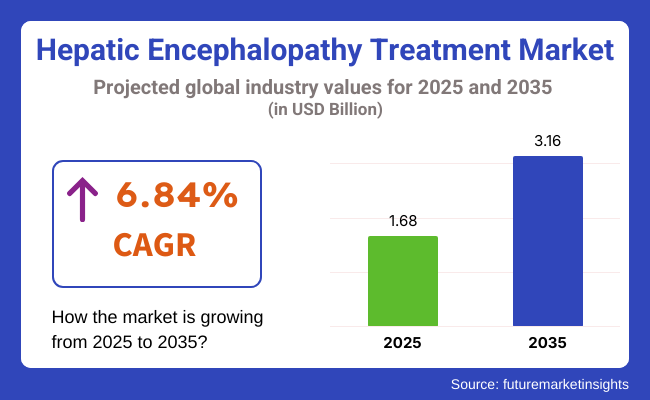

The hepatic encephalopathy treatment industry is valued at USD 1.68 billion in 2025. As per FMI's analysis, the industry will grow at a CAGR of 6.84% and reach USD 3.16 billion by 2035.

In 2024, the hepatic encephalopathy or liver disease therapeutic treatment industry saw rising investments in drug development, with top pharmaceutical companies speeding up clinical trials for new formulations. Approvals for newer drugs such as second-generation rifaximin and novel ammonia-lowering agents helped fuel industry growth.

The analysis revealed that North America dominated the landscape, with a rise in early-stage liver disease therapeutic diagnoses fueling increased prescription rates. European countries, on the other hand, experienced improved access to therapeutics due to supportive reimbursement policies.

The industry will become even more dynamic by 2025 as healthcare providers incorporate AI-based diagnostic solutions, enabling early intervention and improving treatment outcomes. AI will facilitate more accurate and timely diagnoses, particularly in liver diseases, leading to better patient management. Furthermore, increasing awareness campaigns and government-supported liver disease management initiatives will play an important role in educating the public, driving early detection, and encouraging healthier lifestyles.

The decade ahead will see increased innovation, with precision medicine strategies and microbiome-directed therapies transforming treatment paradigms. These advancements will enhance personalized care and targeted therapies. By 2035, according to FMI research, the industry will reach USD 3.16 billion, driven by an aging population and rising incidences of cirrhosis complications.

The hepatic encephalopathy treatment industry is poised for steady growth, fuelled by the increasing incidence of liver diseases and technological innovations in drug delivery. Pharmaceutical companies developing novel therapeutics and healthcare providers implementing early diagnostic devices are likely to benefit, whereas regions with limited access to specialised treatments will face challenges. With the rise in global awareness and the establishment of reimbursement strategies, industry stakeholders investing in precision medicine and microbiome-targeted therapies are expected to experience long-term growth.

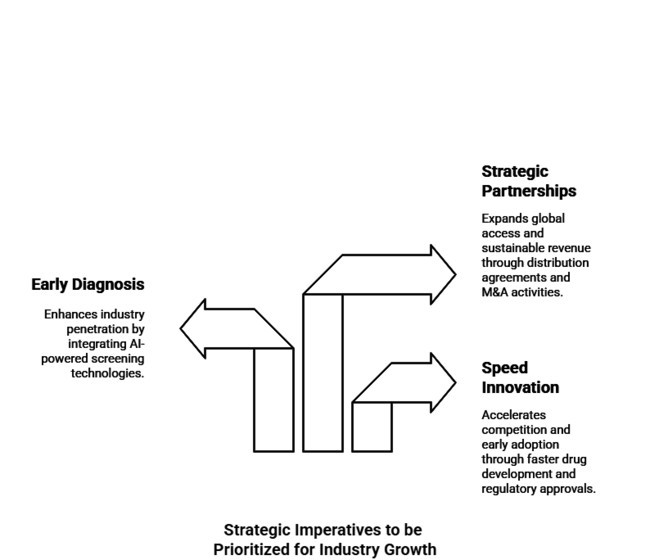

Speeding Innovation Drugs and Regulatory Reviews

R&D Funding Needed for a New Ammonia-Lowering Drug and Next-Gen RifaximinProducts. Quicker clinical trials and regulatory approvals will put them ahead of the competition and spur early adoption

Integrating early diagnosis will boost industry penetration.

AI-powered early detection through AI-based screening technology should involve a collaborative partnership between healthcare professionals and diagnostic firms. Aligning with evolving healthcare policies and reimbursement frameworks will increase patient access and accelerate adoption of treatment options.

Scale Strategic Partnerships for Global Industry Access

Industry players are required to start distribution agreements and M&A activities that will provide them with access to underpenetrated regions. Partnerships with regional health systems and payers will make broader availability and sustainable revenue growth possible.

| Risk | Probability & Impact |

|---|---|

| Regulatory Delays in Drug Approvals | High Probability - High Impact |

| Limited Patient Access in Emerging Markets | Medium Probability - High Impact |

| Rising Competition from Alternative Therapies | High Probability - Medium Impact |

| Priority | Immediate Action |

|---|---|

| Accelerate New Drug Approvals | Fast-track late-stage clinical trials and engage with regulatory agencies for expedited approvals |

| Enhance Early Diagnosis Adoption | Partner with AI-driven diagnostic firms to integrate screening tools in healthcare systems |

| Expand Global Reach | Establish distribution partnerships in emerging landscapes and negotiate favorable reimbursement terms |

To stay ahead, companies must prioritize treatment innovation in liver disease therapeutics, accelerate R&D on next-generation drugs and expedite regulatory clearance. Leveraging early diagnostic potential through AI development will enhance industry presence while improving the quality of treatment for patients.

Anticipate forging higher-profile partnerships with payors and providers in emerging landscapes, alongside demand acceleration in these regions, leading to increased revenue and accessibility. This vision marks a shift towards targeted treatment and active moderation, necessitating a new set of directives focused on growth in new geographies, payment advocacy, and truly innovative drug discovery.

Regional Variance:

Extreme Heterogeneity in Innovation Use:

Discovering Commonality on ROI:

Global Price Pressures:

Regional Differences:

Global Alignment:

Regional Investment Priorities:

Manufacturers:

Healthcare Providers:

Key Consensus Areas:

Regional Variances:

Strategic Insight:

| Countries | Regulatory Impact & Mandatory Certifications |

|---|---|

| United States | The FDA's rigorous drug approval process guarantees high safety levels but prolongs timelines for entry into the industry . Medicare and Medicaid's reimbursement policy has a significant impact on treatment uptake. The Breakthrough Therapy Designation accelerates approval of new drugs. |

| United Kingdom | The Medicines and Healthcare Products Regulatory Agency (MHRA) regulates, with post-Brexit reforms providing the opportunity for faster entry in the industry . NICE (National Institute for Health and Care Excellence) is the cost-effectiveness threshold that controls drug pricing and reimbursement. |

| France | All his intensive clinical trials are mandated by the ANSM (French National Agency for Medicament and Health Products Safety). Reimbursement on the basis of therapeutic benefit ratings has some effect on price and patient access; the HAS (High Authority for Health) has a say in this. |

| Germany | Comprehensive efficacy and cost-effectiveness assessment is mandated by the BfArM (Federal Institute for Drugs and Medical Devices) and G-BA (Federal Joint Committee). AMNOG price negotiations inform the strategies for pricing in the early stages of drugs. |

| Italy | Pharmaceutical approvals and prices are regulated by negotiated reimbursement contracts with the AIFA (Italian Medicines Agency). Foreign manufacturers have a local preference for generics and biosimilars. |

| South Korea | The Ministry of Food and Drug Safety (MFDS) regulates drug approvals, whereas HIRA (Health Insurance Review and Assessment Service) oversees reimbursement policy. This role gives an increasing push to regulators to incentivize digital health solutions. |

| Japan | Safety and efficacy are stringently regulated by the PMDA (Pharmaceuticals and Medical Devices Agency). The government provides a fast-track approval scheme for orphan drugs for liver disease therapeutic , with the aim of enabling them to enter the industry . |

| China | Current reforms have rationalized drug approval procedures and minimized waiting periods, according to the Chinese National Medical Products Administration (NMPA). Price reductions in VBP policies based on evidence from the data favor generics over innovative, expensive medications. |

| India | The CDSCO (Central Drugs Standard Control Organization ) controls drug approvals, and biosimilars are receiving more attention. Across all industries, the National Pharmaceutical Pricing Authority (NPPA) enforces price caps on manufacturers. |

Antibiotics dominate the hepatic encephalopathy treatment industry, with rifaximin being the leading drug because of its efficacy in lowering ammonia-producing gut bacteria. The increasing prescription of rifaximin, especially in the USA and Europe, can be attributed to its low systemic absorption and favorable safety profile. Laxatives, mainly lactulose, are a close second, as they are still the first-line therapy for ammonia detoxification.

Even though L-ornithine L-aspartate (LOLA) is the fastest-growing segment, FMI opines that its increasing adoption in medicine, especially in Asia, is due to its ability to enhance liver cell ammonia metabolism. Although classically overshadowed by laxatives and antibiotics, LOLA is gaining popularity as an adjunct therapy, especially in emerging economies. Greater study of new ammonia-lowering drugs, including possible enzyme-based treatments, will continue to increase treatment options in the coming decade.

Hepatic encephalopathy can only be diagnosed through lab tests. FMI data indicates that the most common screening methods worldwide include measuring ammonia levels and profiling liver enzymes. They are the most readily available economic diagnostic tools, and so they remain the dominant segment within both developed and developing nations. Yet, CT scans are observing the quickest growth since advanced imaging modalities are being used more for comprehensive brain evaluation in severe cases of liver disease.

Hospitals are increasingly utilizing CT and MRI scans to identify mild neurological alterations induced by hyperammonemia in nations with strong healthcare infrastructure, such as Germany and Japan. Liver function tests, although commonly applied, are a second-line diagnostic tool to ammonia testing and neuroimaging. Wider implementation of AI-based diagnosis platforms will likely increase the precision and speed of detecting liver disease, especially in developed countries.

Oral administration continues to be the most prevalent segment, with FMI’s analysis identifying rifaximin, lactulose, and LOLA in tablet or syrup formulation as receiving most of the prescriptions owing to their convenience and patient compliance. Rifaximin's widespread usage in outpatient clinics supports this trend, especially in the USA and Western Europe. Nevertheless, intravenous administration is the fastest-growing segment, primarily due to its necessity in severe cases requiring hospital-based treatment.

The need for IV-administered lactulose infusions and LOLA is growing with the rising prevalence of acute hepatic encephalopathy in intensive care units. Although injectables hold a significant share, they are primarily used in hospitals, particularly for ammonia-reducing medications in emergency settings. Upcoming developments in drug delivery systems, such as sustained-release drugs, would bring about a shift in this segment's dynamics by enhancing therapy's efficacy and decreasing hospitalization rates.

Hospital pharmacies lead the industry, with FMI analysis indicating that most hepatic encephalopathy treatment, especially injectable and IV drugs, is provided in hospital outlets. The predominant role of hospitals as the central treatment facilities for advanced cases guarantees this segment's leadership. Nevertheless, online pharmacies have been the fastest-growing sector, fuelled by growing digital acceptance and increased consumer demand for at-home delivery of prescription drugs.

Countries such as China and India, the growth of e-pharmacies has greatly enhanced patient availability to treatment of chronic liver disease. Retail pharmacies also hold a large industry share, particularly in developed countries where rifaximin and lactulose are commonly prescribed for chronic use. As telemedicine services and electronic prescriptions receive regulatory clearances, the expansion of online pharmacies is likely to accelerate further, transforming the distribution landscape for liver disease therapeutic treatments.

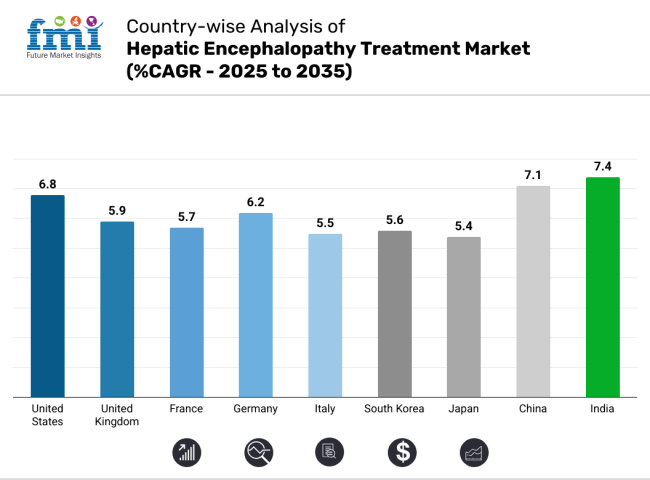

The United States hepatic encephalopathy treatment industry is estimated to be valued at USD 1,586.2 million in 2025. It is expected to expand at a CAGR of 6.8% over the forecast years, owing to high R&D expenditure by various companies, favorable reimbursement policies, and the rising prevalence of liver diseases. The FDA’s expedited pathways help the agency approve more drugs, and Medicare and Medicaid make treatment more accessible.

Innovations are growing and include AI-driven diagnostics and microbiome therapies. However, pricing and reimbursement bottlenecks pose significant challenges. Major players emphasize price strategy and partnerships to remain profitable. Funding for digital health solutions is increasing, facilitating early detection. The long-term outlook for the industry remains positive, supported by tech advances and rising healthcare spending.

With the NHS's reimbursement policies, the UK hepatic encephalopathy treatment industry is expected to grow at a compound annual growth rate (CAGR) of 5.9% between 2025 and 2035. This is because more people are getting liver diseases because of obesity and better diagnostic tools that use artificial intelligence (AI). Post-Brexit regulatory adjustments enabled MHRA to accelerate approvals, enhancing drug availability. Cost-effectiveness evaluations by NICE determine whether to enter the industry.

Some gut microbiome-targeted treatments are currently being investigated in clinical trials and could represent the next frontier in personalized medicine. Budgetary restraint with the NHS continues to hamper uptake of premium pharmaceuticals. Sustainable drug manufacturing is coming into view. Pharma companies are negotiating reimbursement strategies while ensuring structured, competitive pricing in subsequent processes.

In France, the industry for hepatic encephalopathy treatment is estimated to expand at a CAGR of 5.7% over the course of 2025 to 2035 owing to government-supported healthcare initiatives, robust R&D expenditure, and the growing burden of cirrhosis. HAS assesses the added therapeutic value of new drugs as compared to existing alternatives, which impacts pricing and reimbursement, among others. High demand for ammonia-lowering agents due to jaundice prevalence among alcohol-related liver disease (20%) and metabolic disorders.

There is an expansion in AI-powered diagnostics and microbiome-based therapies. But limits on public health care budgets may be a brake on the uptake of costly treatment. France also focuses on sustainable drug manufacturing, propelling companies to adopt greener production methods. The industry is still promising for pharmaceutical companies that have adopted innovative but affordable solutions.

The German hepatic encephalopathy treatment industry is expected to register a growth rate of 6.2% during 2025 to 2035, driven by rigorous health regulations, extremely high R&D expenditure, and early adoption of technology. The cost-effectiveness assessment by the G-BA dictates reimbursement approvals. Because of metabolic disorders and cirrhosis, people are very interested in new ways to treat liver disease, such as microbiome modulation therapy and AI-assisted diagnosis.

Sustainable pharmaceutical production is increasing, courtesy of government incentives. Stringent price controls pose barriers by requiring proof of long-term cost savings. In regulation, apart from challenges, Germany's highly funded health care and rich pipeline of innovation make it a leading industry for liver disease therapeutic drugs.

From 2025 to 2035, the industry for hepatic encephalopathy treatment in Italy is expected to grow at a compound annual growth rate (CAGR) of 5.5%, supported by an ageing population, growing prevalence of liver diseases, and growing investment in healthcare. The AIFA- Italian Drug Agency - negotiates the price and reimbursement of drugs, hence the accessibility to the industry. The increasing incidence of NAFLD and cirrhosis cases requires cost-efficient treatment alternatives.

Spending limits in the public health system mean that biosimilars and generics are prioritized over the most expensive drugs. Digital healthcare is on the rise, with telemedicine facilitating better patient management. In fact, pharmaceutical companies need to work closely with regulatory agencies to obtain favorable reimbursement conditions. Companies providing novel but cost-effective liver disease therapies will find an industry rewarding.

The South Korean hepatic encephalopathy treatment industry is projected to grow at a CAGR of 5.6% over the period from 2025 to 2035, owing to an increasing number of patients with nonalcoholic liver disease and the modernization of the healthcare system. The MFDS is trying to expedite drug approvals, meaning that people can access new treatments more quickly. In South Korea, robots and artificial intelligence are used in diagnostic processes.

But pricing sensitivity and reimbursement constraints create obstacles for premium drug uptake. Public-private partnerships in medical research are surging, and innovation is accelerating. By offering cost-effective solutions and leveraging South Korea's advanced healthcare infrastructure, we can achieve industry growth.

The Japan hepatic encephalopathy treatment industry is estimated to grow at a CAGR of 5.4% from 2025 to 2035, aided by an ageing demographic, increasing liver disease incidences, and rapid development of precision medicine. The Pharmaceuticals and Medical Devices Agency (PMDA) conducts rigorous drug evaluations, which often results in delayed approvals. Japanese consumers tend to favor conservative treatment methods, which can affect their rapid adoption of high-cost drugs.

However, this means that research into diagnostics, microbiome therapies, and other AI fields is accelerating. The Japanese regulatory system supports cost-effective treatment models, which encourage the use of generic drugs. For drug manufacturers targeting Japan, looking to highlight long-term clinical benefits at an affordable price is critical to gaining industry and regulatory acceptance.

China's hepatic encephalopathy treatment industry is projected to experience a CAGR of 7.1% from 2025 to 2035, largely driven by the rising prevalence of liver disease, healthcare reforms, and improved insurance coverage. The National Medical Products Administration (NMPA) has accelerated drug approvals to improve accessibility in the industry.

Government strategies aim to improve treatment affordability, and homegrown pharmaceutical companies are investing in ammonia-reducing therapies and AI-enabled diagnostics. Nonetheless, disparities in healthcare access and regulatory divergences persist regionally. To penetrate the industry, companies targeting China need to systematically adjust pricing strategies and use local partnerships.

The hepatic encephalopathy treatment industry in India is projected to register a substantial CAGR of 7.4% between 2025 and 2035, driven by a high prevalence of hepatitis-related liver diseases, rising awareness among people regarding healthcare, and government initiatives. The Central Drugs Standard Control Organisation (CDSCO) is accelerating the approval process for drugs, giving companies a bigger window to sale their products.

However, affordability is still a significant issue, with cheaper generics being preferred over premium therapies. A spectrum of care, including Ayushman Bharat, is making advanced treatments more accessible. Implementing pricing strategies, distribution networks, and patient education programs in India Companies need to set their footing in the Indian industry by developing pricing strategies to keep a competitive edge, expanding distribution networks, and looking at patient education programs.

The industry for hepatic encephalopathy treatments is fragmented. The landscape is influenced by mergers and collaborations, but it still consists of several regional networks with varying degrees of penetration. The diversity of players, ranging from large pharmaceutical firms with premium-priced branded drugs to generic manufacturers offering more affordable alternatives, suggests that the industry shall remain fragmented during the forecast years.

According to FMI studies, leading firms are focusing on investment in R&D to develop innovative ammonia-reducing therapies, thereby improving the safety and efficacy of the drugs. Branded drugs, such as rifaximin, differentiate themselves through premium pricing, while generic alternatives enhance affordability.

The global liver disease therapeutic treatment industry consists of several regional networks with strong penetration, influenced by mergers and collaborations with research centers and hospitals. The companies are also furthering distribution networks in high-growth regions, such as Asia and Latin America. Approval of new formulations and lifecycle management strategies also shape the competitive landscape.

Industry Share Analysis

Bausch Health Companies, Inc.

Industry Share: ~25-30%

The company is the industry leader for hepatic encephalopathy (HE) treatment, with its lead asset, Xifaxan (rifaximin), commanding the HE treatment industry.

Salix Pharmaceuticals (subsidiary company of Bausch Health)

Industry Share: ~20-25%

The primary driver behind HE treatment through Xifaxan is Salix, which has ensured Bausch Health's dominance in the space.

Mallinckrodt Pharmaceuticals

Industry Share: ~15 to 20%

Mallinckrodt is a major player known for HE and ammonia-lowering treatment products.

Horizon Therapeutics (which was acquired by Amgen)

Industry Share: ~10-15%

The product was already present among HE-associated metabolic therapies prior to its acquisition by Amgen in October 2023.

Pfizer Inc.

Industry Share: ~5-10%

The research share for HE treatment is smaller than that of specialist players.

Other players (non-branded drug manufacturers)

Industry Share: ~10-15%

The competitive landscape includes companies producing lactulose and other generics.

the industry is segmented into antibiotics, laxatives, L-ornithine and L-aspartate.

it is segmented into blood tests, CT scan, liver functioning tests

it is fragmented among oral, injectable, intravenous and others.

it is segmented among hospital pharmacy, online pharmacy and retail pharmacy.

the industry is studied across North America, Latin America, Europe, South Asia, East Asia, Oceania, Middle East & Africa.

Increasing liver disease prevalence, enhanced diagnostic technology, and greater awareness of treatment choices are driving the sales of the industry.

Ammonia-lowering therapy advancements, growing healthcare access, and approvals will create a steady growth in the upcoming years.

These companies include Bausch Health, Abbott, Norgine, Mallinckrodt, and Cipla, among others.

L-ornithine L-aspartate is experiencing high uptake as a result of its efficacy in ammonia metabolism.

The industry will reach USD 3.16 billion in 2035.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Value (US$ Million) Forecast by Drug Class, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Diagnosis, 2018 to 2033

Table 4: Global Market Value (US$ Million) Forecast by Route of Administration , 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 6: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 7: North America Market Value (US$ Million) Forecast by Drug Class, 2018 to 2033

Table 8: North America Market Value (US$ Million) Forecast by Diagnosis, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Route of Administration , 2018 to 2033

Table 10: North America Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 11: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 12: Latin America Market Value (US$ Million) Forecast by Drug Class, 2018 to 2033

Table 13: Latin America Market Value (US$ Million) Forecast by Diagnosis, 2018 to 2033

Table 14: Latin America Market Value (US$ Million) Forecast by Route of Administration , 2018 to 2033

Table 15: Latin America Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 16: Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 17: Europe Market Value (US$ Million) Forecast by Drug Class, 2018 to 2033

Table 18: Europe Market Value (US$ Million) Forecast by Diagnosis, 2018 to 2033

Table 19: Europe Market Value (US$ Million) Forecast by Route of Administration , 2018 to 2033

Table 20: Europe Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 21: South Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 22: South Asia Market Value (US$ Million) Forecast by Drug Class, 2018 to 2033

Table 23: South Asia Market Value (US$ Million) Forecast by Diagnosis, 2018 to 2033

Table 24: South Asia Market Value (US$ Million) Forecast by Route of Administration , 2018 to 2033

Table 25: South Asia Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 26: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 27: East Asia Market Value (US$ Million) Forecast by Drug Class, 2018 to 2033

Table 28: East Asia Market Value (US$ Million) Forecast by Diagnosis, 2018 to 2033

Table 29: East Asia Market Value (US$ Million) Forecast by Route of Administration , 2018 to 2033

Table 30: East Asia Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 31: Oceania Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 32: Oceania Market Value (US$ Million) Forecast by Drug Class, 2018 to 2033

Table 33: Oceania Market Value (US$ Million) Forecast by Diagnosis, 2018 to 2033

Table 34: Oceania Market Value (US$ Million) Forecast by Route of Administration , 2018 to 2033

Table 35: Oceania Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 36: MEA Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 37: MEA Market Value (US$ Million) Forecast by Drug Class, 2018 to 2033

Table 38: MEA Market Value (US$ Million) Forecast by Diagnosis, 2018 to 2033

Table 39: MEA Market Value (US$ Million) Forecast by Route of Administration , 2018 to 2033

Table 40: MEA Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Drug Class, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Diagnosis, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Route of Administration , 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 5: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 6: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 7: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 8: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 9: Global Market Value (US$ Million) Analysis by Drug Class, 2018 to 2033

Figure 10: Global Market Value Share (%) and BPS Analysis by Drug Class, 2023 to 2033

Figure 11: Global Market Y-o-Y Growth (%) Projections by Drug Class, 2023 to 2033

Figure 12: Global Market Value (US$ Million) Analysis by Diagnosis, 2018 to 2033

Figure 13: Global Market Value Share (%) and BPS Analysis by Diagnosis, 2023 to 2033

Figure 14: Global Market Y-o-Y Growth (%) Projections by Diagnosis, 2023 to 2033

Figure 15: Global Market Value (US$ Million) Analysis by Route of Administration , 2018 to 2033

Figure 16: Global Market Value Share (%) and BPS Analysis by Route of Administration , 2023 to 2033

Figure 17: Global Market Y-o-Y Growth (%) Projections by Route of Administration , 2023 to 2033

Figure 18: Global Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 19: Global Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 20: Global Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 21: Global Market Attractiveness by Drug Class, 2023 to 2033

Figure 22: Global Market Attractiveness by Diagnosis, 2023 to 2033

Figure 23: Global Market Attractiveness by Route of Administration , 2023 to 2033

Figure 24: Global Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 25: Global Market Attractiveness by Region, 2023 to 2033

Figure 26: North America Market Value (US$ Million) by Drug Class, 2023 to 2033

Figure 27: North America Market Value (US$ Million) by Diagnosis, 2023 to 2033

Figure 28: North America Market Value (US$ Million) by Route of Administration , 2023 to 2033

Figure 29: North America Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 30: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 31: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 32: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 33: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 34: North America Market Value (US$ Million) Analysis by Drug Class, 2018 to 2033

Figure 35: North America Market Value Share (%) and BPS Analysis by Drug Class, 2023 to 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections by Drug Class, 2023 to 2033

Figure 37: North America Market Value (US$ Million) Analysis by Diagnosis, 2018 to 2033

Figure 38: North America Market Value Share (%) and BPS Analysis by Diagnosis, 2023 to 2033

Figure 39: North America Market Y-o-Y Growth (%) Projections by Diagnosis, 2023 to 2033

Figure 40: North America Market Value (US$ Million) Analysis by Route of Administration , 2018 to 2033

Figure 41: North America Market Value Share (%) and BPS Analysis by Route of Administration , 2023 to 2033

Figure 42: North America Market Y-o-Y Growth (%) Projections by Route of Administration , 2023 to 2033

Figure 43: North America Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 44: North America Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 45: North America Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 46: North America Market Attractiveness by Drug Class, 2023 to 2033

Figure 47: North America Market Attractiveness by Diagnosis, 2023 to 2033

Figure 48: North America Market Attractiveness by Route of Administration , 2023 to 2033

Figure 49: North America Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 50: North America Market Attractiveness by Country, 2023 to 2033

Figure 51: Latin America Market Value (US$ Million) by Drug Class, 2023 to 2033

Figure 52: Latin America Market Value (US$ Million) by Diagnosis, 2023 to 2033

Figure 53: Latin America Market Value (US$ Million) by Route of Administration , 2023 to 2033

Figure 54: Latin America Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 55: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 56: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 57: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 58: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 59: Latin America Market Value (US$ Million) Analysis by Drug Class, 2018 to 2033

Figure 60: Latin America Market Value Share (%) and BPS Analysis by Drug Class, 2023 to 2033

Figure 61: Latin America Market Y-o-Y Growth (%) Projections by Drug Class, 2023 to 2033

Figure 62: Latin America Market Value (US$ Million) Analysis by Diagnosis, 2018 to 2033

Figure 63: Latin America Market Value Share (%) and BPS Analysis by Diagnosis, 2023 to 2033

Figure 64: Latin America Market Y-o-Y Growth (%) Projections by Diagnosis, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) Analysis by Route of Administration , 2018 to 2033

Figure 66: Latin America Market Value Share (%) and BPS Analysis by Route of Administration , 2023 to 2033

Figure 67: Latin America Market Y-o-Y Growth (%) Projections by Route of Administration , 2023 to 2033

Figure 68: Latin America Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 69: Latin America Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 70: Latin America Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 71: Latin America Market Attractiveness by Drug Class, 2023 to 2033

Figure 72: Latin America Market Attractiveness by Diagnosis, 2023 to 2033

Figure 73: Latin America Market Attractiveness by Route of Administration , 2023 to 2033

Figure 74: Latin America Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 75: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 76: Europe Market Value (US$ Million) by Drug Class, 2023 to 2033

Figure 77: Europe Market Value (US$ Million) by Diagnosis, 2023 to 2033

Figure 78: Europe Market Value (US$ Million) by Route of Administration , 2023 to 2033

Figure 79: Europe Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 80: Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 81: Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 82: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 83: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 84: Europe Market Value (US$ Million) Analysis by Drug Class, 2018 to 2033

Figure 85: Europe Market Value Share (%) and BPS Analysis by Drug Class, 2023 to 2033

Figure 86: Europe Market Y-o-Y Growth (%) Projections by Drug Class, 2023 to 2033

Figure 87: Europe Market Value (US$ Million) Analysis by Diagnosis, 2018 to 2033

Figure 88: Europe Market Value Share (%) and BPS Analysis by Diagnosis, 2023 to 2033

Figure 89: Europe Market Y-o-Y Growth (%) Projections by Diagnosis, 2023 to 2033

Figure 90: Europe Market Value (US$ Million) Analysis by Route of Administration , 2018 to 2033

Figure 91: Europe Market Value Share (%) and BPS Analysis by Route of Administration , 2023 to 2033

Figure 92: Europe Market Y-o-Y Growth (%) Projections by Route of Administration , 2023 to 2033

Figure 93: Europe Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 94: Europe Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 95: Europe Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 96: Europe Market Attractiveness by Drug Class, 2023 to 2033

Figure 97: Europe Market Attractiveness by Diagnosis, 2023 to 2033

Figure 98: Europe Market Attractiveness by Route of Administration , 2023 to 2033

Figure 99: Europe Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 100: Europe Market Attractiveness by Country, 2023 to 2033

Figure 101: South Asia Market Value (US$ Million) by Drug Class, 2023 to 2033

Figure 102: South Asia Market Value (US$ Million) by Diagnosis, 2023 to 2033

Figure 103: South Asia Market Value (US$ Million) by Route of Administration , 2023 to 2033

Figure 104: South Asia Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 105: South Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 106: South Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 107: South Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 108: South Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 109: South Asia Market Value (US$ Million) Analysis by Drug Class, 2018 to 2033

Figure 110: South Asia Market Value Share (%) and BPS Analysis by Drug Class, 2023 to 2033

Figure 111: South Asia Market Y-o-Y Growth (%) Projections by Drug Class, 2023 to 2033

Figure 112: South Asia Market Value (US$ Million) Analysis by Diagnosis, 2018 to 2033

Figure 113: South Asia Market Value Share (%) and BPS Analysis by Diagnosis, 2023 to 2033

Figure 114: South Asia Market Y-o-Y Growth (%) Projections by Diagnosis, 2023 to 2033

Figure 115: South Asia Market Value (US$ Million) Analysis by Route of Administration , 2018 to 2033

Figure 116: South Asia Market Value Share (%) and BPS Analysis by Route of Administration , 2023 to 2033

Figure 117: South Asia Market Y-o-Y Growth (%) Projections by Route of Administration , 2023 to 2033

Figure 118: South Asia Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 119: South Asia Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 120: South Asia Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 121: South Asia Market Attractiveness by Drug Class, 2023 to 2033

Figure 122: South Asia Market Attractiveness by Diagnosis, 2023 to 2033

Figure 123: South Asia Market Attractiveness by Route of Administration , 2023 to 2033

Figure 124: South Asia Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 125: South Asia Market Attractiveness by Country, 2023 to 2033

Figure 126: East Asia Market Value (US$ Million) by Drug Class, 2023 to 2033

Figure 127: East Asia Market Value (US$ Million) by Diagnosis, 2023 to 2033

Figure 128: East Asia Market Value (US$ Million) by Route of Administration , 2023 to 2033

Figure 129: East Asia Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 130: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 131: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 132: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 133: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 134: East Asia Market Value (US$ Million) Analysis by Drug Class, 2018 to 2033

Figure 135: East Asia Market Value Share (%) and BPS Analysis by Drug Class, 2023 to 2033

Figure 136: East Asia Market Y-o-Y Growth (%) Projections by Drug Class, 2023 to 2033

Figure 137: East Asia Market Value (US$ Million) Analysis by Diagnosis, 2018 to 2033

Figure 138: East Asia Market Value Share (%) and BPS Analysis by Diagnosis, 2023 to 2033

Figure 139: East Asia Market Y-o-Y Growth (%) Projections by Diagnosis, 2023 to 2033

Figure 140: East Asia Market Value (US$ Million) Analysis by Route of Administration , 2018 to 2033

Figure 141: East Asia Market Value Share (%) and BPS Analysis by Route of Administration , 2023 to 2033

Figure 142: East Asia Market Y-o-Y Growth (%) Projections by Route of Administration , 2023 to 2033

Figure 143: East Asia Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 144: East Asia Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 145: East Asia Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 146: East Asia Market Attractiveness by Drug Class, 2023 to 2033

Figure 147: East Asia Market Attractiveness by Diagnosis, 2023 to 2033

Figure 148: East Asia Market Attractiveness by Route of Administration , 2023 to 2033

Figure 149: East Asia Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 150: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 151: Oceania Market Value (US$ Million) by Drug Class, 2023 to 2033

Figure 152: Oceania Market Value (US$ Million) by Diagnosis, 2023 to 2033

Figure 153: Oceania Market Value (US$ Million) by Route of Administration , 2023 to 2033

Figure 154: Oceania Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 155: Oceania Market Value (US$ Million) by Country, 2023 to 2033

Figure 156: Oceania Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 157: Oceania Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 158: Oceania Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 159: Oceania Market Value (US$ Million) Analysis by Drug Class, 2018 to 2033

Figure 160: Oceania Market Value Share (%) and BPS Analysis by Drug Class, 2023 to 2033

Figure 161: Oceania Market Y-o-Y Growth (%) Projections by Drug Class, 2023 to 2033

Figure 162: Oceania Market Value (US$ Million) Analysis by Diagnosis, 2018 to 2033

Figure 163: Oceania Market Value Share (%) and BPS Analysis by Diagnosis, 2023 to 2033

Figure 164: Oceania Market Y-o-Y Growth (%) Projections by Diagnosis, 2023 to 2033

Figure 165: Oceania Market Value (US$ Million) Analysis by Route of Administration , 2018 to 2033

Figure 166: Oceania Market Value Share (%) and BPS Analysis by Route of Administration , 2023 to 2033

Figure 167: Oceania Market Y-o-Y Growth (%) Projections by Route of Administration , 2023 to 2033

Figure 168: Oceania Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 169: Oceania Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 170: Oceania Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 171: Oceania Market Attractiveness by Drug Class, 2023 to 2033

Figure 172: Oceania Market Attractiveness by Diagnosis, 2023 to 2033

Figure 173: Oceania Market Attractiveness by Route of Administration , 2023 to 2033

Figure 174: Oceania Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 175: Oceania Market Attractiveness by Country, 2023 to 2033

Figure 176: MEA Market Value (US$ Million) by Drug Class, 2023 to 2033

Figure 177: MEA Market Value (US$ Million) by Diagnosis, 2023 to 2033

Figure 178: MEA Market Value (US$ Million) by Route of Administration , 2023 to 2033

Figure 179: MEA Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 180: MEA Market Value (US$ Million) by Country, 2023 to 2033

Figure 181: MEA Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 182: MEA Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 183: MEA Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 184: MEA Market Value (US$ Million) Analysis by Drug Class, 2018 to 2033

Figure 185: MEA Market Value Share (%) and BPS Analysis by Drug Class, 2023 to 2033

Figure 186: MEA Market Y-o-Y Growth (%) Projections by Drug Class, 2023 to 2033

Figure 187: MEA Market Value (US$ Million) Analysis by Diagnosis, 2018 to 2033

Figure 188: MEA Market Value Share (%) and BPS Analysis by Diagnosis, 2023 to 2033

Figure 189: MEA Market Y-o-Y Growth (%) Projections by Diagnosis, 2023 to 2033

Figure 190: MEA Market Value (US$ Million) Analysis by Route of Administration , 2018 to 2033

Figure 191: MEA Market Value Share (%) and BPS Analysis by Route of Administration , 2023 to 2033

Figure 192: MEA Market Y-o-Y Growth (%) Projections by Route of Administration , 2023 to 2033

Figure 193: MEA Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 194: MEA Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 195: MEA Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 196: MEA Market Attractiveness by Drug Class, 2023 to 2033

Figure 197: MEA Market Attractiveness by Diagnosis, 2023 to 2033

Figure 198: MEA Market Attractiveness by Route of Administration , 2023 to 2033

Figure 199: MEA Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 200: MEA Market Attractiveness by Country, 2023 to 2033

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Progressive Multifocal Leukoencephalopathy Treatment Market Size and Share Forecast Outlook 2025 to 2035

Hepatic Markers Market Size and Share Forecast Outlook 2025 to 2035

Treatment-Resistant Hypertension Management Market Size and Share Forecast Outlook 2025 to 2035

Treatment-Resistant Depression Treatment Market Size and Share Forecast Outlook 2025 to 2035

Treatment Pumps Market Insights Growth & Demand Forecast 2025 to 2035

Pretreatment Coatings Market Size and Share Forecast Outlook 2025 to 2035

Air Treatment Ozone Generator Market Size and Share Forecast Outlook 2025 to 2035

CNS Treatment and Therapy Market Insights - Trends & Growth Forecast 2025 to 2035

Seed Treatment Materials Market Size and Share Forecast Outlook 2025 to 2035

Acne Treatment Solutions Market Size and Share Forecast Outlook 2025 to 2035

Scar Treatment Market Overview - Growth & Demand Forecast 2025 to 2035

Soil Treatment Chemicals Market

Water Treatment System Market Size and Share Forecast Outlook 2025 to 2035

Water Treatment Chemical Market Size and Share Forecast Outlook 2025 to 2035

Algae Treatment Chemical Market Forecast and Outlook 2025 to 2035

Water Treatment Market Size and Share Forecast Outlook 2025 to 2035

Water Treatment Ozone Generator Market Size and Share Forecast Outlook 2025 to 2035

Water Treatment Equipment Market Size and Share Forecast Outlook 2025 to 2035

Burns Treatment Market Overview – Growth, Demand & Forecast 2025 to 2035

CRBSI Treatment Market Insights - Growth, Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA