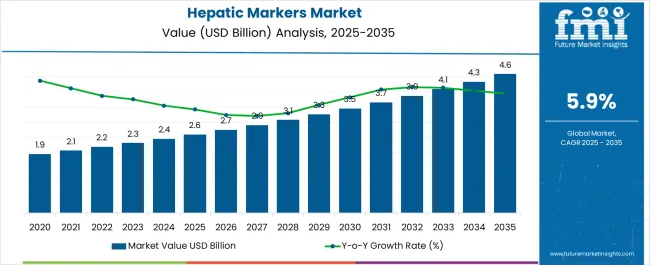

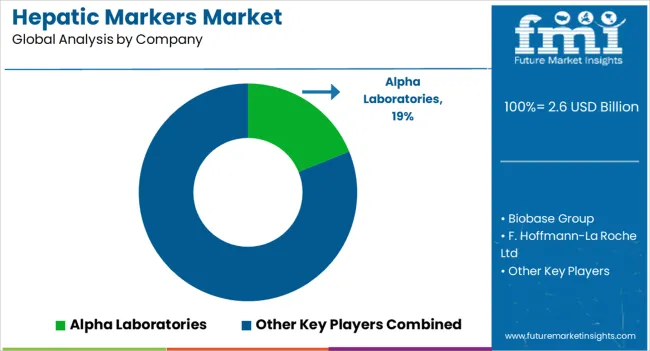

The Hepatic Markers Market is estimated to be valued at USD 2.6 billion in 2025 and is projected to reach USD 4.6 billion by 2035, registering a compound annual growth rate (CAGR) of 5.9% over the forecast period.

| Metric | Value |

|---|---|

| Hepatic Markers Market Estimated Value in (2025 E) | USD 2.6 billion |

| Hepatic Markers Market Forecast Value in (2035 F) | USD 4.6 billion |

| Forecast CAGR (2025 to 2035) | 5.9% |

The hepatic markers market is experiencing consistent growth as liver diseases become a critical global health concern driven by rising incidences of viral hepatitis, alcohol-related disorders, fatty liver disease, and metabolic syndromes. Early detection and monitoring are essential to prevent progression toward cirrhosis and hepatocellular carcinoma, which has increased the demand for reliable hepatic marker tests.

Technological improvements in assay sensitivity, automation of diagnostic platforms, and integration with electronic health records have enhanced diagnostic precision and workflow efficiency. Public health initiatives, combined with government programs focused on hepatitis screening and awareness campaigns, have supported broader adoption across both developed and emerging economies.

The outlook remains favorable as the market continues to benefit from increasing preventive healthcare measures, advanced laboratory infrastructure, and a growing emphasis on early intervention strategies for liver-related conditions.

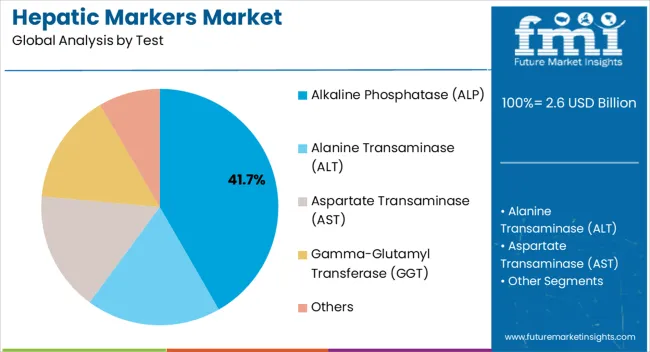

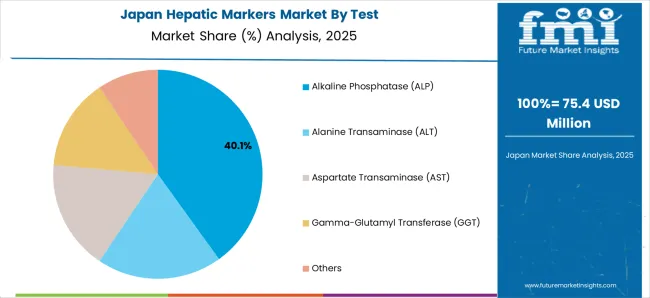

The alkaline phosphatase test segment is projected to hold 41.70% of the total market revenue by 2025 within the test category, establishing itself as the leading test segment. Its dominance is attributed to its routine use in assessing liver function, bile duct obstruction, and metabolic bone disorders.

The test is widely recognized for its reliability, cost-effectiveness, and integration into standard liver function panels, which has reinforced its high demand across diagnostic laboratories and hospitals.

As healthcare systems emphasize preventive screening and continuous monitoring of chronic conditions, the use of alkaline phosphatase tests is expected to maintain its leading role within the test segment.

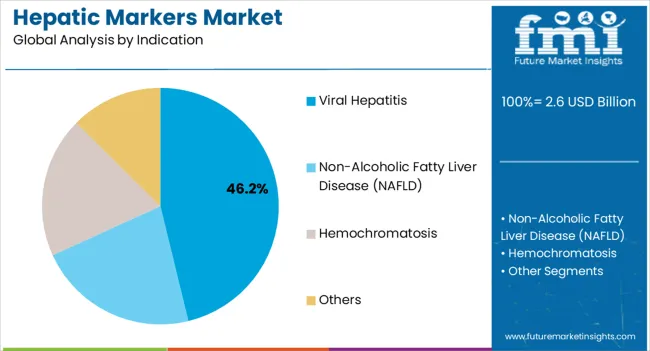

The viral hepatitis segment is expected to account for 46.20% of total market revenue by 2025 within the indication category, making it the most significant contributor. This growth is being driven by the high global prevalence of hepatitis B and C infections and the associated burden on healthcare systems.

Widespread awareness programs, government-funded screening campaigns, and rising availability of antiviral therapies have further reinforced the demand for accurate hepatic marker testing.

The need for regular monitoring of viral load and disease progression has positioned hepatic marker testing as a critical tool in disease management, thereby securing the leadership of viral hepatitis in the indication segment.

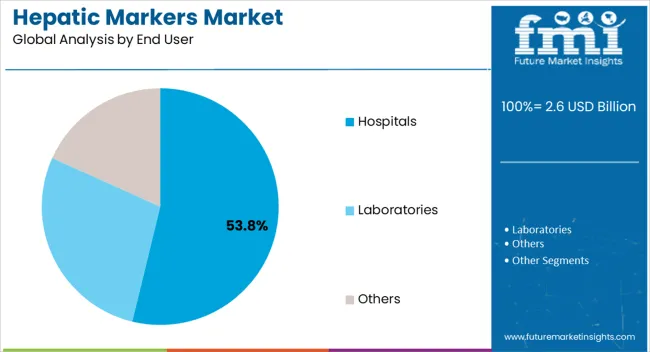

The hospitals segment is anticipated to hold 53.80% of total market revenue by 2025 within the end user category, positioning it as the dominant segment. Hospitals are primary centers for diagnostic testing, patient monitoring, and treatment of liver-related diseases, which has solidified their leading share.

The availability of advanced laboratory facilities, integration of automated analyzers, and strong clinical expertise contribute to higher adoption levels in this setting. Moreover, hospitals frequently manage high patient volumes, making them central to government-led hepatitis screening initiatives and chronic liver disease management programs.

These factors collectively underpin the dominance of hospitals as the leading end user in the hepatic markers market.

From 2012 to 2025, the global hepatic markers market experienced a CAGR of 4.7%, reaching a market size of USD 2.6 billion in 2025.

From 2012 to 2025, the global hepatic markers industry has witnessed growing awareness about liver diseases and the importance of early detection and intervention has led to increased screening programs and initiatives. Public health campaigns, educational programs, and screening efforts have resulted in improved detection rates and increased demand for hepatic markers. Screening programs targeting high-risk populations, such as individuals with viral hepatitis, obesity, or diabetes, have further fueled the growth of the market.

Future Forecast for Hepatic Markers Market Industry:

Looking ahead, the global hepatic markers market industry is expected to rise at a CAGR of 6.2% from 2025 to 2035. During the forecast period, the market size is expected to reach USD 4.6 billion by 2035.

The hepatic markers industry is expected to continue its growth trajectory from 2025 to 2035, driven by growing emphasis on early detection and monitoring of liver diseases to enable timely intervention and improve patient outcomes. Hepatic markers play a critical role in identifying high-risk individuals, assessing disease progression, and monitoring treatment response. The future growth of the hepatic markers market will be driven by the increasing focus on early detection, disease monitoring, and personalized treatment strategies.

The integration of digital health technologies, such as mobile apps, wearables, and connected devices, will shape the future growth of the hepatic markers market. These technologies enable remote monitoring, real-time data collection, and improved patient engagement.

| Country | The United States |

|---|---|

| Market Size (USD billion) by End of Forecast Period (2035) | USD 4.6 Billion |

| CAGR % 2025 to End of Forecast (2035) | 3.7% |

The hepatic markers industry in the United States is expected to reach a market size of USD 4.6 billion by 2035, expanding at a CAGR of 3.7%. Liver transplantation is a well-established treatment option for end-stage liver disease. The United States has witnessed a steady increase in liver transplantation procedures, which further drives the demand for hepatic markers. These markers are used to assess liver function before transplantation, monitor graft function after transplantation, and detect potential complications.

| Country | The United Kingdom |

|---|---|

| Market Size (USD million) by End of Forecast Period (2035) | USD 180.2 million |

| CAGR % 2025 to End of Forecast (2035) | 3.8% |

The hepatic markers industry in the United Kingdom is expected to reach a market value of USD 180.2 million, expanding at a CAGR of 3.8% during the forecast period. There is a growing emphasis on promoting liver health and raising awareness about the importance of early detection and management of liver diseases in the United Kingdom.

Public health campaigns, educational programs, and screening initiatives aim to educate the population about liver diseases and encourage regular liver function tests. This contributes to the increased demand for hepatic markers in the country.

| Country | China |

|---|---|

| Market Size (USD million) by End of Forecast Period (2035) | USD 241.2 million |

| CAGR % 2025 to End of Forecast (2035) | 6.4% |

The hepatic markers industry in China is anticipated to reach a market size of USD 241.2 million, moving at a CAGR of 6.4% during the forecast period. The Chinese government has implemented initiatives and healthcare reforms aimed at improving the diagnosis and treatment of liver diseases.

These initiatives focus on raising awareness, promoting early detection, and providing accessible and affordable healthcare services. The government's support and investment in the healthcare sector contribute to the growth of the hepatic markers market.

| Country | Japan |

|---|---|

| Market Size (USD million) by End of Forecast Period (2035) | USD 177.4 million |

| CAGR % 2025 to End of Forecast (2035) | 6.2% |

The hepatic markers industry in Japan is estimated to reach a market size of USD 177.4 million by 2035, thriving at a CAGR of 6.2%. Japan has a high healthcare expenditure and a strong healthcare infrastructure. Increasing healthcare expenditure, coupled with rising disposable income, contributes to the growth of the hepatic markers market. As individuals seek better healthcare services, there is an increased demand for advanced diagnostic tests, including hepatic markers, for accurate diagnosis and management of liver diseases.

| Country | South Korea |

|---|---|

| Market Size (USD million) by End of Forecast Period (2035) | USD 77.4 million |

| CAGR % 2025 to End of Forecast (2035) | 6.0% |

The hepatic markers industry in South Korea is expected to reach a market size of USD 77.4 million, expanding at a CAGR of 6.0% during the forecast period. South Korea, like many other countries, is witnessing a rise in the incidence of non-alcoholic fatty liver disease (NAFLD). Lifestyle changes, including sedentary behavior and unhealthy diets, contribute to the growing burden of NAFLD. Hepatic markers play a crucial role in diagnosing and monitoring NAFLD, leading to increased demand for these markers.

Aspartate transaminase (AST) is expected to dominate the hepatic markers industry with a CAGR of 5.6% from 2025 to 2035. This segment captures a significant market share in 2025 as it plays a crucial role in conjunction with other hepatic markers and liver function tests to assess liver health and diagnose various liver conditions. It helps in identifying liver damage or dysfunction caused by viral hepatitis, drug-induced liver injury, cirrhosis, and other liver diseases.

Viral hepatitis is expected to dominate the hepatic markers industry with a CAGR of 5.5% from 2025 to 2035. Hepatic markers are employed to monitor the response to antiviral therapies in viral hepatitis patients. Viral load testing, which measures the amount of virus in the blood, is used to assess the effectiveness of antiviral treatment and determine if viral suppression has been achieved. Other hepatic markers, such as ALT and AST, can indicate changes in liver function during treatment.

Hospitals is expected to dominate the hepatic markers industry with a CAGR of 5.5% from 2025 to 2035. Hospitals cater to both inpatient and outpatient care, and hepatic markers are utilized in both settings. Inpatient care involves monitoring liver function in patients admitted with liver diseases, drug toxicity, or other conditions affecting liver health. Outpatient clinics within hospitals offer services like liver disease management, regular check-ups, and monitoring of treatment response using hepatic markers.

The hepatic markers market is fiercely competitive, with many companies fighting for market dominance. To stay ahead of the competition in such a circumstance, essential players must develop effective conjugates.

Key Strategies Used by the Participants

Product Development

Companies are investing in research & development to deliver product that improve efficiency, dependability, and cost-effectiveness. Product innovation allows businesses to differentiate themselves from their competition while also catering to the changing demands of their clients.

Strategic Alliances & Collaborations

Key industry leaders frequently develop strategic partnerships and collaborations with other companies in order to harness their strengths and increase their market reach. Companies might also gain access to new technology and markets through such agreements.

Expansion into Emerging Markets

The hepatic markers market is expanding rapidly in emerging regions such as China and India. Key firms are enhancing their distribution networks and developing local manufacturing facilities to increase their presence in these areas.

Acquisitions and mergers

Mergers and acquisitions are frequently used by key players in the hepatic markers industry to consolidate their market position, extend their product range, and gain access to new markets.

Key Developments in the Hepatic Markers Market:

The global hepatic markers market is estimated to be valued at USD 2.6 billion in 2025.

The market size for the hepatic markers market is projected to reach USD 4.6 billion by 2035.

The hepatic markers market is expected to grow at a 5.9% CAGR between 2025 and 2035.

The key product types in hepatic markers market are alkaline phosphatase (alp), alanine transaminase (alt), aspartate transaminase (ast), gamma-glutamyl transferase (ggt) and others.

In terms of indication, viral hepatitis segment to command 46.2% share in the hepatic markers market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Hepatic Encephalopathy Treatment Market Trends, Analysis & Forecast by Drug Class, Diagnosis, Route of Administration, Distribution Channel and Region through 2035

Veno-Occlusive Hepatic Disease Therapeutics Market Size and Share Forecast Outlook 2025 to 2035

EPO Biomarkers Market Size and Share Forecast Outlook 2025 to 2035

Utility Markers Market Size and Share Forecast Outlook 2025 to 2035

Imaging Markers Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Diabetic Markers Market Size and Share Forecast Outlook 2025 to 2035

Fiducial Markers Market - Demand, Growth & Forecast 2025 to 2035

Vitamin Biomarkers Market Size and Share Forecast Outlook 2025 to 2035

Electrolyte Markers Market Size and Share Forecast Outlook 2025 to 2035

Coagulation Markers Market Trends - Growth, Demand & Forecast 2025 to 2035

Cell Surface Markers Detection Market Size and Share Forecast Outlook 2025 to 2035

Molecular Biomarkers For Cancer Detection Market Size and Share Forecast Outlook 2025 to 2035

Inflammatory Markers Market

Chronic Phase Markers Market Size and Share Forecast Outlook 2025 to 2035

Prognostic Biomarkers Market

Neurological Biomarkers Market Size and Share Forecast Outlook 2025 to 2035

Predisposition Biomarkers Market Size and Share Forecast Outlook 2025 to 2035

Diagnostic Imaging Markers Market Size and Share Forecast Outlook 2025 to 2035

Asthma and COPD Biomarkers Market

Diagnostic Exosome Biomarkers Market Trends – Growth & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA