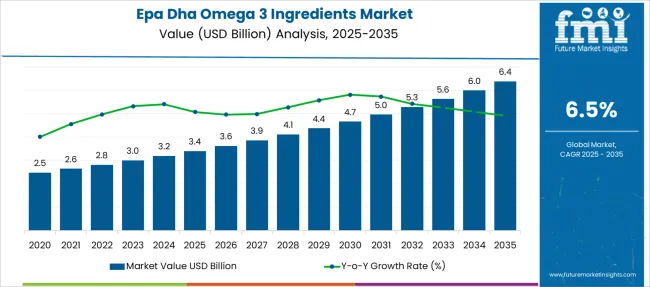

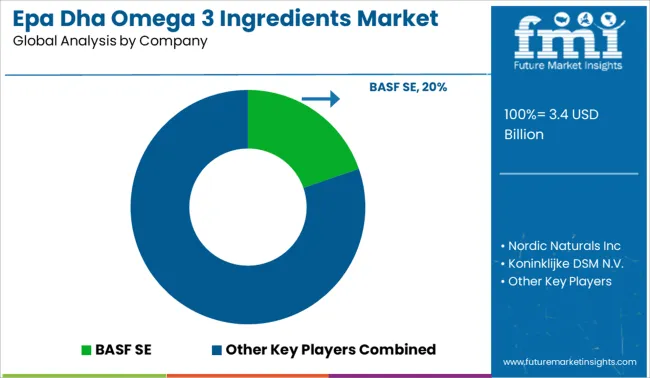

The EPA DHA Omega 3 Ingredients Market is estimated to be valued at USD 3.4 billion in 2025 and is projected to reach USD 6.4 billion by 2035, registering a compound annual growth rate (CAGR) of 6.5% over the forecast period.

| Metric | Value |

|---|---|

| EPA DHA Omega 3 Ingredients Market Estimated Value in (2025 E) | USD 3.4 billion |

| EPA DHA Omega 3 Ingredients Market Forecast Value in (2035 F) | USD 6.4 billion |

| Forecast CAGR (2025 to 2035) | 6.5% |

The EPA DHA Omega 3 ingredients market is expanding steadily due to growing consumer awareness about the health benefits of omega-3 fatty acids. Increasing focus on cardiovascular health, cognitive function, and overall wellness has driven demand for EPA and DHA enriched products. Innovations in sourcing and extraction techniques have improved ingredient purity and sustainability.

The rising preference for plant-based and clean-label products has fueled interest in algae oil as a sustainable and vegetarian source of omega-3s. Additionally, the dietary supplements segment has experienced consistent growth as consumers seek convenient ways to meet their nutritional needs.

Public health campaigns and dietary guidelines emphasizing omega-3 intake have further propelled market demand. Looking ahead, the market is expected to benefit from expanded applications across food and beverage sectors alongside supplements. Segmental growth is anticipated to be driven by DHA as the dominant product, algae oil as a key sustainable source, and dietary supplements as the primary application area.

The EPA DHA omega-3 ingredients market is segmented by product, source, and application and geographic regions. The product of the EPA DHA omega-3 ingredients market is divided into DHA and EPA. In terms of the source of the EPA DHA omega-3 ingredients, the market is classified into Algae oil, Anchovy/Sardine Oils, High concentrates, Medium Concentrates, Low concentrates, Tuna oil, Cod liver oil, Salmon oil, Krill oil, and Menhaden oil. Based on the application of the EPA DHA omega-3 ingredients, the market is segmented into Dietary Supplements, Functional Food, Pharmaceutical Food, Infant Food, Pet & Animal Feed, and Others. Regionally, the EPA DHA omega-3 ingredients industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

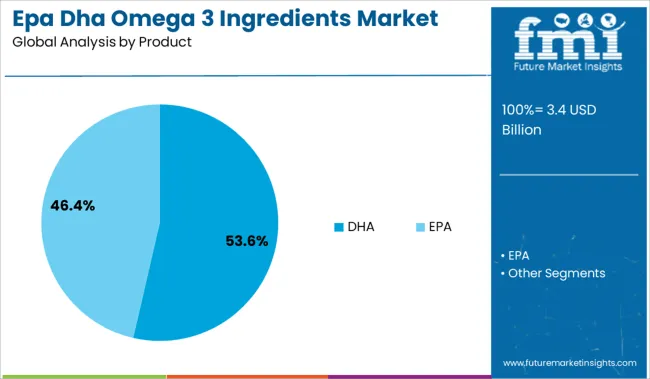

The DHA segment is projected to hold 53.6% of the market revenue in 2025, establishing it as the leading product category. This growth has been driven by DHA’s critical role in brain and eye health, which consumers and healthcare professionals have widely recognized. DHA is often preferred in formulations targeting maternal health, infant nutrition, and cognitive support, leading to increased inclusion in supplements and fortified foods.

Advances in extraction and concentration technologies have enhanced DHA bioavailability and stability. Furthermore, ongoing research highlighting DHA’s benefits has strengthened consumer trust and demand.

The segment benefits from its established health claims and regulatory approvals, reinforcing its position as a market leader.

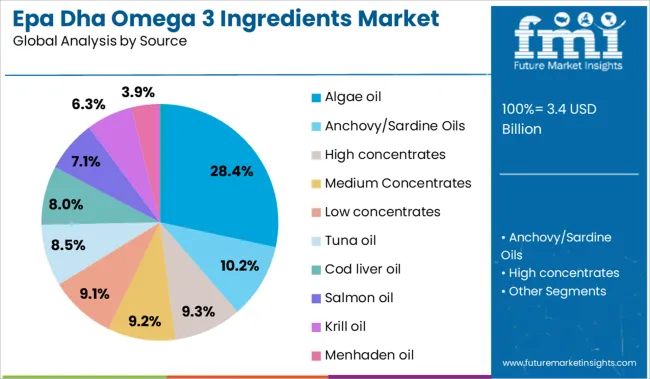

The algae oil source segment is expected to account for 28.4% of the market revenue in 2025, reflecting growing interest in sustainable and plant-based omega-3 sources. Algae oil offers an environmentally friendly alternative to traditional fish oil, addressing concerns about overfishing and ocean pollution. The segment has been favored by vegan and vegetarian consumers as well as those seeking clean-label products.

Technological advancements have improved algae cultivation and extraction efficiencies, reducing production costs and enhancing product quality. Additionally, algae oil has been incorporated into a wide range of product formats including capsules, beverages, and functional foods.

As sustainability becomes a key purchasing factor, algae oil is expected to gain further traction as a preferred omega-3 source.

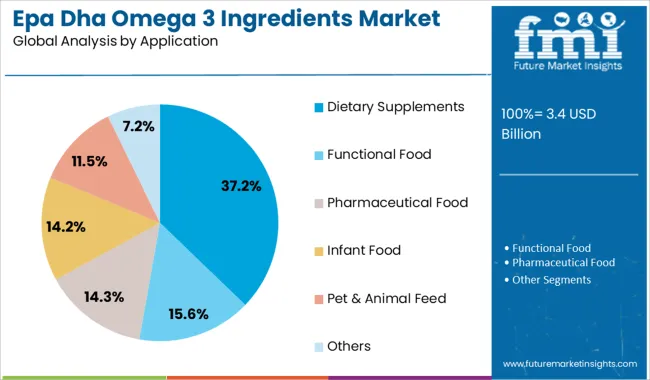

The dietary supplements application segment is projected to represent 37.2% of the market revenue in 2025, maintaining its leading role. Growth in this segment has been propelled by increasing consumer inclination toward proactive health management and nutritional supplementation. Dietary supplements offer a convenient and effective way to deliver EPA and DHA, meeting the daily recommended intake for various population groups.

The segment’s expansion has been supported by diverse product formats such as soft gels, gummies, and liquids that cater to different consumer preferences. Moreover, the rise in e-commerce and direct-to-consumer sales channels has facilitated easier access to omega-3 supplements globally.

As awareness about the benefits of omega-3 fatty acids continues to grow, the dietary supplements segment is expected to sustain its market dominance.

Demand for EPA DHA omega-3 ingredients is accelerating as dietary supplement, functional food, and infant formula sectors expand globally. Sales of algae- and fish-derived concentrates are gaining traction amid formulation innovation, regional regulatory shifts, and premium-positioned heart, brain, and prenatal health products.

Demand for high-purity EPA DHA omega-3 concentrates increased 19% in 2025, with formulators in Japan, Germany, and South Korea favoring microencapsulated powders for fortified beverages and dairy. Suppliers scaled up 70% EPA concentrates with oxidation levels below 5 meq/kg, targeting sports nutrition and brain health SKUs. U.S. brands launched gummies with triglyceride-form omega-3s showing 1.6× higher bioavailability than ethyl esters, prompting a 22% rise in repeat purchases. In India and Brazil, omega-3 fortified baby cereals and yogurts entered mid-tier retail channels, supported by oil-stabilization innovations that extended shelf life by 9 months under ambient conditions.

Sales of algal EPA DHA omega-3 rose 27% YoY in 2025 as plant-based nutrition trends converged with allergen-sensitive demand. Infant formula manufacturers in China and the EU switched from fish oil to algae-based DHA to meet clean-label and vegan certification requirements. Prenatal supplement brands adopted hexane-free algal oils, citing traceability and marine toxin avoidance. USA medical nutrition companies incorporated algae-derived omega-3s into parenteral emulsions and dysphagia-compatible formats, supported by GRAS and EFSA-compliant status. Production volumes in closed photobioreactors increased by 38%, lowering heavy metal risk and ensuring consistent EPA: DHA ratios for clinical and pharmaceutical applications.

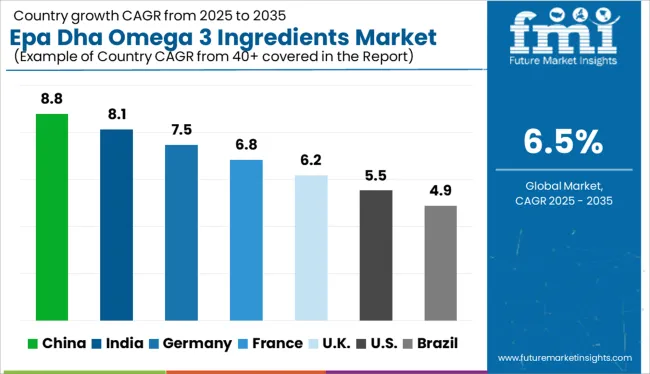

| Country | CAGR |

|---|---|

| China | 8.8% |

| India | 8.1% |

| Germany | 7.5% |

| France | 6.8% |

| UK | 6.2% |

| USA | 5.5% |

| Brazil | 4.9% |

The EPA-DHA omega-3 ingredients market is projected to grow globally at a CAGR of 6.5% from 2025 to 2035. China is setting the pace with a CAGR of 8.8%, fueled by rising nutraceutical production and domestic dietary supplement consumption. India follows at 8.1%, driven by growing functional food demand and a maturing clinical nutrition sector. Among OECD nations, Germany is progressing at 7.5%, reflecting strong pharma-grade EPA-DHA applications and consumer health awareness. The UK is expanding at a moderate 6.2%, supported by preventive healthcare focus and premium product uptake.

The USA is lagging slightly at 5.5%, where market maturity and strict regulatory compliance temper acceleration. This performance mix highlights how BRICS countries, particularly China and India, are scaling supply and demand faster, while OECD economies maintain steady momentum through innovation, clinical backing, and established retail channels in omega-3-based wellness. The report provides insights across 40+ countries. The five below are highlighted for their strategic influence and growth trajectory.

China’s EPA DHA omega-3 ingredients market is expected to grow at a CAGR of 8.8% between 2025 and 2035, driven by rising demand from functional foods, maternal nutrition, and pediatric health supplements. From 2020 to 2024, growth was primarily seen in fish oil capsules and imported prenatal supplements. Moving forward, the market is transitioning toward microencapsulated omega-3 powders and algal-based sources to meet clean-label and vegetarian consumer trends. Domestic supplement brands are scaling up R&D and in-house formulation of EPA-DHA blends to reduce reliance on imports and target health-conscious urban consumers.

India’s EPA DHA omega-3 ingredients market is projected to grow at a CAGR of 8.1% from 2025 to 2035, led by increased awareness of heart health and cognitive development supplements. During 2020-2024, omega-3 consumption remained niche, focused mostly in urban nutraceutical markets. The next decade is expected to witness broader penetration via fortified foods and personalized nutrition packs. Indian startups are launching value-priced fish oil capsules targeting middle-income groups, while contract manufacturers are introducing vegan omega-3 options derived from marine microalgae for Ayurvedic and holistic medicine lines.

Germany’s EPA DHA omega-3 ingredients market is projected to expand at a CAGR of 7.5% from 2025 to 2035, supported by strong demand for brain health and cardiovascular supplements among the aging population. Between 2020 and 2024, growth was driven by prescription omega-3 formulations and OTC supplements. In the coming years, dietary supplement companies are expected to launch EPA-DHA combinations with co-nutrients like vitamin D and CoQ10, targeting bioavailability and compliance. Consumer interest in sustainable sourcing is also pushing manufacturers to invest in Friend of the Sea-certified fish oils and algae-based solutions.

The EPA DHA omega-3 ingredients market in the United Kingdom is forecast to grow at a CAGR of 6.2% from 2025 to 2035, influenced by preventive health trends and clinical recommendations for omega-3 use in pregnancy and heart disease. From 2020 to 2024, demand stemmed mainly from the OTC supplement channel. Over the next decade, growth is expected to come from functional bakery, dairy fortification, and cognitive health-targeted gummies. Local nutraceutical brands are increasing imports of algal DHA concentrates for eco-friendly positioning, while regulatory clarity on EFSA claims is expected to boost market transparency.

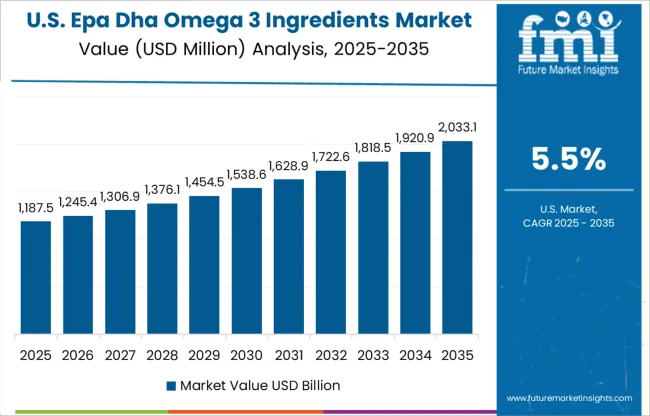

The United States EPA DHA omega-3 ingredients market is projected to grow at a CAGR of 5.5% during the forecast period, supported by an aging population, sports nutrition trends, and prescription-grade omega-3 formulations. Between 2020 and 2024, consumption was driven by heart health supplements and fortified beverages. Going forward, omega-3 usage will expand through direct-to-consumer personalized nutrition services, as well as higher inclusion in protein bars and ready-to-drink shakes. Regulatory pressure for heavy metal testing is also reshaping sourcing practices, favoring refined fish oils and algae-based concentrates.

Sales of EPA DHA Omega-3 ingredients are witnessing steady global expansion in 2025, supported by rising consumer awareness of cardiovascular and cognitive health. BASF SE holds the leading position with a 19.7% market share, capitalizing on advanced purification technologies and scalable production. Koninklijke DSM N.V. and Epax Norway AS continue to dominate the high-potency segment, particularly in pharmaceutical-grade formulations. Demand for EPA DHA Omega-3 from microalgae is accelerating, with companies like Solutex and Clover Corporation enhancing sustainable supply chains. Croda International and GC Rieber have grown their share in functional foods and infant nutrition applications. Meanwhile, Copeinca ASA and Omega Protein remain influential in marine-based sourcing, as dietary supplement manufacturers seek reliable, high-purity omega-3 inputs.

In July 2024, DSM-Firmenich launched life’sDHA® B54‑O100, a high‑potency algal DHA oil offering 545 mg DHA plus 80 mg EPA per gram, fish-odor-free and ideal for gummies and chews, strengthening its premium plant‑based omega‑3 portfolio.

| Item | Value |

|---|---|

| Quantitative Units | USD 3.4 Billion |

| Product | DHA and EPA |

| Source | Algae oil, Anchovy/Sardine Oils, High concentrates, Medium Concentrates, Low concentrates, Tuna oil, Cod liver oil, Salmon oil, Krill oil, and Menhaden oil |

| Application | Dietary Supplements, Functional Food, Pharmaceutical Food, Infant Food, Pet & Animal Feed, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | BASF SE, Nordic Naturals Inc, Koninklijke DSM N.V., Clover Corporation, Omega Protein, Copeinca ASA, Solutex, Epax Norway AS, Croda International Plc, Arista Industries Inc, GC Rieber, OLVEA, and Lysi |

| Additional Attributes | Dollar sales by ingredient source and concentration grade, demand dynamics across dietary supplements and infant nutrition, regional trends in algae-based versus fish oil formulations, innovation in microencapsulation and oxidation-stable delivery systems, environmental impact of marine biodiversity and sustainable harvesting practices, and emerging use cases in medical nutrition and personalized wellness products. |

The global epa dha omega 3 ingredients market is estimated to be valued at USD 3.4 billion in 2025.

The market size for the epa dha omega 3 ingredients market is projected to reach USD 6.4 billion by 2035.

The epa dha omega 3 ingredients market is expected to grow at a 6.5% CAGR between 2025 and 2035.

The key product types in epa dha omega 3 ingredients market are dha and epa.

In terms of source, algae oil segment to command 28.4% share in the epa dha omega 3 ingredients market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

ePayment System Market Analysis by Component, Deployment, Enterprise Size, Industry, and Region through 2025 to 2035

HEPA Air Purifier Market Forecast and Outlook 2025 to 2035

HEPA vacuum cleaners Market Size and Share Forecast Outlook 2025 to 2035

Hepatic Markers Market Size and Share Forecast Outlook 2025 to 2035

Hepatitis C Virus (HCV) Testing Market Size and Share Forecast Outlook 2025 to 2035

Hepatocellular Carcinoma HCC Treatment Market Size and Share Forecast Outlook 2025 to 2035

Hepatitis - B Therapeutics Market Size and Share Forecast Outlook 2025 to 2035

Separation Machinery Market Size and Share Forecast Outlook 2025 to 2035

Nepal Eco Trekking market Analysis from 2025 to 2035

Heparin-Induced Thrombocytopenia (HIT) Treatment Market - Trends & Forecast 2025 to 2035

Hepatic Encephalopathy Treatment Market Trends, Analysis & Forecast by Drug Class, Diagnosis, Route of Administration, Distribution Channel and Region through 2035

The Hepatitis B Diagnostic Tests Market is segmented by product type & end user from 2025 to 2035

Competitive Landscape of HEPA Air Purifier Providers

Heparin Market

Depalletizers Market

Preparative and Process Chromatography Market Forecast and Outlook 2025 to 2035

Preparative Chromatography Market Size and Share Forecast Outlook 2025 to 2035

Prepared Baby Food Market Size and Share Forecast Outlook 2025 to 2035

Prepared Flour Mixes Market Analysis by Product and application Through 2035

Gas Separation Membrane Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA