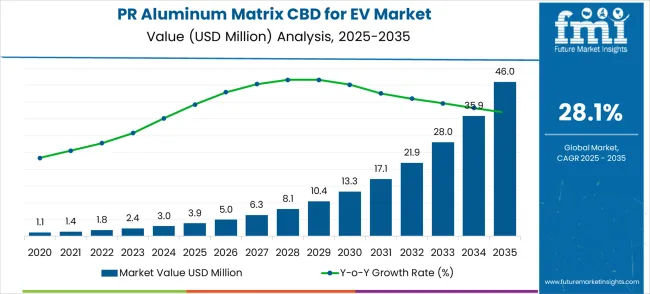

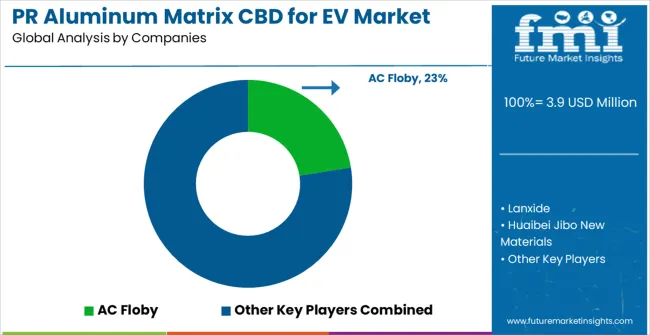

The particle reinforced aluminum matrix composite brake disc market for electric automobiles is projected to grow from USD 3.9 million in 2025 to USD 46.0 million in 2035, advancing at a CAGR of 28.1%. The initial stage from 2020 to 2025, covering values from USD 1.1 million to 3.9 million, represents the technology validation phase. During this period, adoption is gradual as the focus is placed on demonstrating performance reliability and thermal efficiency. This stage is critical because OEMs selectively test these discs in high-performance EV models to validate their advantages over conventional materials, forming the base for future acceleration.

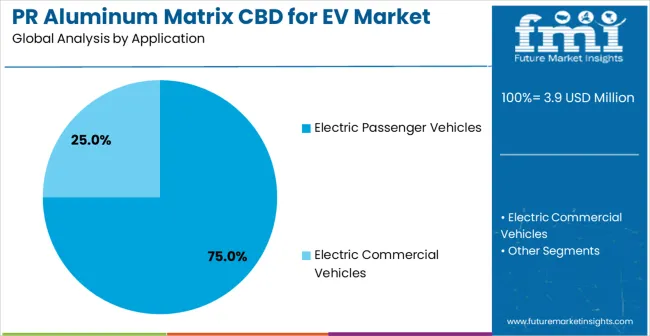

Leading Application in Particle Reinforced Aluminum Matrix Composite Brake Disc for Electric Automobiles Market: Electric Passenger Vehicles (75.0%)

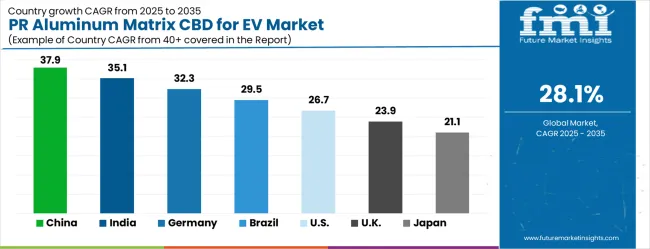

Key Growth Regions in Particle Reinforced Aluminum Matrix Composite Brake Disc for Electric Automobiles Market: China, India, and Germany

Top Key Players in Particle Reinforced Aluminum Matrix Composite Brake Disc for Electric Automobiles Market: AC Floby, Lanxide, Huaibei Jibo New Materials, Hunan Xiangtou Lightweight Material Technology, Hunan Wenchang New Material Technology, Kailong High Technology Co., Ltd., Shanghai Ruier Industrial

| Metric | Value |

|---|---|

| Market Value (2025) | USD 3.9 million |

| Forecast Value (2035) | USD 46 million |

| Forecast CAGR (2025–2035) | 28.1% |

The second major growth stage emerges between 2026 and 2030, where the market expands from USD 5 million to 13.3 million. This inflection reflects a clear breakpoint driven by advancements in material processing and cost-efficiency gains. Wider industry acceptance is expected as automotive manufacturers scale their integration programs. The period also benefits from stronger EV production numbers and the rising demand for lightweight braking systems. Breakpoint mapping here highlights a transition from pilot-scale adoption to broader commercialization, underpinned by technical improvements and evolving consumer demand for enhanced driving performance.

The third and most pronounced breakpoint appears from 2030 to 2035, when revenues surge from USD 13.3 million to 46 million. This represents mass adoption, where OEMs integrate composite brake discs across mid-range and volume EVs, not just premium categories. Factors such as supply chain maturity, improved cost structures, and heightened focus on braking efficiency push the market into exponential growth. The curve steepens significantly, signaling full-scale commercialization. Breakpoint analysis therefore indicates a structured pathway: early validation, scaling adoption, and eventual mass-market integration, with each phase driving momentum for the next.

Market expansion is being supported by the rapid increase in electric vehicle production and the corresponding need for specialized braking components that enable optimal performance characteristics including weight reduction, thermal management, and regenerative braking compatibility. Modern electric vehicle manufacturers rely on advanced composite brake disc technologies to enhance vehicle efficiency including improved energy recovery, reduced unsprung weight, and enhanced thermal dissipation capabilities. Even minor weight reductions in braking components require sophisticated composite materials to maintain optimal braking performance and safety standards.

The growing complexity of electric vehicle systems and increasing performance requirements are driving demand for particle reinforced composite brake discs from certified manufacturers with appropriate material expertise and quality systems. Automotive regulatory agencies are increasingly requiring comprehensive testing of composite braking components to maintain safety compliance and ensure vehicle performance standards. Industry specifications and electric vehicle manufacturing requirements are establishing standardized composite brake disc procedures that require specialized materials and trained manufacturing technicians.

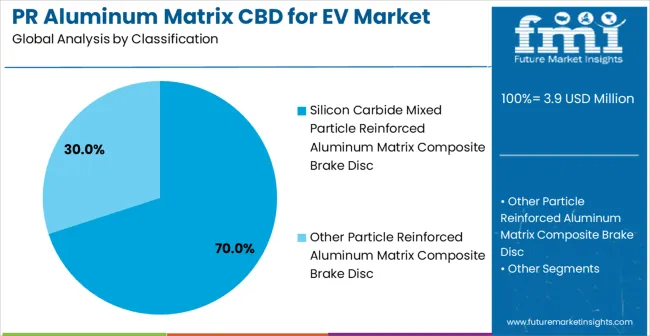

The market is segmented by product type, application, and region. By product type, the market is divided into silicon carbide mixed particle reinforced aluminum matrix composite brake disc and other particle reinforced aluminum matrix composite brake disc. Based on application, the market is categorized into electric passenger vehicles and electric commercial vehicles. Regionally, the market is divided into North America, Europe, East Asia, South Asia & Pacific, Latin America, and Middle East & Africa.

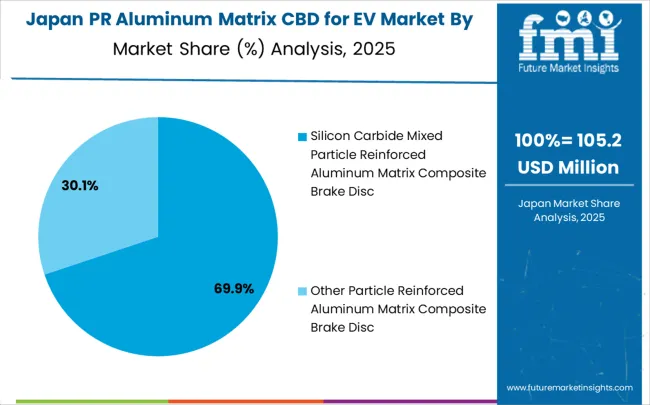

In 2025, silicon carbide mixed particle reinforced aluminum matrix composite brake discs are anticipated to capture nearly 70% of the market. Their widespread adoption is attributed to unmatched advantages in wear resistance, thermal stability, and braking reliability under intense EV operating conditions. Silicon carbide reinforcement addresses limitations of conventional cast iron brake discs, ensuring heat management and extended lifespan. Electric vehicles impose significant demands on braking systems due to heavy battery weight, regenerative braking cycles, and torque-intensive driving. Silicon carbide composites meet these requirements by delivering stable braking performance during rapid temperature variations. The segment’s dominance is reinforced by established supply chain processes and validation across global automotive platforms. Manufacturers prioritize these discs for premium EVs and high-performance SUVs, where braking safety and lightweight construction remain crucial. Continued R&D investments and automaker collaborations ensure that silicon carbide AMC brake discs will shape performance standards for next-generation electric mobility.

Electric passenger vehicles are expected to represent about 75% of the total market share in 2025, highlighting their central role in adopting composite brake disc technology. Passenger EVs, including sedans, hatchbacks, and SUVs, generate the highest demand for advanced braking solutions due to large-scale production volumes. Automakers focus on aluminum matrix composite brake discs to meet consumer expectations of enhanced safety, energy efficiency, and improved driving range. The lightweight property of AMC brake discs reduces overall vehicle mass, extending range without sacrificing performance. Their superior thermal management capabilities also counteract heat buildup from frequent urban braking and regenerative cycles. Government policies accelerating EV adoption further strengthen this segment’s growth trajectory. Cost efficiencies and scaling enable AMC brake discs to extend beyond premium categories into mid-tier EV models. As passenger EVs dominate electrification trends, they continue to drive long-term demand, reinforcing AMC brake discs as an essential material innovation for the sector.

The particle reinforced aluminum matrix composite brake disc for electric automobiles market is advancing steadily due to increasing electric vehicle production and growing recognition of composite material advantages in automotive braking applications. However, the market faces challenges including high manufacturing costs for advanced composite materials, need for continuous development of processing technologies, and varying quality requirements across different electric vehicle platforms. Material standardization efforts and certification programs continue to influence manufacturing methods and market development patterns.

The growing deployment of sophisticated composite manufacturing processes is enabling improved brake disc quality with enhanced performance characteristics and reduced production costs. Advanced powder metallurgy and sintering technologies provide optimized material properties while maintaining consistent quality and dimensional accuracy. These technologies are particularly valuable for electric vehicle manufacturers and component suppliers that require high-performance brake discs with specific thermal and mechanical properties for electric vehicle applications.

Modern composite brake disc manufacturers are incorporating advanced design optimization techniques and material selection strategies that improve performance while reducing component weight. Integration of computer-aided engineering and finite element analysis enables precise optimization of composite material distribution and brake disc geometry. Advanced design technologies support development of application-specific brake disc solutions that meet stringent electric vehicle performance requirements and safety standards.

| Country | CAGR (2025-2035) |

|---|---|

| China | 37.9% |

| India | 35.1% |

| Germany | 32.3% |

| Brazil | 29.5% |

| United States | 26.7% |

| United Kingdom | 23.9% |

| Japan | 21.1% |

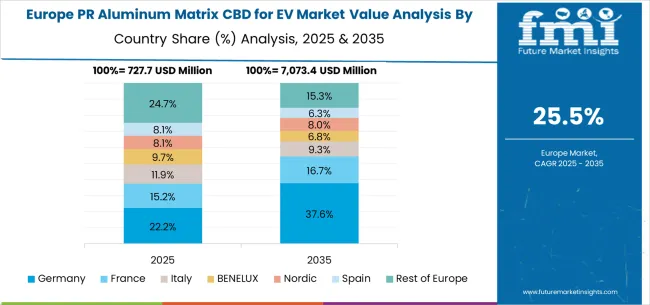

The particle reinforced aluminum matrix composite brake disc for electric automobiles market is growing rapidly, with China leading at a 37.9% CAGR through 2035, driven by massive electric vehicle production expansion, government electrification policies, and increasing composite material manufacturing capabilities. India follows at 35.1%, supported by rising electric vehicle adoption and growing automotive component manufacturing infrastructure. Germany grows steadily at 32.3%, integrating advanced composite technologies into established automotive manufacturing networks. Brazil records 29.5%, emphasizing electric vehicle market development and composite material production expansion. The United States shows solid growth at 26.7%, focusing on electric vehicle technology advancement and lightweight component integration. The United Kingdom demonstrates steady progress at 23.9%, maintaining established automotive research capabilities and electric vehicle development activities. Japan records 21.1% growth, concentrating on precision manufacturing and quality enhancement initiatives.

Revenue from particle reinforced aluminum matrix composite brake disc for electric automobiles in China is projected to exhibit the highest growth rate with a CAGR of 37.9% through 2035, driven by rapid expansion of electric vehicle production capabilities and increasing investment in advanced automotive component manufacturing. The country’s dominant electric vehicle manufacturing sector and expanding composite material production facilities are creating significant demand for high-performance brake disc solutions. Major automotive manufacturers and component suppliers are establishing comprehensive manufacturing networks to support the growing electric vehicle market across domestic and international applications.

Revenue from particle reinforced aluminum matrix composite brake disc for electric automobiles in India is expanding at a CAGR of 35.1%, supported by increasing electric vehicle market penetration and growing automotive component manufacturing capabilities in composite materials. The country’s expanding electric vehicle sector and rising automotive export activities are driving demand for cost-effective composite brake disc manufacturing technologies. Automotive manufacturers and component suppliers are gradually establishing advanced manufacturing capabilities to serve the growing electric vehicle component market.

Demand for particle reinforced aluminum matrix composite brake disc for electric automobiles in Germany is projected to grow at a CAGR of 32.3%, supported by the country’s emphasis on automotive technology innovation and premium component manufacturing excellence. German automotive manufacturers and component suppliers are implementing advanced composite brake disc technologies that meet stringent quality requirements and performance specifications. The market is characterized by focus on technical precision, advanced manufacturing processes, and compliance with comprehensive automotive safety standards.

Revenue from particle reinforced aluminum matrix composite brake disc for electric automobiles in Brazil is growing at a CAGR of 29.5%, driven by increasing electric vehicle market development activities and growing recognition of composite component importance in automotive manufacturing. The country’s expanding automotive industry is gradually integrating advanced composite brake disc technologies to enhance vehicle performance and manufacturing capabilities. Automotive manufacturers and component suppliers are investing in composite manufacturing systems to address evolving electric vehicle market demands.

Demand for particle reinforced aluminum matrix composite brake disc for electric automobiles in the USA is expanding at a CAGR of 26.7%, driven by established automotive industry leadership and growing emphasis on electric vehicle component development. Large automotive manufacturers and component suppliers are implementing comprehensive composite brake disc manufacturing capabilities to serve diverse electric vehicle development requirements. The market benefits from advanced research infrastructure and established regulatory frameworks that support innovative composite component technologies.

Demand for particle reinforced aluminum matrix composite brake disc for electric automobiles in the UK is projected to grow at a CAGR of 23.9%, supported by established automotive research capabilities and growing emphasis on electric vehicle component innovation activities. British automotive manufacturers and research institutions are implementing composite brake disc technologies that meet industry quality standards and performance requirements. The market benefits from established automotive infrastructure and comprehensive research programs for electric vehicle component development.

Revenue from particle reinforced aluminum matrix composite brake disc for electric automobiles in Japan is growing at a CAGR of 21.1%, driven by the country’s focus on precision automotive manufacturing and quality enhancement applications in electric vehicle components. Japanese automotive manufacturers and component suppliers are implementing advanced composite brake disc systems that demonstrate superior processing quality and technical reliability. The market is characterized by emphasis on technological excellence, quality assurance, and integration with established automotive production workflows.

The particle reinforced aluminum matrix composite brake disc for electric automobiles market is defined by competition among specialized composite manufacturers, automotive component suppliers, and advanced materials companies. Companies are investing in advanced manufacturing process development, material optimization technologies, quality enhancement systems, and automotive integration capabilities to deliver high-performance, reliable, and cost-effective composite brake disc solutions. Strategic partnerships, technological innovation, and manufacturing scaling are central to strengthening product portfolios and market presence.

AC Floby specializes in advanced composite brake disc manufacturing with focus on electric vehicle applications and performance optimization. Lanxide provides comprehensive aluminum matrix composite solutions with emphasis on automotive component applications and manufacturing expertise. Huaibei Jibo New Materials delivers specialized composite materials with advanced manufacturing capabilities for automotive applications. Hunan Xiangtou Lightweight Material Technology focuses on lightweight automotive component development with composite material expertise.

Hunan Wenchang New Material Technology offers advanced composite manufacturing solutions with emphasis on automotive component applications. Kailong High Technology Co., Ltd. provides specialized composite material production with focus on high-performance automotive applications. Shanghai Ruier Industrial delivers comprehensive composite manufacturing expertise with automotive component specialization and quality enhancement capabilities across electric vehicle and automotive component market segments.

The AMC brake disc market is positioned at the intersection of lightweighting, thermal management, safety innovation, and EV adoption. With the EV sector expanding rapidly, the shift toward advanced materials such as particle reinforced aluminum composites is vital to meet performance requirements. Coordinated efforts across governments, industry associations, OEMs, suppliers, and investors are essential to scale production, ensure affordability, and accelerate adoption in mass-market EVs.

How Governments Could Accelerate Market Development and Adoption?

How Industry Bodies Could Support Market Growth?

How OEMs and EV Manufacturers Could Strengthen the Ecosystem?

How Suppliers Could Adapt and Scale?

How Investors and Financial Enablers Could Unlock Value?

| Item | Value |

|---|---|

| Quantitative Units | USD 3.9 million |

| Classification | Silicon Carbide Mixed Particle Reinforced Aluminum Matrix Composite Brake Disc, Other Particle Reinforced Aluminum Matrix Composite Brake Disc |

| Application | Electric Passenger Vehicles, Electric Commercial Vehicles |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Country Covered | China, India, Germany, Brazil, United States, United Kingdom, Japan, and 40+ countries |

| Key Companies Profiled | AC Floby, Lanxide, Huaibei Jibo New Materials, Hunan Xiangtou Lightweight Material Technology, Hunan Wenchang New Material Technology, Kailong High Technology Co., Ltd., Shanghai Ruier Industrial |

| Additional Attributes | Dollar sales by composite classification and vehicle application segment, regional demand trends across major electric vehicle markets, competitive landscape with established composite manufacturers and emerging automotive component companies, preferences for different particle reinforcement systems versus traditional brake disc materials, integration with electric vehicle manufacturing platforms and lightweight design optimization, innovations in composite manufacturing processes and performance enhancement technologies, and adoption of advanced material characterization solutions with quality control systems and automotive certification features for improved electric vehicle component development workflows. |

The global particle reinforced aluminum matrix composite brake disc for electric automobiles market is estimated to be valued at USD 3.9 million in 2025.

The market size for the particle reinforced aluminum matrix composite brake disc for electric automobiles market is projected to reach USD 46.0 million by 2035.

The particle reinforced aluminum matrix composite brake disc for electric automobiles market is expected to grow at a 28.1% CAGR between 2025 and 2035.

The key product types in particle reinforced aluminum matrix composite brake disc for electric automobiles market are silicon carbide mixed particle reinforced aluminum matrix composite brake disc and other particle reinforced aluminum matrix composite brake disc.

In terms of application, electric passenger vehicles segment to command 75.0% share in the particle reinforced aluminum matrix composite brake disc for electric automobiles market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Particle Board Market Size and Share Forecast Outlook 2025 to 2035

Particle Foam Molding Machines Market Size and Share Forecast Outlook 2025 to 2035

Particle Counter Market Growth – Trends & Forecast 2018-2028

Particle Size Analyzers Market

Nanoparticle Technology Market Size and Share Forecast Outlook 2025 to 2035

Microparticle Injectables Market

Lipid Nanoparticles Market Insights - Growth & Forecast 2025 to 2035

Silver Nanoparticles Market Size and Share Forecast Outlook 2025 to 2035

Acrylic Fine Particle Market Size and Share Forecast Outlook 2025 to 2035

Platinum Nanoparticles Market

Colloidal Metal Particles Market - Growth & Demand 2025 to 2035

Cerium Oxide Nanoparticle Market Growth – Trends & Forecast 2024-2034

Metal Nitride Nanoparticles Market

Colloidal Selenium Nanoparticles Market Size and Share Forecast Outlook 2025 to 2035

Tungsten Disulphide Nanoparticles Market

Metal & Metal Oxide Nanoparticles Market Growth – Trends & Forecast 2024-2034

Reinforced Nonwoven Plastics Market Size and Share Forecast Outlook 2025 to 2035

Fiber Reinforced Polymer Panel and Sheet Market Size and Share Forecast Outlook 2025 to 2035

Fiber Reinforced Plastic (FRP) Panels & Sheets Market Size and Share Forecast Outlook 2025 to 2035

Fiber Reinforced Polymer (FRP) Rebars Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA