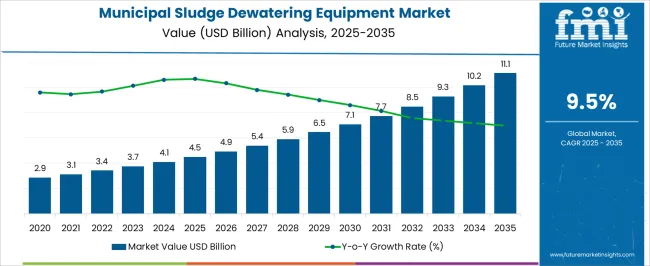

The municipal sludge dewatering equipment market is estimated to be valued at USD 4.5 billion in 2025 and is projected to reach USD 11.1 billion by 2035, registering a compound annual growth rate (CAGR) of 9.5% over the forecast period.

Growth is driven by increasing urbanization, stringent wastewater treatment regulations, and the need for efficient management of municipal sludge to reduce environmental impact. Adoption is fueled by rising investments in advanced sludge dewatering technologies, such as centrifuges, belt presses, screw presses, and decanter systems, which enhance water recovery, reduce sludge volume, and lower operational costs for municipalities and industrial wastewater treatment facilities. Compound absolute growth analysis highlights the cumulative impact of annual market expansion over the forecast period. From 2025 to 2028, incremental growth is steady, supported by early adoption in North America and Europe, where aging infrastructure and regulatory compliance drive demand.

Between 2029 and 2032, the market accelerates as Asia Pacific, Latin America, and the Middle East increase wastewater treatment capacity, driven by urban population growth and industrial expansion. From 2033 to 2035, growth stabilizes as early-adopting regions reach higher equipment penetration, and incremental revenue comes primarily from upgrades, retrofits, and maintenance services. Overall, the USD 6.6 billion opportunity reflects the combined effects of regulatory pressure, urban infrastructure development, and technology adoption, demonstrating consistent and compounding growth in the municipal sludge dewatering equipment market between 2025 and 2035.

| Metric | Value |

|---|---|

| Municipal Sludge Dewatering Equipment Market Estimated Value in (2025 E) | USD 4.5 billion |

| Municipal Sludge Dewatering Equipment Market Forecast Value in (2035 F) | USD 11.1 billion |

| Forecast CAGR (2025 to 2035) | 9.5% |

The municipal sludge dewatering equipment market is driven by five primary parent markets with specific shares. Wastewater treatment plants lead with 50%, as they require efficient dewatering solutions to manage increasing volumes of municipal sludge. Industrial wastewater management contributes 20%, using equipment for chemical, food, and paper processing effluents. Environmental services and recycling account for 15%, where dewatered sludge is processed for composting or energy recovery.

Construction and infrastructure represent 10%, utilizing dewatering equipment for site runoff and treatment systems. Research and technology providers hold 5%, supporting innovation and process optimization. These segments collectively shape global demand for sludge dewatering equipment. Recent developments in the municipal sludge dewatering equipment market focus on energy efficiency, automation, and sustainable operations. Manufacturers are introducing advanced centrifuges, belt presses, and screw presses with higher throughput and lower power consumption.

Smart monitoring systems with real-time performance tracking enable predictive maintenance and optimized operation. Integration with anaerobic digestion and biogas recovery systems is increasing, turning sludge into renewable energy sources. Environmental regulations and the push for reduced landfill usage are driving adoption of high-efficiency dewatering technologies. These trends are promoting innovation, operational cost reduction, and sustainability in municipal and industrial wastewater management.

The municipal sludge dewatering equipment market is gaining traction due to increasing urbanization, stringent environmental regulations, and the growing need for efficient wastewater treatment infrastructure. Municipalities worldwide are prioritizing sustainable sludge management solutions to reduce operational costs, improve water quality, and comply with disposal standards.

Rising population density in urban centers has significantly increased sludge volumes, prompting investments in technologies that enhance water recovery and minimize waste. Energy efficiency, automation, and compact system designs are becoming key selection criteria as cities upgrade or replace aging infrastructure.

Over the coming years, continued regulatory pressure, coupled with public-private partnerships and government funding for smart water projects, is expected to bolster market growth.The focus on circular economy models and the reuse of treated sludge for agriculture or energy production will further drive innovation and adoption of advanced dewatering technologies across municipal settings.

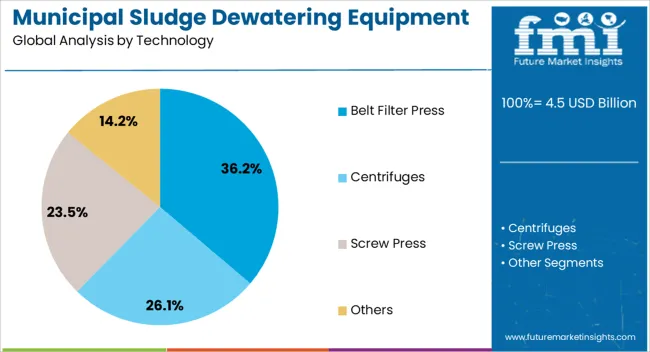

The municipal sludge dewatering equipment market is segmented by technology, and geographic regions. By technology, municipal sludge dewatering equipment market is divided into belt filter press, centrifuges, screw press, and others. Regionally, the municipal sludge dewatering equipment industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The belt filter press segment accounts for 36.2% of the municipal sludge dewatering equipment market, maintaining its position as a widely adopted and cost-effective solution for medium-to-large-scale municipal operations. Its ability to provide continuous dewatering with moderate energy consumption and relatively low operating costs has made it a preferred choice among wastewater treatment facilities.

The technology is well-suited for processing large volumes of sludge with moderate solid concentrations, delivering consistent performance with minimal supervision. Ongoing enhancements in belt materials and system automation have improved dewatering efficiency, cake dryness, and equipment durability, leading to lower lifecycle costs.

Moreover, its compatibility with polymer conditioning and pre-thickening processes offers added operational flexibility.As municipalities seek dependable and scalable solutions to manage growing sludge loads, the belt filter press remains a practical and economically viable choice for both new installations and retrofitting projects.

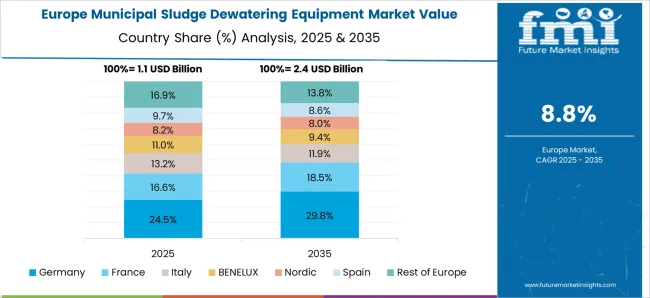

The municipal sludge dewatering equipment market is expanding globally due to increasing urban wastewater generation and stringent environmental regulations. Asia Pacific accounts for over 40% of installations, led by China and India, while North America and Europe focus on high-efficiency, energy-saving dewatering technologies. Equipment such as belt filter presses, centrifuges, and screw presses are increasingly adopted to reduce sludge volume, improve disposal efficiency, and recover water. Technological advancements in automation, polymer dosing, and process optimization are enhancing performance. Growing urbanization, wastewater treatment expansion, and sustainable waste management initiatives are driving market growth worldwide.

The primary driver of the municipal sludge dewatering equipment market is the growing volume of urban wastewater requiring efficient treatment. Rising population and industrial activities in Asia Pacific, North America, and Europe are increasing sludge generation by approximately 3–5% annually. High-efficiency dewatering reduces sludge volume by 50–70%, lowering transportation and disposal costs. Equipment such as centrifuges, screw presses, and belt filter presses provide energy-efficient solutions and enhanced water recovery. Stringent government regulations on wastewater treatment, sludge disposal, and environmental compliance drive adoption in municipal and industrial wastewater plants. Technological integration with automated polymer dosing and monitoring systems further improves throughput, safety, and operational efficiency.

Opportunities in the municipal sludge dewatering market arise from the adoption of advanced treatment technologies and circular economy initiatives. Recovery of water and energy from sludge through integrated dewatering and anaerobic digestion improves sustainability and operational cost-efficiency. Europe and North America emphasize nutrient recovery and biosolid reuse in agriculture, creating additional market potential. Asia Pacific’s expanding wastewater infrastructure and urbanization present measurable growth opportunities for automated, high-capacity dewatering systems. Adoption of hybrid technologies combining centrifuges, screw presses, and belt filter presses enhances sludge reduction efficiency. Manufacturers investing in energy-efficient, modular, and IoT-enabled equipment are well-positioned to capitalize on global demand for sustainable wastewater management solutions.

Key trends include automation, real-time process monitoring, and energy-efficient equipment in municipal sludge dewatering. Integration of SCADA systems and sensors allows continuous monitoring of sludge feed, polymer dosing, and moisture content, reducing operational errors and downtime by up to 15%. Hybrid and modular systems combining centrifuges and belt filter presses are increasingly adopted for higher throughput and reliability. Energy-efficient equipment, including low-power decanter centrifuges, reduces operational costs by 10–12%. Asia Pacific leads in high-capacity installations, while Europe and North America focus on sustainability and nutrient recovery. Adoption of predictive maintenance and IoT-enabled monitoring is improving equipment lifecycle management and process efficiency in municipal wastewater treatment globally.

Despite growth, the municipal sludge dewatering equipment market faces challenges from high capital investment, maintenance complexity, and technical barriers. Equipment such as high-capacity centrifuges or belt filter presses can cost USD 150,000 to USD 500,000 per unit, limiting adoption in small municipalities. Operational efficiency depends on sludge characteristics, requiring continuous monitoring and skilled labor for polymer dosing, cleaning, and maintenance. Power supply inconsistencies and corrosion issues in humid or saline sludge environments can reduce equipment lifespan. Regulatory variations in sludge disposal and nutrient recovery across regions create compliance challenges. Manufacturers must focus on modular, energy-efficient, and low-maintenance designs to overcome cost and technical barriers while enabling global adoption.

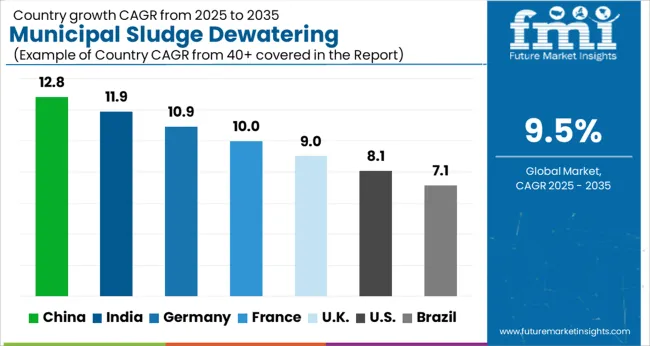

| Country | CAGR |

|---|---|

| China | 12.8% |

| India | 11.9% |

| Germany | 10.9% |

| France | 10.0% |

| UK | 9.0% |

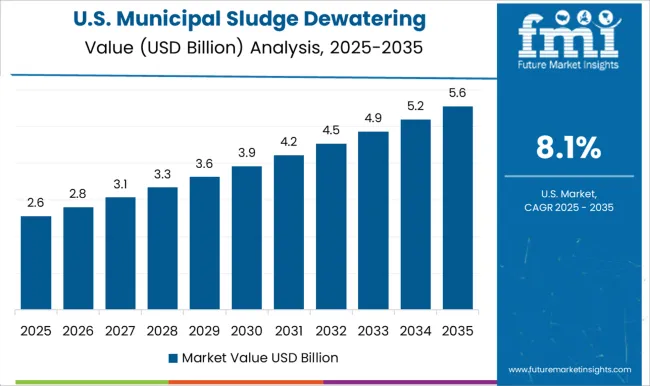

| USA | 8.1% |

| Brazil | 7.1% |

The municipal sludge dewatering equipment market is projected to expand at a global CAGR of 9.5% through 2035, driven by increasing urban wastewater management, industrial effluent treatment, and regulatory compliance requirements. China leads at 12.8%, a 1.35× multiple over the global benchmark, supported by BRICS-driven investments in wastewater infrastructure, urban sanitation projects, and industrial treatment facilities. India follows at 11.9%, a 1.25× multiple, reflecting growth in municipal wastewater management, industrial effluent treatment, and infrastructure modernization. Germany records 10.9%, a 1.15× multiple, shaped by OECD-backed technological innovation, efficiency improvements, and advanced wastewater management systems. The United Kingdom posts 9.0%, 0.95× the global rate, with adoption concentrated in municipal treatment plants and industrial dewatering solutions. The United States stands at 8.1%, 0.85× the benchmark, with steady uptake in municipal and industrial sludge dewatering projects. BRICS economies drive the majority of market volume, OECD countries focus on innovation and efficiency, while ASEAN markets contribute through expanding wastewater treatment infrastructure. This report includes insights on 40+ countries; the top markets are shown here for reference.

The municipal sludge dewatering equipment market in China is projected to grow at a CAGR of 12.8%, driven by increasing urban wastewater treatment capacity, government regulations on sludge management, and rapid industrial expansion. Leading manufacturers such as ANDRITZ, Veolia, and local Chinese firms supply centrifuges, belt presses, and filter presses optimized for energy efficiency and high throughput. Adoption is concentrated in municipal wastewater treatment plants, industrial effluent management, and large-scale sludge processing facilities. Technological trends focus on automated control, high solids handling, and integration with anaerobic digestion. Policies promoting environmental compliance, resource recovery, and water management reinforce market growth. Rising demand for sustainable wastewater treatment and sludge management solutions accelerates adoption in China.

The municipal sludge dewatering equipment market in India is expected to expand at a CAGR of 11.9%, supported by increasing wastewater treatment plants, industrial effluent management, and sludge disposal needs. Key suppliers such as Veolia, ANDRITZ, and Thermax provide belt presses, centrifuges, and filter presses for municipal and industrial applications. Adoption is concentrated in municipal wastewater facilities, industrial plants, and urban sludge management projects. Technological developments focus on energy-efficient equipment, high solids handling, and automation. Government initiatives promoting environmental compliance, urban sanitation, and waste management infrastructure reinforce market growth. Rising demand for efficient, high-throughput sludge dewatering solutions accelerates adoption across India.

The municipal sludge dewatering equipment market in Germany is projected to grow at a CAGR of 10.9%, driven by demand for efficient sludge management, wastewater treatment, and industrial effluent processing. Leading companies such as ANDRITZ, Veolia, and Flottweg supply centrifuges, decanter presses, and belt presses with high energy efficiency and automation features. Adoption is concentrated in municipal wastewater treatment plants, industrial facilities, and resource recovery projects. Technological trends emphasize high solids handling, automation, and integration with anaerobic digestion. Government regulations on wastewater treatment, sludge disposal, and environmental compliance reinforce market growth. Rising focus on energy recovery and efficient sludge processing accelerates adoption in Germany.

The municipal sludge dewatering equipment market in the United Kingdom is projected to grow at a CAGR of 9.0%, supported by increasing municipal wastewater treatment, sludge disposal efficiency, and environmental compliance requirements. Key suppliers such as Veolia, ANDRITZ, and Huber Technology provide centrifuges, belt presses, and filter presses with energy-efficient and automated capabilities. Adoption is concentrated in municipal wastewater plants, industrial facilities, and sludge management projects. Technological trends focus on high solids handling, automation, and integration with energy recovery solutions. Government policies supporting sanitation, wastewater treatment, and environmental sustainability reinforce market growth. Rising demand for efficient sludge dewatering solutions accelerates adoption in the United Kingdom.

The municipal sludge dewatering equipment market in the United States is expected to grow at a CAGR of 8.1%, supported by urban wastewater treatment expansion, industrial effluent management, and sludge disposal needs. Leading companies such as ANDRITZ, Veolia, and Flottweg supply centrifuges, belt presses, and filter presses optimized for high throughput and energy efficiency. Adoption is concentrated in municipal wastewater facilities, industrial plants, and resource recovery operations. Technological trends emphasize automation, high solids handling, and integration with anaerobic digestion systems. Government regulations promoting wastewater treatment, environmental compliance, and energy recovery reinforce market adoption. Rising demand for efficient sludge dewatering solutions supports steady growth in the United States.

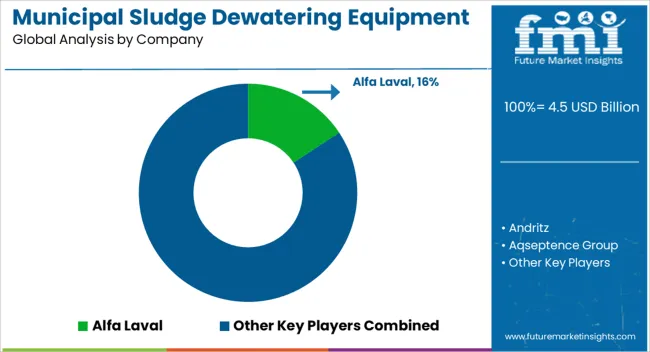

Competition in the municipal sludge dewatering sector is being driven by efficiency, throughput, and compliance with environmental regulations, with companies focusing on performance, reliability, and energy optimization. Alfa Laval and Andritz are being advanced with centrifuge and decanter solutions designed for high-capacity sludge handling, ensuring water recovery and solids reduction. Aqseptence Group and Encon Evaporators are being positioned with modular equipment tailored for urban wastewater treatment plants, offering flexible operation and reduced maintenance requirements.

Evoqua Water Technologies and Flotrend are being showcased with compact, automated systems that integrate monitoring, filtration, and separation technologies to enhance operational efficiency and minimize sludge volume. Hiller Separation & Process and Hitachi Zosen are being applied with solutions that provide high dewatering performance for industrial and municipal applications. Huber and Keppel Seghers are being highlighted with screw presses, belt presses, and filter presses designed for variable sludge types and throughput rates.

Komline-Sanderson, Kontek Ecology Systems, Phoenix Process Equipment, Sebright Products, and Veolia are being positioned with advanced, automated systems that optimize cake dryness, minimize energy consumption, and ensure regulatory compliance. Product brochures are being structured with equipment specifications including throughput capacity, cake dryness, power consumption, footprint, and maintenance guidelines. Strategies focus on enhancing automation, improving energy efficiency, and providing scalable solutions that support municipal and industrial sludge management while reducing environmental impact and operational costs.

| Item | Value |

|---|---|

| Quantitative Units | USD 4.5 billion |

| Technology | Belt Filter Press, Centrifuges, Screw Press, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Alfa Laval, Andritz, Aqseptence Group, Encon Evaporators, Evoqua Water Technologies, Flotrend, Hiller Separation & Process, Hitachi Zosen, Huber, Keppel Seghers, Komline-Sanderson, Kontek Ecology Systems, Phoenix Process Equipment, Sebright Products, and Veolia |

| Additional Attributes | Dollar sales by equipment type and end use, demand dynamics across wastewater treatment plants, industrial effluents, and municipal facilities, regional trends in urban sanitation and sludge management, innovation in efficiency, automation, and energy savings, environmental impact of disposal and water reuse, and emerging use cases in circular economy and resource recovery. |

The global municipal sludge dewatering equipment market is estimated to be valued at USD 4.5 billion in 2025.

The market size for the municipal sludge dewatering equipment market is projected to reach USD 11.1 billion by 2035.

The municipal sludge dewatering equipment market is expected to grow at a 9.5% CAGR between 2025 and 2035.

The key product types in municipal sludge dewatering equipment market are belt filter press, centrifuges, screw press and others.

In terms of technology, the belt filer press segment is set to command 36.2% share in the municipal sludge dewatering equipment market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Municipal Solid Waste Management Market Size and Share Forecast Outlook 2025 to 2035

Municipal Pump Market Size and Share Forecast Outlook 2025 to 2035

Sludge Treatment Chemicals Market Growth - Trends & Forecast 2025 to 2035

Sludge Handling Equipment Market Size and Share Forecast Outlook 2025 to 2035

Equipment Management Software Market Size and Share Forecast Outlook 2025 to 2035

Equipment cases market Size and Share Forecast Outlook 2025 to 2035

Farm Equipment Market Forecast and Outlook 2025 to 2035

Golf Equipment Market Size and Share Forecast Outlook 2025 to 2035

Port Equipment Market Size and Share Forecast Outlook 2025 to 2035

Pouch Equipment Market Growth – Demand, Trends & Outlook 2025 to 2035

Garage Equipment Market Forecast and Outlook 2025 to 2035

Mining Equipment Industry Analysis in Latin America Size and Share Forecast Outlook 2025 to 2035

Subsea Equipment Market Size and Share Forecast Outlook 2025 to 2035

Pavers Equipment Market Size and Share Forecast Outlook 2025 to 2035

Tennis Equipment Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Galley Equipment Market Analysis and Forecast by Fit, Application, and Region through 2035

Sorting Equipment Market Size and Share Forecast Outlook 2025 to 2035

General Equipment Rental Services Market Size and Share Forecast Outlook 2025 to 2035

Bagging Equipment Market Size and Share Forecast Outlook 2025 to 2035

RF Test Equipment Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA