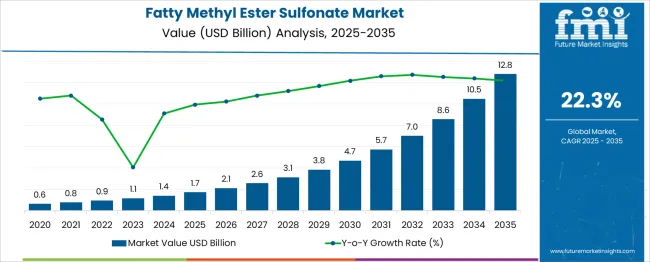

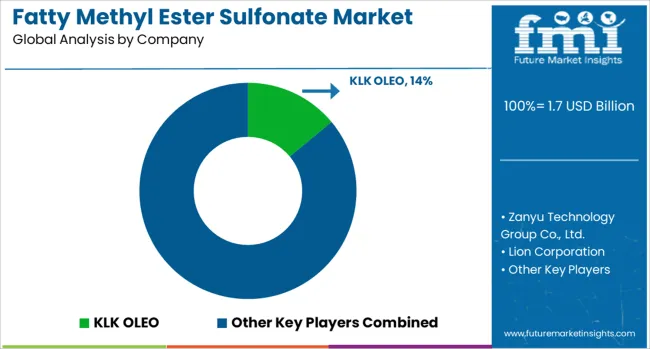

The global fatty methyl ester sulfonate market is likely to grow from USD 1.7 billion in 2025 to approximately USD 12.8 billion by 2035, recording an absolute increase of USD 11.09 billion over the forecast period. This translates into a total growth of 648.5%, with the market forecast to expand at a compound annual growth rate (CAGR) of 22.3% between 2025 and 2035. Market size is expected to grow by nearly 7.5X during the same period, supported by the rising adoption of eco-efficient surfactants and increasing demand for biodegradable cleaning products across various industrial and consumer applications.

Between 2025 and 2030, the fatty methyl ester sulfonate market is projected to expand from USD 1.7 billion to USD 4.7 billion, resulting in a value increase of USD 3.8 billion, which represents 28% of the total forecast growth for the decade. This phase of growth will be shaped by rising demand for eco-friendly surfactants in household cleaning products, increasing penetration of eco-efficient ingredients in personal care formulations, and growing consumer awareness about environmental impact of chemical products. Manufacturers are expanding their production capabilities to address the growing complexity of modern surfactant requirements.

From 2030 to 2035, the market is forecast to grow from USD 4.7 billion to USD 12.8 billion, adding another USD 8 billion, which constitutes 72.3% of the overall ten-year expansion. This period is expected to be characterized by widespread adoption of fatty methyl ester sulfonate in industrial cleaning applications, integration of advanced production technologies, and development of specialized formulations for diverse end-use applications. The growing emphasis on eco-efficient manufacturing practices will drive demand for more sophisticated fatty methyl ester sulfonate products and specialized technical expertise.

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 1.7 billion |

| Forecast Value in (2035F) | USD 12.8 billion |

| Forecast CAGR (2025 to 2035) | 22% |

Market expansion is being supported by the rapid increase in environmental regulations promoting biodegradable surfactants and the corresponding need for eco-efficient alternatives to conventional synthetic detergents. Modern cleaning formulations rely on fatty methyl ester sulfonate for superior cleaning performance while maintaining environmental compatibility. The growing complexity of cleaning requirements and increasing eco-efficiency concerns are driving demand for professional grade fatty methyl ester sulfonate from certified manufacturers with appropriate quality standards.

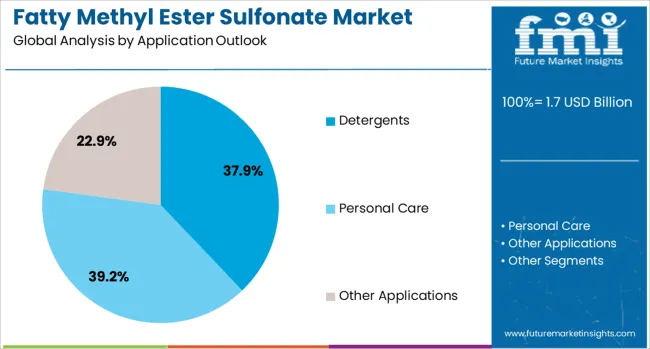

The market is segmented by application, region. By application, the market is divided into detergents, personal care, and other applications. Regionally, the market is divided into North America, Europe, East Asia, South Asia & Pacific, Latin America, and Middle East & Africa.

Detergents are projected to account for 39.2% of the fatty methyl ester sulfonate market in 2025. This leading share is supported by the widespread adoption of fatty methyl ester sulfonate in household and industrial cleaning products, which represent the majority of current surfactant applications. Detergent formulations provide superior cleaning performance using specialized fatty methyl ester sulfonate compounds. The segment benefits from established manufacturing processes and comprehensive supply chain networks from multiple suppliers.

The fatty methyl ester sulfonate market is advancing rapidly due to increasing environmental awareness and growing recognition of eco-efficient surfactant benefits. However, the market faces challenges including higher production costs compared to conventional surfactants, need for specialized manufacturing equipment, and varying quality standards across different regions. Standardization efforts and certification programs continue to influence product quality and market development patterns.

The growing deployment of fatty methyl ester sulfonate in eco-friendly cleaning products is enabling development of high-performance formulations with reduced environmental impact. These products provide superior cleaning action while maintaining biodegradability and reduced aquatic toxicity. Eco-efficient formulations are particularly valuable for institutional and industrial customers that require effective cleaning performance without environmental compromise.

Modern fatty methyl ester sulfonate manufacturers are incorporating advanced production technologies that improve efficiency and reduce manufacturing costs. Integration of continuous processing systems and automated quality control enables more consistent product specifications and comprehensive batch documentation. Advanced manufacturing also supports production of specialized fatty methyl ester sulfonate grades for specific applications.

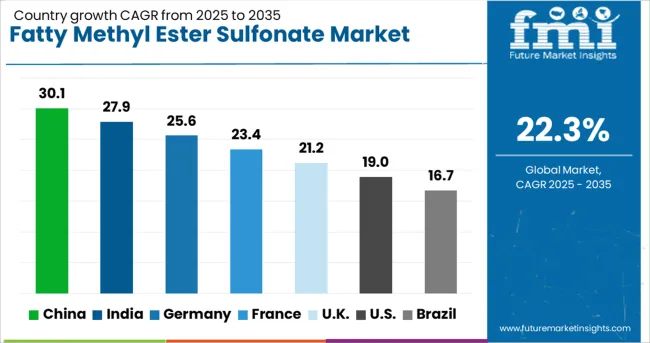

| Country | CAGR (2025 to 2035) |

|---|---|

| China | 30.1% |

| India | 27.9% |

| Germany | 25.6% |

| France | 23.4% |

| United Kingdom | 21.2% |

| United States | 19% |

| Brazil | 16.7% |

The fatty methyl ester sulfonate market demonstrates robust growth across major economies, with China leading at a 30.1% CAGR through 2035, driven by massive industrial expansion and increasing environmental regulations. India follows at 27.9%, supported by growing consumer goods manufacturing and rising awareness of eco-efficient ingredients. Germany records 25.6% growth, emphasizing quality standards and technical innovation. France shows 23.4% expansion, driven by consumer preference for eco-friendly products. The United Kingdom demonstrates 21.2% growth, focusing on regulatory compliance and eco-efficient formulations. The United States records 19.0% growth, supported by established manufacturing infrastructure, while Brazil grows at 16.7% with developing industrial applications.

The report covers an in-depth analysis of 40+ countries; seven top-performing countries are highlighted below.

Revenue from fatty methyl ester sulfonate in China is projected to exhibit the highest growth rate with a CAGR of 30.1% through 2035, driven by massive expansion of cleaning product manufacturing and increasing adoption of eco-efficient surfactants. The country's growing consumer goods industry and expanding industrial cleaning sector are creating significant demand for fatty methyl ester sulfonate products. Major chemical manufacturers and detergent producers are establishing comprehensive production facilities to support the growing population of environmentally conscious consumers.

Government environmental protection regulations are mandating adoption of biodegradable surfactants in cleaning products, driving demand for certified fatty methyl ester sulfonate suppliers throughout major manufacturing regions. Industrial modernization programs are supporting development of advanced production facilities and quality control systems that enhance manufacturing capability across chemical processing networks.

Revenue from fatty methyl ester sulfonate in India is expanding at a CAGR of 27.9%, supported by increasing production of household cleaning products and growing awareness of eco-efficient surfactant benefits. The country's expanding middle class and increasing consumer spending on cleaning products are driving demand for high-quality fatty methyl ester sulfonate formulations. Manufacturing facilities and chemical suppliers are gradually establishing capabilities to serve the growing population of quality-conscious consumers.

Consumer goods industry growth and premium product adoption are creating opportunities for specialized fatty methyl ester sulfonate suppliers that can support diverse formulation requirements. Professional manufacturing and quality certification programs are developing technical expertise among producers, enabling comprehensive fatty methyl ester sulfonate supply chains that meet international standards.

Demand for fatty methyl ester sulfonate in Germany is projected to grow at a CAGR of 25.6%, supported by the country's emphasis on chemical innovation and precision manufacturing. German chemical manufacturers are implementing comprehensive fatty methyl ester sulfonate production capabilities that meet stringent quality standards and environmental regulations. The market is characterized by focus on technical excellence, advanced process optimization, and compliance with comprehensive chemical safety requirements.

Chemical industry investments are prioritizing advanced fatty methyl ester sulfonate production technologies that demonstrate superior performance and reliability while meeting German quality standards. Professional certification programs are ensuring comprehensive technical expertise among manufacturers, enabling specialized fatty methyl ester sulfonate products that support diverse industrial applications.

Demand for fatty methyl ester sulfonate in France is expanding at a CAGR of 23.4%, driven by strong consumer preference for eco-friendly cleaning products and comprehensive environmental regulations. French consumer goods manufacturers are incorporating fatty methyl ester sulfonate into premium cleaning formulations that meet demanding performance standards. The market benefits from established distribution networks and consumer awareness of eco-efficient product benefits.

Consumer goods industry development is facilitating adoption of advanced fatty methyl ester sulfonate formulations that provide superior cleaning performance while maintaining environmental compatibility. Professional quality standards are ensuring comprehensive technical capabilities among suppliers, enabling specialized fatty methyl ester sulfonate products that meet evolving consumer preferences.

Demand for fatty methyl ester sulfonate in the United Kingdom is projected to grow at a CAGR of 21.2%, supported by stringent environmental regulations and established cleaning product manufacturers. British consumer goods companies are implementing comprehensive fatty methyl ester sulfonate formulations to meet regulatory requirements and consumer expectations. The market is characterized by focus on eco-efficiency, product safety, and compliance with comprehensive chemical regulations.

Consumer goods industry investments are enabling standardized fatty methyl ester sulfonate applications across multiple product categories, providing consistent quality and comprehensive coverage throughout retail markets. Professional development programs are ensuring specialized technical expertise among manufacturers, enabling comprehensive fatty methyl ester sulfonate capabilities supporting evolving regulatory requirements.

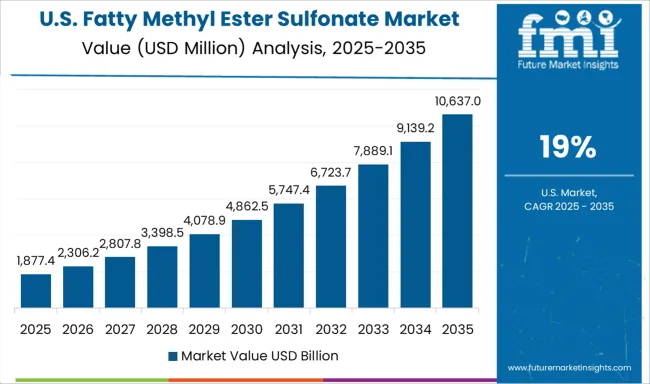

Demand for fatty methyl ester sulfonate in the United States is expanding at a CAGR of 19%, driven by established chemical manufacturing infrastructure and growing consumer awareness of eco-efficient products. American cleaning product manufacturers are establishing comprehensive fatty methyl ester sulfonate supply chains to serve diverse customer needs. The market benefits from advanced logistics networks and comprehensive distribution systems throughout regional markets.

Chemical industry consolidation is enabling standardized fatty methyl ester sulfonate production across multiple facilities, providing consistent service quality and comprehensive coverage throughout domestic markets. Professional training programs are developing specialized technical expertise among manufacturers, enabling comprehensive fatty methyl ester sulfonate capabilities supporting evolving market requirements.

Revenue from fatty methyl ester sulfonate in Brazil is growing at a CAGR of 16.7%, driven by expanding industrial cleaning applications and increasing adoption of eco-efficient surfactants. The country's established chemical industry is gradually integrating fatty methyl ester sulfonate production to serve growing domestic demand. Industrial facilities and chemical suppliers are investing in production capabilities to address evolving market requirements.

Industrial development programs are facilitating adoption of advanced fatty methyl ester sulfonate technologies that support comprehensive cleaning applications across manufacturing and institutional sectors. Professional service development initiatives are enhancing technical capabilities among producers, enabling specialized fatty methyl ester sulfonate products that meet evolving industrial requirements.

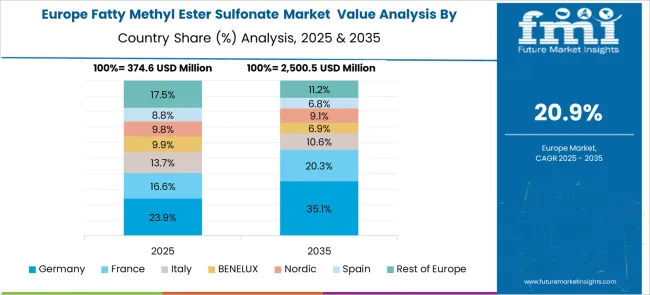

The fatty methyl ester sulfonate market in Europe is projected to grow steadily across major countries, with Germany leading the regional market development. The United Kingdom maintains strong demand for fatty methyl ester sulfonate products, supported by established cleaning product manufacturers and stringent environmental regulations. France demonstrates consistent growth in eco-efficient surfactant adoption, driven by consumer preference for eco-friendly products and regulatory support for biodegradable ingredients.

Germany is expected to maintain its leadership position in European fatty methyl ester sulfonate consumption, supported by its advanced chemical manufacturing infrastructure and strong export market for cleaning products. The country benefits from comprehensive research and development capabilities and established supply chain networks serving both domestic and international markets.

The fatty methyl ester sulfonate market is defined by competition among chemical manufacturers, surfactant suppliers, and specialty ingredient companies. Companies are investing in advanced production technologies, eco-efficient manufacturing processes, standardized quality systems, and technical expertise to deliver high-performance, reliable, and cost-effective fatty methyl ester sulfonate solutions. Strategic partnerships, technological innovation, and geographic expansion are central to strengthening product portfolios and market presence.

KLK OLEO, Malaysia-based, offers comprehensive fatty methyl ester sulfonate products with focus on eco-efficient production and technical expertise. Zanyu Technology Group Co., Ltd., China, provides specialized fatty methyl ester sulfonate solutions integrated with advanced manufacturing capabilities. Lion Corporation, Japan, delivers technologically advanced fatty methyl ester sulfonate products with standardized quality procedures. Chemithon Corporation, United States, emphasizes process technology and production expertise for fatty methyl ester sulfonate manufacturing. FENCHEM provides specialized fatty methyl ester sulfonate ingredients with focus on application development. Emery Oleochemicals offers comprehensive oleochemical solutions including fatty methyl ester sulfonate products. Wilmar International Ltd, KPL International Limited, Procter & Gamble, Stepan Company, Henan Jiahe Biotechnology Co.,Ltd., Shaoxing Zhenggang Chemical Co.,Ltd, and Surface Chemical Industry Co. Ltd offer specialized fatty methyl ester sulfonate expertise, standardized manufacturing processes, and reliable supply capabilities across global and regional networks.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.7 billion |

| Application | Detergents, personal care, and other applications |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, India, Brazil, Australia and 40+ countries |

| Key Companies Profiled | KLK OLEO, Zanyu Technology Group Co., Ltd., Lion Corporation, Chemithon Corporation, FENCHEM, Emery Oleochemicals, Wilmar International Ltd, KPL International Limited, Procter & Gamble, Stepan Company, Henan Jiahe Biotechnology Co.,Ltd., Shaoxing Zhenggang Chemical Co.,Ltd, Surface Chemical Industry Co. Ltd. |

| Additional Attributes | Dollar sales by application, regional demand trends across North America, Europe, and Asia-Pacific, competitive landscape with established manufacturers and emerging suppliers, production capabilities for eco-efficient versus conventional surfactants, integration with advanced manufacturing technologies and automated quality control systems, innovations in biodegradable surfactant formulations and specialized application development, and adoption of eco-efficient production solutions with environmental compliance and technical performance optimization for enhanced industrial applications. |

The global fatty methyl ester sulfonate market is estimated to be valued at USD 1.7 billion in 2025.

The market size for the fatty methyl ester sulfonate market is projected to reach USD 12.8 billion by 2035.

The fatty methyl ester sulfonate market is expected to grow at a 22.3% CAGR between 2025 and 2035.

The key product types in fatty methyl ester sulfonate market are detergents, personal care and other applications.

In terms of application, the personal care segment is set to command 39.2% share in the fatty methyl ester sulfonate market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Fatty Acids Market Size and Share Forecast Outlook 2025 to 2035

Fatty Acid Supplements Market Size and Share Forecast Outlook 2025 to 2035

Fatty Amine Market Analysis by Product Type, End Use, and Region Forecast Through 2035

Fatty Liver Treatment Market - Trends & Forecast 2025 to 2035

Fatty Esters Market Growth - Trends & Forecast 2025 to 2035

Tallow Fatty Acids Market Size and Share Forecast Outlook 2025 to 2035

Coconut Fatty Acids Market

Tall Oil Fatty Acid Market Size and Share Forecast Outlook 2025 to 2035

Rice Bran Fatty Alcohols Market Size and Share Forecast Outlook 2025 to 2035

Essential Fatty Acids Market Size and Share Forecast Outlook 2025 to 2035

Fractionated Fatty Acid Market Size, Growth, and Forecast for 2025 to 2035

Polyunsaturated Fatty Acids Market Trends 2025 to 2035

Naturally Derived Fatty Alcohol Market Size and Share Forecast Outlook 2025 to 2035

Bio-Inspired Omega Fatty Acids Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Polyglycerol Esters Of Fatty Acids Market

Propane-1,2-Diol Esters of Fatty Acid Market Analysis by Toppings, Processed Meat, Confectionery, Soft and Fizzy Drinks and others Through 2035

Palm Kernel Oil and Coconut Oil Based Natural Fatty Acids Market Size and Share Forecast Outlook 2025 to 2035

Lactic Acid Esters Of Mono And Diglycerides Of Fatty Acids Market

Mixed Acetic and Tartaric Acid Esters of Mono and Diglycerides of Fatty Acids Market

Methylparaben Market Forecast and Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA