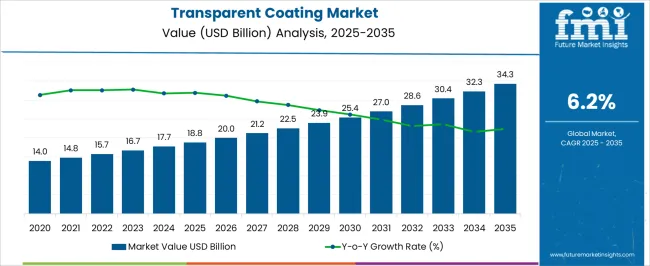

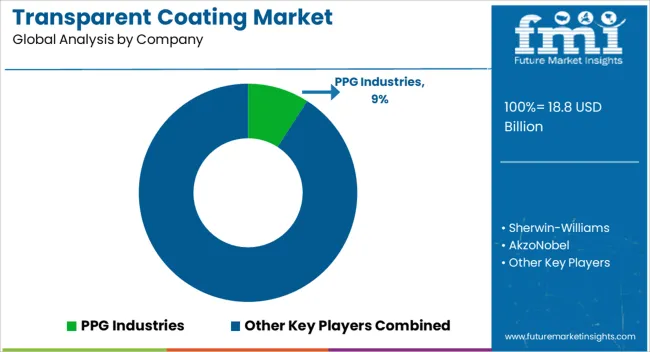

The Transparent Coating Market is estimated to be valued at USD 18.8 billion in 2025 and is projected to reach USD 34.3 billion by 2035, registering a compound annual growth rate (CAGR) of 6.2% over the forecast period.

| Metric | Value |

|---|---|

| Transparent Coating Market Estimated Value in (2025 E) | USD 18.8 billion |

| Transparent Coating Market Forecast Value in (2035 F) | USD 34.3 billion |

| Forecast CAGR (2025 to 2035) | 6.2% |

The Transparent Coating market is experiencing strong growth, driven by increasing demand for surface protection, aesthetic enhancement, and durability across multiple industries. Rising awareness of environmental factors, UV degradation, and wear and tear is prompting the adoption of advanced coatings that provide high transparency while maintaining protective properties. Innovations in material science, including nanotechnology and polymer-based formulations, are improving adhesion, scratch resistance, and chemical stability, enabling broader application across surfaces.

Growing construction, automotive, and furniture sectors are increasingly investing in coatings that preserve material integrity and visual appeal. Emphasis on sustainable and environmentally friendly formulations is further encouraging adoption, as regulations on volatile organic compounds and eco-compliance are becoming more stringent.

The ability to combine aesthetic enhancement with functional protection has positioned transparent coatings as a preferred choice for industrial and commercial applications With continuous technological advancements and rising demand for surface longevity, the market is expected to maintain robust expansion over the next decade.

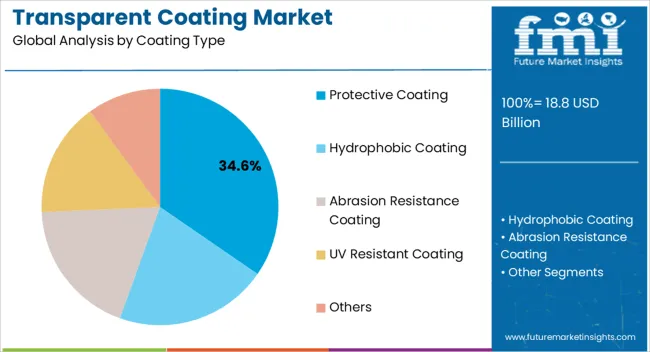

The protective coating segment is projected to hold 34.6% of the Transparent Coating market revenue in 2025, establishing it as the leading coating type. Growth in this segment is being driven by the ability to shield surfaces from scratches, UV exposure, moisture, and chemical degradation, thereby extending product life and performance. Protective coatings are increasingly preferred across industrial, commercial, and residential applications due to their multifunctional benefits, which include corrosion resistance and aesthetic maintenance.

Advanced formulations and innovative deposition techniques have improved durability, adhesion, and transparency, enhancing their adoption. Integration with environmentally friendly components and compliance with regulatory standards further strengthens the segment’s market position.

Manufacturers benefit from reduced maintenance costs and enhanced product longevity, which supports continued demand As surface protection requirements intensify across construction, automotive, and furniture sectors, the protective coating segment is expected to retain its leadership, driven by technological innovation and increasing application diversity.

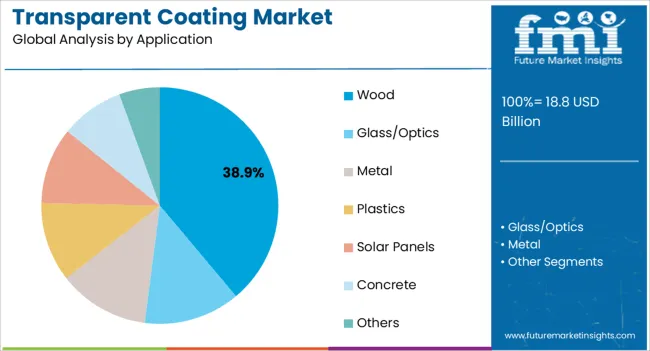

The wood application segment is expected to account for 38.9% of the Transparent Coating market revenue in 2025, making it the leading application area. Growth in this segment is being driven by the increasing use of transparent coatings to preserve wood surfaces while highlighting natural textures and grain patterns. These coatings enhance durability, resist environmental degradation, and provide a visually appealing finish, meeting both functional and aesthetic requirements.

Rising demand in furniture, interior décor, flooring, and construction industries has reinforced adoption. Formulations optimized for wood surfaces provide excellent adhesion, UV resistance, and moisture protection, which ensures long-term performance. Sustainability trends and eco-friendly coating solutions are further encouraging market penetration.

The ability to apply coatings without altering the inherent characteristics of wood, while providing reliable protection and maintenance, has strengthened preference in this application As wood continues to be a preferred material in modern construction and interior design, the segment is expected to sustain its market-leading position, supported by innovation in protective and decorative coating technologies.

During 2020 and 2025, the global transparent coating market grew with 4.7% CAGR. The product witnessed increasing demand from end-use industries as its benefits and methods of applications became vibrant.

The demand for transparent coatings remained high from electronics applications where these coatings are primarily used over electronic display to protect it from water, scratches and absorb the UV radiation.

During the forecast period of 2025 to 2035, the transparent Coating market is anticipated to grow at a CAGR of 6.5%. The product’s demand will spur due to their growing usage in multiple end-uses that are set to capture significant portion of market share.

The solar panel application of the transparent coatings is expected to lead the market expansion in the coming years. The rising inclination towards renewable energy and thereby growing solar energy market is bolstering the demand for self-cleaning transparent coatings. Similarly, the expansion in optics industry is set to fuel the growth for transparent coatings market. The rising adoption of these coatings for UV resistance, anti-glare, anti-fogging and night-vision applications is anticipated to create lucrative growth opportunities for the product market in coming years.

| Country | The United States |

|---|---|

| Market Size (USD billion) by End of Forecast Period (2035) | USD 5.0 billion |

| CAGR % 2025 to End of Forecast (2035) | 6.0% |

The transparent coating market in the United States is expected to reach USD 5.0 billion by the end of forecast period. The market will expand at a CAGR of 6.0% during this period. The growing usage of transparent coating in wood surface coating applications in furniture and construction industry is expected to be the key growth driver for the market in the country.

| Country | India |

|---|---|

| Market Size (USD billion) by End of Forecast Period (2035) | USD 34.3 billion |

| CAGR % 2025 to End of Forecast (2035) | 7.2% |

In India, the transparent coatings market is anticipated to grow at a 7.2% CAGR to reach the market size of USD 34.3 billion by the end of 2035. The increasing use of transparent coatings in solar panel applications to enhance the efficiency and self-cleaning properties of the solar panel surface from dirt and pollution is the key growth driver for the market in India.

| Country | China |

|---|---|

| Market Size (USD billion) by End of Forecast Period (2035) | USD 4.4 billion |

| CAGR % 2025 to End of Forecast (2035) | 6.8% |

China has the world’s largest plastic industry where transparent coatings are used to increase the strength, durability and antimicrobial activity of the plastics. With the growing production of plastics and bio-plastics in the country and rising demand for quality products from the end-users the market for transparent coatings in china is anticipated to grow at a considerable CAGR of 6.8% from 2025 to 2035 and reach a market size of USD 4.4 billion by the end of forecast period.

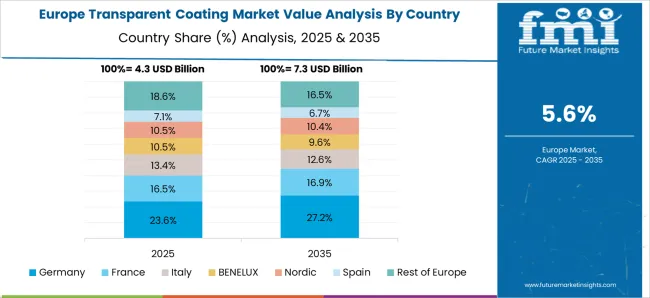

| Country | Germany |

|---|---|

| Market Size (USD billion) by End of Forecast Period (2035) | USD 3.1 billion |

| CAGR % 2025 to End of Forecast (2035) | 5.7% |

In the European region, Germany will be the key country to lead the expansion of transparent coating market. The country’s demand for transparent coating is expected to grow at 5.7% CAGR in terms of value to reach a market size of USD 3.1 billion by 2035. Steady growth among the end-use industries coupled with the introduction of advanced coating technologies will cater to the growth of the market.

| Country | Japan |

|---|---|

| Market Size (USD billion) by End of Forecast Period (2035) | USD 2.5 billion |

| CAGR % 2025 to End of Forecast (2035) | 5.9% |

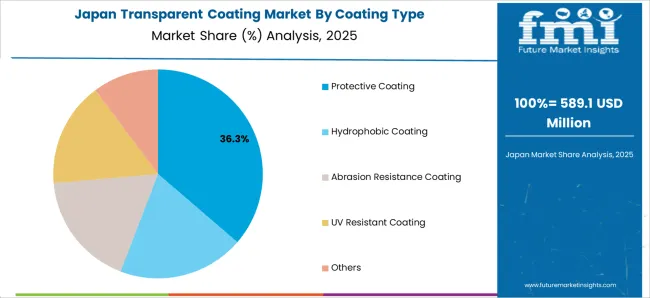

Japan is ranked second in the global optical industry. The country offers substantial growth potential in the optical coatings market, with transparent coatings projected to play a crucial role. By 2035, the country’s transparent coatings market is projected to worth more than USD 2.5 billion.

Based on the coating type, the protective coating segment dominates the market with more than 40% of the market share. These coatings are preferably applied on wood, glass, metal, and solar panels to protect the surface from environmental factors.

The main advantage of using protective coatings is that they not only shield the surface of the material they're applied to, but also maintain its appearance, preserving the aesthetic appeal of the product. For instance, coatings applied to wood or metal surfaces in the furniture industry protect the surface from wear and tear, corrosion, and degradation, while also enhancing their visual appeal. As a result, the demand for these coatings is expected to grow significantly in the coming years.

With a CAGR of more than 10%, the solar panel applications segment is anticipated to lead the market expansion of transparent coatings during the forecast period. Particularly, transparent self-cleaning coatings have gained significant traction from the solar panel application where these coatings are used to protect the surface from dirt and dust. These coatings reduce the excess efforts of brushing, blowing and washing the debris from the panel surface and improve their efficiency to produce electricity.

The global solar panel market is anticipated to grow at an 8.9% CAGR during the forecast period which will benefit the transparent coatings market all over the world.

The global transparent coatings market is fragmented in nature where a few leading players occupy less than 30% of the market share. In order to drive the market's expansion into new areas, leading manufacturers have embraced the important industry trend of investigating consumer product applications for transparent coatings.

Some manufacturers of transparent coatings are also offering user-friendly, ready-to-use products through e-commerce platforms, which helps them to reach a wider audience and educate their customers on innovative products.

Apart from this following strategies are adopted by the key market participants:

Product Innovation and Differentiation

Companies invest hugely in research and development to introduce innovative products that offer enhanced efficiency, reliability, sustainability, recyclability and cost-effectiveness. Product innovation enables companies to differentiate themselves from their competitors and cater to the evolving needs of customers.

In October 2025, In order to encourage the cyclical use of paper products, Shin-Etsu Chemical has created a transparent, water-resistant covering material.

Strategic Partnerships and Collaborations

Key players in the industry often form strategic partnerships and collaborations with other companies to leverage their strengths and expand their reach in the market. Such collaborations also allow companies to gain access to new technologies and markets.

Expansion into Emerging Markets

The Transparent Coating industry is witnessing significant growth in emerging markets such as India and Middle East. Key players are expanding their presence in these markets by establishing local manufacturing facilities and strengthening their distribution networks.

Mergers and Acquisitions

Key players in the Transparent Coating industry often engage in mergers and acquisitions to consolidate their market position, expand their product portfolio, and gain access to new markets.

In April 2025, Sherwin-Williams Company announced the acquisition of European Industrial Coatings business of Sika AG.

Key Players in the Market

The global transparent coating market is estimated to be valued at USD 18.8 billion in 2025.

The market size for the transparent coating market is projected to reach USD 34.3 billion by 2035.

The transparent coating market is expected to grow at a 6.2% CAGR between 2025 and 2035.

The key product types in transparent coating market are protective coating, hydrophobic coating, abrasion resistance coating, uv resistant coating and others.

In terms of application, wood segment to command 38.9% share in the transparent coating market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Transparent Barrier Laminators Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Transparent Paper Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Transparent Plastics Market Size and Share Forecast Outlook 2025 to 2035

Transparent Conductive Films Market Size and Share Forecast Outlook 2025 to 2035

Transparent Plastic Packaging Market Size and Share Forecast Outlook 2025 to 2035

Transparent Ceramics Market Size and Share Forecast Outlook 2025 to 2035

Transparent Display Market Size and Share Forecast Outlook 2025 to 2035

Transparent Digital Signage Market Analysis by Type, End Users and Region Through 2035

Multilayer Transparent Conductors Market Size and Share Forecast Outlook 2025 to 2035

UV-Blocking Transparent Film Market Size and Share Forecast Outlook 2025 to 2035

Coating Pretreatment Market Size and Share Forecast Outlook 2025 to 2035

Coating Resins Market Size and Share Forecast Outlook 2025 to 2035

Coating Auxiliaries Market Size and Share Forecast Outlook 2025 to 2035

Coatings and Application Technologies for Robotics Market Outlook – Trends & Innovations 2025-2035

Coating Additives Market Growth – Trends & Forecast 2025 to 2035

Coating Thickness Gauge Market

Coating Thickness Measurement Instruments Market

AR Coating Liquid Market Size and Share Forecast Outlook 2025 to 2035

UV Coatings Market Growth & Forecast 2025 to 2035

2K Coatings Market Growth – Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA