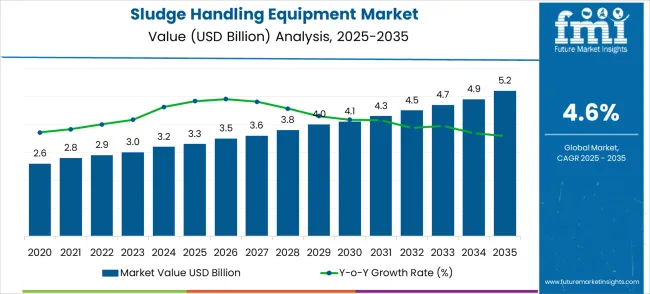

The Sludge Handling Equipment Market is estimated to be valued at USD 3.3 billion in 2025 and is projected to reach USD 5.2 billion by 2035, registering a compound annual growth rate (CAGR) of 4.6% over the forecast period.

| Metric | Value |

|---|---|

| Sludge Handling Equipment Market Estimated Value in (2025 E) | USD 3.3 billion |

| Sludge Handling Equipment Market Forecast Value in (2035 F) | USD 5.2 billion |

| Forecast CAGR (2025 to 2035) | 4.6% |

Market expansion is being supported by the continuous growth of global wastewater treatment activities across established and emerging markets and the corresponding need for efficient sludge processing equipment that ensures optimal treatment performance and environmental compliance. Modern wastewater treatment operations require sophisticated handling systems that can deliver precise sludge management, reduced operational downtime, and enhanced treatment efficiency while operating under diverse wastewater characteristics and environmental requirements. The superior processing capacity and reliability characteristics of high-quality sludge handling equipment make them essential components in treatment operations where sludge management performance directly impacts treatment efficiency and regulatory compliance.

The growing emphasis on environmental regulations and operational efficiency enhancement is driving demand for advanced sludge processing equipment from certified manufacturers with proven track records of quality and reliability in wastewater treatment applications. Wastewater treatment facilities and industrial operators are increasingly investing in premium sludge handling systems that offer extended service life while maintaining consistent processing performance and system efficiency. Regulatory requirements and treatment standards are establishing performance benchmarks that favor high-quality processing equipment with superior engineering properties and resistance to operational stresses.

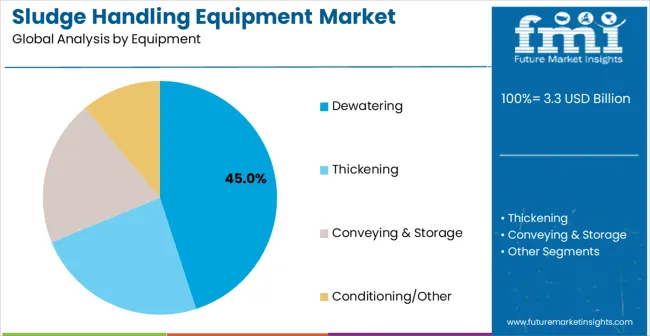

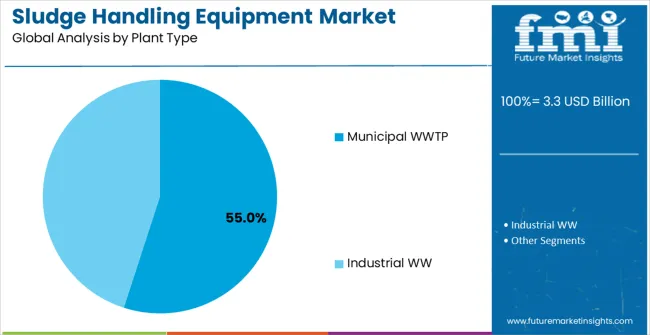

The sludge handling equipment market is segmented by equipment, capacity (m³/d), plant type, , and geographic regions. By equipment, sludge handling equipment market is divided into Dewatering, Thickening, Conveying & Storage, and Conditioning/Other. In terms of capacity (m³/d), sludge handling equipment market is classified into 501–2000, ≤500, and >2000. Based on plant type, sludge handling equipment market is segmented into Municipal WWTP and Industrial WW. Regionally, the sludge handling equipment industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The market is segmented by equipment type, capacity, plant type, and region. By equipment type, the market is divided into dewatering, thickening, conveying & storage, and conditioning/other configurations. Based on capacity, the market is categorized into ≤500 m³/d, 501–2000 m³/d, and >2000 m³/d segments. By plant type, the market includes municipal WWTP and industrial WWTP. Regionally, the market is divided into North America, Europe, East Asia, South Asia & Pacific, Latin America, and the Middle East & Africa.

Dewatering equipment configurations are projected to account for 45% of the sludge handling equipment market in 2025. This leading share is supported by the critical importance of dewatering processes in sludge volume reduction and the widespread need for moisture removal systems in both municipal and industrial wastewater treatment facilities. Dewatering equipment offers excellent solid-liquid separation efficiency and operational reliability, making it essential for sludge management operations and challenging wastewater treatment environments where volume reduction and disposal cost optimization are critical. The segment benefits from technological advancements that have improved dewatering efficiency, energy consumption, and maintenance requirements.

Modern dewatering equipment incorporates advanced centrifuge technologies, precision-engineered filtration components, and specialized control systems that deliver exceptional moisture removal performance while maintaining operational simplicity and reliability under demanding treatment conditions. These innovations have significantly improved sludge processing efficiency while preserving compatibility with various sludge characteristics and reducing operational costs through enhanced energy efficiency and reduced disposal requirements. The municipal wastewater treatment sector particularly drives demand for dewatering solutions, as treatment facilities require reliable processing equipment that can meet stringent performance standards and environmental requirements.

Medium capacity (501-2000 m³/d) applications are expected to represent 45% of sludge handling equipment demand in 2025. This significant share reflects the substantial volume of medium-scale wastewater treatment operations globally and the need for specialized processing equipment that meets mid-throughput treatment requirements and efficiency standards. Medium capacity operations require consistent supplies of sludge handling equipment for municipal wastewater treatment, industrial wastewater processing, and specialized treatment applications across diverse operational environments and flow conditions. The segment benefits from ongoing wastewater treatment industry growth and increasing emphasis on processing efficiency and reliability in treatment operations.

Medium capacity applications demand exceptional equipment reliability to ensure consistent processing performance throughout operational periods while meeting stringent wastewater treatment standards and regulatory compliance requirements. These applications require sludge handling equipment that can withstand continuous operation, load variations, and long-term service under demanding conditions and treatment schedules. The growing emphasis on treatment efficiency and operational optimization, particularly in municipal wastewater treatment requiring sophisticated processing systems for sludge volume reduction and disposal management, drives consistent demand for high-quality medium-capacity processing equipment.

Municipal Wastewater Treatment Plants are projected to account for 55% of the sludge handling equipment market in 2025. This substantial share is supported by the growing emphasis on municipal infrastructure development and the increasing need for advanced sludge management solutions that meet environmental regulations and public health requirements. Municipal WWTPs require comprehensive and reliable sludge processing equipment that can perform across varying wastewater characteristics and treatment loads while maintaining operational efficiency and regulatory compliance. The segment benefits from the increasing complexity of wastewater treatment requirements and growing investments in municipal water infrastructure.

Modern municipal WWTPs demand sludge handling equipment that offers superior operational flexibility, reduced maintenance requirements, and enhanced processing efficiency to support diverse wastewater treatment requirements and regulatory specifications. These facilities operate under strict environmental regulations and treatment standards, requiring equipment that can adapt to different operational conditions while maintaining consistent performance and compliance standards. The growing emphasis on environmental protection and sustainable wastewater management drives demand for municipalities that can provide comprehensive sludge management solutions with proven track records of operational excellence and regulatory compliance.

The sludge handling equipment market is advancing steadily due to continuing global wastewater treatment industry growth and increasing recognition of the importance of sludge processing equipment reliability in operational efficiency and environmental compliance. However, the market faces challenges, including raw material price volatility affecting equipment costs, increasing adoption of automated processing systems requiring significant capital investments, and varying environmental regulations across different regional markets affecting equipment specifications. Ecological laws and sustainability requirements continue to influence equipment design and market development patterns.

The growing deployment of automated control systems, digital monitoring technologies, and smart processing solutions is enabling superior operational efficiency and enhanced performance characteristics in sludge handling equipment applications. Advanced automation systems and digital integration provide improved process control, real-time performance monitoring, and predictive maintenance capabilities compared to traditional manual processing systems. These innovations are particularly valuable for wastewater treatment operations that require reliable equipment capable of meeting automated treatment processes and demanding operational conditions.

Modern sludge handling equipment manufacturers are incorporating energy-efficient drive systems and sustainable processing technologies that provide enhanced operational efficiency and reduced environmental impact compared to traditional processing systems. Integration of variable speed drives, intelligent process control, and energy recovery systems creates opportunities for advanced processing equipment that supports both high-performance treatment operation and environmental sustainability requirements. Advanced control technologies and energy management systems also support the development of more sophisticated processing solutions for modern wastewater treatment applications.

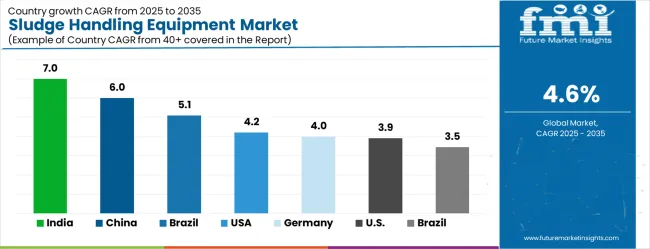

| Country | CAGR (2025-2035) |

|---|---|

| India | 7.0% |

| China | 6.0% |

| Brazil | 5.1% |

| United States | 4.2% |

| Germany | 4.0% |

The sludge handling equipment market is growing steadily, with India leading at a 7.0% CAGR through 2035, driven by massive wastewater treatment infrastructure expansion, increasing municipal development projects, and comprehensive environmental protection programs supporting both domestic consumption and infrastructure development. China follows at 6.0%, supported by extensive wastewater treatment investments, expanding industrial activities, and increasing focus on environmental compliance and water quality management serving domestic and regional markets. Brazil records strong growth at 5.1%, emphasizing water infrastructure development, industrial wastewater treatment expansion, and operational excellence in municipal and industrial water management operations. The United States shows steady growth at 4.2%, focusing on wastewater infrastructure replacement, environmental compliance, and advanced treatment technologies. Germany maintains consistent expansion at 4.0%, supported by engineering excellence and precision manufacturing capabilities.

The report covers an in-depth analysis of 40+ countries; five top-performing countries are highlighted below.

Revenue from sludge handling equipment in India is projected to exhibit the highest growth rate with a CAGR of 7.0% through 2035, driven by massive wastewater treatment infrastructure expansion and comprehensive urban development, creating substantial opportunities for sludge processing equipment suppliers across municipal water treatment, industrial wastewater processing, and environmental compliance sectors. The country's growing wastewater treatment capacity and expanding infrastructure projects are creating significant demand for both traditional mechanical and advanced automated processing equipment. Major water treatment companies and municipal operators are establishing comprehensive local equipment procurement to support large-scale operations and meet growing demand for efficient sludge handling solutions.

Revenue from sludge handling equipment in China is expanding at a CAGR of 6.0%, supported by extensive wastewater treatment investments and comprehensive industrial development, creating sustained demand for reliable sludge processing equipment across diverse treatment categories and industrial segments. The country's strategic focus on environmental protection and expanding industrial capabilities is driving demand for processing equipment that provides consistent performance while supporting cost-effective operational requirements. Sludge handling equipment manufacturers are investing in local production facilities to support growing treatment operations and industrial demand.

Demand for sludge handling equipment in Brazil is projected to grow at a CAGR of 5.1%, supported by the country's focus on water infrastructure development and expanding wastewater treatment capabilities requiring sophisticated sludge processing equipment for municipal and industrial water management operations. Brazilian water treatment facilities are implementing high-quality processing systems that support advanced treatment techniques, operational efficiency, and comprehensive environmental protocols. The market is characterized by a focus on operational excellence, equipment reliability, and compliance with stringent environmental performance standards.

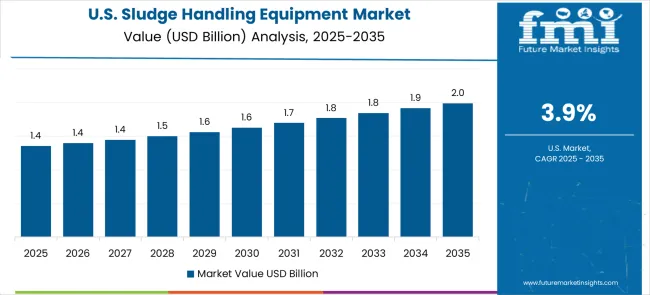

Revenue from sludge handling equipment in the United States is growing at a CAGR of 4.2%, driven by wastewater infrastructure replacement programs and increasing environmental compliance, creating sustained opportunities for sludge processing equipment suppliers serving both municipal facilities and industrial operators. The country's mature wastewater treatment sector and expanding ecological regulations are creating demand for processing equipment that supports diverse operational requirements while maintaining performance standards. Wastewater treatment facilities and industrial operators are developing equipment procurement strategies to support operational efficiency and regulatory compliance.

Demand for sludge handling equipment in Germany is expanding at a CAGR of 4.0%, driven by engineering excellence and precision manufacturing capabilities supporting advanced sludge processing equipment development and comprehensive wastewater treatment applications. The country's established engineering expertise and premium wastewater treatment market segments are creating demand for high-quality processing equipment that supports operational performance and regulatory standards. Equipment manufacturers and wastewater treatment suppliers are maintaining comprehensive development capabilities to support diverse treatment requirements.

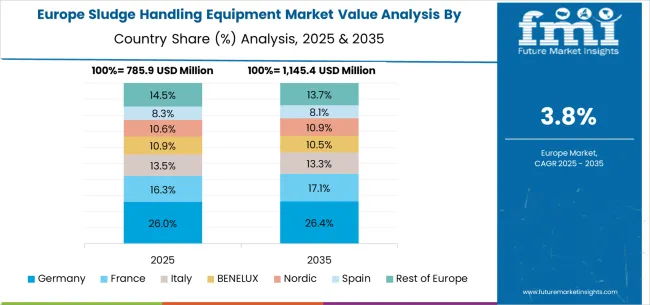

The sludge handling equipment market in Europe is projected to grow from USD 0.8 billion in 2025 to USD 1.2 billion by 2035, registering a CAGR of 4.2% over the forecast period. Germany is expected to maintain its leadership position with a 35.2% market share in 2025, remaining stable at 35.0% by 2035, supported by its advanced wastewater treatment equipment manufacturing sector, precision engineering capabilities, and comprehensive innovation expertise serving European and international wastewater treatment markets.

The United Kingdom follows with a 22.8% share in 2025, projected to reach 23.1% by 2035, driven by wastewater infrastructure modernization programs, advanced treatment technology development capabilities, and growing focus on operational efficiency solutions for premium wastewater treatment operations. France holds an 18.4% share in 2025, expected to maintain 18.2% by 2035, supported by municipal wastewater treatment demand and advanced processing technology applications, but facing challenges from market competition and economic considerations.

Italy commands a 12.6% share in 2025, projected to reach 12.8% by 2035, while Spain accounts for 7.3% in 2025, expected to reach 7.5% by 2035. The Netherlands maintains a 3.7% share in 2025, growing to 3.8% by 2035. The Rest of Europe region, including Nordic countries, Eastern Europe, Belgium, Switzerland, and Austria, is anticipated to hold 18.6% in 2025, declining slightly to 18.4% by 2035, attributed to mixed growth patterns with strong expansion in some Nordic wastewater treatment markets balanced by moderate growth in smaller countries implementing wastewater infrastructure modernization programs.

The sludge handling equipment market is defined by competition among established wastewater treatment equipment manufacturers, specialized sludge processing system providers, and emerging environmental technology firms. Companies are investing in advanced processing technology, manufacturing process optimization, quality management systems, and global distribution capabilities to deliver reliable, efficient, and cost-effective sludge handling equipment. Strategic partnerships, technological advancement, and geographic expansion are central to strengthening product portfolios and market presence.

ANDRITZ, operating globally, offers comprehensive wastewater treatment processing solutions with a focus on advanced technology, operational excellence, and wastewater treatment industry partnerships, holding an 18% market share. Alfa Laval provides specialized sludge processing equipment with emphasis on separation technology and operational reliability. Centrisys/CNP, an American sludge processing equipment specialist, delivers advanced handling technologies with a focus on precision engineering and municipal wastewater treatment applications. These leading companies demonstrate strong market presence through technological innovation and comprehensive service capabilities.

Established processing equipment providers include Flottweg, offering specialized sludge handling solutions with a focus on separation performance and customer service excellence. GEA delivers comprehensive processing systems with emphasis on industrial applications and technical support. HUBER SE provides sludge handling equipment with a focus on municipal applications and European distribution networks. Hiller Separation offers specialized processing solutions with emphasis on dewatering technology and regional market development.

Emerging market participants include JWC Environmental, Schwing Bioset, and WesTech Engineering, offering specialized sludge processing expertise, innovative technologies, and technical support across global and regional wastewater treatment markets, with a focus on advanced handling capabilities and operational efficiency solutions.

The sludge handling equipment market underpins wastewater treatment efficiency enhancement, environmental compliance optimization, operational productivity improvement, and infrastructure reliability. With wastewater treatment industry growth, advancing processing technologies, and increasing environmental regulations, the sector must balance equipment quality, operational efficiency, and cost competitiveness. Coordinated contributions from governments, wastewater treatment associations, equipment manufacturers, treatment facilities, and investors will accelerate the transition toward advanced, reliable, and highly efficient sludge processing systems.

The global sludge handling equipment market is estimated to be valued at USD 3.3 billion in 2025.

The market size for the sludge handling equipment market is projected to reach USD 5.2 billion by 2035.

The sludge handling equipment market is expected to grow at a 4.6% CAGR between 2025 and 2035.

The key product types in sludge handling equipment market are dewatering, thickening, conveying & storage and conditioning/other.

In terms of capacity (m³/d), 501–2000 segment to command 45.0% share in the sludge handling equipment market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Sludge Treatment Chemicals Market Growth - Trends & Forecast 2025 to 2035

Municipal Sludge Dewatering Equipment Market Size and Share Forecast Outlook 2025 to 2035

Air Handling Unit Market Size and Share Forecast Outlook 2025 to 2035

BOP Handling Systems Market Growth - Trends & Forecast 2025 to 2035

Roll Handling Machine Market Size and Share Forecast Outlook 2025 to 2035

Goat Handling Equipment Market Size and Share Forecast Outlook 2025 to 2035

Drum Handling Equipment Market

Crate Handling Systems Market Size and Share Forecast Outlook 2025 to 2035

Glass Handling Robot Market Trends & Forecast 2025 to 2035

Sheep Handling Equipment Market Size and Share Forecast Outlook 2025 to 2035

Cattle Handling Systems Market Size and Share Forecast Outlook 2025 to 2035

Manure Handling Equipment Market Size and Share Forecast Outlook 2025 to 2035

Patient Handling Equipment Market Size and Share Forecast Outlook 2025 to 2035

Material Handling Integration Market Size and Share Forecast Outlook 2025 to 2035

Material Handling Monorails Market

Material Handling Equipment Market Growth - Trends & Forecast 2025 to 2035

Microplate Handling Instruments Market Size and Share Forecast Outlook 2025 to 2035

Storage And Handling Equipment Market Size and Share Forecast Outlook 2025 to 2035

Case and Box Handling Robots Market Size and Share Forecast Outlook 2025 to 2035

Marine Waste Handling Equipment Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA