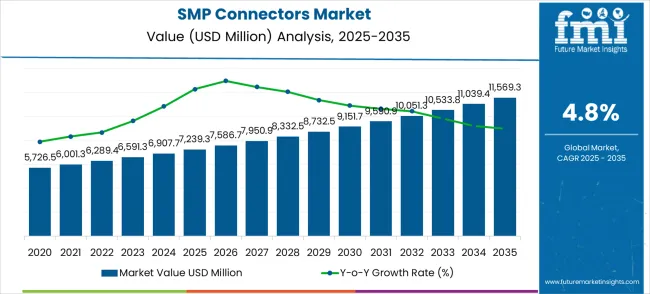

The global SMP connectors market is projected to grow from USD 7,239.3 million in 2025 to approximately USD 11,569.3 million by 2035, recording an absolute increase of USD 4,330.0 million over the forecast period. This translates into a total growth of 59.8%, with the market forecast to expand at a CAGR of 4.8% between 2025 and 2035. The market size is expected to grow by nearly 1.60X during the same period, supported by increasing 5G network deployments, growing demand for high-frequency applications, and rising adoption in aerospace and defense communications systems.

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 7,239.3 million |

| Forecast Value in (2035F) | USD 11,569.3 million |

| Forecast CAGR (2025 to 2035) | 4.8% |

The SMP connectors market holds a vital position within the broader RF and microwave connectors ecosystem, accounting for around 32% share of the parent segment. Closely linked with high-frequency signal transmission, its share is influenced by growing deployment in telecommunications, aerospace, and defense electronics. Industrial automation and high-speed data transmission segments collectively contribute nearly 26%, while satellite communication and navigation systems represent about 20%. Additional contributions emerge from medical imaging and diagnostics at 12%, with specialized testing and measurement equipment covering the remaining 10%. The share of SMP connectors continues to rise due to their compact size, blind-mate capability, and strong performance under high vibration environments, making them indispensable in next-generation electronic and defense systems.

Rapid advancements in 5G infrastructure, IoT-enabled devices, and military-grade electronic systems are reinforcing the importance of SMP connectors in ensuring low-loss, reliable, and stable signal transmission. Their adaptability across board-to-board, cable-to-board, and module-to-module connections enhances their role in high-density packaging applications. Manufacturers are focusing on improving frequency range capabilities, enhancing durability under extreme conditions, and integrating advanced plating materials to reduce signal degradation. This growing share highlights not just their increasing use in core industries but also their strategic role in enabling high-speed connectivity, reliable data transfer, and miniaturization of modern electronic systems. As global reliance on advanced communication and aerospace technologies deepens, the SMP connectors market continues to expand its footprint within the RF and microwave connector landscape.

Market expansion is being supported by the rapid deployment of 5G networks worldwide and the corresponding need for high-performance RF connectors that can handle increased frequency ranges and data transmission requirements. Modern telecommunications infrastructure requires connectors that provide exceptional electrical performance, minimal signal loss, and reliable connections in compact form factors. SMP connectors meet these demanding specifications while offering the miniaturization benefits essential for modern wireless equipment and base station applications.

The growing complexity of aerospace and defense communication systems is driving demand for specialized connector solutions that can operate reliably under extreme environmental conditions while maintaining signal integrity. SMP connectors provide the precision and durability required for mission-critical applications including radar systems, electronic warfare equipment, and satellite communications. The increasing emphasis on Internet of Things devices and autonomous systems is also contributing to market growth as these applications require miniaturized, high-performance connectors that can support advanced wireless communication protocols.

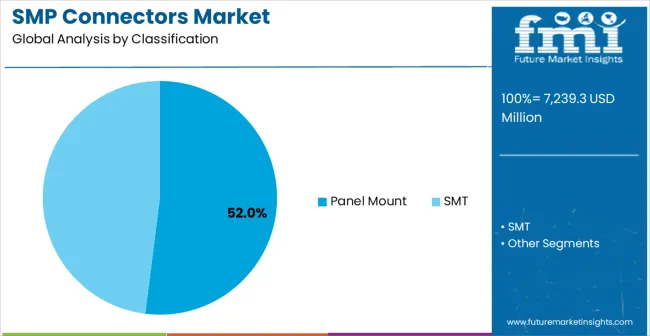

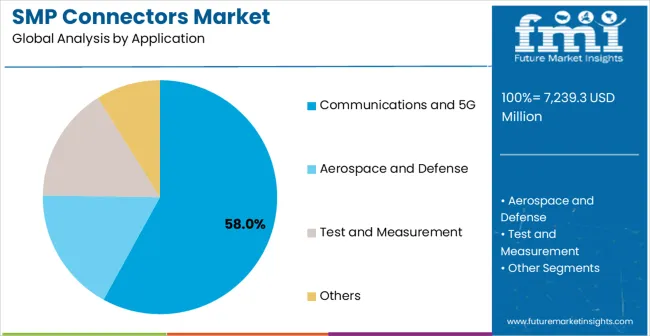

The market is segmented by connector type, application, and region. By connector type, the market is divided into panel mount and SMT. By application, the market is categorized into communications and 5G, aerospace and defense, test and measurement, and others. Regionally, the market is divided into North America, Europe, East Asia, South Asia & Pacific, Latin America, and Middle East & Africa.

Panel mount SMP connectors are projected to account for approximately 52% of the SMP connectors market in 2025. This leading market share is driven by extensive adoption across telecommunications, test instrumentation, and aerospace sectors, where panel-mounted designs provide reliable mechanical connections and facilitate easy maintenance and system upgrades. These connectors combine robust mechanical stability with superior electrical performance, making them ideal for high-frequency applications where signal integrity and operational reliability are critical.

The segment’s growth is reinforced by established manufacturing processes and a long track record of dependable performance in demanding environments. Panel mount connectors are particularly favored in applications requiring secure attachment within equipment racks, control panels, and instrument interfaces, where maintaining consistent connectivity is essential for system functionality. Their mechanical design ensures resistance to vibration, shock, and environmental stresses, which is crucial in aerospace, defense, and industrial applications.

The segment also benefits from increasing telecommunications infrastructure modernization, particularly in 5G network deployment, where high-frequency performance and secure connectivity are non-negotiable. Test and measurement equipment further relies on panel mount connectors for accessible interface points, enabling precise calibration and operational accuracy without compromising signal integrity.

Communications and 5G applications are expected to represent 58% of SMP connector demand in 2025. This dominant share reflects the critical role of high-performance connectors in modern wireless communication infrastructure where signal integrity and minimal insertion loss are paramount for system effectiveness. 5G network deployment requires connectors that can handle higher frequencies and increased data transmission rates while maintaining compact form factors essential for dense equipment installations. The segment provides essential connectivity infrastructure for base stations, small cells, and distributed antenna systems that form the backbone of modern wireless communications networks.

Modern communications applications drive continuous demand for SMP connectors that support evolving wireless standards and increasing performance requirements. The transition to 5G and preparation for 6G technologies create opportunities for connector manufacturers to develop advanced solutions that address next-generation communication system needs.

Aerospace and defense applications represent a critical growth segment within the SMP connectors market, driven by continuous modernization of communication systems, radar equipment, and electronic warfare platforms. The segment benefits from stringent performance requirements and long product lifecycle demands that support premium pricing and specialized product development. Defense spending on advanced communication systems and radar modernization programs creates demand for high-reliability connectors that meet military specifications for environmental durability and electrical performance. Commercial aerospace applications also contribute by increasing adoption of advanced avionics and communication systems requiring precision RF connectivity.

Growth in this segment is supported by global defense modernization programs and increasing complexity of aerospace communication systems that require sophisticated connector solutions. The segment demands the highest performance standards for connector reliability and environmental compatibility, creating opportunities for specialized product positioning and technical support services.

The SMP connectors market is advancing steadily due to increasing 5G network deployment and growing demand for high-frequency RF applications across telecommunications and aerospace sectors. Market expansion is driven by the need for miniaturized connector solutions that maintain exceptional electrical performance while supporting higher data transmission rates and frequency ranges required by modern communication systems. Telecommunications infrastructure modernization creates demand for reliable connector solutions that can handle the performance requirements of advanced wireless technologies while providing cost-effective installation and maintenance characteristics. Aerospace and defense applications contribute through continuous equipment modernization programs that require high-reliability connectors meeting stringent environmental and performance specifications.

Growth faces constraints from complex manufacturing processes that require specialized materials and precision fabrication techniques, resulting in higher production costs and longer development cycles compared to conventional connector solutions. Supply chain challenges for high-performance materials and specialized components create potential delivery delays and cost pressures that may impact market expansion in price-sensitive applications. Technical complexity requirements for achieving optimal electrical performance while maintaining mechanical reliability pose engineering challenges that increase development costs and extend product qualification timelines. Market competition from alternative connector technologies and standardization pressures may limit premium pricing opportunities and reduce differentiation advantages for specialized SMP connector solutions.

Key market trends include the integration of advanced materials such as low-loss dielectrics and high-conductivity plating materials that enhance electrical performance while reducing signal degradation in high-frequency applications. Manufacturing automation and precision assembly techniques are improving product consistency and reducing production costs while enabling larger-scale production capabilities. Digital modeling and simulation technologies are accelerating product development processes and improving first-pass design success rates for complex connector applications. Standardization initiatives across telecommunications and aerospace industries are promoting connector interoperability while creating opportunities for volume production and cost optimization. Environmental compliance requirements are driving development of lead-free and halogen-free connector solutions that meet regulatory standards without compromising performance characteristics.

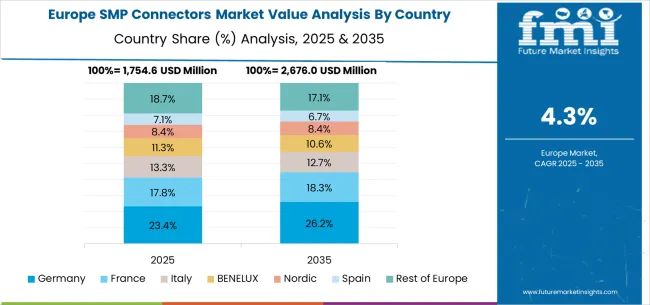

The SMP connectors market in Europe is projected to grow from USD 1,736.2 million in 2025 to USD 2,511.8 million by 2035, registering a CAGR of 3.8% over the forecast period. Germany is expected to maintain its leadership position with a 28.5% market share in 2025, supported by its precision manufacturing capabilities and strong telecommunications infrastructure development programs. The country's emphasis on Industry 4.0 initiatives and advanced automotive electronics integration creates demand for high-performance RF connector solutions across multiple application sectors.

France represents the second-largest market with 18.7% share, driven by aerospace industry leadership and defense electronics modernization programs that require specialized connector solutions meeting stringent military specifications. The United Kingdom holds 16.2% market share, benefiting from telecommunications network advancement and defense industry collaboration with international partners. Italy and Spain collectively contribute 19.1% of the regional market through expanding telecommunications infrastructure and industrial automation adoption. Nordic countries and BENELUX nations account for 17.5% combined share, supported by advanced materials research and precision manufacturing capabilities that serve specialized connector applications.

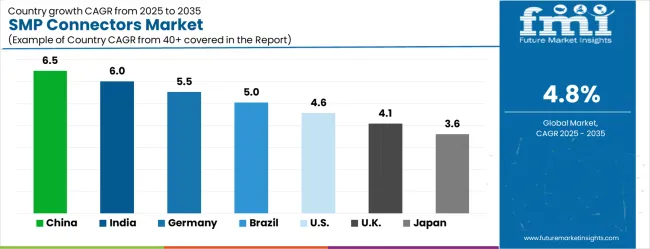

| Country | CAGR (2025-2035) |

|---|---|

| China | 6.5% |

| India | 6% |

| Germany | 5.5% |

| Brazil | 5% |

| United States | 4.6% |

| United Kingdom | 4.1% |

| Japan | 3.6% |

The SMP connectors market is experiencing steady growth globally, with China leading at a 6.5% CAGR through 2035, driven by massive 5G infrastructure deployment, expanding telecommunications equipment manufacturing, and growing aerospace industry development. India follows at 6%, supported by telecommunications modernization initiatives, defense procurement programs, and increasing electronic manufacturing capabilities. Germany records 5.5% growth, emphasizing precision manufacturing, automotive electronics integration, and advanced communication system development. Brazil shows 5% growth, focusing on telecommunications infrastructure expansion and aerospace industry development. The United States maintains 4.6% growth through mature market conditions with emphasis on technology innovation and defense applications.

The report covers an in-depth analysis of 40+ countries, top-performing countries are highlighted below.

Revenue from SMP connectors in China is projected to exhibit strong growth with a CAGR of 6.5% through 2035, driven by comprehensive 5G network deployment and rapid expansion of telecommunications equipment manufacturing across urban and rural regions. The country's massive infrastructure investment programs create demand for high-performance RF connectors that support advanced wireless communication systems and base station installations. Beijing, Shanghai, and Shenzhen serve as primary technology centers where telecommunications operators and equipment manufacturers drive connector adoption through competitive network deployment initiatives and international market expansion programs. Domestic manufacturing capabilities increasingly serve both local market needs and export demand for specialized connector solutions that meet international quality and performance standards.

Government telecommunications policy initiatives prioritize 5G coverage expansion and technology leadership that creates comprehensive market opportunities for connector manufacturers. The country's aerospace and defense modernization programs contribute additional demand through requirements for high-reliability connector solutions meeting military specifications and performance requirements.

Revenue from SMP connectors in India is expanding at a CAGR of 6%, supported by comprehensive telecommunications infrastructure development and increasing adoption of advanced communication technologies across diverse geographic regions. The country's growing telecommunications equipment manufacturing sector and defense modernization programs create demand for high-performance connector solutions that address both domestic infrastructure needs and export market opportunities. Mumbai, Delhi, and Bangalore serve as technology centers where telecommunications operators and equipment manufacturers implement advanced communication systems requiring specialized RF connectivity solutions. Government initiatives promoting digital infrastructure development and domestic manufacturing capabilities support long-term market growth and technology adoption across telecommunications and defense applications.

Educational expansion programs and workforce development initiatives enhance technical expertise in connector technologies and applications that support domestic manufacturing capabilities and international competitiveness. Defense procurement programs prioritize indigenous manufacturing capabilities that create opportunities for domestic connector production and technology development.

The demand for SMP connectors in Germany is expected to grow at a CAGR of 5.5%, driven by the country’s global leadership in precision manufacturing, advanced engineering, and innovation capabilities. Germany’s strong industrial base and emphasis on technical excellence make it a key hub for high-performance connector solutions, particularly in telecommunications, automotive electronics, and aerospace applications. Cities such as Munich, Frankfurt, and Hamburg serve as major technology and manufacturing centers, where established engineering expertise supports the design and production of specialized SMP connectors tailored for demanding environments. German industrial customers prioritize long-term reliability, high-frequency performance, and consistent operational standards, which drives adoption of premium connector technologies with proven performance characteristics.

The integration of automotive electronics with telecommunications systems creates additional demand for SMP connectors that can meet rigorous performance requirements in both sectors. German manufacturers also benefit from a strong export market, leveraging their reputation for engineering precision and high-quality manufacturing to supply international telecommunications and aerospace clients. Advanced production techniques, rigorous quality control, and adherence to international standards reinforce Germany’s position as a benchmark for SMP connector performance, reliability, and durability.

Revenue from SMP connectors in Brazil is growing at a CAGR of 5%, driven by telecommunications infrastructure modernization and increasing adoption of advanced communication technologies across major metropolitan regions. The country's focus on expanding mobile network coverage and improving communication service quality creates opportunities for RF connector adoption in base station installations and network equipment upgrades. São Paulo, Rio de Janeiro, and Brasília serve as primary markets where telecommunications operators implement advanced communication systems requiring high-performance connector solutions that support network reliability and service quality improvement. Aerospace industry development and defense modernization programs provide complementary market opportunities for specialized connector applications serving precision communication and radar systems.

Infrastructure development programs benefit from international technology partnerships and investment programs that facilitate adoption of advanced communication equipment and associated connector requirements. Government telecommunications policy initiatives promote network modernization and service quality improvement that support connector demand.

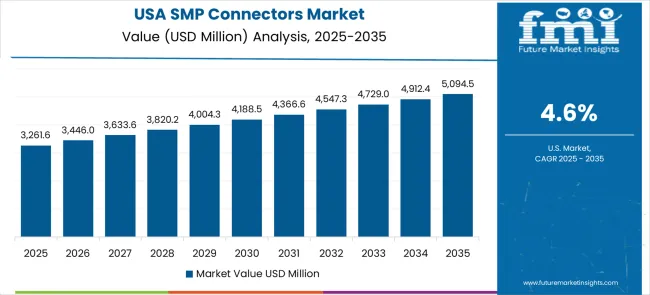

The United States maintains market leadership through continuous technology innovation and advanced manufacturing capabilities that serve telecommunications, aerospace, and defense applications requiring sophisticated connector solutions. Market growth at a CAGR of 4.6% reflects mature market conditions where development focuses on advanced performance characteristics and specialized applications rather than basic market expansion. New York, Los Angeles, and Chicago serve as primary technology centers where established telecommunications infrastructure and aerospace industry capabilities drive demand for premium connector solutions and advanced application development. Defense spending on communication system modernization and aerospace technology advancement creates demand for high-performance connectors that meet stringent military specifications and reliability requirements.

Technology sector leadership drives continuous improvement in connector performance characteristics and manufacturing capabilities that enable next-generation communication systems and aerospace applications. Regulatory framework leadership establishes international standards for connector performance and quality requirements that influence global market development and technology adoption.

The United Kingdom demonstrates steady growth in the SMP connectors market, with a projected CAGR of 4.1%, driven by a balanced approach that combines established telecommunications infrastructure with adoption of modern technologies across multiple application sectors. Key technology hubs such as London, Manchester, and Edinburgh support the development and deployment of advanced connector solutions used in telecommunications, aerospace, and defense applications. The country’s focus on maintaining high-quality communication networks alongside aerospace industry competitiveness encourages demand for SMP connectors that meet stringent performance, reliability, and operational standards.

Defense sector collaboration with international partners further stimulates adoption of SMP connectors that comply with military specifications and global performance benchmarks. Telecommunications modernization programs prioritize network reliability, low signal loss, and high-frequency performance, creating a consistent requirement for high-performance connectivity solutions. The aerospace sector benefits from advanced precision manufacturing capabilities, which synergize with telecommunications needs, supporting high-quality connector solutions that serve both domestic and international markets.

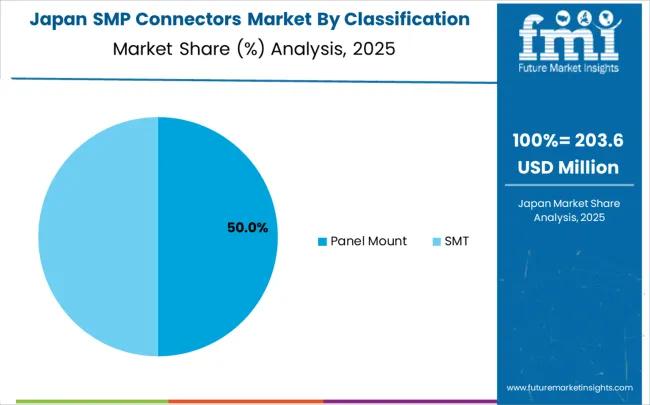

Japan continues to demonstrate strong technology leadership in precision manufacturing and advanced communication system development, creating robust demand for sophisticated connector solutions that meet the highest performance specifications. The market is projected to grow at a CAGR of 3.6%, reflecting stable conditions driven by emphasis on technological advancement, quality excellence, and innovation across telecommunications, automotive electronics, and aerospace sectors. Key technology hubs including Tokyo, Osaka, and Nagoya serve as centers for developing advanced communication systems, precision instrumentation, and specialized connector solutions that meet stringent performance and reliability requirements.

Automotive electronics integration and continuous development in telecommunications infrastructure create diverse demand for connectors capable of supporting high-frequency performance, precise signal transmission, and operational reliability under challenging environmental conditions. Japanese manufacturers maintain a focus on continuous improvement, technical refinement, and precision engineering, establishing international benchmarks for connector performance and durability. These capabilities allow domestic companies to serve both local markets and export high-performance connector solutions globally.

The SMP connectors market is characterized by competition among established RF connector manufacturers, specialized precision component suppliers, and emerging technology companies focusing on advanced materials and manufacturing processes. Companies are investing in precision manufacturing capabilities, advanced materials research, quality assurance systems, and customer support services to deliver reliable, high-performance, and cost-effective connector solutions that meet diverse application requirements across telecommunications, aerospace, and defense sectors. Product innovation, manufacturing excellence, and strategic partnerships are central to strengthening market positions and customer relationships in this specialized technology segment.

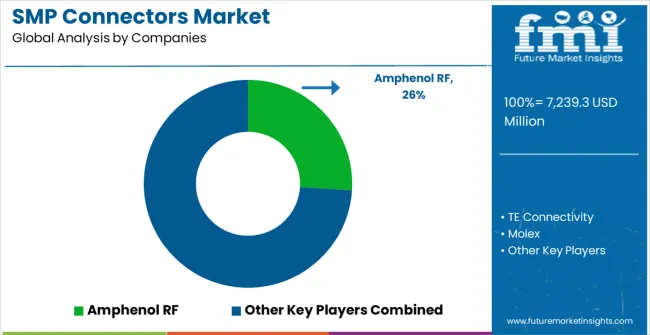

Amphenol RF, USA-based, leads the market with comprehensive SMP connector product lines emphasizing precision manufacturing, quality assurance, and customer support services across telecommunications and aerospace applications. TE Connectivity, operating globally, provides advanced connector solutions with a focus on reliability, performance optimization, and application engineering support. Molex, USA, delivers innovative connector technologies with emphasis on miniaturization, high-frequency performance, and manufacturing efficiency. Radiall, France-based, offers specialized RF connector solutions with a focus on aerospace, defense, and telecommunications applications requiring superior performance characteristics.

Huber+Suhner, Switzerland, provides high-quality connector systems with emphasis on precision engineering, environmental durability, and comprehensive testing capabilities. Luxshare Precision Industry Co., LTD., China, focuses on volume manufacturing capabilities and cost-effective solutions for telecommunications and electronic applications. JONHON, SV Microwave, Pasternack, and Times Microwave Systems offer specialized connector solutions with a focus on specific market segments and application requirements. Fujitsu Component and Luxshare-ICT provide comprehensive connector portfolios serving diverse technology applications with emphasis on quality, reliability, and customer service support across global markets.

SMP (SubMiniature Push-on) connectors represent essential components for high-frequency RF and microwave applications across telecommunications, aerospace, and defense sectors where signal integrity and miniaturization are critical. With the market projected to grow from USD 7.24 billion in 2025 to USD 11.57 billion by 2035 at a 4.8% CAGR, scaling adoption requires coordinated action across standards organizations, industry associations, connector manufacturers, system integrators, and financial institutions to address precision manufacturing challenges, high-frequency performance requirements, and cost optimization pressures across panel mount and SMT configurations serving 5G, aerospace, and test measurement applications.

How Standards Organizations Could Establish Technical Excellence and Interoperability?

RF Performance Standards and Test Methods: Develop comprehensive technical standards defining electrical performance specifications, frequency response characteristics, and insertion loss requirements for SMP connectors across different frequency bands, while establishing standardized test procedures that ensure consistent performance measurement and vendor comparison capabilities across diverse application requirements.

Environmental and Reliability Specifications: Create standardized environmental testing protocols covering temperature cycling, vibration resistance, humidity exposure, and corrosion resistance that validate SMP connector performance under harsh operating conditions, while establishing reliability requirements and qualification procedures for aerospace, defense, and telecommunications applications.

Interoperability and Interface Standards: Define interface specifications and mating compatibility requirements that ensure SMP connectors from different manufacturers provide consistent mechanical and electrical performance, while developing standardized marking and identification systems that facilitate proper connector selection and installation procedures.

Quality Assurance and Certification Programs: Establish certification frameworks that validate manufacturing processes, quality control systems, and product performance characteristics, while creating accreditation programs for testing laboratories and manufacturing facilities that ensure consistent quality standards across global supply chains.

Technology Roadmap Development: Coordinate industry-wide technology development initiatives that address emerging requirements for higher frequency operation, enhanced miniaturization, and improved environmental resistance, while facilitating collaborative research programs focused on advanced materials and manufacturing processes.

How Industry Associations Could Accelerate Market Development and Technical Innovation?

Technical Education and Training Programs: Develop comprehensive educational initiatives that train engineers, technicians, and sales personnel in SMP connector technology, application design, and performance optimization, while establishing certification programs that validate technical competency in high-frequency connector applications and system integration procedures.

Market Intelligence and Application Development: Conduct market research that identifies emerging application opportunities, competitive dynamics, and technology trends affecting SMP connector adoption, while promoting awareness of performance advantages and cost-effectiveness across telecommunications, aerospace, and defense sectors through technical publications and industry events.

Supply Chain Coordination and Risk Management: Facilitate collaboration among connector manufacturers, raw material suppliers, and end-user industries to ensure reliable component availability and quality consistency, while developing supply chain risk mitigation strategies that address material shortages, quality issues, and technology obsolescence concerns.

Standards Development and Harmonization: Coordinate with international standards organizations to develop unified specifications for SMP connector performance and testing, while promoting adoption of common standards that reduce certification costs and improve global market access for manufacturers and users.

Innovation Partnerships and Technology Transfer: Support collaborative research programs between connector manufacturers, material suppliers, and academic institutions that advance connector technology, while facilitating technology transfer initiatives that help smaller manufacturers adopt advanced manufacturing processes and quality control systems.

How Connector Manufacturers Could Enhance Product Performance and Market Position?

Precision Manufacturing Excellence and Quality Systems: Invest in advanced manufacturing technologies including automated assembly systems, precision machining capabilities, and comprehensive quality control that ensure consistent electrical and mechanical performance across high-volume production, while developing specialized manufacturing processes for custom connector configurations serving unique application requirements.

Advanced Materials Research and Development: Develop specialized materials including low-loss dielectrics, high-conductivity plating systems, and environmentally resistant compounds that enhance electrical performance while providing superior durability under harsh operating conditions, while creating material qualification programs that validate long-term performance and reliability characteristics.

Application Engineering and Technical Support: Establish comprehensive application engineering capabilities that help customers optimize connector selection, circuit design, and installation procedures, while providing ongoing technical support including performance analysis, failure investigation, and design optimization throughout the product lifecycle.

Product Portfolio Optimization and Customization: Develop specialized SMP connector variants optimized for specific applications including high-frequency operation, harsh environment resistance, and miniaturized form factors, while creating modular product platforms that enable cost-effective customization for diverse customer requirements and performance specifications.

Digital Integration and Smart Manufacturing: Implement digital manufacturing systems with real-time quality monitoring, statistical process control, and predictive maintenance capabilities that optimize production efficiency and product consistency, while developing digital tools that assist customers with connector selection, performance simulation, and reliability prediction.

How System Integrators Could Optimize Integration and Performance Delivery?

System Design Optimization and Integration Services: Develop comprehensive design methodologies that optimize SMP connector integration into RF and microwave systems, telecommunications equipment, and aerospace platforms, while creating standardized design libraries and simulation tools that accelerate product development and reduce integration risks for customers.

Performance Testing and Validation Services: Establish specialized testing facilities that validate SMP connector performance in complete system configurations under real-world operating conditions, while providing comprehensive testing services that demonstrate system-level performance, signal integrity, and environmental compliance across diverse application requirements.

Installation and Maintenance Support: Provide technical training programs that educate customers in optimal connector installation procedures, torque specifications, and maintenance practices, while offering field support services including installation assistance, performance verification, and troubleshooting guidance throughout the system lifecycle.

System Integration Platforms and Tools: Create standardized integration platforms and software tools that simplify SMP connector integration into RF systems and test equipment, while developing modular hardware solutions that reduce custom engineering requirements and accelerate time-to-market for customer applications.

Lifecycle Management and Upgrade Services: Deploy monitoring systems that track connector performance in customer systems and provide predictive maintenance recommendations, while developing upgrade pathways that enable customers to adopt next-generation connector technologies without complete system redesign.

How Financial Enablers Could Support Technology Advancement and Market Growth?

Technology Development and Innovation Funding: Provide venture capital and research funding for companies developing advanced SMP connector technologies including next-generation materials, manufacturing processes, and high-frequency performance capabilities, while supporting collaborative research programs between manufacturers, material suppliers, and academic institutions focused on connector technology advancement.

Manufacturing Infrastructure and Automation Investment: Finance advanced manufacturing facility development and precision equipment acquisition that enables high-performance SMP connector production at competitive costs, while supporting automation initiatives and quality system implementation that improve manufacturing efficiency and product consistency across global production operations.

Market Expansion and Customer Support: Offer equipment financing and leasing programs that help telecommunications operators, aerospace companies, and defense contractors acquire advanced RF systems incorporating SMP connectors, while providing working capital support for manufacturers expanding into emerging markets and developing specialized product variants.

Supply Chain Development and Materials Investment: Support supply chain optimization initiatives that improve materials availability and reduce cost volatility for specialized connector materials, while financing inventory management systems and supplier development programs that ensure reliable component availability and quality consistency.

Risk Management and Performance Assurance: Provide risk management solutions including supply disruption insurance, performance guarantees, and technology obsolescence protection that reduce customer investment risks in SMP connector-based systems, while developing warranty programs and technical support services that protect customer investments in critical RF infrastructure and aerospace applications.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 7,239.3 million |

| Connector Type | Panel Mount, SMT |

| Application | Communications and 5G, Aerospace and Defense, Test and Measurement, Others |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, India, Brazil, Australia and 40+ countries |

| Key Companies Profiled | Amphenol RF, TE Connectivity, Molex, Radiall, Huber+Suhner, Luxshare Precision Industry Co., LTD., JONHON, SV Microwave, Pasternack, Times Microwave Systems |

| Additional Attributes | Dollar sales by connector type and application segments, regional demand trends across North America, Europe, and Asia-Pacific, competitive landscape with established manufacturers and emerging technology specialists, adoption patterns in telecommunications versus aerospace applications, integration with 5G infrastructure development and advanced RF system platforms, innovations in precision manufacturing processes and high-performance materials, and development of next-generation connector solutions with enhanced electrical performance, environmental durability, and miniaturization capabilities for critical RF and microwave applications. |

The global SMP connectors market is estimated to be valued at USD 7,239.3 million in 2025.

The market size for the SMP connectors market is projected to reach USD 11,569.3 million by 2035.

The SMP connectors market is expected to grow at a 4.8% CAGR between 2025 and 2035.

The key product types in SMP connectors market are panel mount and smt.

In terms of application, communications and 5G segment to command 58.0% share in the SMP connectors market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

RF Connectors Market Size and Share Forecast Outlook 2025 to 2035

Gas Connectors and Gas Hoses Market - Safety, Demand & Market Outlook 2025 to 2035

Cable Connectors and Adapters Market Analysis by Application, Product, Type and Region: Forecast from 2025 to 2035

Automotive Connectors Market Size and Share Forecast Outlook 2025 to 2035

Underwater Connectors Market Size and Share Forecast Outlook 2025 to 2035

Small Bore Connectors Market Analysis - Size, Growth, and Forecast 2025 to 2035

Automotive Connectors Global Market

Fiber Optic Connectors Market Growth – Trends & Forecast through 2034

Non-Magnetic Connectors Market Size and Share Forecast Outlook 2025 to 2035

Multi Coaxial Connectors Market - Growth & Forecast 2025 to 2035

Automotive Data Connectors Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Miniature Duplex Connectors Market Size and Share Forecast Outlook 2025 to 2035

Intravenous Line Connectors Market Size and Share Forecast Outlook 2025 to 2035

Small Form Factor (SFF) Connectors Market Size and Share Forecast Outlook 2025 to 2035

Demand for Miniature Duplex Connectors in USA Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA