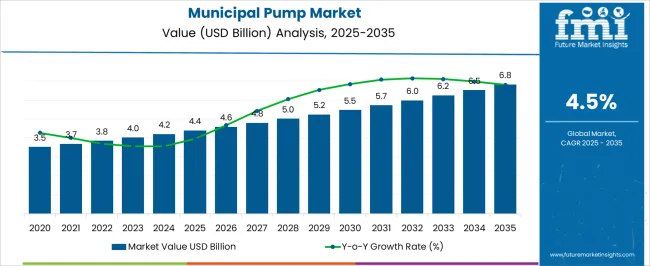

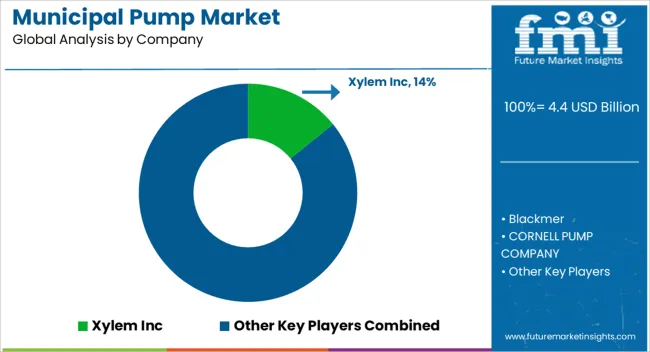

The municipal pump market is estimated to be valued at USD 4.4 billion in 2025 and is projected to reach USD 6.8 billion by 2035, registering a compound annual growth rate (CAGR) of 4.5% over the forecast period.

The absolute dollar opportunity over this period is USD 2.4 billion, representing the additional market potential from 2025 to 2035. This growth reflects steady demand for municipal pumping solutions across water supply, wastewater management, and related infrastructure projects. Companies can capitalize on this opportunity by expanding production capacity, enhancing distribution networks, and targeting regions with increasing infrastructure investments. The incremental growth provides a clear financial incentive for strategic planning and investment over the decade. From a business perspective, the USD 2.4 billion absolute dollar opportunity demonstrates tangible revenue potential for both new entrants and established players.

With the market gradually rising from USD 4.4 billion in 2025 to USD 6.8 billion in 2035 at a CAGR of 4.5%, firms can plan phased investments and optimize operational efficiency. By focusing on high-demand regions, improving service networks, and strengthening client relationships, stakeholders can capture incremental revenue. This predictable growth trajectory allows companies to reinforce market positioning, expand reach, and achieve sustained profitability throughout the ten-year period.

| Metric | Value |

|---|---|

| Municipal Pump Market Estimated Value in (2025 E) | USD 4.4 billion |

| Municipal Pump Market Forecast Value in (2035 F) | USD 6.8 billion |

| Forecast CAGR (2025 to 2035) | 4.5% |

A breakpoint analysis for the municipal pump market highlights key thresholds where growth accelerates or strategic adjustments become necessary. With the market valued at USD 4.4 billion in 2025 and projected to reach USD 6.8 billion by 2035 at a CAGR of 4.5%, early breakpoints occur around USD 5.0–5.2 billion. These levels represent the initial phase of notable market expansion, indicating increased demand for municipal pumping solutions. Recognizing these breakpoints enables companies to allocate resources efficiently, expand production, and optimize distribution channels to capture incremental revenue during periods of accelerated growth, ensuring early-mover advantages in high-demand regions.

Later-stage breakpoints appear between USD 6.0–6.5 billion as the market approaches maturity and competition intensifies. Surpassing these thresholds may require firms to refine pricing strategies, enhance operational efficiency, and strengthen relationships with key clients to sustain growth momentum. Monitoring these breakpoints allows companies to anticipate shifts in demand and adjust production, marketing, and service strategies accordingly. By aligning strategic actions with these critical thresholds, stakeholders can maximize revenue potential, reinforce market positioning, and navigate the steady growth trajectory from 2025 to 2035 with informed precision.

The market is witnessing robust growth driven by escalating urbanization and the increasing demand for efficient water management systems in cities and towns. Infrastructure developments focused on water supply, wastewater treatment, and flood control are propelling investments in modern pumping solutions.

The growing emphasis on sustainable and energy-efficient technologies is shaping the future trajectory of the market. Advancements in pump design and automation, along with rising government initiatives to upgrade aging municipal water networks, are creating significant opportunities.

The integration of smart monitoring systems and the adoption of renewable energy sources for pump operations are further enhancing the market’s appeal Overall, the shift towards reliable and environmentally friendly water infrastructure solutions is underpinning the expanding market potential across global municipalities.

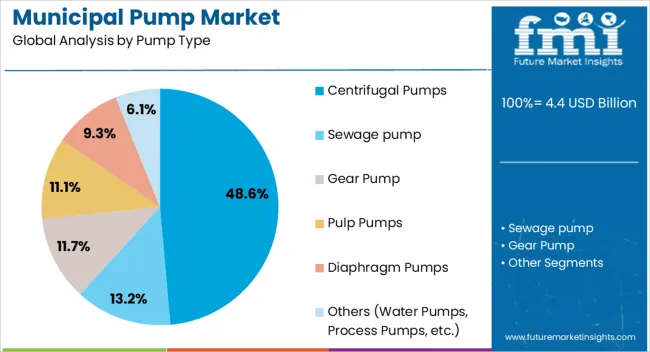

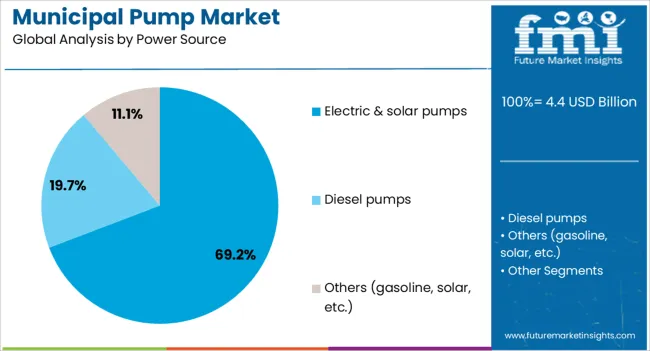

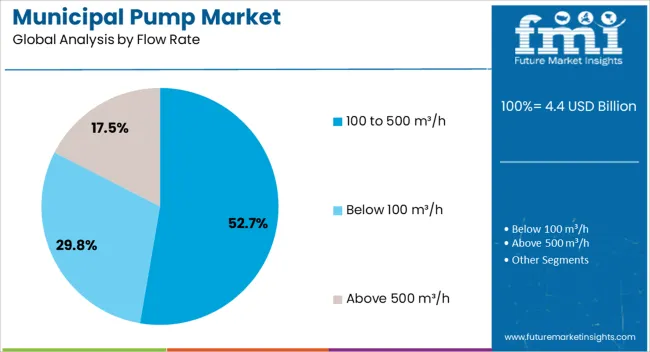

The municipal pump market is segmented by pump type, power source, flow rate, horse power, technology, application, distribution channel, and geographic regions. By pump type, municipal pump market is divided into centrifugal pumps, sewage pump, gear pump, pulp pumps, diaphragm pumps, and others (Water Pumps, Process Pumps, etc.). In terms of power source, municipal pump market is classified into electric & solar pumps, diesel pumps, and others (gasoline, solar, etc.). Based on flow rate, municipal pump market is segmented into 100 to 500 m³/h, below 100 m³/h, and above 500 m³/h. By horse power, municipal pump market is segmented into below 100 HP, 100 to 500 HP, and above 500 HP. By technology, municipal pump market is segmented into conventional and smart. By application, municipal pump market is segmented into wastewater and sewage handling, clean water systems, grey water recycling, and others. By distribution channel, municipal pump market is segmented into indirect and direct. Regionally, the municipal pump industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The centrifugal pump type is projected to hold 48.6% of the municipal pump market revenue share in 2025, making it the dominant pump category. This segment’s leadership is attributed to the pumps’ simple design, high efficiency, and suitability for a wide range of municipal water applications such as water distribution and sewage handling.

The adaptability of centrifugal pumps to varying flow rates and pressures allows their deployment in both large and small-scale municipal projects. Additionally, their proven reliability and relatively low maintenance requirements have encouraged widespread adoption. The scalability of centrifugal pumps for different municipal needs has positioned them as the preferred choice for water utilities aiming to optimize operational performance while managing costs effectively.

Electric and solar-powered pumps are expected to capture 69.2% of the market revenue share in 2025, leading the power source segment. This dominance results from increasing focus on energy efficiency and the adoption of renewable power in municipal water systems.

Solar pumps offer sustainable alternatives for remote or off-grid areas where electricity supply may be inconsistent or costly. Meanwhile, electric pumps continue to be favored for their ease of integration with existing power grids and automation systems.

The growing environmental awareness and government incentives promoting clean energy solutions have accelerated the shift towards electric and solar pump technologies As municipalities prioritize reducing carbon footprints and operational costs, these power sources are set to sustain their market leadership.

Pumps with flow rates ranging from 100 to 500 cubic meters per hour are estimated to hold 52.7% of the Municipal Pump market revenue in 2025, representing the largest share among flow rate categories. This preference is driven by the suitability of this flow range for typical municipal water supply and wastewater applications.

Pumps within this capacity are capable of handling medium-scale water transfer needs efficiently, balancing performance and energy consumption. The segment benefits from a wide range of applications including potable water distribution, irrigation, and sewage pumping, making it highly versatile.

The ability to maintain consistent flow while adapting to varying municipal demand has reinforced the growth of pumps in this flow rate bracket Consequently, this segment remains a focal point for manufacturers and municipal planners seeking effective and scalable pumping solutions.

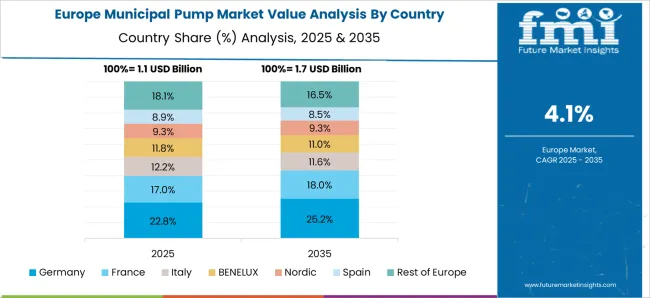

The municipal pump market is expanding due to rising urbanization, increasing water and wastewater infrastructure projects, and growing demand for efficient water management. North America and Europe lead with high-capacity, energy-efficient pumps for municipal water supply, wastewater treatment, and flood control systems. Asia-Pacific shows rapid growth driven by infrastructure development, smart city projects, and industrial water demand. Manufacturers differentiate through pump type, energy efficiency, durability, and automation. Regional variations in regulatory standards, municipal budgets, and water management practices influence adoption and market competitiveness globally.

Municipal pumps vary in type, including centrifugal, submersible, and positive displacement, with capacities suited to urban and industrial requirements. Europe and North America prioritize high-capacity, energy-efficient pumps for water treatment, distribution, and sewage management, supporting long-term reliability and operational efficiency. Asia-Pacific often adopts medium-capacity or cost-effective pumps for rapidly expanding urban infrastructure and smaller municipal projects. Differences in type and capacity affect system performance, maintenance requirements, and lifecycle costs. Global suppliers offering advanced, high-performance pumps capture premium municipal projects, while regional manufacturers focus on cost-efficient solutions. These contrasts shape adoption rates, project planning, and supplier competitiveness across mature and emerging municipal markets.

Energy-efficient pumps with automation features, including variable speed drives and remote monitoring, are preferred in North America and Europe to reduce operational costs and comply with sustainability mandates. Asia-Pacific markets increasingly adopt automated solutions, but cost constraints often favor conventional designs with lower energy optimization. Differences in energy efficiency and automation affect operating costs, reliability, and long-term maintenance. Manufacturers providing smart, energy-optimized pumps gain advantages in premium municipal contracts, while regional producers meet volume-driven demand. These contrasts drive adoption patterns, competitive positioning, and long-term utility satisfaction in water supply and wastewater treatment infrastructure projects.

Compliance with environmental regulations, water quality standards, and municipal codes is crucial for pump adoption. North America and Europe enforce strict efficiency, noise, and emission standards, requiring certified, tested pumps for municipal applications. Asia-Pacific regulations vary, with emerging markets balancing compliance with budget considerations. Differences in regulatory adherence impact procurement, project approvals, and product selection. Suppliers ensuring compliance gain access to high-value contracts, while regional producers focus on affordable, standard-compliant units. Regulatory contrasts directly influence adoption rates, project feasibility, and competitiveness in global and regional municipal water and wastewater markets.

Municipal pumps are supplied through OEMs, specialized distributors, engineering procurement contracts, and service providers. Europe and North America rely on direct sales, project-based contracts, and maintenance support for high-value municipal projects. Asia-Pacific depends on distributors, regional suppliers, and local service networks to reach smaller municipalities and urban centers. Differences in distribution and support affect accessibility, adoption speed, and operational reliability. Leading suppliers offer turnkey solutions and after-sales service, while regional manufacturers prioritize local availability and affordability. Distribution contrasts influence market penetration, customer satisfaction, and long-term growth across municipal pump applications.

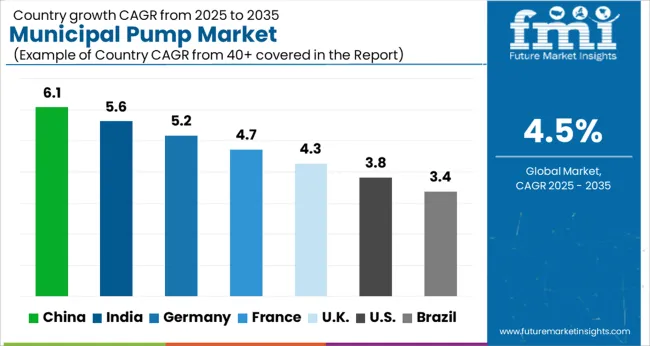

| Country | CAGR |

|---|---|

| China | 6.1% |

| India | 5.6% |

| Germany | 5.2% |

| France | 4.7% |

| UK | 4.3% |

| USA | 3.8% |

| Brazil | 3.4% |

The global municipal pump market was projected to grow at a 4.5% CAGR through 2035, driven by demand in water supply, wastewater management, and municipal infrastructure applications. Among BRICS nations, China recorded 6.1% growth as large-scale production and deployment facilities were commissioned and compliance with industrial and safety standards was enforced, while India at 5.6% growth saw expansion of manufacturing units to meet rising regional municipal demand. In the OECD region, Germany at 5.2% maintained substantial output under strict industrial and environmental regulations, while the United Kingdom at 4.3% relied on moderate-scale operations for urban water management and municipal projects. The USA, expanding at 3.8%, remained a mature market with steady demand across municipal, industrial, and residential segments, supported by adherence to federal and state-level safety and quality standards. This report includes insights on 40+ countries; the top five markets are shown here for reference.

Municipal pump market in China is growing at a CAGR of 6.1%. Between 2020 and 2024, growth was driven by urban infrastructure expansion, rising demand for water supply and wastewater management, and government investments in smart city projects. Manufacturers focused on high-efficiency, durable, and energy-saving pumps suitable for municipal water treatment and distribution. Adoption of advanced monitoring systems and corrosion-resistant materials enhanced reliability and reduced maintenance. In the forecast period 2025 to 2035, growth is expected to accelerate with deployment of IoT-enabled, smart, and automated municipal pump systems. Rising urbanization, infrastructure modernization, and government initiatives for sustainable water management will further support market growth. China remains a leading market due to large urban population, rapid industrialization, and focus on modern municipal services.

Municipal pump market in India is growing at a CAGR of 5.6%. Historical period 2020 to 2024 saw growth supported by urbanization, rising municipal water supply demand, and expansion of wastewater treatment infrastructure. Manufacturers focused on cost-effective, energy-efficient, and durable pumps suitable for municipal applications, including water distribution and sewage management. In the forecast period 2025 to 2035, market growth is expected to continue with adoption of smart, IoT-enabled, and automated pumping solutions. Government initiatives for clean water supply, urban infrastructure modernization, and growing industrial water demand will further boost adoption. India is projected to maintain strong growth due to population density, urban development, and increasing emphasis on sustainable water management.

Municipal pump market in Germany is growing at a CAGR of 5.2%. Between 2020 and 2024, growth was supported by modernization of municipal water networks, industrial wastewater management, and adoption of energy-efficient pumping systems. Manufacturers focused on durable, high-performance, and low-maintenance pumps suitable for water supply and sewage management. In the forecast period 2025 to 2035, growth is expected to continue steadily with deployment of smart, IoT-integrated, and predictive maintenance-enabled pump systems. Regulatory support, sustainability initiatives, and investment in infrastructure will further drive market adoption. Germany remains a key European market due to strong industrial base, focus on energy efficiency, and environmental regulations.

Municipal pump market in the United Kingdom is growing at a CAGR of 4.3%. During 2020 to 2024, adoption was driven by urban water supply expansion, wastewater management projects, and growing demand for energy-efficient municipal pumps. Manufacturers focused on reliable, durable, and low-maintenance pumping solutions suitable for water distribution and treatment. In the forecast period 2025 to 2035, market growth is expected to continue moderately with adoption of smart, automated, and predictive maintenance-enabled pumps. Expansion of urban infrastructure, government initiatives for sustainable water management, and focus on energy efficiency will further support growth. The United Kingdom market demonstrates stable growth with emphasis on reliability, sustainability, and advanced pumping technologies.

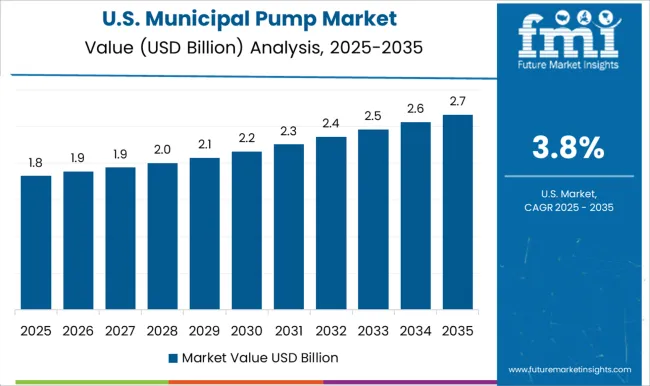

Municipal pump market in the United States is growing at a CAGR of 3.8%. Historical period 2020 to 2024 saw growth fueled by urban infrastructure development, municipal water and wastewater projects, and adoption of energy-efficient pumping solutions. Manufacturers focused on high-performance, durable, and low-maintenance pumps for municipal applications. In the forecast period 2025 to 2035, growth is expected to continue steadily with deployment of IoT-integrated, automated, and predictive maintenance-enabled pump systems. Investment in smart water management, sustainable infrastructure projects, and regulatory support will further drive market adoption. The United States market demonstrates consistent growth with emphasis on energy efficiency, reliability, and advanced municipal pumping technologies.

The municipal pump market is supplied by Xylem Inc, Blackmer, CORNELL PUMP COMPANY, Crane Pumps & Systems, EBARA Pumps Americas Corporation, EXAIR LLC, Grundfos Pumps Corporation, Liberty Pumps, MDM Incorporated, NETZSCH Pumps & Systems, Pentair plc, SEEPEX, Inc., Smith & Loveless Inc., Sulzer Ltd, and Wanner Engineering, Inc. Competition is shaped by hydraulic efficiency, energy consumption, durability, and ease of maintenance. Xylem and Grundfos brochures highlight centrifugal pumps, submersible models, and smart monitoring systems for wastewater and potable water applications. Sulzer and Pentair datasheets detail corrosion-resistant materials, variable-speed drives, and high-flow capacities.

Observed patterns show growing demand for modular designs, automation-ready units, and environmentally compliant components. Supplier strategies focus on application-specific solutions, aftermarket services, and system integration. Crane Pumps & Systems and Liberty Pumps target municipal water treatment facilities with corrosion- and abrasion-resistant units. EBARA and SEEPEX emphasize sludge handling, chemical dosing, and metering pumps suitable for municipal and industrial processes. Blackmer and Wanner Engineering prioritize energy-efficient designs with low lifecycle costs, while NETZSCH and MDM invest in customizable pump systems for varying flow and pressure requirements. Observed practices include regional partnerships, preventive maintenance programs, and predictive performance analytics. Product brochures provide technical specifications including flow rates, head pressure, efficiency curves, construction materials, and motor compatibility.

Xylem and Grundfos include corrosion- and abrasion-resistant coatings, seal types, and impeller configurations. EBARA and Sulzer datasheets cover submersible depths, temperature limits, and vibration tolerances. Liberty Pumps and Crane Pumps & Systems highlight installation guidelines, pump sizing, and maintenance intervals. Verified technical details allow municipal engineers, procurement teams, and facility managers to select pumps optimized for long-term reliability, energy efficiency, and operational performance.

| Item | Value |

|---|---|

| Quantitative Units | USD 4.4 Billion |

| Pump Type | Centrifugal Pumps, Sewage pump, Gear Pump, Pulp Pumps, Diaphragm Pumps, and Others (Water Pumps, Process Pumps, etc.) |

| Power Source | Electric & solar pumps, Diesel pumps, and Others (gasoline, solar, etc.) |

| Flow Rate | 100 to 500 m³/h, Below 100 m³/h, and Above 500 m³/h |

| Horse Power | Below 100 HP, 100 to 500 HP, and Above 500 HP |

| Technology | Conventional and Smart |

| Application | Wastewater and sewage handling, Clean Water Systems, Grey water recycling, and Others |

| Distribution Channel | Indirect and Direct |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Xylem Inc, Blackmer, CORNELL PUMP COMPANY, Crane Pumps & Systems, EBARA Pumps Americas Corporation, EXAIR LLC, Grundfos Pumps Corporation, Liberty Pumps, MDM Incorporated, NETZSCH Pumps & Systems, Pentair plc, SEEPEX, Inc., Smith & Loveless Inc., Sulzer Ltd, and Wanner Engineering, Inc |

| Additional Attributes | Dollar sales vary by pump type, including centrifugal, submersible, and positive displacement pumps; by application, such as water supply, wastewater management, stormwater management, and sewage treatment; by end-use, spanning municipal water authorities, wastewater treatment plants, and infrastructure projects; by region, led by North America, Europe, and Asia-Pacific. Growth is driven by urbanization, water infrastructure development, and increasing demand for efficient municipal pumping solutions. |

The global municipal pump market is estimated to be valued at USD 4.4 billion in 2025.

The market size for the municipal pump market is projected to reach USD 6.8 billion by 2035.

The municipal pump market is expected to grow at a 4.5% CAGR between 2025 and 2035.

The key product types in municipal pump market are centrifugal pumps, sewage pump, gear pump, pulp pumps, diaphragm pumps and others (water pumps, process pumps, etc.).

In terms of power source, electric & solar pumps segment to command 69.2% share in the municipal pump market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Municipal Sludge Dewatering Equipment Market Size and Share Forecast Outlook 2025 to 2035

Municipal Solid Waste Management Market Size and Share Forecast Outlook 2025 to 2035

Pump Jack Market Forecast Outlook 2025 to 2035

Pump and Dispenser Market Size and Share Forecast Outlook 2025 to 2035

Pump Testers Market Size and Share Forecast Outlook 2025 to 2035

Pumpjacks Market Size and Share Forecast Outlook 2025 to 2035

Pumps Market Size and Share Forecast Outlook 2025 to 2035

Pumpkin Seed Protein Market Size and Share Forecast Outlook 2025 to 2035

Pumped Hydro Storage Market Size and Share Forecast Outlook 2025 to 2035

Pump Tubes Market Size and Share Forecast Outlook 2025 to 2035

Pumpkin Pie Spices Market Analysis - Size, Share, and Forecast 2025 to 2035

Pumps and Trigger Spray Market Trends - Growth & Forecast 2025 to 2035

Pump Condiment Dispensers Market - Effortless Portion Control 2025 to 2035

Pumpkin Spice Products Market Trends - Seasonal Demand & Growth 2025 to 2035

Pump Feeders Market Growth - Trends & Forecast 2025 to 2035

Examining Market Share Trends in the Pump and Dispenser Industry

Mud Pumps Market Growth - Trends & Forecast 2025 to 2035

USA Pump and Dispenser Market Report – Demand, Trends & Industry Forecast 2025-2035

Fire Pump Test Meter Market Size and Share Forecast Outlook 2025 to 2035

Heat Pump Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA