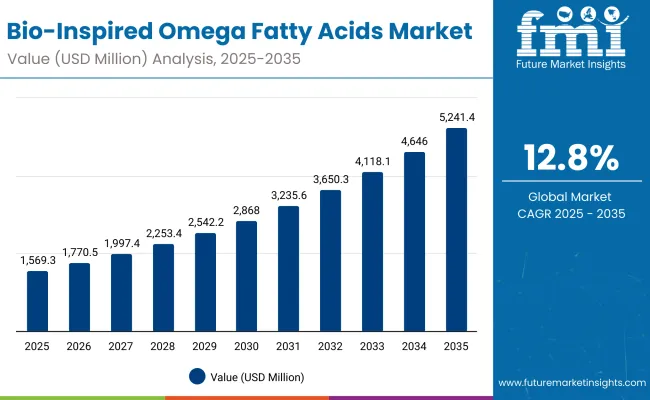

The Bio-Inspired Omega Fatty Acids Market is expected to record a valuation of USD 1,569.3 million in 2025 and USD 5,241.4 million in 2035, with an increase of USD 3,672.1 million, which equals a growth of 193% over the decade. The overall expansion represents a CAGR of 12.8% and nearly a 3.3X increase in market size.

Bio-Inspired Omega Fatty Acids Market Key Takeaways

| Metric | Value |

|---|---|

| Bio-Inspired Omega Fatty Acids Market Estimated Value in (2025E) | USD 1,569.3 million |

| Bio-Inspired Omega Fatty Acids Market Forecast Value in (2035F) | USD 5,241.4 million |

| Forecast CAGR (2025 to 2035) | 12.8% |

During the first five-year period from 2025 to 2030, the market increases from USD 1,569.3 million to USD 2,868.0 million, adding USD 1,298.7 million, which accounts for 35% of the total decade growth. This phase records steady adoption in anti-pollution shield formulations, SPF-included moisturizers, and dermatologist-tested innovations, driven by the need for skin defense against blue light and UV damage. Moisturizers with SPF dominate this period, contributing nearly half of revenues.

The second half from 2030 to 2035 contributes USD 2,373.4 million, equal to 65% of total growth, as the market jumps from USD 2,868.0 million to USD 5,241.4 million. This acceleration is powered by clean-label, vegan-certified innovations, and AI-personalized skincare systems that embed bio-inspired omega fatty acids into multi-functional products. Premium beauty retail and e-commerce drive sales momentum, while Asia-Pacific markets (China and India) show exceptional growth. The competitive landscape shifts as software-led personalization platforms and subscription-based skincare solutions expand recurring revenue opportunities.

From 2020 to 2024, the Bio-Inspired Omega Fatty Acids Market expanded steadily, supported by rising adoption of SPF-included and anti-pollution formulations. Competitive dominance during this period came from multinational cosmetic giants who controlled nearly all revenues, emphasizing dermatological efficacy, premium positioning, and functional claims like blue-light protection. Digital-first entrants had limited traction, while service-led personalization models contributed less than 10% of market value.

By 2025, demand will rise to USD 1,569.3 million, and the revenue mix will pivot towards clean-label, dermatologist-tested, and AI-driven skincare personalization platforms. Traditional leaders are pivoting toward hybrid models combining bio-inspired actives with digital skincare ecosystems, while emerging players focus on subscription-based solutions, AR/VR-enabled try-ons, and eco-certified formulations. The basis of competition is shifting from raw ingredient efficacy to ecosystem strength, consumer trust, and recurring service models.

The market is expanding due to the heightened consumer focus on blue-light defense and anti-pollution skincare. Urban populations are experiencing unprecedented exposure to digital screens and airborne pollutants, creating skin barrier damage and oxidative stress. Bio-inspired omega fatty acids are being integrated into SPF-included moisturizers and serums that combine hydration with protective functions. This dual utility is enabling brands to position their offerings as next-generation shield formulations, ensuring high adoption across premium beauty and dermatology-driven segments.

Another growth driver is the strong consumer shift toward clean-label, vegan, and dermatologist-tested claims. Unlike generic oils, bio-inspired omega fatty acids are engineered for biocompatibility and targeted skin barrier repair, making them more suitable for sensitive skin users. Brands are increasingly investing in clinical validation and transparent ingredient sourcing, which resonates with regulatory trends and consumer trust requirements. This claim-driven positioning is giving the category a competitive edge, especially across pharmacies, dermatology clinics, and e-commerce platforms where clinical credibility drives higher conversion rates.

The Bio-Inspired Omega Fatty Acids Market is segmented by photoreactive system, function, product type, channel, claim, and geography, reflecting its diverse application potential across skincare and wellness. Photoreactive systems include photolyase complexes, photochromic polymer shields, light-activated microcapsules, and blue-light reactive antioxidants, each contributing to enhanced skin defense. By function, key segments comprise anti-pollution shield, blue-light/IR defense, detox & decongestion, and repair & barrier support, addressing consumer needs linked to environmental and digital stressors.

Product types range from moisturizers with SPF, serums, mists/essences, and primers, which align with daily skincare routines. Distribution channels include pharmacies, e-commerce, premium beauty retail, and dermatology clinics, ensuring broad accessibility. Claims such as SPF-included, blue-light protection, clean-label, and dermatologist-tested are pivotal in differentiating offerings and building consumer trust. Geographically, the market spans North America, Europe, East Asia, South Asia & Pacific, Latin America, and the Middle East & Africa, with Asia-Pacific emerging as the most dynamic growth hub.

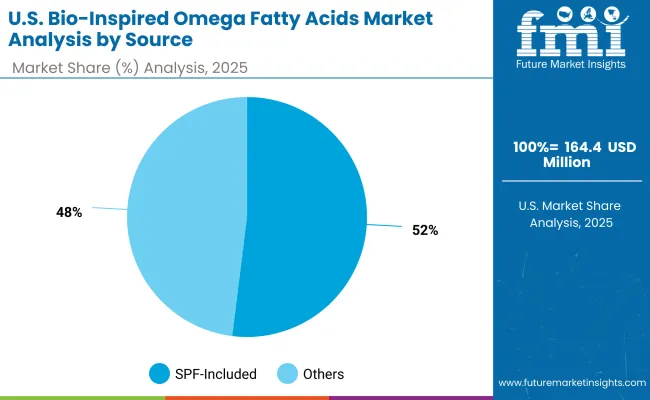

| Source | Value Share% 2025 |

|---|---|

| SPF-included | 52% |

| Others | 48.0% |

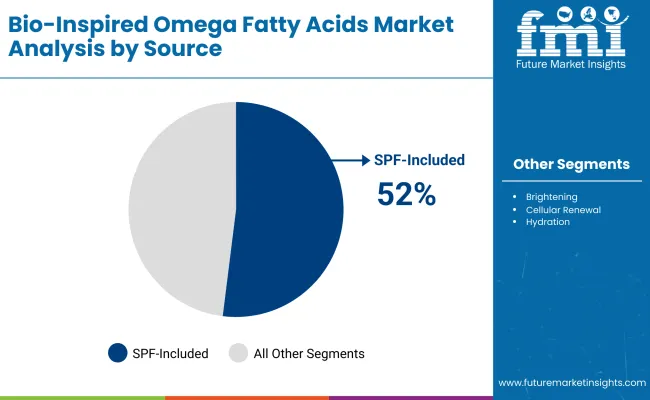

The SPF-included segment is projected to contribute 52% of the Bio-Inspired Omega Fatty Acids Market revenue in 2025, maintaining its position as the dominant source category. This leadership is driven by increasing consumer preference for multifunctional formulations that combine moisturization with UV protection, addressing both skincare efficacy and preventive health needs. The integration of SPF within omega fatty acid products enhances their appeal in daily routines, particularly in markets with high UV exposure.

The segment’s expansion is further fueled by rising demand for clean-label, photoreactive solutions that balance environmental protection with skin-barrier strengthening. As lifestyle-driven sun damage awareness increases, brands are embedding SPF-included claims as a core differentiator. By aligning with dermatologist-tested and clinical-grade certifications, SPF-included products are expected to retain their dominance and remain the backbone of Bio-Inspired Omega Fatty Acids innovation.

| Function | Value Share% 2025 |

|---|---|

| Anti-pollution shield | 55% |

| Others | 45.0% |

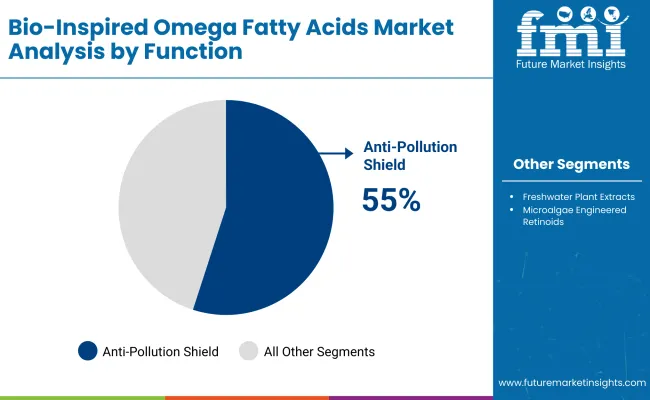

The anti-pollution shield segment is forecasted to hold 55% of the Bio-Inspired Omega Fatty Acids Market revenue in 2025, emerging as the leading functional benefit. Its dominance is linked to growing urban concerns over particulate matter, blue-light exposure, and oxidative stress, where bio-inspired fatty acid formulations provide a protective barrier for skin health. Consumers increasingly seek multifunctional products that not only hydrate but also shield against environmental aggressors, making this segment highly relevant.

The growth of this category is further strengthened by innovations that combine omega fatty acids with antioxidants and SPF filters, enhancing product claims of defense against pollution and UV/IR rays. Premium skincare and dermatology-driven lines are positioning anti-pollution formulations as daily essentials in both emerging and mature markets. As awareness of urban skin challenges continues to rise, anti-pollution shield applications are expected to maintain their lead in driving demand.

| Product Type | Value Share% 2025 |

|---|---|

| Moisturizers with SPF | 49% |

| Others | 51.0% |

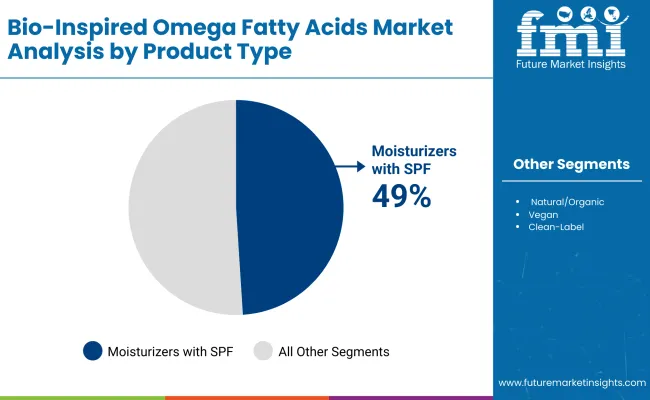

The moisturizers with SPF segment is projected to account for 49% of the Bio-Inspired Omega Fatty Acids Market revenue in 2025, highlighting its strong consumer preference as a multifunctional product. This category leads because it merges hydration, photoprotection, and anti-pollution benefits into a single application, addressing multiple urban skincare concerns at once. Consumers are increasingly demanding convenient yet effective solutions, and SPF-infused moisturizers fit this growing lifestyle-driven trend.

The segment’s adoption is further bolstered by clinical-grade claims and dermatologist endorsements, particularly in urban centers where UV exposure and pollution levels are high. Product innovations combining omega fatty acids with blue-light and IR defense capabilities are reinforcing consumer trust. Given its versatility and broad appeal across both mass and premium channels, moisturizers with SPF are expected to remain a cornerstone of product development and market expansion in this category.

Rising Demand for Blue-Light & Pollution Protection

The market is witnessing strong growth due to rising consumer awareness about blue-light damage and urban pollution. Bio-inspired omega fatty acids, when combined with SPF and antioxidant formulations, provide dual protection both barrier strengthening and environmental defense. This unique positioning makes them highly relevant for city-dwelling consumers, particularly in Asia-Pacific. As digital screen exposure rises and air quality deteriorates, such multifunctional formulations are becoming essentials rather than luxuries, thereby accelerating market adoption across skincare categories.

Innovation in Photoreactive Delivery Systems

The adoption of photolyase complexes and photochromic polymer shields is driving demand, as these delivery systems enhance the stability and targeted release of omega fatty acids. Such technologies allow products to activate under light exposure, maximizing efficacy and reducing product degradation. These innovations appeal to both consumers and formulators by ensuring higher performance and longer shelf life. Their growing integration into moisturizers, serums, and mists reflects the industry’s pivot toward science-backed, functional beauty solutions, solidifying consumer trust and brand differentiation.

High R&D and Production Complexity

One major restraint for the Bio-Inspired Omega Fatty Acids Market is the high cost of R&D and complex production processes required for photoreactive systems. Advanced encapsulation, light-triggered release, and clinical-grade testing make development both capital- and time-intensive. Smaller brands often struggle to compete due to these entry barriers, limiting innovation diversity. Additionally, stringent cosmetic regulations in regions like Europe add compliance costs. This combination of scientific and regulatory challenges can slow down commercialization timelines and restrict widespread market penetration.

Shift Toward Clean-Label and Dermatologist-Tested Claims

A key trend shaping the market is the rising demand for clean-label and dermatologist-tested claims. Consumers are increasingly skeptical of synthetic additives, favoring formulations that combine natural omega fatty acids with scientific validation. Brands responding with transparent labeling and clinical endorsements are building stronger consumer loyalty. This trend is particularly strong in premium beauty retail and dermatology clinics, where credibility is paramount. The fusion of natural positioning with dermatologist trust signals marks the next wave of growth in functional skincare innovation.

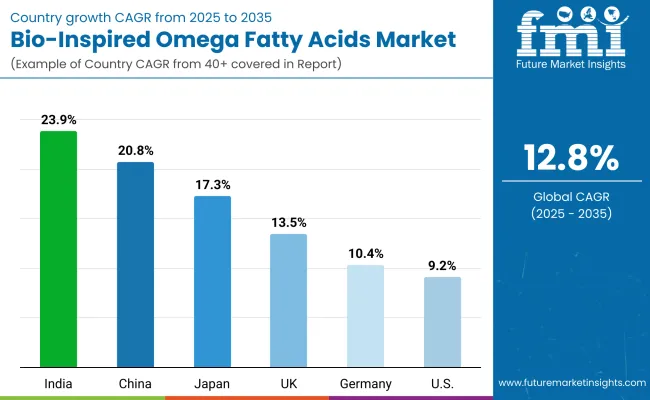

| Countries | Estimated CAGR (2025 to 2035) |

|---|---|

| China | 20.8% |

| USA | 9.2% |

| India | 23.9% |

| UK | 13.5% |

| Germany | 10.4% |

| Japan | 17.3% |

The global Bio-Inspired Omega Fatty Acids Market shows a pronounced regional disparity in adoption speed, strongly influenced by consumer wellness awareness, functional skincare demand, and regulatory frameworks. Asia-Pacific emerges as the fastest-growing region, anchored by China at 20.8% CAGR and India at 23.9% CAGR. This acceleration is driven by large-scale investment in SPF-included formulations, blue-light/IR defense, and government-backed clean-label initiatives. China’s regulatory framework promoting skin barrier health and multifunctional skincare further accelerates adoption, while India’s trajectory reflects growing middle-class consumption and MSME-led product innovation.

Europe maintains a strong growth profile, led by Germany at 10.4% CAGR and the UK at 13.5% CAGR, supported by stringent EU compliance on natural/organic claims and sustainability reporting. High penetration of dermo-cosmetics and heritage brands integrating bio-inspired actives keep Europe competitive in functional skincare. Japan drives significant expansion at 17.3% CAGR, fueled by consumer preference for advanced delivery systems such as photolyase complexes and blue-light reactive antioxidants.

North America shows moderate expansion, with the USA at 9.2% CAGR, reflecting maturity in premium skincare and slower penetration of new claims compared to Asia. Growth is primarily service-driven through dermatology clinics, AR/VR-enabled beauty retail, and clinical-grade claims rather than mass hardware adoption.

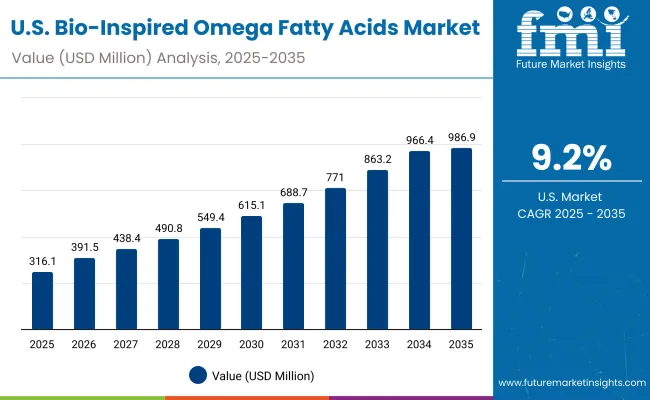

| Year | USA Bio-Inspired Omega Fatty Acids Market (USD Million) |

|---|---|

| 2025 | 316.15 |

| 2026 | 391.58 |

| 2027 | 438.40 |

| 2028 | 490.81 |

| 2029 | 549.49 |

| 2030 | 615.19 |

| 2031 | 688.74 |

| 2032 | 771.08 |

| 2033 | 863.27 |

| 2034 | 966.48 |

| 2035 | 986.94 |

The Bio-Inspired Omega Fatty Acids Market in the United States is projected to grow from USD 316.15 million in 2025 to nearly USD 986.94 million by 2035, reflecting robust expansion over the decade. This trajectory indicates a compound annual growth rate (CAGR) of ~12.0%, fueled by premium skincare innovation, dermatologist-driven adoption, and rising consumer preference for multifunctional products with SPF, blue-light protection, and clean-label claims.

Growth is reinforced by clinical integration of omega-based formulations into dermatology practices and functional beauty lines. High demand for moisturizers with SPF and serums has supported consistent year-on-year increases, while new product launches are creating opportunities across pharmacies, e-commerce, and premium beauty retail. USA consumers’ focus on barrier repair and anti-pollution claims aligns with the broader clean beauty and wellness trend, further enhancing revenue streams.

The Bio-Inspired Omega Fatty Acids Market in the United Kingdom is forecast to grow at a CAGR of 13.5% from 2025 to 2035, driven by increasing adoption in advanced skincare, wellness, and clinical-grade cosmetic applications. Brands are leveraging bio-inspired formulations to address blue-light defense, anti-pollution protection, and barrier repair, which align with consumer preferences for multifunctional and dermatologist-tested products. The rising emphasis on natural/organic and clean-label claims is also strengthening consumer confidence, particularly in premium beauty retail and dermatology clinics.

Government-backed research programs, combined with academic collaborations, are spurring innovation in next-generation omega fatty acid formulations. Retail adoption is expanding, with e-commerce and specialty stores integrating digital wellness platforms, offering personalized recommendations for barrier support and hydration needs. This momentum positions the UK as a key hub in Europe for sustainable, high-performance beauty and skincare innovation.

India is projected to expand at a 23.9% CAGR through 2035, the fastest among major markets. This growth is driven by tier-2 and tier-3 city adoption, where affordability and local product innovation are enabling broader access. Demand is particularly strong for multifunctional products with SPF-included and blue-light protection benefits, aligning with rising consumer awareness of pollution defense and urban skincare needs.

The country’s booming MSME sector is driving cost-sensitive innovation in formulations and packaging, making bio-inspired omega fatty acids accessible beyond premium channels. Educational and vocational institutions are also fostering awareness by integrating nutricosmetics and bio-actives into training programs, preparing a skilled workforce for the domestic beauty and wellness industry. Additionally, cultural heritage and wellness positioning resonate with India’s consumers, supporting the rise of natural, clean-label, and Ayurvedic-aligned claims within this segment.

The Bio-Inspired Omega Fatty Acids Market in China is forecasted to expand at a 20.8% CAGR between 2025 and 2035, the fastest among global leaders. This rapid momentum stems from strong government-backed digitization programs and rising consumer adoption of SPF-included and anti-pollution shield formulations, reflecting the country’s focus on urban wellness. Affordable innovations by domestic brands are making these products highly accessible across mass retail and e-commerce platforms, enabling deeper penetration beyond tier-1 cities.

Industrial adoption mirrors this consumer demand, with electronics and automotive manufacturers leveraging bio-inspired fatty acid systems to enhance product resilience against environmental stressors. Municipal governments are also deploying blue-light and IR defense applications in healthcare and wellness initiatives. With China’s role as a global manufacturing hub, competitive pricing and high-volume production further accelerate scaling. These dynamics position China not just as a demand hotspot but also as a key global supplier of bio-inspired omega fatty acid technologies.

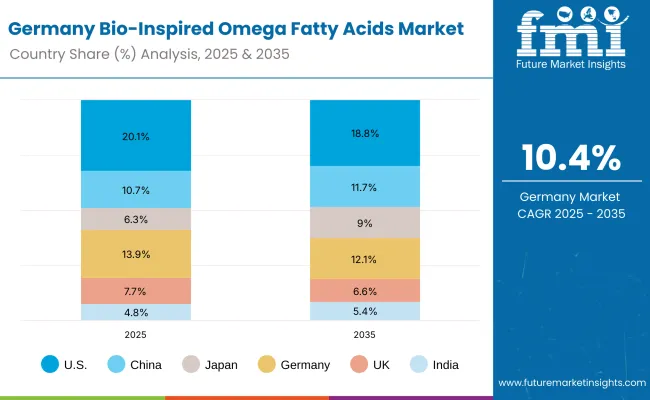

| Countries | 2025 Share (%) |

|---|---|

| USA | 20.1% |

| China | 10.7% |

| Japan | 6.3% |

| Germany | 13.9% |

| UK | 7.7% |

| India | 4.8% |

| Countries | 2035 Share (%) |

|---|---|

| USA | 18.8% |

| China | 11.7% |

| Japan | 9.0% |

| Germany | 12.1% |

| UK | 6.6% |

| India | 5.4% |

The Bio-Inspired Omega Fatty Acids Market in Germany is projected to grow at a 10.4% CAGR between 2025 and 2035, reinforcing the country’s position as a leader in advanced formulations and dermatological applications. Germany’s prominence is tied to its cosmetic innovation ecosystem, where research-driven companies integrate omega fatty acids into skin-barrier strengthening and anti-pollution skincare products. With 2025 accounting for 13.9% global market share and moderating to 12.1% by 2035, Germany remains a pivotal hub, albeit with slower relative expansion compared to Asia-Pacific.

German manufacturers are increasingly adopting synthetic and engineered bio-inspired fatty acids to meet EU sustainability and safety regulations, enabling long-term alignment with clean-label and dermatologist-tested claims. Additionally, partnerships with local biotech firms and dermatology clinics are driving tailored formulations that address sensitive skin relief and blue-light defense, resonating with rising consumer wellness demands. While competition intensifies, Germany’s regulatory rigor and high-quality standards ensure sustained leadership in premium product categories.

| USA by Source | Value Share% 2025 |

|---|---|

| SPF-included | 52% |

| Others | 48.0% |

The Bio-Inspired Omega Fatty Acids Market in the USA is forecast to expand steadily at a 9.2% CAGR from 2025 to 2035. In 2025, the market is driven by SPF-included formulations, which account for 52% share, reflecting heightened consumer demand for multifunctional skincare products that combine sun defense with lipid barrier strengthening. These products are increasingly featured in moisturizers and serums, targeting urban consumers exposed to UV and digital blue-light stressors.

The growing focus on dermatologist-tested and clinically validated claims is strengthening trust and boosting adoption across pharmacies and dermatology clinics. Parallelly, rising investments by American cosmetic brands in bio-engineered omega fatty acids ensure compliance with FDA safety standards while addressing the surge in clean-label demand. Looking ahead, the USA market will retain its importance by anchoring global premium skincare innovation and acting as an export hub for advanced phospholipid-based formulations.

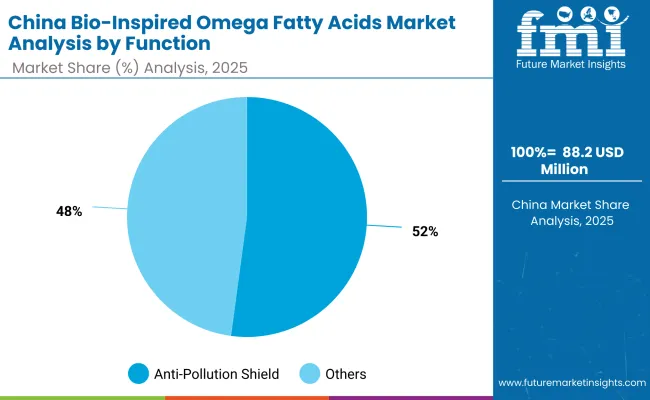

| China by Function | Value Share% 2025 |

|---|---|

| Anti-pollution shield | 52% |

| Others | 47.7% |

The Bio-Inspired Omega Fatty Acids Market in China is set to benefit strongly from rising consumer awareness of urban air pollution and blue-light skin damage, making the anti-pollution shield function dominant at 52% share in 2025. This segment reflects the lifestyle-driven demand from younger, urban populations who face high exposure to particulate matter and digital radiation. Domestic brands are innovating by embedding photoreactive complexes and SPF-included fatty acids into mainstream skincare, creating cost-accessible yet scientifically backed formulations.

This dynamic positions China as a regional hub for multifunctional, pollution-defense skincare, with opportunities expanding into premium retail and pharmacy-based distribution. Cross-sector collaboration between biotech suppliers and cosmetic majors further enhances market penetration. As bio-inspired technologies gain traction, the anti-pollution shield will remain the central pillar of China’s market expansion.

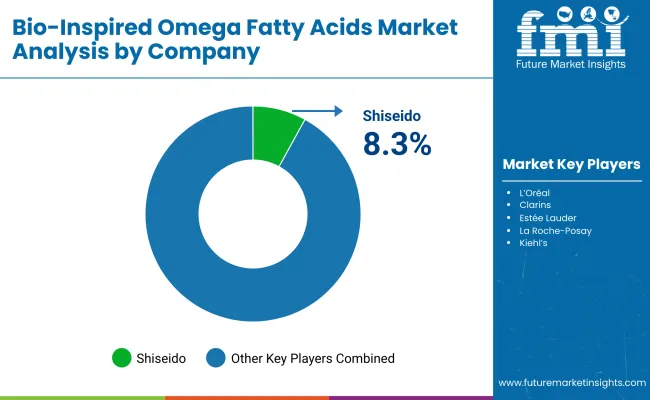

The Bio-Inspired Omega Fatty Acids Market is moderately fragmented, with global cosmetic leaders, mid-sized innovators, and specialized biotech companies competing across diverse functional categories. Multinational players such as Shiseido, L’Oréal, and Estée Lauder command significant visibility through their extensive R&D pipelines, global distribution reach, and integration of bio-inspired actives into skincare lines. Their strategies increasingly emphasize SPF-included formulations, blue-light protection, and multifunctional claims, aligning with consumer demand for defense against modern environmental stressors.

Mid-sized innovators like Clarins, La Roche-Posay, and Murad focus on niche segments, bringing dermatologist-tested and clean-label offerings to premium beauty and pharmacy channels. These companies leverage partnerships with biotech firms to co-develop light-activated or photoreactive fatty acid systems tailored for sensitive skin and anti-pollution defense. Specialized entrants such as Supergoop! and Dr. Jart+ differentiate through format innovation (mists, essences, primers) and direct-to-consumer models, often backed by strong digital engagement strategies. Their strength lies in customization, regional adaptability, and brand positioning rather than global scale.

Overall, competitive differentiation is shifting from traditional moisturizing benefits toward ecosystem-driven portfolios that combine SPF inclusion, blue-light protection, and clean-label claims. Leaders are investing in sustainability, biotech partnerships, and AR/VR beauty-tech integration to capture the next phase of growth.

Key Developments in Bio-Inspired Omega Fatty Acids Market

| Item | Value |

|---|---|

| Quantitative Units | USD 1,569.3 Million |

| Photoreactive System | Photolyase complexes, Photochromic polymer shields, Light-activated microcapsules, Blue-light reactive antioxidants |

| Function | Anti-pollution shield, Blue-light/IR defense, Detox & decongestion, Repair & barrier support |

| Product Type | Moisturizers with SPF, Serums, Mists/essences, Primers |

| Channel | Pharmacies, E-commerce, Premium beauty retail, Dermatology clinics |

| Claim | SPF-included, Blue-light protection, Clean-label, Dermatologist-tested |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Shiseido, L’Oréal, Clarins, Estée Lauder, La Roche- Posay, Kiehl’s, Olay, Murad, Supergoop !, Dr. Jart + |

| Additional Attributes | Dollar sales by photoreactive system and function, adoption trends across moisturizers with SPF and anti-pollution shield formulations, rising demand for multifunctional skincare combining blue-light/IR defense with barrier repair, sector-specific growth in premium beauty retail, dermatology clinics, and e-commerce platforms, revenue segmentation between SPF-included and clean-label claims, integration of bio-inspired actives with AI-driven skin analysis apps and AR-based virtual try-ons, regional trends shaped by stricter sun-care and anti-pollution regulations, and innovations in photolyase complexes, photochromic polymer shields, and light-activated microcapsules. |

The global Bio-Inspired Omega Fatty Acids Market is estimated to be valued at USD 1,569.3 million in 2025.

The market size for the Bio-Inspired Omega Fatty Acids Market is projected to reach USD 5,241.4 million by 2035.

The Bio-Inspired Omega Fatty Acids Market is expected to grow at a 12.8% CAGR between 2025 and 2035.

The key product types in the Bio-Inspired Omega Fatty Acids Market are moisturizers with SPF, serums, mists/essences, and primers.

In terms of functional segmentation, anti-pollution shield formulations are projected to command a significant share of the Bio-Inspired Omega Fatty Acids Market in 2025, accounting for 55% of value share.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Omega-3 Concentrates Market Size and Share Forecast Outlook 2025 to 2035

Omega-6 Market Size and Share Forecast Outlook 2025 to 2035

Omega-9 Market Size and Share Forecast Outlook 2025 to 2035

Omega-3 in Animal Feed Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Omega 3 Prescription Drugs Market Size and Share Forecast Outlook 2025 to 2035

Omega-3 Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Market Outlook of Omega-3 Pet Supplement by Pet, Type, Form, Application and Other Types Through 2035

Omega 3 Ingredients Market Trends - Health Benefits & Demand 2024 to 2034

Cytomegalovirus Treatment Market Size and Share Forecast Outlook 2025 to 2035

UK Omega 3 Market Analysis – Size, Demand & Forecast 2025-2035

USA Omega 3 Market Insights – Growth, Trends & Industry Outlook 2025-2035

USA Omega-3 Concentrates Market Report – Trends, Demand & Outlook 2025-2035

Algae Omega Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Evaluating Algae Omega Market Share & Key Manufacturers

ASEAN Omega 3 Market Growth - Demand, Innovations & Forecast 2025 to 2035

Europe Omega-3 Concentrates Market Insights – Growth, Demand & Forecast 2025-2035

Europe Omega 3 Market Trends – Size, Share & Forecast 2025-2035

EPA DHA Omega 3 Ingredients Market Size and Share Forecast Outlook 2025 to 2035

UK Algae Omega Market Analysis – Demand, Growth & Forecast 2025-2035

Australia Omega-3 Market Insights – Size, Share & Industry Trends 2025-2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA