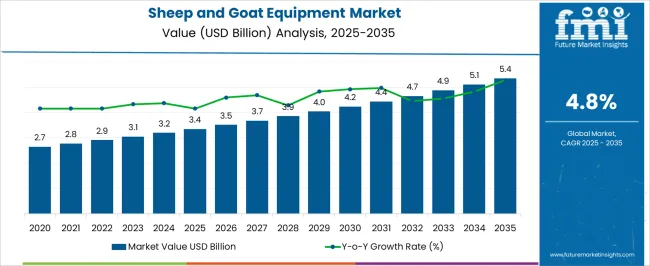

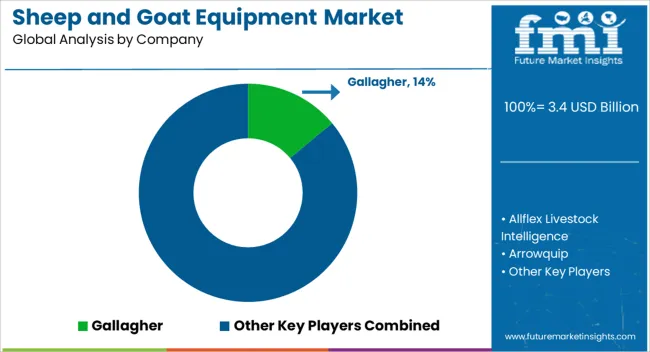

The Sheep and Goat Equipment Market is estimated to be valued at USD 3.4 billion in 2025 and is projected to reach USD 5.4 billion by 2035, registering a compound annual growth rate (CAGR) of 4.8% over the forecast period.

The sheep and goat equipment market is projected to grow from USD 3.4 billion in 2025 to USD 5.4 billion by 2035, registering a CAGR of 4.8%. Between 2021 and 2025, the market demonstrates gradual year-on-year (YoY) growth, increasing from USD 2.7 billion in 2021 to USD 3.4 billion in 2025. This growth reflects the rising adoption of mechanized and automated equipment in small ruminant farming, including feeding systems, milking machines, and health monitoring tools, driven by the need for efficiency and improved livestock management. From 2021 to 2025, incremental increases are observed, with the market reaching USD 2.8 billion in 2022, USD 2.9 billion in 2023, USD 3.1 billion in 2024, and USD 3.2 billion in early 2025. This phase indicates consistent YoY growth, supported by rising investments in modern farming infrastructure and the growing emphasis on animal welfare and productivity enhancement. From 2025 to 2030, the market continues its upward trajectory, reaching USD 4.2 billion by 2030. Annual growth during this period is sustained by increasing mechanization, adoption of smart farming equipment, and expansion in goat and sheep rearing across emerging economies. By 2035, the market value is expected to reach USD 5.4 billion, reflecting steady YoY increases of approximately USD 0.2–0.3 billion annually.

| Metric | Value |

|---|---|

| Sheep and Goat Equipment Market Estimated Value in (2025 E) | USD 3.4 billion |

| Sheep and Goat Equipment Market Forecast Value in (2035 F) | USD 5.4 billion |

| Forecast CAGR (2025 to 2035) | 4.8% |

The Sheep and Goat Equipment market is experiencing consistent expansion, driven by the rising global demand for efficient and sustainable small livestock management solutions. As per recent industry developments and agricultural equipment announcements, farmers are increasingly adopting purpose-built tools that streamline feeding, handling, and care operations. This shift is being supported by improvements in animal welfare standards, mechanized agriculture practices, and broader commercial livestock initiatives.

Future outlook remains strong as rural infrastructure continues to modernize and small ruminant farming scales up to meet growing protein and dairy consumption. In recent agribusiness updates and investor briefings, there has been a notable rise in demand for durable, cost-effective, and easy-to-maintain equipment that enhances farm productivity and reduces labor dependency.

Moreover, advancements in design and materials used for equipment manufacturing are extending product lifespans and improving biosecurity These ongoing developments are expected to provide new growth avenues for stakeholders across both developed and developing agricultural economies.

The sheep and goat equipment market is segmented by equipment type, operation type, end use, distribution channel, and geographic regions. Regionally, the sheep and goat equipment industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

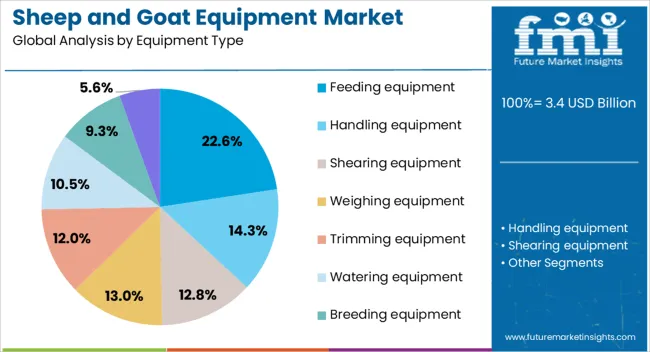

The feeding equipment segment is projected to hold 22.6% of the Sheep and Goat Equipment market revenue share in 2025, making it a key category within equipment type. The segment’s leadership is being driven by increasing mechanization of livestock nutrition practices and the need to minimize feed wastage on commercial and smallholder farms.

Feeding equipment has been preferred due to its role in maintaining consistent feeding schedules, ensuring nutritional balance, and supporting herd health across varying scales of operation. Recent updates from farm equipment manufacturers have indicated that the segment benefits from innovations such as adjustable feed troughs and corrosion-resistant materials, which improve durability and efficiency.

Additionally, demand is being reinforced by farmers’ focus on reducing manual labor and optimizing feeding processes to improve weight gain and milk output These factors, coupled with the ease of installation and compatibility with different farming setups, have supported the strong position of feeding equipment in the overall market landscape.

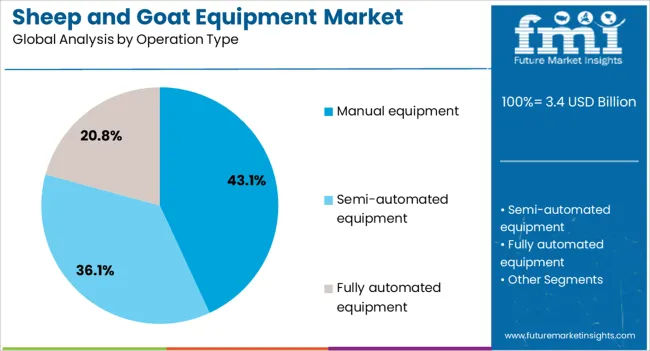

The manual equipment segment is anticipated to contribute 43.1% of the Sheep and Goat Equipment market revenue share in 2025, establishing it as the dominant operation type. This dominance is being attributed to its affordability, simplicity, and widespread suitability for small to mid-scale farms. Manual tools such as shears, feeders, and handling crates have been widely adopted in regions where electrification and automation are limited or cost-prohibitive.

The segment’s growth is being supported by the ongoing reliance on low-maintenance, user-friendly solutions that require minimal training and upkeep. Updates from rural development programs and agritech firms have emphasized the enduring role of manual equipment in traditional and semi-modern farming systems.

Furthermore, the ability to customize these tools for local farming needs has strengthened their relevance As a result, the segment continues to lead, particularly in emerging economies where smallholder farming forms the backbone of livestock production.

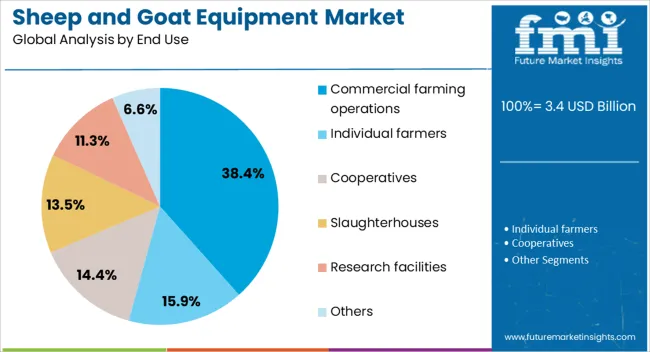

The commercial farming operations segment is expected to account for 38.4% of the Sheep and Goat Equipment market revenue share in 2025, making it the leading end-use category. The segment’s growth is being reinforced by rising demand for large-scale, high-efficiency livestock production systems that prioritize animal welfare, productivity, and operational optimization.

Equipment solutions tailored for commercial farms have been favored due to their scalability, durability, and compatibility with herd management software and biosecurity protocols. Recent farm investment announcements and infrastructure development plans have shown increasing interest in equipping commercial operations with advanced systems for feeding, housing, and health monitoring.

Additionally, regulatory standards around hygiene and traceability have necessitated more structured and consistent handling processes, which are better supported by commercial-grade equipment These factors, combined with the rising number of vertically integrated livestock enterprises, have driven the strong adoption of sheep and goat equipment within commercial farming environments.

The sheep and goat equipment market is experiencing steady expansion as farms embrace modernization and automation to enhance productivity and animal management. Feeding, handling, and shearing systems are increasingly integrated into livestock operations to reduce manual labor and improve efficiency. Although high production costs and raw material volatility pose challenges, demand is supported by precision-based solutions and animal welfare considerations. Regional adoption patterns vary, with developed markets advancing toward automated technologies and emerging markets focusing on cost-effective equipment tailored to local conditions.

Modernization of livestock farming is strengthening the adoption of sheep and goat equipment across regions. Farmers are increasingly relying on automated and semi-automated solutions for feeding, handling, and shearing to improve efficiency and animal welfare. Growing awareness of productivity gains, reduced manual labor, and improved management of large herds is boosting the use of advanced equipment. Feeding systems and handling tools are particularly seeing greater preference as they reduce wastage and minimize stress on animals. The growing shift toward mechanized farming practices has positioned equipment manufacturers to cater to both small-scale and large-scale producers, making modernization a central factor in driving overall market expansion.

Despite notable adoption, the sheep and goat equipment market faces significant challenges related to production costs and raw material availability. Equipment manufacturing requires specialized components, durable metals, and advanced designs, which make production more expensive compared to traditional tools. Smaller farmers often hesitate to invest due to high upfront costs, particularly in developing regions. Volatility in raw material availability also affects supply chains and leads to inconsistent pricing, thereby impacting accessibility for end users. The competitive nature of the market adds further pressure on companies to control costs while maintaining quality, which sometimes restricts innovation and limits rapid adoption across certain farming communities.

The increasing focus on automation in livestock management is creating new opportunities in sheep and goat equipment. Advanced feeding systems, electronic identification devices, and automated shearing tools are being designed to minimize losses, reduce feed wastage, and improve herd monitoring. These solutions not only save labor but also enhance efficiency in managing larger flocks. Precision-based systems are gaining popularity as farms adopt data-driven management practices to optimize resources. Manufacturers offering integrated solutions that combine feeding, monitoring, and handling into compact systems are expected to capture rising interest. Such innovations promise to deliver efficiency improvements and attract both established producers and emerging farmers looking to modernize.

Expansion into emerging regions and the integration of new technologies are shaping future dynamics of sheep and goat equipment. In developed regions, advanced equipment such as electronic ID systems, automated feeders, and precision shearing devices are seeing wide use. In developing regions, demand is rising for cost-efficient solutions that balance durability with affordability. Companies are tailoring product portfolios to local conditions, such as climate-adaptive water systems or space-efficient handling tools. The growing emphasis on animal welfare and efficient resource management is further pushing adoption. With governments supporting modern farming practices, and producers investing in long-term productivity, regional expansion remains a defining trend for this market.

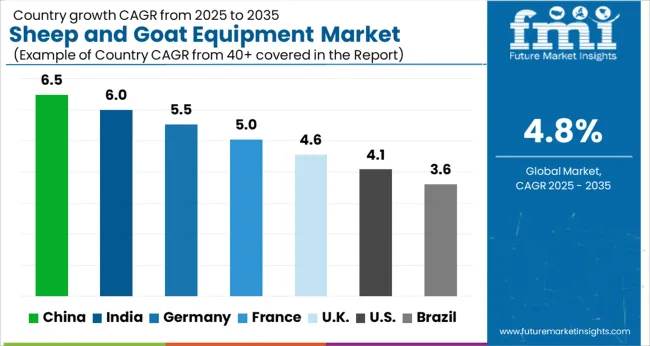

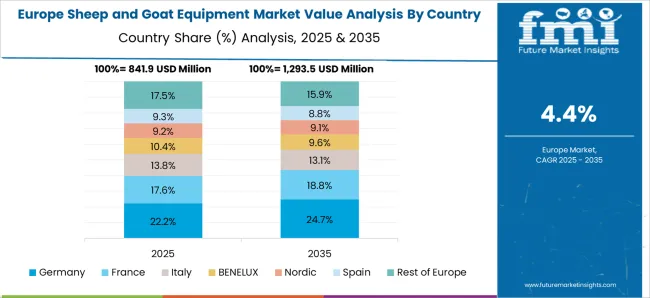

The global sheep and goat equipment market is projected to grow at a CAGR of 4.8% from 2025 to 2035. China leads with a CAGR of 6.5%, followed by India at 6.0% and Germany at 5.5%. The United Kingdom and the United States show more moderate growth at 4.6% and 4.1%, respectively. Growth is being fueled by rising demand for meat and dairy products, modernization of livestock farming practices, and increased accessibility of advanced equipment through retail and distribution networks. Government initiatives and innovation in specialized farming tools are expected to further enhance market expansion across all key regions. The analysis spans over 40+ countries, with the leading markets shown below.

China is forecast to lead the sheep and goat equipment market, growing at a CAGR of 6.5% from 2025 to 2035. Rising demand for high-quality meat and dairy products is driving investment in modern livestock equipment. The adoption of advanced tools for feeding, milking, housing, and healthcare supports efficiency improvements in the small ruminant sector. Government initiatives promoting modernization in animal husbandry further encourage equipment adoption. With a vast population and increasing demand for protein-rich food, commercial farms are upgrading to reliable and durable equipment. E-commerce and specialized agricultural suppliers are also boosting accessibility to advanced solutions across China’s livestock sector.

The sheep and goat equipment market in India is projected to grow at a CAGR of 6.0% between 2025 and 2035. Demand is strongly supported by the country’s expanding livestock population and growing preference for goat milk and mutton in domestic consumption. The need for improved productivity has resulted in rising adoption of mechanized equipment for feeding, breeding, and healthcare management. Farmers are increasingly investing in modern housing and disease management systems to improve animal welfare and output. Retail channels and cooperative networks are contributing to greater awareness and adoption of these products. The government’s support for livestock development programs also boosts market demand.

Germany is projected to expand at a CAGR of 5.5% in the sheep and goat equipment market from 2025 to 2035. The demand is largely driven by a growing focus on improving efficiency and productivity in small-scale livestock farming. With high standards of animal welfare and emphasis on modern farming techniques, farmers are investing in automated feeding systems, advanced housing, and precision healthcare equipment. Germany’s established meat and dairy processing industries also support the adoption of modern tools for better product yield and quality. Specialty equipment manufacturers in Europe contribute to technological advancements and availability of tailored solutions for small ruminant farms.

The United Kingdom’s sheep and goat equipment market is expected to grow at a CAGR of 4.6% from 2025 to 2035. The market benefits from the country’s established sheep farming industry, which is among the largest in Europe. Rising consumer demand for premium lamb and goat milk products supports greater investment in modern farming tools. Farmers are increasingly turning to automated feeders, improved healthcare solutions, and advanced housing facilities to maintain quality standards and reduce labor dependency. The adoption of e-commerce distribution for agricultural equipment is also expanding accessibility for farmers in rural areas, further supporting market growth.

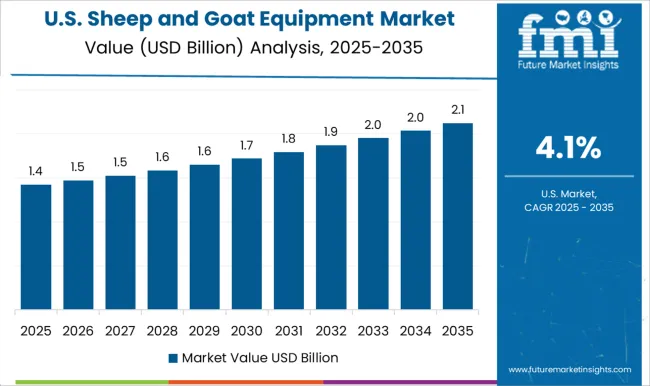

The United States sheep and goat equipment market is forecast to expand at a CAGR of 4.1% between 2025 and 2035. Growth is supported by increasing consumer demand for goat cheese, lamb, and specialty dairy products. The market is also driven by the adoption of advanced livestock management systems to improve productivity and animal welfare. Farmers are increasingly investing in milking systems, automated feeding solutions, and climate-controlled housing to optimize output. The role of specialized distributors and agricultural cooperatives is enhancing the accessibility of modern equipment across both large and small farms. Rising focus on efficient disease management is also driving adoption of veterinary tools and monitoring systems.

In the sheep and goat equipment market, competition is defined by product specialization, ease of handling, and technological integration. Gallagher and Allflex Livestock Intelligence (Datamars) dominate through advanced monitoring, weighing, and identification systems that improve herd management and ensure compliance with traceability standards. Arrowquip, Priefert, and IAE focus on animal handling solutions, offering chutes, races, and pens engineered for safety and efficiency in both small-scale farms and large commercial operations. Heiniger, Lister Shearing, and Kerbl differentiate with electric shearing and clipping equipment designed for speed, durability, and reduced animal stress, appealing to professional shearers and livestock owners alike. Ritchie Agricultural, Sydell Inc., and Stockpro compete with specialized feeding and watering systems, emphasizing durability and reliability for outdoor environments.

Strategies vary across players but revolve around innovation, farmer convenience, and regional market reach. Gallagher emphasizes smart fencing and weighing equipment, tying its strategy to precision livestock farming trends. Allflex focuses on electronic identification systems and data-driven herd management tools that connect with farm management software. Arrowquip and Te Pari Products enhance their competitive stance by offering modular handling systems, enabling farms to scale equipment as herds grow. WOPA stands out with hoof trimming crushes tailored for sheep and goats, addressing health and welfare compliance. Premier 1 Supplies leverages direct-to-consumer retail channels, ensuring accessibility for smaller farms through catalog and online sales.

Product brochures showcase this breadth. Gallagher details electronic ID readers, weighing crates, and fencing systems. Allflex highlights EID tags, monitoring devices, and software integration. Arrowquip and Priefert present livestock handling systems with ergonomic features. Heiniger and Lister emphasize professional shearing machines. Ritchie, Sydell, and Stockpro focus on feeding, watering, and penning equipment, while WOPA outlines hoof trimming systems that improve animal welfare and productivity.

| Item | Value |

|---|---|

| Quantitative Units | USD 3.4 Billion |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Additional Attributes | Dollar sales by product type (fencing systems, shearing equipment, feeders, weighing and monitoring devices), application (sheep, goats, mixed livestock), and automation level (manual, semi-automated, automated). Demand dynamics are driven by the need for farm efficiency, animal welfare, and labor reduction. Regional trends show strong growth in Europe, North America, and Oceania, fueled by organized livestock farming, technological adoption, and farm modernization initiatives. |

The global sheep and goat equipment market is estimated to be valued at USD 3.4 billion in 2025.

The market size for the sheep and goat equipment market is projected to reach USD 5.4 billion by 2035.

The sheep and goat equipment market is expected to grow at a 4.8% CAGR between 2025 and 2035.

The key product types in sheep and goat equipment market are feeding equipment, handling equipment, shearing equipment, weighing equipment, trimming equipment, watering equipment, breeding equipment and health management equipment.

In terms of operation type, manual equipment segment to command 43.1% share in the sheep and goat equipment market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Sheep Tilt Table Market Size and Share Forecast Outlook 2025 to 2035

Sheep Supplies Market Analysis by Supply, Farm, Sales and Region: A Forecast for 2025 and 2035

Sheep Creep Feeder Market – Innovations & Market Outlook 2025-2035

Sheep Shearing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Sheep Handling Equipment Market Size and Share Forecast Outlook 2025 to 2035

Anderson Cascade Impactor Market Size and Share Forecast Outlook 2025 to 2035

Andersen-Tawil Syndrome Treatment Market Trends - Growth & Future Prospects 2025 to 2035

Andro Supplements Market

Handheld Imaging Systems Market Size and Share Forecast Outlook 2025 to 2035

Sandwich Panel System Market Size and Share Forecast Outlook 2025 to 2035

Hand Tools Market Size and Share Forecast Outlook 2025 to 2035

Handloom Product Market Size and Share Forecast Outlook 2025 to 2035

Band File Sander Belts Market Size and Share Forecast Outlook 2025 to 2035

Handheld XRF Analyzers Market Size and Share Forecast Outlook 2025 to 2035

Sand Abrasion Tester Market Size and Share Forecast Outlook 2025 to 2035

Landscape Lighting Market Size and Share Forecast Outlook 2025 to 2035

Handheld Police Radar Guns Market Size and Share Forecast Outlook 2025 to 2035

Handheld DNA Reader Market Size and Share Forecast Outlook 2025 to 2035

Handheld Robotic Navigation Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Handheld Mesh Nebulizer Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA