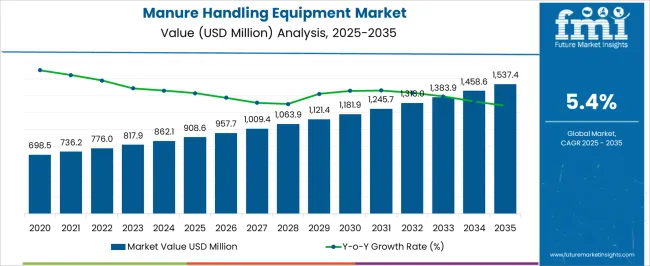

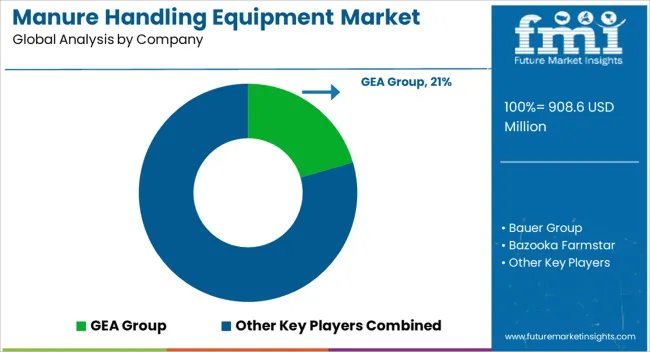

The manure handling equipment market is anticipated to be USD 908.6 million in 2025 and forecasted to reach USD 1,537.4 million by 2035, progressing at a CAGR of 5.4 percent. Market share dynamics across this timeline suggest both erosion and gain, depending on technology adoption, regional demand, and structural changes within the agriculture sector. Early years in the cycle point toward share consolidation by established manufacturers, as farms in North America and Europe replace outdated systems with automated handling solutions.

However, as the forecast period advances, erosion of share may occur for those unable to adapt to the rising preference for precision farming tools, slurry separators, and integrated waste-to-energy systems. Gains are expected in Asia-Pacific, where farm mechanization and government incentives expand adoption across small- to medium-sized farms. Share redistribution is also linked to innovation in mobile units, advanced scrapers, and vacuum tankers, which provide flexibility for diverse farm sizes. Companies that emphasize service support, customization, and financing models are likely to capture incremental share, while traditional players relying solely on volume-based equipment sales could see erosion. The next decade reflects a reshaping of competitive distribution, with agile innovators gaining ground as established brands defend core segments.

| Metric | Value |

|---|---|

| Manure Handling Equipment Market Estimated Value in (2025 E) | USD 908.6 million |

| Manure Handling Equipment Market Forecast Value in (2035 F) | USD 1537.4 million |

| Forecast CAGR (2025 to 2035) | 5.4% |

The manure handling equipment market is influenced by several interlinked parent markets, each shaping adoption and overall sales. The livestock farming segment holds the largest share at 40%, as dairy and poultry farms increasingly rely on scrapers, separators, and spreaders to manage large-scale waste efficiently. The bioenergy and biogas sector contributes 25%, with manure used as a critical input for anaerobic digestion systems, driving demand for advanced pumps, mixers, and slurry handling equipment. The agricultural machinery segment accounts for 20%, where equipment is integrated with tractors and tankers to facilitate field application and soil enrichment.

The waste management and environmental solutions sector represents 10%, supported by the need for odor control, nutrient recycling, and compliance with waste treatment regulations. Finally, niche applications such as contract farming and specialty livestock operations comprise 5%, where portable and customized solutions are preferred.

Livestock farming and bioenergy account for 65% of the demand, underscoring the central role of animal agriculture and renewable energy integration in driving this market. Share distribution highlights how manure handling has shifted from being a simple farm necessity to a multi-functional contributor to energy, compliance, and environmental management objectives globally.

The market is experiencing steady growth driven by the increasing need for efficient waste management in the agriculture and livestock sectors. Current market dynamics are shaped by growing awareness of environmental regulations, rising adoption of sustainable farming practices, and advancements in equipment technology.

The future outlook is positive as farmers and agricultural enterprises seek to optimize manure management to improve soil health and reduce environmental impact. Investments in modernizing agricultural infrastructure and increasing mechanization in developing regions are further supporting market expansion.

The rising demand for eco-friendly and cost-effective solutions continues to pave the way for innovation and adoption of automated manure handling systems, promoting overall farm productivity and sustainability.

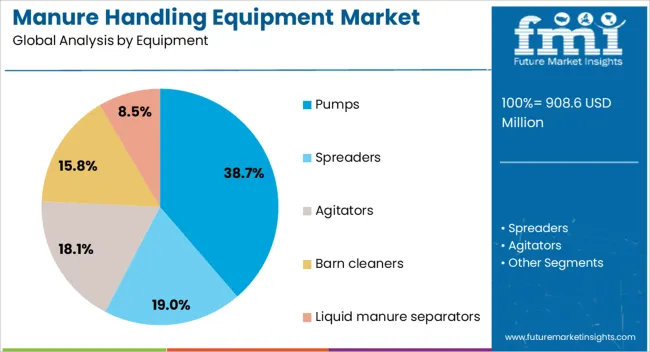

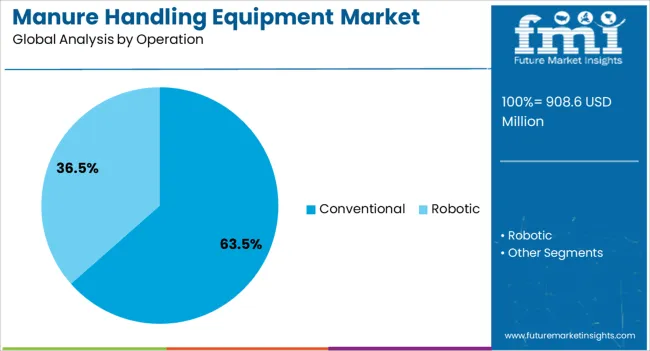

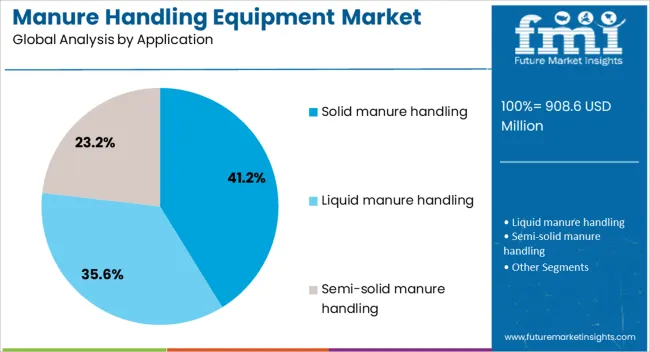

The manure handling equipment market is segmented by equipment, operation, application, end-user, animals, and geographic regions. By equipment, manure handling equipment market is divided into Pumps, Spreaders, Agitators, Barn cleaners, and Liquid manure separators. In terms of operation, manure handling equipment market is classified into Conventional and Robotic. Based on application, manure handling equipment market is segmented into Solid manure handling, Liquid manure handling, and Semi-solid manure handling.

By end-user, manure handling equipment market is segmented into Individual farmers, Cooperative farms, Corporate farms, and Others. By animals, manure handling equipment market is segmented into Cows, Cattle, Pigs, Chicken & turkey, and Sheep & goats. Regionally, the manure handling equipment industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The Pumps equipment segment is anticipated to hold 38.7% of the Manure Handling Equipment market revenue share in 2025, establishing it as the leading equipment type. This prominence is attributed to the ability of pumps to efficiently transport manure in liquid and semi-liquid forms, which is essential for large-scale livestock operations.

The segment's growth has been supported by improvements in pump design that allow handling of high solids content and corrosive materials while minimizing maintenance requirements. The versatility of pumps in facilitating both collection and disposal processes has increased their adoption.

Additionally, the demand for energy-efficient and durable pumps that can operate continuously under harsh farm conditions has contributed to the segment’s expansion.

The Conventional operation segment is projected to account for 63.5% of the market revenue in 2025, reflecting its dominant role in manure handling processes. This segment's leadership is driven by the familiarity and reliability of conventional methods among farmers and agricultural operators.

Conventional systems are preferred for their proven efficiency, ease of use, and lower initial investment compared to automated or advanced alternatives. The continued dependence on established operational practices, particularly in small to medium-sized farms, has maintained the segment’s growth.

Furthermore, conventional equipment often requires less technical expertise, making it accessible across diverse geographic and economic farming contexts.

The Solid manure handling application segment is expected to represent 41.2% of the total market revenue in 2025, making it the largest application category. This is primarily because solid manure is widely produced across various types of livestock farms, necessitating robust and specialized equipment for collection, transport, and processing.

The segment’s growth has been facilitated by increased awareness of the benefits of proper solid manure management, including odor control, nutrient recovery, and soil amendment applications. Equipment designed for solid manure is often versatile and durable, supporting long operational life under challenging farm conditions.

As sustainable agriculture practices gain traction, the importance of efficient solid manure handling solutions continues to rise, supporting the segment’s leading position.

Manure handling equipment growth is shaped by livestock expansion, bioenergy adoption, environmental compliance, and automation. Service-based models and regulatory-driven demand ensure manufacturers have recurring and long-term opportunities.

Rising livestock populations and expanding dairy operations have been identified as the primary drivers for manure handling equipment demand. Farms are investing in automated scrapers, spreaders, and separators to manage waste more efficiently while ensuring compliance with hygiene standards. The steady growth of poultry and swine industries also supports equipment adoption, as these sectors generate high manure volumes requiring specialized handling. Larger farms are turning toward mechanized systems to cut labor costs and streamline operations, while medium farms adopt modular solutions for flexibility. The livestock boom has placed manure management at the center of farm investments, making equipment adoption a necessity rather than a discretionary decision.

The integration of manure into renewable energy generation through biogas projects has created an opportunity for specialized handling equipment. Slurry pumps, mixers, and digestate separators have become vital for feeding anaerobic digesters and optimizing energy yields. Countries promoting bioenergy are encouraging farms to participate in waste-to-energy initiatives, driving steady demand for upgraded equipment. Equipment suppliers that design machines compatible with energy plants benefit most from this shift, as projects expand across Asia and Europe. The linkage between waste management and energy recovery creates a structural tailwind for manufacturers, adding long-term resilience to their business models and revenue streams.

Stringent rules on manure disposal, nutrient management, and water contamination prevention have influenced equipment choices among farms. Governments are mandating efficient manure handling practices to minimize runoff, odor, and methane emissions. This has increased demand for precision equipment such as slurry injectors, vacuum tankers, and separators that ensure nutrient recycling. Compliance costs can be high, but farms view equipment adoption as a necessary safeguard against fines and operational disruptions. Regional markets with strict enforcement show faster adoption compared to areas with weaker compliance frameworks. Environmental regulation has not only pressured farms but also created steady revenue opportunities for equipment manufacturers supplying compliance-driven solutions.

Automation has gained prominence in manure handling as farms seek efficiency and labor savings. Automated scrapers, robotic spreaders, and sensor-enabled separators are increasingly being offered as part of equipment portfolios. Beyond equipment sales, manufacturers are also focusing on service contracts, rental models, and maintenance programs to ensure recurring revenue. These models appeal to farms unable to invest heavily upfront, while larger farms prefer automation to reduce manual workloads. This combination of automation and service diversification strengthens customer loyalty. Manufacturers willing to integrate after-sales support and automation into their strategies will secure stronger market share and long-term positioning.

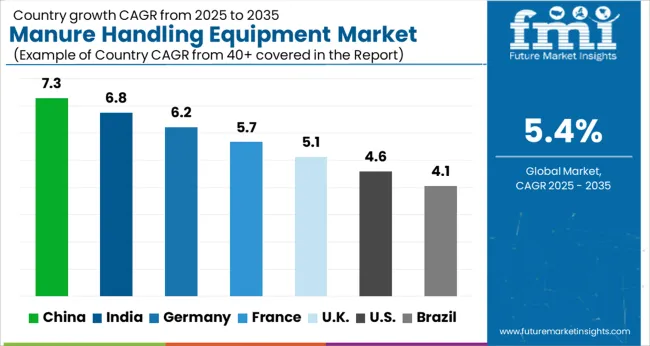

| Country | CAGR |

|---|---|

| China | 7.3% |

| India | 6.8% |

| Germany | 6.2% |

| France | 5.7% |

| UK | 5.1% |

| USA | 4.6% |

| Brazil | 4.1% |

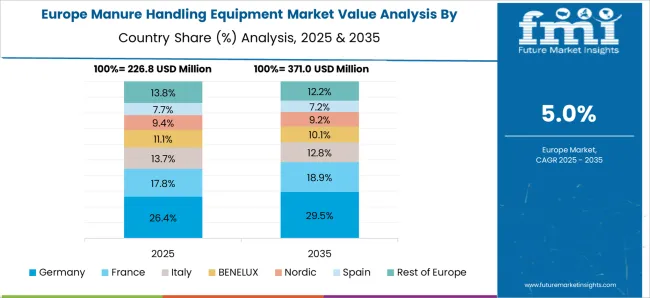

The global manure handling equipment market is projected to grow at a CAGR of 5.4% from 2025 to 2035. China leads at 7.3%, followed by India at 6.8% and Germany at 6.2%, while the UK records 5.1% and the USA posts 4.6%. Rising adoption of automated scrapers, separators, and slurry systems has accelerated demand in China and India, supported by large livestock populations and government programs promoting farm mechanization. Germany benefits from strict compliance frameworks and integration with biogas projects, creating steady equipment investments. The UK and the USA grow at slower rates, where mature markets focus on equipment efficiency, premium solutions, and service-based models. Dollar sales, share, and regional adoption patterns emphasize that Asia-Pacific drives expansion through scale and infrastructure growth, while Europe and North America maintain market balance through compliance-driven adoption and technology-based differentiation. The analysis covers over 40 countries, with the above markets shaping the global trajectory.

The manure handling equipment market in China is projected to grow at a CAGR of 7.3% from 2025 to 2035. Expansion is supported by the country’s large livestock population, particularly in dairy and swine farming, where waste management has become critical for efficiency and compliance. Equipment such as automated scrapers, slurry pumps, and separators is increasingly adopted to address both environmental requirements and farm productivity needs. Provinces like Shandong, Henan, and Sichuan act as agricultural hubs, creating strong regional demand for mechanized solutions. Government programs encouraging waste-to-energy adoption through biogas projects further reinforce equipment investment. Dollar sales and share trends reveal strong growth in automated and integrated systems, while traditional manual tools decline in relevance. China’s scale, regulatory emphasis, and energy-linked usage place it as the most influential market globally.

The manure handling equipment market in India is expected to expand at a CAGR of 6.8% from 2025 to 2035. Growth is driven by expanding dairy production, poultry farming, and mechanization initiatives in rural regions. States like Punjab, Haryana, and Maharashtra are emerging as key adopters, with small and medium farms gradually shifting from manual handling to mechanized solutions. Equipment such as spreaders, scrapers, and vacuum tankers are gaining traction due to increasing awareness of labor efficiency and soil nutrient recycling. Government-backed schemes promoting farm mechanization and renewable energy projects encourage investment in biogas-linked manure handling systems. Dollar sales and share analysis highlight a rising preference for mid-range and mobile equipment suited to diverse farm sizes. India’s growth path is tied closely to rural adoption, policy incentives, and evolving farm practices.

The manure handling equipment market in Germany is projected to grow at a CAGR of 6.2% from 2025 to 2035. Demand is supported by strict environmental regulations requiring efficient nutrient management and waste recycling. Advanced slurry injectors, separators, and tankers dominate demand, particularly in regions with intensive livestock production. Integration with biogas plants is a defining trend, as manure serves as a valuable input for renewable energy generation. German manufacturers emphasize product quality, precision, and compliance, making the country a leader in advanced equipment solutions. Dollar sales and share patterns indicate that high-value, technologically advanced machinery holds the largest contribution. Germany’s regulatory framework and renewable energy integration make it a model for structured growth and long-term equipment adoption.

The manure handling equipment market in the UK is anticipated to grow at a CAGR of 5.1% from 2025 to 2035. Expansion is underpinned by dairy and beef farming, along with regulatory frameworks focused on reducing water contamination and managing nutrient runoff. Equipment such as vacuum tankers, spreaders, and compact scrapers is increasingly deployed across small and medium-sized farms. Government policies supporting environmental compliance have accelerated adoption, particularly in regions with intensive livestock operations. Dollar sales and share figures emphasize steady demand for portable and cost-effective solutions, as farms prioritize affordability alongside compliance. The UK is moving toward a balanced growth model where environmental mandates and efficiency considerations shape consistent but moderate expansion.

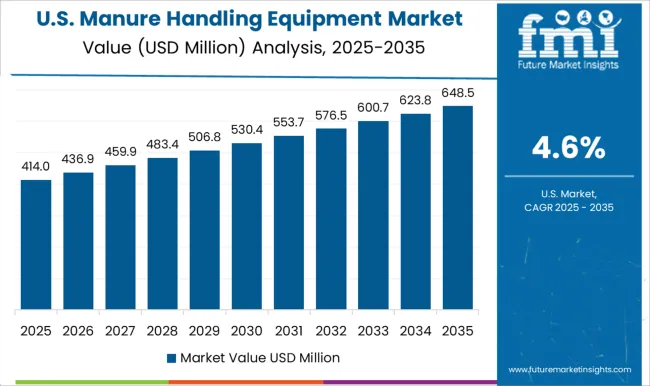

The manure handling equipment market in the USA is projected to expand at a CAGR of 4.6% from 2025 to 2035. Growth is comparatively slower due to market maturity, but demand persists in dairy and poultry-intensive states like Wisconsin, California, and Iowa. Large-scale farms adopt advanced separators, injectors, and automated scrapers, while smaller farms prefer affordable spreaders and tankers. Regulatory pressures tied to nutrient management and methane reduction push farms toward mechanized systems, although adoption rates vary by state. Dollar sales and share analysis highlight strong contributions from large equipment categories designed for industrial-scale operations. While the USA grows at a slower pace, its scale and reliance on large farms make it a stable and high-value contributor.

Competition in the manure handling equipment market is strongly influenced by efficiency of products, adaptability across different farm scales, compliance with regulations, and the ability of companies to maintain broad distribution networks. GEA Group and Bauer Group are recognized as industry leaders, supported by their wide product portfolios that include scrapers, separators, pumps, and slurry systems, making them the preferred choice for large-scale livestock operations. Bazooka Farmstar and Cadman Power Equipment have positioned themselves as specialists in slurry injection and pumping systems, with their equipment gaining traction on large-acre farms and in operations connected to modern biogas facilities. BouMatic and Daritech stand apart by offering integrated automation solutions designed for dairy farming, ensuring hygiene standards are met while enabling nutrient recycling. Lely and Patz Corporation have gained visibility through their development of automated scrapers and conveyors, equipment that reduces labor requirements while maintaining efficient manure management practices.

Phil’s Pumping & Fabrication and Valmetal maintain strong positions in regional markets by delivering customized solutions, including mobile and specialized systems that align with niche farm requirements. Strategically, many companies are shifting their focus toward automation, energy-linked manure solutions, and service-based business models to capture recurring revenue and strengthen long-term relationships with farms. Advanced systems for slurry separation, odor control, and nutrient recovery are being developed to address both efficiency and compliance challenges faced by livestock operators. Collaborations with distributors, contractors, and renewable energy developers are expanding access to regional and international markets.

| Item | Value |

|---|---|

| Quantitative Units | USD 908.6 Million |

| Equipment | Pumps, Spreaders, Agitators, Barn cleaners, and Liquid manure separators |

| Operation | Conventional and Robotic |

| Application | Solid manure handling, Liquid manure handling, and Semi-solid manure handling |

| End-user | Individual farmers, Cooperative farms, Corporate farms, and Others |

| Animals | Cows, Cattle, Pigs, Chicken & turkey, and Sheep & goats |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | GEA Group, Bauer Group, Bazooka Farmstar, BouMatic, Cadman Power Equipment, Daritech, Lely, Patz Corporation, Phil's Pumping & Fabrication, and Valmetal |

| Additional Attributes | Dollar sales, share, regional adoption rates, regulatory impacts, competitive positioning, product segmentation trends, service model opportunities, and integration with biogas projects. |

The global manure handling equipment market is estimated to be valued at USD 908.6 million in 2025.

The market size for the manure handling equipment market is projected to reach USD 1,537.4 million by 2035.

The manure handling equipment market is expected to grow at a 5.4% CAGR between 2025 and 2035.

The key product types in manure handling equipment market are pumps, _electric driven pumps, _engine driven pumps, spreaders, agitators, _electric driven agitators, _engine driven agitators, barn cleaners, _feed pushers, _manure cleaning and liquid manure separators.

In terms of operation, conventional segment to command 63.5% share in the manure handling equipment market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Phosphorus Enriched Organic Manure Market Growth – Trends & Forecast 2024-2034

Air Handling Unit Market Size and Share Forecast Outlook 2025 to 2035

BOP Handling Systems Market Growth - Trends & Forecast 2025 to 2035

Roll Handling Machine Market Size and Share Forecast Outlook 2025 to 2035

Goat Handling Equipment Market Size and Share Forecast Outlook 2025 to 2035

Drum Handling Equipment Market

Crate Handling Systems Market Size and Share Forecast Outlook 2025 to 2035

Glass Handling Robot Market Trends & Forecast 2025 to 2035

Sheep Handling Equipment Market Size and Share Forecast Outlook 2025 to 2035

Cattle Handling Systems Market Size and Share Forecast Outlook 2025 to 2035

Sludge Handling Equipment Market Size and Share Forecast Outlook 2025 to 2035

Patient Handling Equipment Market Size and Share Forecast Outlook 2025 to 2035

Material Handling Integration Market Size and Share Forecast Outlook 2025 to 2035

Material Handling Monorails Market

Material Handling Equipment Market Growth - Trends & Forecast 2025 to 2035

Microplate Handling Instruments Market Size and Share Forecast Outlook 2025 to 2035

Storage And Handling Equipment Market Size and Share Forecast Outlook 2025 to 2035

Case and Box Handling Robots Market Size and Share Forecast Outlook 2025 to 2035

Marine Waste Handling Equipment Market Size and Share Forecast Outlook 2025 to 2035

Smart Baggage Handling System Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA