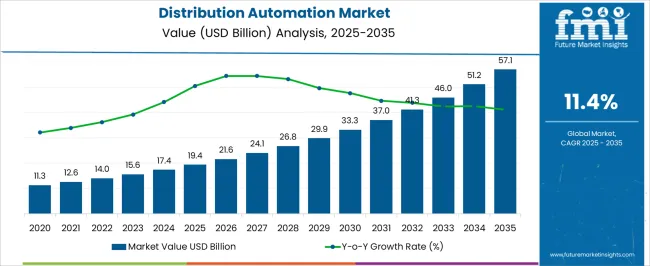

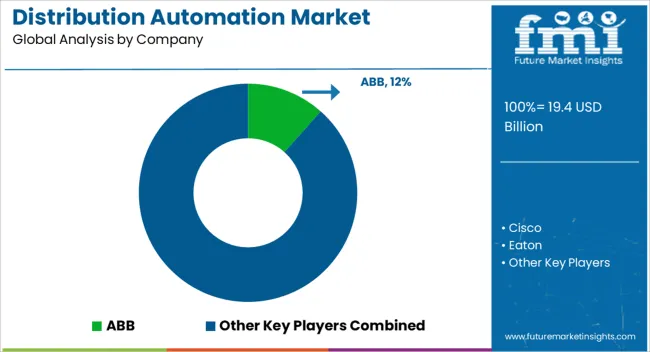

The distribution automation market was valued at USD 19.4 billion in 2025 and is projected to reach USD 57.1 billion by 2035, reflecting a CAGR of 11.4%. Observing the compound absolute growth over the decade, the market demonstrates a strong upward trajectory, rising from USD 21.6 billion in 2026 to USD 51.2 billion in 2034, before reaching the forecasted value. This growth underscores the increasing reliance on automated solutions for monitoring, controlling, and optimizing electricity distribution networks.

The compound absolute growth highlights how utilities and grid operators are prioritizing operational efficiency, reliability, and fault management, making distribution automation a key driver of performance improvements across power networks. The distribution automation market was valued at USD 19.4 billion in 2025 and is projected to reach USD 57.1 billion by 2035, growing at a CAGR of 11.4%. Year-on-year increments reveal a consistent expansion, with values moving from USD 24.1 billion in 2027 to USD 46.0 billion in 2033. The compound absolute growth analysis suggests that adoption is being reinforced by demand for real-time grid monitoring, outage detection, and automated control systems that reduce operational costs and enhance network resilience.

The market’s trajectory indicates that stakeholders who invest in advanced distribution automation platforms and integration capabilities are positioned to capture significant value, as utilities increasingly seek reliable, efficient, and data-driven solutions for power management.

| Metric | Value |

|---|---|

| Distribution Automation Market Estimated Value in (2025 E) | USD 19.4 billion |

| Distribution Automation Market Forecast Value in (2035 F) | USD 57.1 billion |

| Forecast CAGR (2025 to 2035) | 11.4% |

The distribution automation market has been increasingly positioned as a crucial segment within multiple expansive parent industries, each reflecting measurable adoption and operational relevance. Within the power transmission and distribution market, distribution automation accounts for approximately 6.5%, driven by its role in optimizing feeder operations, improving fault detection, and enhancing load management for reliable electricity delivery.

In the smart grid solutions market, its share is estimated at 7.2%, reflecting the integration of automated switches, sensors, and communication networks that allow real-time monitoring, system reconfiguration, and operational efficiency. The electrical equipment market records a penetration of about 5.8%, as distribution automation systems are incorporated with circuit breakers, transformers, and switchgear to enhance network stability and minimize downtime. Within the industrial automation and control systems market, the segment contributes roughly 5.4%, highlighting adoption for centralized monitoring, predictive maintenance, and operational optimization across utilities and industrial power networks. In the utility management solutions market, distribution automation holds approximately 4.9% share, driven by deployment in demand response, energy management, and grid reliability solutions.

Adoption has been driven by the need for network reliability, rapid fault isolation, and operational visibility, prompting utilities and industrial operators to integrate distribution automation systems as essential components, thereby reshaping competitive strategies and operational approaches within their parent markets.

The distribution automation market is advancing steadily, driven by the growing need for efficient, reliable, and resilient power distribution networks across global utilities. The current landscape reflects increased adoption of automation solutions to reduce outage durations, improve voltage regulation, and optimize grid performance under rising load demands.

Technological progress in advanced metering infrastructure, real-time monitoring, and predictive maintenance has significantly influenced adoption rates, with utility providers prioritizing grid modernization projects. The integration of automation within distribution systems is also supported by regulatory mandates for energy efficiency and carbon reduction targets, compelling stakeholders to upgrade outdated infrastructure.

Demand growth is further reinforced by the proliferation of renewable energy sources, which necessitates improved grid flexibility and control mechanisms. Over the forecast horizon, investments in smart grid infrastructure, coupled with the rising digitalization of utility operations, are expected to sustain robust market expansion, positioning distribution automation as a critical enabler of next-generation energy systems.

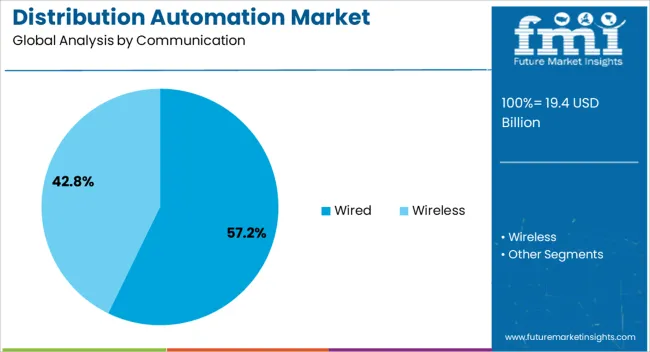

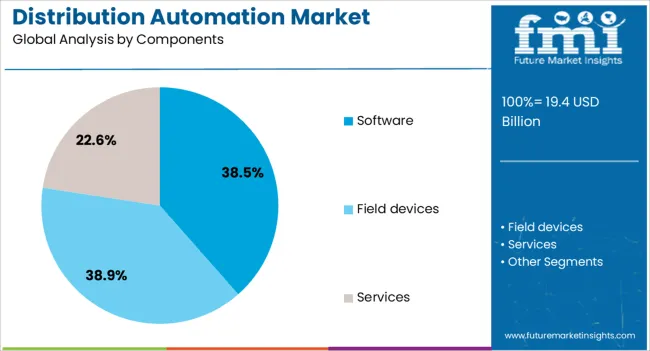

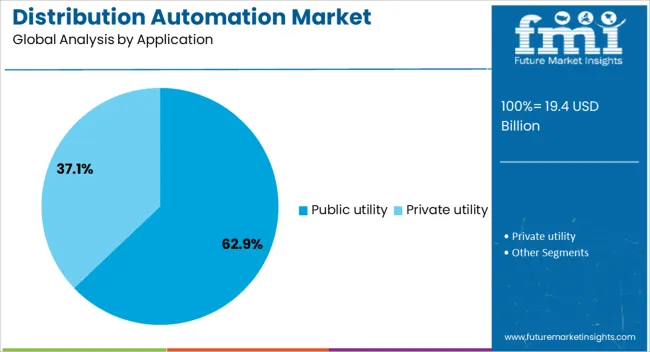

The distribution automation market is segmented by communication, components, application, and geographic regions. By communication, distribution automation market is divided into Wired and Wireless. In terms of components, distribution automation market is classified into Software, Field devices, and Services. Based on application, distribution automation market is segmented into Public utility and Private utility. Regionally, the distribution automation industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The wired communication segment holds a leading share of approximately 57.2% in the distribution automation market, driven by its established reliability, security, and high-speed data transmission capabilities. Wired solutions have been widely adopted by utility providers for mission-critical applications due to their immunity to electromagnetic interference and consistent performance in diverse environmental conditions.

Their dominance is reinforced by existing network infrastructure, which minimizes the need for extensive new deployments, thereby lowering integration costs for utilities. This segment benefits from long-standing technical standards and compatibility with a broad range of automation equipment, enhancing operational continuity.

The preference for wired systems is particularly notable in regions with dense urban grids, where interference management and high-volume data transfer are essential for operational efficiency. Continued investment in fiber-optic and Ethernet-based grid communication is expected to maintain the segment’s leadership, supported by ongoing modernization initiatives and the growing complexity of power distribution networks.

The software component segment commands around 38.5% of the market, reflecting its pivotal role in enabling real-time monitoring, control, and analytics within distribution automation systems. This segment’s prominence is supported by the increasing shift toward data-driven decision-making, where advanced algorithms and AI-enabled platforms optimize load distribution, fault detection, and asset management.

Utility companies are increasingly investing in software solutions that provide predictive insights and automated control functionalities, thereby reducing downtime and enhancing service reliability. The scalability and flexibility of software platforms allow utilities to integrate emerging technologies without significant hardware overhauls, making them a cost-effective modernization strategy.

The segment’s growth is further encouraged by cloud-based deployment models, which improve accessibility and operational coordination across distributed networks. As utilities expand renewable integration and distributed energy resources, demand for advanced distribution automation software is expected to rise, securing its position as a central component of grid optimization strategies.

The public utility application segment leads the distribution automation market with a share of approximately 62.9%, attributed to its extensive deployment of automation technologies to ensure reliable and uninterrupted power supply to large consumer bases. Public utilities face increasing regulatory and customer pressure to minimize outages and improve service quality, prompting significant investment in automation systems.

The segment benefits from large-scale government funding programs and grid modernization mandates, particularly in developed economies where aging infrastructure requires urgent upgrades. Public utilities have also been early adopters of advanced monitoring and control solutions, enabling them to improve operational efficiency and integrate renewable energy sources effectively.

The focus on reducing technical and non-technical losses, improving grid resilience against extreme weather events, and complying with stringent service reliability standards has further bolstered this segment’s share. With ongoing electrification initiatives and urban infrastructure expansion, the public utility segment is expected to maintain its dominant position in the coming years.

The distribution automation market has been influenced by growing demand for efficient electricity distribution, grid reliability, and real-time monitoring of energy networks. Adoption has been driven by the need to reduce power outages, improve operational efficiency, and enable predictive maintenance. Opportunities are emerging in integration with smart grid systems, advanced sensor networks, and analytics-based monitoring solutions. Trends indicate increased deployment of automated switching, fault detection, and demand-response technologies. Challenges persist in high installation costs, complex system integration, and cybersecurity risks. Overall, market growth is expected to remain positive, supported by expanding electricity network modernization initiatives.

The demand for distribution automation systems has been strongly influenced by the need to enhance electricity distribution efficiency and improve grid reliability across transmission and distribution networks. Utility operators, independent power producers, and industrial energy consumers have been observed increasingly relying on automated systems to manage load fluctuations, minimize outages, and optimize energy flow. This demand has been reinforced by growing pressure on aging grid infrastructure and the need for consistent power quality in residential, commercial, and industrial applications. Automation enables real-time monitoring, rapid fault detection, and predictive maintenance, reducing operational downtime and improving customer service. Regional initiatives to modernize power networks and meet increasing electricity consumption have further strengthened reliance on distribution automation. Overall, the market is being driven by the strategic requirement for reliable, resilient, and efficient electricity delivery across diverse sectors.

Opportunities in the distribution automation market have been largely defined by integration with smart grid technologies, deployment of advanced sensor networks, and use of analytics-driven monitoring systems. Utilities have been observed adopting automated switches, remote-controlled reclosers, and sensors to improve operational control, reduce outage durations, and enhance load management capabilities. Emerging markets with expanding electricity demand present significant opportunities for digital monitoring, predictive fault analysis, and automated energy management. The incorporation of IoT-enabled devices, cloud-based analytics, and adaptive control systems is enabling utilities to optimize distribution networks while reducing manual interventions. Furthermore, partnerships between automation providers and grid operators are creating tailored solutions for large-scale deployments, supporting regional reliability goals. Overall, opportunities are being reinforced by the growing requirement for efficient energy management, operational optimization, and enhanced network observability across power distribution networks.

The distribution automation market has been shaped by trends in automated switching, predictive fault detection, and enhanced monitoring capabilities for power distribution networks. Systems are being increasingly equipped with self-healing functions, which isolate faults and reroute power automatically, minimizing service interruptions. These trends are redefining conventional distribution operations, where manual switching and inspection were previously relied upon. Predictive analytics are being employed to anticipate equipment failures, optimize maintenance schedules, and enhance asset performance. Multi-functional devices capable of load balancing, voltage regulation, and real-time monitoring are being widely deployed to meet operational and regulatory requirements. These developments are also influencing adoption in microgrids, renewable integration, and industrial power systems. Overall, trends in automation, fault intelligence, and proactive control are expected to enhance network efficiency, reduce operational costs, and redefine competitive strategies in the distribution automation market.

The distribution automation market has faced persistent challenges related to high installation and operational costs, complex system integration, and cybersecurity vulnerabilities. Deployment of automated switches, remote sensors, and communication networks requires substantial capital expenditure, particularly for retrofitting older infrastructure. Integrating distribution automation systems with legacy grids and multiple utility platforms has created technical and operational challenges. The increasing use of connected devices and cloud-based analytics introduces cybersecurity concerns, as unauthorized access or system breaches can disrupt energy supply and compromise data integrity. Skilled workforce requirements for system operation, maintenance, and monitoring further add to operational constraints.

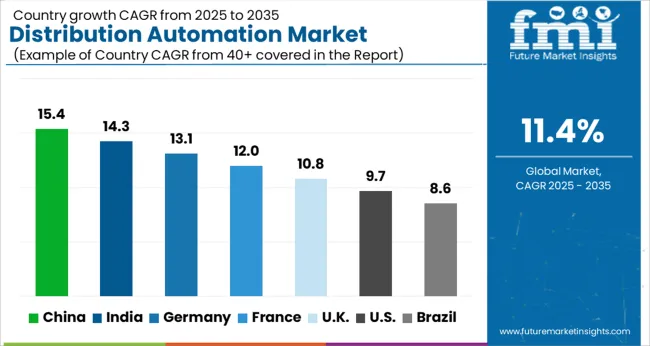

| Country | CAGR |

|---|---|

| China | 15.4% |

| India | 14.3% |

| Germany | 13.1% |

| France | 12.0% |

| UK | 10.8% |

| USA | 9.7% |

| Brazil | 8.6% |

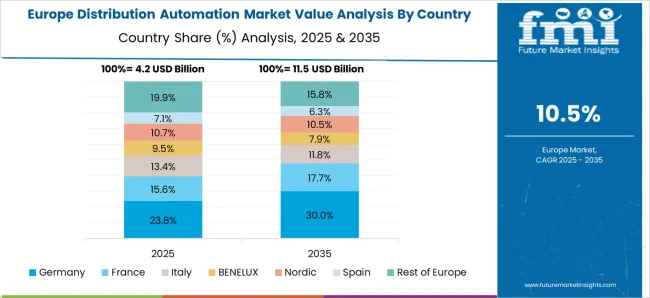

The global distribution automation market is projected to grow at a CAGR of 11.4% from 2025 to 2035. China leads with 15.4% growth, followed by India at 14.3% and France at 12%. The United Kingdom records 10.8%, while the United States shows 9.7% growth. Expansion is driven by increasing adoption of smart grids, demand for efficient energy distribution, and growing investment in digital utility infrastructure. Emerging markets such as China and India are witnessing rapid deployment of automated grid solutions to improve reliability and reduce losses, while developed markets focus on upgrading legacy systems, integrating advanced metering, and optimizing distribution performance. This report includes insights on 40+ countries; the top markets are shown here for reference.

The distribution automation market in China is growing at a CAGR of 15.4%, fueled by the rapid adoption of smart grid initiatives, expanding urban energy networks, and increasing investment in renewable energy integration. Chinese utilities are deploying automated distribution systems to monitor, control, and optimize energy flow, reduce losses, and enhance grid reliability. Growth is further reinforced by government policies promoting energy efficiency, digital infrastructure upgrades, and technology-driven grid modernization. The country benefits from large-scale implementation of intelligent switches, sensors, and automated control devices, enabling real-time monitoring and fault detection in the distribution network.

The distribution automation market in India is expanding at a CAGR of 14.3%, supported by increasing investment in smart grid infrastructure, urban electrification, and energy loss reduction initiatives. Indian utilities are adopting automated systems to improve operational efficiency, enhance grid reliability, and integrate renewable energy sources. Growth is reinforced by government programs such as the Smart Grid Mission, funding for advanced distribution projects, and increasing awareness of energy optimization solutions. Adoption is further enhanced by the deployment of intelligent sensors, remote monitoring systems, and automated switches across both urban and rural electricity networks.

The distribution automation market in France is projected to grow at a CAGR of 12%, driven by modernization of distribution networks, integration of renewable energy, and demand for improved grid reliability. French utilities are implementing automated switches, sensors, and control systems to optimize energy distribution, reduce downtime, and enhance operational efficiency. Growth is supported by regulatory requirements for energy efficiency, government incentives for digital infrastructure, and increasing adoption of smart grid technologies. The country also benefits from strong collaboration between utilities and technology providers to deploy advanced automation solutions across urban and industrial networks.

The distribution automation market in the United Kingdom is growing at a CAGR of 10.8%, supported by the adoption of smart grid solutions, renewable energy integration, and energy efficiency initiatives. UK utilities are deploying automated switches, remote monitoring systems, and predictive control technologies to reduce losses and enhance grid resilience. Growth is reinforced by government programs promoting grid modernization, investments in digital infrastructure, and increasing demand for reliable energy distribution across urban and industrial sectors. Adoption is further enhanced by integration with advanced metering infrastructure and real-time analytics to optimize energy flow.

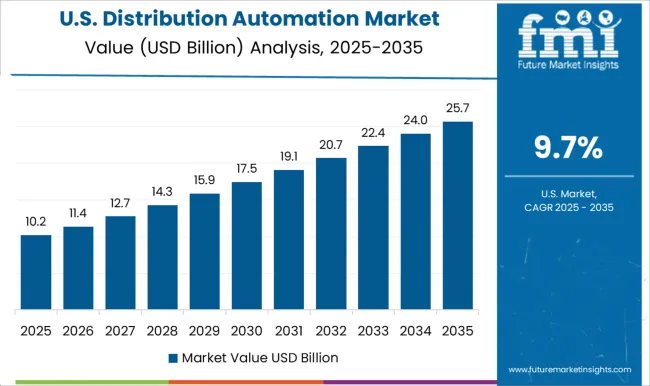

The distribution automation market in the United States is expanding at a CAGR of 9.7%, fueled by modernization of legacy grids, increasing renewable energy penetration, and the demand for improved energy reliability. USA utilities are implementing automated switches, intelligent sensors, and control systems to optimize distribution, reduce operational costs, and enhance outage management. Growth is reinforced by government incentives for smart grid adoption, investment in digital infrastructure, and collaboration with technology providers for advanced automation solutions. Adoption is further supported by the deployment of real-time monitoring systems and predictive analytics to improve decision-making and operational efficiency.

The distribution automation market is being driven by global electrical leaders, smart grid innovators, and industrial automation specialists. ABB, Siemens, and Schneider Electric are being positioned as front-runners through integrated automation platforms, advanced sensors, and real-time monitoring solutions that optimize power distribution and grid reliability. Their strategy is being executed with modular architectures, digital twin simulations, and predictive maintenance features, ensuring operational efficiency and reduced downtime.

GE, Hitachi, and Toshiba Energy Systems & Solutions are being recognized for their turnkey solutions, which combine hardware, software, and analytics to enhance grid performance. Eaton, G&W Electric, and S&C Electric Company are being directed toward high-reliability switching and control solutions, while Hubbell, Itron, Landis+Gyr, NovaTech, Trilliant Holdings, and Xylem are noted for their specialized smart metering, communication, and IoT-enabled monitoring capabilities. Competition is being defined by system scalability, integration capability, and automation intelligence, while market leadership is reinforced through proven field performance, certifications, and comprehensive after-sales support.

| Item | Value |

|---|---|

| Quantitative Units | USD 19.4 Billion |

| Communication | Wired and Wireless |

| Components | Software, Field devices, and Services |

| Application | Public utility and Private utility |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | ABB, Cisco, Eaton, GE, G&W Electric, Hitachi, Hubbell, Itron, Landis+Gyr, NovaTech, Schneider Electric, Schweitzer Engineering Laboratories, S&C Electric Company, Siemens, Toshiba Energy Systems & Solutions, Trilliant Holdings, and Xylem |

| Additional Attributes | Dollar sales by system type (sensors, switches, control units, communication networks) and application (substations, distribution lines, smart grids, industrial facilities) are key metrics. Trends include rising demand for grid reliability, growth in smart grid deployment, and increasing adoption of automated monitoring and control solutions. Regional adoption, technological advancements, and regulatory support are driving market growth. |

The global distribution automation market is estimated to be valued at USD 19.4 billion in 2025.

The market size for the distribution automation market is projected to reach USD 57.1 billion by 2035.

The distribution automation market is expected to grow at a 11.4% CAGR between 2025 and 2035.

The key product types in distribution automation market are wired and wireless.

In terms of components, software segment to command 38.5% share in the distribution automation market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Power Distribution Automation Components Market Analysis by Component, End-Use and Region: Forecast for 2025 to 2035

Distribution Board Market Forecast Outlook 2025 to 2035

Distribution Components Market Size and Share Forecast Outlook 2025 to 2035

Distribution Substation Market Size and Share Forecast Outlook 2025 to 2035

Distribution Lines And Poles Market Size and Share Forecast Outlook 2025 to 2035

Distribution Transformers Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Distribution Panel Market Size and Share Forecast Outlook 2025 to 2035

Automation Testing Market Size and Share Forecast Outlook 2025 to 2035

Distribution Logistics Market Size and Share Forecast Outlook 2025 to 2035

Automation COE Market Insights by Organization Size, Service Type, End User Verticals, and Region through 2035

Lab Automation Market Growth – Size, Trends & Forecast 2025 to 2035

Home Automation Sensors Market Size and Share Forecast Outlook 2025 to 2035

Home Automation Market Analysis by Product, Application, Networking Technology, and Region Through 2035

Form Automation Software Market – Digitizing Workflows

Hyperautomation Market

Cable Distribution Cabinets Market Size and Share Forecast Outlook 2025 to 2035

Power Distribution Component Market Size and Share Forecast Outlook 2025 to 2035

Power Distribution Vacuum Circuit Breaker Market Size and Share Forecast Outlook 2025 to 2035

Power Distribution Unit (PDU) Market Size and Share Forecast Outlook 2025 to 2035

Water Automation & Instrumentation Market Trends & Forecast by Process Stage, Automation Technology, Instrumentation, End-User and Region through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA