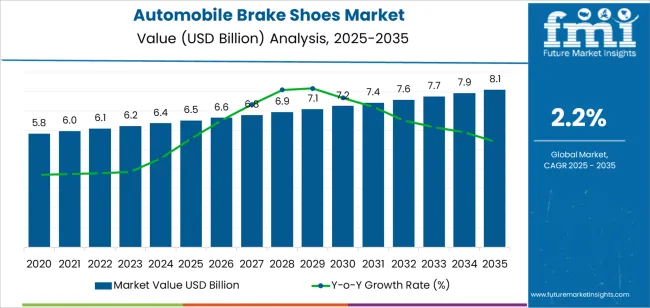

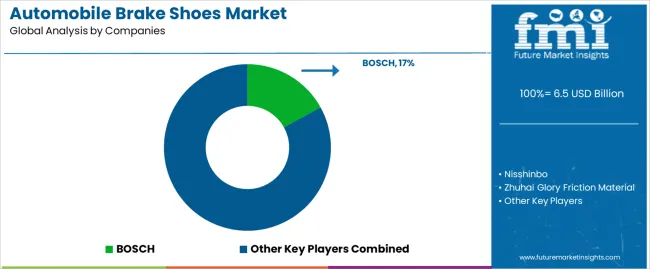

The global automobile brake shoes market is valued at USD 6.5 billion in 2025 and is projected to reach USD 8 billion by 2035, expanding at a CAGR of 2.2%. The absolute dollar opportunity during this period stands at USD 1.5 billion, reflecting measured but steady demand as global vehicle production stabilizes and replacement cycles lengthen across passenger and commercial fleets. Rolling CAGR indicates moderate growth, supported by consistent aftermarket activity and sustained use of drum brake systems in cost-sensitive vehicle categories.

Manufacturers are refining friction material formulations to improve temperature tolerance, wear resistance, and noise reduction under varying load conditions. The transition toward non-asbestos organic and low-copper compounds continues as environmental regulations tighten. Automation in production lines and enhanced bonding techniques are improving dimensional accuracy and overall product consistency.

Asia Pacific remains the largest market due to extensive automotive manufacturing bases in China, India, and Japan. North America and Europe sustain replacement demand driven by established vehicle populations and maintenance compliance. Through 2035, material cost management, distribution efficiency, and compatibility with evolving braking technologies will remain critical factors influencing long-term performance in the automobile brake shoes market.

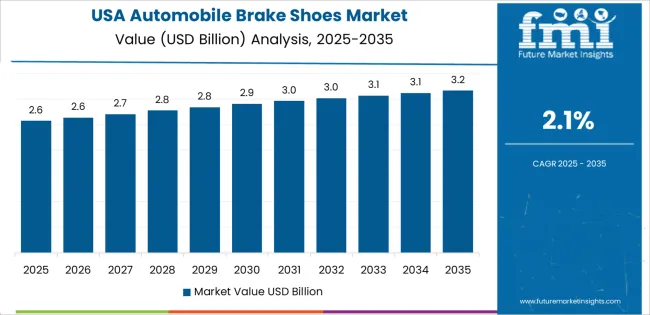

Between 2025 and 2030, the Automobile Brake Shoes Market is expected to expand from USD 6.5 billion to USD 7.2 billion, registering a rolling compound annual growth rate (CAGR) of approximately 2%. This period will be shaped by steady demand for replacement parts in both passenger and commercial vehicles, driven by fleet maintenance cycles and the aging vehicle population. The adoption of lightweight friction materials, such as advanced ceramics and composites, will enhance braking efficiency and longevity. Market players are focusing on optimizing manufacturing processes and improving wear resistance to align with environmental and safety regulations across global automotive sectors.

From 2030 to 2035, the market is forecast to increase from USD 7.2 billion to USD 8.0 billion, achieving a rolling CAGR of around 2.1%. This growth will be supported by the ongoing electrification of vehicles and the sustained use of drum brakes in compact and electric models where cost efficiency and parking brake integration are key. The aftermarket segment will remain a significant growth contributor, particularly in emerging markets with expanding vehicle fleets. Strategic collaborations between friction material suppliers and OEMs will drive innovation in eco-friendly formulations, ensuring compliance with evolving emission and noise reduction standards.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 6.5 billion |

| Market Forecast Value (2035) | USD 8.0 billion |

| Forecast CAGR (2025–2035) | 2.2% |

The automobile brake shoes market maintains steady growth as global vehicle fleets expand and demand for cost-efficient braking solutions persists in light commercial and passenger vehicles. Brake shoes remain essential in drum braking systems, widely used for rear-wheel applications due to their durability and low maintenance requirements. Manufacturers focus on improving friction material formulations using advanced composites that enhance heat dissipation, wear resistance, and braking consistency. Growing vehicle production in Asia-Pacific and the replacement needs of aging fleets in Europe and North America sustain consistent aftermarket demand, reinforcing the segment’s long-term stability.

Technological refinement also supports gradual modernization within the market. Automated manufacturing processes ensure uniform material density and precise curvature, reducing noise and vibration under braking stress. Environmental regulations influence a shift toward copper-free and low-dust friction materials that comply with regional emission standards. Electric and hybrid vehicles, although equipped primarily with disc systems, still incorporate brake shoes for parking or secondary braking mechanisms, ensuring continued relevance. Distribution networks strengthen through integration with online retail platforms and authorized service centers offering certified replacement parts. While price competition and raw material fluctuations affect margins, ongoing product standardization and regional automotive recovery trends maintain steady global market performance.

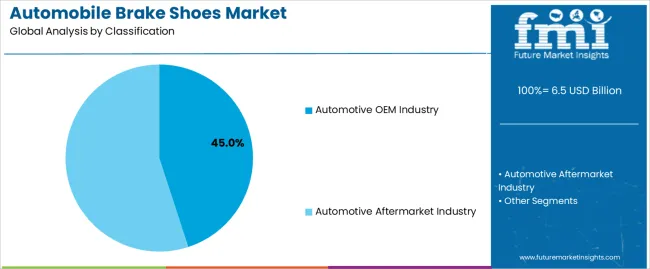

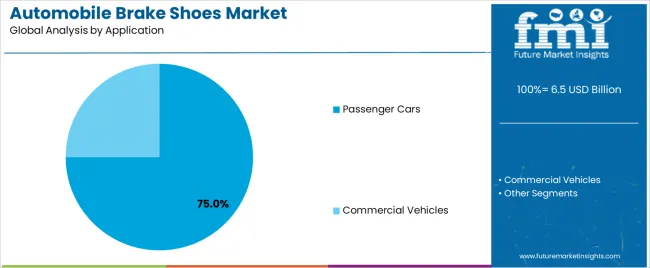

The automobile brake shoes market is segmented by classification, application, and region. By classification, the market is divided into automotive OEM industry and automotive aftermarket industry. Based on application, it is categorized into passenger cars and commercial vehicles. Regionally, the market is segmented into North America, Europe, East Asia, South Asia, Latin America, and the Middle East & Africa. These segments define supply structure, end-use integration, and regional production alignment across the global automotive component industry.

The automotive OEM industry segment accounts for approximately 45.0% of the global automobile brake shoes market in 2025, representing the leading classification category. This dominance results from the consistent demand for factory-installed braking components in new vehicle production. Brake shoes supplied to OEMs are designed to meet precise dimensional tolerances, material standards, and safety certifications required by automotive manufacturers during assembly processes.

The segment benefits from global vehicle production volumes, particularly in East Asia and North America, where original equipment supply chains are well established. Manufacturers prioritize friction material consistency, wear resistance, and thermal stability to ensure reliable braking performance and compliance with vehicle safety regulations. Strategic supplier partnerships with OEMs provide stable demand, supported by standardized procurement cycles and quality validation frameworks. Growth within the segment is reinforced by technological improvements in brake lining materials and automation of manufacturing processes. The automotive OEM industry remains the primary driver of brake shoe consumption due to its scale, regulatory alignment, and continuous integration of advanced materials for improved performance and durability in passenger and commercial vehicles.

The passenger cars segment represents about 75.0% of the total automobile brake shoes market in 2025, making it the largest application category. This leadership reflects the high global volume of passenger vehicles requiring frequent maintenance and component replacement cycles. Brake shoes are used primarily in rear drum braking systems, providing consistent frictional force and cost efficiency compared with disc brake assemblies.

The segment’s dominance is supported by widespread passenger vehicle production, particularly in East Asia and Europe, where compact and mid-size cars maintain strong market share. Demand is further reinforced by replacement requirements within the existing vehicle fleet, as brake shoes experience wear through regular operation. Manufacturers continue to enhance friction material formulations to improve heat dissipation, noise control, and service life. In developing regions, drum brake systems remain prevalent due to lower manufacturing and servicing costs. The passenger cars segment’s consistent volume ensures stable demand across both OEM and aftermarket supply channels. Its share is expected to remain substantial as affordability, ease of maintenance, and regulatory safety compliance continue to sustain drum brake system installations in the global passenger vehicle market.

The automobile brake shoes market is rising in parallel with vehicle production, especially in regions where drum-brake systems remain common in rear axles or for smaller vehicles. As safety regulations tighten and vehicle parc ages, replacement demand for brake shoes increases. At the same time, the shift toward disc brakes and electric vehicles may reduce reliance on traditional brake shoes. A notable trend is the introduction of advanced friction materials and integrated sensors in brake shoes to improve durability, enable predictive maintenance and align with digital vehicle systems.

Growth is primarily driven by expanding vehicle fleets globally, the growth of light commercial vehicles and two-wheelers in emerging markets, and increasing aftermarket demand as vehicles age. Furthermore, stricter vehicle safety standards and consumer expectations for reliable braking performance encourage manufacturers to invest in higher-quality brake shoes. In regions where drum brakes still dominate or are cost-effective for smaller vehicles, demand remains strong. Maintenance cycles and replacement requirements assure steady demand in the aftermarket channel, providing a stable base for market growth.

One key restraint is the gradual transition from drum brake systems—which use brake shoes—to disc brake systems or regenerative braking systems in electric vehicles that depend less on traditional shoe components. As disc brakes and braking by wire systems become more prevalent in many vehicle segments, the demand for brake shoes may decline. Additionally, cost pressures on original equipment manufacturers may limit investment in advanced materials for brake shoes. Supply-chain disruptions and raw-material price volatility also pose challenges for manufacturers and affect market dynamics.

The market is shifting toward brake shoes made with lighter, higher performance friction materials that reduce weight and improve thermal resistance while meeting durability and noise regulations. Integration of wear sensors or wireless monitoring embedded in braking systems is gradually appearing, enabling predictive maintenance and reducing downtime. Regional aftermarket growth is expected in Asia-Pacific and Latin America where vehicle ownership is rising and service infrastructure is expanding. Also, manufacturers are focusing on modular and interchangeable designs that can service multiple vehicle platforms, reducing inventory complexity and supporting cost-effective replacement strategies.

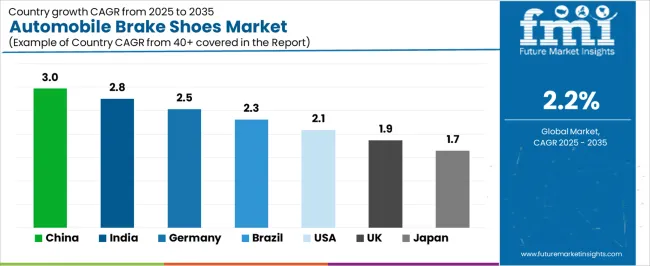

| Country | CAGR |

|---|---|

| China | 3.0% |

| India | 2.8% |

| Germany | 2.5% |

| Brazil | 2.3% |

| USA | 2.1% |

| UK | 1.9% |

| Japan | 1.7% |

The Automobile Brake Shoes Market is expanding at a moderate pace globally, with China leading at a 3% CAGR through 2035, supported by strong vehicle production volumes, aftermarket demand, and the shift toward improved braking efficiency. India follows at 2.8%, driven by growing automotive manufacturing and increased consumer focus on safety and maintenance. Germany records 2.5%, reflecting advanced engineering standards and adoption of high-performance materials. Brazil grows at 2.3%, benefiting from expansion in commercial vehicle fleets and repair market activity. The USA, at 2.1%, maintains steady demand driven by replacement cycles and technological upgrades, while the UK (1.9%) and Japan (1.7%) focus on lightweight materials, sustainability, and continued integration of advanced friction technologies in braking systems.

The report covers an in-depth analysis of 40+ countries top-performing countries are highlighted below.

In China, revenue from automobile brake shoes is projected to grow at a CAGR of 3.0% through 2035, supported by expanding automotive manufacturing and continuous investment in production capacity. The country’s large-scale passenger and commercial vehicle output sustains high demand for braking components. Local suppliers are focusing on friction material formulation and heat resistance improvements to meet regulatory standards. Increasing electric vehicle production is encouraging innovation in lightweight brake assemblies and low-noise systems for both domestic and export markets.

India is witnessing consistent growth in the automobile brake shoes market, advancing at a CAGR of 2.8%, supported by increased vehicle production and localization of component manufacturing. Expanding domestic supply chains and Make-in-India initiatives have boosted local production efficiency. Manufacturers emphasize enhanced wear resistance, temperature endurance, and cost competitiveness to serve both OEM and aftermarket sectors. Rising demand from two-wheelers and light commercial vehicles contributes significantly to market volume expansion.

Across Germany, the automobile brake shoes market is advancing at a CAGR of 2.5%, supported by the country’s expertise in automotive component engineering and focus on product quality. Manufacturers prioritize dimensional accuracy, material uniformity, and advanced surface treatment for improved performance. Integration of sensor technology and disc-brake compatibility systems continues to support innovation. Strong relationships with global automakers and Tier-1 suppliers sustain consistent export activity and technological leadership in friction system development.

Brazil is recording stable progress in the automobile brake shoes market, growing at a CAGR of 2.3%, supported by recovery in domestic vehicle production and aftermarket replacement cycles. Local manufacturers focus on cost-effective production and improved heat dissipation properties. The replacement market remains a key revenue contributor due to aging vehicle fleets. Import partnerships with international component suppliers help maintain product quality and technical standards, ensuring steady market activity in both OEM and service segments.

In the United States, the automobile brake shoes market is increasing at a CAGR of 2.1%, supported by product advancements and strong aftermarket activity. Manufacturers are emphasizing low-noise designs, corrosion resistance, and uniform friction performance. Integration with electronic braking systems in light commercial vehicles supports incremental product innovation. The mature automotive sector continues to generate replacement demand, ensuring consistent consumption of brake components across service networks nationwide.

Across the United Kingdom, the automobile brake shoes market is advancing at a CAGR of 1.9%, supported by modernization of vehicle maintenance networks and aftermarket distribution. Growth in e-commerce-based spare parts sales is improving accessibility for workshops and end users. Manufacturers focus on friction consistency, longevity, and eco-friendly material formulations to comply with European regulations. Replacement demand from older vehicle segments remains the primary market driver, supported by stable maintenance frequency.

Japan is growing steadily in the automobile brake shoes market, projected to rise at a CAGR of 1.7% through 2035. Domestic producers emphasize compact, durable, and heat-stable designs suited for small and mid-size vehicles. Continuous improvement in production precision and automated inspection processes ensures consistent performance standards. Demand remains stable across passenger vehicles, with aftermarket replacement providing the primary revenue stream. Industry collaboration promotes material innovation aligned with next-generation braking technologies.

The global automobile brake shoes market is highly competitive, supported by a broad mix of OEM suppliers and aftermarket specialists. BOSCH occupies a prominent role through integrated braking systems and supplier relationships across passenger and commercial vehicle manufacturers. Nisshinbo and Akebono focus on friction material science and stable production processes for original equipment supply.

ZF Aftermarket, Tenneco, MAT Holdings, and ITT Corporation extend reach through branded aftermarket channels and distribution networks. Brembo and Hitachi supply premium and performance-oriented friction solutions tailored to high-demand braking applications. Sangsin Brake, ADVICS, and GM ACDelco maintain sizable presence in replacement parts and tiered OEM supply. Regional manufacturers in China and Brazil, including Zhuhai Glory Friction Material and Shandong Gold Phoenix, provide volume capacity and cost-competitive alternatives.

Aftermarket specialists such as Fras-le, Brake Parts Inc, EBC Brakes, and TMD Friction address replacement demand with certified product lines. Heavy vehicle and rail sectors are served by Knorr-Bremse and BorgWarner through application-specific formulations and assemblies. Competitive differentiation in this market relies on friction compound performance, thermal stability, and noise vibration harshness control. Manufacturers also compete on regulatory compliance, certification, and production scalability. Supply chain resilience and material sourcing influence lead times and cost structures. Long-term strategic advantage depends on advances in low-dust formulations, EV-adapted braking characteristics, and sustained partnerships with vehicle OEMs and aftermarket distributors.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD billion |

| Type (Classification) | Automotive OEM Industry, Automotive Aftermarket Industry |

| Application | Passenger Cars, Commercial Vehicles |

| Regions Covered | North America, Europe, East Asia, South Asia, Latin America, Middle East & Africa, Eastern Europe |

| Countries Covered | China, India, USA, Germany, Brazil, UK, Japan, and 40+ countries |

| Key Companies Profiled | BOSCH, Nisshinbo, ZF Aftermarket (TRW), Tenneco (Federal Mogul), MAT Holdings, ITT Corporation, Akebono, Sangsin Brake, Brembo, Hitachi, ADVICS, GM (ACDelco), BorgWarner (Delphi), Continental (ATE), Fras-le, Brake Parts Inc, Knorr-Bremse AG, EBC Brakes, TMD Friction (AEQUITA), Shandong Gold Phoenix, Zhuhai Glory Friction Material |

| Additional Attributes | Dollar sales by classification and application; OEM vs aftermarket revenue shares; regional adoption patterns in passenger and commercial vehicles; material innovation in copper-free and low-dust formulations; advancements in friction composites and heat management; EV integration trends for secondary braking; distribution networks across online and authorized service centers; lifecycle cost analysis and regulatory compliance benchmarks. |

The global automobile brake shoes market is estimated to be valued at USD 6.5 billion in 2025.

The market size for the automobile brake shoes market is projected to reach USD 8.1 billion by 2035.

The automobile brake shoes market is expected to grow at a 2.2% CAGR between 2025 and 2035.

The key product types in automobile brake shoes market are automotive oem industry and automotive aftermarket industry.

In terms of application, passenger cars segment to command 75.0% share in the automobile brake shoes market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Automobile Accessories Market

Waterborne Automobile Coating Market - Trends & Forecast 2025 to 2035

Predictive Automobile Technology Market

Beryllium Copper for Automobile Market Size and Share Forecast Outlook 2025 to 2035

Particle Reinforced Aluminum Matrix Composite Brake Disc for Electric Automobiles Market Size and Share Forecast Outlook 2025 to 2035

Brake System Market Size and Share Forecast Outlook 2025 to 2035

Brake Cables Market Size and Share Forecast Outlook 2025 to 2035

Brake Override System Market

Brake Shoe Market

Brake Pads and Shoes Market Size and Share Forecast Outlook 2025 to 2035

Air Brake Systems Market Growth & Demand 2025 to 2035

HCV Brake Components Market

Drum Brake Shoe Market Size and Share Forecast Outlook 2025 to 2035

Rail Brake Frame Market

Press Brakes Market Size and Share Forecast Outlook 2025 to 2035

Bicycle Brake Lever Market Size and Share Forecast Outlook 2025 to 2035

Automotive Brake Linings Market Size and Share Forecast Outlook 2025 to 2035

Automotive Brake Hoses and Assemblies Market Size and Share Forecast Outlook 2025 to 2035

Automotive Brake Fluid Market Size and Share Forecast Outlook 2025 to 2035

Automotive Brake Booster and Master Cylinder Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA