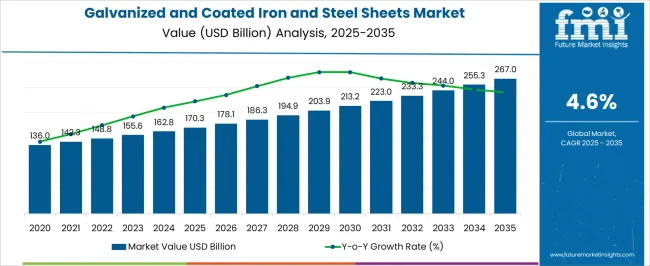

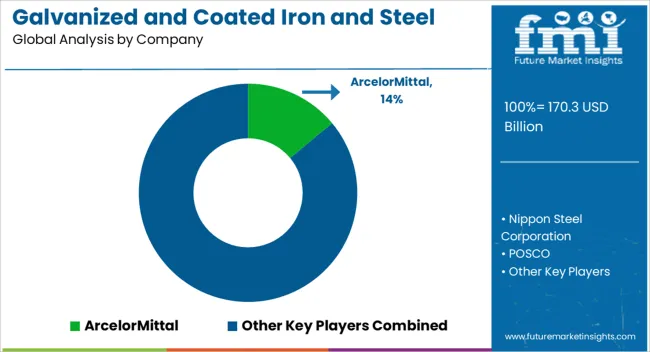

The galvanized and coated iron and steel sheets market is estimated to be valued at USD 170.3 billion in 2025 and is projected to reach USD 267.0 billion by 2035, registering a compound annual growth rate (CAGR) of 4.6% over the forecast period.

Growth during this period is driven by increasing applications in automotive, construction, and infrastructure sectors, where corrosion-resistant sheets are essential for long-term durability and structural integrity. Incremental increases are observed with market values reaching USD 142.3 billion in 2022, USD 148.8 billion in 2023, USD 155.6 billion in 2024, and USD 162.8 billion prior to attaining USD 170.3 billion in 2025. From 2026 to 2030, the market continues its growth trajectory but with a slightly accelerated pace, rising from USD 170.3 billion in 2025 to USD 213.2 billion in 2030. This phase is marked by increased adoption of advanced coating technologies, higher production capacities, and rising investments in industrial and commercial infrastructure.

Market values progress to USD 178.1 billion in 2026, USD 186.3 billion in 2027, USD 194.9 billion in 2028, USD 203.9 billion in 2029, culminating at USD 213.2 billion in 2030. Between 2031 and 2035, growth continues steadily but shows a gradual deceleration as mature markets experience saturation and large-scale production meets most industrial demand.

| Metric | Value |

|---|---|

| Galvanized and Coated Iron and Steel Sheets Market Estimated Value in (2025 E) | USD 170.3 billion |

| Galvanized and Coated Iron and Steel Sheets Market Forecast Value in (2035 F) | USD 267.0 billion |

| Forecast CAGR (2025 to 2035) | 4.6% |

The galvanized and coated iron and steel sheets market is supported by several parent markets that collectively influence its demand across multiple industries. The steel and metal sheets market forms the foundation, with galvanized and coated sheets contributing nearly 25-30% of the share. Their corrosion resistance, strength, and versatility make them essential for both industrial and consumer applications. The construction and building materials market contributes around 18-20%, as these sheets are widely used in roofing, cladding, wall panels, and structural reinforcements. Their durability and weather resistance make them critical for residential, commercial, and large-scale infrastructure projects. The automotive market accounts for approximately 12-15% of the demand for galvanized and coated sheets.

Automakers rely on these materials for vehicle bodies, chassis, and safety components due to their combination of strength and resistance to rust. The industrial machinery and equipment market contributes about 8-10%, with galvanized and coated sheets being used in the production of heavy machinery, consumer appliances, and equipment where long service life and resistance to wear are vital. Finally, the energy and utilities market holds roughly 6-8% of the share, as these sheets are employed in transmission towers, pipelines, and renewable energy structures, offering durability in harsh environments.

The market is demonstrating strong growth, supported by rising demand across construction, automotive, and industrial applications. Increasing infrastructure investment and the shift towards materials that offer durability, corrosion resistance, and low maintenance have significantly influenced market adoption. Advancements in coating technologies and processing methods have improved product performance, enabling broader use in harsh environmental conditions.

The demand for sustainable building materials has further boosted the adoption of galvanized and coated sheets due to their extended service life and recyclability. Rapid urbanization in emerging economies, along with stringent regulations for corrosion protection in structural applications, is creating consistent growth opportunities.

Additionally, integration of automated coating lines and improved quality control systems is enhancing production efficiency, ensuring consistent supply to meet rising global demand The market outlook remains positive as end-users increasingly seek materials that balance strength, aesthetics, and longevity, while supporting cost-efficient and environmentally responsible construction practices.

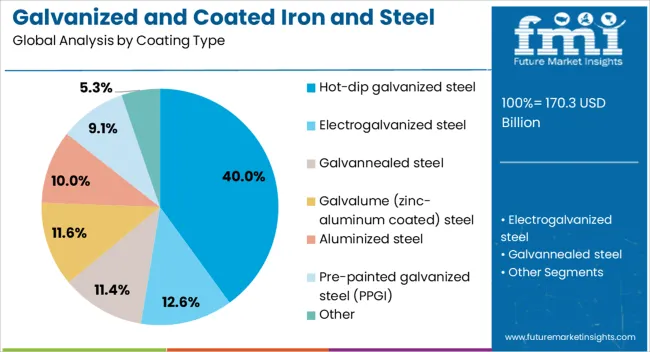

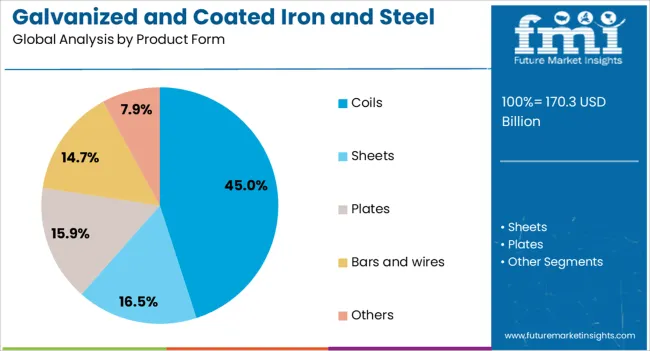

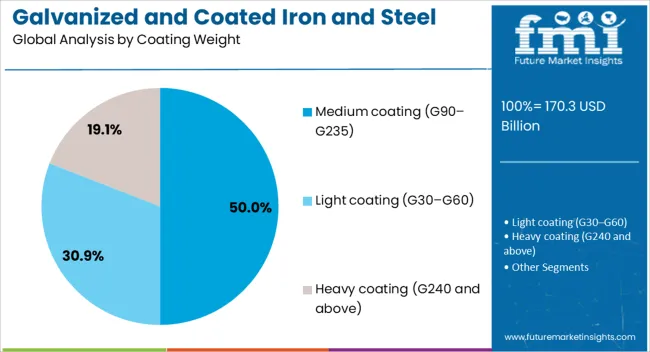

The galvanized and coated iron and steel sheets market is segmented by coating type, product form, coating weight, base steel grade, end use industry, specific applications, distribution channel, and geographic regions. By coating type, galvanized and coated iron and steel sheets market is divided into hot-dip galvanized steel, electrogalvanized steel, galvannealed steel, galvalume (zinc-aluminum coated) steel, aluminized steel, pre-painted galvanized steel (PPGI), and other. In terms of product form, galvanized and coated iron and steel sheets market is classified into coils, sheets, plates, bars and wires, and others. Based on coating weight, galvanized and coated iron and steel sheets market is segmented into medium coating (G90–G235), light coating (G30–G60), and heavy coating (G240 and above). By base steel grade, galvanized and coated iron and steel sheets market is segmented into commercial steel, drawing steel, structural steel, high-strength low-alloy steel (HSLA), advanced high-strength steel (AHSS), and others. By end use industry, galvanized and coated iron and steel sheets market is segmented into construction and infrastructure, residential construction, commercial construction, industrial construction, infrastructure development, automotive and transportation, home appliances and electronics, energy and power, agriculture, industrial equipment and machinery, and others. By specific applications, galvanized and coated iron and steel sheets market is segmented into roofing and cladding, structural components, automotive body parts, appliance casings, electrical conduits and enclosures, HVAC ductwork, and others. By distribution channel, galvanized and coated iron and steel sheets market is segmented into distributors and service centers, direct sales, retail outlets, e-commerce, and others. Regionally, the galvanized and coated iron and steel sheets industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The hot-dip galvanized steel segment is projected to hold 40% of the galvanized and coated iron and steel sheets market revenue share in 2025, making it the leading coating type. This dominance is driven by the segment’s proven ability to deliver long-lasting corrosion protection through a uniform zinc coating applied via immersion in molten zinc. The coating process forms a metallurgical bond, enhancing resistance to mechanical damage and environmental degradation. Demand for this coating type has been reinforced by its suitability for both structural and decorative applications in construction and automotive industries. Its compatibility with high-strength steel grades and adaptability to various thicknesses has further contributed to its adoption. The low maintenance requirements and extended service life offered by hot-dip galvanized steel align with the priorities of industries seeking reduced lifecycle costs With growing infrastructure projects worldwide, the segment continues to benefit from its reliability, cost-effectiveness, and consistent performance under diverse operating conditions.

The coils segment is expected to account for 45% of the market revenue share in 2025, positioning it as the dominant product form. This leadership is attributed to the efficiency and versatility offered by coils in manufacturing and fabrication processes. Coils enable easy transportation, storage, and further processing into sheets, strips, or custom dimensions, which meets the diverse needs of end-use industries. The form’s compatibility with automated cutting and shaping equipment enhances productivity while reducing material waste. Coils also facilitate uniform coating application, ensuring consistent surface quality and corrosion resistance. Their high demand in automotive body panels, roofing materials, and appliance manufacturing has sustained their growth. In addition, the ability to store and handle large volumes of material in a compact form provides cost advantages for producers and distributors The segment’s adaptability to various coating types and thicknesses further reinforces its competitive position in the market.

The medium coating (G90–G235) segment is projected to hold 50% of the market revenue share in 2025, making it the leading coating weight category. Its growth is primarily driven by the optimal balance it offers between corrosion protection, material cost, and product weight. Medium coating levels provide sufficient zinc thickness to ensure long-term durability in both indoor and moderately harsh outdoor environments. This category has been preferred in applications where strength and corrosion resistance are required without significantly increasing the overall weight of the structure. Industries such as construction, automotive, and appliance manufacturing favor this coating weight for its ability to meet performance standards while maintaining cost-efficiency. The segment also benefits from compatibility with a wide range of steel grades and processing methods. As industries continue to prioritize sustainable and long-lasting materials, medium coating weight products are expected to maintain their strong market position.

The galvanized and coated iron and steel sheets market is driven by rising construction, automotive, and industrial demand where durability and resistance remain key requirements. High raw material costs and energy-intensive production processes continue to challenge profitability and accessibility, particularly in cost-sensitive regions. Opportunities are emerging from expanding applications in automotive bodies, industrial machinery, and specialized packaging. Regional collaborations, product customization, and investments in coating technologies are shaping the competitive landscape, ensuring these sheets maintain a central role in modern infrastructure, industrial, and manufacturing value chains globally.

The galvanized and coated iron and steel sheets market is expanding steadily as demand from construction and infrastructure sectors continues to rise. These sheets are valued for their durability, corrosion resistance, and ability to withstand harsh environments, making them essential for roofing, cladding, and structural applications. Urban growth and industrial expansion have intensified the requirement for reliable building materials, driving stronger consumption. The automotive sector also contributes significantly, with galvanized and coated sheets being integral for body panels and structural reinforcements where strength and resistance to wear are critical. The packaging industry has also integrated these sheets into containers and specialized applications, further boosting demand. As manufacturers seek materials that combine longevity with cost efficiency, galvanized and coated iron and steel sheets remain a preferred choice across multiple industries, reinforcing their importance in both established and emerging economies.

New opportunities are emerging in industrial and automotive sectors, where galvanized and coated sheets are increasingly used to enhance performance and durability. In the automotive industry, their use in vehicle bodies, chassis components, and safety reinforcements continues to grow as manufacturers seek stronger materials capable of enduring intensive use. Industrial machinery and equipment also benefit from coated sheets that reduce wear and extend service life in demanding environments. Packaging, particularly for food and beverage containers, represents another expanding application due to the protective properties of coated steel. Companies are also focusing on developing advanced coating formulations that provide enhanced adhesion and resistance to extreme conditions, opening avenues for specialized industrial uses. By catering to diversified needs across sectors, manufacturers are tapping into growth opportunities that extend beyond construction, ensuring galvanized and coated sheets remain critical in multiple industrial value chains.

New opportunities are emerging in industrial and automotive sectors, where galvanized and coated sheets are increasingly used to enhance performance and durability. In the automotive industry, their use in vehicle bodies, chassis components, and safety reinforcements continues to grow as manufacturers seek stronger materials capable of enduring intensive use. Industrial machinery and equipment also benefit from coated sheets that reduce wear and extend service life in demanding environments. Packaging, particularly for food and beverage containers, represents another expanding application due to the protective properties of coated steel. Companies are also focusing on developing advanced coating formulations that provide enhanced adhesion and resistance to extreme conditions, opening avenues for specialized industrial uses. By catering to diversified needs across sectors, manufacturers are tapping into growth opportunities that extend beyond construction, ensuring galvanized and coated sheets remain critical in multiple industrial value chains.

Regional dynamics and strategic partnerships are shaping trends in the galvanized and coated iron and steel sheets market. In developed economies, demand is concentrated in construction, automotive, and infrastructure renewal projects, while in developing regions, rising industrialization is fueling significant consumption growth. Manufacturers are collaborating with downstream industries to provide tailored sheet solutions that meet specific technical and design requirements. Cross-industry partnerships are also enabling innovations in coating technologies and expanded product ranges. Regional trade agreements and investments in steel production hubs are further influencing availability and pricing, strengthening competitive positions of local producers. The growing emphasis on operational efficiency and longer product lifecycles has led to increased focus on tailored solutions for end users. These dynamics highlight the importance of regional factors and collaborations in shaping market growth and competitive differentiation among key manufacturers worldwide.

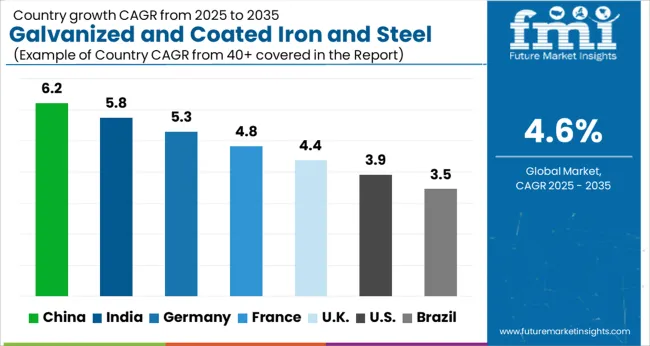

| Country | CAGR |

|---|---|

| China | 6.2% |

| India | 5.8% |

| Germany | 5.3% |

| France | 4.8% |

| UK | 4.4% |

| USA | 3.9% |

| Brazil | 3.5% |

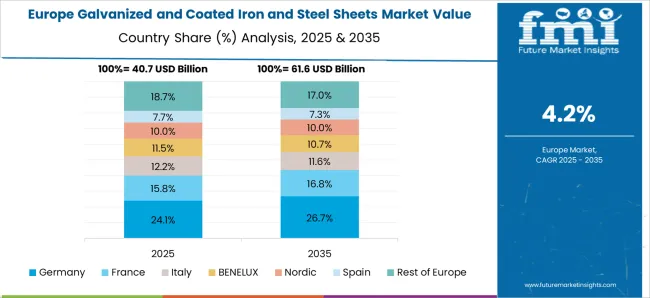

The global galvanized and coated iron and steel sheets market is expected to grow at a CAGR of 4.6% from 2025 to 2035. China leads with 6.2%, followed by India at 5.8% and France at 4.8%. The United Kingdom and the United States record moderate growth at 4.4% and 3.9%, respectively. Market expansion is being driven by strong demand in construction, automotive, appliance manufacturing, and infrastructure projects. Asia dominates growth due to large-scale industrialization and investments in construction, while Europe and North America continue to focus on modernization, advanced coating technologies, and specialized applications to maintain competitiveness. The analysis includes over 40+ countries, with the leading markets detailed below.

China is projected to lead the galvanized and coated iron and steel sheets market with a CAGR of 6.2% from 2025 to 2035. The growth is driven by large-scale construction, infrastructure projects, and the expansion of the automotive industry. The country’s role as a global manufacturing hub further strengthens demand for galvanized and coated steel sheets, widely used in roofing, wall panels, automotive body structures, and appliances. Domestic producers are expanding production capacities to cater to both local consumption and exports, while international firms are partnering with Chinese companies to strengthen supply chains. Government investment in housing and industrial construction continues to provide a strong foundation for long-term demand.

The galvanized and coated iron and steel sheets market in India is forecast to grow at a CAGR of 5.8% from 2025 to 2035. Rising demand is supported by rapid urban expansion, strong infrastructure development, and a growing automotive sector. Increased investments in real estate and housing projects are also fueling the adoption of galvanized and coated sheets for structural and protective applications. Domestic steel producers are investing in advanced coating technologies to improve quality and durability. Government initiatives such as industrial corridor development and rural electrification are contributing to rising steel sheet consumption. With increased focus on expanding production capacity, India is emerging as one of the fastest-growing markets globally.

France is expected to grow at a CAGR of 4.8% in the galvanized and coated iron and steel sheets market between 2025 and 2035. The demand is primarily supported by construction activities, automotive production, and appliance manufacturing. French manufacturers focus heavily on high-performance, durable coated sheets for structural and decorative applications. The growth of export markets for French steel products also contributes to rising output. Technological advancement in coating techniques is helping improve product quality and efficiency. The emphasis on modernization of transport infrastructure and housing projects supports steady consumption of galvanized and coated sheets.

The United Kingdom is projected to grow at a CAGR of 4.4% from 2025 to 2035 in the galvanized and coated iron and steel sheets market. Growth is being driven by the ongoing demand from construction and automotive sectors, along with infrastructure renewal projects. Retail and commercial building activities are also increasing the adoption of coated steel sheets for exterior and structural uses. Import reliance is notable in the UK, with global suppliers catering to growing demand, while local producers focus on specialized products. The modernization of transportation and industrial facilities is expected to further support demand for high-quality galvanized steel sheets. <

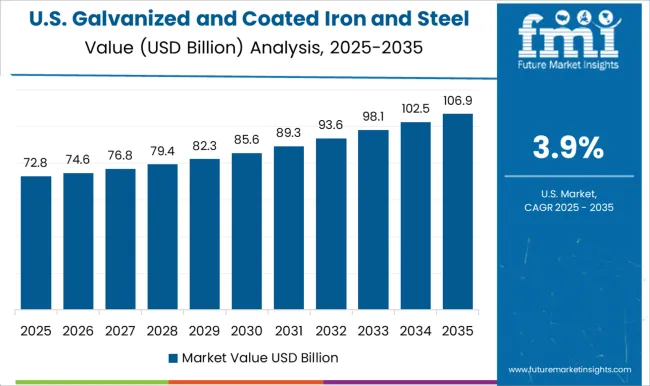

The United States is projected to expand at a CAGR of 3.9% between 2025 and 2035 in the galvanized and coated iron and steel sheets market. Demand is primarily supported by residential and commercial construction projects, along with steady automotive production. The USA steel industry emphasizes innovation in coating processes to provide enhanced durability and corrosion resistance. Rising investments in infrastructure renewal, particularly bridges, highways, and public buildings, are also contributing to demand. Appliance manufacturing and energy sector applications add to the steady consumption of galvanized steel sheets. Domestic producers are focusing on value-added products to remain competitive in both local and export markets.

In the galvanized and coated iron and steel sheets market, competition is defined by scale, product mix, and regional supply dominance. ArcelorMittal leads with an extensive range of galvanized and coated flat products serving automotive, construction, and appliance industries, supported by its integrated global supply network. Nippon Steel Corporation focuses on advanced coatings and high-strength galvanized steels tailored for automotive body panels, reinforcing its presence in Japan and international markets through partnerships with automakers. POSCO emphasizes premium galvanized and color-coated steels, leveraging proprietary technologies to meet demanding structural and architectural requirements across Asia and global exports.

Tata Steel competes through a diversified portfolio of galvanized and coated sheets targeted at automotive, infrastructure, and consumer appliance sectors, expanding capacity in India and Europe to capture both domestic and export demand. China Baowu, through Baosteel, utilizes its scale and government-backed strength to dominate regional supply, offering high-volume galvanized and coated steel to construction and heavy industry, while also focusing on advanced automotive-grade products. JFE Steel differentiates by providing highly engineered galvanized and coated sheets with precise surface quality and mechanical performance, positioning itself strongly in both domestic Japanese markets and international supply chains.

Other global players, including Nucor, JSW, and ThyssenKrupp, maintain competitiveness by focusing on regional supply chains, efficiency in production, and specialized coating technologies that cater to niche applications. Strategies across these companies emphasize product innovation, capacity expansion, and supply agreements with downstream industries. Product brochures highlight hot-dip galvanized sheets, electro-galvanized sheets, aluminized sheets, and pre-painted steel, each designed for applications in automotive exteriors, roofing, cladding, consumer goods, and structural components, underscoring the critical role of surface-treated steel in modern manufacturing and construction.

| Item | Value |

|---|---|

| Quantitative Units | USD 170.3 billion |

| Coating Type | Hot-dip galvanized steel, Electrogalvanized steel, Galvannealed steel, Galvalume (zinc-aluminum coated) steel, Aluminized steel, Pre-painted galvanized steel (PPGI), and Other |

| Product Form | Coils, Sheets, Plates, Bars and wires, and Others |

| Coating Weight | Medium coating (G90–G235), Light coating (G30–G60), and Heavy coating (G240 and above) |

| Base Steel Grade | Commercial steel, Drawing steel, Structural steel, High-strength low-alloy steel (HSLA), Advanced high-strength steel (AHSS), and Others |

| End Use Industry | Construction and infrastructure, Residential construction, Commercial construction, Industrial construction, Infrastructure development, Automotive and transportation, Home appliances and electronics, Energy and power, Agriculture, Industrial equipment and machinery, and Others |

| Specific Applications | Roofing and cladding, Structural components, Automotive body parts, Appliance casings, Electrical conduits and enclosures, HVAC ductwork, and Others |

| Distribution Channel | Distributors and service centers, Direct sales, Retail outlets, E-commerce, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | ArcelorMittal, Nippon Steel Corporation, POSCO, Tata Steel, China Baowu Group, JFE Steel, and ThyssenKrupp |

| Additional Attributes | Dollar sales by product type (hot-dip galvanized, electro-galvanized, coated sheets), thickness (thin, medium, thick), and application (automotive, construction, appliances). Demand is influenced by industrial growth, urban infrastructure expansion, and requirements for corrosion-resistant materials. Regional trends indicate strong growth in Asia-Pacific, North America, and Europe, supported by large-scale construction projects, automotive manufacturing, and government-driven industrial development initiatives. |

The global galvanized and coated iron and steel sheets market is estimated to be valued at USD 170.3 billion in 2025.

The market size for the galvanized and coated iron and steel sheets market is projected to reach USD 267.0 billion by 2035.

The galvanized and coated iron and steel sheets market is expected to grow at a 4.6% CAGR between 2025 and 2035.

The key product types in galvanized and coated iron and steel sheets market are hot-dip galvanized steel, electrogalvanized steel, galvannealed steel, galvalume (zinc-aluminum coated) steel, aluminized steel, pre-painted galvanized steel (ppgi) and other.

In terms of product form, coils segment to command 45.0% share in the galvanized and coated iron and steel sheets market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Galvanized Rigid Conduit Market Size and Share Forecast Outlook 2025 to 2035

Android Automotive OS (AAOS) Market Size and Share Forecast Outlook 2025 to 2035

Anderson Cascade Impactor Market Size and Share Forecast Outlook 2025 to 2035

Andersen-Tawil Syndrome Treatment Market Trends - Growth & Future Prospects 2025 to 2035

Andro Supplements Market

Handheld Ultrasound Scanner Market Size and Share Forecast Outlook 2025 to 2035

Handheld Tagging Gun Market Forecast and Outlook 2025 to 2035

Handheld Imaging Systems Market Size and Share Forecast Outlook 2025 to 2035

Sandwich Panel System Market Size and Share Forecast Outlook 2025 to 2035

Hand Tools Market Size and Share Forecast Outlook 2025 to 2035

Land Survey Equipment Market Size and Share Forecast Outlook 2025 to 2035

Handloom Product Market Size and Share Forecast Outlook 2025 to 2035

Band File Sander Belts Market Size and Share Forecast Outlook 2025 to 2035

Handheld XRF Analyzers Market Size and Share Forecast Outlook 2025 to 2035

Sand Abrasion Tester Market Size and Share Forecast Outlook 2025 to 2035

Sand Testing Equipments Market Size and Share Forecast Outlook 2025 to 2035

Landscape Lighting Market Size and Share Forecast Outlook 2025 to 2035

Handheld Police Radar Guns Market Size and Share Forecast Outlook 2025 to 2035

Handheld DNA Reader Market Size and Share Forecast Outlook 2025 to 2035

Handheld Robotic Navigation Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA