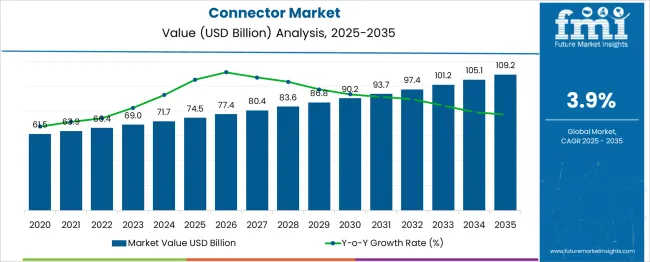

The Connector Market is estimated to be valued at USD 74.5 billion in 2025 and is projected to reach USD 109.2 billion by 2035, registering a compound annual growth rate (CAGR) of 3.9% over the forecast period. A saturation point analysis reveals that while the market maintains steady expansion, the rate of absolute annual growth begins to taper in the latter half of the forecast period. Between 2025 and 2030, the market experiences an absolute increase of USD 15.7 billion, with annual additions gradually climbing from USD 2.9 billion to USD 3.4 billion.

This initial phase is marked by strong demand from consumer electronics, automotive, and telecommunications sectors, driven by ongoing digitization and miniaturization of devices. The market adds USD 19 billion in value from 2030 to 2035, with yearly increments stabilizing near the USD 3.8–4.1 billion range. The rate of acceleration softens as core end-use industries approach maturity, signaling the beginning of a plateau phase in some segments, such as traditional industrial and mobile connectivity applications.

Despite the slowdown, newer trends like electric vehicle architectures, aerospace upgrades, and 5G infrastructure continue to sustain moderate growth. By 2035, the market edges closer to its saturation point, where most innovations become incremental, and competitive dynamics pivot toward customization, integration, and system-level value rather than volume expansion.

| Metric | Value |

|---|---|

| Connector Market Estimated Value in (2025 E) | USD 74.5 billion |

| Connector Market Forecast Value in (2035 F) | USD 109.2 billion |

| Forecast CAGR (2025 to 2035) | 3.9% |

The connector market comprises approximately 26–28% of the overall Electronic Components Market, led by strong demand for signal and power transmission solutions in automotive, industrial, and consumer electronics applications. Within the Interconnect Solutions Market, connectors account for 55–60%, providing the physical interface for wire-to-board, board-to-board, and I/O configurations.

The segment contributes 20–22% of the Global PCB Assembly Market, ensuring electrical continuity and modularity in complex multilayer assemblies. In the Industrial Automation Components Market, connectors hold 12–14% share, enabling secure and ruggedized connections in robotics, sensors, and programmable logic controllers. It also represents 15–17% of the Telecom Infrastructure Hardware Market, particularly in fiber-optic, coaxial, and high-speed data transmission applications across 5G and cloud networking environments.

Demand is rising due to increasing miniaturization, faster data rates, and greater use of hybrid electrical-optical systems. The shift toward electric mobility, smart manufacturing, and modular device design is pushing innovation in high-speed, high-density, and EMI-shielded connectors. Key players are investing in circular, micro, and modular connector platforms to meet specific needs across aerospace, medical, and automotive electronics. Sustainability mandates are influencing materials and design, while automation in connector assembly is reducing production cycle times and enhancing quality control in high-volume applications.

Innovations in materials and design are enabling connectors to meet stringent performance requirements while remaining cost-effective and reliable. Increased investments in 5G networks, data centers, and automotive electronics are driving adoption across diverse industries. Future growth is expected to be fueled by the emergence of IoT-enabled devices, rising automation in manufacturing, and the push for energy-efficient infrastructure.

Compliance with evolving technical standards, combined with growing expectations for durability and compact form factors, is paving the way for further opportunities in advanced connectivity solutions.

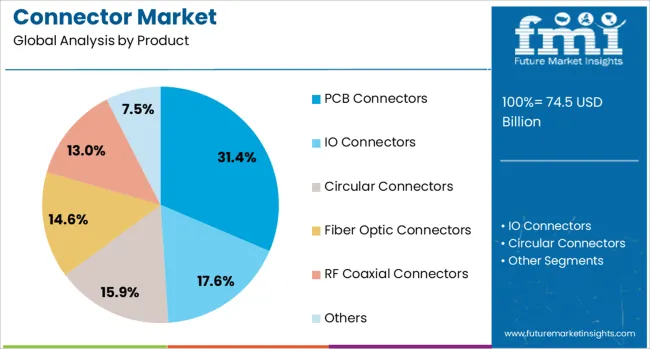

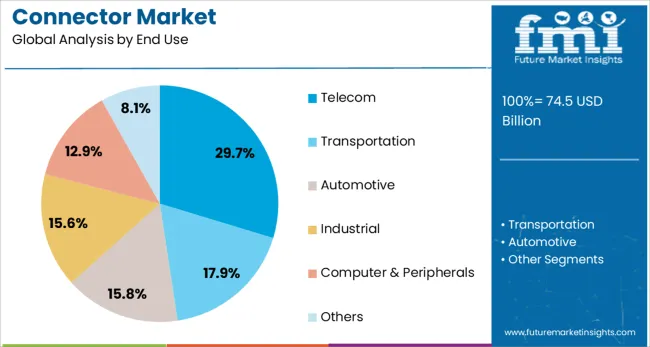

The connector market is segmented by product, end use, and geographic regions. The connector market is divided into PCB Connectors, IO Connectors, Circular Connectors, Fiber Optic Connectors, RF Coaxial Connectors, and Others. The connector market is classified by end use into Telecom, Transportation, Automotive, Industrial, Computer & Peripherals, and Others.

Regionally, the connector industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

When segmented by product, PCB connectors are projected to hold 31.40% of the total market revenue in 2025, positioning them as the leading product category. This dominance is being driven by the increasing complexity of printed circuit boards, which necessitate high-density, reliable interconnections capable of handling both power and signal integrity.

Enhanced manufacturing techniques and improved contact materials have allowed PCB connectors to support higher data rates and withstand harsh operational environments, reinforcing their adoption in critical applications. Their modularity and adaptability to miniaturized designs have been advantageous in compact electronic assemblies.

The widespread incorporation of these connectors into high-volume consumer electronics, industrial control systems, and communication equipment has further strengthened their leadership position in the product segment.

Segmented by end use, the telecom sector is expected to account for 29.70% of the connector market revenue in 2025, securing its role as the top contributing industry. This leadership is being supported by accelerated deployment of 5G networks, fiber-optic infrastructure expansion, and rising global demand for broadband connectivity.

The telecom industry’s requirement for high-frequency, low-loss, and durable connectors to enable seamless communication between equipment has driven continuous product innovation and specialization. Growing investments in cloud services, edge computing, and data-intensive applications have increased the reliance on robust connectivity hardware, including advanced connector systems.

The ability to support high-density installations while ensuring signal fidelity has ensured that connectors remain indispensable to telecom infrastructure, solidifying the segment’s dominance in the market.

Demand for electrical and data connectors has grown as device interconnectivity, modular production and IoT integration increased. Sales of high‑speed signal, board‑to‑board and rugged industrial connectors are accelerating. Growth is strongest in the Asia‑Pacific region, where manufacturing scale is expanding, while North America leads in automotive and aerospace precision applications.

Significant demand for high‑speed connector formats surged in North America and Europe in 2025, especially among automotive and advanced electronics manufacturers. USB‑C, PCIe gen5 and board‑to‑board signal connectors supporting data rates above 32 Gbps became standard in EVs and server platforms. Use of automotive-grade connectors featuring IP67 sealing and vibration‑proof locking reduced signal interruption incidents by approximately 22%. OEMs favored suppliers bundling pre‑terminated harness assemblies with TÜV‑certified interface testing, driving repeat module specification in new vehicle and compute system designs.

A notable increase in demand for rugged industrial connector systems was observed in Asia‑Pacific throughout 2025, especially in factory automation, renewable equipment and railway sectors. Circular economy trends boosted sales of recyclable thermoplastic connectors and push‑pull locking variants that offer chemical resistance and serviceability. Factory operators reported up to 28% faster maintenance cycles and 18% fewer connection failures in dusty or oil‑exposed zones. Local manufacturers partnering with global contact plating and sealing technology firms gained repeat orders from OEMs deploying modular automation cells and smart grid hardware.

Rising preference for modular production and reconfigurable assembly lines encouraged broader adoption of modular connector systems in 2025. These connectors allowed flexible pin configurations and hot-swappable interface designs, improving system uptime in robotics, packaging, and semiconductor manufacturing. Global factories using modular connectors experienced a 16% decrease in unplanned equipment downtime. In Germany and Japan, compact DIN rail–mounted connectors with hybrid signal-power ports were integrated into PLCs and motor control panels. Manufacturers offering tool-free locking mechanisms and color-coded terminals gained traction among automation integrators focused on quick retrofit cycles and lean maintenance practices.

The connector market saw intensified demand for ultra-miniaturized formats, driven by the global expansion of wearables, foldable devices, and wireless earbuds. Connectors with a pitch below 0.4 mm were increasingly used in audio modules, haptic engines, and biometric sensors. In South Korea and the US, foldable phone manufacturers reported a 21% increase in flexible board interconnects using high-bend-cycle connectors. Suppliers providing micro-coaxial and FPC-to-board solutions with EMI shielding became preferred partners for device makers pursuing higher feature density without compromising battery space. Design-in cycles for these mini connectors shortened as OEMs prioritized slimmer profiles and durability over legacy formats.

| Country | CAGR |

|---|---|

| China | 5.3% |

| India | 4.9% |

| Germany | 4.5% |

| France | 4.1% |

| UK | 3.7% |

| USA | 3.3% |

| Brazil | 2.9% |

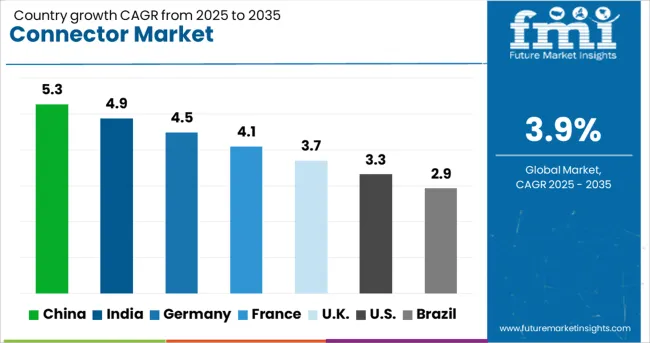

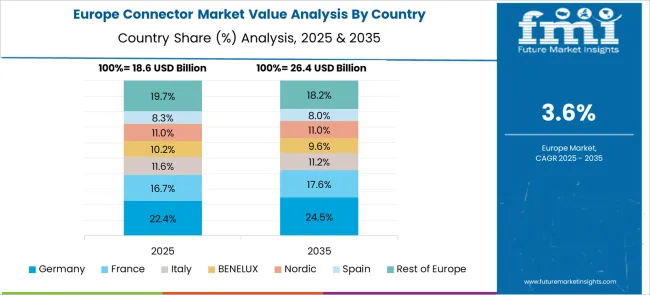

The global market is projected to grow at a CAGR of 3.9% between 2025 and 2035, driven by increasing electronic content in industrial equipment, vehicles, and consumer devices. China is anticipated to lead with a CAGR of 5.3%, owing to its dominance in electronics manufacturing, 5G infrastructure rollout, and rising EV production. India follows closely with 4.9% CAGR, propelled by expanding domestic electronics assembly and government incentives for localization. Germany’s market is expected to grow at 4.5%, supported by demand from automation, robotics, and high-end automotive segments.

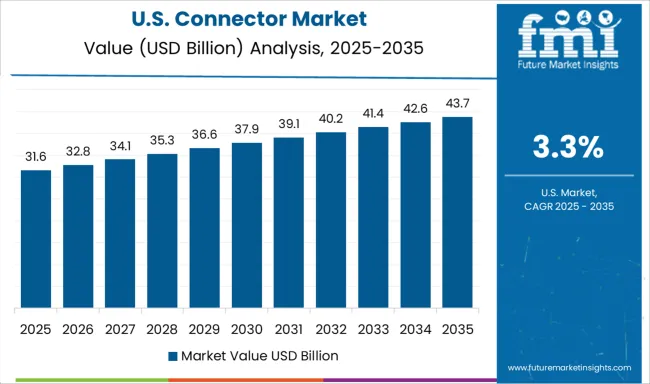

The UK, growing at 3.7%, sees moderate momentum through aerospace, defense, and telecom modernization. In the USA, the market is forecasted to rise at 3.3%, backed by ongoing upgrades in industrial connectivity and medical device sectors. These five countries serve as strategic anchors in shaping technological deployment and global connector supply chains. The report provides insights across 40+ countries. The five below are highlighted for their strategic influence and growth trajectory.

China is projected to register a CAGR of 5.3% between 2025 and 2035 in the Connector Market. Between 2020 and 2024, high-speed connectors witnessed accelerated deployment across 5G base stations and cloud data centers. In the coming decade, increased PCB density in EVs, telecom infrastructure, and industrial robotics is expected to generate robust demand for compact interconnect solutions. Sales of Connector Market products in China will be driven by aggressive digitization, electric mobility push, and smart factory upgrades.

India is forecast to grow at a CAGR of 4.9% from 2025 to 2035 in the Connector Market. During 2020 to 2024, expansion in consumer electronics and government-led smart city projects drove early adoption. Moving forward, strong momentum is anticipated in automotive harness connectors and industrial I/O ports for factory automation. Demand for Connector Market solutions in India will also be shaped by growing localization mandates and semiconductor assembly investments.

Germany is expected to expand at a CAGR of 4.5% from 2025 to 2035 in the Connector Market. From 2020 to 2024, precision connectors were adopted primarily in industrial automation and EV powertrains. In the forecast period, miniaturized and rugged connectors are likely to gain traction across aerospace, robotics, and rail electronics sectors. Sales of Connector Market products in Germany will be supported by increased investment in edge computing and machine vision platforms.

The United Kingdom is estimated to grow at a CAGR of 3.7% during the 2025 to 2035 period in the Connector Market. Between 2020 and 2024, key adoption was seen in medical imaging equipment and aerospace sensor modules. The upcoming years will likely see rising usage in EV charging networks, rail telematics, and military electronics. Demand for Connector Market offerings in United Kingdom will benefit from policy-driven digital infrastructure and localized R&D initiatives.

The United States is expected to post a CAGR of 3.3% from 2025 to 2035 in the Connector Market. From 2020 to 2024, most growth occurred in data center networking and industrial robotics. Moving ahead, rising demand is expected for signal-dense connectors in AI hardware, autonomous vehicles, and 6G telecom prototypes. Sales of Connector Market components in United States will be reinforced by domestic semiconductor manufacturing and DoD-backed electronics supply chain investments.

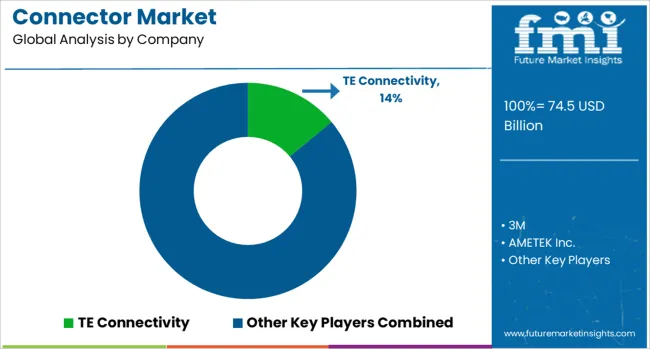

TE Connectivity remains a leading player in the global connector market, backed by a broad portfolio that spans automotive, industrial, and consumer electronics sectors. The company’s focus on miniaturized and high-speed connectivity solutions positions it at the forefront of growth areas such as electric vehicles and 5G infrastructure. Amphenol Corporation and Molex, Inc. are also major contributors, offering advanced interconnect systems used in data communications, aerospace, and defense-grade applications.

Aptiv PLC and YAZAKI Corporation hold strong positions in the automotive connector space, where rising EV production continues to drive demand. Foxconn Technology Group and Luxshare Precision Industry Co., Ltd. are gaining momentum by supplying cost-effective, high-volume connectors for mobile and wearable technologies. Additional players such as 3M, AVX Corporation, Japan Aviation Electronics, and the Rosenberger Group provide specialized connectors for niche high-performance applications, enhancing reliability and speed across multiple industrial environments.

| Item | Value |

|---|---|

| Quantitative Units | USD 74.5 Billion |

| Product | PCB Connectors, IO Connectors, Circular Connectors, Fiber Optic Connectors, RF Coaxial Connectors, and Others |

| End Use | Telecom, Transportation, Automotive, Industrial, Computer & Peripherals, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | TE Connectivity, 3M, AMETEK Inc., Amphenol Corporation, Aptiv PLC, AVX Corporation, Foxconn Technology Group, GTK UK Ltd., Japan Aviation Electronics Industry, Ltd., Luxshare Precision Industry Co., Ltd., Molex, Inc, Rosenberger Group, and YAZAKI Corporation |

| Additional Attributes | Dollar sales by connector type (PCB, I/O, fiber‑optic, RF) and material (copper, aluminum, stainless/plastic, others), demand dynamics across consumer electronics, telecom, automotive/EV, and aerospace sectors, regional dominance in Asia‑Pacific (~40+ %), innovation in miniaturized high‑speed connectors and durable rugged types, and environmental impact through recyclable materials and energy‑efficient manufacturing. |

The global connector market is estimated to be valued at USD 74.5 billion in 2025.

The market size for the connector market is projected to reach USD 109.2 billion by 2035.

The connector market is expected to grow at a 3.9% CAGR between 2025 and 2035.

The key product types in connector market are pcb connectors, io connectors, circular connectors, fiber optic connectors, rf coaxial connectors and others.

In terms of end use, telecom segment to command 29.7% share in the connector market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Connector Adapter Kits Market

Connector Kits Market

RF Connectors Market Size and Share Forecast Outlook 2025 to 2035

SMP Connectors Market Size and Share Forecast Outlook 2025 to 2035

PCB Connector Market Size and Share Forecast Outlook 2025 to 2035

Gas Connectors and Gas Hoses Market - Safety, Demand & Market Outlook 2025 to 2035

Cable Connectors and Adapters Market Analysis by Application, Product, Type and Region: Forecast from 2025 to 2035

Optical Connector Polishing Films Market Size and Share Forecast Outlook 2025 to 2035

Ethernet Connector and Transformer Market Size and Share Forecast Outlook 2025 to 2035

Aviation Connector Market

Global Luer Lock Connector Market Analysis – Size, Share & Forecast 2024-2034

Automotive Connectors Market Size and Share Forecast Outlook 2025 to 2035

Underwater Connectors Market Size and Share Forecast Outlook 2025 to 2035

Small Bore Connectors Market Analysis - Size, Growth, and Forecast 2025 to 2035

Automotive Connectors Global Market

Fiber Optic Connectors Market Growth – Trends & Forecast through 2034

Non-Magnetic Connectors Market Size and Share Forecast Outlook 2025 to 2035

Wire to Board Connector Market Report - Growth & Forecast 2025 to 2035

Multi Coaxial Connectors Market - Growth & Forecast 2025 to 2035

Automotive Data Connectors Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA