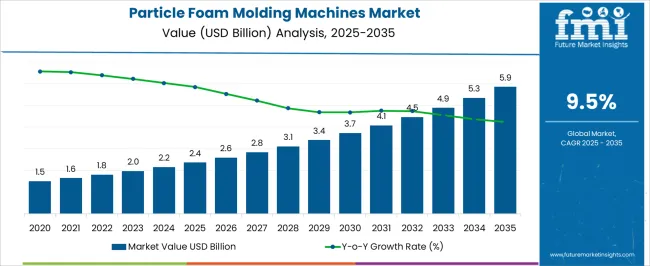

The particle foam molding machines market is expected to rise from USD 2.4 billion in 2025 to USD 5.9 billion by 2035, advancing at a CAGR of 9.5%. This trajectory suggests that technological differentiation will play a decisive role in shaping overall market contribution, with advanced molding methods capturing a higher value share. Conventional molding technologies, including steam chest molding and block molding, are projected to maintain a base level contribution through their continued use in packaging, insulation, and protective applications. Their steady performance is indicated by the smooth incremental growth from USD 2.4 billion to 3.4 billion by 2029. However, their contribution will be gradually overshadowed by more efficient and precise molding systems.

High-performance technologies such as vacuum-assisted molding, multi-density foaming, and automated molding lines are expected to drive the bulk of incremental gains beyond 2030. As the market rises from USD 4.1 billion in 2031 to USD 5.9 billion in 2035, these advanced systems will account for a disproportionate share of the value due to their ability to reduce material waste, support lightweight structures, and meet performance standards in automotive, aerospace, and electronics. The contribution analysis, therefore, indicates a transition where traditional technologies sustain baseline demand while advanced molding innovations emerge as the leading revenue contributors in the long term.

| Metric | Value |

|---|---|

| Particle Foam Molding Machines Market Estimated Value in (2025 E) | USD 2.4 billion |

| Particle Foam Molding Machines Market Forecast Value in (2035 F) | USD 5.9 billion |

| Forecast CAGR (2025 to 2035) | 9.5% |

The particle foam molding machines market represents a specialized share of the global molding equipment industry, with an estimated 4.5% contribution within the broader polymer processing machinery market. Within the foam plastics manufacturing sector, it holds close to 6.8%, driven by the demand for expanded polystyrene, expanded polypropylene, and related particle foams.

Across packaging machinery, the segment accounts for 3.7%, reflecting its use in protective and insulated packaging production. In the construction and insulation equipment sector, its share is nearly 2.9%, highlighting its role in thermal insulation and lightweight materials. Within the automotive manufacturing equipment market, it contributes 2.3%, driven by lightweight component production for energy efficiency. Recent industry developments in the particle foam molding machines market have centered on automation, energy efficiency, and sustainable manufacturing practices.

Manufacturers are integrating IoT-based monitoring systems and predictive maintenance solutions to enhance production reliability. Hybrid and fully electric molding machines are gaining attention due to lower energy consumption and reduced emissions during production cycles. Groundbreaking innovations include advanced molding systems capable of processing biodegradable foams, creating opportunities in eco-friendly packaging and construction materials. Leading companies are focusing on modular machine designs that allow flexible production setups and shorter changeover times.

Strategic collaborations between equipment producers and foam material developers are enhancing the performance of particle foam parts, particularly in packaging, mobility, and infrastructure applications.

The market is experiencing strong growth, supported by the rising demand for lightweight, durable, and energy-efficient molded products across diverse industries. The market in 2025 reflects an increasing focus on automation, precision manufacturing, and eco-friendly production methods, enabling manufacturers to achieve higher efficiency and reduced waste.

The integration of advanced control systems and energy-saving technologies in molding machines is driving operational improvements and lowering production costs. Growing applications in packaging, automotive components, consumer goods, and construction materials are expanding the adoption of particle foam molding technology.

The versatility of particle foams further reinforces demand in achieving complex geometries, superior insulation properties, and high strength-to-weight ratios. As sustainability standards and recycling initiatives continue to evolve, the market outlook points to accelerated innovation in machine capabilities and materials compatibility, creating significant growth opportunities for manufacturers over the coming decade.

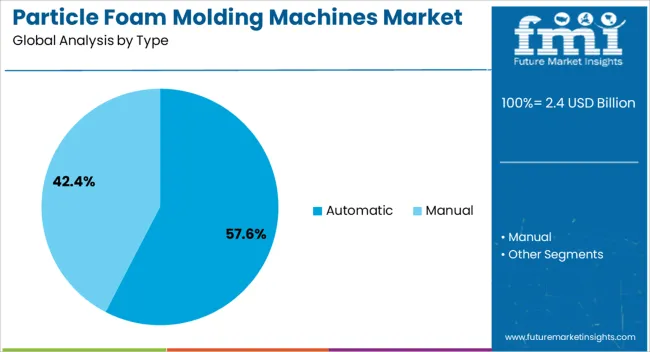

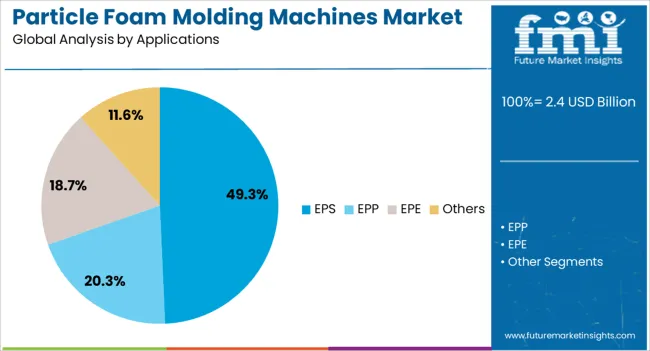

The particle foam molding machines market is segmented by type, applications, and geographic regions. By type, particle foam molding machines market is divided into automatic and manual. In terms of applications, particle foam molding machines market is classified into EPS, EPP, EPE, and others. Regionally, the particle foam molding machines industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The automatic type segment is projected to account for 57.6% of the particle foam molding machines market revenue in 2025, making it the largest contributor by machine type. This leading share is being attributed to the ability of automatic machines to deliver high throughput with consistent quality, significantly reducing labor requirements.

The integration of programmable logic controls, automated cycle adjustments, and real-time monitoring enhances precision and operational stability, supporting mass production needs. Manufacturers benefit from reduced downtime, faster mold changeovers, and lower defect rates, which directly improve cost efficiency.

The preference for automatic systems has been strengthened by the growing need for scalable production in industries such as automotive, electronics, and construction, where demand patterns are increasingly dynamic. The ability to maintain uniformity in complex mold shapes while operating with minimal manual intervention has positioned automatic machines as a preferred choice for high-volume production environments.

The EPS application segment is expected to capture 49.3% of the market revenue in 2025, emerging as the leading application category. This dominance is being driven by the widespread use of expanded polystyrene in packaging, thermal insulation, and protective components across multiple industries. EPS offers exceptional moldability, low weight, and high shock absorption, making it suitable for a broad range of functional and protective uses.

The compatibility of molding machines with a variety of EPS grades and densities has further enhanced adoption. Growth has been reinforced by the demand for cost-effective, recyclable materials that meet evolving environmental and safety regulations.

The continued expansion of construction and e-commerce sectors, where EPS is heavily utilized for insulation and protective packaging, is expected to sustain the segment’s market leadership. Advances in machine technology, enabling faster cycle times and reduced material waste, are also supporting the EPS segment’s upward trajectory.

The market has been driven by the growing need for efficient production systems in packaging, automotive, insulation, and consumer goods industries. These machines are widely applied for processing expanded polystyrene, expanded polypropylene, and other advanced foam materials that provide durability, lightweight properties, and energy absorption. Increasing demand for protective packaging solutions, rising vehicle production, and expanding infrastructure development have supported consistent machine adoption. Manufacturers are investing in automated systems, energy efficient molding technologies, and digital control solutions to enhance precision, reduce material waste, and improve cost competitiveness across global industries.

The packaging industry has remained one of the largest consumers of particle foam molding machines due to the continuous rise in e commerce, food delivery, and consumer product distribution. Protective packaging solutions made from molded foams such as EPS and EPP are widely used to safeguard fragile items during transportation. Lightweight foam inserts, corner protectors, and cushioning materials are produced efficiently using advanced molding machines. Growth in online retail has significantly raised shipment volumes, increasing demand for reliable protective packaging. The food packaging applications such as trays, containers, and insulated boxes also utilize molded foams. As manufacturers prioritize efficiency and recyclability, particle foam molding machines are being increasingly equipped with automation, precision control, and reduced cycle time features to meet high output requirements.

The automotive and transportation industries have been major users of particle foam molding machines for the production of lightweight, impact resistant components. Applications include bumpers, seating elements, headrests, door panels, and insulation parts that require high energy absorption and safety performance. The ability of foams like expanded polypropylene to reduce vehicle weight while maintaining durability has reinforced machine demand within this sector. Rising global vehicle production, coupled with stricter fuel efficiency regulations, has accelerated the adoption of lightweight materials. The electric vehicle manufacturers are increasingly incorporating molded foam components to improve energy efficiency and passenger safety. With automotive companies shifting toward high-volume production, molding machines with advanced cycle control and automated handling systems are being deployed to optimize throughput.

Technological improvements in foam processing have influenced the growth of particle foam molding machines by enabling manufacturers to work with advanced materials and achieve higher precision. Machines are now equipped with sophisticated control systems that regulate steam, pressure, and cooling cycles to produce consistent quality parts. Developments in mold design, multi-cavity tooling, and high-speed automation have expanded production capacity while lowering operational costs. The manufacturers are investing in hybrid molding systems capable of processing multiple foam types within a single platform. Energy-saving mechanisms, such as optimized steam chambers and closed-loop water systems, have further increased efficiency. These technological advancements have enabled foam molding machines to cater to demanding industries like construction, electronics, and automotive, where high quality and performance are crucial.

The construction sector has increasingly adopted particle foam molding machines for producing insulation materials, panels, and lightweight blocks. Expanded polystyrene and expanded polypropylene foams are extensively used in insulation systems, underfloor heating panels, roofing solutions, and structural lightweight blocks due to their thermal efficiency and durability. The rising need for energy-efficient buildings has created demand for reliable insulation products, directly influencing the use of foam molding machines. The large scale infrastructure development in emerging economies has led to higher consumption of foam based components that reduce construction costs while improving performance. The versatility of foam molding machines to produce custom shapes and sizes has enabled construction firms to meet specific design requirements. This steady demand ensures that construction applications remain a long term driver for the global market.

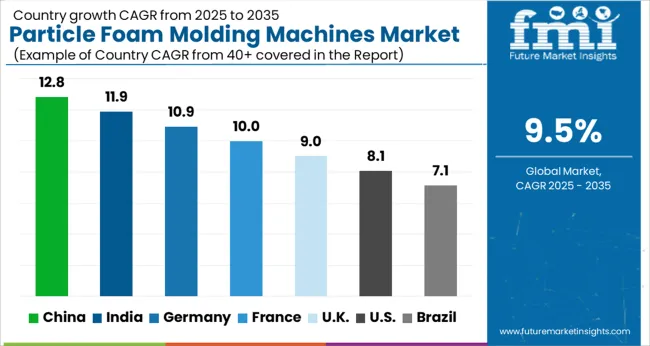

| Country | CAGR |

|---|---|

| China | 12.8% |

| India | 11.9% |

| Germany | 10.9% |

| France | 10.0% |

| UK | 9.0% |

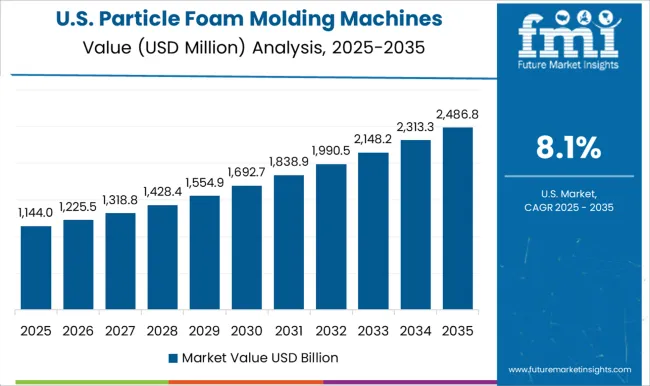

| USA | 8.1% |

| Brazil | 7.1% |

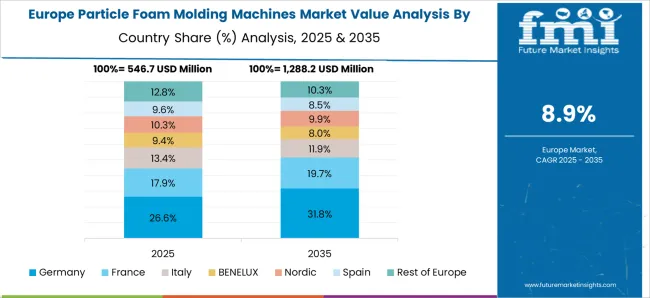

The market is expanding steadily, driven by applications in automotive, packaging, and construction sectors. India achieves 11.9%, supported by demand for lightweight and recyclable materials. Germany posts 10.9%, where emphasis on precision molding and automation enhances growth. China remains the leader at 12.8%, with dominance in large-scale machinery manufacturing and export capacity. The United Kingdom secures 9.0%, driven by adoption of efficient molding equipment in industrial production. The United States records 8.1%, reflecting the steady use of molded foam in packaging and insulation. This performance shows a balanced contribution from leading economies that are reinforcing growth in industrial machinery markets. This report includes insights on 40+ countries; the top markets are shown here for reference.

The market in China is forecast to expand at a CAGR of 12.8%, supported by large-scale manufacturing capacity and sustained demand from packaging, construction, and automotive sectors. The growth has been shaped by the country’s leadership in molded foam production, where expanded polystyrene and expanded polypropylene are widely used. It is observed that the push for lightweight automotive components and protective packaging has enhanced the demand for advanced molding systems. Domestic equipment manufacturers have been investing in automation and energy efficient machinery to meet the needs of large industrial clients. Exports of molding machines from Chinese suppliers to Southeast Asia and Africa have also been growing steadily. China remains positioned as a hub for both domestic utilization and global supply of foam molding machinery.

In India, the market for particle foam molding machines is expected to progress at a CAGR of 11.9%, driven by increasing requirements in packaging, building materials, and consumer goods industries. The use of molded foam has expanded across logistics and food delivery services, thereby raising demand for efficient molding equipment. It is assessed that Indian manufacturers are gradually adopting automated molding systems to improve production consistency and reduce waste. Demand has also been encouraged by expansion of cold chain storage facilities where insulated foam is widely utilized. Domestic machine builders are scaling up but imported equipment still accounts for a significant portion of installations in India. The country is projected to become one of the fastest growing markets in Asia for foam molding technology.

Germany is anticipated to record a CAGR of 10.9% in the market, strongly supported by its engineering excellence and industrial integration. German manufacturers are recognized for producing high precision molding machines that serve the automotive, appliance, and packaging industries. It is considered that molded foams play a crucial role in insulation materials and lightweight vehicle parts, which continue to be prioritized in German manufacturing. Domestic companies such as Kurtz Ersa and Hirsch are active in exporting advanced molding technology across Europe and beyond. Research and development activities are centered on energy efficiency and digital control systems. Germany’s reputation for advanced engineering ensures that the country will remain a technology leader in this market.

The United Kingdom market is projected to advance at a CAGR of 9.0%, supported by demand in packaging, construction, and consumer goods applications. It is observed that molded foam packaging remains essential for electronics and fragile goods distribution, making molding machines critical for domestic manufacturers. Adoption of energy efficient and automated molding machines has been rising among U K producers to meet cost efficiency and performance standards. The country continues to import a significant share of molding equipment from Germany and China due to advanced technology requirements. Opportunities are emerging in customized foam packaging and construction insulation boards. Market progression in the U K is expected to be steady with technology upgrades shaping future demand.

The market in the United States is anticipated to grow at a CAGR of 8.1%, driven by applications in automotive, appliances, and protective packaging. U S manufacturers continue to focus on lightweight design in vehicles and consumer electronics, increasing reliance on molded foams. It is considered that leading machine suppliers have been investing in digital monitoring and energy efficiency upgrades to meet customer requirements. Domestic foam production has remained strong, while imports of molding equipment from Europe and Asia have filled technology gaps. The steady growth trajectory is supported by demand from construction insulation and furniture industries as well. The US market is likely to remain competitive, with global players actively engaged alongside local producers

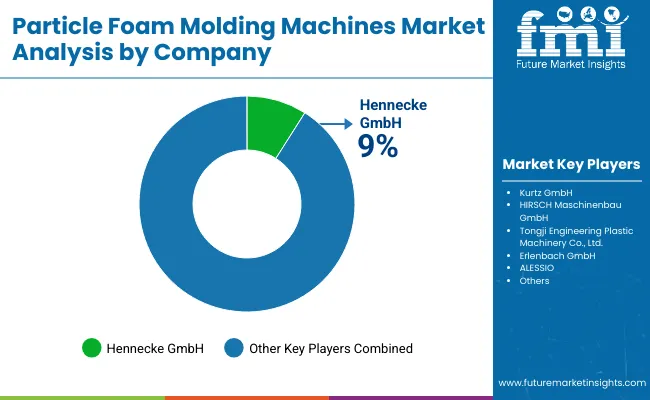

The competitive landscape of the particle foam molding machines market is characterized by a mix of established global players and emerging regional manufacturers, each competing on technology, cost-efficiency, and service capabilities. Leading companies focus on advanced automation, energy-efficient molding systems, and sustainable foam processing technologies to differentiate their offerings. European and Japanese firms dominate high-precision machinery, while Asian manufacturers increasingly gain traction with cost-competitive solutions.

Strategic partnerships, mergers, and after-sales service networks play a crucial role in retaining customers. Additionally, players are investing in R&D to enable multi-material molding, digital monitoring, and integration with Industry 4.0 platforms. This dynamic environment fosters innovation, yet also intensifies price competition, compelling firms to balance quality, sustainability, and affordability.

| Item | Value |

|---|---|

| Quantitative Units | USD 2.4 billion |

| Type | Automatic and Manual |

| Applications | EPS, EPP, EPE, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Kurtz GmbH, HIRSCH Maschinenbau GmbH, Tongji Engineering Plastic Machinery Co., Ltd., Erlenbach GmbH, ALESSIO, Hennecke GmbH, Sabic, and Polyformes Ltd |

| Additional Attributes | Dollar sales by machine type and application, demand dynamics across packaging, automotive, and construction sectors, regional trends in foam processing adoption, innovation in energy efficiency, molding precision, and automation, environmental impact of plastic use and recycling, and emerging use cases in lightweight components, protective packaging, and sustainable insulation solutions. |

The global particle foam molding machines market is estimated to be valued at USD 2.4 billion in 2025.

The market size for the particle foam molding machines market is projected to reach USD 5.9 billion by 2035.

The particle foam molding machines market is expected to grow at a 9.5% CAGR between 2025 and 2035.

The key product types in particle foam molding machines market are automatic and manual.

In terms of applications, eps segment to command 49.3% share in the particle foam molding machines market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Particle Board Market Size and Share Forecast Outlook 2025 to 2035

Particle Reinforced Aluminum Matrix Composite Brake Disc for Electric Automobiles Market Size and Share Forecast Outlook 2025 to 2035

Particle Counter Market Growth – Trends & Forecast 2018-2028

Particle Size Analyzers Market

Nanoparticle Technology Market Size and Share Forecast Outlook 2025 to 2035

Microparticle Injectables Market

Lipid Nanoparticles Market Insights - Growth & Forecast 2025 to 2035

Silver Nanoparticles Market Size and Share Forecast Outlook 2025 to 2035

Acrylic Fine Particle Market Size and Share Forecast Outlook 2025 to 2035

Platinum Nanoparticles Market

Colloidal Metal Particles Market - Growth & Demand 2025 to 2035

Cerium Oxide Nanoparticle Market Growth – Trends & Forecast 2024-2034

Metal Nitride Nanoparticles Market

Colloidal Selenium Nanoparticles Market Size and Share Forecast Outlook 2025 to 2035

Tungsten Disulphide Nanoparticles Market

Metal & Metal Oxide Nanoparticles Market Growth – Trends & Forecast 2024-2034

Foam Mixing Machine Market Size and Share Forecast Outlook 2025 to 2035

Foam Market Size and Share Forecast Outlook 2025 to 2035

Foam-Free Pad Formers Market Size and Share Forecast Outlook 2025 to 2035

Foam Cups Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA