The lignosulfonates market is anticipated to expand from USD 1 billion in 2025 to USD 1.4 billion by 2035, reflecting a modest compound annual growth rate (CAGR) of 3.5% over the ten-year period. Growth is being driven as demand for versatile binders, dispersants, and chemical additives is being recognized across construction, cement, and agricultural applications.

Market adoption is being influenced by the ability of lignosulfonates to improve workability, reduce water usage, and enhance performance in formulations. Product applications are being diversified, and manufacturing processes are being adjusted to maintain consistent quality and support wider industrial integration. Over the 2025–2035 period, the lignosulfonates market is being shaped by steady demand in key end-use industries, with applications being expanded in concrete admixtures, animal feed, and drilling fluids. Price competitiveness and supply chain reliability are being emphasized to strengthen market penetration.

The market is being positioned as a necessary component for efficiency improvements across multiple sectors, while operational performance and product consistency are being prioritized. Distribution networks are being optimized to meet evolving industry needs, and market growth is being reinforced by end-users seeking dependable and multifunctional chemical solutions.

| Metric | Value |

|---|---|

| Lignosulfonates Market Estimated Value in (2025 E) | USD 1.0 billion |

| Lignosulfonates Market Forecast Value in (2035 F) | USD 1.4 billion |

| Forecast CAGR (2025 to 2035) | 3.5% |

The lignosulfonates market has established a substantial presence across its parent industries, driven by its multifunctional properties that enhance performance, cost-efficiency, and process optimization in diverse applications. Within the adhesives and binders market, lignosulfonates account for approximately a 15–18% share, as they are widely used in particleboards, plywood, and composite materials to improve bonding and reduce reliance on synthetic resins.

In the animal feed additives market, the segment contributes around a 12–14% share, with lignosulfonates functioning as pellet binders, chelating agents, and nutritional supplements to improve feed quality and digestibility. Within the concrete admixtures market, lignosulfonates hold nearly 20–22% share, reflecting their use as water-reducing agents, dispersants, and plasticizers that optimize workability and strength in cement and concrete formulations. In the pulp and paper chemicals market, lignosulfonates represent about a 10–12% share, where they serve as dispersants, deinking agents, and retention aids, enhancing production efficiency and paper quality. Within the industrial chemicals market, lignosulfonates account for a roughly 8–10% share, due to their application in dust control, drilling fluids, and metal processing.

While challenges such as raw material price fluctuations and competition from synthetic alternatives exist, the market remains resilient, with its adoption reinforced by performance reliability, versatility, and industrial integration. Lignosulfonates have evolved from a by-product to a critical component across multiple sectors, shaping functional performance in construction, agriculture, and chemical processes while sustaining their relevance in industrial applications.

The lignosulfonates market is progressing steadily, supported by their wide-ranging applications across construction, oil and gas, agriculture, and animal feed industries. Demand growth is being reinforced by infrastructure development projects, advancements in oil drilling technologies, and rising agricultural productivity needs.

Derived as a by-product of the sulfite pulping process, lignosulfonates have gained prominence for their dispersing, binding, and emulsifying properties. Industry reports and company disclosures have emphasized their increasing use in environmentally sustainable formulations, given their biodegradable and non-toxic nature.

Additionally, ongoing research into lignosulfonate-based value-added products has expanded their commercial potential. The market outlook remains optimistic, with heightened investments in industrial-grade lignosulfonates and a strong push toward eco-friendly additives in various end-use sectors.

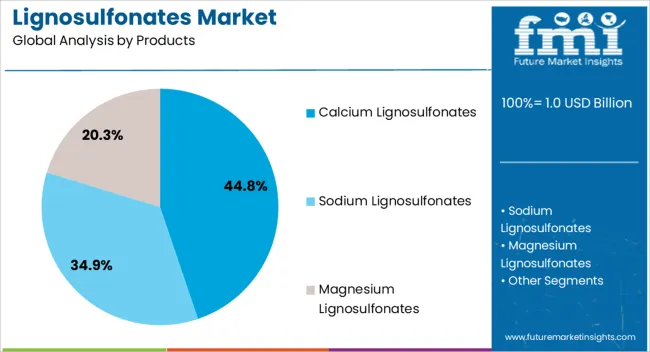

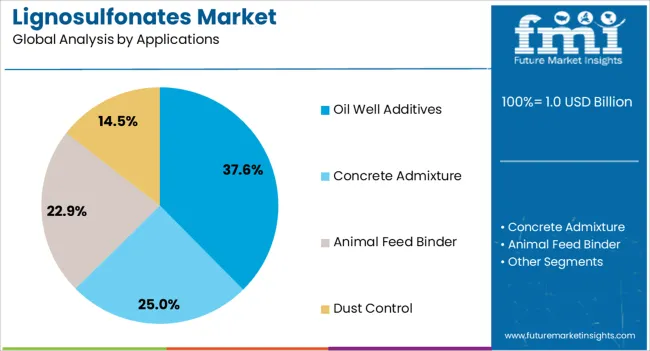

The lignosulfonates market is segmented by products, applications, and geographic regions. By products, lignosulfonates market is divided into Calcium Lignosulfonates, Sodium Lignosulfonates, and Magnesium Lignosulfonates. In terms of applications, lignosulfonates market is classified into Oil Well Additives, Concrete Admixture, Animal Feed Binder, and Dust Control. Regionally, the lignosulfonates industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The Calcium Lignosulfonates segment is projected to account for 44.8% of the lignosulfonates market revenue in 2025, positioning it as the leading product category. This dominance has been driven by its versatile functional properties, including superior water reduction, binding strength, and dispersibility, which have made it a preferred choice in construction, ceramics, and animal feed applications.

In the oil and gas sector, calcium lignosulfonates have been widely used in drilling fluids to control viscosity and enhance mud properties. Manufacturers have increasingly optimized production processes to improve quality consistency, further reinforcing their market share.

The segment’s growth has also benefited from its cost-effectiveness compared to synthetic alternatives, making it attractive for large-scale industrial operations. With infrastructure growth and agricultural sector expansion driving higher consumption, the Calcium Lignosulfonates segment is expected to maintain its strong market position.

The Oil Well Additives segment is projected to capture 37.6% of the lignosulfonates market revenue in 2025, securing its role as the top application area. The increased exploration and production activities in both onshore and offshore oilfields have fueled growth in this segment.

Lignosulfonates have proven highly effective in drilling fluids, where they help manage viscosity, stabilize boreholes, and reduce filtration losses under high-pressure conditions. Their ability to perform reliably in varying geological formations has reinforced their preference among oilfield service providers.

Additionally, the shift toward sustainable drilling practices has encouraged the use of lignosulfonates as an eco-friendly additive, replacing certain petroleum-derived chemicals. With ongoing investments in deepwater and unconventional oil exploration, demand from this segment is anticipated to remain strong, further cementing the role of lignosulfonates in modern oilfield operations.

The lignosulfonates market is growing due to rising demand in construction, cement, and specialty industrial applications. Opportunities exist in agriculture, drilling, and chemical processing, while trends emphasize biorefinery-derived and specialty formulations. Challenges include raw material volatility, regulatory compliance, and competition from synthetic alternatives. Overall, the market outlook remains favorable as manufacturers focus on high-performance, eco-compliant, and application-specific lignosulfonate solutions to meet diverse industrial and agricultural needs globally.

The lignosulfonates market is experiencing growing demand due to their widespread use as dispersants and water-reducing agents in cement, concrete, and construction applications. Their ability to improve workability, reduce water usage, and enhance strength properties makes them essential in modern construction practices. Increasing infrastructure development, urban expansion, and government investment in housing and commercial projects are driving consumption. Manufacturers are also exploring customized formulations for high-performance concrete and specialty construction materials, positioning lignosulfonates as a critical additive in enhancing productivity, cost-efficiency, and sustainability in the construction sector.

Significant opportunities are emerging in agriculture, where lignosulfonates are utilized as soil conditioners, chelating agents, and fertilizer carriers. Additionally, industrial applications such as animal feed binders, drilling fluids, and metal processing chemicals present untapped potential. Rising demand for eco-friendly and multi-functional additives in emerging markets creates avenues for product innovation. Companies offering application-specific, high-purity, and environmentally compliant lignosulfonates can capture growth in these sectors. Collaborations with agricultural and industrial end-users facilitate better market penetration, helping expand the reach of lignosulfonates across diverse applications beyond traditional construction use.

A notable trend in the market is the production of lignosulfonates from biorefinery and wood-processing by-products, aligning with the circular economy approach. Specialty grades with tailored molecular weights, solubility, and functional properties are being developed to meet specific industrial requirements. Innovations in formulation techniques improve dispersion, compatibility, and performance across applications like concrete admixtures and soil enhancement. These trends reflect a growing focus on performance optimization, eco-conscious sourcing, and process efficiency, enabling manufacturers to address diverse industrial needs while enhancing product functionality and value across construction, agricultural, and chemical sectors.

The market faces challenges due to fluctuations in raw material availability and cost, particularly in wood pulp and sulfite liquor supplies. Variations in quality and composition can impact product consistency, affecting performance in end-use applications. Additionally, regulatory compliance regarding chemical additives, environmental standards, and waste management introduces complexity for manufacturers. Competition from alternative dispersants and synthetic additives may also constrain growth. Addressing these challenges requires investment in stable sourcing, quality control, and R&D to develop reliable, compliant, and high-performance lignosulfonate products for a range of industrial and agricultural applications.

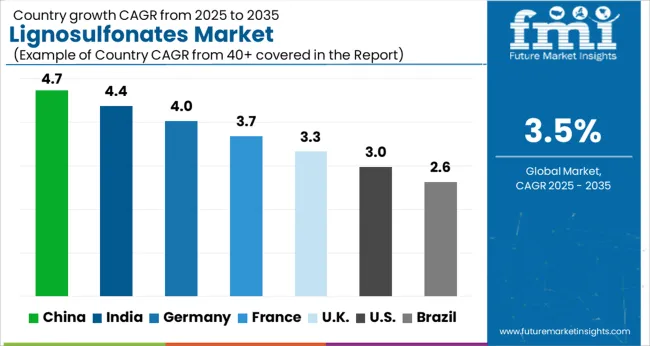

| Country | CAGR |

|---|---|

| China | 4.7% |

| India | 4.4% |

| Germany | 4.0% |

| France | 3.7% |

| UK | 3.3% |

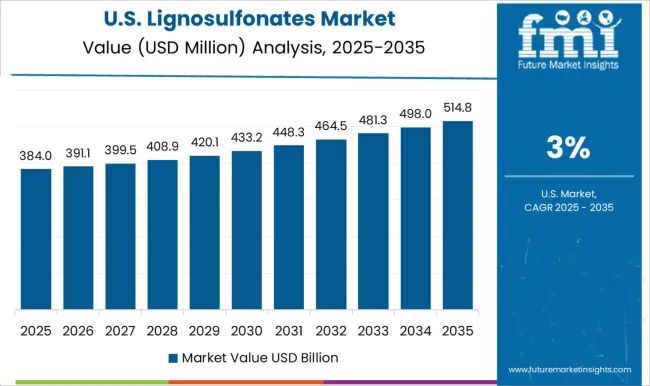

| USA | 3.0% |

| Brazil | 2.6% |

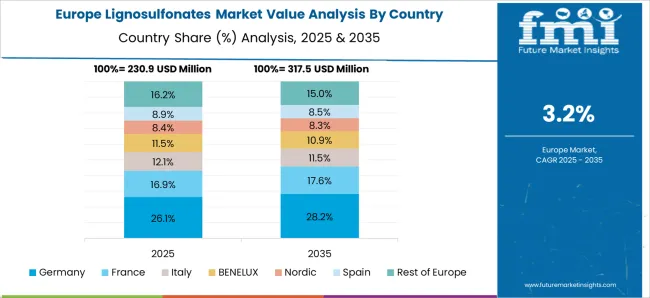

The global lignosulfonates market is projected to grow at a CAGR of 3.5% from 2025 to 2035. China leads with a growth rate of 4.7%, followed by India at 4.4% and Germany at 4%. The United Kingdom records a growth rate of 3.3%, while the United States shows the slowest growth at 3%. Expansion is driven by increasing use in construction, animal feed, adhesives, and concrete admixtures. Emerging markets such as China and India experience higher growth due to rising industrial activity, infrastructure development, and growing demand for bio-based additives. Developed economies like Germany, the UK, and the USA maintain steady growth supported by regulatory frameworks, focus on efficiency in industrial applications, and integration of lignosulfonates in diverse sectors. This report includes insights on 40+ countries; the top markets are shown here for reference.

The lignosulfonates market in China is projected to grow at a CAGR of 4.7%. Demand is primarily driven by extensive use in concrete admixtures, construction chemicals, and animal feed applications. Rapid urbanization and infrastructure development have increased the requirement for high-performance additives, supporting market growth. Adoption in adhesives, drilling fluids, and specialty chemicals is also expanding steadily. Local manufacturers are investing in production capacity and high-quality lignosulfonates to meet industrial demand. Government initiatives promoting bio-based chemicals further enhance market adoption.

The lignosulfonates market in India is expected to grow at a CAGR of 4.4%. Demand is fueled by increasing use in construction, cement additives, and drilling applications. The growing industrial sector and rapid infrastructure expansion create strong opportunities for lignosulfonates. Manufacturers are focusing on improving product quality and meeting international standards to cater to the domestic market. Additionally, rising adoption in animal feed, adhesives, and specialty chemical applications accelerates market growth. Awareness campaigns and government incentives for bio-based products further support adoption.

The lignosulfonates market in Germany is projected to grow at a CAGR of 4%. Demand is supported by established construction, chemical, and animal feed industries. Adoption in concrete admixtures and specialty chemicals is steadily increasing. Manufacturers focus on high-quality and environmentally compliant lignosulfonates to meet regulatory standards. The growing emphasis on eco-friendly additives and efficient industrial processes supports market expansion. Research initiatives and collaborations with chemical companies ensure product innovation and consistent adoption across various industrial applications.

The lignosulfonates market in the United Kingdom is expected to grow at a CAGR of 3.3%. Growth is driven by adoption in construction chemicals, animal feed, and adhesives. Manufacturers focus on providing high-quality, standardized lignosulfonates to meet industrial requirements. Increasing awareness of eco-friendly and bio-based chemicals encourages steady adoption. Integration into cement and concrete applications continues to support demand. Industrial partnerships and product development initiatives further enhance market penetration in the UK

The lignosulfonates market in the United States is projected to grow at a CAGR of 3%. Demand is fueled by use in concrete admixtures, adhesives, and animal feed. Manufacturers emphasize high-quality, environmentally compliant lignosulfonates for industrial applications. Adoption is supported by awareness of bio-based and sustainable chemical solutions. Expanding use in construction, drilling fluids, and specialty chemicals continues to drive market growth. Additionally, research programs and collaborations with chemical companies enhance product performance and adoption.

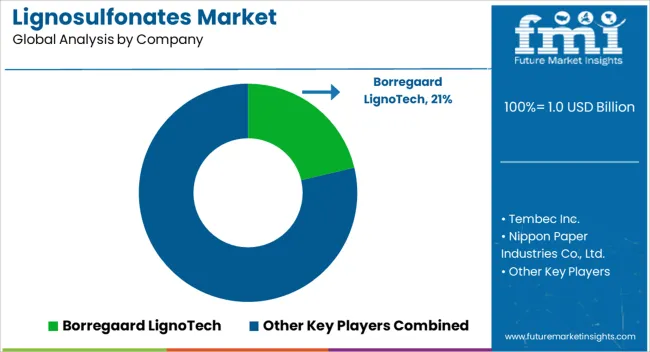

The lignosulfonates market is shaped by specialty chemical and pulp industry suppliers competing on purity, molecular weight control, and application versatility. Borregaard LignoTech, Tembec Inc., and Nippon Paper Industries lead with brochures emphasizing high-quality lignosulfonates for dispersants, binders, and concrete admixtures. Marketing materials highlight consistent solubility, thermal stability, and compatibility with diverse industrial formulations. Burgo Group S.p.A. and Domsjö Fabriker AB differentiate through tailored grades for adhesives, animal feed, and dust control applications, with brochures showcasing performance in cement, drilling, and agrochemical sectors. Brochures serve as a key tool for communicating operational reliability, regulatory compliance, and technical support, helping buyers assess suitability for specific industrial processes.

Regional players such as Qingdao New World Material Co. Ltd focus on cost-effective supply and localized product customization. Brochures emphasize ease of integration, uniform particle size, and environmental compliance, targeting manufacturers across construction, chemical, and feed industries. Competitive strategies are shaped by product consistency, application-specific performance, and supply chain reliability. Across the market, brochure-driven narratives are central to differentiating suppliers, conveying credibility, and reinforcing trust.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.0 Billion |

| Products | Calcium Lignosulfonates, Sodium Lignosulfonates, and Magnesium Lignosulfonates |

| Applications | Oil Well Additives, Concrete Admixture, Animal Feed Binder, and Dust Control |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Borregaard LignoTech, Tembec Inc., Nippon Paper Industries Co., Ltd., Burgo Group S.p.A., Domsjö Fabriker AB, and Qingdao New World Material Co. Ltd |

| Additional Attributes | Dollar sales by product type (calcium, sodium, magnesium lignosulfonates) and application (concrete admixtures, animal feed, dust control, oil drilling) are key metrics. Trends include rising demand for construction and industrial applications, growth in eco-friendly additives, and increasing adoption in drilling and agricultural operations. Regional adoption, technological advancements, and regulatory compliance are driving market growth. |

The global lignosulfonates market is estimated to be valued at USD 1.0 billion in 2025.

The market size for the lignosulfonates market is projected to reach USD 1.4 billion by 2035.

The lignosulfonates market is expected to grow at a 3.5% CAGR between 2025 and 2035.

The key product types in lignosulfonates market are calcium lignosulfonates, sodium lignosulfonates and magnesium lignosulfonates.

In terms of applications, oil well additives segment to command 37.6% share in the lignosulfonates market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA