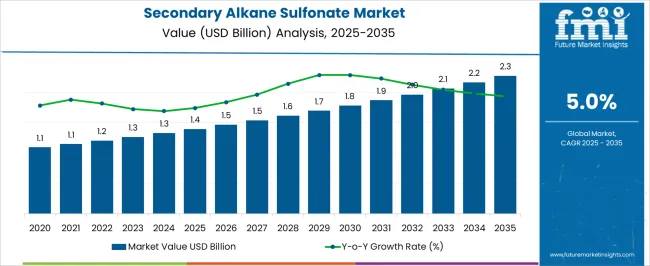

The secondary alkane sulfonate market is estimated to be valued at USD 1.4 billion in 2025 and is projected to reach USD 2.3 billion by 2035, registering a compound annual growth rate (CAGR) of 5.0% over the forecast period.

Market expansion is driven by increasing demand for surfactants in household cleaning, personal care, and industrial applications, where effective foaming, emulsifying, and wetting properties are critical. Rising consumer preference for biodegradable and eco-friendly detergents and cleaning agents is influencing product formulation trends and adoption rates across North America, Europe, and Asia-Pacific.

Dollar sales and share analyses indicate that household detergents and laundry care products account for a significant portion of revenue, while industrial cleaning and institutional applications are steadily growing. Regional growth is supported by expanding retail distribution networks, e-commerce penetration, and increasing awareness about hygiene and sanitation standards.

Manufacturers are focusing on product differentiation through high-efficiency formulations, compatibility with other surfactants, and multi-functional applications to capture larger market share. Research and development activities are enhancing solubility, foam stability, and environmental compliance, while partnerships with OEMs and chemical distributors help expand market reach. Overall, the market demonstrates consistent momentum fueled by consumer demand, regulatory compliance, and industrial adoption, ensuring sustainable growth over the forecast period.

| Metric | Value |

|---|---|

| Secondary Alkane Sulfonate Market Estimated Value in (2025 E) | USD 1.4 billion |

| Secondary Alkane Sulfonate Market Forecast Value in (2035 F) | USD 2.3 billion |

| Forecast CAGR (2025 to 2035) | 5.0% |

The secondary alkane sulfonate market is influenced by several interconnected parent markets, each contributing differently to overall demand and growth. The household cleaning and laundry care market holds the largest share at 35%, as consumers increasingly prefer surfactants that provide effective foaming, emulsifying, and stain-removal properties in detergents, dishwashing liquids, and laundry powders. The personal care and cosmetic market contributes 25%, where secondary alkane sulfonates are used in shampoos, body washes, and facial cleansers to enhance lather, mildness, and compatibility with other active ingredients. The industrial and institutional cleaning market accounts for 20%, with usage in large-scale cleaning solutions, floor care, and equipment sanitation across manufacturing plants, hotels, and hospitals. The textile, leather, and paper processing market holds 12%, driven by demand for surfactants that improve wetting, dispersion, and emulsification during production processes.

Finally, the chemical intermediates and formulation market represents 8%, using secondary alkane sulfonates as key components in emulsifiers, wetting agents, and specialty formulations. Collectively, household, personal care, and industrial cleaning segments account for 80% of overall demand, highlighting that consumer hygiene, fabric care, and commercial cleaning applications remain the primary growth drivers, while industrial processing and chemical formulation offer incremental opportunities for market expansion globally.

The secondary alkane sulfonate (SAS) market is experiencing steady growth, driven by rising demand for high-performance, biodegradable surfactants in household and industrial cleaning applications. Industry publications and chemical sector reports have emphasized the increasing shift towards environmentally sustainable cleaning agents, supported by regulatory pressures to reduce reliance on non-biodegradable detergents.

SAS is recognized for its strong detergency, excellent foaming, and stability across a wide pH range, making it a preferred choice in both concentrated and diluted formulations. Technological advancements in sulfonation processes have improved product consistency and cost efficiency, further strengthening its market presence.

Expanding urbanization and consumer spending on premium cleaning products have contributed to increased consumption in both developed and emerging markets. Additionally, global brands are incorporating SAS into their formulations to meet eco-label standards and consumer preferences for green cleaning products. Market growth is expected to be further supported by innovations in liquid and gel-based detergent formats, with dish washing liquids leading the application share due to their everyday household relevance and superior cleaning performance.

The secondary alkane sulfonate market is segmented by application, and geographic regions. By application, secondary alkane sulfonate market is divided into dish washing liquids, household detergents & cleaners, industrial cleaners, personal care products, and others. Regionally, the secondary alkane sulfonate industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The dish washing liquids segment is projected to account for 41.6% of the secondary alkane sulfonate market revenue in 2025, maintaining its position as the leading application area. This dominance has been driven by SAS’s ability to deliver high cleaning efficiency, grease removal, and consistent foaming, even in hard water conditions.

Formulators have favored SAS in dish washing liquids for its mildness to skin combined with strong cleaning action, meeting consumer expectations for both performance and safety. Additionally, the growing demand for eco-friendly and phosphate-free dishwashing products has supported SAS adoption, as it is readily biodegradable and aligns with sustainability goals.

Retail trends have shown increased sales of liquid dishwashing detergents across both mass-market and premium product categories, particularly in regions with high dishwashing frequency. The segment’s growth is also supported by expanding penetration of concentrated and refillable formats, which rely on SAS for maintaining performance in smaller dosage volumes. With ongoing consumer preference for effective, skin-safe, and environmentally responsible cleaning solutions, the dish washing liquids segment is expected to retain its market leadership.

Secondary alkane sulfonates see strong demand from household, personal care, and industrial cleaning segments. Industrial processing and formulation applications offer additional growth opportunities globally.

The secondary alkane sulfonate market is primarily driven by rising demand in household cleaning products, including laundry detergents, dishwashing liquids, and surface cleaners. Dollar sales and share analyses indicate that consumer preference for effective foaming, emulsification, and stain-removal properties has strengthened adoption. Growth is further supported by expanding retail distribution, e-commerce platforms, and brand penetration in both developed and emerging regions. Formulation improvements, such as concentrated liquids and powder blends, are enhancing performance and convenience. Consumer education regarding hygiene, cleaning efficiency, and compatibility with other cleaning agents has increased repeat usage. Household cleaning remains the largest revenue contributor, accounting for over one-third of the total market, with opportunities for cross-selling with other personal and industrial cleaning solutions.

Secondary alkane sulfonates are widely used in shampoos, body washes, facial cleansers, and other personal care formulations. Dollar sales and share indicate a growing demand for mild, high-foaming surfactants compatible with other ingredients and suitable for sensitive skin. Consumers increasingly prefer products that combine cleansing with moisturization and smooth texture, driving market penetration. Cosmetic and personal care manufacturers focus on enhanced solubility, stability, and compatibility, creating specialty formulations for different hair and skin types. Regional growth is led by North America and Asia-Pacific due to higher disposable incomes and brand awareness. The personal care segment contributes roughly one-quarter of market demand, reflecting the importance of secondary alkane sulfonates in daily hygiene routines and cosmetic formulations.

The industrial and institutional cleaning segment is steadily adopting secondary alkane sulfonates for large-scale cleaning, floor care, and equipment sanitation. Dollar sales and share analyses highlight usage in hospitals, hotels, manufacturing plants, and food-processing facilities. High-efficiency formulations that reduce water usage and provide enhanced wetting and emulsifying properties are in demand. Vendors are supplying concentrated liquids and bulk powders for commercial applications, supported by distribution partnerships and logistics networks. Compliance with regulatory standards and certifications is critical to ensure safety and reliability. Industrial and institutional cleaning accounts for roughly 20% of total demand, driven by hygiene standards, regulatory requirements, and operational efficiency needs across commercial and manufacturing sectors globally.

Secondary alkane sulfonates are used as emulsifiers, wetting agents, and intermediates in textile, leather, paper, and chemical processing. Dollar sales and share indicate steady adoption due to their ability to improve dispersion, wetting, and emulsification efficiency. Manufacturers leverage specialized blends to optimize production processes, reduce chemical usage, and maintain consistent product quality. Regional production hubs in Europe, Asia-Pacific, and North America are expanding capacity to meet demand from industrial processors. Formulators integrate secondary alkane sulfonates with other surfactants and additives to create customized solutions. While industrial processing represents a smaller portion of total market demand, approximately 20%, it provides incremental revenue opportunities and supports market diversification.

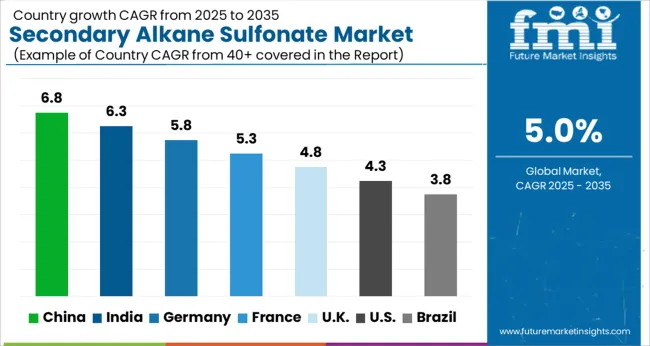

| Country | CAGR |

|---|---|

| China | 6.8% |

| India | 6.3% |

| Germany | 5.8% |

| France | 5.3% |

| U.K. | 4.8% |

| U.S. | 4.3% |

| Brazil | 3.8% |

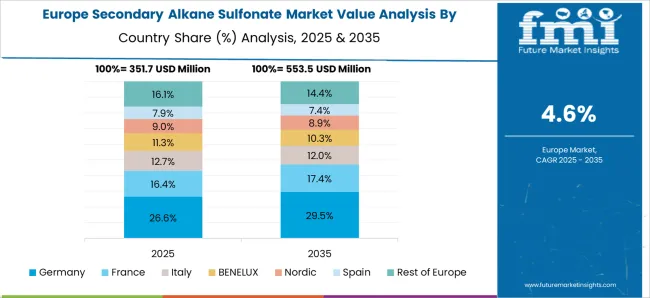

The global Secondary Alkane Sulfonate market is projected to grow at a CAGR of 5.0% from 2025 to 2035. China leads at 6.8%, followed by India at 6.3%, France at 5.3%, the U.K. at 4.8%, and the U.S. at 4.3%. Growth is driven by rising demand for surfactants in household cleaning, personal care, and industrial applications, where foaming, emulsification, and wetting properties are critical. Asia, particularly China and India, exhibits rapid expansion due to increasing consumer awareness, retail penetration, and industrial usage, while Europe emphasizes high-quality formulations, regulatory compliance, and industrial cleaning adoption. North America focuses on personal care, laundry care, and specialty industrial applications. Product differentiation, formulation variety, and strategic distribution networks enhance dollar sales and share, ensuring market penetration across diverse sectors. The analysis includes over 40+ countries, with the leading markets detailed above.

The secondary alkane sulfonate market in China is projected to grow at a CAGR of 6.8% from 2025 to 2035, driven by high consumption in household cleaning, personal care, and industrial applications. Rising consumer awareness about hygiene and cleaning efficiency has increased adoption of detergents, dishwashing liquids, and surface cleaners formulated with secondary alkane sulfonates. Industrial users in manufacturing plants, food processing, and hospitality sectors are increasingly utilizing these surfactants for high-efficiency cleaning solutions. Retail expansion, e-commerce penetration, and brand promotions further fuel growth. Manufacturers are introducing water-soluble, concentrated, and multi-functional formulations to enhance cleaning performance and reduce chemical usage. Government regulations emphasizing safe and effective cleaning products also support consistent market expansion.

The secondary alkane sulfonate market in India is expected to expand at a CAGR of 6.3% from 2025 to 2035. Household cleaning, laundry, and personal care segments drive most demand, with consumers favoring effective foaming, emulsification, and mild surfactants for everyday use. Industrial and institutional cleaning sectors, including hotels, hospitals, and factories, increasingly adopt concentrated and water-soluble formulations for efficiency and hygiene. Dollar sales and share indicate significant opportunities in tier-2 and tier-3 cities due to growing awareness of cleanliness and hygiene. Local manufacturers are innovating multi-functional, cost-effective solutions while international brands focus on premium products. Distribution through retail chains, modern trade, and online platforms accelerates adoption.

The secondary alkane sulfonate market in France is projected to grow at a CAGR of 5.3% from 2025 to 2035. Growth is fueled by the personal care, laundry, and industrial cleaning segments, with consumers emphasizing product mildness, biodegradability, and effectiveness. Industrial users, including food processing, textile, and manufacturing facilities, rely on these surfactants for wetting, emulsification, and cleaning efficiency. Dollar sales and share trends indicate premium household and cosmetic products contribute a substantial portion of revenue. Manufacturers are focusing on eco-friendly, high-performance formulations to meet regulatory requirements and consumer expectations. Strategic partnerships with distributors and retailers, combined with marketing campaigns highlighting product efficiency and safety, further boost adoption across urban and rural areas.

The secondary alkane sulfonate market in the U.K. is expected to grow at a CAGR of 4.8% from 2025 to 2035, driven by household cleaning, personal care, and industrial applications. Consumers favor high-foaming, multi-functional detergents, dishwashing liquids, and shampoos, supporting consistent market growth. Industrial and institutional sectors, including hotels, hospitals, and manufacturing units, increasingly adopt concentrated and water-soluble formulations for cleaning efficiency. Dollar sales and share highlight that personal care products and high-value detergents contribute significantly to revenue. Manufacturers emphasize quality, regulatory compliance, and environmentally compatible surfactants, while retail and online channels facilitate widespread accessibility. Educational campaigns and product demonstrations encourage adoption among both commercial and residential users.

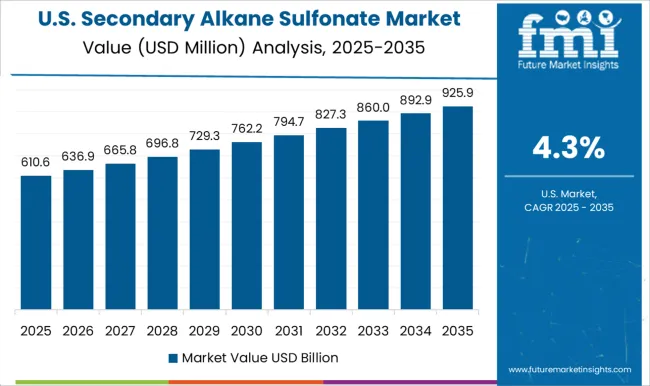

The secondary alkane sulfonate market in the U.S. is projected to grow at a CAGR of 4.3% from 2025 to 2035. Household detergents, laundry, dishwashing liquids, and personal care products constitute the majority of demand. Industrial cleaning in food processing, hospitality, and manufacturing sectors is steadily increasing, with concentrated and multi-functional formulations preferred. Dollar sales and share indicate high-value product segments, such as premium personal care and eco-friendly detergents, drive significant revenue. Manufacturers focus on R&D to improve solubility, foaming, and environmental compliance. Distribution through retail chains, specialty stores, and e-commerce platforms ensures wide accessibility. Awareness campaigns, demonstrations, and strategic partnerships reinforce market growth, particularly in urban and industrial regions.

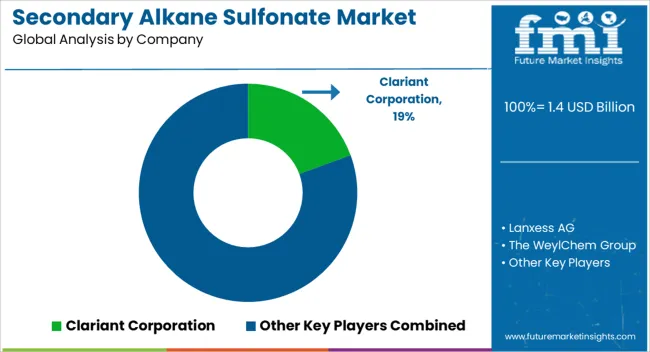

Competition in the Secondary Alkane Sulfonate market is defined by product quality, formulation versatility, and regional distribution capabilities. Clariant Corporation leads through specialty surfactants and high-performance alkane sulfonates optimized for household cleaning, personal care, and industrial applications. Lanxess AG competes with water-soluble, concentrated formulations emphasizing wetting, emulsification, and cleaning efficiency for institutional and industrial clients. The WeylChem Group differentiates through tailored solutions for textile, leather, and paper processing industries, focusing on improved dispersibility, solubility, and compliance with environmental regulations.

BIG SUN Chemical Corporation targets high-volume detergent and industrial cleaning applications, leveraging scalable production capacity and consistent product performance. Acar Chemicals and Rajvin Chemicals compete in niche segments, offering cost-effective formulations, regional distribution expertise, and customized surfactant blends for local markets. Strategies across all players emphasize product differentiation through multi-functional formulations, regulatory compliance, and technical advisory services. Partnerships with distributors, OEMs, and retailers ensure wide market penetration, while R&D investments enhance surfactant performance, compatibility, and eco-friendliness.

Companies also focus on marketing, field demonstrations, and product training programs to educate industrial and commercial users on effective application and handling. Product portfolios are presented with detailed specifications, including surfactant content, solubility, foaming capability, and compatibility with other ingredients. Packaging sizes, storage guidelines, and usage instructions are clearly defined to ensure optimal performance and ease of handling. Industrial and household applications are highlighted, covering laundry detergents, dishwashing liquids, floor cleaners, and personal care formulations. Safety certifications, environmental compliance, and quality standards are emphasized to establish credibility. Complementary services such as technical support, customized formulations, and pilot-scale trials further reinforce adoption, reflecting a market focused on efficiency, versatility, and consistent quality across diverse end-use sectors.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.4 billion |

| Application | Dish washing liquids, Household detergents & cleaners, Industrial cleaners, Personal care products, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Clariant Corporation, Lanxess AG, The WeylChem Group, BIG SUN Chemical Corporation, Acar Chemicals, and Rajvin Chemicals |

| Additional Attributes | Dollar sales, share by region and application, key competitors, formulation trends, adoption in household, personal care, industrial cleaning, distribution channels, regulatory requirements, and growth opportunities. |

The global secondary alkane sulfonate market is estimated to be valued at USD 1.4 billion in 2025.

The market size for the secondary alkane sulfonate market is projected to reach USD 2.3 billion by 2035.

The secondary alkane sulfonate market is expected to grow at a 5.0% CAGR between 2025 and 2035.

The key product types in secondary alkane sulfonate market are dish washing liquids, household detergents & cleaners, industrial cleaners, personal care products and others.

In terms of application, the dish washing liquids segment is set to command 41.6% share in the secondary alkane sulfonate market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Secondary Smelting and Alloying of Aluminium Market Size and Share Forecast Outlook 2025 to 2035

Secondary Myelofibrosis Therapeutics Market Size and Share Forecast Outlook 2025 to 2035

Secondary Containment Trays Market Size and Share Forecast Outlook 2025 to 2035

Agricultural Secondary Nutrients Market Size and Share Forecast Outlook 2025 to 2035

Pharmaceutical Secondary Packaging Market Size and Share Forecast Outlook 2025 to 2035

Industry Share & Competitive Positioning in Pharmaceutical Secondary Packaging

Medical Devices Secondary Packaging Market Analysis by Material and Application Through 2035

Sulfonated Melamine Formaldehyde Market

Lignosulfonates Market Size and Share Forecast Outlook 2025 to 2035

Calcium Sulfonate Market

Sodium Cumenesulfonate Market Size and Share Forecast Outlook 2025 to 2035

Alpha Olefin Sulfonates Market Growth - Trends & Forecast 2025 to 2035

Fatty Methyl Ester Sulfonate Market Size and Share Forecast Outlook 2025 to 2035

Linear Alkylbenzene Sulfonate (LAS) Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA