and Share Forecast Outlook 2025 to 2035

Automatic Chicken Deboning Machine Market Size and Share Forecast Outlook 2025 to 2035

Automated Radionuclide Dispenser Market Size and Share Forecast Outlook 2025 to 2035

Automotive Performance Part Market Size and Share Forecast Outlook 2025 to 2035

Automated Tool Grinding Systems Market Size and Share Forecast Outlook 2025 to 2035

Automatic Filter Press Solutions Market Size and Share Forecast Outlook 2025 to 2035

Automatic Filter Presses (AFPs) Market Size and Share Forecast Outlook 2025 to 2035

Automotive Carbon Ceramic Brake Market Size and Share Forecast Outlook 2025 to 2035

Automotive Camshaft Market Size and Share Forecast Outlook 2025 to 2035

Automotive Stamping Industry Analysis in India Size and Share Forecast Outlook 2025 to 2035

Automotive Cylinder Liner Market Size and Share Forecast Outlook 2025 to 2035

Automotive Microcontroller Market Size and Share Forecast Outlook 2025 to 2035

Autonomous Aerial Robot Market Size and Share Forecast Outlook 2025 to 2035

Automotive Roof Rails Market Size and Share Forecast Outlook 2025 to 2035

Automated Test Equipment Market Size and Share Forecast Outlook 2025 to 2035

Autoclave Market Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA