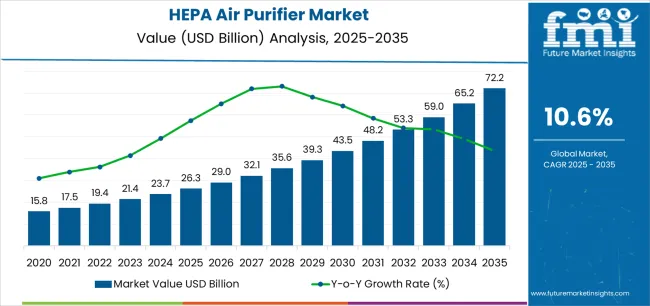

The HEPA Air Purifier Market is estimated to be valued at USD 26.3 billion in 2025 and is projected to reach USD 72.2 billion by 2035, registering a compound annual growth rate (CAGR) of 10.6% over the forecast period.

The HEPA Air Purifier market is witnessing steady growth, driven by rising concerns about indoor air quality and increasing awareness of the health impacts of pollutants, allergens, and airborne particles. Growing urbanization, industrialization, and rising incidence of respiratory diseases are creating strong demand for effective air purification solutions across residential and commercial environments. Technological advancements in HEPA filtration, multi-stage purification systems, and smart connectivity have enhanced the efficiency, ease of use, and reliability of air purifiers.

The market is further supported by the integration of energy-efficient designs, low noise operations, and real-time monitoring features that improve user experience. Increasing regulatory focus on air quality standards and health safety protocols in workplaces and public spaces has accelerated adoption in commercial settings.

Rising investments in healthcare infrastructure, corporate wellness programs, and air quality management initiatives in urban areas are further fueling market expansion As consumers and businesses increasingly prioritize safe and clean indoor environments, the HEPA Air Purifier market is expected to sustain growth over the coming decade.

| Metric | Value |

|---|---|

| HEPA Air Purifier Market Estimated Value in (2025 E) | USD 26.3 billion |

| HEPA Air Purifier Market Forecast Value in (2035 F) | USD 72.2 billion |

| Forecast CAGR (2025 to 2035) | 10.6% |

The market is segmented by Coverage Area, End Use, CADR (Clean Air Delivery Rate), and Sales Channel and region. By Coverage Area, the market is divided into 250-400 Sq. Ft., Above 700 Sq. Ft., 401-700 Sq. Ft., and Below 250 Sq. Ft.. In terms of End Use, the market is classified into Commercial, Industrial, and Residential. Based on CADR (Clean Air Delivery Rate), the market is segmented into Smoke, Dust, and Pollen. By Sales Channel, the market is divided into Direct Sales, Indirect Sales, Hypermarkets/Supermarkets, Discount Stores, Speciality Stores, and Online Retailing. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

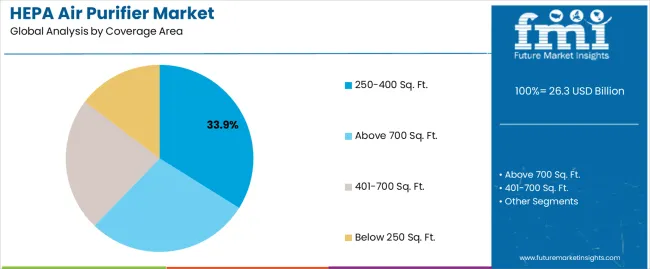

The 250-400 Sq. Ft. coverage area segment is projected to hold 33.9% of the HEPA Air Purifier market revenue in 2025, positioning it as the leading coverage category. Growth in this segment is being driven by its suitability for medium-sized spaces such as offices, classrooms, and small commercial establishments, where optimal air circulation and purification efficiency are critical.

HEPA air purifiers in this coverage range are engineered to maintain high filtration performance while ensuring energy efficiency and low operational noise. Users benefit from enhanced removal of fine particulate matter, allergens, and smoke particles, creating healthier indoor environments. Integration with smart sensors and automatic fan control systems allows real-time air quality monitoring and adaptive purification, increasing operational convenience. The ability to effectively serve commonly sized indoor spaces without the need for multiple units strengthens adoption.

As demand for medium-area air purification solutions rises in commercial and residential settings, the 250-400 Sq Ft coverage segment is expected to maintain its leading position in the market, supported by technological innovations and growing awareness of indoor air quality.

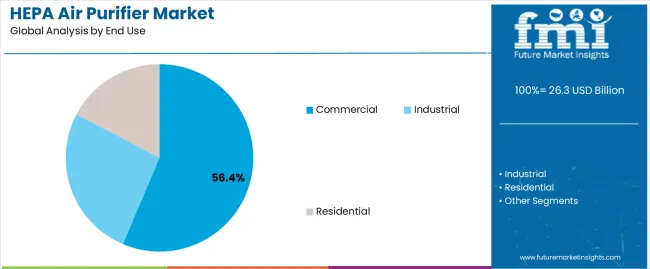

The commercial end-use segment is anticipated to account for 56.4% of the HEPA Air Purifier market revenue in 2025, establishing it as the leading end-use category. Its growth is being driven by increasing investments in indoor air quality management across offices, retail spaces, healthcare facilities, and public buildings. Commercial establishments prioritize the reduction of airborne pollutants to enhance employee productivity, protect customer health, and comply with workplace safety regulations.

HEPA air purifiers are increasingly integrated with building management systems and smart monitoring tools to enable real-time air quality tracking and efficient maintenance. The ability to provide large-scale, reliable purification without significant energy or operational costs enhances adoption in commercial spaces.

Rising awareness of the impact of smoke, dust, and airborne pathogens on workplace health has further strengthened demand As commercial infrastructure continues to expand and indoor air quality standards become more stringent, the commercial segment is expected to remain the primary driver of market growth, supported by continuous innovation in HEPA filtration technologies and scalable purification solutions.

.webp)

The smoke Clean Air Delivery Rate (CADR) segment is projected to hold 36.8% of the market revenue in 2025, making it the leading CADR category. Growth is being driven by the increasing need for effective removal of fine smoke particles generated by tobacco, cooking, and urban pollution sources.

HEPA air purifiers with high smoke CADR are designed to capture ultrafine particles and volatile organic compounds efficiently, improving indoor air quality and user health. Integration of activated carbon layers and multi-stage filtration systems enhances performance against odor and chemical pollutants.

The segment’s adoption is further strengthened by rising awareness of the health hazards associated with long-term smoke exposure, regulatory emphasis on clean air in workplaces, and growing demand in urban residential and commercial settings As consumers and businesses seek reliable and high-performance air purification solutions, the smoke CADR segment is expected to maintain its leading position, supported by continuous technological enhancements and increasing emphasis on indoor air safety.

The HEPA air purifier landscape has left a substantial growth legacy from 2020 to 2025. With substantial investments pouring in to develop innovative product lines, a CAGR of 10.5% was observed in the past 5 years alone.

The primary driving force in the period was the prevalence of the pandemic. The pandemic outbreak emphasized the importance of air quality. Moreover, many hospitals demanded pure air for patients, which surged the subject market during the historical period.

Apart from this, the rise in air-borne diseases surged the requirement for air purifier, resulting in a driving force for the subject market. The awareness about the purified air increased, surging the demand for HEPA air purifier.

| Historical CAGR from 2020 to 2025 | 10.5% |

|---|---|

| Forecast CAGR from 2025 to 2035 | 11.2% |

The forecasted period will be more concerned about the rising pollution, which is making various metropolitan cities unliveable. People have been flocking out of these cities due to deteriorating air quality. Hence, this will be the primary market driver in the forecasted period.

Technological innovations likely drive the market. Due to the integration of cutting-edge technology, air purifier' efficiency and effectiveness have increased recently. This will likely create more demand, resulting in a market driver.

Forecast CAGRs from 2025 to 2035

| Countries | Forecasted CAGR |

|---|---|

| Canada | 17.4% |

| Spain | 17.7% |

| China | 12.7% |

| India | 19.5% |

| Japan | 16.5% |

Given the growing emphasis on improving air quality, HEPA air purifiers covering an area of 250-400 sq. ft. are slated to observe high growth in sales. Their demand is forecast to be higher than other key categories based on coverage area.

| Category | Coverage Area (250-400 Sq. Ft.) |

|---|---|

| Market Share in 2025 | 33.9% |

| Market Segment Drivers |

|

The end user industry is highly diversified and requires air purifier extensively. However, commercial use of air purifier is observed the most, resulting in its growing popularity.

| Category | End Use (Commercial) |

|---|---|

| Market Share in 2025 | 56.4% |

| Market Segment Drivers |

|

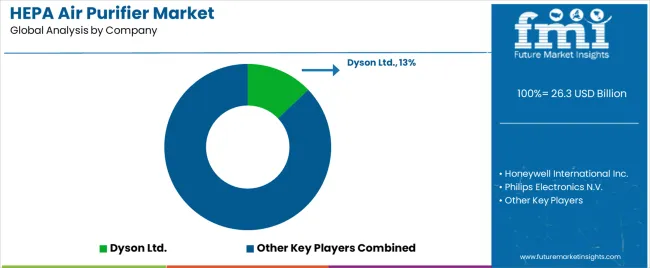

Cluttering the competitive space results from the presence of numerous market players. Their presence influences the competitive landscape significantly. It also affects the presence of new entrants.

The main reason is the need for more space in the market. However, product innovation through technological upgradation can leave a strong mark. Furthermore, market penetration can be ensured with the help of an effective marketing strategy.

Key competitors in the global HEPA air purifier market employ different strategic moves to achieve a significant market share of HEPA air purifier market. Innovation, strategic partnerships, mergers and acquisitions, collaborations, and international expansion are key initiatives that help organizations secure a strong market position.

Key Market Developments

| Attributes | Details |

|---|---|

| Estimated Market Size in 2025 | USD 26.3 billion |

| Projected Market Valuation in 2035 | USD 72.2 billion |

| Value-based CAGR 2025 to 2035 | 10.6% |

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2025 |

| Market Analysis | Value in USD billion |

| Key Regions Covered | North America; Latin America; Western Europe; Eastern Europe; South Asia and Pacific; East Asia; The Middle East and Africa |

| Key Market Segments Covered | Coverage Area, End Use, CADR (Clean Air Delivery Rate), Sales Channel, Region |

| Key Countries Profiled | The United States, Canada, Brazil, Mexico, Germany, The United Kingdom, France, Spain, Italy, Poland, Russia, Czech Republic, Romania, India, Bangladesh, Australia, New Zealand, China, Japan, South Korea, GCC Countries, South Africa, Israel |

| Key Companies Profiled | Honeywell International Inc.; Dyson Ltd.; Blueair AB; Coway Co. Ltd.; IQAir North America Inc.; Philips Electronics N.V.; Levoit; Winix Inc.; Alen Corporation; GermGuardian; Molekule Inc.; Airmega Coway Co. Ltd.; Rabbit Air; Whirlpool Corporation |

The global hepa air purifier market is estimated to be valued at USD 26.3 billion in 2025.

The market size for the hepa air purifier market is projected to reach USD 72.2 billion by 2035.

The hepa air purifier market is expected to grow at a 10.6% CAGR between 2025 and 2035.

The key product types in hepa air purifier market are 250-400 sq. ft., above 700 sq. ft., 401-700 sq. ft. and below 250 sq. ft..

In terms of end use, commercial segment to command 56.4% share in the hepa air purifier market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Competitive Landscape of HEPA Air Purifier Providers

HEPA vacuum cleaners Market Size and Share Forecast Outlook 2025 to 2035

Hepatic Markers Market Size and Share Forecast Outlook 2025 to 2035

Hepatitis C Virus (HCV) Testing Market Size and Share Forecast Outlook 2025 to 2035

Hepatocellular Carcinoma HCC Treatment Market Size and Share Forecast Outlook 2025 to 2035

Hepatitis - B Therapeutics Market Size and Share Forecast Outlook 2025 to 2035

Heparin-Induced Thrombocytopenia (HIT) Treatment Market - Trends & Forecast 2025 to 2035

Hepatic Encephalopathy Treatment Market Trends, Analysis & Forecast by Drug Class, Diagnosis, Route of Administration, Distribution Channel and Region through 2035

The Hepatitis B Diagnostic Tests Market is segmented by product type & end user from 2025 to 2035

Heparin Market

Rapid Hepatitis Testing Market – Demand & Forecast 2025 to 2035

Chronic Hepatitis B Virus Testing Market Size and Share Forecast Outlook 2025 to 2035

Ischemic Hepatitis Treatment Market Size and Share Forecast Outlook 2025 to 2035

Alcoholic Hepatitis Treatment Market Analysis - Size, Share & Forecast 2025 to 2035

Unresectable Hepatocellular Carcinoma Market - Growth & Outlook 2025 to 2035

Veno-Occlusive Hepatic Disease Therapeutics Market Size and Share Forecast Outlook 2025 to 2035

Non-Alcoholic Steatohepatitis Clinical Trials Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Non-alcoholic Steatohepatitis Drugs Pipeline Market Outlook 2025 to 2035

Airless Sprayer Accessories Market Size and Share Forecast Outlook 2025 to 2035

Air Purge Valve Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA